5G in China

China Unicom & Huawei deploy 2.1 GHz 8T8R 5G network for high-speed railway in China

China Unicom Jilin, the local affiliate of China Unicom in the Jilin province, has completed the deployment of a 2.1 GHz 8T8R 5G network for a segment of the national Harbin-Dalian high-speed railway with 5G network equipment from Huawei.

Tests show that 8T8R AAUs increase the coverage area by 44% compared with 4T4R, and 5G user experience improves by 5.2 times compared with 4G. The train passengers can heartily access the network for entertainment such as HD video, live streaming, and New Calling as well as for work on-the-move such as remote video conferencing.

In 2023, China Unicom embarked on a 5G coverage project along China’s sixteen trunk high-speed railways. Its affiliate in Jilin province contributed to its share of constructing the province’s premium 5G network for high-speed railways within the provincial borders. At first, this network construction project was daunted by four serious challenges. To begin with, the distance between sites is large. What’s worse, the penetration loss was greater with high-speed railways than common railways. Additionally, high-speed mobility increased the Doppler shift, a direct cause of performance deterioration. Lastly, user experience was poor due to short camping time caused by frequent handovers (every 3–4 seconds) on trains running at a high speed of 300 km/hr.

To address these challenges, in this project, China Unicom Jilin deployed the 2.1 GHz 8T8R AAU, and activated the High-speed Railway Excellent Experience feature and Cell Combination feature.

The 2.1 GHz 8T8R AAU solution integrates with technologies like multi-antenna, integrated high-gain array, intelligent beamforming, and precise and fast beam sweeping. Compared with 4T4R, it improves coverage by 7.5 dB, user experience by an impressive 55%, and capacity by 85%. This solution solves the problem of poor coverage caused by large distances and large insertion loss on high-speed railways. It also uses the same antenna as the legacy 4G 1.8 GHz network, simplifying site deployment and reducing tower rental by 10%. This series of solutions with Huawei FDD beamforming technology took home the GSMA GLOMO award for “Best Mobile Technology Breakthrough” and was listed in the “Guangdong Province Energy Saving Technology and Equipment (Product) Recommendation Catalogue”, issued by the Guangdong Energy Bureau in July 2023, for its excellent performance in energy saving.

After the High-Speed Railway Excellent Experience feature is enabled, the 5G base station proactively adjusts the signal frequency to offset the negative impact caused by frequency offset. This solves the Doppler shift problem in high-speed railway continuous coverage scenarios. After Cell Combination feature is enabled, the number of inter-cell handovers can be reduced in a cell combination network, which solves the problems of fast handovers and short camping time on high-speed railways. Test results show that after this feature is enabled, the access success rate increases to 99.4% and the call drop rate decreases by 57%. This overcomes the difficulties of difficult network access in ultra-high-speed scenarios.

This commercial deployment of the 2.1 GHz 8T8R AAU solution will greatly facilitate the operator’s future plans for similar 5G rollouts. China Unicom Jilin will continue to explore 5G network deployments in different scenarios as well as innovative applications of 2.1 GHz 8T8R in order to build differentiated 5G advantages based on service requirements in various 5G scenarios.

China Unicom to deploy Huawei’s 64T64R MetaAAU product-an upgrade of Huawei MetaAAU

China’s telecom industry business revenue at $218B or +6.9% YoY

Huawei’s comeback: 2023 revenue approaches $100B with smart devices gaining ground

ABI Research: Telco transformation measured via patents and 3GPP contributions; 5G accelerating in China

Omdia: China’s 5G network co-sharing + cloud will create growth opportunities for Chinese service providers

ABI Research: Telco transformation measured via patents and 3GPP contributions; 5G accelerating in China

Every single telecom operator in the world is now attempting to transform from telco to techco, to break free from their antiquated, legacy, and stale connectivity business and evolve to sell technology platforms, a considerably more lucrative and promising business. Their success is not guaranteed, and many find it difficult – if not impossible – to unshackle themselves from their history and comfort zone.

ABI Research now says it’s measuring the progress of telco transformation by quantifying the number of patents that telcos hold and also measuring their involvement in standards-setting initiatives like 3GPP (whose specs are standardized by ETSI and ITU-R).

