Technology Assessment

Global telecom infrastructure market outlook after a dismal 2024

Despite the telecom industry’s hopes that 2025 will usher in a turnaround for the global network equipment market, there’s no hint of that happening considering how bad 2024 was.

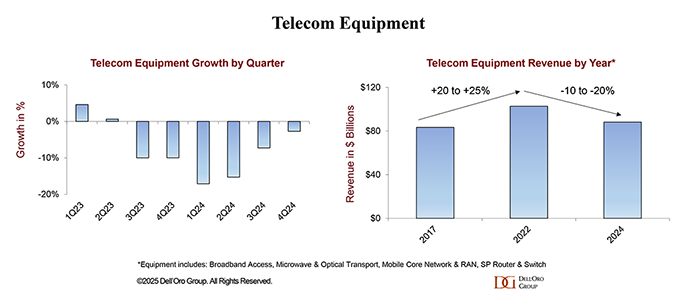

According to Dell’Oro Group, worldwide telecom equipment market revenues in 2024 dropped 11% year-over-year – marking “the steepest annual decline in more than 20 years.”

Dell’Oro VP Stefan Pongratz wrote:

“Preliminary findings suggest that worldwide telecom equipment revenues across the six telecom programs tracked at Dell’Oro Group—Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch—declined 11% year-over-year (YoY) in 2024, recording the steepest annual decline in more than 20 years (decline was >20% in 2002), propelling total equipment revenue to fall by 14% over the past two years. This remarkable output deceleration was broad-based across the telecom segments and driven by multiple factors, including excess inventory, challenging macro environment, and difficult 5G comparisons.

In 4Q24, stabilization was driven by growth in North America and EMEA, which nearly offset constrained demand in Asia Pacific (including China).

The full-year decline was uneven across the six telecom programs. Optical Transport, SP Routers, and RAN saw double-digit contractions, collectively shrinking by 14% in 2024. Microwave Transport and MCN experienced a more moderate combined decline in the low single digits, while Broadband Access revenues were fairly stable.

Similarly, regional developments were mixed in 2024. While the slowdown was felt across the five regions — North America, EMEA, Asia Pacific, China, and CALA — the deceleration was more pronounced in the broader Asia Pacific region, reflecting challenging conditions in China and Asia Pacific outside of China.

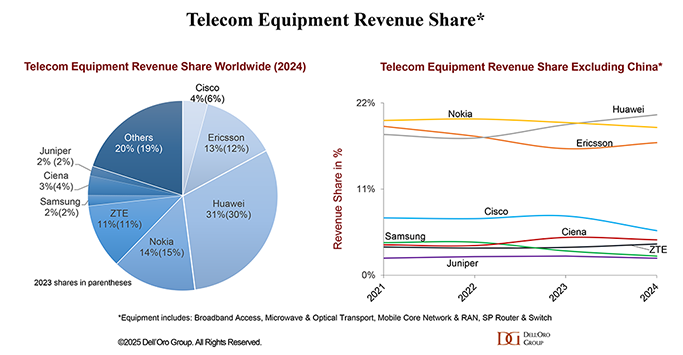

Supplier rankings were mostly unchanged globally, while revenue shares shifted slightly as both Huawei and Ericsson positions improved. Overall market concentration was stable with the 8 suppliers comprising around ~80% of the worldwide market in 2024.

Rankings changed outside of China. Initial estimates suggest Huawei passed Nokia to become the #1 supplier, followed by Nokia and Ericsson. Huawei’s revenue share outside of China was up 2 to 3 percentage points in 2024, relative to 2021, while Ericsson is down roughly two percentage points over the same period/region.

A glimmer of hope is that the Covid instigated inventory correction is over and the supply chain is starting to recover. For example, Ciena recently noted its problems with “inventory digestion” are mostly over. CEO Gary Smith said that customers are again investing in scaling their networks, specifically for the anticipated increase in cloud traffic and new AI workloads, including Managed Optical Fiber Networks opportunities with the cloud providers.

