Month: July 2024

Post COVID Telco AI Blueprint for the UK

By Afnan Khan with Ajay Lotan Thakur

Introduction

In the eerie silence of deserted streets and amidst the anxious hum of masked conversations, the world found itself gripped by the rapid proliferation of COVID-19. Soon labelled a global pandemic due to the havoc wreaked by soaring death tolls, it brought unprecedented disruption and accelerated the inevitable rise of the digital age. The era of digital transformation has swiftly transitioned, spawning a multitude of businesses catering to every human need. Today, our dependence on digital technology remains steadfast, with remote work becoming the norm and IT services spending increasing from $1.071 trillion in 2020 to $1.585 trillion. [1]

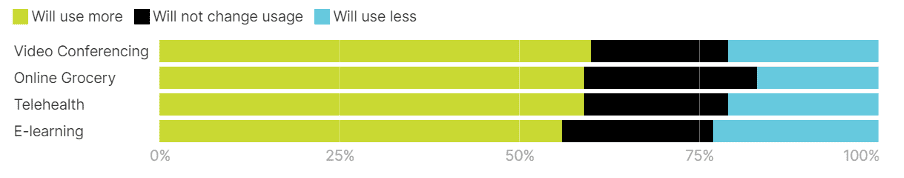

The chart below, sourced from Oliver Wyman Forum Analysis,[2] vividly illustrates our increasing dependence on technology. It presents findings from a survey conducted in the latter half of 2020 across eight countries – US, UK, France, Germany, Italy, Spain, Singapore, and China. The survey reveals that 60% of respondents favoured increased use of video conferencing, while online grocery shopping and telehealth services each garnered 59% approval, and E-learning showed a strong preference at 56%. This data underscores how swiftly digital solutions integrated into our daily lives during the pandemic.

Accelerating Telecom Growth in Britain

Europe was among the hardest-hit regions by the pandemic, with death tolls exceeding 2.1 million. [3] This crisis accelerated the adoption of digital technologies, prompting businesses to invest in smarter, more sustainable operations to increase their longevity and stay relevant in the market.

In the United Kingdom, despite the government’s injection of £21.3 billion into the economy to support small businesses, the emphasis on digital transformation has been paramount. [4] The push towards digital solutions, including enhanced internet connectivity and robust data centres, underscores the long-term strategic shift towards a more resilient and technologically advanced business landscape.

Statistically, the UK telecom industry has experienced significant growth, driven by increased demand and advancements in network equipment. The shift towards digital dependency, accelerated by the COVID-19 pandemic and the rise of remote work, is expected to be long-term. This trend has also led to a surge in 5G and data centre deals.

According to Proximo, a leading Project and Infrastructure Finance Journal, projects worth $30.967 billion have closed in Europe between 2020 and 2023, highlighting the critical role of data centres in boosting the telecommunications sector. Of this, the UK accounted for $14.133 billion across seven deals, comprising both refinancing and new financing deals, representing 45.6% of Europe’s total contribution. Notably, one of the recent financing deals to close was for Ark Data Centres, based in London, with the term loan reported to be in the region of £170 million for five years, aimed at supporting a significant data project in the UK – thus establishing the country as one of the market leaders in Europe. [5]

Telecom Landscape in the UK’s New Normal

Imagine having the ability to pinpoint precisely when hardware needs replacement, akin to pre-emptively replacing floorboards. Vodafone’s United Performance Management (UPM) facilitates real-time monitoring and proactive identification of anomalies. [6] Predictive maintenance can reduce unplanned downtime by 30-50%, lower maintenance costs by 10-40%, and extend asset lifespan by 20-40%. [7][8]

Virtual Assistants

The integration of virtual assistants has not only streamlined operations but has also emerged as one of the most sought-after roles, as reported by Forbes. [9] In the telecom industry, where customer service reigns supreme, consider the live example of broadband giant BT/EE. Their adoption of remote customer support in the post-COVID world has propelled them to the forefront as the leading data provider in the UK. Mirroring European trends, the demand for virtual assistant roles has surged by 20%, [10] spurred on by initiatives such as digital nomad visas in Spain and Portugal. This trend not only reflects the changing landscape of customer service but also signals significant injections into the economy.

Traffic congestion

In the hustle and bustle of post-pandemic London, navigating the city’s streets amidst fluctuating traffic patterns and network demands presents a unique challenge. Telecom companies are stepping up to the plate, leveraging cutting-edge AI and ML technologies to tackle these issues head-on. By predicting traffic patterns and dynamically managing network loads, they’re ensuring that Londoners experience optimal connectivity and responsiveness, even during peak hours when congestion is at its peak. Imagine this: congestion hotspots are pinpointed in real-time, and network resources are strategically directed to these areas, reducing disruptions. This means that residents and commuters alike enjoy a smoother, more reliable connection, whether they’re streaming, working remotely, or simply staying connected on the go.

