Subsea cable systems: the new high-capacity, high-resilience backbone of the AI-driven global network

Introduction:

The subsea cable industry is entering a high-growth, high-complexity phase driven primarily by AI, hyperscale cloud expansion, and geopolitical risk. Subsea fiber-optic systems that carry more than 95% of international data traffic are being reassessed, re-engineered, and re-regulated. As of 2024, there were reportedly more than 600 submarine cable systems (532 operational + 77 planned).

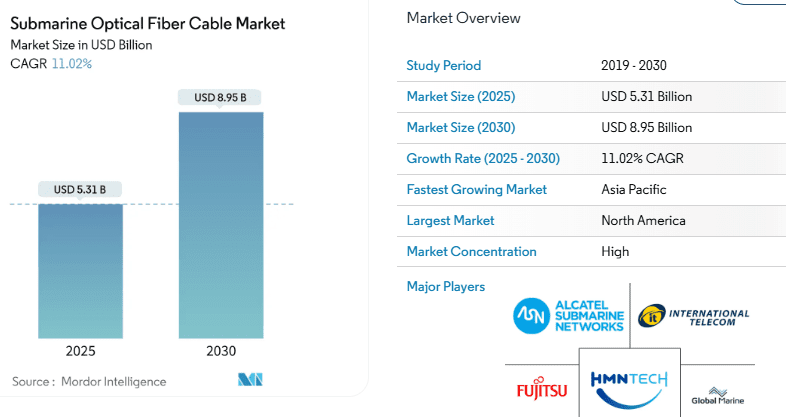

According to a Mordor Intelligence report, the global subsea-cable market is expected to grow from $5.31 Billion in 2025 to $8.95 Billion in 2030 for a CAGR of 11.02 %. That’s mostly due to rising demand for both throughput and redundancy. Here’s the market overview from Mordor Intelligence:

• The demand for submarine optical fiber cables continues to increase, driven by the growth in global internet usage, cloud services, and data consumption. The expanding digital communication needs, video streaming services, and requirements for real-time connectivity necessitate high-capacity, low- latency infrastructure for intercontinental data transmission. Submarine cables now transport more than 95% of international internet traffic, establishing themselves as essential components of global communications infrastructure.

• The expansion of data centers and investments by hyperscale companies, including Google, Meta, Amazon, and Microsoft, significantly influences market demand. These technology companies are developing private submarine cable networks to reduce their reliance on external providers and enhance platform connectivity. Their investments expand the submarine cable network and advance cable technology through improvements in wavelength-division multiplexing (WDM) and increased fiber pair capacity.

• The market growth also reflects broader geopolitical and economic developments. Developing nations seeking digital inclusion require integration into global submarine cable networks. Government initiatives and regional partnerships are implementing cable projects to connect underserved regions, improve network redundancy, and support economic growth. Geopolitical considerations have prompted countries to establish diverse cable routes, reducing dependence on specific regions or nations.

• The need for environmental resilience and network redundancy further strengthens demand. Natural disasters and geopolitical events highlight vulnerabilities in existing routes, increasing the implementation of multiple cable pathways. New opportunities for transcontinental connections are emerging, such as Arctic routes becoming viable as polar ice diminishes. These factors indicate sustained demand for submarine optical fiber cables, with ongoing investments continuing to shape international communications infrastructure.

Technology roadmaps are shifting from incremental upgrades to large-scale architectural redesign. As AI workloads surge and hyperscale cloud deployments scale globally, the priority is shifting from basic connectivity to resilient, strategically differentiated network infrastructure.

Capacity and Architecture Evolution:

-

Throughput is accelerating from traditional 20–40 Tbps systems to 400 Tbps+ class designs, enabled by:

-

Space-division multiplexing (SDM) with higher fiber-pair counts

-

Advanced coherent optics and probabilistic constellation shaping

-

More efficient repeaters and lower-loss fibers

-

-

Subsea cable systems are increasingly co-designed with hyperscalers for AI-training workloads that require extreme bandwidth and consistent low latency.

-

Hyperscalers support global cloud services, AI/ML workloads, and massive data flows — requirements that only high-capacity, high-performance undersea cables can satisfy. By owning or co-owning cables, these companies reduce dependency on traditional telecom carriers, improve redundancy, and gain more control over routing, latency, and capacity planning.

