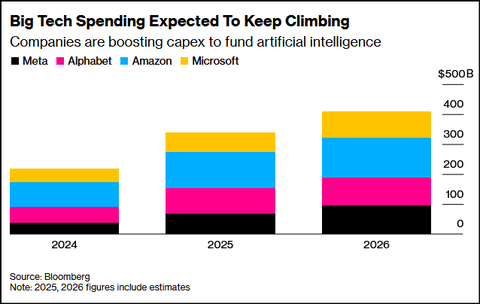

AI spending boom accelerates: Big tech to invest an aggregate of $400 billion in 2025; much more in 2026!

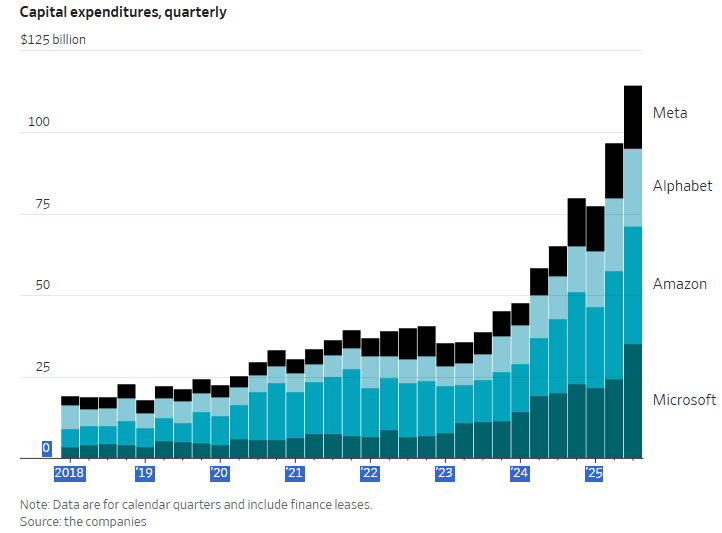

- Meta Platforms says it continues to experience capacity constraints as it simultaneously trains new AI models and supports existing product infrastructure. Meta CEO Mark Zuckerberg described an unsatiated appetite for more computing resources that Meta must work to fulfill to ensure it’s a leader in a fast-moving AI race. “We want to make sure we’re not underinvesting,” he said on an earnings call with analysts Wednesday after posting third-quarter results. Meta signaled in the earnings report that capital expenditures would be “notably larger” next year than in 2025, during which Meta expects to spend as much as $72 billion. He indicated that the company’s existing advertising business and platforms are operating in a “compute-starved state.” This condition persists because Meta is allocating more resources toward AI research and development efforts rather than bolstering existing operations.

- Microsoft reported substantial customer demand for its data-center-driven services, prompting plans to double its data center footprint over the next two years. Concurrently, Amazon is working aggressively to deploy additional cloud capacity to meet demand. Amy Hood, Microsoft’s chief financial officer, said: “We’ve been short [on computing power] now for many quarters. I thought we were going to catch up. We are not. Demand is increasing.” She further elaborated, “When you see these kinds of demand signals and we know we’re behind, we do need to spend.”

- Alphabet (Google’s parent company) reported that capital expenditures will jump from $85 billion to between $91 billion and $93 billion. Google CFO Anat Ashkenazi said the investments are already yielding returns: “We already are generating billions of dollars from AI in the quarter. But then across the board, we have a rigorous framework and approach by which we evaluate these long-term investments.”

- Amazon has not provided a specific total dollar figure for its planned AI investment in 2026. However, the company has announced it expects its total capital expenditures (capex) in 2026 to be even higher than its 2025 projection of $125 billion, with the vast majority of this spending dedicated to AI and related infrastructure for Amazon Web Services (AWS).

- Apple: Announced it is also increasing its AI investments, though its overall spending remains smaller in comparison to the other tech giants.

As big as the spending projections were this week, they look pedestrian compared with OpenAI, which has announced roughly $1 trillion worth of AI infrastructure deals of late with partners including Nvidia , Oracle and Broadcom.

Despite the big capex tax write-offs (due to the 2025 GOP tax act) there is a large degree of uncertainty regarding the eventual outcomes of this substantial AI infrastructure spending. The companies themselves, along with numerous AI proponents, assert that these investments are essential for machine-learning systems to achieve artificial general intelligence (AGI), a state where they surpass human intelligence.

Yet skeptics question whether investing billions in large-language models (LLMs), the most prevalent AI system, will ultimately achieve that objective. They also highlight the limited number of paying users for existing technology and the prolonged training period required before a global workforce can effectively utilize it.