However, that might take time to play out. Vendors may have to take at least 6-12 months to retool their supply chains due to tariffs, AvidThink Principal Roy Chua has said. And given the “will-they, won’t-they” situation going on with the tariffs, their ultimate impact remains to be seen.

…………………………………………………………………………………………………………………………………..

It’s been six years since 5G networks have been commercially deployed. But aside from deploying fixed wireless access (FWA), telcos have struggled to “find large use cases that require 5G speeds and features,” Deloitte said in its latest telecom industry forecast.

“Not only were there seemingly few additional use cases driving 5G adoption and monetization in 2024, but there may not be many more for 2025 or even 2026 either.” The market research/accounting firm continued:

Our outlook focuses on three of those difficult choices, and we have a full chapter on each:

- In 2025, the most discussed source of growth for many industries is generative AI, and telcos are asking how they can share in that excitement. Telcos are using gen AI to reduce costs, become more efficient, and offer new services. Some are building new gen AI data centers to sell training and inference to others. A gen AI gold rush expected over the next five years. Spending estimates range from hundreds of billions to over a trillion dollars on the physical layer required for gen AI: chips, data centers, electricity. Close to another hundred billion US dollars will likely be spent on the software and services layer.

- At the same time, telcos are roughly at the midpoint between the launch of 5G and the expected launch of 6G, and they want to confirm that they can shape 6G to be more profitable than 5G has so far been.

- Finally, after years of divesting noncore assets, telcos are getting primed to deploy M&A strategies in pursuit of growth.

Globally, the telecommunications industry is expected to have revenues of about US$1.53 trillion in 2024, up about 3% over the prior year. Both in 2024 and out to 2028, growth is expected to be higher in Asia Pacific and Europe, Middle East, and Africa, with growth in the Americas being around 1% annually. All three regions are expected to surpass half a trillion dollars in revenue each by 2027. By market cap, the sector is about US$2.6 trillion globally (Figure 1, below).

Stefan summed up: “Market conditions are expected to stabilize in 2025 on an aggregated basis, though it will still be a challenging year. The analyst team is collectively forecasting global telecom equipment revenues across the six programs to stay flat.”

References:

https://www.fierce-network.com/broadband/global-telecom-infra-faced-ultimate-pitfall-2024

Telco spending on RAN infrastructure continues to decline as does mobile traffic growth

Dell’Oro: Global RAN Market to Drop 21% between 2021 and 2029

Dell’Oro: Global telecom CAPEX declined 10% YoY in 1st half of 2024

Dell’Oro: Private RAN revenue declines slightly, but still doing relatively better than public RAN and WLAN markets

Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

Dell’Oro: 4G and 5G FWA revenue grew 7% in 2024; MRFR: FWA worth $182.27B by 2032

Highlights of Dell’Oro’s 5-year RAN forecast

India’s Data Transmission Capacity to Quadruple in 2025 via New Submarine Cables

India’s data transmission capacity is projected to increase fourfold by 2025 with the activation of new submarine cable systems connecting the country to key global markets, said TRAI Chairman Anil Kumar Lahoti at the Digicom Summit. Currently, India hosts 17 international subsea cables across 17 landing stations.

“As of the end of 2023, the total lit capacity and activity and activated capacity of these cables stood at 180 TBPS (terabit per second) and 132 TBPS, respectively. Multiple next-generation systems are due to become operational in 2025, replacing ageing cables. Once the new systems are fully operational, India’s data transmission capacity is projected to quadruple with additional crucial routes,” Lahoti said.

Lahoti highlighted the telecom sector’s role in driving India’s digital economy, which contributes 12% to GDP and is expected to reach 20% by 2026-27. The telecom user base in India has expanded to approximately 1.2 billion users, with 944 million having broadband access.