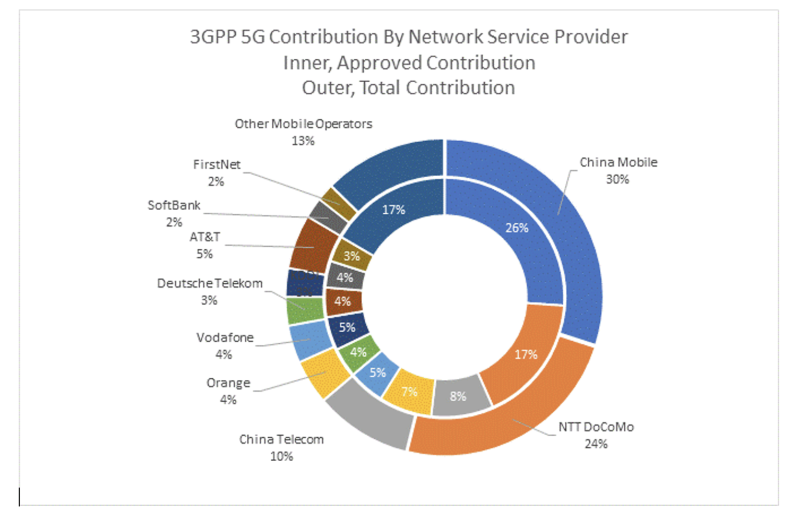

Telecom operators from China and Japan are currently at the forefront of technology transformation, which shows in their involvement in 3GPP and patent holdings,” says Dimitris Mavrakis, Senior Research Director at ABI Research. “China Mobile, NTT Docomo, and China Telecom have invested time, effort, and capital in both domains, which now translates to significant expertise, knowledge, and recognition in the industry. Although this is not the only metric for innovation, these leading network operators are well suited to transforming their business, technology, and strategic platforms to look to the future.”

The findings of the latest ABI Research report on telecom operator innovation indicate that they consistently contribute to 3GPP work, approximately 8% of the total contribution. Of these telecom operator contributions to 3GPP, 43% originate from China, 29% from Japan, 14% from Europe, and 12% from the United States. Leading operators are China Mobile, NTT Docomo, China Telecom, Orange, Vodafone, and Deutsche Telekom. Their Standards Essential Patent (SEP) holdings are similar, with China Mobile and NTT Docomo leading the market.

Standards contributions and patent holdings are good measures of willingness to innovate and get involved in leading the market. “Telecom operators must get involved and not let other companies lead the direction of the market – especially when geopolitics and semiconductor supply constraints are affecting the market. With 5G Advanced and upcoming 6G, they have the technology to innovate, but they must now take more risks and lead the market,” Mavrakis concludes.

Fierce Wireless asked why T-Mobile didn’t rank, given the good progress that it’s made with its 5G SA network and network slicing trials. Mavrakis said, “T-Mobile US is part of Deutsche Telekom, which is represented in the chart above. They are indeed making progress toward network slicing, but our report measures 3GPP standards activities and patents, which is a different area of innovation.”

These findings are from ABI Research’s Telco versus Techco: Operators’ Role in Shaping Cellular Innovation and 3GPP Standards application analysis report. This report is part of the company’s Cellular Standards & IPR research service, which includes research, data, and ABI Insights. Based on extensive primary interviews, Application Analysis reports present in-depth analysis on key market trends and factors for a specific application, which could focus on an individual market or geography.

…………………………………………………………………………………………………………………………………

Separately, ABI Research says 5G end-user services deployment continue to accelerate in China, which is very much leaving other markets in its wake. Not only does it have 3.2 million 5G base stations up and running, but also a wide range of 5G-to-Business (5GtoB) applications.

According to China’s Ministry of Industry and Information Technology (MIIT), the country has built or upgraded more than 3.2 million 5G base stations—accounting for 30% of the overall mobile base stations nationwide—which has already exceeded the initial target of deploying 2.9 million 5G base stations by the end of 2023. A fourth mobile operator, China Broadnet, has also been issued a 5G mobile cellular license to help stimulate consumer and enterprise competition.