During investor calls following the earnings announcements, analysts directed incisive questions at company executives. On Microsoft’s call, one analyst voiced a central market concern, asking: “Are we in a bubble?” Similarly, on the call for Google’s parent company, Alphabet, another analyst questioned: “What early signs are you seeing that gives you confidence that the spending is really driving better returns longer term?”

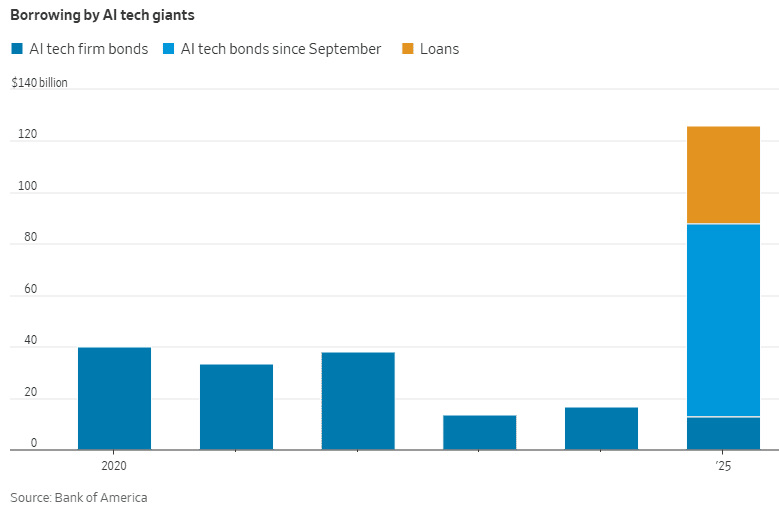

Bank of America (BofA) credit strategists Yuri Seliger and Sohyun Marie Lee write in a client note that capital spending by five of the Magnificent Seven megacap tech companies (Amazon.com, Alphabet, and Microsoft, along with Meta and Oracle) has been growing even faster than their prodigious cash flows. “These companies collectively may be reaching a limit to how much AI capex they are willing to fund purely from cash flows,” they write. Consensus estimates of AI capex suggest will climb to 94% of operating cash flows, minus dividends and share repurchases, in 2025 and 2026, up from 76% in 2024. That’s still less than 100% of cash flows, so they don’t need to borrow to fund spending, “but it’s getting close,” they add.

………………………………………………………………………………………………………………………………………………………………….

Google, which projected a rise in its full-year capital expenditures from $85 billion to a range of $91 billion to $93 billion, indicated that these investments were already proving profitable. Google’s Ashkenazi stated: “We already are generating billions of dollars from AI in the quarter. But then across the board, we have a rigorous framework and approach by which we evaluate these long-term investments.”

Microsoft reported that it expects to face capacity shortages that will affect its ability to power both its current businesses and AI research needs until at least the first half of the next year. The company noted that its cloud computing division, Azure, is absorbing “most of the revenue impact.”

Amazon informed investors of its expedited efforts to bring new capacity online, citing its ability to immediately monetize these investments.

“You’re going to see us continue to be very aggressive in investing capacity because we see the demand,” said Amazon Chief Executive Andy Jassy. “As fast as we’re adding capacity right now, we’re monetizing it.”

Meta’s chief financial officer, Susan Li, stated that the company’s capital expenditures—which have already nearly doubled from last year to $72 billion this year—will grow “notably larger” in 2026, though specific figures were not provided. Meta brought this year’s biggest investment-grade corporate bond deal to market, totaling some $30 billion, the latest in a parade of recent data-center borrowing.

Apple confirmed during its earnings call it is also increasing investments in AI . However, its total spending levels remain significantly lower compared to the outlays planned by the other major technology firms.

Skepticism and Risk:

While proponents argue the investments are necessary for AGI and offer a competitive advantage, skeptics question if huge spending (capex) on AI infrastructure and large-language models will achieve this goal and point to limited paying users for current AI technology. Meta CEO Zuckerberg addressed this by telling investors the company would “simply pivot” if its AGI spending strategy proves incorrect.

The mad scramble by mega tech companies and Open AI to build AI data centers is largely relying on debt markets, with a slew of public and private mega deals since September. Hyperscalers would have to spend 94% of operating cash flow to pay for their AI buildouts so are turning to debt financing to help defray some of that cost, according to Bank of America. Unlike earnings per share, cash flow can’t be manipulated by companies. If they spend more on AI than they generate internally, they have to finance the difference.

