MediaTek overtakes Qualcomm in 5G smartphone chip market

According to new figures from Omdia’s Smartphone Model Market Tracker, shipments of 5G smartphones powered by Taiwan based MediaTek reached 53 million in the first three months of the year, representing an impressive 53% uptick on Q1 2023. Shipments of smartphones with Qualcomm’s Snapdragon inside were comparatively flat, inching up to 48.3 million from 47.2 million.

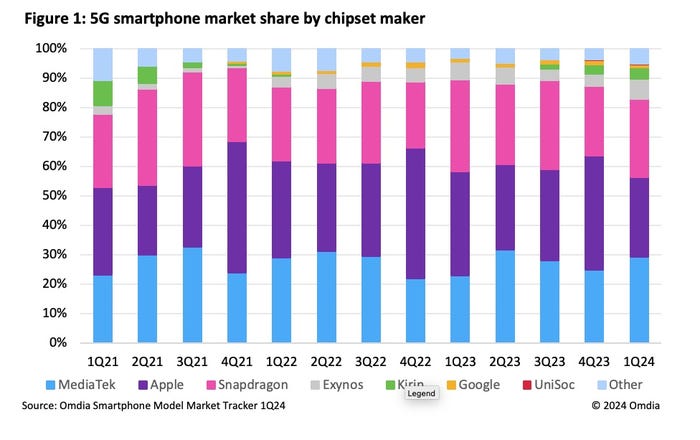

MediaTek’s market share in 5G smartphones rose to 29.2% in 1Q24, up from 22.8% in 1Q23, while Qualcomm Snapdragon’s share decreased from 31.2% to 26.5% over the same period.

As a result, MediaTek’s market share in the 5G smartphone chipset market increased to 29.2% from 22.8%, while Qualcomm’s fell to 26.5% from 31.2%. Apple is third, while a Samsung owned Exynos, Huawei-owned HiSilicon’s Kirin, Google Tensor and Shanghai-based Unisoc make up the rest (see chart below).

Notes:

- It’s not clear whether Omdia includes both processors and 5G modem chip sets in their statistics.

- Apple uses in-house processors for its iPhones, but it still relies on Qualcomm for the 5G modem chips.

- Both MediaTek and Qualcomm sell SoC’s which include both a 4G/5G modem and an ARM processor.

……………………………………………………………………………………………………………………………

According to Omdia, Q1 shipments of 5G smartphones below $250 surged by 62% year-on-year to 62.8 million. This favors MediaTek as the preferred choice for this segment. Furthermore, in June, Omdia also reported in booming demand for sub-$150 phones, with shipments in this category growing to 120 million in the first quarter, up from 90 million a year earlier.

“The smartphone chipset industry is primarily shaped by two major trends: the widespread adoption of 5G and the expanding low-end segment. As 5G technology becomes more affordable and is integrated into smartphones priced below $250, MediaTek stands to benefit the most,” explained Aaron West, senior analyst in Omdia’s smartphone group.

The premium end of the market, where prices start at $600, is also growing – albeit not as rapidly. According to Omdia, shipments increased to 73 million from 70 million, driven by the launch of Samsung’s Galaxy S24 series, and the iPhone 15 Pro Max.

The popularity of premium devices should help Qualcomm come roaring back – it has spent much of this year promoting the on-device AI capabilities of its latest Snapdragon chipset, features that will be incorporated first and foremost into pricier handsets.

“On-device AI capabilities are becoming increasingly important to smartphone OEMs, with Snapdragon emerging as a key innovator and preferred choice for premium devices,” West said.

……………………………………………………………………………………………………………………………

Other Voices:

- According to Markets and Markets, the global 5G chipsets market size is estimated to be USD 36.29 billion in 2023 and is projected to reach USD 81.03 billion by 2028 at a CAGR of 17.4%.

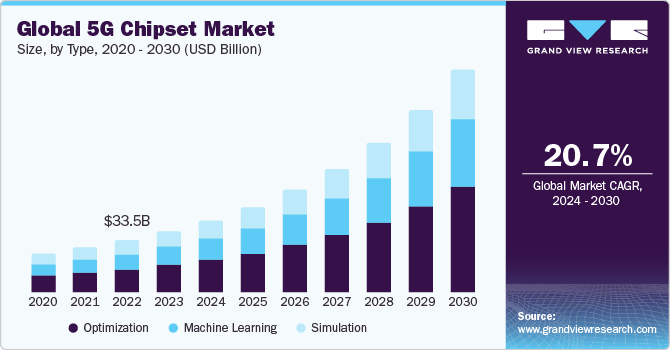

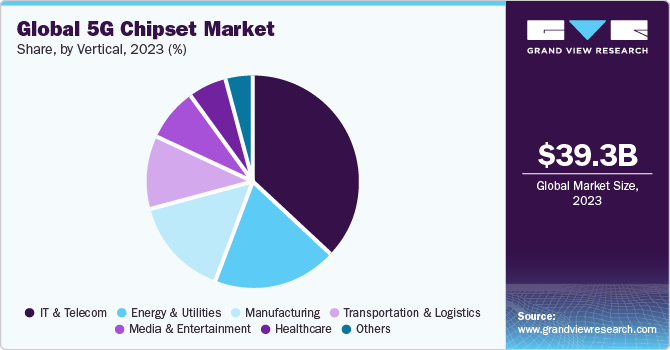

- Grandview Markets says the global 5G chipset market size was estimated at USD 39.32 billion in 2023 and is expected to grow at a CAGR of 20.7% from 2024 to 2030.

Illustrations:

References:

https://www.lightreading.com/5g/mediatek-outgrowing-qualcomm-snapdragon-in-the-5g-smartphone-market-omdia

https://www.telecoms.com/mobile-devices/rise-of-cheaper-5g-phones-lifts-mediatek-above-qualcomm

https://www.marketsandmarkets.com/Market-Reports/5g-chipset-market-150390562.html

https://www.grandviewresearch.com/industry-analysis/5g-chipset-market

GSA: More 5G SA devices, but commercial 5G SA deployments lag

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

Mediatek Dimensity 6000 series with lower power consumption for affordable 5G devices

One thought on “MediaTek overtakes Qualcomm in 5G smartphone chip market”

Comments are closed.

MediaTek and Qualcomm’s rivalry heats up in 5G smartphone market – Omdia

MediaTek is outpacing Qualcomm in gaining 5G smartphone market share, according to research group Omdia, a Light Reading sister company. This shift is largely due to the increased availability of “phones priced under $250 equipped with 5G chipsets – a segment dominated by MediaTek,” said Omdia.

Within this growing segment of low-priced smartphones are devices with increasingly impressive hardware for the price point. Electronics maker Nothing, for example, launched its first smartphone this month – the CMF Phone 1 – for $199. Nothing’s phone includes a MediaTek Dimensity 7300 5G chipset plus an Android 14-powered OS, dual-SIM capability, 8GB of RAM and 128GB of storage.

Shipment of low-end priced smartphones – under $150 – increased by 30 million year-over-year, from 90 million in Q1 2023 to 120 million in Q1 2024, an uptick of 33%, according to Omdia. This shift comes in large part from mid-end smartphone buyers upgrading or downgrading their phones.

MediaTek and Qualcomm’s rivalry is complicated

MediaTek’s focus on the mid to low-end price tier “comes from their portfolio of chipsets but also through their longstanding ties and links with Chinese smartphone OEMs such as Transsion and Xiaomi, which also specialize in that price tier,” Aaron West, senior analyst in Omdia’s Smartphone group, told Light Reading in an email. “Qualcomm has arguably done a better job, however, in being cutting-edge and building a reputation with both vendors and consumers for producing the best chipsets.”

West added that MediaTek is focused on the cheapest new 5G phones, and Qualcomm Snapdragon leads in the mid-range 5G smartphone category, with phones priced above $400. Apple tops the premium segment with the company’s iPhones and A16 and A7 chips.

“But as Apple is its own separate ecosystem, it is not in true competition with the others in this space,” said West. “If you’re just looking at Android phones, Qualcomm Snapdragon with its 8 Gen 2 and Gen 3 chips are the top premium chipsets.”

MediaTek’s 5G smartphone market share has increased from 22.8% in Q1 2023 to 29.2% in Q1 of this year. By comparison, Qualcomm Snapdragon’s market share dropped from 31.2% to 26.5% over the same period, according to Omdia.

Shipment of 5G smartphones with MediaTek chipsets grew 53% year-over-year, increasing from 34.7 million in Q1 2023 to 53.0 million in Q1 2024. On the other hand, 5G smartphones with Qualcomm’s Snapdragon chips experienced nominal growth with 48.3 million shipments in Q1 2024, compared to 47.2 million units in Q1 2023.

However, comparing MediaTek and Qualcomm as rivals is a bit of an apples-to-oranges situation as they focus on different price tiers in the 5G smartphone market.

“While MediaTek is the biggest industry rival to Qualcomm, I don’t think they necessarily challenge one another hugely,” said West. “This is due to the how Qualcomm Snapdragon chips are the go-to for premium phones, and Qualcomm’s bread-and-butter, while MediaTek have a richer mid-to-low end range of chipsets. MediaTek has repeatedly tried to make gains in the premium segment, with their latest 9000 series of chips, but doesn’t have the same reputation Snapdragon has in this.”

“MediaTek stands to benefit the most” from the increased affordability of 5G technology that’s being integrated into the low-priced tier of smartphones, said West. However, on-device AI features are gaining importance to smartphone OEMs “with Snapdragon emerging as a key innovator and preferred choice for premium devices.”

Trade tensions stir up the chipset market

“Other chipset manufacturers, such as Exynos, Google, Kirin and UniSoC collectively account for 17% of shipments,” said Omdia. Kirin’s growth, in particular from the Huawei Mate 60 Pro and Nova 12 series, has played a significant role in increased market share from these manufacturers.

However, after HiSilicon’s announcement to end Kirin chipset production from September 15, 2020, during trade tensions between Huawei and the United States, the Kirin 9000s chipset concluded its production in August 2023, said Omdia. HiSilicon is Huawei’s in-house chips division.

As chipset manufacturers, such as Apple, Exynos and Snapdragon, have moved away from producing 4G chipsets in favor of 5G chipsets, UniSoC has increased its share of the 4G market and is now MediaTek’s primary competitor in that sector. Exynos, for example, reduced its 4G chipset shipments significantly from 77% of smartphone shipments in Q1 2021 to only 1% in Q1 2024. MediaTek, on the other hand, still uses 4G chipsets for over 50% of its shipments.

US-based Qualcomm had a one-up on MediaTek with a license to sell 4G chips to Huawei, reported Light Reading’s Iain Morris.

“Unlike MediaTek, a Taiwanese rival, Qualcomm secured an export license to sell 4G chips to Huawei in late 2020, just before a change in US administration,” wrote Morris. “An authoritative source estimates Qualcomm has made about $1.2 billion from chip sales to Huawei since receiving that license.”

Unfortunately for Qualcomm, this license doesn’t allow it to sell 5G chips to Huawei, and the market for 4G chips is diminishing. “In a world turning to 5G, this means the value of the license has been diminishing fast, especially since Huawei’s revelation of its own 5G chip in September last year,” reported Morris

https://www.lightreading.com/smartphones-devices/mediatek-and-qualcomm-s-rivalry-heats-up-in-5g-smartphone-market-omdia