mmWave

Deutsche Telekom offers 5G mmWave for industrial customers in Germany on 5G SA network

Deutsche Telekom (DT) has successfully trialed 5G millimeter wave (mmWave) frequencies at 26 gigahertz (GHz) with industrial use cases and is now offering them commercially to industrial customers. For the customer Ger4tech Mechatronik Center, autonomous industrial machines and robots were networked with a router in the 5G campus environment of the Werner-von-Siemens Centre for Industry and Science in Berlin. In addition to the 5G standalone (SA) network in the industrial spectrum at 3.7 GHz, this router also supports mmWave spectrum for the first time. With low latency times of three to four milliseconds RTT (round trip time) and a data rate of over 4 gigabits per second in download and 2 gigabits in upload, mmWave has huge potential in data-intensive applications in the manufacturing industry. The 5G mmWave communications are enabled by Telit Cinterion, a global end-to-end IoT solutions provider.

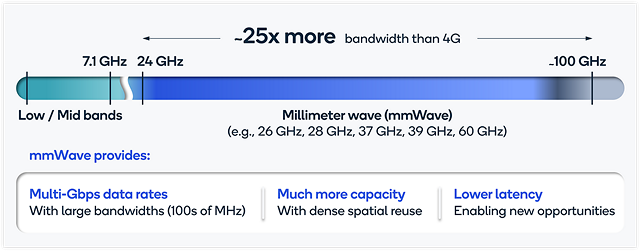

5G mmWave is playing an increasingly important role in wireless communication technology and imaging, among others. It is characterized by short coverage range and high bandwidth and speeds. It has enormous potential for development within 5G campus networks and for applications in the field of autonomous vehicles and the manufacturing industry. The special ability of mmWave lies in its ability to transmit large amounts of data in real time. The frequency spectrum around 26 GHz is allocated exclusively to interested parties in Germany by the Federal Network Agency. It can currently only be used for local applications.

“It is important for our industrial customers in the age of artificial intelligence to be able to upload data from machines and thus make it available and analyzable in real time,” explains Klaus Werner, Managing Director Business Customers at Telekom Deutschland GmbH. “This is the only way for companies to introduce AI applications sensibly and efficiently and derive great benefits for their business,” he added.

“We’re enabling customers to access unparalleled levels of efficiency, productivity and innovation. Through the seamless integration of 5G mmWave into their operations, every device and process can achieve connectivity at an unprecedented scale,” said Marco Contento, VP of Product Management, Mobile Broadband at Telit Cinterion. “Collaboratively, we’re helping to pave the way for industries to streamline operations, anticipate maintenance needs, and a multitude of future possibilities.”

The 5G standalone campus network at the Werner-von-Siemens Centre operates separately from Telekom’s public mobile network. The entire infrastructure, from the antennas and active system technology to the core network, comes from Ericsson. Based on this network, a fleet of autonomously driving and operating robots works on various use cases at the center. The 5G standalone network is often sufficient to control the robots. The 5G millimeter waves come into play when the requirements for communication and data transmission increase, and therefore also when solving more complex tasks. For example, in a computer vision application: the robot picks up an order and checks whether the ordered goods are complete on the way to the next destination. If there is a discrepancy, it immediately reorders the goods.

In addition to these, many other scenarios are mapped in the Werner-von-Siemens Centre. Here, industry, research institutions (including TU Berlin and Fraunhofer), small and medium-sized enterprises and start-ups work on practical solutions for companies – including for autonomous production logistics and other challenges in industrial manufacturing.

In the UK, regulator Ofcom launched a new consultation in April and the sector is awaiting the details of when and in what form an auction will take place.

Additional Resources:

About Ger4Tech Mechatronik Center

About Telit Cinterion

……………………………………………………………………………………………………………………………………………………

References:

https://www.telecoms.com/5g-6g/deutsche-telekom-looking-to-flog-5g-mmwave-to-industrial-sector

Daryl Schoolar: 5G mmWave still in the doldrums!

T-Mobile combines Millimeter Wave spectrum with its 5G Standalone (SA) core network

T-Mobile, with the help of with Ericsson and Qualcomm Technologies, Inc., has tested millimeter wave (mmWave) on its production 5G SA network (note that mmWave identifies higher frequencies used on a 5G RAN, while 5G SA refers to a true 5G core network). The Un-carrier aggregated eight channels of mmWave spectrum to reach download speeds topping 4.3 Gbps without relying on low-band or mid-band spectrum to anchor the connection. T-Mobile also aggregated four channels of mmWave spectrum on the uplink, reaching speeds above 420 Mbps.

In the latest revision of ITU-R M.1036- Frequency Arrangements for IMT-the following mmWave bands were approved:

-Frequency arrangements in the band 24.25-27.5 GHz

-Frequency arrangements in the band 45.5-47 GHz

-Frequency arrangements in the band 47.2-48.2 GHz

-Frequency arrangements in the band 66-71 GHz

In the U.S., Verizon has historically been the carrier promoting 5G mmWave, which they dubbed “5G Ultra Wideband.” The telco claims they’ve achieved 1.26 Gbps upload speed using 5G Ultra Wideband. With uploading data becoming increasingly important for video chats, uploading large files or live streaming video. “We have achieved remarkable speed in downloading using various combinations of spectrum in our world-class spectrum portfolio,” said Adam Koeppe, Senior Vice President of Technology Planning at Verizon. “This new achievement indicates how much additional performance we can unleash for our customers on the uplink as we aggregate different combinations of spectrum.”

T-Mobile took the opposite path, focusing on mid and low-band spectrum for its 5G network…until now. 5G mmWave can deliver very fast speeds because it offers massive capacity. But the signal doesn’t travel very well through obstacles, making it less ideal for mobile phone users who aren’t sitting still. That’s why T-Mobile has implemented a multi-band spectrum strategy using low-band to blanket the country and mid-band and high-band (Ultra Capacity) to deliver insanely fast speeds to nearly everyone. Now the Un-carrier is testing 5G mmWave on 5G SA for crowded areas like stadiums and, potentially, for fixed wireless service.