5G subscriber adoption has been robust. At the end of 1Q 2023, the number of 5G subscriptions in the country had increased to around 1.3 billion, which is an increase of more than 53% from approximately 850 million 5G subscribers as of March 2022. The China Telecom Research Institute reported that the average download speed for 5G is a very robust 340 Megabits per Second (Mbps).

China’s mobile operators have seen an overall increase in service revenue. China Mobile reported an 8.1% Year-over-Year (YoY) increase in telecommunication service revenue, with mobile Average Revenue per User (ARPU) up 0.4% to CNY49 (US$6.9). China Telecom also reported a 3.7% YoY increase in mobile communications service revenue with mobile ARPU up 0.4% to CNY45.2 (US$6.3), whereas China Unicom saw a 3-year consecutive growth in mobile ARPU to CNY44.3 (US$6.2).

Growth in revenue has been primed by an expansion in revenue models the telcos can offer. Revenue for China Mobile’s 5G private networks also saw an increase of 107.4% YoY growth, reaching RMB2.55 billion (US$365.5 million) by December 2022. Meanwhile, China Unicom experienced a spike in 5G industry virtual private network customers from 491 to 5,816 between June 2022 and June 2023. Across the board, the three operators have collectively reached a cumulative total of more than 49,000 5G commercial enterprise projects, with China’s MIIT reporting that the operators have built more than 6,000 5G private networks, to date.

China’s mobile cellular ecosystem is not resting on its laurels. Urged on by China’s government, the sector has been embracing 5G-Advanced, as underpinned by The 3rd Generation Partnership Project’s (3GPP) Release 18. Included in Release 18 are greater support for Artificial Intelligence (AI) integration, 10 Gigabits per Second (Gbps) for peak downlink and 1 Gbps for peak uplink experience, supporting a wider range of Internet of Things (IoT) scenarios, and integrated sensing & communication. Information gathered through sensors can enable communication to be more deterministic, which improves the accuracy of channel conditions assessment. Another example is dynamic beam alignment for vehicle communications using Millimeter Wave (mmWave). China’s mobile operators and vendors are keen to adopt 5G-Advanced due to its ability to support a 10X densification of IoT devices compared to 5G. There is also support for passive 5G IoT devices that can be queried by campus and/or indoor small cells to provide telemetry-related data. Instead of a field or warehouse worker, or even an Autonomous Guided Vehicle (AGV) with a portable Radio Frequency Identification (RFID) reader, the campus cellular network can track asset tags in real time and remotely—eliminating the need to check up and down warehouse aisles individually.

5G-Advanced (not yet standardized) deployments are materializing in China. China Mobile Hangzhou launched its Dual 10 Gigabit City project in early 2023. This project focuses on using 5G-Advanced technologies to support applications such as glasses-free Three-Dimensional (3D) experiences on different devices during the Asian Games. Such early experimental projects are not limited to only one city in China. To the northeast of Hangzhou, China Mobile Shanghai has also started its own project to build the first 5G-Advanced intelligent 10 Gigabit Everywhere City (10 GbE City). The network is built using the 2.6 Gigahertz (GHz) network initially for the main urban areas before expanding the coverage to the entirety of Shanghai.

5G deployment, integration, and usage is accelerating. The China Academy of Information and Communications Technology anticipates that US$232 billion will have been invested in 5G by 2025. An additional US$37.9 billion (RMB3.5 trillion) of investment will also take place in the upstream and downstream segments of the industrial chain. During a 2023 Science and Technology Week and Strategic Emerging Industries Co-creation and Development Conference, MIIT stated that 5G connectivity has been integrated into “60 out of 97 national economic categories, covering over 12,000 application themes.” ABI Research has not verified all the use cases reported by MIIT, but ABI Research’s ongoing research into the 5G-to-Business (5GtoB) market in Asia has validated that there are a wide range of 5GtoB trials, pilots, and commercial rollouts taking place in China.

A further ABI Insight that you may find interesting is “China Telecom Is the First Operator Worldwide to Launch a “Device-to-Device” Service on a Smartphone to Improve Coverage.”

About ABI Research:

ABI Research is a global technology intelligence firm delivering actionable research and strategic guidance to technology leaders, innovators, and decision makers around the world. Our research focuses on the transformative technologies that are dramatically reshaping industries, economies, and workforces today.

