BT Group, Ericsson and Qualcomm demo network slicing on 5G SA core network in UK

Years after 5G network slicing was hyped to the sky (see References below dating from 2028), BT Group, Ericsson and Qualcomm Technologies, Inc. have successfully demonstrated end-to-end consumer and enterprise 5G differentiated connectivity enabled by 5G network slicing on Ericsson’s 5G Core and Radio Access Network technology in the UK with devices powered by the Snapdragon ® 8 Gen 2 for Galaxy Mobile Platform.

The trial, which took place at Adastral Park, BT Group’s home of research and innovation, established network slices for Gaming, Enterprise and Enhanced Mobile Broadband (eMBB), and showed how, by allocating a portion of the 5G SA network to provide dynamic partitions for specific use-cases, optimal performance can be maintained for bandwidth-heavy activities including mobile gaming and video conferencing even during peak times.

Mobile gaming is experiencing relentless growth, with traffic on EE’s network almost doubling since the beginning of 2023 to more than two petabytes of data every month. With consistent low-latency, jitter-free and immersive experiences increasingly essential to the gaming experience, network slicing is expected to be a key enabler of performance and growth in the 5G SA era.

Together, BT Group, Ericsson and Qualcomm Technologies demonstrated an optimal mobile cloud gaming experience on Nvidia’s GeForce Now, maintaining a throughput comfortably in excess of the recommended 25 Mbps at 1080p even when a background load was generated. The companies initiated a gaming session on Fortnite using the Samsung S23 Ultra device, equipped with the Snapdragon 8 Gen 2 for Galaxy Mobile Platform, and Ericsson implemented Network slicing along with the Ericsson RAN feature Radio Resource Partitioning on EE’s Network to achieve a smooth experience. The experience was simultaneously compared to a non-optimised eMBB RAN partition, which was congested by the background load, resulting in a less than optimal gaming experience.

The trial also validated the potential of network slicing for BT Group’s business customers. Using the enterprise and eMBB slices, configured via URSP rules which enables a device to connect to multiple network slices simultaneously depending on the application, it demonstrated consistent 4K video streaming and enterprise use-cases using the Samsung S23 Ultra device, powered by Snapdragon 8 Gen 2 for Galaxy. Enterprise communications platforms and video applications such as YouTube require a stable connection and low jitter to work well. The Ericsson 5G RAN Slicing feature, Radio Resource Partitioning, was enabled to ensure the enterprise traffic to achieve an optimal experience.

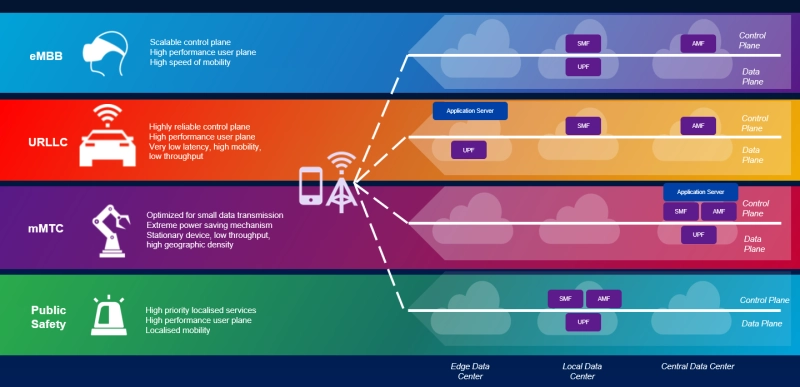

5G network slicing requires a 5G SA core network. It supports these diverse services and reassigns resources as needed from one virtual network slice to another, making the one-size-fits-all approach to service delivery obsolete.

Image courtesy of Viavi

Greg McCall, Chief Networks Officer, BT Group, said: “Network slicing will enable us to deliver new and improved capabilities for customers in the 5G SA era. As we work diligently towards the launch of our own 5G SA network, today’s successful demonstration of how slicing enables us to differentiate Quality of Service to guarantee performance for different segments is a significant milestone, and illustrative of the new services that will be enabled by 5G SA.”

Enrico Salvatori, Senior Vice President and President, Qualcomm Europe/MEA of Qualcomm Europe, Inc., said: “We are proud to collaborate with BT Group and Ericsson on the network slicing trial, which used a device powered by the Snapdragon 8 Gen 2 for Galaxy mobile platform. Together, we showcased the enhanced performance and flexibility 5G Standalone capabilities, such as network slicing, will bring to consumers and enterprise experiences.”

Katherine Ainley, CEO, Ericsson UK & Ireland, said: “5G standalone and network slicing demonstrates that leading operators like EE will be able to offer customers tailored connectivity with different requirements on speed, latency and reliability for specific applications, such as video streaming and gaming. This ultimate next step in connectivity will enable new service offerings for consumers and businesses who require premium performance, while helping to drive future market growth and innovation for the UK in a wide range of new industries.”

References:

ABI Research: 5G Network Slicing Market Slows; T-Mobile says “it’s time to unleash Network Slicing”

Ericsson, Intel and Microsoft demo 5G network slicing on a Windows laptop in Sweden

Ericsson and Nokia demonstrate 5G Network Slicing on Google Pixel 6 Pro phones running Android 13 mobile OS

Samsung and KDDI complete SLA network slicing field trial on 5G SA network in Japan

Nokia and Safaricom complete Africa’s first Fixed Wireless Access (FWA) 5G network slicing trial

Is 5G network slicing dead before arrival? Replaced by private 5G?

