GSA

GSA: More 5G SA devices, but commercial 5G SA deployments lag

Findings from the latest GSA report on the 5G standalone (SA) ecosystem include:

- 1,764 announced devices with claimed support for 5G SA, up 43.7% from 1,227 at the end of 2022.

- Devices with support for 5G SA account for 68.1% of all 5G devices, as of the end of March 2024, up from 43.3% in December 2019.

- 97 modems or mobile processors/platform chipsets state support for 5G SA, 93 of which are understood to be commercially available.

………………………………………………………………………..

Other Estimates of deployed 5G SA core networks:

According to a recent LinkedIn post by Kaneshwaran Govindasamy, at least 49 network 29 have launched or deployed public 5 , one of which has only soft-launched their 5G SA networks.

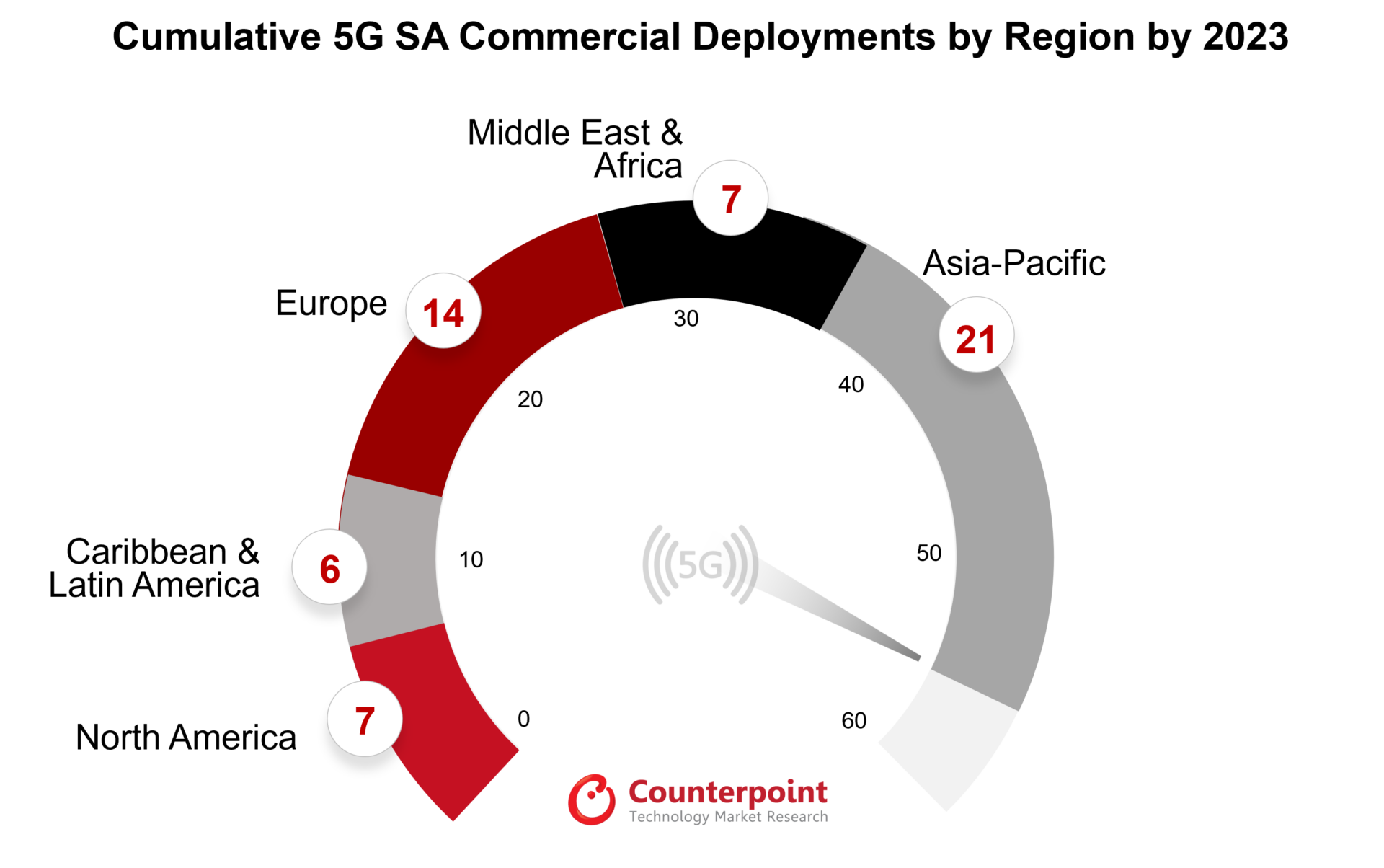

A February 2024 report from Counterpoint Research in February 2024 states that only 55 operators have commercially implemented 5G SA, with many more in testing and trial stages.

As of January 2024, Dell’Oro Group has identified 50 5G SA enhanced Mobile BroadBand (eMMB) networks that have been deployed worldwide. Dell’Oro Group’s Research Director, Dave Bolan, stated that the build-out of 5G SA networks is slower than expected, and that the number of new 5G SA networks deployed in 2023 (12) was lower than in 2022 (18). However, Bolan predicts that 2024 will see more 5G SA launches than 2022, and that 5G SA launches will occur in almost all global markets except Africa.

……………………………………………………………………………………………………

It should be noted that there is only one 5G SA network deployed in the U.S. from T-Mobile. AT&T and Verizon have promised 5G SA for years but it’s not commercially deployed by either operator at this time.

5G SA networks support higher-density device deployments and improved network performance. Without a 5G SA network, there are no 3GPP defined 5G features available, such as 5G Security, Network Slicing, MEC, etc.

References:

GSA 5G SA Core Network Update Report – Technology Blog

Building and Operating a Cloud Native 5G SA Core Network

Mobile Core Market Stagnant Due to Lack of 5G Standalone Deployments, According to Dell’Oro Group

https://www.ericsson.com/en/5g/5g-sa

GSA 5G SA Core Network Update Report

GSA is tracking the emergence of the 5G SA core network, including the availability of chipsets and devices for customers, plus the testing and deployment of 5G SA networks by public mobile network operators as well as private network operators.

5G SA networks can be deployed in a variety of scenarios: as an overlay for a public 5G non-SA network, as a greenfield 5G deployment for a public network operator without a separate LTE network, or as a private network deployment for an enterprise, utility, education, government or other organization requiring its own private campus network.

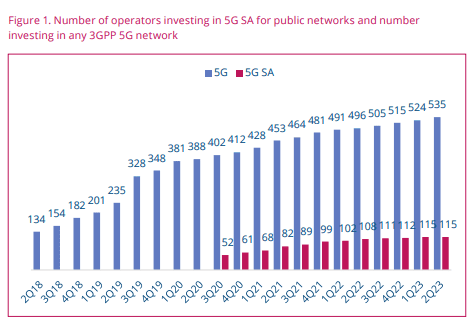

GSA has identified 115 operators in 52 countries and territories worldwide that have been investing (?) in public 5G SA networks in the form of trials, planned or actual deployments (see Figure 1.). This equates to 21.4% of the 535 operators known to be investing in 5G licenses, trials or deployments of any type.

At least 36 operators in 25 countries and territories are now understood to have launched or deployed public 5G SA networks, two of which have only soft-launched their 5G SA networks.

NOTE: Incredibly, that’s a DECREASE from GSA’s June 5G SA report which stated “GSA has catalogued 41 operators as having deployed or launched 5G standalone (SA) in public networks.”

Also, 19 cellular network operators have been catalogued as deploying or piloting 5G SA for public networks, and 29 as planning to deploy or evaluating, testing or trialing the technology.

Several organizations are testing, piloting or deploying 5G SA technologies for private networks. As of May 2024, 66 (just over 13% of total cellular private networks) organizations are known to be working with 5G SA core networks. These organizations include manufacturers, academic institutions, commercial research institutes, construction, communications and IT services, rail and aviation industries.

The number of 5G SA devices as a percentage of all 5G devices announced has been steadily increasing. They accounted for 35.6% of 5G devices in December 2019, 49.7% in December 2020 and 54.6% in December 2021 and a large increase to 81.8% in December 2022. As of June 2023, they account for 85.8%.

Software upgrades are almost always needed to enable 5G SA capability for existing 5G devices. There is a range of form factors to cater for different users, including modules for equipment manufacturers and vendors; customer-premises equipment (CPE), routers and gateways for enterprise or industrial customers or their systems integrators; CPE for home and business broadband; phones; and battery-operated hot spots for portable services.

Smartphones make up over half (59.0%) of the announced 5G devices with stated 5G SA support (1,034 phones), followed by fixed wireless access CPE (246) and modules (220).

Spectrum Support in 5G SA Devices:

Selected sub-6 GHz frequencies are increasingly well supported in 5G SA devices. The pattern of most-supported bands in sub-6 GHz 5G SA devices largely matches the pattern for most-supported bands across all 5G devices, with C-band, 2.6 GHz, 2 GHz, 1.8 GHz and 700 MHz.

Sub-6 GHz support by band, announced 5G SA devices, most-supported bands by most devices. Support for millimeter wave is not yet common.

Chipsets are being developed to support this capability — GSA has currently only catalogued eight chipsets specifically supporting 5G SA in millimeter-wave spectrum (eight mobile processors and platforms). 320 393 397 421 449 519 739 741 743 817 846 979 1,025 1,115 1,183 1,257 1,309 1,444 1,465 n48 n25 n66 n71 n12 n2 n20 n40 n79 n38 n7 n8 n5 n3 n28 n77 n1 n41 n78 We can expect support for spectrum bands above 6 GHz to increase in the future, as these bands are being promoted as an option for deployment of private 5G networks by regulators in various countries, as well as being promoted as capacity bands for high-traffic locations in public networks.

Summary:

The market is seeing the emergence of a strong 5G SA ecosystem with chipsets, devices of many types and users of public as well as private networks. We can expect to see the market go from strength to strength.

–>This author opines the 5G SA market is going from nowhere to no place!

As it does, GSA will continue to track its evolution and will be looking out for important new trends as they emerge.

Topics likely to become more important in the coming year in this context include 5G carrier aggregation in SA networks, ultrareliable low-latency communications (can’t be accomplished till 3GPP Release 16 URLLC in the RAN spec has been completed and performance tested) capabilities to support machine-to-machine connections in 5G SA systems, increasing support for millimeter-wave connections, network slicing in 5G networks and the introduction of VoNR in 5G SA networks.

……………………………………………………………………………………………………………………..

References:

GSM 5G-Market Snapshot Highlights – July 2023 (includes 5G SA status)

5G SA networks (real 5G) remain conspicuous by their absence

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

GSA Report: Spectrum Above 6 GHz & related FCC Activity

Executive Summary:

GSA’s latest report provides a snapshot of the global status of national usage of spectrum above 6 GHz for 5G services. It is part of a series of reports which separately also cover spectrum bands below 1 GHz and between 1 GHz and 6 GHz. This report reflects a market that is in constant flux (which this author has repeatedly stated would be the case till the most important IMT 2020 recommendations have been approved by ITU-R and ITU-T).

Key statistics:

- Sixty-seven operators in 13 countries hold licences enabling operation of 5G networks using mmWave spectrum.

- Fourteen operators are known to be deploying 5G networks using mmWave spectrum.

- Fourteen countries have announced formal (date-specified) plans for allocating frequencies above 6 GHz between now and end-2021.

- Fifty-nine announced 5G devices explicitly support one or more of the 5G spectrum bands above 6 GHz (though note that details of spectrum support is patchy for pre-commercial devices). Eleven of those devices are known to be commercially available.

5G deployments in bands above 6 GHz:

Spectrum bands above 6 GHz are being explicitly opened up to enable provision of 5G services. GSA is aware of the following usage for 5G. The 24250–29500 MHz range covering the overlapping bands n257 (26500–29500 MHz), n258 (24250–27500 MHz) and n261 (27500–28350 MHz) has been the most-used 5G mmWave spectrum range to date:

- 113 operators in 39 countries are investing in pre-standard 5G (in the form of trials, licences, deployments or operational networks) across this spectrum range.

- 66 operators are licensed to deploy 5G in this range.

- 12 operators are understood to be actively deploying 5G networks using spectrum above 6 GHz.

- Eight operators in seven countries have reported running 5G tests/trials at 15 GHz.

- One operator has reported running 5G tests/trials at 18 GHz.

- Band n260, covering 37–40 GHz, is also already being used, with three companies in the USA actively deploying networks using this spectrum.

- Thirteen operators in eleven countries have been evaluating/ testing/trialling 5G using spectrum from 66 GHz to 76 GHz.

- GSA has identified four operators that have run tests/trials using spectrum from 81 GHz to 87 GHz.

Figure 1: Use of 5G spectrum between 24.25 GHz and 29.5 GHz, countries plotted by status of most advanced operator activities

At WRC-2019 in November, delegates identifi ed several new frequency ranges for IMT and IMT-2020 (5G). These encompassed many of the existing 3GPP specified bands plus some new spectrum ranges:

• 24.25–27.5 GHz

• 37–43.5 GHz

• 45.5–47 GHz

• 47.2–48.2 GHz

• 66–71 GHz.

Other spectrum being considered by national regulators and international standards bodies, or that has been used in operator trials, is between the 71–86 GHz range.

………………………………………………………………………………………

5G device support for bands above 6 GHz:

5G device support for spectrum bands above 6 GHz is still at an early stage. GSA’s GAMBoD database includes 59 announced 3GPP compliant 5G devices that do or will support mmWave spectrum bands. Eleven of those are commercially available. The numbers of devices identified as supporting specific bands is much lower, as details of spectrum support is patchy for pre-commercial devices.

………………………………………………………………………………………………..

USA (Federal Communications Commission (FCC)):

In the USA, any bands already used for mobile service can also be deployed for 5G; FCC doesn’t require any particular technology and the choice is driven by carriers. This means multiple historic auctions are relevant for 5G including but not limited to those for spectrum at 28 GHz (March 1998 and May 1999) and 39 GHz (May 2000).

The FCC is currently undertaking a range of activities with a view to opening up extra spectrum for mobile use. In 2016, the FCC adopted its Upper Microwave Flexible Use Rules to make spectrum at 28 GHz, upper 37 GHz and 39 GHz available (including for 5G). Then the new Spectrum Frontier order dated 16 November 2017 put in place plans to open up an additional 1.7 GHz of mmWave spectrum in the 24 GHz and 47 GHz bands for fl exible terrestrial wireless use. FCC also enabled use of spectrum between 64 GHz and 71 GHz by unlicensed devices (subject to restrictions).

In October 2018, the Commission issued a notice of proposed rules that would open up the 5.925–6.425 GHz and 6.425–7.125 GHz bands for unlicensed use, subject to establishing a mechanism to prevent interference with incumbent services. It specifi cally anticipates – depending upon the part of the spectrum concerned – the use of low or standard power WiFi or variants of LTE for indoor or outdoor use.

The FCC has been running auctions of spectrum in the 24 GHz and 28 GHz bands. The auction of spectrum at 28 GHz (27.5–28.35 GHz) completed in January 2019, with bids totalling more than $700 million. Thirty-three bidders won 2965 licences.

The auction of spectrum at 24 GHz (24.25–24.45 GHz and 24.75–25.25 GHz) ended in May 2019 raising $2.02 billion in net bids. Twenty-nine bidders won 2904 licences.

In June 2018, FCC announced that it is also considering making an additional 2.75 GHz of the 26 GHz and 42 GHz bands available for 5G. In December 2018, FCC announced an incentive auction (Auction 103) covering spectrum at 37 GHz (37.6–38.6 GHz), 39 GHz (38.6–40 GHz) and 47 GHz (47.2–48.2 GHz) in order to free up more spectrum for 5G. Under the incentive auction, existing rights holders in those bands can choose either to relinquish their rights in exchange for a share of the auction revenue or alternatively receive modifi ed licences after the auction consistent with a new band plan and service rules.

Auctions for 37 GHz, 39 GHz and 47 GHz bands are planned by the end of 2019. Procedures for reconfiguring the 39 GHz band, enabling existing licensees to relinquish or modify their licences were published in March 2019. Technical guides for bidding procedures were published in April 2019, along with the announcement of a process for sharing the spectrum at 37 GHz with the Department of Defense. Timelines for the reconfiguration of existing rights were published in June 2019.

……………………………………………………………………………………………

Planned 5G auctions and their dates:

Fourteen countries have announced formal (date-specifi ed) plans for allocating mmWave frequencies between now and end-2021. A few other auctions/ allocations are timetabled to happen from 2022 onwards. Many countries are still deciding whether and when to hold auctions/ allocations for spectrum above 6 GHz.

Summary:

Spectrum above 6 GHz, and in particular mmWave spectrum, has rapidly become important for mobile telecoms. It is clear, with the number of spectrum awards expected over the coming years, and the agreement of new mmWave spectrum bands at WRC-19, the investment in these spectrum bands by operators and commitments to launch compatible devices by vendors, that the importance of spectrum above 6 GHz is going to continue to grow. GSA will continue to track this trend. This report will be next updated in early 2020.