“Since the current growth rate of the digital economy is 2.8 times the GDP growth rate. Accordingly, the government aims for a USD 1 trillion digital economy by 2027-28. The Indian telecom sector, which is the backbone of a digital economy, has witnessed significant development in recent years, setting the stage for a transformative era given unprecedented data consumption, a vast user base, and a policy-type friendly environment. India continues to foster industry growth and digital connectivity,” Lahoti said.

“One of the hallmarks is achieving over 100 times growth in rural broadband subscriptions in the last decade. In license service areas such as Assam, Bihar, Himachal Pradesh, Odisha and Uttar Pradesh East, the aggregate count of rural broadband connections is significantly higher than the aggregate count of urban broadband connections,” he added.

India’s telecom user base has expanded to 1.2 billion, including 944 million broadband subscribers. Rural broadband subscriptions have surged 100-fold over the past decade, outpacing urban growth in states such as Assam, Bihar, and Uttar Pradesh East.

Lahoti also reportedly acknowledged the effort of telecom operators in providing 4G coverage across 97% of the villages and 5G connectivity in over 99 per cent of districts in the country. The upgraded submarine cable network is expected to further strengthen India’s global connectivity and drive the next phase of its digital transformation.

References:

India’s Data Transmission Capacity to Quadruple in 2025 with New Submarine Cables: Report

Communications Minister: India to be major telecom technology exporter in 3 years with its 4G/5G technology stack

India Mobile Congress 2024 dominated by AI with over 750 use cases

Reliance Jio vs Starlink: administrative process or auction for satellite broadband services in India?

Strand Consult’s 2024 Telecom Predictions

by John Strand, Founder and CEO of Strand Consult

Introduction:

2024 is poised to be an important year as more than half of the world’s population is poised to vote. Elections create clarity and regime change. They are pivotal because they signal national policy direction for industry and society, not the least being mobile telecom stakeholders. Following are Strand Consult’s hard thoughts on the year ahead. For some holiday mirth and an insightful summary of the challenges facing the telecom industry in 2024, listen to the Telecoms.com podcast featuring telecom legend Denis O’Brien from Digicel in conversation with editors Scott Bicheno (Telecoms.com) and Iain Morris (Light Reading.com).

Geopolitics

2024 is an election year, and more than half of the world’s population are scheduled to vote in 2024. Four critical elections will be held in the Free World: Taiwan on January 23; General elections in India in April-May; the European Parliament on 6 to 9 June; and the US Presidential election on November 5. Separately, a press release notes that a Russian presidential election will be held on 15 to 17 March, and Vladimir Putin will get a fifth term. China canceled free elections again in 2024.

There is limited policymaking in countries during election years, so the policy action is likely to be in the countries in off-election years. However, elections may slow needed action to address conflicts in Ukraine and the Middle East.

Moreover, China continues to partner with dictators, and grow more aggressive. General Secretary Xi Jinping faces limited opposition and critical press. However, many see his reign as a disaster including the mishandling of Covid, the souring economy, and the lost goodwill with other nations, particularly as XI cozies up to Russia’s Putin, North Korea’s Kim Jong Un, and Iran’s Hassan Rouhani.

There still remain mobile telecom operators in the free world which espouse democratic values and yet partner with China’s Huawei and ZTE. The operators reject the claim of security risk and dismiss or downplay the demonstrated control Xi and the party exact on China’s enterprises. The policy secure networks in US and EU has nothing to do with trade, but rather reflects the reality that China has changed fundamentally in the last decade.

2024 will also show the results of the implementation of the EU 5G security toolbox with increased attention on trusted versus non-trusted operators, not just vendors. Nations outside the EU will be inspired by the diplomatic EU approach.

Misguided Regulation

When Strand Consult launched almost 30 years ago, “regulation” had little to no impact on the industry. There were no internet activists trolling telecom regulatory authorities. Today, however, regulation can have a huge impact for both good and ill.

A decade ago Strand Consult published the report The EU’s Broadband and Telecom policy is not working. Europe is falling further behind the US documenting how US operators invested twice as much in infrastructure as their European counterparts over a long period. That trend is ongoing. The US still invests at twice the rate of the EU; the EU is further behind, and the EU gap to close the digital divide has widened from €150 billion to €274 billion.