“We’ve been industry leaders – rolling out the first, largest and fastest 5G standalone network across the country – and now we’re continuing to push the boundaries of wireless technology,” said Ulf Ewaldsson, President of Technology at T-Mobile. “We’ve always said we’ll use millimeter wave where it makes sense, and this test allows us to see how the spectrum can be put to use in different situations like crowded venues or to power things like fixed-wireless access when combined with 5G standalone.”

T-Mobile is the U.S. leader in 5G [1.] delivering the largest, fastest and most awarded 5G network in the country. The Un-carrier’s 5G network covers more than 330 million people across two million square miles — more than AT&T and Verizon combined. 300 million people nationwide are covered by T-Mobile’s super-fast Ultra Capacity 5G with over 2x more square miles of coverage than similar mid-band 5G offerings from the Un-carrier’s closest competitors. According to Ookla’s quarterly speed test reports, T-Mobile’s 5G network has consistently outperformed AT&T’s and Verizon’s when it comes to median download speed.

Note 1. AT&T is the leading provider of mobile services in the U.S. with 229.1 subscribers as of Q2 2023, followed by: Verizon: 143.3 million (Q2 2023),,T-Mobile US: 117.9 million (Q3 2023), Dish Wireless: 7.5 million (Q3 2023), and uscellular: 4.6 million (Q3 2023).

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

T-Mobile also offers wireless solutions to connect homes and businesses. 5G Home Internet (FWA) is available to over 50 million homes today, plus Small Business Internet and Business Internet is available across the country. This means millions of homes and businesses can finally ditch traditional ISPs for fast, reliable and hassle-free internet service with T-Mobile. The telco’s FWA customer base increased by 557,000 during Q3, giving it a total of 4.2 million. It has allowed T-Mobile to offer a compelling alternative to fixed broadband, but its service comes with the caveat that speeds will fluctuate depending on demand.

The extra capacity offered by mmWave could help to offer a faster, more consistent connection, making it even more appealing. However, the propagation challenges of mmWave spectrum means customers will have to ensure their FWA hub is sitting on the right shelf or window sill to establish a fast, reliable connection. Addressing complaints as customers struggle to put their hub in the right spot may be a problem for the Un-carrier.

Editor’s Note:

The NTIA will study the following bands in the next two years, noting that the spectrum could support a range of uses, including mobile broadband (IMT), drones and satellite operations:

- 3.1 GHz-3.45 GHz

- 5.03 GHz-5.091 GHz

- 7.125 GHz-8.4 GHz

- 18.1 GHz-18.6 GHz

- 37.0 GHz-37.6 GHz

References:

https://www.t-mobile.com/news/network/t-mobile-revs-up-millimeter-wave-with-5g-standalone

https://www.verizon.com/about/news/verizon-achieves-upload-speeds-surpassing-1-gbps

https://www.telecoms.com/5g-6g/t-mobile-finally-puts-mmwave-to-work-in-5g-sa-network

https://www.telecoms.com/wireless-networking/t-mobile-network-speeds-still-way-ahead-of-verizon-at-t

U.S. Launches National Spectrum Strategy and Industry Reacts

UAE network operator “etisalat by e&” achieves 5G mmWave distance milestone

UAE network operator etisalat by e& today claimed the world’s first deployment of 5G mmWave covering more than 10 kilometres, as it highlighted the potential of the range to support fixed wireless access (FWA) and industrial applications over private networks. In a statement, e& explained the pilot used the 26Ghz band and delivered high speeds. The test forms part of a push to address demand for mobile networks capable of delivering large amounts of data reliably and securely.

The UAE telco claimed its test demonstrated the network’s ability to uplink heavy video and real-time data transfer with faster speed and lower latency, supporting “industries operating over vast areas.”

Alongside citing opportunities for FWA, the operator highlighted the potential of private networks using the frequencies across various industry verticals, citing healthcare, manufacturing and public safety.

The implementation of 5G mmWave (FR2 only) network capability was steered as part of etisalat by e& vision to deliver state of art technologies to the society. This is considered as a global first 5G deployment on mmWave @ 26Ghz, FR2 only over 10 km with high speeds. The step aimed at addressing the demand of consumers and enterprises to have a solution following the highest standards of data security and digitalisation over mobile network that’s also capable to deliver large amounts of data reliably and securely.

The mmWave spectrum generally refers to above 24GHz, that can deliver extreme capacity, ultra-high throughput and ultra-low latency which has huge potential in multiple applications for consumers as well as enterprises.

The solution demonstrates the ability of 5G networks to enable uplink heavy video and real-time data transfer scenarios over a specific geographical area, effectively paving the way toward the digital transformation of industries operating over vast areas.

Marwan Bin Shakar, SVP Access Network Development, etisalat by e& said: “This deployment is a commitment to unleashing the full potential of 5G network and pushing the boundaries to redefine the world of connectivity. This is a significant milestone for 5G mmWave, especially that the demand for data has increased exponentially, and this plays a pivotal role in increasing network capacity. Our partnerships with technology leaders has also contributed to setting these benchmarks in the industry and bring advanced solutions to the country making sure we address customer digitalization’s requirements and enabling quicker time to market.”

This achievement will support the use of 5G network for FWA subscribers who can enjoy fiber like user experience over wireless network and also accelerate the adoption of 5G private network technology in other sectors like oil and gas, public safety, healthcare, manufacturing and more to have complete control over their user data with on-premise hosted MEC (Multi-access edge computing) and use their enterprise data and security policies to manage data delivered from a private 5G network.

References:

UAE’s “etisalat by e&” announces first software defined quantum satellite network

T-Mobile and Charter propose 5G spectrum sharing in 42GHz band

This June, we noted that the FCC was exploring shared use of the 42 GHz band using in 500 megahertz of spectrum. Recently, T-Mobile and Charter voiced support for some kind of spectrum sharing scenario.

“While wireless carriers continue to require additional spectrum that is licensed on an exclusive-use basis, T-Mobile agrees that the technical characteristics of the 42GHz band, along with its separation from other millimeter wave spectrum that has already been licensed, means that the commission may wish to consider a different approach here,” T-Mobile wrote in an August 30th FCC filing.

“The commission, however, should avoid applying untested, novel sharing approaches to the 42GHz band. Instead, it should implement the nationwide non-exclusive licensing framework currently used in the 70/80/90GHz bands, with a few modifications to ensure that the spectrum will be used efficiently and may be deployed for [a] variety of advanced communications services.”

……………………………………………………………………………………………………………………….

Charter has long eyed the 37GHz band as a way to bolster mobile operations in its planned 3.5GHz CBRS network. The MSO/cableco has said it could offer speeds up to 1 Gbit/s via concurrent operations in the CBRS and 37GHz bands.

Charter’s FCC filing is similar to T-Mobile’s, as it supports a “unified nationwide, non-exclusive simple shared licensing regime.” The company urged the FCC to implement the same spectrum sharing design across both the lower 37GHz band and the 42GHz band.

“Allocating the lower 37GHz band for non-exclusive use would offer 600 megahertz for innovative new wireless connectivity in the United States,” Charter noted. “The allocation of the 42GHz band alongside the lower 37GHz band would of course increase the total spectrum available for innovative new deployments by 500 megahertz.”

……………………………………………………………………………………………………………….

Backgrounder:

The 42GHz band resides in what is known as millimeter wave (mmWave) spectrum. 5G transmissions in those bands are at very high speeds, but they typically travel just a few thousand feet, and generally cannot pass through obstructions like walls, trees, glass or concrete, i.e. they require line of sight communications.

WRC 19 identified mmWave frequencies for 5G, but ITU-R WP 5D did not complete and agree on the frequency arrangements for same (revision 6 of ITU-R M.1036) until very recently. WRC 19 identified the frequency bands: 24.25-27.5 GHz, 37-43.5 GHz, 45.5-47 GHz, 47.2-48.2 and 66-71 GHz for the deployment of 5G networks and the frequency arrangements for them is in draft recommendation ITU-R M.1036 which is expected to be approved this November. Note that 42GHz is not included!

Some analysts are quite positive on mmWave communications. For example, “mmWave 5G offers a way to improve on the current situation because the bands have extremely high capacity that are able to support very large amounts of data traffic and users, although in a small area,” wrote OpenSignal analyst Ian Fogg in a post on the network-monitoring firm’s website.

Qualcomm is also an advocate of spectrum sharing in mmWave bands since at least July 2022.

Image Credit: Qualcomm

Qualcomm’s filings to open the Lower 37 GHz band to shared licensed access ask the FCC to adopt a Notice of Proposed Rulemaking (NPRM) to allocate six 100-MHz-wide priority licenses in the Lower 37 GHz band and allow each priority operator—which may be a federal government or a commercial operator—to use the rest of the band on a secondary basis. To enable these secondary operations on an interference-free basis, each priority operator would implement a technology-neutral, equipment-based rule to provide coordinated, periodic listening of the channel, referred to as long term sensing (LTS), to determine whether its secondary operations on spectrum outside its priority licensed spectrum may cause harmful interference to the priority license holder of that swath of spectrum.

Secondary operations are only allowed for communications links that sensing determines will not cause interference to the priority licensee. The coordinated sensing procedure allows each priority license holder to access all other channels (i.e., the other 500 MHz) on a secondary – and interference-free – basis, increasing overall spectrum utilization while not degrading the QoS for the priority licensee.

References:

https://www.fcc.gov/ecfs/document/10830309419380/1

https://www.fcc.gov/ecfs/document/10830021467677/1

WRC 19 Wrap-up: Additional spectrum allocations agreed for IMT-2020 (5G mobile)

Saudi Arabia’s Stc Achieves 10 Gbps Speeds in 5G mmWave Trials

Saudi Arabia’s Stc (Saudi Telecom Company) Group announced the successful completion of the first live trials of advanced 5G technology in the Middle East and North Africa. The trials demonstrated speeds exceeding 10 Gbps using Millimeter Wave (mmWave) technology. The trials are an extension of the robust infrastructure of the advanced 5.5G network in the Kingdom

According to the company, these trials complement the existing advanced 5.5G network in the kingdom, enabling data transfer at new record speeds in a live working environment.

“This achievement signifies a new stage in facilitating digital transformation in the region and places the Kingdom of Saudi Arabia at the forefront of advanced nations in the field of telecommunications.”

The Kingdom’s residents can now anticipate faster and more efficient data connectivity than before. The company said that the success of these trials is an essential aspect of stc’s “Dare” strategy. The goal is to offer access to new services and enhance customer experiences to new heights, aligned with the Saudi Vision 2030 and supporting digital transformation in the region.

The latest progress in advanced 5G technology puts Saudi Arabia at the forefront of technological innovation in the region, paving the way for even more advancements. By adopting this technology, the country is preparing itself for upcoming developments and the digital age.

References:

Nokia achieves extended range mmWave 5G speed record in Finland

Nokia today announced it has achieved sustained average downlink speeds of over 2 Gigabits per second (Gbps) using millimetre wave (mmWave) spectrum and 5G Fixed Wireless Access (FWA), over a distance of 10.86 kilometres. This milestone download speed, the fastest recorded worldwide to date, was accomplished using Nokia’s 5G extended range mmWave solution at the OuluZone test facility in Oulu, Finland.

The test utilised Nokia’s AirScale baseband and AirScale 24GHz (n258 band) mmWave radio and a Nokia FastMile 5G PoC CPE (customer premises equipment). Testing involved eight component carriers (8CC) in the downlink, aggregating 800MHz of mmWave spectrum. This enabled a top downlink speed of 2.1 Gbps, and an uplink speed of 57.2 Mbps.

This achievement, which builds on a previous world record announced by Nokia in 2021, demonstrates the reach and connectivity speeds that 5G mmWave can deliver. It also lays the foundations for high-quality internet connectivity solutions delivered via FWA to areas where wired connections are not always possible.

Nokia’s mmWave radio portfolio is comprised of compact, high- and medium-power solutions, offering a wide range of deployment options that provide flexibility in ensuring service continuity across a wide variety of environments.

The Nokia FastMile 5G PoC device used in these tests is currently being trialed by major operators globally. High speeds over significant distances can be achieved with its high-gain 360° antenna (27dBi), which dynamically adapts to changing conditions to overcome mmWave deployment challenges.

Source: Nokia

Ari Kynäslahti, Head of Strategy and Technology at Nokia Mobile Networks, said: “We just set a new speed record for extended range 5G mmWave. This demonstrates that mmWave solutions will be an essential building block for operators to efficiently deliver widespread, multi-gigabit 5G broadband coverage to their customers in urban, suburban, and rural areas, complementing sub-6 GHz spectrum assets. This is a substantial achievement that reflects how we are constantly innovating and evolving our 5G services and solutions.”

References:

Resources and additional information

Nokia AirScale

AirScale mmWave Radio

5G mmWave for Fixed Wireless Access

Fixed Wireless Access

Nokia FastMile

Samsung achieves record speeds over 10km 5G mmWave FWA trial in Australia

Samsung achieves record speeds over 10km 5G mmWave FWA trial in Australia

South Korea’s Samsung Electronics says it has achieved record-setting average downlink speeds of 1.75 Gbps and uplink speeds of 61.5 Mbps over a 10 km (6.2 miles) 5G mmWave network in a recent field trial conducted with Australia’s NBN Co. As the farthest 28 GHz 5G mmWave Fixed Wireless Access (FWA) connection recorded by Samsung, this milestone demonstrates the expanded reach possible with this powerful spectrum, and its ability to efficiently deliver widespread broadband coverage across the country.

Source: Accton

To achieve average downlink speeds of 1.75 Gbps at such extended range, the trial by Samsung and NBN utilized eight component carriers (8CC), which is an aggregation of 800MHz of mmWave spectrum. The potential to support large amounts of bandwidth is a key advantage of the mmWave spectrum and Samsung’s beamforming technology enables the aggregation of such large amounts of bandwidth at long distance. At its peak, the company also reached a top downlink speed of 2.7Gbps over a 10km distance from the radio.

“The results of these trials with Samsung are a significant milestone and demonstrate how we are pushing the boundaries of innovation in support of the digital capabilities in Australia,” said Ray Owen, Chief Technology Officer at NBN Co. “As we roll out the next evolution of our network to extend its reach for the benefit of homes and businesses across the country, we are excited to demonstrate the potential for 5G mmWave. nbn will be among the first in the world to deploy 5G mmWave technology at this scale, and achievements like Samsung’s 10km milestone will pave the way for further developments in the ecosystem.”

There’s a total of AUD $750 million investment in the nbn Fixed Wireless network (made up of AUD $480 million from the Australian Government and supported by an additional AUD $270 million from nbn). NBN will use software enhancements and advances in 5G technology, and in particular 5G mmWave technology, to extend the reach of the existing fixed wireless footprint by up to 50 percent and introduce two new wholesale high-speed tiers. The nbn FWA network covers nearly 650,000 premises in the country. The company wants to add at least 120,000 locations in Australia that are currently served by a satellite-based service.

“This new 5G record proves the massive potential of mmWave technology, and its ability to deliver enhanced connectivity and capacity for addressing the last mile challenges in rural areas,” said Junehee Lee, Executive Vice President and Head of R&D, Networks Business at Samsung Electronics. “We are excited to work with nbn to push the boundaries of 5G technology even further in Australia and tap the power of mmWave for customer benefit.”

As demonstrated in the trials, 5G mmWave spectrum is not only viable for the deployment of high-capacity 5G networks in dense urban areas, but also for wider FWA coverage. Extending the effective range of 5G data signals on mmWave will help address the connectivity gap, providing access to rural and remote areas where fiber cannot reach.

For the trial, Samsung used its 28GHz Compact Macro and third-party 5G mmWave customer premise equipment (CPE). Samsung’s Compact Macro is the industry’s first integrated radio for mmWave spectrum, bringing together a baseband, radio and antenna into a single form factor. This compact and lightweight solution can support all frequencies within the mmWave spectrum, simplifying deployment, and is currently deployed in commercial 5G networks across the globe, including Japan, Korea and the U.S.

Since launching the world’s first 5G mmWave FWA services in 2018 in the U.S., Samsung has been leading the industry, offering an end-to-end portfolio of 5G mmWave solutions — including in-house chipsets and radios — and advancing the 5G mmWave momentum globally.

The nbn® network is Australia’s digital backbone that helps deliver reliable and resilient broadband across a continent spanning more than seven million square kilometers. nbn is committed to responding to the digital connectivity needs of people across Australia, working with industry, governments, regulators and community partners to increase the digital capability of Australia.

Samsung has pioneered the successful delivery of 5G end-to-end solutions including chipsets, radios and core. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from RAN and Core to private network solutions and AI-powered automation tools. The company is currently providing network solutions to mobile operators that deliver connectivity to hundreds of millions of users around the world.

Nokia had previously announced it was supplying 5G FWA mmWave CPE equipment for nbn’s efforts that also operates in the 28 GHz band with similar performance characteristics stated by Samsung for its test, including a range of up to 6.2 miles from the transmission tower. However, Samsung said that Nokia’s equipment was not part of its test.

Nokia noted that its CPE includes an antenna installed on the roof of a premises that is linked using a 2.5 Gb/s power over Ethernet (PoE) connection to an indoor unit that powers the on-premises internet connectivity.

Related Articles:

- Samsung Electronics Supports NTT East’s Continued Expansion of Private 5G Networks in Japan

- Samsung Electronics Tapped To Support Comcast’s 5G Connectivity Efforts

- Samsung Electronics To Deliver Private 5G Network Solutions to Korea’s Public and Private Sectors

References:

https://www.sdxcentral.com/articles/news/samsung-nokia-power-5g-mmwave-potential/2022/11/

OpenSignal reports shed light on 5G mmWave and 5G User Experiences

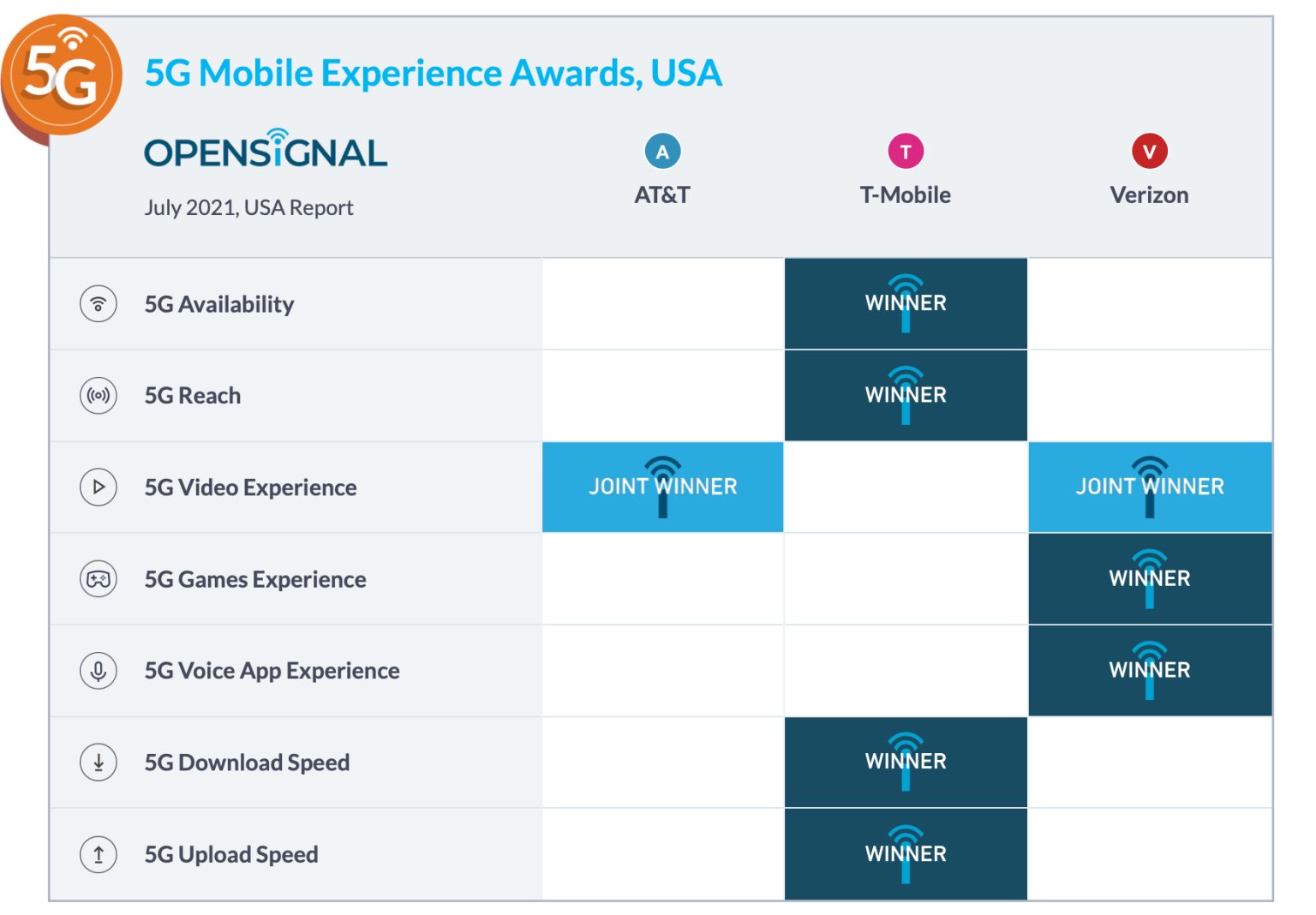

According to a new report, “Quantifying the mmWave 5G experience in the US — July update“ by OpenSignal, the average U.S. mobile user connects to a 5G millimeter wave (mmWave) network less than 1% of the time. The difference between AT&T, Verizon, and T-Mobile’s 5G mmWave network access is miniscule with Verizon customers at 0.7% of the time, AT&T’s at 0.4% of the time, and T-Mobile’s at 0.2% of the time. OpenSignal’s latest mmWave 5G report features data collected from March to June, 2021. The network monitoring company obtained its data from software installed in more than 100 million smartphones around the world, which send back anonymized usage data to OpenSignal on a daily basis.

Regarding 5G mmWave network speeds, T-Mobile users experienced the fastest average 5G mmWave network download speeds of 618.4 Mbps with Verizon, which was nearly twice as fast as users’ average experience on T-Mobile, and more than two and a half times faster than what our users experienced on AT&T. Verizon users continue to experience the fastest average 5G mmWave download speed which Opensignal has seen to date. Users’ average download speed on AT&T’s 5G mmWave was 245 Mbps, while we recorded an average 5G mmWave download speed of 312 Mbps on T-Mobile. AT&T and T-Mobile’s scores were statistically tied.

T-Mobile users experienced the fastest average 5G upload speeds on 5G mmWave networks with a score of 39.9 Mbps, which was 29.7-33.1% faster than what was observed on both AT&T and Verizon. Average upload speeds for AT&T and Verizon’s mmWave 5G services were 30 Mbps and 30.8 Mbps, respectively.

…………………………………………………………………………………………………………………………………………………………..

5G technology promised to support high-speed mobile operations in the mmWave spectrum bands, thus allowing operators to raise their peak network speeds from around 100Mbit/s to above 1Gbit/s. However, distance is extremely limited and line of sight connectivity is required. Transmissions in mmWave spectrum can’t travel more than a few thousand feet, and usually cannot penetrate through glass or trees. So many small cells close to the 5G mmWave user are needed which are often difficult to get permits for and install on public property (like street lights, lamps, rooftops, etc).

In contrast, wireless transmissions in traditional, lowband cellular spectrum bands, such as 800MHz or 1900MHz, can often travel miles and reach deep inside homes or office buildings.

Furthermore, ITU-R WP 5D has not agreed on the revisions of ITU-R M.1036 Frequency Arrangements for terrestrial IMT which MUST include (but do not now) the mmWave bands approved at WRC 19. Therefore, there is no standard for exactly what 5G mmWave frequencies should be used along with their duplexing and other arrangements.

………………………………………………………………………………………………………………………………………………………

In a companion report on 5G User Experiences, OpenSignal found that T-Mobile doubled its lead in the 5G Download Speed category. T-Mobile users saw average 5G Download Speeds of 87.5 Mbps, ahead of our users on AT&T and Verizon which both scored 52.3 Mbps. Our T-Mobile users’ average 5G Download Speed has increased by an impressive 16.3 Mbps compared to our April 5G report, and 29.4 Mbps compared to our January 5G report. By comparison, our users on AT&T saw their average 5G Download Speeds reduce by 2.7 Mbps since our last report, while our users on Verizon experienced a 4.5 Mbps improvement.

T-Mobile won the 5G Upload Speed award with a score of 15.1 Mbps, which is statistically unchanged compared to our previous report. Verizon places second showing an improvement of 1.2 Mbps and reaching 14.2 Mbps, while AT&T follows behind with 8.8 Mbps — a 1.2 Mbps decline since our April 2021 5G report.

SOURCE: OpenSignal

AT&T and Verizon shared the award for 5G Video Experience, scoring 61.3 points and 61.2 points, respectively. AT&T claimed the award in April 2021, while Verizon was the sole winner in January 2021. T-Mobile has placed third across all 5G Video Experience awards, this time scoring 54.8 points. Video Experience quantifies the quality of video streamed to mobile devices by measuring real-world video streams over carriers’ networks.

Finally, Verizon won the 5G Voice App Experience award scoring 83.3 points and moving past AT&T, which was the previous winner. Verizon has improved its score by 0.7 points since our previous report, while we have observed 0.6-0.8 points declines on both AT&T and T-Mobile. All three mobile operators place in the Good category (80-87 points). Voice App Experience measures the quality of experience real-time communications using over-the-top (OTT) voice apps. Examples of these types of apps include WhatsApp, Skype and Facebook Messenger.

References:

https://www.opensignal.com/2021/07/13/quantifying-the-mmwave-5g-experience-in-the-us-july-update

https://www.opensignal.com/reports/2021/07/usa/mobile-network-experience-5g

https://www.lightreading.com/5g/the-age-of-mmwave-5g-sputters-to-dusty-death/a/d-id/770838?

Telstra wins most lots in Australia’s 5G mmWave auction

Five companies have won spectrum in the Australian Communications and Media Authority’s (ACMA) latest spectrum auction in the 26 GHz band. The 26 GHz band has been identified as optimal for the delivery of 5G wireless broadband services.

Of the 360 lots available in the auction, 358 were sold, realizing a total revenue of Australian $647,642,100, equivalent to almost $0.0127/MHz/POP. The new licensees will have rights to the spectrum for 15 years, starting from later in 2021 through 2036.

Dense Air Australia Pty Ltd won 2 lots for $28,689,900, Mobile JV Pty Limited won 86 lots for $108,186,700, Optus Mobile Pty Ltd won 116 lots for $226,203,100, Pentanet Limited won 4 lots for $7,986,200, and Telstra Corporation Limited won 150 lots for $276,576,200.

Further apparatus licenses in the 26GHz band will be issued next month by ACMA.

“This outcome represents another significant milestone for 5G in Australia. The successful allocation of this spectrum will support high-speed communications services in metropolitan cities and major regional centers throughout Australia,” said ACMA Chair Nerida O’Loughlin.

“This auction is one among a suite of licensing approaches that the ACMA has introduced in the 26 GHz and 28 GHz bands to encourage a wide range of innovative communications uses,” said Ms O’Loughlin.

Optus said it had secured “the most highly valued position at the top of the spectrum band” and foreshadowed new services such as AR/VR video, next-generation cloud gaming and massive simultaneous usage, as well as enterprise use cases such as automation and private networking.

In a blog post, Telstra CEO Andy Penn expressed similar expectations. Penn said the new spectrum capacity was more than ten-times Telstra’s existing 5G spectrum holdings and would be deployed to increase capacity in high-traffic locations such as shopping centers, inner-city train stations and sporting stadiums. Telstra’s mobile networks was increasing by an average of 40% annually.

Telstra is leading in 5G Australia deployments with its 3.6GHz spectrum network expected to reach 75% of the population by the end of June.

References:

https://www.acma.gov.au/articles/2021-04/outcome-millimetre-wave-spectrum-auction

https://www.lightreading.com/asia/australian-operators-pay-a$648m-for-mmwave-spectrum/d/d-id/768991?

Connected Home IoT Technolgies and the EU TeamUp5G Project

by David Alejandro Urquiza Villalonga and Manuel José López Morales, researchers at Universidad Carlos III de Madrid

Introduction:

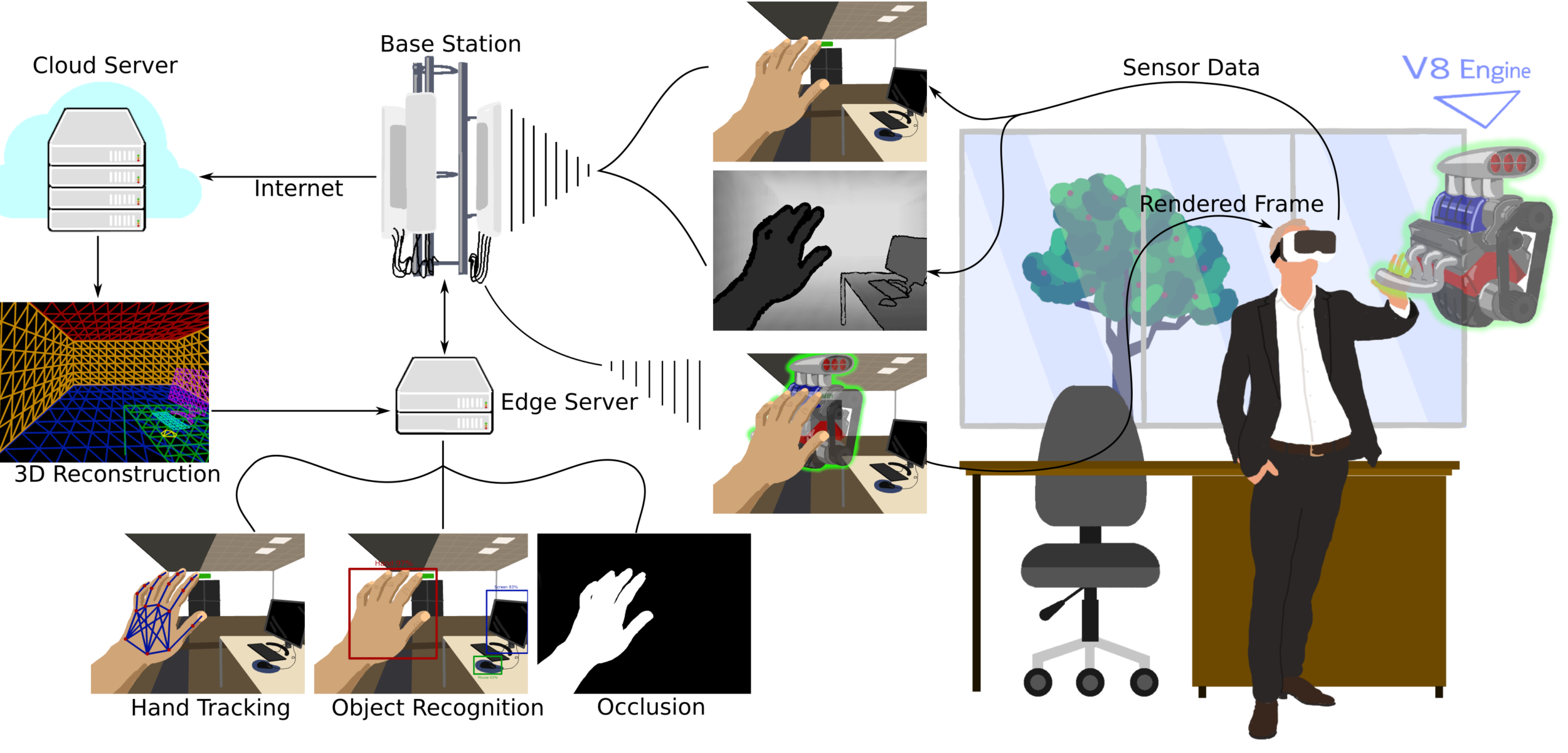

The concept of the “connected home” has gained a lot of attention in the last decade as a means to improve various aspects of life. Entertainment, security, energy and appliance control, and electronic health monitoring are just a few representative applications. Recently, the Internet of Things (IoT) has become increasingly important due to the COVID19 pandemic. With most employees working from home, remote access tools are booming because they connect people with their machines and assets. They enable people to remotely communicate with machines and perform virtual inspections, remote diagnostics as well as remote support.

Therefore, the development of a dynamic IoT environment that adapts to each individual’s needs is essential to provide an optimal productivity scenario. In this article, we describe an intelligent platform which interconnects several sensors and actuators using an IoT approach to collect and process big volumes of data. The IoT system, combined with a powerful artificial intelligence (AI) tool, learns the user’s behavior and offers improved new services according to their preferences [1] [2].

In this context, applications related to home security, remote health monitoring, climate control and lighting, entertainment, smart sleep, and intelligent shopping have been developed.

Challenges in IoT development and deployment:

There are several challenges to support massive IoT deployments providing connectivity for both cellular and non-cellular devices. New technologies with higher energy and spectral efficiency are required to enable smart device-to-device (D2D) communications with reduced connectivity costs [3]. The technical requirements to fulfill include:

• The interconnection of several sensors in an intelligent management platform according to a massive machine-type-communications (mMTC) approach. In this sense, new spectrum access techniques and energy-efficient technologies to support the operation of a large number of devices are required.

• Enhanced mobile broadband (eMBB) communication to support video streaming for entertainment, remote working, and online teaching.

• Scalability: this will become an issue mainly in relations to generic consumers as the number of devices in operation rises.

• Dense and durable off-grid power sources: it would make a difference if power could be broadcasted wirelessly to smartphones and sensors from a distance.

Popular current smart home devices:

Some of the most popular smart home devices include the intelligent wireless speaker “Google Home” with a connected voice management system that interacts with the Google Assistant helping with music, calendar, news, traffic, etc. On the other hand, Amazon has developed its own intelligent devices, namely “Amazon Echo” (with Alexa) and “Amazon Echo Plus,” which includes a smart home Zigbee hub for easy setup and control of compatible smart home devices.

Far-field speech recognition is included in the “Amazon Echo Spot,” which is designed with a smart alarm clock that can make video calls with a tiny 2.5-inch screen, or become a nursery camera. LifeSmart provides smart home solutions focusing on security, energy-saving, and bringing convenience to life with a complex network of automatic intercommunication devices that simplifies daily routines [4].

Renesas offers a wide variety of IoT solutions for security, comfiness, health, connectivity and others, for different sectors such as automotive, healthcare, industrial, and home appliances [5].

Supporting technologies for massive IoT deployment:

Nevertheless, many products offered by companies still provide IoT solutions that can be thought as of being in an infancy state. The underlying communication technologies have to increase their capabilities in order to overcome the challenging needs and provide an improvement to IoT solutions.

Therefore, new wireless communication technologies [including 5G (IMT 2020), WiFi 6 (IEEE 802.11ax), Bluetooth 5, etc.] will be combined with classical short range wireless technologies [such as ZigBee, NFC and others] and installed in homes and small business offices. Low Power Wide Area Network (LPWAN) technologies from cellular carriers are LTE-Cat M1 , narrow band IoT (NB-IoT) and LoRa/LoRaWAN.

Several studies reveal that higher frequencies are expected to be able to operate as complementary bands for the deployment of 5G networks with higher capacity. It is expected that millimeter wave (mmWave) ultra-dense small-cells supported by massive multiple-input multiple-output (mMIMO) will be able to offer the capabilities to interconnect multiple devices and to provide high-speed services even in indoor scenarios. These small-cells may be interconnected with each other and with the core network by means of a fiber optic connection or with a mmWave backhaul.