Hyperscaler debt taken on so far this year have raised almost as much money as all debt financings done between 2020 and 2024, the BofA research said. BofA calculates $75 billion of AI-related public debt offerings just in the past two months!

In bubbles, everyone gets caught up in the idea that spending on the hot theme will deliver vast profits — eventually. When the bubble is big enough, it shifts the focus of the market as a whole from disliking capital expenditure, and hating speculative capital spending in particular, to loving it. That certainly seems the case today with surging AI spending. For much more, please check-out the References below.

Postscript: November 23, 2025:

In this new AI era, consumers and workers are not what drives the economy anymore. Instead, it’s spending on all things AI, mostly with borrowed money or circular financing deals.

BofA Research noted that Meta and Oracle issued $75 billion in bonds and loans in September and October 2025 alone to fund AI data center build outs, an amount more than double the annual average over the past decade. They warned that “The AI boom is hitting a money wall” as capital expenditures consume a large portion of free cash flow. Separately, a recent Bank of America Global Fund Manager Survey found that 53% of participating fund managers felt that AI stocks had reached bubble proportions. This marked a slight decrease from a record 54% in the prior month’s survey, but the concern has grown over time, with the “AI bubble” cited as the top “tail risk” by 45% of respondents in the November 2025 poll.

JP Morgan Chase estimates up to $7 trillion of AI spending will be with borrowed money. “The question is not ‘which market will finance the AI-boom?’ Rather, the question is ‘how will financings be structured to access every capital market?’ according to strategists at the bank led by Tarek Hamid.

As an example of AI debt financing, Meta did a $27 billion bond offering. It wasn’t on their balance sheet. They paid 100 basis points over what it would cost to put it on their balance sheet. Special purpose vehicles happen at the tail end of the cycle, not the early part of the cycle, notes Rajiv Jain of GQG Partners.

It’s clear to me that Big Tech is making a huge bet on AI. Such massive investments will certainly accelerate progress, but also pose high risks if LLM models and infrastructure don’t deliver commensurate returns.

“The gen AI paradox”:

In a June 2025 study by consulting firm McKinsey, almost 80% of companies reported using generative A.I., but about the same number reported that the tools had not significantly affected their earnings. At the heart of this paradox is an imbalance between “horizontal” (enterprise-wide) copilots and chatbots—which have scaled quickly but deliver diffuse, hard-to-measure gains—and more transformative “vertical” (function-specific) use cases—about 90% of which remain stuck in pilot mode

https://www.mckinsey.com/capabilities/quantumblack/our-insights/seizing-the-agentic-ai-advantage

It’s unlikely, however, that big established companies will be able to substitute A.I. for large numbers of workers over the next year or two. One reason is that big companies are by their nature plodding and bureaucratic when reimagining their work processes. The McKinsey report observed that many companies’ flirtation with A.I. had involved “a proliferation of disconnected micro-initiatives” that suffered from “limited coordination.”

A study released this summer by researchers at M.I.T. reached a similar conclusion, finding that industries other than technology and media showed “little structural change” as a result of A.I.

https://www.nytimes.com/2025/11/07/business/layoffs-ai-replacement.html

From Nov 8, 2025 NY Times:

According to an investor offering sheet obtained by DealBook, Blackstone is on the cusp of closing a $3.46 billion commercial-mortgage-backed securities (C.M.B.S.) offering to refinance debt held by QTS, the biggest player in the artificial intelligence infrastructure market. It would be the largest deal of its type this year in a fast-accelerating market. (Blackstone declined to comment.)

The bonds would be backed by 10 data centers in six markets (including Atlanta, Dallas and Norfolk, Va.) that together consume enough energy to power Burlington, Vt., for half a decade.

Blackstone’s offering is part of the latest push in the A.I. infrastructure financing blitz. According to McKinsey, $7 trillion in data center investment will be required by 2030 to keep up with projected demand. Google, Meta, Microsoft and Amazon have together spent $112 billion on capital expenditures in the past three months alone.

The sheer scale of spending is spooking investors: Meta’s stock tumbled 11 percent after the company revealed its aggressive capital expenditure plans last week, and tech stocks have sold off this week on overvaluation fears.

Now, the tech giants are turning to financing maneuvers that may add to the risk. To obtain the capital they need, hyperscalers have leveraged a growing list of complex debt-financing options, including corporate debt, securitization markets, private financing and off-balance-sheet vehicles. That shift is fueling speculation that A.I. investments are turning into a game of musical chairs whose financial instruments are reminiscent of the 2008 financial crisis.