-

Historically telcos and specialized carriers laid and operated undersea cables. Now, cloud giants themselves are wrapping subsea infrastructure into their global network stacks.

-

Here’s a summary of hyperscalers in the Subsea-Cable Market:

Google

-

Google is among the most prolific investors: reportedly involved in about 33 subsea cables globally.

-

Recent and planned projects include the upcoming Humboldt Cable (linking Chile and Australia), intended to create a new South America ↔ Asia-Pacific route.

-

Google’s involvement typically aims to serve its cloud and data-center operations, improving capacity, latency, and resiliency across its global network.

Meta (parent of Facebook / Instagram / WhatsApp)

-

Meta has significantly broadened its subsea footprint. According to recent reporting, it plans a major new global cable project — possibly its largest — which would mark the first time the company is the sole owner of a fully private, global-scale undersea cable. TechCrunch+2suboptic.org+2

-

This shift underscores the company’s drive to fully own its data transport infrastructure (rather than rely on traditional telco-owned cables), giving it greater control over capacity, latency, and where traffic moves. TechCrunch+1

Amazon Web Services (AWS / Amazon)

-

AWS is also listed among the major hyperscalers investing in subsea cables globally. americangovernancetoday.com+1

-

This investment reflects the growing need for cloud providers to ensure high-bandwidth, low-latency, and resilient global connectivity to support cloud services and AI workloads. FlipHTML5+1

Microsoft

-

Microsoft is likewise involved in the construction and ownership of subsea infrastructure. americangovernancetoday.com+2German Marshall Fund+2

-

Historically, it has co-owned systems — for example, with Meta — but as with other hyperscalers, the motivation is strategic: ensuring predictable capacity, performance, and data-center interconnectivity for cloud services.

-

Resilience-by-Design:

-

The market is shifting from “best-effort” reliability to assumed-failure design, incorporating:

-

Diversified routing (avoiding choke points and geopolitically sensitive zones)

-

Deeper burial and armoring for seabed stability

-

Carrier-neutral landing stations that allow rapid rerouting

-

-

Operators are integrating real-time monitoring, predictive maintenance, and autonomous fault detection into cable management platforms.

Integration with Cloud and Edge:

-

New cables are being deployed with cloud data center adjacency as a primary requirement, not an afterthought.

-

Growth in regional AI/ML clusters is prompting:

-

More mid-ocean branching units to improve localization

-

Distributed landing sites connected to edge compute locations

-

Greater dependence on software-defined interconnection and global WAN orchestration

-

Pressure Points – Capacity, Risk, and Regulation:

Network operators and governments are navigating three major challenges:

1. Geopolitical and security risk: Accidental cuts, anchor strikes, and deliberate interference are increasingly treated as systemic vulnerabilities.

2. Permitting, route diversity, and climate exposure: Coastal erosion, the need for protected landing zones, and more complex regulatory regimes are reshaping route planning and deployment timelines.

3. AI-driven bandwidth requirements: Next-generation systems must support orders-of-magnitude higher capacity with lower latency, optimized for AI-training and high-density cloud workloads.

These forces are shifting strategies from “What is the lowest-cost route?” to “What routes provide strategic resilience, scalability, and long-term value?”

Key Takeaways from the Modor Intelligence Report:

- By component, wet-plant equipment held 53.20% of the submarine optical fiber cable market share in 2024, and auxiliary and marine services are projected to advance at a 12.03% CAGR between 2025-2030.

- By cable type, single-mode fiber accounted for 67.89% of the submarine optical fiber cable market size in 2024, and SDM multi-core fiber is forecast to grow at a 13.89% CAGR through 2030.

- By client type, telecom operators still held a 62.00% market share in 2024 of the submarine optical fiber cable market size, while hyperscale cloud providers are outpacing them at a 12.98% CAGR through 2030.

- By capacity design, systems rated 16-60 Tbps held 56.00% market share in 2024, and above-60 Tbps links are advancing at a 13.70% CAGR through 2030.

- By geography, North America led with a 36.78% revenue share in 2024; the Asia Pacific is poised for the fastest expansion at an 11.56% CAGR through 2030.