References:

https://www.fiercewireless.com/5g/abi-research-praises-china-mobile-ntt-docomo-5g-innovation

6th Digital China Summit: China to expand its 5G network; 6G R&D via the IMT-2030 (6G) Promotion Group

ABI Research: 5G Network Slicing Market Slows; T-Mobile says “it’s time to unleash Network Slicing”

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

ABI Research: Major contributors to 3GPP; How 3GPP specs become standards

ABI Research: 5G-Advanced (not yet defined by ITU-R) will include AI/ML and network energy savings

Highlights of 2023 Mobile World Congress Shanghai, China

Mobile World Congress Shanghai (from June 28-30, 2023) showcased the impact of 5G networks on global businesses in Asia. This fourth anniversary of commercial 5G adoption offered a chance for network operators and vendors alike to reflect on the benefits of the latest network technology and what’s needed for broader 5G adoption.

According to Robert Clark of Light Reading, “Industry leaders returned after a four-year hiatus with little to say and even less to announce.” That’s nothing new. Shira Ovide, writing for the Washington Post in June 2023, called claims about 5G’s benefits for retail customers “mostly hot air.”

China Mobile talked up its prospects in two new 5G consumer services:

- Cloud phones, which could be tailored to meet the needs of different user segments – general-purpose use, gaming, streaming and so on. The apps, OS and processing of cloud phone voice and data are all running in the cloud, according to Li Bin, vice president of subsidiary China Mobile Internet Co.

- 5G new calling – an enhancement to VoNR that is meant to transform the voice call experience. It enables integration of other apps into a phone call, like real-time translation, or multi-party video or remote guidance.

Source: Grid Scheduler on Flickr (public domain)

……………………………………………………………………………………………………………………………………………

Meng Wanzhou Deputy Chairwoman, Rotating Chairwoman, CFO, daughter of Huawei founder Ren Zhengfei:

“5-point-5G is the next step forward for 5G. 5-point-5G will feature 10-gigabit downlink speeds, gigabit uplink speeds, the ability to support 100-billion connections, and native AI.” With much higher speeds, it’s believed 5-point-5G will offer greater levels of targeted support for industrial needs, in domains like IoT, sensing and advanced manufacturing.

A partnership between Huawei and Shaanxi Coal Industry Co. mines installed sensors that can deliver real-time data about dangerous gas levels and instability in mine tunnels, to alert control centers above ground as needed to ensure worker safety.

5G network technology in Tianjin, China, leverages Huawei’s 5GtoB solutions for remote operators. Higher network speeds allow for more efficient operations that yield meaningful results for port operator’s bottom lines, while consumers benefit by receiving goods faster.

In the manufacturing sector, companies are seeing a significant transformation in operations, as digitalization increases production capacity. A factory in Jingzhou, China, operated by Midea Group, became the world’s first fully 5G-connected electrical appliance factory. Powered by advanced mobile solutions from China Mobile and Huawei, production line capacity significantly increased — reducing inventory needs and delivering savings which can be passed on to consumers. As data volume requirements for operating modern businesses rise, 5G networks’ efficiency can be both more cost-efficient and require less energy.

Huawei made a bold claim that it would provide all the necessary components for running a 5.5G network by next year. However, no-one can define what 5.5G even is.

Yang Chaobin, the director and president of ICT Products & Solutions at Huawei, announced the company’s ambitious plans, stating that the launch would signify the beginning of the 5.5G era for the industry.

However, the term “5.5G” is currently not recognized by the 3rd Generation Partnership Project (3GPP), the organisation responsible for defining 5G and related standards.

The 3GPP is currently focused on evolving 5G through its work on Release 18, known as “5G-Advanced,” which includes significant enhancements like 10Gbps connections and the utilization of mmWave frequencies.

Huawei’s use of the term 5.5G seems to be an attempt to position Release 18 as the next iteration of 5G. Despite the lack of formal recognition, Huawei is confident in its ability to deliver advanced technologies, including AI-native capabilities, to enhance network performance and availability.

“With a clearly defined standardization schedule, the 5.5G Era is already poised for technological and commercial verification. In 2024, Huawei will launch a complete set of commercial 5.5G network equipment to be prepared for the commercial deployment of 5.5G,” Yang said. He claims that Huawei’s approach will enable the deployment of AI capabilities throughout the network.