2024 will be another year in which the EU will publish reports showing that Europe is behind. And yet, European policymakers continue to reject solutions like in-country consolidation which could help firms improve their business case for growth and investment and could ultimately improve the dismal picture for the EU.

Meanwhile the United States, India, and many African nations have completed successful consolidations. The operating results of most telecom firms in these countries are better than those in Europe. EU policymakers accept the status quo of ever-worsening returns and a growing investment deficit.

When it comes to creating better conditions for infrastructure deployment, Europe is also far behind other parts of the world. The only exception in the EU is Denmark, where Strand Consult’s research which started 10 years ago, has made it easier and significantly cheaper to roll out infrastructure in Denmark.

The EU Parliament’s Gigabit Infrastructure Act introduced this year promises faster rollout of gigabit-capable connectivity. It is a solution that helps fixed infrastructure providers. The question remains as to how many years it takes before implementation at the local level. Strand Consult does not expect to see this the effect of this Act in 2024, or even for some years, given rising interest rates. Simply put, the EU bill is too little and about 15 years too late.

The EU’s Digital Markets Act (DMA) proposes to regulate online content and social media platforms. The big question is how to implement it in practice. It will be interesting to see whether Big Tech will censor EU policymakers. There is a similar hubris with the EU’s Artificial Intelligence Act (AI Act) and how it promises “transparency” of algorithms. It’s hard to believe that any European official has the skills to make such an assessment. As AI business models have yet to be proven, the regulation seems premature. No bureaucrat can say whether Google, Microsoft, AWS, ChatGPT, or some other entity has the better AI solution.

Chips, chips, and Chinese chips

All chips matter – whether NVIDIA’s state of the art chips for AI or workhorse memory chips. This has only been heightened by the supply chain shortages driven by Covid-19 and security challenges. Russia, Iran, North Korea and China want advanced chips used for military purposes. Free world nations have imposed restrictions on chips for certain military users; this could only work because firms in the US, Netherlands, Korea, Japan, and Taiwan have the relevant IP.

China is heavily dependent on this advanced chip technology, and indeed firms of all kinds try to work around these rules. Some companies even break them with the expectation that they won’t be caught or fined (See Applied Materials). China has tried for 40 years to get a leadership position in advanced chips with limited success. However, though size and scale, China can impact global chip supply with currency manipulation and by flooding the market with low-end products.

In 2024 China will bombard the media with propaganda saying that if they can’t get an advanced supply of chips, then they will make it themselves. This should be taken with a grain of salt. Strand Consult describes Huawei’s challenges given chip restrictions and its various workarounds and creative messaging. Huawei is diversifying its business and doing an IBM-style transformation, going from a hardware company to a software/service one. It could make Huawei less dependent on its own hardware.

Chip policy will stay salient in 2024.

OpenRAN vs. 3GPP 5G RAN

Strand Consult’s predictions about OpenRAN have been spot on, revealing the stories to be the greater part of hype rather than market value. OpenRAN revenue as a share of the mobile infrastructure market is miniscule, but OpenRAN takes an outsized share of press and policymaker attention owing to Washington policy spin and Hollywood storytelling.

The party version of OpenRAN is to break incumbent vendor lock-in, reduce costs, promote innovation, and simplify network deployment and upgrade. This approach has gained attention and support from some telecommunications industry players, standardization bodies, and regulatory authorities to enhance competition and accelerate the development of 5G and beyond. However compelling a storyline, the reality is that OpenRAN does not provide a meaningful technical and commercial alternative to existing RAN players Huawei, Ericsson, Nokia, ZTE and Samsung.

