Amazon’s Jeff Bezos at Italian Tech Week: “AI is a kind of industrial bubble”

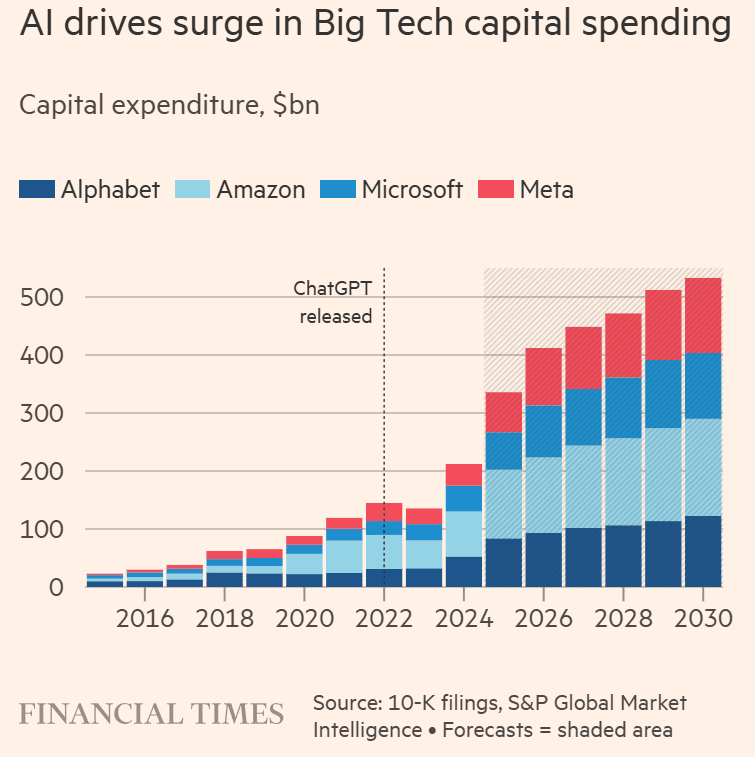

Tech firms are spending hundreds of billions of dollars on advanced AI chips and data centers, not just to keep pace with a surge in the use of chatbots such as ChatGPT, Gemini and Claude, but to make sure they’re ready to handle a more fundamental and disruptive shift of economic activity from humans to machines. The final bill may run into the trillions. The financing is coming from venture capital, debt and, lately, some more unconventional arrangements that have raised concerns among top industry executives and financial asset management firms.

At Italian Tech Week in Turin on October 3, 2025, Amazon founder Jeff Bezos said this about artificial intelligence, “This is a kind of industrial bubble, as opposed to financial bubbles.” Bezos differentiated this from “bad” financial or housing bubbles, which cause harm. Bezos’s comparison of the current AI boom to a historical “industrial bubble” highlights that, while speculative, it is rooted in real, transformative technology.

“It can even be good, because when the dust settles and you see who are the winners, societies benefit from those investors,” Bezos said. “That is what is going to happen here too. This is real, the benefits to society from AI are going to be gigantic.”

He noted that during bubbles, everything (both good and bad investments) gets funded. When these periods of excitement come along, investors have a hard time distinguishing the good ideas from the bad, he said, adding this is “probably happening today” with AI investments. “Investors have a hard time in the middle of this excitement, distinguishing between the good ideas and the bad ideas,” Bezos said of the AI industry. “And that’s also probably happening today,” he added.

- A “good” kind of bubble: He explained that during industrial bubbles, excessive funding flows to both good and bad ideas, making it hard for investors to distinguish between them. However, the influx of capital spurs significant innovation and infrastructure development that ultimately benefits society once the bubble bursts and the strongest companies survive.

- Echoes of the dot-com era: Bezos drew a parallel to the dot-com boom of the 1990s, where many internet companies failed, but the underlying infrastructure—like fiber-optic cable—endured and led to the creation of companies like Amazon.

- Gigantic benefits: Despite the market frothiness, Bezos reiterated that AI is “real” and its benefits to society “are going to be gigantic.”

