Point Topic: Global Broadband Subscribers in Q2 2025: 5G FWA, DSL, satellite and FTTP

Overview:

Global broadband subscribers surpassed 1.53 billion in Q2 2025, marking a 1.1% growth. Broadband subscriptions[1] declined in 24 countries[2], compared to 22 in Q1 2025. In some of these markets consumers are migrating to mobile broadband, others are experiencing economic headwinds or are already highly saturated. Some are still in the midst of conflict. Globally, the growth in Q2 2025 has increased slightly, compared to the same quarter of 2024.

Notes:

[1] Whenever Point Topic refers to ‘broadband’ in this report, they mean fixed broadband. Also, ‘subscriptions’ and ‘connections’ are used interchangeably.

[2] It is possible there will be restatements in the coming quarter/s and single period data should be viewed in that light. Decline in some markets can be due to changes in methodology used by national regulatory authorities.

Key Points:

-

In terms of growth, India remained at the top of the largest 20 fixed broadband markets with a 6.7% quarterly growth rate.

-

The share of FTTH/B in the total fixed broadband subscriptions increased further and stood at 72.68%. Broadband connections based on other technologies saw their market shares shrink again, with an exception of satellite and fixed wireless access (FWA).

-

Year-on-year, FTTH/B connections grew by 7.2%. Satellite and FWA saw an even higher annual growth (41.6% and 31% respectively).

-

Legacy copper subscriptions declined by 12.1% y-o-y, while FTTx lines (mainly VDSL) went down by 6%, with Spain becoming one of the first countries in the world and the first major European economy to shut down its copper network completely.

-

5G FWA take-up accelerated, especially in India and the US, as a result of aggressive investments by Reliance, Bharti Airtel, T-Mobile, Verizon and AT&T.

In Q2 2025, the global fixed broadband subscriber figure grew by 1.1%, exceeding 1.53 billion. In line with seasonal trends, the growth rate was slower than in the previous quarter but it was slightly higher than in the respective quarter of 2024 (Figure 1. above and Table 1. below).

Table 1. Global broadband subscribers and quarterly growth rates. Source – Point Topic

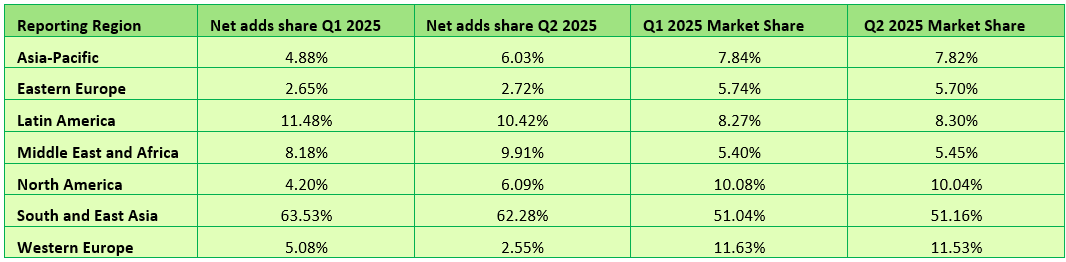

South and East Asia continues to claim the largest share of net adds in global fixed broadband subscribers, though it dropped slightly quarter-on-quarter from 63.5% to 62.3%. This was largely due to the slower quarterly growth in China, the largest broadband market of the region[3], which is inevitable due to the increasing market saturation (Table 2. below).

Other regions saw their net adds shares expand, with an exception of Latin America and Western Europe. In Western Europe, whose net adds share halved, most of the Scandinavian countries, the UK and some others saw a decline in fixed broadband subscribers, as the extent of migration to gigabit capable technologies was not sufficient to offset the decline in copper based subscriptions.

For the largest twenty broadband markets, once again all except the UK saw fixed broadband subscriber growth in Q2 2025 (Figure 5). The UK saw a -0.05% decline (compared to -0.3% in the previous quarter), as the FTTP growth was not sufficient to offset the decline in DSL, FTTx and cable broadband connections. For several quarters now India is at the top of this cohort, with a 6.7% growth, continuing to show huge growth potential due to the low fixed broadband penetration (16% of households) and the fast growing economy. Along with Canada, India also saw the largest increase in quarterly growth, compared to Q1 2025.

Globally, healthy quarterly FTTH/B growth rates were spread around the world, with the less advanced economies and more youthful fibre markets generally exhibiting higher growth. In the last 12 months to the end of Q2 2025, the number of DSL lines saw another decline (-12.1%), while FTTH/B connections grew by 7.2%. The decline in FTTx was -6%, while cable (HFC) broadband subscribers dropped by -0.9%.

The decline in copper and FTTx (mainly VDSL) is not surprising. When it comes to cable/HFC, it is not immune to competition from other technologies either. The US is a good example, being the largest cable market globally. There the decline has continued as major players such as Comcast, Charter, Cox, Altice and others are losing customers. Competition from telcos who are rapidly expanding their fibre footprints (AT&T, Verizon, Frontier, Lumen, Consolidated Communications) and offering symmetric bandwidth, superior upload speeds and lower latency is partly to blame. At the same time, cable broadband prices have risen steadily due to promotional offer expirations, ‘network fees’, and equipment costs. Finally, 5G FWA home broadband from T-Mobile, Verizon and AT&T has exploded, with their customer numbers jumping year-on-year by 31%, 34% and 194% respectively.

Globally, wireless broadband (FWA, 5G FWA and LTE fixed) connections also continued to grow – they went up by 31% year-on-year, largely impacted by an explosive growth of 5G FWA in India (332% year-on-year) as well as the US (39%). In India, Reliance and Bharti Airtel are marching ahead with 5G FWA rollouts, capitalising on the huge potential of the enormous broadband hungry market.

Point Topic expects this trend to continue due to the fact that FWA networks are easier to scale after the initial investment, FWA broadband services being generally cheaper for consumers than the alternatives, easy to self-install, and being ‘good enough’ for streaming, remote work, and average household use, as well as the demand for connectivity in remote and underserved areas. Having said that, this applies primarily to the more advanced FWA, especially 5G based. They are also seeing a decline in subscriptions based on older FWA variants in some markets.

Point Topic: FTTP broadband subs to reach 1.12bn by 2030 in 29 largest markets

U.S. broadband subscriber growth slowed in 1Q-2024 after net adds in 2023

Point Topic Comprehensive Report: Global Fixed Broadband Connections at 1.377B as of Q1-2023

Point Topic: Global Broadband Tariff Benchmark Report- 2Q-2022

Point Topic: Global fixed broadband connections up 1.7% in 1Q-2022, FTTH at 58% market share

Cable broadband subscriber growth slows while FTTx and FWA gain ground