In other words, you can’t put a hodge podge of virtual elements in a 1:1 matchup for existing RAN solutions. There are a few one-off OpenRAN solutions, but these are sideshows. There are proprietary RAN solutions that can connect to different interfaces. OpenRAN has the same function as a USB cable when connecting an iPhone with a Windows PC. With the new OpenRAN specifications launched in Osaka this summer, it is equivalent to going from using a USB-A to a lightning cable to using a USB-C to a USB-C cable.

Of the 200 3GPP/5G networks deployed globally, just three could be classified as OpenRAN. Of the install base of 5G RAN base stations, OpenRAN has about 1 percent market share of the install 5G base.

2024 could see the O-RAN Alliance folded into 3GPP. Or it could be pushed to 2025. 3GPP already works with many open interfaces, and this will drive the O-RAN Alliance to dismantle itself. The key stumbling block to OpenRAN implementation is operators themselves; they don’t want more complexity in networks. There is still value to the one-stop shop, as AT&T just demonstrated with its 5-year, $14 billion deal with Ericsson.

Business models

Over the last 25 years, the mobile telecom industry has moved from selling volume-based traffic to flat rate, all you can eat models. This has been driven for a variety of reasons. However, we predict 2024 will mark a shift with more flexibility at the high and low end of the market, read high value premium service for gamers and packages with bespoke services for the budget market.

Something’s gotta give. Internet adoption has stalled with 2.6 billion people globally offline for lack of access and affordability. Interest rates are rising, and average revenue per user (ARPU) is falling. Alternatively, we could see some nations allow needed in-market consolidation.

Operators have tried and failed to launch new platforms (think Orange World, Vodafone Live, GSMA’s OneAPI). In the year 2000, there was a 3G dream to double ARPU, from €36 to €72 Euro. Today ARPU is at or below €14 in many European countries. OTT solutions like Skype and WhatApp have proven more successful. Hence Strand Consult is not optimistic for GSMA’s Open Gateway in 2024.

For a deep dive on the state the mobile operators today, read Strand Consult’s latest research note Has the iPhone improved the mobile operators’ business case? which revisits Strand Consult’s groundbreaking report.

Operators have four key challenges:

- Regulation which prevents business model innovation and competition with OTTs

- Competition with other operators

- Customer budget constraint

- Operators’ lack of creativity, innovation, product development, strategy etc.

Connectivity may be the most compelling service on this earth. Just turn off the internet to a 9-year-old boy’s iPhone. The problem is that telecommunications providers have not succeeded to monetize sufficiently the value they provide. Ironically connectivity is increasingly valuable, yet its unit price continues to fall, and consumers expect greater value at a ever falling price point.

Broadband cost recovery and fair share

2024 will likely see the reboot of the Free Ride Prevention Act in South Korea, as firms like Google’s Alphabet which devour more than a quarter of the nation’s bandwidth, refuse to come to the table to negotiate. There is also likely to be progress in the USA, India, and Brazil where proceedings are underway, among other countries. Given recent court cases proving that Big Tech pays for placement, the arguments against fair share have been demolished. Moreover, the court cases have documented systematic Big Tech strong-arming, if not abuse of market power. Expect Big Tech to be more open to dealmaking in lieu of being regulated. Check out Strand Consult’s Global Research Project for Broadband Cost Recovery, Affordability, and Fair Share for more information.

Satellite Industry: Musk vs. Bezos

2024 will see more focus on the use of the low earth orbit (LEO) satellites. The fight between Elon Musk (Starlink) and Jeff Bezos (Kuiper) overshadows the big picture. Musk’s Starlink is lightyear’s ahead of Bezos’ Kuiper and already has 5,420 satellites orbiting the Earth; Kuiper has just two satellites. Bezos and Musk share the same dream; the difference is that Musk has already delivered. Bezos has opened his first satellite burger bar. Musk owns the interstellar McDonald’s.

Starlink has first-mover advantage and some lock-in tech dependence. It has access to cheap lifting capacity to get its satellites into space and to operate ground stations. Even with the FCC’s partisan cancelling of $886 million in subsidies (which appears to be a punishment for Musk buying Twitter and not towing the progressive party line), the company is still likely to succeed as it thrives on overcoming adversity and challenge. Satellite is here to stay as a bona fide broadband technology, and 2024 will only make that clearer.

