Omdia

Ookla: Europe severely lagging in 5G SA deployments and performance

According to a new joint study from Omdia and Ookla, Europe has had the poorest 5G SA availability and performance among major regions. In Q4 2024, China (80%), India (52%), and the United States (24%) led the world in 5G SA availability based on Speedtest® sample share, markedly ahead of Europe (2%).

The European region also lagged behind its peers in performance, with the median European consumer experiencing 5G SA download speeds of 221.17 Mbps—lower than those in the Americas (384.42 Mbps) and both Developed (237.04 Mbps) and Emerging (259.73 Mbps) Asia Pacific. The interplay of earlier deployments, a more diversified multi-band spectrum strategy, and greater operator willingness to invest in the 5G core to monetize new use cases have driven rollouts at a faster pace in regions outside Europe.

The European Commission has championed measures to accelerate private investment in 5G SA, highlighting network slicing—a flagship capability of cloud-native core networks—as a key potential driver of its broader industrial strategy in sectors such as precision manufacturing, defense and clean energy. Up until this point, high-quality public data examining Europe’s progress in 5G SA—and benchmarking its competitive position relative to other global regions—has been scarce. In its latest annual report, Connect Europe, the trade body representing Europe’s telecoms operators, noted that “there is limited information available about the extent of operators’ rollout of 5G SA.”

Advanced network capabilities enabled by the technology remain stubbornly limited to just a few operators in leading markets such as the U.S., according to the study, while Europe lags behind its peers on several 5G SA performance indicators, “raising concerns about the bloc’s competitiveness in the technology.”

Network operator investment per capita also lags in Europe as per the below chart:

When faced with choices among investments in fiber, 5G RAN, and 5G SA core, the latter frequently loses out, since operators can still launch a “5G” network by leveraging alternative technologies. There is also a lack of 5G SA-compatible devices, especially devices with User Equipment Routing Selection Policy (URSP) technology, which allows a device to dynamically select a slice (or multiple slices) provisioned by an operator. However, only Android 12/iOS 17 mobile devices support that largely unknown technology.

While capital spending on the 5G core transition is now increasing rapidly, European network operators will remain committed to strict cost discipline Based on Omdia’s Q3 2024 quarterly core software market share and forecast, the research firm believes that the global core market revenue from both 4G and 5G network functions will grow with a five-year CAGR of 3.2% between 2023 and 2028. When considering the spending in 5G core software, the forecasted growth with a five-year CAGR during the same period is of 17.0%.

Omdia now forecasts that 5G SA core spending in EMEA will grow with a five-year CAGR of 26.2% between 2023 and 2028. Nonetheless, as a prerequisite, deploying the 5G core also requires a good 5G radio coverage, to avoid a degraded experience where the 5G coverage is limited or nonexistent, and where the user falls back on 4G-LTE or 2G/3G. This means operators must invest in 5G RAN, which is usually considered the highest capex draining activity for an operator. While 5G is known for very high throughput speeds using mid-band (and particularly C-band) spectrum, these bands need to be complemented by sub-GHz spectrum deployment, in order to offer improved in-building and wide area coverage. This rollout has been slow in many European markets, with 5G availability in all countries outside the Nordics remaining significantly lower than that in the United States and China, according to Ookla’s Q4 2024 Speedtest Intelligence® data.

One bright spot is that Europe has made progress on achieving low latency on its 5G networks. In Q4 2024, the average country-wide median latency in Europe was 32 milliseconds (ms) compared to 35 ms in the Americas and 36 ms in Emerging Asia Pacific region.

References:

https://www.lightreading.com/5g/eurobites-europe-behind-on-5g-sa-study

https://www.ookla.com/s/media/2025/02/ookla_omdia-5GSA_0225.pdf

Building and Operating a Cloud Native 5G SA Core Network

Latest Ericsson Mobility Report talks up 5G SA networks and FWA

GSA 5G SA Core Network Update Report

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

Vision of 5G SA core on public cloud fails; replaced by private or hybrid cloud?