Huawei’s involvement in 5G infrastructure has raised concerns among many governments due to security risks associated with the company. Several countries have even banned or restricted the use of Huawei’s 5G and 4G equipment. Consequently, it is unlikely that a significant number of global buyers will consider Huawei’s 5.5G offerings.

However, Huawei’s announcement could still garner positive attention domestically. Developing nations may also be attracted by Huawei’s competitively-priced communication equipment.

While Huawei’s claim to offer comprehensive solutions for a 5.5G network is ambitious, the term itself lacks formal recognition from standardization bodies. The company’s emphasis on AI capabilities and network enhancements may resonate with certain markets, but the geopolitical challenges it faces could limit its global reach.

References:

Omdia: China’s 5G network co-sharing + cloud will create growth opportunities for Chinese service providers

After building the world’s largest 5G network with 2.3 million 5G base stations by the end of 2022, China is on track add over 600,000 5G base stations and reach 2.9 million by the end 2023, according to new Omdia market research (owned by Informa). A key milestone in terms of China’s co-building and co-sharing 5G networks recently took place in May 2023, through the 5G network collaboration between all the four service providers in China. Under the organization and guidance of the Ministry of Industry and Information Technology (MIIT), the four major mobile operators in China – China Mobile, China Telecom, China Unicom, and China Broadnet, jointly announced the launch of what they claimed as the world’s first 5G inter-network roaming service trial. The service enables customers to access other telecom operators’ 5G networks and continue using 5G services when outside the range of their original operators’ 5G network.

Ramona Zhao, Research Manager at Omdia said: “Omdia expects inter-network roaming to improve operators’ 5G network coverage particularly in rural areas. Driven by better 5G network coverage, 5G will overtake 4G’s leading position and become the largest technology in China’s mobile market by 2026. By the end of 2028, we anticipate 5G will account for 65.1% of the total mobile subscriptions (including IoT connections).”

An advertisement for 5G mobile service at Shanghai Pudong International Airport. Image Credit: DIGITIMES

Omdia deems China as a 5G pioneer in terms of many areas, including technology innovation, network deployment, and 5G use cases. Driven by the increasing 5G adoption, Chinese service providers’ mobile service revenue and reported mobile (non-IoT) ARPU have all achieved year-on-year (YoY) growth in 2022. China Telecom reported an increase of 3.7% in its mobile service revenue; China Unicom‘s mobile service revenue saw a YoY increase of 3.6%; while China Mobile’s mobile service revenue also increased by 2.5% YoY.

Owing to the digital transformation demand from various state-owned enterprises, cloud services are also considered a growing business for Chinese service providers.

“Omdia recommends that Chinese service providers innovate more applications through the integration of cloud and the 5G network. This will be vital to enable the digital transformation of various industries and the acquisition of new revenue streams,” concludes Zhao.

According to a previous GSMA report, dubbed “The Mobile Economy China 2023”, 5G technology will add $290 billion to the Chinese economy in 2030, with benefits spread across industries.

“Mainland China is the largest 5G market in the world, accounting for more than 60% of global 5G connections at the end of 2022. With strong takeup of 5G among consumers, the focus of operators is now increasingly shifting to 5G for enterprises. This offers opportunities to grow revenues beyond connectivity in adjacent areas such as cloud services – a segment where operators in China have recently made significant progress,” the GSMA report reads.

5G will overtake 4G in 2024 to become the dominant mobile technology in China, according to the report. “4G and 5G dominance in China means legacy networks are now being phased out. While most users have been migrated to 4G and 5G, legacy networks continue to support various IoT services. However, some estimates suggest that legacy networks could be almost entirely shut down in China by 2025,” the study reads.

Chinese vendor Huawei Technologies has secured over half of a major contract to deploy 5G mobile base stations for local carrier China Mobile, according to recent reports by Chinese media.

Huawei obtained over 50% of the total of China Mobile’s centralized procurement program in 2023.

The report also stated that Huawei will provide 5G base stations for different frequency bands. The bands ranging from 2.6 GHz to 4.9 GHz will have around 63,800 stations, divided into two projects, while the number of base stations to operate in the 700 MHz band will be 23,100, divided into three projects. ZTE was the second-biggest winner in terms of base stations, followed by Datang Mobile Communications Equipment, Ericsson and Nokia Shanghai Bell.