Wrap up

As some 4 billion people go to the polls in 2024, some important policy may be put on hold, and broadband shortfalls will remain. At the same time, voters have a valuable opportunity to signal a change in leadership and direction. However, many governments will promote policy and legislation to improve access to 5G and broadband.

Rising interest rates will have a negative impact on investment. Fiber will be hit harder than mobile, and emerging markets will have a tougher time than the developed world.

While we don’t expect a business model revolution, we expect many operators to increase prices for connectivity. And indeed, many nations will further their broadband cost recovery and fair share policy solutions to improve access and affordability.

We also predict management cleanup. CEOs who have not delivered will be let go. Consider Vodafone which was Europe’s most capitalized company in year 2000 with well over $300 billion; it has shrunk to $24 billion today. Its main success during this period was to divest Verizon in USA. Its multi billion investment in India was a dismal failure and was written off the balance sheet.

Despite the security and reputational risk, Vodafone continues to work closely with Huawei and uses this equipment across many countries. The company appointed a new CEO in early 2023. Strand Consult observed that Vodafone needs a “cleaner” like Harvey Keitel The Wolf in “Pulp Fiction.” Or they need Meryl Streep from the The Iron Lady, not the Meryl Streep in Mama Mia! Margherita Della Valle’s performance at Vodafone is associated with a falling share price.

Strand Consult does not expect to see results for mobile telecom shareholders driven by GSMA or ENTO. However, these organizations will likely continue to pay their top management high salaries. GSMA CEO Mats Granryd gets $2.4 million in annual salary to hold trade shows featuring increasingly Huawei and Meta while serving on the board of Swedish National TV and chairing Vattenfall AB and Coore AB.

Elections and security of national infrastructure will take center stage in 2024. China will wage a proxy war against those countries which don’t adopt its equipment and service platforms. With growing interest rates and inflation, there is little to make telecom shareholders happy in the coming year.

In 2023 Strand Consult published many research notes and reports and featured cool people on its guest blog. Strand Consult’s analysis was quoted in some 1000 news stories globally. Our work took us to all the continents except Antarctica. Our readership continues to grow. For the last 23 years, Strand Consult has made predictions for the coming year. Our archive shows that we get it right.

Thank you for your support and readership.

Feel free to reach me at [email protected]

References:

StrandConsult Analysis: European Commission second 5G Cybersecurity Toolbox report

StrandConsult: 2022 Year in Review & 2023 Outlook for Telecom Industry

Strand Consult: Open RAN hype vs reality leaves many questions unanswered

O-RAN Alliance tries to allay concerns; Strand Consult disagrees!

Strand Consult: What NTIA won’t tell the FCC about Open RAN

ASPI’s Critical Technology Tracker finds China ahead in 37 of 44 technologies evaluated

The Australian Strategic Policy Institute (ASPI finds that China is further ahead in more technologies than has been realized. It’s the leading country in 37 of the 44 technologies evaluated, often producing more than five times as much high-impact research as its closest competitor. This means that only seven of the 44 analysed technologies are currently led by a democratic country, and that country in all instances is the U.S. Of the ten AI and ICT-related technologies examined, China dominates in seven, the study concluded.

The ASPI study is based on an analysis of the top 10% most-cited papers in each area of research published between 2018 and 2022 – a total of 2.2 million papers. It acknowledges that a widely cited piece of research does not automatically translate into successfully deployed technology. The study also does not reflect the current state of commercialization or of technology diffusion. Here’s a table showing China leading technologies:

![]()

Source: Australian Strategic Policy Institute

……………………………………………………………………………………………………………………………………………

China leads globally in photonic sensors (43% of world’s top 10% high-impact research, 3.41 times the US), quantum communications (31%, 1.89 times the US), advanced optical communications (38%, 2.95 times the US) and post-quantum cryptography (31%, 2.3 times the US). Taken together, these observations increase the risk of Chinese communications going dark83 to the efforts of western intelligence services. This reduces the capacity to plan for contingencies in the event of hostilities85 and tensions.