- Sam Altman (OpenAI): The CEO of OpenAI has stated that he believes “investors as a whole are overexcited about AI.” In In August, the OpenAI CEO told reporters the AI market was in a bubble. When bubbles happen, “smart people get overexcited about a kernel of truth,” Altman warned, drawing parallels with the dot-com boom. Still, he said his personal belief is “on the whole, this would be a huge net win for the economy.”

- David Solomon (Goldman Sachs): Also speaking at Italian Tech Week, the Goldman Sachs CEO warned that a lot of capital deployed in AI would not deliver returns and that a market “drawdown” could occur.

- Mark Zuckerberg (Meta): Zuckerberg has also acknowledged that an AI bubble exists. The Meta CEO acknowledged that the rapid development of and surging investments in AI stands to form a bubble, potentially outpacing practical productivity and returns and risking a market crash. However, he would rather “misspend a couple hundred billion dollars” on AI development than be late to the technology.

- Morgan Stanley Wealth Management’s chief investment officer, Lisa Shalett, warned that the AI stock boom was showing “cracks” and was likely closer to its end than its beginning. The firm cited concerns over negative free cash flow growth among major AI players and increasing speculative investment. Shalett highlighted that free cash flow growth for the major cloud providers, or “hyperscalers,” has turned negative. This is viewed as a key signal of the AI capital expenditure cycle’s maturity. Some analysts estimate this growth could shrink by about 16% over the next year.

Bezos’s remarks come as some analysts express growing fears of an impending AI market crash.

- Underlying technology is real: Unlike purely speculative bubbles, the AI boom is driven by a fundamental technology shift with real-world applications that will survive any market correction.

- Historical context: Some analysts believe the current AI bubble is on a much larger scale than the dot-com bubble due to the massive influx of investment.

- Significant spending: The level of business spending on AI is already at historic levels and is fueling economic growth, which could cause a broader economic slowdown if it were to crash.

- Potential for disruption: The AI industry faces risks such as diminishing returns for costly advanced models, increased competition, and infrastructure limitations related to power consumption.

Ian Harnett argues, the current bubble may be approaching its “endgame.” He wrote in the Financial Times:

“The dramatic rise in AI capital expenditure by so-called hyperscalers of the technology and the stock concentration in US equities are classic peak bubble signals. But history shows that a bust triggered by this over-investment may hold the key to the positive long-run potential of AI.

Until recently, the missing ingredient was the rapid build-out of physical capital. This is now firmly in place, echoing the capex boom seen in the late-1990s bubble in telecommunications, media and technology stocks. That scaling of the internet and mobile telephony was central to sustaining ‘blue sky’ earnings expectations and extreme valuations, but it also led to the TMT bust.”

Today’s AI capital expenditure (capex) is increasingly being funded by debt, marking a notable shift from previous reliance on cash reserves. While tech giants initially used their substantial cash flows for AI infrastructure, their massive and escalating spending has led them to increasingly rely on external financing to cover costs.

This is especially true of Oracle, which will have to increase its capex by almost $100 billion over the next two years for their deal to build out AI data centers for OpenAI. That’s an annualized growth rate of some 47%, even though Oracle’s free cash flow has already fallen into negative territory for the first time since 1990. According to a recent note from KeyBanc Capital Markets, Oracle may need to borrow $25 billion annually over the next four years. This comes at a time when Oracle is already carrying substantial debt and is highly leveraged. As of the end of August, the company had around $82 billion in long-term debt, with a debt-to-equity ratio of roughly 450%. By comparison, Alphabet—the parent company of Google—reported a ratio of 11.5%, while Microsoft’s stood at about 33%. In July, Moody’s revised Oracle’s credit outlook to negative from, while affirming its Baa2 senior unsecured rating. This negative outlook reflects the risks associated with Oracle’s significant expansion into AI infrastructure, which is expected to lead to elevated leverage and negative free cash flow due to high capital expenditures. Caveat Emptor!

References:

https://fortune.com/2025/10/04/jeff-bezos-amazon-openai-sam-altman-ai-bubble-tech-stocks-investing/

https://www.ft.com/content/c7b9453e-f528-4fc3-9bbd-3dbd369041be

Can the debt fueling the new wave of AI infrastructure buildouts ever be repaid?