References:

6th Digital China Summit: China to expand its 5G network; 6G R&D via the IMT-2030 (6G) Promotion Group

China will ratchet up resources to advance the construction of its 5G network, expand the application of 5G technology in various fields, and promote the research and development of 6G, officials and experts said at the 6th Digital China Summit, which ended on Friday in Fuzhou, Fujian province.

“China has built the world’s largest 5G network with the most advanced technologies. The number of the country’s 5G base stations had exceeded 2.64 million by the end of March this year,” said Zhao Ce, deputy head of the information and telecommunications development department at the Ministry of Industry and Information Technology.

Zhao said the ministry will make more efforts to bolster the building of the 5G network in an orderly manner and accelerate its industrial applications, push forward the R&D of 6G, and strengthen international exchange and communication in 5G-related technology, standards and application. 5G wireless technology has been used in 52 of the 97 major economic categories, with large-scale application expanded to mining, ports and electricity, he said. Moreover, China has already established the IMT-2030 (6G) Promotion Group, a flagship platform in China promoting 6G and international cooperation.

As 5G technology serves as a critical foundation supporting the development of artificial intelligence, big data and cloud computing, heightened efforts should be made to explore application scenarios of 5G and empower the transformation of traditional industries, said Zhang Wang, deputy head of the informatization development bureau of the Cyberspace Administration of China.

China has recently unveiled a plan for the overall layout of the country’s digital development, vowing to make important progress in the construction of a digital China by 2025, with effective interconnectivity in digital infrastructure, a significantly improved digital economy, and major breakthroughs achieved in digital technology innovation.

Cao Ming, president of the wireless product line at Huawei Technologies, said China is taking the lead in 5G development across the globe, and 5G is expected to play a bigger role in bolstering digitalization in a wide range of sectors covering intelligent connected vehicles and intelligent transportation.

6G is the upcoming sixth-generation cellular network technology that is currently in early development. One of the goals of 6G cellular technology is not just to deliver basic content faster to smartphones, like streaming video, but to create a cellular network capable of supporting real-time augmented reality, virtual reality, and a future Internet of Things (IoT) model where small smart devices are a ubiquitous presence in and outside of our homes.

When reading anything about 6G, especially the breathless and hype-laden announcements from telecommunications companies that emphasize how 6G will usher in the metaverse, a fusion of our physical and virtual lives, and so on, you should keep the “early” part of early development in mind.

Currently, there are no established 6G specifications or standards, let alone deployed 6G networks or devices. Even the most basic aspects of 6G development, like which specific frequencies the next generation cellular technology will rely on, are still being ironed out along with technical challenges like energy and heat dissipation demands of advanced 6G devices.

That said, we do have some idea what 6G will look like. Current cellular technology operates in the Megahertz (MHz) and the lower Gigahertz (GHz) frequency ranges. The portion of the radio spectrum under consideration and testing for 6G includes frequencies in the 30-300 Ghz range—also known as millimeter waves (mmWave) or Extremely High Frequency (EHF) radio—and the Terahertz (THz) frequency up to 3000 Ghz. The use of these frequencies will allow for data transmission well beyond the bandwidth capacity of current cellular technology.

In December of 2022, Qualcomm released a 6G development plan with 2030 as a projected rollout date for 6G tech. Ericsson’s 6G messaging echoes the early 2030s timeframe too, as do various interviews with telecom executives.

5G was first introduced in 2019. Four years later, there are still millions of cellular subscribers using 4G, and 5G is yet to have a fully realized coast-to-coast rollout. GSMA’s authoritative 2023 Mobile Economy report, for instance, indicates North American adoption rate of 5G is only 39%, with more than half of cellular subscribers still using 4G. By their projections, the North American 5G adoption rate will be 91% by 2030, meaning by the time 6G potentially arrives, there will still be 4G subscribers out there.