China has reportedly built the physical infrastructure to claim the world’s largest quantum communication network,86 and has even established quantum communication with moving drones87 and satellites.88 As with many things, the risk is cumulative—the risk increases as China leads in both cryptography resistant to decryption by quantum computers and the ability to share encryption keys via quantum communication. One mitigating factor is the current US lead in quantum computing (34% of world’s top 10% high-impact research output, 2.26 times China).

Here are three key tech areas where China dominates in high-impact research papers:

- In advanced radiofrequency communications, including 5G and 6G, (there is no such thing as 6G radio) China ranks 1st with 29.65% vs 9.50% for the U.S. and 5.2% for the UK.

- In advanced optical communications, China ranks 1st with 37.69% vs. 12.76% for the U.S.

- In artificial intelligence (AI) algorithms and hardware accelerators, China ranks 1st with 36.62% vs. 13.26% for the U.S.

The ASPI report designates China’s lead in these technologies as “high-risk,” meaning it is a long way ahead of its closest competitor and that it is home to most of the world’s leading research bodies in that field.

Quantum communications is another area of strength for China. USTC is the top institution irrespective of the quality metrics, and a total of eight out of 20 top institutions are based in China (see Figure 9). Tsinghua University and Delft University of Technology in the Netherlands occupy the second and third places depending on the quality metrics. China’s lead in quantum communications is especially prominent in the proportion of publications in the top 10% of highly cited papers. China’s quantum research was spearheaded by the Xiangshan Science Forum for quantum information in Beijing in 1998, which resulted in experimental research in quantum information within several Chinese universities and research institutes, including USTC, Shanxi University and the Chinese Academy of Sciences’ Institute of Physics.

USTC scientist Jian-Wei Pan to demonstrate the potential of quantum communications to Xi Jinping and other Politburo members, and he became known as the founder of Chinese quantum science. In China’s Thirteenth Five-Year National Science and Technology Innovation Plan announced in August 2016,163 the CCP strengthened its quantum strategy further by listing quantum communications and computing as major science and technology projects for advances by 2030. USTC demonstrated China’s dominance in quantum communication by building the first fibre-based ‘Beijing–Shanghai Quantum Secure Communication Backbone’ in 2013, connecting Beijing, Shanghai, Jinan Hefei and 32 reliable nodes over a total transmission distance of more than 2,000 kilometres.164 The strength of quantum communications is that it ensures secure communication due to quantum entanglement, which effectively ensures that any quantum information is modified when observed. This effectively makes it difficult to amplify quantum signals in the conventional way used for current optical communications. Pan’s research team made another significant breakthrough in 2017 by using the first quantum satellite (Micius, launched in 2016), and the free space reduced attenuation to transmit image and sound information using quantum keys over 7,600 kilometres between Austria and China.

………………………………………………………………………………………………………………………………………………………………………..

ASPI warns that China’s advanced research “at the intersection of” photonic sensors, quantum communications, optical communications and post-quantum cryptography could undermine the U.S. led “Five Eyes” global intelligence network.

“Taken together, these observations increase the risk of Chinese communications going dark to the efforts of western intelligence services,” the report said. ASPI said its research will be updated with the aim of assessing the future tech capabilities of nations and to highlight long-term strategic trends.

………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.aspi.org.au/report/critical-technology-tracker

https://techtracker.aspi.org.au/

https://www.lightreading.com/6g/china-dominates-research-in-6g-and-optical-report/d/d-id/783630?

China’s MIIT to prioritize 6G project, accelerate 5G and gigabit optical network deployments in 2023

China Mobile unveils 6G architecture with a digital twin network (DTN) concept

With no 5G standard (IMT 2020) China is working on 6G!