Big tech companies are looking for new sources of financing. While Meta, Microsoft, Amazon and Google previously relied on their own cash flow to invest in data centers, more recently they’ve turned to loans. To diversify their debt, they’re repackaging much of it as asset-backed securities (A.B.S.). About $13.3 billion in A.B.S. backed by data centers has been issued across 27 transactions this year, a 55 percent increase over 2024.

If investors want to buy data center A.B.S., they have two options, according to Sarah McDonald, a senior vice president in the capital solutions group at Goldman Sachs: They can invest in a data center that has one tenant, like a hyperscaler, or in a co-location data center, which has thousands of smaller tenants. The former is an investment-grade tenant with a long-term lease, but the risk is highly concentrated; the latter is most likely renting out to noninvestment-grade tenants with short-term leases, but the investment is extremely diversified.

Digital infrastructure “is something that investors have a huge appetite for,” McDonald said.

Despite the increase in popularity, data center securities are just a small slice of the A.B.S. market, which is dominated by credit card, auto, consumer and student loans.

Blackstone’s $3.46 billion C.M.B.S. offering may seem like small potatoes compared with some other debt-fueled deals, such as Meta’s $30 billion corporate offering to finance its data center in Louisiana. But it’s unprecedented for the C.M.B.S. market, where issuance for data-center-backed deals was just $3 billion for all of 2024.

“They realize how much cash they’re going to need, so they’re getting the C.M.B.S. market comfortable with this type of asset,” said Dan McNamara, the founder and chief investment officer of Polpo Capital, a hedge fund that focuses on C.M.B.S. He added that while most traders in the market were well versed in assets like office space or industrial buildings, with data centers, “it’s not traditional ‘bricks and sticks’ commercial real estate.”

To complicate matters further, the share of single-asset-single-borrower securities (S.A.S.B.) — for example, the assets inside the bond being sold are all from the same company or a single data center — is rising, with 13 percent of all S.A.S.B. deals coming from data centers, according to Goldman Sachs.

“It’s one company, and these assets are quite similar. If there’s a problem with A.I. data centers, like if their current chips are obsolete in five years, you could have big losses in these deals,” McNamara said. “That’s the knock on S.A.S.B.: When things go bad, they go really bad.”

https://www.nytimes.com/2025/11/08/business/dealbook/debt-has-entered-the-ai-boom.html

Fears of an AI bubble fueled stock market volatility in recent weeks as big tech valuations stretched and Wall Street’s top executives warned of a market correction. Global AI-related investments are projected to exceed $4 trillion by 2030, reflecting investor zeal to capitalize on a technology that surged in popularity after ChatGPT was launched three years ago. Record spending by big tech persists despite skepticism about a near-term payoff as many organizations report zero measurable return from billions in capital investment. Tech sector valuations have soared to dot-com era levels – and, based on price-to-sales ratios, well beyond them. Some of AI’s biggest proponents acknowledge the fact that valuations are overinflated, including OpenAI chairman Bret Taylor:

AI will transform the economy… and create huge amounts of economic value in the future,” Taylor told The Verge. “I think we’re also in a bubble, and a lot of people will lose a lot of money.”

Alphabet’s (GOOG) (GOOGL) Sundar Pichai sees “elements of irrationality” in the current scale of AI investing, not unlike the excessive investment during the dot-com boom. If the AI bubble bursts, Pichai added, no company will be immune, including Alphabet, despite its breakthrough technology, Gemini, fueling gains.

Big tech and AI start-ups like OpenAI and Anthropic are leaning heavily on circular deals and heavy debt to finance AI spending has raised eyebrows on Wall Street.

The top five hyperscalers have raised a record $108B worth of debt in 2025 – more than 3x the average over the past nine years, according to data compiled by Bloomberg Intelligence. Moreover, some firms are turning to off-balance-sheet entities, including special-purpose vehicles (SPVs) – structures with a checkered history going back to Enron, D.A. Davidson analyst Gil Luria observed. A slowdown in AI demand could render the debt tied to these SPVs “worthless,” Luria warned, potentially triggering another financial crisis.

AI’s rapid expansion has masked some underlying economic issues. As US investment in AI-related industries surged over the past five years, non-AI investment remained stagnant, a Deutsche Bank research report revealed. And, outside of data centers, economic demand has been weak. In fact, the US would be close to a recession this year without technology-related spending, the report added. Meanwhile, a front-loading of chip orders has helped offset some of the tariff-driven constraints on global trade.

https://seekingalpha.com/article/4848572-5-top-stocks-for-ai-fatigue