AI Data Center Boom Carries Huge Default and Demand Risks

Big tech spending on AI data centers and infrastructure vs the fiber optic buildout during the dot-com boom (& bust)

Gartner: AI spending >$2 trillion in 2026 driven by hyperscalers data center investments

Will the wave of AI generated user-to/from-network traffic increase spectacularly as Cisco and Nokia predict?

Analysis: Cisco, HPE/Juniper, and Nvidia network equipment for AI data centers

RtBrick survey: Telco leaders warn AI and streaming traffic to “crack networks” by 2030

https://fortune.com/2025/09/19/zuckerberg-ai-bubble-definitely-possibility-sam-altman-collapse/

https://finance.yahoo.com/news/why-fears-trillion-dollar-ai-130008034.html

In a Friday interview with Axios, Dario Perkins, managing director of global macro at TS Lombard, said that tech companies are increasingly taking on massive debts in their race to build out AI data centers in a way that is reminiscent of the debts held by companies during the dot-com and subprime mortgage bubbles.

Perkins told Axios that he’s particularly wary because the big tech companies are claiming “they don’t care whether the investment has any return, because they’re in a race.” “Surely that in itself is a red flag,” he added.

CNBC reported on Friday that Goldman Sachs SEO David Solomon told an audience at the Italian Tech Week conference that he expected a “drawdown” in the stock market over the next year or two given that so much money has been pumped into AI ventures in such a short time.

“I think that there will be a lot of capital that’s deployed that will turn out to not deliver returns, and when that happens, people won’t feel good,” he said.

That’s the first analysis I have seen that brings in the relative debt load of the major players. It will be interesting to see the impact of debt load as things move forward in the AI space.

Thanks Ken. In addition to this article and the comment from Perkins, debt taken on by major players was thoroughly discussed in this referenced IEEE Techblog post:

Can the debt fueling the new wave of AI infrastructure buildouts ever be repaid? https://techblog.comsoc.org/2025/09/30/can-the-debt-fueling-the-new-wave-of-ai-infrastructure-buildouts-ever-be-repaid/

For example:

1. OpenAI, for example, is set to take borrowing and large-scale contracts to an unbelievable new level. OpenAI’s position, despite the hype, seems very shaky. D.A. Davidson analyst Gil Luria estimates the company would need to generate over $300 billion in annual revenue by 2030 to justify the spending implied in its Oracle deal—a steep climb from its current run rate of about $12 billion.

2, Companies like Oracle and other less-capitalized AI players such as CoreWeave have little choice but to take on more debt if they want to compete at the highest level.

3.xAI (Elon Musk’s AI firm): xAI raised $10 billion in combined debt + equity. Specifically ~$5 billion in secured notes / term loans (debt), with the remainder in equity.

From a San Jose Mercury news article titled,

Chatbot dreams generate AI nightmares for Bay Area lawyers

A Palo Alto lawyer with nearly a half-century of experience admitted to an Oakland federal judge this summer that legal cases he referenced in an important court filing didn’t actually exist and appeared to be products of artificial intelligence “hallucinations.”

A specialist in computer law, Jack Russo found himself in the rapidly growing company of lawyers publicly shamed as wildly popular but error-prone artificial intelligence technology like ChatGPT collides with the rigid rules of legal procedure.

Hallucinations — when AI produces inaccurate or nonsensical information — have posed an ongoing problem in the generative AI that has birthed a Silicon Valley frenzy since San Francisco’s OpenAI released its ChatGPT bot in late 2022. In the legal arena, AI-generated errors are drawing heightened scrutiny as lawyers flock to the technology, and irate judges are making referrals to disciplinary authorities and, in dozens of U.S. cases since 2023, levying financial penalties of up to $31,000, including a California-record fine of $10,000 last month in a Southern California case.

Amazon plans to cut 30,000 employees- largest layoff in the company’s history!

