5G Auctions

Big U.S. Wireless Carriers to bid at FCC mid-band auction; cablecos missing in action

The FCC will conduct another 5G spectrum auction on October 5th. FCC Auction 110 will be for 100MHz in the 3.45GHz to 3.55GHz band for flexible use of wireless services.

Full Title: Auction of Flexible-Use Service Licenses in the 3.45-3.55 GHz Band for Next-Generation Wireless Services; Status of Short-Form Applications to Participate in Auction 110

Auction 110 will offer approximately 4,060 new flexible‐use licenses of 100Mhz within the 3.45–3.55 GHz band (3.45 GHz Service) throughout the contiguous United States. Bidding in Auction 110 is scheduled to begin on October 5, 2021.

…………………………………………………………………………………………….

Analysis:

AT&T, T-Mobile, US Cellular and Dish Network are among the 42 different entities that registered interested in participating in Auction 110, based on the roster contained in FCC filings related to the auction (attachments A & B in References below). Verizon’s application is listed as incomplete.

We’ve never heard of most of the other companies bidding, but note that the big cablecos/MSOs (Comcast, Charter Communications, Altice USA and Cox Communications) are not listed.

3.45 GHz spectrum up for auction is in the mid-band range seen as key for 5G by offering a mix of coverage and capacity, and sits nearby the 3.7 GHz C-band and the shared 3.5 GHz Citizen Broadband Radio Service (CBRS) band.

Financial analysts at New Street Research say that Auction 110 will increase the total overall amount of spectrum in circulation in the US from 1023MHz to 1123MHz. They believe that AT&T and T-Mobile to be the big winners with Dish Network an also ran.

“We think that AT&T, T-Mobile and Dish each want 40MHz in the 3.45GHz auction (the limit any one company can buy), but there is only 100MHz to go around,” the analysts wrote in a note to investors in July. “Based on visible resources, AT&T and T-Mobile are best positioned to end up with 40MHz each, leaving 20MHz for Dish (and other participants).”

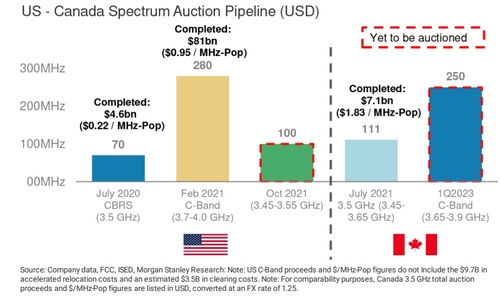

Analysts at Morgan Stanley offered a their perspective at how the upcoming 3.45GHz-3.55GHz FCC auction compares with recently completed spectrum auctions in the U.S. and Canada.

Source: Morgan Stanley

“AT&T will be keen to get the maximum 40MHz allowable on a quasi-nationwide basis, while T-Mobile has said they will be opportunistic, although they and Verizon already have some 200MHz of midband spectrum. Dish is another wild card, although it lacks the financial resources of the larger wireless players,” wrote the financial analysts at Morgan Stanley in a note to investors this week.

…………………………………………………………………………………………….

Recent FCC auctions have included the 37GHz, 39GHz and 47GHz spectrum bands in Auction 103, Auction 101 of 28GHz spectrum and Auction 102 of 28GHz spectrum, Auction 105 for 3.5GHz CBRS spectrum licenses, and Auction 107 -the C-band auction (which ended earlier this year and generated an astounding $81 billion in winning bids).

“We think Auction 110 looks much more similar to the smaller, cheaper CBRS auction that had $4.5 billion in net bids for 70MHz of spectrum ($0.215 per MHz POP), than the larger, more expensive C-band auction that ended with $81 billion in net bids for 280MHz of spectrum ($0.945 per MHz POP),” wrote the financial analysts with Raymond James in a note to investors this week. (The per MHz-POP calculation is applied to most spectrum transactions and reflects the number of people covered compared with the amount of spectrum available, though it can be affected by a wide variety of factors.) The Raymond James analysts cited Andromeda’s 40MHz ownership cap and military sharing zones as reasons for their conclusions.

“Still, midband spectrum remains crucial in densifying 5G networks, and while we do not expect anywhere close to C-band-like prices, this is a good opportunity for price-conscious bidders (e.g. Dish) to augment spectrum holdings,” the Raymond James analyst team concluded.