One shining example is Vodafone, which has implemented AI-driven traffic prediction models specifically tailored to London’s intricate traffic patterns. The result? A remarkable 25% reduction in network congestion during peak hours, as reported by TechRadar. [11] This underscores the significance of bespoke solutions in addressing London’s unique challenges post-pandemic, solidifying network performance and reliability for the city’s diverse population and thriving businesses.

Another notable case is BT/EE, which has also deployed AI-driven traffic prediction models in London. This initiative led to a significant 30% reduction in network congestion during peak hours. [12] Such tailored AI solutions not only enhance operational efficiency but also demonstrate the telecom industry’s commitment to leveraging technology to improve urban infrastructure.

Dynamic Spectrum

In the dynamic realm of post-COVID technology, telecom pioneers are revolutionising spectrum management with dynamic spectrum allocation. Imagine a digital symphony where frequencies dance to the beat of demand, seamlessly adapting to surges in digital traffic. This innovative approach ensures uninterrupted connectivity, even in the busiest digital arenas. According to recent studies, dynamic spectrum allocation has shown to increase spectrum efficiency by up to 40%, supporting seamless connectivity for the data-hungry masses. [13] Telecom wizards are thus reshaping the digital landscape, delivering turbo-charged connectivity.

References

- https://www.statista.com/statistics/203291/global-it-services-spending-forecast/

- https://www.oliverwyman.com/our-expertise/perspectives/health/2021/mar/why-4-technologies-that-boomed-during-covid-19-will-keep-people-.html

- https://www.worldometers.info/coronavirus/

- https://www.gov.uk/government/news/new-data-shows-small-businesses-received-213-billion-in-covid-19-local-authority-business-support-grants#:~:text=Press%20release-,New%20data%20shows%20small%20businesses%20received%20%C2%A321.3%20billion%20in,and%20arts%2C%20entertainment%20and%20recreation.

- Proximo Intelligence Data: www.proximoinfra.com

- Vodafone Press Release, 2022.

- “McKinsey & Company. “Predictive maintenance: The rise of self-maintaining assets.”

- Deloitte. “Predictive maintenance: Taking proactivity to the next level.”

- Forbes. “Why Virtual Assistants Are Becoming Essential for Businesses.”

- Statista. “Growth in Demand for Virtual Assistants in Europe.”

- TechRadar. “Vodafone’s AI traffic prediction cuts network congestion by 25% in London.”

- The Guardian. “BT/EE’s AI traffic prediction cuts network congestion by 30% in London.”

Afnan Khan is a Machine Learning Engineer specialising in Marketing Analytics, currently working as a Marketing Analyst at the Exile Group in London. He is involved in various projects, research, and roles related to Machine Learning, Data Science, and AI.

Ajay Lotan Thakur is a Senior IEEE Member, IEEE Techblog Editorial Board Member, BCS Fellow, TST Member of ONF’s Open-Source Aether (Private 5G) Project, Cloud Software Architect at Intel Canada.

Vodafone: GenAI overhyped, will spend $151M to enhance its chatbot with AI

GenAI is probably the most “overhyped” technology for many years in the telecom industry, said Vodafone Group’s chief technology officer (CTO) Scott Petty at a press briefing this week. “Hopefully, we are reaching the peak of those inflated expectations, because we are about to drop into a trough of disillusionment,” he said.

“This industry is moving too quickly,” Petty explained. “The evolution of particularly GPUs and the infrastructure means that by the time you’d actually bought them and got them installed you’d be N minus one or N minus two in terms of the technology, and you’d be spending a lot of effort and resource just trying to run the infrastructure and the LLMs that sit around that.”

Partnerships with hyper-scalers remain Vodafone’s preference, he said. Earlier this year, Vodafone and Microsoft signed a 10-year strategic agreement to use Microsoft GenAI in Vodafone’s network.

Vodafone is planning to invest some €140 million ($151 million) in artificial intelligence (AI) systems this year to improve the handling of customer inquiries, the company said on July 4th. Vodafone said it is investing in advanced AI from Microsoft and OpenAI to improve its chatbot, dubbed TOBi, so that it can respond faster and resolve customer issues more effectively.

The chatbot was introduced into Vodafone’s customer service five years ago and is equipped with the real voice of a Vodafone employee.

The new system, which is called SuperTOBi in many countries, has already been introduced in Italy and Portugal and will be rolled out in Germany and Turkey later this month with other markets to follow later in the year, Vodafone said in a press release.