Case Study: Mid-Atlantic Positioning:

Smaller jurisdictions are emerging as strategic nodes traditionally dominated by major cable hubs. Bermuda is one example: the island’s 2020 Submarine Communications Cable Act introduced one of the Atlantic region’s most transparent frameworks for landing-site permitting and protection zones.

With multiple new systems planned or announced, Bermuda demonstrates how geography combined with regulatory clarity can create a defensible strategic position. Rather than relying on promotional incentives, the jurisdiction offers disciplined permitting processes, alignment with investor timelines, and compatibility with broader route-diversification strategies.

Three trends will define the next phase of subsea-cable strategy:

-

Explosive throughput growth: Designs are moving toward 400-Tbps-class systems and high-fiber-pair architectures purpose-built for AI-training workloads.

-

Resilience and route diversity by default: Outages are assumed rather than hypothetical. Systems are being engineered with alternative paths, deeper burial, and more carrier-neutral landing facilities.

-

Regulation as part of core infrastructure strategy: Governments are treating subsea cables as strategic assets, increasing scrutiny on landing rights, environmental permitting, and data-sovereignty implications.

Security and Sovereignty Considerations:

-

Governments are classifying subsea cables as strategic infrastructure, driving:

-

Tighter control over landing rights and ownership structures

-

Requirements for physical and logical segmentation

-

Increased surveillance for tampering, espionage, and sabotage

-

-

Encryption and trust architectures are being embedded deeper into cable system design.

Deployment Speed and Regulatory Overhead:

-

As climate risk, permitting complexity, and geopolitical scrutiny increase, deployments take longer and require more contingencies.

-

Technology choices now depend partly on which routes can be approved, protected, and operationally supported long-term.

Implications for Site-Selectors, Executives, and Policymakers:

- For site-selectors and investors, landing-site decisions now hinge on risk exposure, operational flexibility, and regulatory transparency.

- For C-suite leaders, infrastructure alignment and ecosystem partnerships influence not only latency and cost, but also resilience, compliance readiness, and diversification.

- For policymakers, agile and predictable regulatory frameworks will determine whether a jurisdiction becomes a preferred landing point or is bypassed entirely.

Conclusions:

The subsea cable market is rapidly evolving into a hyperscale-driven, AI-optimized, resilience-centric segment of global infrastructure. Future systems will be defined not just by terabits per second, but also by architectural flexibility, geopolitical robustness, integration with cloud and AI ecosystems, and regulatory alignment. In summary, the subsea-cable sector is becoming a foundational layer of the global digital economy—an economy increasingly shaped by AI, cloud expansion, and geopolitical complexity. Jurisdictions that anticipate these shifts and design for resilience and scalability will play disproportionate roles in the decade ahead. The question is no longer simply where cables land, but how the broader ecosystem supports the next wave of digital growth.

References:

https://www.mordorintelligence.com/industry-reports/submarine-optical-fiber-cable-market

Update- Dec 24, 2025

Undersea cables form the hidden backbone of global connectivity. Stretching a combined 1.3 million kilometres under the oceans, these fibre lines link continents and carry an estimated USD $10 trillion worth of financial transactions every day. In fact, more than 95 per cent of international data traffic travels through submarine cables, making them essential for cross-border business, finance and online services. Despite their invisibility in daily life, modern economies and technologies rely on this vast underwater network – and its importance is only growing as data usage soars.

The rise of AI is adding a new surge of traffic to these networks. Training and running advanced AI models involves shuttling enormous datasets between data centres, often across different continents. For example, developing a large language model can require processing terabytes of data distributed over global computing clusters – a task that demands high-capacity links with minimal delay. At the same time, real-time AI services such as financial trading algorithms and interactive assistants rely on ultra-low latency connections to deliver instant results for users around the world.

Industry analysts note that AI-related applications currently account for only a single-digit percentage of international bandwidth, but this share is climbing fast. By 2035, AI workloads could consume roughly a third of the capacity on key routes like the busy transatlantic cables, reflecting how quickly data-hungry machine learning tasks are growing.

Recognizing the strategic importance of connectivity, the world’s largest tech companies have become major builders of undersea cable systems. Firms like Google, Meta, Microsoft and Amazon are no longer just customers of telecom operators – they are funding and laying their own fibre cables beneath the ocean. This shift allows these companies to secure dedicated high-capacity routes optimised for their needs and to add network redundancy on their own terms. By owning infrastructure, they can lower latency for their users and ensure critical services stay online even if other networks fail.

Several recent major projects illustrate this trend. Meta, for instance, has announced a USD $10 billion plan to construct one of the longest cables ever. The 50,000-kilometre cable will connect the US with India, South Africa and Brazil, linking these regions with much higher capacity. Dubbed Project Waterworth, it will use 24 fibre pairs (far more than earlier cable designs) to deliver vast bandwidth for Meta’s platforms and future AI initiatives. Meta is also a lead investor in the 45,000-kilometre 2Africa cable – one of the world’s largest – linking 33 countries across Africa, Europe and Asia to boost internet capacity in emerging markets.

Google has similarly invested in over 30 subsea cables worldwide. These include private cables like Grace Hopper (connecting the US to the UK and Spain) and Equiano (connecting Europe to southern Africa with 144 Tbps (terabits per second) of capacity). Each new link bolsters Google’s cloud data centre network and helps deliver services like search, video streaming and AI-powered applications with lower delay.

Microsoft’s flagship Atlantic cable, MAREA – built with Meta – has provided Azure’s cloud with a 160 Tbps (terabits per second) connection between North America and Europe since 2018. Microsoft is now planning new, shorter cables between Ireland and the UK, aiming to directly connect its huge Dublin data centre hub to Britain and onward to continental Europe for greater resilience. Amazon, meanwhile, has until now chiefly participated in consortia or leased fibre capacity on existing routes such as the Hawaiki cable in the Pacific. Now the company is moving into owning its own subsea infrastructure. It recently announced a dedicated transatlantic cable (landing in Ireland) slated to go live by 2028, explicitly designed to handle rising cloud and AI traffic on its Amazon Web Services platform.

Underpinning these investments is an effort to future-proof against skyrocketing demand. The latest cable systems can transmit on the order of hundreds of terabits per second – enough bandwidth to stream millions of HD videos simultaneously – which is a necessity as AI and cloud services generate ever-larger data flows. For the tech giants, controlling the oceanic pipelines of data has become as crucial as the data centres and algorithms at the core of their business.

The growing dependency on undersea data routes has also put a spotlight on their vulnerability. Unlike satellites, cables concentrate huge volumes of data in physical bundles that can be damaged by natural disasters or human activity. In recent years, there have been several high-profile outages where cables were severed. Whether caused by a ship’s dragging anchor or by suspected sabotage, a single cut can knock out internet access to entire islands or regions. These incidents have prompted calls for better protection and redundancy. NATO, for example, launched a dedicated mission in the Baltic Sea in 2025 to deter interference with critical undersea fibre lines after a string of mysterious cable cuts in northern Europe.

Cable operators and governments are responding by building more diverse routes and hardening the infrastructure. New cables like Amazon’s planned Fastnet are being routed along less congested corridors and built with extra shielding near shorelines to guard against ship anchors and fishing nets. Companies are burying cables deeper in the seabed where possible and using advanced optical switching systems that can quickly reroute traffic if a line is cut. By spreading data across multiple paths, the aim is to ensure that no single break can knock major services offline. This push for resilience has become as important as raw capacity. It is not just about moving data faster, but also about keeping the data flowing under all circumstances.

All signs indicate that the subsea cable boom will continue as the AI era accelerates. Industry forecasts project that annual spending on new cable systems and upkeep will grow from roughly USD $8 billion in 2023 to around USD $10 billion by 2029. Much of this investment is driven by cloud and content companies, often in partnership with telecom carriers, to add both capacity and backup routes. New projects are on the drawing board across the globe – from transatlantic links and pan-Asian cables to regional systems connecting emerging data centre hubs in Africa, the Middle East and Southeast Asia.