………………………………………………………………………………..

Terms & Conditions for Auction 110:

Upfront payments for Auction 110 are due in the proper account at the U.S. Treasury by 6:00 p.m. Eastern Time (ET) on Thursday, September 2, 2021. In order to meet the Commission’s upfront payment deadline, an applicant’s payment must be credited to the Commission’s account by the deadline.

Due Diligence: The FCC reminds each potential bidder that it is solely responsible for investigating and evaluating all legal, technical, and marketplace factors and risks associated with the licenses that it is seeking in Auction 110; evaluating the degree to which those factors and risks may have a bearing on the value of the licenses being offered and/or affect the bidder’s ability to bid on, otherwise acquire, or make use of such licenses; and conducting any technical analyses necessary to assure itself that, if it wins any license(s), it will be able to build and operate facilities in accordance with the Commission’s rules.

Non Disclosure Rules: Bidding applicants must take care not to communicate non-public information to the public, financial analysts, or the press.45 Examples of communications raising concern, given the limited information procedures in effect for Auction 110, would include an applicant’s statement to the press or other public statement (for example, a statement on social media) about its upfront payment or bidding eligibility, an applicant’s statement to the press or other public statement that it is or is not interested in bidding in the auction, or an applicant’s statement to the press or other public statement prior to the down payment deadline that it is the winning bidder in any particular geographic areas.

References:

https://www.fcc.gov/auction/110

https://www.fcc.gov/document/auction-110-345-ghz-service-application-status

https://www.fcc.gov/document/auction-110-345-ghz-service-application-status/attachment-a

https://www.fcc.gov/document/auction-110-345-ghz-service-application-status/attachment-b

https://www.fcc.gov/document/facilitating-5g-345-355-ghz-band

https://www.lightreading.com/5g/what-to-expect-from-upcoming-345ghz-auction-for-5g/d/d-id/771612?

https://www.lightreading.com/5g/cable-may-miss-americas-next-big-5g-spectrum-auction/d/d-id/771578?

https://www.benton.org/headlines/big-wireless-carriers-apply-fccs-mid-band-spectrum-auction

Telstra wins most lots in Australia’s 5G mmWave auction

Five companies have won spectrum in the Australian Communications and Media Authority’s (ACMA) latest spectrum auction in the 26 GHz band. The 26 GHz band has been identified as optimal for the delivery of 5G wireless broadband services.

Of the 360 lots available in the auction, 358 were sold, realizing a total revenue of Australian $647,642,100, equivalent to almost $0.0127/MHz/POP. The new licensees will have rights to the spectrum for 15 years, starting from later in 2021 through 2036.

Dense Air Australia Pty Ltd won 2 lots for $28,689,900, Mobile JV Pty Limited won 86 lots for $108,186,700, Optus Mobile Pty Ltd won 116 lots for $226,203,100, Pentanet Limited won 4 lots for $7,986,200, and Telstra Corporation Limited won 150 lots for $276,576,200.

Further apparatus licenses in the 26GHz band will be issued next month by ACMA.

“This outcome represents another significant milestone for 5G in Australia. The successful allocation of this spectrum will support high-speed communications services in metropolitan cities and major regional centers throughout Australia,” said ACMA Chair Nerida O’Loughlin.

“This auction is one among a suite of licensing approaches that the ACMA has introduced in the 26 GHz and 28 GHz bands to encourage a wide range of innovative communications uses,” said Ms O’Loughlin.

Optus said it had secured “the most highly valued position at the top of the spectrum band” and foreshadowed new services such as AR/VR video, next-generation cloud gaming and massive simultaneous usage, as well as enterprise use cases such as automation and private networking.

In a blog post, Telstra CEO Andy Penn expressed similar expectations. Penn said the new spectrum capacity was more than ten-times Telstra’s existing 5G spectrum holdings and would be deployed to increase capacity in high-traffic locations such as shopping centers, inner-city train stations and sporting stadiums. Telstra’s mobile networks was increasing by an average of 40% annually.

Telstra is leading in 5G Australia deployments with its 3.6GHz spectrum network expected to reach 75% of the population by the end of June.

References:

https://www.acma.gov.au/articles/2021-04/outcome-millimetre-wave-spectrum-auction

https://www.lightreading.com/asia/australian-operators-pay-a$648m-for-mmwave-spectrum/d/d-id/768991?