References:

China to introduce early 6G applications by 2025- way in advance of 3GPP specs & ITU-R standards

China’s MIIT to prioritize 6G project, accelerate 5G and gigabit optical network deployments in 2023

China Mobile unveils 6G architecture with a digital twin network (DTN) concept

Huawei reinvents itself via 5G-enabled digitalized services to modernize the backbone of China’s industrial sectors

In northern China sits Tianjin port’s “Smart Hub” – a fully digitalized and automated wharf where quay cranes, gantry cranes, stackers and forklifts are all controlled by a command center miles away. Powered by Huawei Technologies’ 5G telecommunications infrastructure, the smart port can move 36 20-foot equivalent units (TEU) per hour, much faster than humans.

“Digitalization is the industry trend, a direction not just for Chinese ports, but for all global ports,” Yang Jiemin, vice- president of Tianjin Port (Group), said during a recent visit by the South China Morning Post. “Our goal is to build a digital twin to Tianjin port in the next three to five years,” he added. The benefits of automation are clear. A staff of 200 operators and engineers can manage 1 million TEU in annual throughput at Tianjin port’s Terminal C, about 25 per cent of the employees needed in a typical year during its pre-digital age. The future has more in store: artificial intelligence (AI) for predicting congestion, big data analysis for parsing traffic trends and driverless trucks – all made possible by the ultra-fast exchange of data in 5G networks.

Shenzhen-based Huawei, with 195,000 employees in 2021 and one of the world’s largest research budgets, surpassing even that of Google and Microsoft, is now promoting the advantages of 5G-enabled digitalized services to modernize the backbone of China’s industrial production in coal mines, ports and even hospitals.

As U.S. sanctions tightened around Huawei’s access to critical technology, the firm’s smartphone business, which beat Apple to become the world’s second-biggest smartphone maker in 2018, came under tremendous pressure. Deprived of Google’s Android operating system and short of vital components, it sold its Honor budget smartphone business in 2020, the biggest driver behind its spectacular success. Huawei then pivoted back to its mainstay enterprise business, opening up new data-heavy products and services for customers to increase their usage and dependence on its 5G infrastructure.

The company established “legions” to spearhead the effort, a nod to the military parlance much liked by founder Ren Zhengfei, who served in the People’s Liberation Army. These cross-departmental business units were established to help clients digitally transform their products and services in mining, customs clearance and ports, energy savings at data centres, smart highways and the photovoltaic industry.

Last June, Huawei added five legions, bringing the total to 20. While it has not disclosed details about each legion, the chief executive of its airport and road legion, Li Junfeng, said the company was hopeful about the digitalization of transport.

“Airports and roads are also key infrastructure and it is difficult to expand in the overseas market. So we do not have plans for global expansion in the short term, but we will make some changes next year,” Li said in November, according to the state-owned Securities Times financial newspaper.

For Huawei, hopes are high that such industrial infrastructure can turn into a source of steady revenue – at least domestically – although the firm has declined to divulge the financial details of its showcase applications.

Huawei’s efforts to forge deeper ties with traditional industries build on its past work with the world’s private enterprises, leveraging its 5G connectivity and computing power to automate and upgrade various verticals, says Matthew Ball, chief analyst at research firm Canalys.

“Overall, this is an extension of what Huawei has done for years, even before the US sanctions, particularly its enterprise business, which had a strong vertical focus on delivering solutions across its portfolio,” Ball said.

“It’s just that its smartphone business has received more headlines.”

The jury is still out on whether Huawei can survive US sanctions, especially given Western reluctance to allow it future access to potentially sensitive data and network infrastructure contracts on national security grounds. The company has already undergone huge change since Trump added it to a trade blacklist in May 2019, barring it from doing businesses with US partners without special permits.

Huawei’s rotating chairman, Eric Xu, said in a new year’s message that the company had exited “crisis mode” and was ready to go “back to business as usual” in 2023. The bleeding has been staunched after it reported preliminary revenue of 636.9 billion yuan (HK$736.3 billion) for 2022, little changed from the previous year.

The pressure remained on Huawei even after Trump lost his re-election bid. Reports emerged last month that Joe Biden’s administration was considering cutting off Huawei from all its US suppliers, including Intel and Qualcomm, which produce the semiconductors critical to the company’s telecoms gear.

Huawei has been reporting its annual results since 2000 even if it is not subject to public disclosure regulations, a practice from bidding for tender contracts in public telecoms networks.