According to the company, SuperTOBi “can understand and respond faster to complex customer enquiries better than traditional chatbots.” The new bot will assist customers with various tasks, such as troubleshooting hardware issues and setting up fixed-line routers, the company said.

Vodafone is not about to expose Vodafone’s data to publicly available models like ChatGPT. Nor will the UK based telco create large language models (LLMs) on its own. Instead, a team of 50 data scientists are working on fine-tuning LLMs like Anthropic and Vertex. Vodafone can expose information to those LLMs by dipping into its 24-petabyte data “ocean,” created with Google. Secure containers within public clouds ensure private information is securely cordoned off and unavailable to others.

According to Petty’s estimates, the performance speed of LLMs has improved by a factor of 12 in the last nine months alone, while operational costs have decreased by a factor of six. A telco that invested nine months ago would already have outdated and expensive technology. Petty, moreover, is not the only telco CTO wary of plunging into Nvidia’s GPU chips.

“This is a very weird moment in time where power is very expensive, natural resources are scarce and GPUs are extremely expensive,” said Bruno Zerbib, the CTO of France’s Orange, at the 2024 Mobile World Congress in Barcelona, Spain. “You have to be very careful with your investment because you might buy a GPU product from a famous company right now that has a monopolistic position.”

Petty thinks LLM processing may eventually need to be processed outside hyper-scalers’ facilities. “To really create the performance that we want, we are going to need to push those capabilities further toward the edge of the network,” he said. “It is not going to be the hype cycle of the back end of 2024. But in 2025 and 2026, you’ll start to see those applications and capabilities being deployed at speed.”

“The time it takes for that data to get up and back will dictate whether you’re happy as a consumer to use that interface as your primary interface, and the investment in latency is going to be critically important,” said Petty. “We’re fortunate that 5G standalone drives low latency capability, but it’s not deployed at scale. We don’t have ubiquitous coverage. We need to make sure that those things are available to enable those applications.”

Data from Ericsson supports that view, showing that 5G population coverage is just 70% across Europe, compared with 90% in North America and 95% in China. The figure for midband spectrum – considered a 5G sweet spot that combines decent coverage with high-speed service – is as low as 30% in Europe, against 85% in North America and 95% in China.

Non-standalone (NSA) 5G, which connects a 5G radio access network (RAN) to a 4G core (EPC), is “dominating the market,” said Ericsson.

Vodafone has pledged to spend £11 billion (US$14 billion) on the rollout of a nationwide standalone 5G network in the UK if authorities bless its proposed merger with Three. With more customers, additional spectrum and a bigger footprint, the combined company would be able to generate healthier returns and invest in network improvements, the company said. But a UK merger would not aid the operator in Europe’s four-player markets.

Petty believes a “pay for search” economic model may emerge using GenAI virtual assistants. “This will see an evolution of a two-sided economic model that probably didn’t get in the growth of the Internet in the last 20 years,” but it would not be unlike today’s market for content delivery networks (CDNs).

“Most CDNs are actually paid for by the content distribution companies – the Netflixes, the TV sports – because they want a great experience for their users for the paid content they’ve bought. When it’s free content, maybe the owner of that content is less willing to invest to build out the capabilities in the network.”

Like other industry executives, Petty must hope the debates about net neutrality and fair contribution do not plunge telcos into a long disillusionment trough.

References:

Vodafone CTO: AI will overhaul 5G networks and Internet economics (lightreading.com)

Vodafone UK report touts benefits of 5G SA for Small Biz; cover for proposed merger with Three UK?

ITU-R WP5D invites IMT-2030 RIT/SRIT contributions

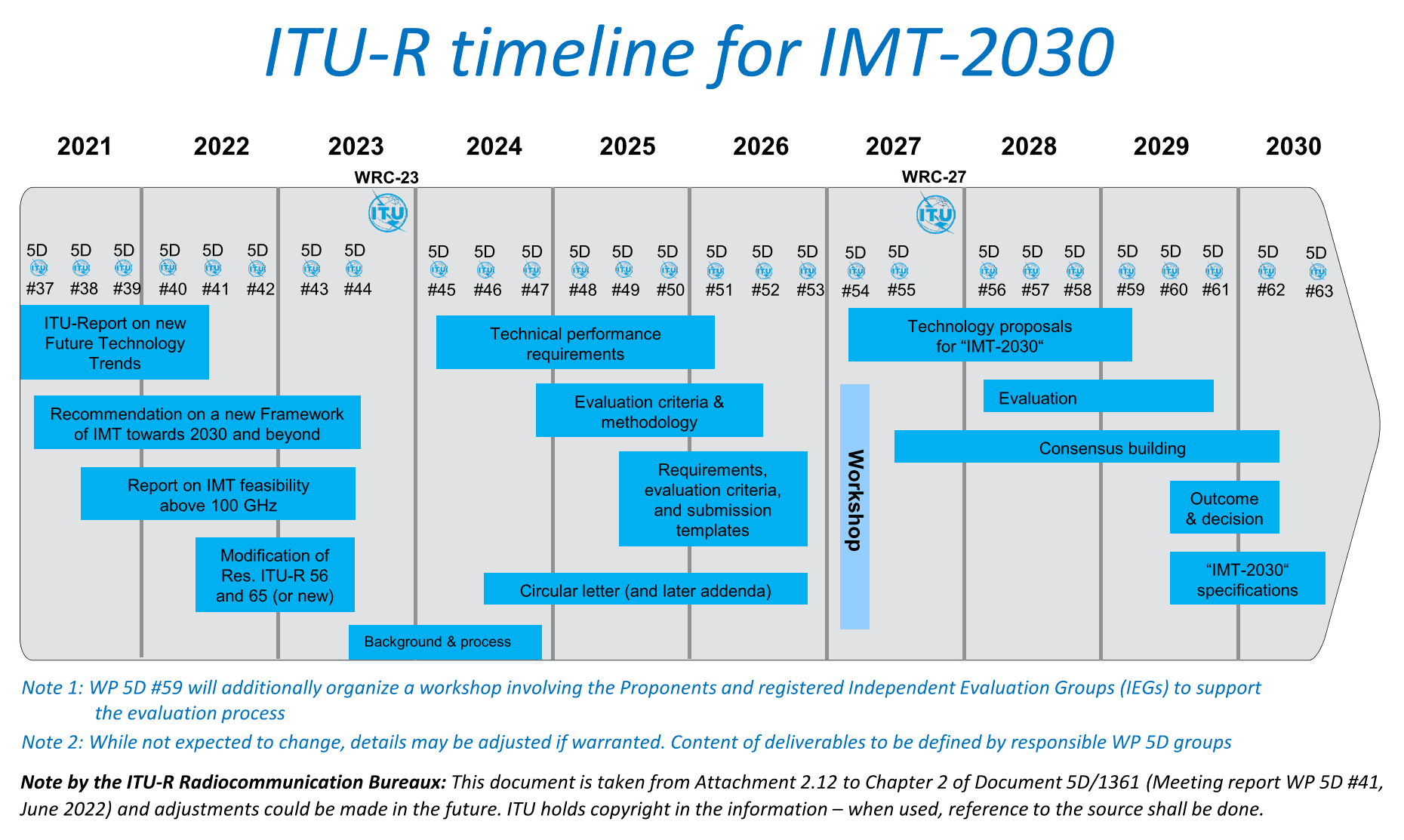

ITU-R has commenced the process of developing ITU-R Recommendations for the terrestrial components of the IMT-2030 (6G) radio interface(s). This work is guided by Resolutions ITU-R 56 and ITU-R 65. As you can see from the timeline below, the final IMT-2030 recommendation won’t be completed until 2030.

The ITU Radiocommunication Bureau has established a “Web page for the IMT-2030 submission and evaluation process” to facilitate the development of proposals and the work of the evaluation groups. The IMT-2030 web page will provide details of the process for the submission of proposals, and will include the RIT and SRIT submissions, evaluation group registration and contact information, evaluation reports and other relevant information on the development of IMT‑2030.

Candidate RITs (Radio Interface Technologies) or SRITs (Set of Radio Interface Technologies) will be evaluated by the ITU membership, standards organizations and other independent evaluation groups. Evaluation groups are requested to register with ITU-R1, preferably before [February/the end of 2027].

The evaluation groups are kindly requested to submit evaluation reports to the ITU-R in accordance with the evaluation process delineated on the IMT‑2030 web page. The evaluation reports will be considered in the development of the ITU-R Recommendation describing the radio interface specifications.

The evaluation guidelines, including the criteria and methodology, are to be finalized by WP 5D in June 2026. The availability of these guidelines on the IMT-2030 web page will be announced in a forthcoming Addendum to a Circular Letter calling for IMT-2030 RIT/SRIT contributions.

3GPP’s contributions will most likely be presented to ITU-R WP5D by ATIS. It remains to be seen what other entities will submit IMT-2030 RIT/SRIT proposals.

References:

https://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-2030/Pages/default.aspx

https://www.itu.int/dms_pub/itu-r/oth/0a/06/R0A060000C80001PDFE.pdf