Editor’s Note: Some wireless communications professionals believe that a 5G fixed wireless network, using massive multiple-input multiple-output (mMIMO) systems at millimeter wave (mmWave) frequencies, will be able to offer high throughput and low latency to support many WiFi connected home devices. Verizon’s 5G Home Internet is an example of this.

On the other hand, network densification is a promising technology to overcome many issues in mmWave systems such as blockage and short-range coverage that can significantly increase the capacity of the network. Therefore, Ultra-dense networks (UDN) compound by small cells (SCs) is also considered to have an important role in IoT connectivity.

In addition, a fundamental feature needed to support massive IoT is scalability on the device and the infrastructure sides which can be provided by 5G cellular networks. 5G systems will be able to offer connectivity to an extremely large number of low-cost, low-power, low-complexity devices, based on an evolution of the current LTE narrow band IoT (NB-IoT) [3].

New radio access technologies will also be required. For example, cognitive radio (CR) to allocate bandwidth dynamically and to handle high interference levels. In addition, the big data processing capabilities for the AI learning and prediction process is supported only by 5G networks.

TeamUp5G Project:

TeamUp5G [6] is a European Training Network (ETN) in the frame of the Marie Skłodowska-Curie Innovative Training Networks (MSCA ITN) of the European Commission’s Horizon 2020 framework. TeamUp5G’s EU funding adds up to 3.72 million Euros between 2019 and 2022.

TeamUp5G is currently working on the use cases, technical challenges, and solutions to facilitate the technical feasibility of ultra-dense small cell networks.

The research objectives of TeamUp5G are focused on solving three problems: (1) Interference Management, waveforms, and mMIMO, (2) Dynamic Spectrum Management and Optimisation, and (3) Energy Consumption Reduction. Among others, it can provide the technical solutions to make massive IoT Smart Home connectivity feasible. Some of their research results include [7] and [8].

Where in Europe is TeamUp5G:

What Is the TeamUp5G Project:

Image Credit: TeamUp5G Project

In reference [7], the authors study a cognitive radio system with energy harvesting capabilities (CR-EH) to improve the spectral and energy efficiency according to the green communication paradigm. A novel optimal sensing policy to maximize detection performance of available spectrum and to protect primary users from interference is developed. The proposed scheme is based on the efficient use of harvested energy to implement spectrum sensing operations. Offline and online scheduling policies are derived with an optimal formulation based on convex optimization theory and Dynamic Programming (DP) algorithm, respectively. In addition, two heuristic solutions with low complexity are also proposed to dynamically manage the use of spectrum with high levels of energy efficiency which is essential for IoT deployment.

In reference [8], the authors demonstrated how scenarios with stringent conditions such as high mobility, high frequency selective, low SNR and short-packet communications can benefit from the use of non-coherent mMIMO. Non-coherent mMIMO avoids the need of channel state information (CSI) to extract the benefits of mMIMO. This avoids the waste of resources due to the overhead created by the orthogonal signals, which is more severe in scenarios with stringent conditions. These types of scenarios are very common in Home IoT, since low battery powered devices will be the most common, such as a variety of domestic sensors and actuators. Furthermore, in short-packet communications, the use of CSI is proportionally greater due to shorter useful data as also happens in Home IoT, in which many devices send short bursts of data from time to time, thus benefiting from the use of non-coherent communications.

Thus, it has been shown that new interference management techniques, energy harvesting, and non-coherent communications can overcome some of the technical challenges inherent in IoT networks for Smart Home applications.

Conclusions:

In this article, we have covered some aspects considered in IoT Smart Home 5G. We have first made an introduction with the basics of the use of IoT in homes, aided by 5G technology and AI. Secondly, we have presented some already existing solutions from companies such as Google, Amazon, LifeSmart, and Renesas, which work over legacy networks and thus do not extract all the potential benefits of 5G IoT Smart Home. We have continued stating the main technical challenges in IoT deployment. We have defined some technologies that will support the use of IoT at homes, including massive multiple-input multiple-output, millimeter waves, ultra dense networks, small cells, and cognitive radio. We have talked about the TeamUp5G project which partly focuses on the research of new solutions that can make the massive deployment of IoT Smart Home feasible.

From the perspective of the authors, the following decade will see an increase in the appearance of products based on the referenced technologies, which will bring the concept of IoT Smart Home based on 5G closer to reality.

References:

[1] K. E. Skouby y P. Lynggaard, «Smart home and smart city solutions enabled by 5G, IoT, AAI and CoT services», en 2014 International Conference on Contemporary Computing and Informatics (IC3I), nov. 2014, pp. 874-878, doi: 10.1109/IC3I.2014.7019822.

[2] H. Uddin et al., «IoT for 5G/B5G Applications in Smart Homes, Smart Cities, Wearables and Connected Cars», en 2019 IEEE 24th International Workshop on Computer Aided Modeling and Design of Communication Links and Networks (CAMAD), sep. 2019, pp. 1-5, doi: 10.1109/CAMAD.2019.8858455.

[3] S. Ahmadi, 5G NR: Architecture, Technology, Implementation, and Operation of 3GPP New Radio Standards. Academic Press, 2019.

[4] https://iot.ilifesmart.com/

[5] https://www.renesas.com/us/en/solutions.html

[6] https://teamup5g.webs.tsc.uc3m.es/

[7] D. A. Urquiza-Villalonga, J. Torres-Gómez, y M. J. Fernández-Getino-García, «Optimal Sensing Policy for Energy Harvesting Cognitive Radio Systems», IEEE Transactions on Wireless Communications, vol. 19, n.o 6, pp. 3826-3838, jun. 2020, doi: 10.1109/TWC.2020.2978818.

[8] M. J. Lopez-Morales, K. Chen-Hu and A. Garcia-Armada, “Differential Data-Aided Channel Estimation for Up-Link Massive SIMO-OFDM,” in IEEE Open Journal of the Communications Society, vol. 1, pp. 976-989, 2020, doi: 10.1109/OJCOMS.2020.3008634.