The share of China revenue in its overall business has increased from about half in 2018 to around two-thirds in 2021 due to a retreat from almost all overseas markets, including the Asia-Pacific, the Americas and Europe, the Middle East and Africa, according to its results.

Its consumer business, mainly smartphones and devices, has been hobbled by a lack of access to advanced chips.

At one point, Huawei briefly surpassed Apple and Samsung Electronics to become the world’s biggest handset vendor, but it is now out of the top five. By the third quarter of 2022, it finally ran out of less advanced in-house- designed semiconductors for its handsets.

Huawei’s carrier unit, once its bread-and-butter business of selling telecoms gear, has slipped as China’s telecoms operators gradually complete network upgrades. In 2021, its carrier business revenue was 40 per cent lower than in 2019 when China began 5G infrastructure installation.

That leaves enterprise as the only segment with growth, notching up a 2.1 per cent revenue increase in 2022, although its contribution was still less than one-sixth of total sales.

At the beginning of 2021, Huawei founder Ren told employees the company must make cloud computing its priority, and personally endorsed the firm’s partnership with coal mines.

The company is developing customized 5G mobile base stations for the mining industry that are resistant to dust, dampness and even shock waves from explosions. These devices are expected to support stable and fast upload of real-time data from unstaffed machinery, sensors and high-definition cameras, which would help China’s most dangerous industry cut back on the number of people working in the pits. The mining industry would be the first to use the model where scientists and experts from different corporate departments could come together to find solutions to specific industry problems, Ren said in 2021 in the Shanxi provincial capital of Taiyuan.

Enhancing end-to-end user experience, real-time processing of massive data and the operation, maintenance and management of complex networks would all become challenges for the financial industry in the future, according to a June speech by Cao Chong, the head of Huawei’s digital finance legion, the Securities Times reported.

Huawei has also made a foray into the electric-vehicle sector, with the high-profile launch of Aito cars, a brand launched jointly with Chinese electric-car maker Seres. However, competition is cutthroat in China, and Huawei ranked only sixth among the country’s electric-vehicle start-ups with a total of 76,180 units by the end of 2022. The company has also forged ties with a series of carmakers offering smart car components.

The change in Huawei’s business is visible to consumers. On the ground floor of its Shenzhen flagship store, a three-storey building with a huge glass facade, customers approached a row of Aito cars during a recent visit, asking sales representatives about vehicle specifications and available discounts. At the other end of the showroom, Huawei’s latest smartphones and tablets were on display on long wooden tables. While analysts are generally sanguine on Huawei’s new enterprise business moves, the digitalization push is not expected to result in a short-term revolution.

“The enterprise business should be able to generate rapid growth in the next five to 10 years,” said Ivan Lam, a senior analyst at Counterpoint Research. But the threat of US sanctions remains the biggest obstacle for Huawei, according to Lam, especially for products that require advanced computing power such as smartphones, servers and car components.

“Huawei has never treated existing sanctions as the last, and it has been preparing for new restrictions in various ways, such as adoption of domestic technologies. We expect Huawei to reap the benefits of these efforts in coming years and close the gap in key technologies,” ” Lam said.

……………………………………………………………………………………………………………………………………………………………………………………………….

Separately, the South China Morning Post reported that Huawei Technologies Co chief financial officer Meng Wanzhou, daughter of company founder and chief executive Ren Zhengfei, is expected to take her turn as “rotating chairwoman” in the company from April, according to local media reports, signalling that a succession plan looks to be in place at the struggling Chinese telecommunications giant.

It would mark the first time that Meng, 50, has assumed the role since she was added as one of three rotating chairmen at Huawei in March last year, alongside Eric Xu Zhijun and Ken Hu Houkun. Xu’s current acting chairman term started on October 1 last year and will conclude on March 31.

During her six-month turn as the company’s top leader, Meng, who also serves as deputy chairwoman at Huawei, will head the company’s board of directors and its executive committee.

Meng was hailed as a national hero upon her return to China in a chartered flight in September 2021, following nearly three years under house arrest in Canada where she fought extradition to the US over a bank fraud case. Under a deal reached with US prosecutors, that case and other charges against Meng were dismissed last December.

References: