Huawei, Qualcomm, Samsung, and Ericsson Leading Patent Race in $15 Billion 5G Licensing Market

According to a new LexisNexis report on the 5G patents landscape, the 5G patent licensing market is now worth ~$15 billion a year. The report underscores that high-fidelity patent data has become a core business variable, with millions of dollars in annual licensing value potentially reallocated as courts, licensors, and implementers increasingly anchor negotiations, litigation strategy, and FRAND rate-setting on standards-essential patents (SEP) and portfolio analytics. As the 5G end point market scales out from smartphones into industrial IoT, automotive, healthcare, and other mission- and safety-critical infrastructure domains, SEPs are now a primary lever shaping competitive dynamics and value capture in global technology markets. Ericsson CEO Börje Ekholm has been talking about humanoid robots and “physical AI” as future cellular connected objects.

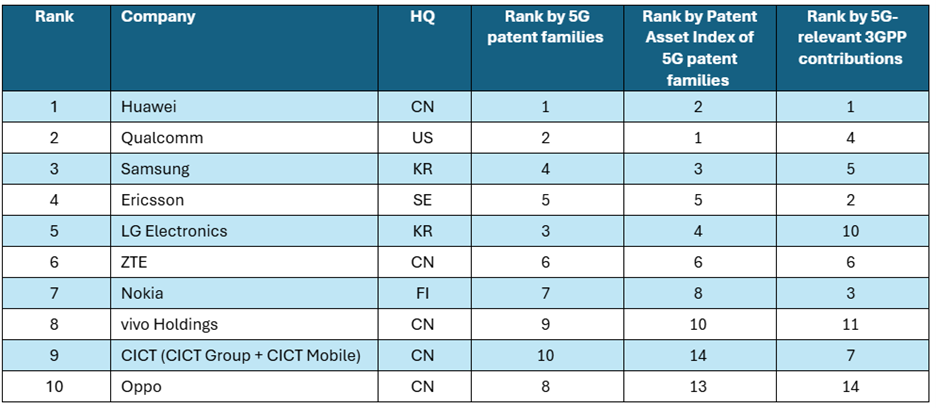

The report extends the analysis to leadership across granted and in-force 5G SEP family declarations, value-adjusted portfolio strength indicators, and the depth and quality of technical contributions into the 3GPP work program.

Key findings from the 2026 analysis include:

- Huawei, Qualcomm, Samsung, and Ericsson continued to lead the global ranking of 5G patent powerhouses as assessed by granted and active 5G patent family volume, portfolio impact, and standards contributions.

- Patent data accuracy has a significant financial impact, as even small discrepancies in perceived portfolio share can translate into hundreds of millions of dollars in annual licensing value in a $15 billion global market.

- New entrants to the Top 50 list in 2026 include research-focused organizations, licensing and investment-led IP holders, and automotive and IoT connectivity specialists, which replaced several operator-centric and diversified industrial portfolios that fell below the Top 50 threshold.

- Top 50 5G patent owners reflected broad geographic diversity, with companies headquartered in China (14), Japan (9), the United States (9), Europe (7), Taiwan (5), South Korea (5), and Canada (1).

- Patent data is increasingly relied upon in FRAND determinations, making the quality, consistency, and verification of declaration data a critical factor for both licensors and implementers.

Top 10 5G Patent Leaders 2026:

The Top 10 ultimate patent owners based on granted and active 5G patent families, value-adjusted portfolio indicators, and sustained participation in 3GPP standards development.

“As 5G licensing moves deeper into industrial, automotive, and infrastructure markets, the financial stakes tied to patent data accuracy continue to rise,” said Tim Pohlmann, Director of SEP Analytics for LexisNexis Intellectual Property Solutions. “In a licensing environment of this scale, even small differences in how 5G patent portfolios are measured can materially influence negotiations. That is why verified, unbiased data has become essential, not only for understanding who leads the 5G patent race, but for supporting defensible, data-driven FRAND discussions.”

The 2026 analysis is grounded in the Cellular Verified initiative led by LexisNexis Intellectual Property Solutions. Through this initiative, LexisNexis compared public ETSI declaration data with internal records from 35 ETSI-declaring companies, applying rigorous matching, normalization, patent family expansion, and corporate-tree ownership analysis.

This validation process is designed to reduce bias introduced by differing declaration practices and to provide a more accurate and impartial representation of declared 5G patent portfolios, an increasingly critical requirement as rankings and portfolio assessments are used as economic and legal reference points in licensing and litigation contexts.

About LexisNexis® Legal & Professional

LexisNexis® Legal & Professional provides AI-powered legal, regulatory, business information, analytics, and workflows that help customers increase their productivity, improve decision-making, achieve better outcomes, and advance the rule of law around the world. As a digital pioneer, the company was the first to bring legal and business information online with its Lexis® and Nexis® services. LexisNexis Legal & Professional, which serves customers in more than 150 countries with 11,800 employees worldwide, is part of RELX, a global provider of information-based analytics and decision tools for professional and business customers.

About LexisNexis® Intellectual Property Solutions

LexisNexis® Intellectual Property Solutions brings clarity to innovation for businesses worldwide. We enable innovators to accomplish more by helping them make informed decisions, be more productive, comply with regulations, and ultimately achieve a competitive advantage for their business. Our broad suite of workflow and analytics solutions (LexisNexis® PatentSight+™, LexisNexis® Classification, LexisNexis® TechDiscovery, LexisNexis® IPlytics™, LexisNexis PatentOptimizer®, LexisNexis PatentAdvisor®, and LexisNexis TotalPatent One®, LexisNexis® IP DataDirect), enables companies to be more efficient and effective at bringing meaningful innovations to our world. We are proud to directly support and serve these innovators in their endeavors to better humankind.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Comment and Analysis:

Huawei’s #1 5G patent position, while significant on headline indicators, does not fully capture the nuances of 5G SEP strength and monetization potential. Portfolio experts consistently stress that patent quality and essentiality vary widely; not every declared SEP underpins a core feature, just as a car seat does not have the same system-critical role as the motor in the overall vehicle architecture.

Beyond raw declaration counts and 3GPP contribution volume, LexisNexis applies its Patent Asset Index methodology to weight portfolio value using factors such as citation impact and international coverage, a framework under which Qualcomm currently ranks first and Huawei second. This aligns with the industry view that some of the most fundamental 5G capabilities extend directly from 4G-era OFDM-based air-interface work, an area where Qualcomm consolidated a strong position with its roughly 600 million dollar acquisition of OFDM specialist Flarion in 2006.

On the licensing side, Qualcomm remains the most financially leveraged SEP holder in the current ranking peer group: its Qualcomm Technology Licensing (QTL) unit generated about 5.6 billion dollars in fiscal 2024 revenue, or roughly 14% of total sales, and delivered around 4 billion dollars in pre-tax earnings, close to 30% of company-wide profit. Huawei, by contrast, reported approximately 630 million dollars in patent licensing revenue for 2024, equivalent to around 0.5% of its overall turnover, and notes that its cumulative royalty outpayments are nearly triple the royalties it has collected to date. While Huawei’s licensing income has roughly doubled compared with its pre‑2020 baseline, the company still spends several times more on patents and R&D than it earns from licensing, reflecting its dual role as both major licensor and large-scale implementer across devices and networks.

Ericsson and Nokia sit between the two on monetization intensity: in 2024, Ericsson’s IPR licensing revenue was about 14 billion Swedish kronor (roughly 1.57 billion dollars), or around 6% of group sales, while Nokia’s licensing business generated approximately 1.9 billion euros (about 2.3 billion dollars), roughly 10% of its total revenue, with both vendors showing solid double‑digit percentage growth in licensing since 2019. The updated LexisNexis study also segments 5G SEP leadership by 3GPP release based on active and granted declared 5G patent families: for Release 15, characterized as the foundational 5G baseline, the top six are Huawei, Qualcomm, Samsung, Ericsson, ZTE, and Nokia, while for Release 18—framing the first wave of 5G‑Advanced—the leaders shift toward LG Electronics, ETRI Korea, Samsung, Oppo, Foxconn, and Huawei, with Nokia the highest-ranked European or US player at eighth.

Assuming the ecosystem avoids major standards fragmentation, current trajectories suggest that Huawei and Qualcomm are well placed to carry substantial 5G-era influence into 6G, which is increasingly positioned as an evolutionary extension of 5G that pushes OFDM-based radio technologies into higher frequency bands and more advanced use cases. Barring disruptive structural changes, future 3GPP plenary and working group meetings are therefore likely to remain populated by the same core SEP powerhouses that dominate today’s 5G landscape.

References:

https://www.lexisnexisip.com/resources/5g-patent-race-2026/

The full “Who Is Leading the 5G Patent Race 2026” analysis, including the Top 50 5G Patent Rankings 2026 and detailed information on the underlying data methodology and validation process, is available at www.LexisNexisIP.com/5G-Report-2026

https://www.lightreading.com/5g/huawei-and-qualcomm-tussle-for-5g-patents-lead-as-6g-draws-closer

Huawei’s Electric Vehicle Charging Technology & Top 10 Charging Trends

ABI Research: Telco transformation measured via patents and 3GPP contributions; 5G accelerating in China

Huawei or Samsung: Leader in 5G declared Standard Essential Patents (SEPs)?

5G Specifications (3GPP), 5G Radio Standard (IMT 2020) and Standard Essential Patents

GreyB study: Huawei undisputed leader in 5G Standard Essential Patents (SEPs)

Chinese companies’ patents awarded in the U.S. increased ~10% while U.S. patent grants declined ~7% in 2021

Samsung Partners with NEC and Qualcomm for 5G, Licenses Nokia Patents