5G Network Slicing Tutorial + Ericsson releases 5G RAN slicing software

Network Slicing and 5G: Why it’s important, ITU-T SG 13 work, related IEEE ComSoc paper abstracts/overviews

https://www.viavisolutions.com/en-us/5g-network-slicing

2 thoughts on “BT Group, Ericsson and Qualcomm demo network slicing on 5G SA core network in UK”

Comments are closed.

The question arises of when BT will offer these better services to customers in its operational networks, but the company was either unable or unwilling to provide us with an answer.

“It is likely that we will see the launch of EE’s 5G SA network at some point this year, and can then expect a phased rollout based upon customer needs and capacity hungry areas,” telecoms analyst Paolo Pescatore of PP Foresight said.

“A trial is great, but now it’s time to start implementing this cool stuff in a real life commercial and operational environment,” he said. Wider industry support is needed, including a broad range of devices, he added.

Gartner VP Analyst Bill Ray said it was surprising that it had taken the industry so long to get here, considering this is part of the 5G standard.

He sounded a note of caution for the mobile industry when commercializing this technology. “I’ve spoken to a lot of network operators who plan to sell slices of their 5G networks to enterprises. However, I have yet to speak to an enterprise which is planning to buy one.”

Phil Harvey, Light Reading:

According to a recent report by Dell’Oro, the number of 5G SA networks commercially deployed by mobile network operators remains the same as at the end of 2023: around 50 5G SA networks.

Research firm Omdia estimates that 54 5G SA networks have been deployed so far, with both firms agreeing that there hasn’t been much growth over the last year.

Both firms agree that roughly one in six 5G networks are standalone. Omdia said 17% of service providers that deployed a 5G RAN have also deployed the 5G core. “The 5G SA market drives market growth, and only about 15% of the 5G networks (5G SA + 5G NSA) are 5G SA,” wrote Dave Bolan, research director at Dell’Oro Group, in an email to Light Reading.

“Without the 5G core, CSPs cannot benefit from network slicing or low-latency use cases, both of which are required for new revenue-generating use cases,” wrote Omdia’s Roberto Kompany, a principal analyst in the firm’s Service Provider Networks team.

Slow growth in the mobile core

The Dell’Oro data showed a 10% decline in the five-year revenue forecast for mobile core networks, indicating that service provider adoption of 5G SA networks is sluggish. The market is growing, but the new core network pieces aren’t deployed in a vacuum.

Mobile core and other 5G network equipment spending has been underwhelming for several quarters, and the big vendors are shedding staff to keep costs down. In the last year, Nokia has cut about 6,000 jobs, around 7% of its total workforce.

Omdia’s Kompany recently wrote that the top four core network vendors (Ericsson, Huawei, Nokia and ZTE) together captured nearly 70% of the 5G core market share last year. Omdia lists the 5G core components (network functions) as packet core, policy and charging; subscriber data management; routing and selection; and, finally, automation, orchestration and analytics.

The compounded annual growth rate (from 2023 to 2028) for mobile core networks is positive and is estimated to be between 5% and 10%, wrote Bolan. “Unfortunately, the 5G Core growth rate is insufficient to offset the negative growth rate for the 4G Evolved Packet Core (EPC), estimated to be between -15% and -20%, bringing the mobile core market average growth rate below 0%,” Bolan wrote.

5G SA is challenging for network operators. Deploying a cloud-native infrastructure in the mobile core can help telcos operate their networks in a way that’s more similar to hyperscalers. However, the architecture is relatively new and very complex. Non-standalone 5G (5G NSA), which hooks a 5G radio access network (RAN) to a 4G core, is less expensive and more straightforward.

“There’s a lot they must get right – RAN build out, telco cloud, and the 5G core itself – before they can offer SA to paying customers,” said Heavy Reading’s Senior Principal Analyst, Mobile Networks, Gabriel Brown.

“The other big factor is the rate at which subscribers/devices are added to the new 5G core once it does launch,” Brown added. “Even though some big operators are live with SA already, they don’t necessarily have many devices on the new core yet.”

In the US, T-Mobile and US Cellular have already launched 5G SA, and EchoStar is still building out its 5G SA network for its Boost Mobile customers. AT&T and Verizon have also discussed their plans to move to 5G SA.

“The customer migration strategy from 5G NSA to 5G SA is really the key swing factor,” Heavy Reading’s Brown said. “Generally, operators are being cautious because the risk of service disruption is high, and they judge it better to get it right than be fast. They want to offer something better with SA, so quality and reliability are critical.”

“In Europe, France and Italy have been behind due to the spectrum limitations,” said Dell’Oro’s Bolan. “Time will tell if the MNOs will choose 5G SA or 5G NSA. Unfortunately, most MNOs select 5G NSA, which has the lowest cost and is the most straightforward way to meet the capacity requirements for more subscribers’ bandwidth. Once an MNO selects the 5G NSA route, it may be years before they switch to 5G SA.”

To Brown’s earlier point, there’s a lot of background work happening but there’s no telling when it will show up in the numbers with new 5G SA network launches. New use cases and 5G capabilities are always just around the corner as technologies mature, standards advance and telcos get comfortable with the new reality of a 5G core, the use of new spectrum bands and devices and customer expectations. Overall market growth, as Dell’Oro’s numbers suggest, may take a while as the operators taking the 5G SA plunge get used to their new services at scale.

https://www.lightreading.com/mobile-core/why-5g-mobile-core-forecasts-keep-slipping