Amazon CEO Andy Jassy said in June that the increased use of artificial intelligence tools would likely lead to further job cuts, particularly through automating repetitive and routine tasks. “This latest move signals that Amazon is likely realizing enough AI-driven productivity gains within corporate teams to support a substantial reduction in force,” said Sky Canaves, an eMarketer analyst. “Amazon has also been under pressure in the short-term to offset the long-term investments in building out its AI infrastructure.”

https://www.reuters.com/business/world-at-work/amazon-targets-many-30000-corporate-job-cuts-sources-say-2025-10-27/

Laura Chambers, CEO of Mozilla—maker of the Firefox browser—sees the situation as a classic, straightforward bubble. Funding is abundant, it is easier than ever to make low-grade products, and most AI companies are running at a loss, she says. “Yes. It’s really easy to build a whole bunch of stuff, and so people are building a whole bunch of stuff, but not all of that will have traction. So the amount of stuff coming out versus the amount of stuff that’s going to [be sustainable] is probably higher than it’s ever been. I mean, I can build an app in four hours now. That would have taken me six months to do before. So there’s a lot of junk being built very, very quickly, and only a part of that will come through. So that’s one piece of the bubble,” she said.

“I think the most interesting piece is monetization, though. All the AI companies, all these AI browsers, are running at a massive loss. At some point that isn’t sustainable, and so they’re going to have to figure out how to monetize.”

Babak Hodjat, chief AI officer at Cognizant, said he believed diminishing returns were setting in to large language models. The DeepSeek launch from earlier this year—in which a Chinese company released an LLM comparable to ChatGPT for a fraction of the cost—was a good example of this. Building AI was once a huge, expensive, and difficult undertaking. But today, many AI use-cases (such as custom-built, task-specific AI agents) don’t need huge models underpinning them, he said.

“The bulk of the money that you see—and people talk about a bubble—is going into commercial companies that are actually building large language models. I think that technology is starting to be commoditized. You don’t really need to use that big of a large language model, but those guys are taking money because they need a lot of compute capacity. They need a lot of data. And their valuation is based on, you know, bigger is better. Which is not necessarily the case,” he told Fortune.

https://www.aol.com/finance/tech-execs-admit-ai-bubble-141038315.html

Fears of an AI bubble fueled stock market volatility in recent weeks as big tech valuations stretched and Wall Street’s top executives warned of a market correction. Global AI-related investments are projected to exceed $4 trillion by 2030, reflecting investor zeal to capitalize on a technology that surged in popularity after ChatGPT was launched three years ago. Record spending by big tech persists despite skepticism about a near-term payoff as many organizations report zero measurable return from billions in capital investment. Tech sector valuations have soared to dot-com era levels – and, based on price-to-sales ratios, well beyond them. Some of AI’s biggest proponents acknowledge the fact that valuations are overinflated, including OpenAI chairman Bret Taylor:

AI will transform the economy… and create huge amounts of economic value in the future,” Taylor told The Verge. “I think we’re also in a bubble, and a lot of people will lose a lot of money.”

Alphabet’s (GOOG) (GOOGL) Sundar Pichai sees “elements of irrationality” in the current scale of AI investing, not unlike the excessive investment during the dot-com boom. If the AI bubble bursts, Pichai added, no company will be immune, including Alphabet, despite its breakthrough technology, Gemini, fueling gains.

Big tech and AI start-ups like OpenAI and Anthropic are leaning heavily on circular deals and heavy debt to finance AI spending has raised eyebrows on Wall Street.

The top five hyperscalers have raised a record $108B worth of debt in 2025 – more than 3x the average over the past nine years, according to data compiled by Bloomberg Intelligence. Moreover, some firms are turning to off-balance-sheet entities, including special-purpose vehicles (SPVs) – structures with a checkered history going back to Enron, D.A. Davidson analyst Gil Luria observed. A slowdown in AI demand could render the debt tied to these SPVs “worthless,” Luria warned, potentially triggering another financial crisis.

AI’s rapid expansion has masked some underlying economic issues. As US investment in AI-related industries surged over the past five years, non-AI investment remained stagnant, a Deutsche Bank research report revealed. And, outside of data centers, economic demand has been weak. In fact, the US would be close to a recession this year without technology-related spending, the report added. Meanwhile, a front-loading of chip orders has helped offset some of the tariff-driven constraints on global trade.

https://seekingalpha.com/article/4848572-5-top-stocks-for-ai-fatigue