Even the advent of low-Earth orbit satellites has not diminished the role of undersea fibre. The sheer volume of data required for AI applications and streaming far exceeds what satellite networks can economically handle, ensuring that subsea cables remain the workhorses of the internet. As more people come online and AI-powered services proliferate, the demand for international bandwidth shows no sign of slowing. The result is an ongoing, largely unseen expansion of oceanic infrastructure beneath the seas. Undersea cables may be out of sight, but they are firmly at the heart of the digital revolution – quietly enabling the connectivity that powers our AI-driven future.

https://telconews.asia/story/explainer-undersea-cables-quietly-powering-the-ai-revolution

The Subsea Cables Powering AI, Cloud, and the Digital Economy. Vish Iyer of Cisco Systems

Stretching across oceans and seas, the global lattice of subsea fiber-optic cables carries more than 95% of the world’s internet traffic. We rarely see them, yet we depend on them every time we open an app, watch a live stream, or train an AI model.

These cables are the digital economy’s arteries. They link cloud regions, data centers, and edge zones across continents. They are the reason a transaction in Sydney can be processed in milliseconds in Singapore, why a machine-learning model in Virginia can be instantly updated from Tokyo, and why billions of people can connect, and stay connected, every day.

Hyperscalers Join the Build-Out

A decade ago, telecom consortiums were the primary owners of this infrastructure. Today, hyperscale cloud providers have taken the helm, spending billions to directly link their global compute facilities.

This shift is redefining the economics and geography of connectivity. Throughout Asia-Pacific, new intra-regional cables are springing up to connect rapidly growing hubs like India, Indonesia, and the Middle East. TeleGeography predicts that over $13 billion in subsea investment is slated to come online between 2025 and 2027, with approximately 10%, or $1.2 billion to be exact, earmarked for Asia-only routes. These regional links are starting to rival traditional trans-Pacific systems in both capacity and strategic importance.

The reasons are clear: existing cables are filling up, cloud providers are moving from leasing to owning fiber, and operators need diverse routes to avoid downtime and cyber risk. Falling costs for installing terabit-class systems and the retirement of old infrastructure further fuel this race.

Technology Meets the Human Imperative

For service providers, this is a dual challenge. They must deliver unprecedented capacity at lower cost while keeping networks secure, sustainable, and reliable. This is not just a technical pivot, it’s a human one. Economies, hospitals, schools, and governments depend on the stability and speed of these cables to function in the modern world.

Halting disruption in one place can save millions from losing internet access. A secure link between two continents can shield sensitive financial data and protect critical national services. This scale of dependency makes reliability a moral obligation as much as a business necessity.

Innovation Beneath the Waves

At the core of the subsea revolution is coherent optical technology, a breakthrough allowing terabit-level capacity on existing fiber with far lower power requirements and physical footprint.

For engineers, this means integrating transport directly into routing layers, cutting operational expenditure (OPEX), and optimizing network performance. For society, it means we can move more data without straining energy systems or raising consumer costs.

But speed alone is not enough. Every new fiber strand widens the cyber-attack surface. Providers are now embedding security at the transport layer with always-on encryption, telemetry, and AI-driven threat detection. If the cables are the arteries, security is the immune system, protecting the lifeblood of the digital economy.

AI Traffic Changes the Game

Artificial intelligence is rewriting the rulebook for global networks. Traffic is no longer predictable and human-paced, it’s machine-to-machine, bursty, and enormous in volume. Clusters of GPUs exchange massive datasets across oceans in near-real time. Latency is the new downtime, and service providers must architect for both speed and adaptability.

Subsea networks are the foundation for this. Distributed AI models rely on cables to link training clusters across continents. The most advanced operators are now building “self-aware” transport systems, powered by AI-assisted management, coherent optics, and integrated secure routing, to react instantly to demand spikes without wasting bandwidth or power.

From Invisible to Indispensable

For nations, subsea cables are digital sovereignty. For hyperscalers, they are scalability. For service providers, they are the arena in which efficiency, innovation, and trust converge.

As global capacity needs double every few years, the winners will not simply be those who lay the most cable, but those who build the smartest, most secure networks on top of it. That means integrating transport and routing seamlessly, optimizing energy use, and seeing security not as a patch, but as architectural DNA.

The subsea era is no longer defined by the number of physical links between continents. It’s defined by how intelligently those links are used, protected, and scaled.

The cables themselves will never stand in the spotlight, but the companies mastering them will be the ones powering the next decade of cloud, AI, and human connection.

https://news-blogs.cisco.com/apjc/2025/12/02/the-subsea-cables-powering-ai-cloud-and-the-digital-economy/