Nokia and Eolo deploy 5G SA mmWave “Cloud RAN” network

Nokia, BT Group & Qualcomm achieve enhanced 5G SA downlink speeds using 5G Carrier Aggregation with 5 Component Carriers

Analysys Mason’s gloomy CAPEX forecast: “there will not be a cyclical recovery”

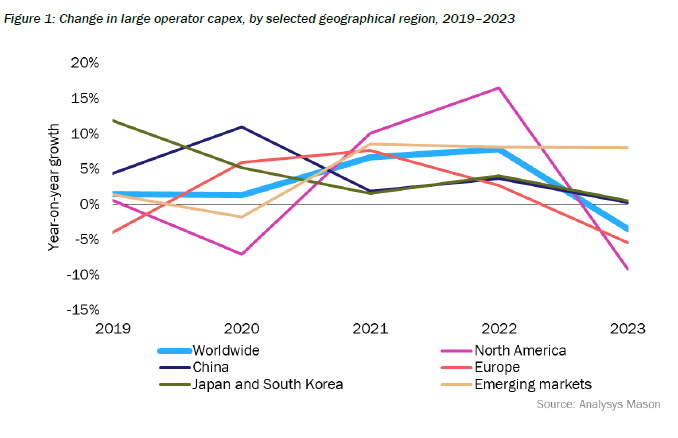

Telco capex declined worldwide in 2023, and predictions in end-of-financial year results indicate further declines this year. Analysys Mason warns that a “long decline” in capital expenditure has now started. “There will not be a cyclical recovery,” says one subhead (see below). Analysys Mason crunched a lot of numbers to arrive at this conclusion, processing historical data for about 50 of the largest operators in the world. Importantly, it also looked at the long-term guidance issued by those companies. Capex has peaked partly because telcos in many regions have completed or are near completing a once-in-a-lifetime upgrade to full-fiber networks. Clearly, that’s bad news for companies selling the actual fiber. Operators will continue to invest in the active electronics for these lines, but that represents a “tiny fraction” of the initial cost.

This new Analysys Mason gloomy CAPEX forecast comes after Dell’Oro and Omdia (owned by Informa) previously forecast another sharp fall in telco spending on mobile network products this year after the big dip of 2023.

Figure 1. below aggregates change in capex, excluding spectrum, in 2023 (or FY2023/2024) for 50 of the largest operators in the world, all with annual capex of over USD1 billion in 2023. These operators account for about 78% of telecoms capex worldwide. Of the 42 operators that provided guidance on capex in 2024, 28 forecast a fall. A notable class of exceptions consisted of cable operators and latecomers to FTTP upgrade, but most of the emerging-market-focused operators indicated a decline.

The steepest decline was in North America. The decline was steeper for the three largest mobile network operator (MNO) groups (–18.1%). This was offset by rises in capex by the two large US cablecos, for which upgrades of HFC plant are now an imperative. The obvious reason for the sharp decline is the near-completion of 5G roll-out, although FTTP capex remains flat.

In China, capex was flat overall. This disguises a decline in 5G and fixed broadband capex, which, taken together with transmission, fell 7% in 2023. The delta of capex has gone on what operators call ‘computility’ (compute power in data centers and edge) and capabilities (developing the ability to serve mainly the industrial enterprise). Together these two items now account for about 35% of operator capex.

In Japan and South Korea, capex was also more or less flat (+0.5%). As in China, a high proportion of capex in Japan now goes on adjacent lines of business.

Capex declined by 5.5% in Europe. The European figure disguises the impact of the large number of smaller players in the continent. 5G spending has peaked, but so too has FTTP spending. FTTP spend represents a very high share of capex in Europe (about one half), although this is distributed differently across individual countries. Countries like France and Spain have passed that peak, but even in the UK, a relatively late starter, spend has plateaued. Among operators in emerging markets, the smallest group in absolute capex terms, there was a rise of 8%, steady now for three years running, driven almost entirely by India, and offset by declines elsewhere.

There will not be cyclical recovery of capex:

Operators’ longer-term projections of capex suggest, if anything, steepening declines in capex. Our forecasts indicate that capital intensity (capex/revenue) will fall from around 20% now to 12–14% by the end of the decade. Capex will fall basically because customers do not need more than the 1Gbit/s fibre and unlimited 5G that the current networks are easily capable of delivering, and growth in measurable demand slows every year. This will have the following effects:

•Fall in fixed access spend. Capex on FTTP is essentially a one-off investment in passive assets with very long useful lives. Future capex on upgrades (in effect replacements) of FTTP actives will come at a tiny fraction of this cost. The pipeline of plans for commercial build is running dry, although this is offset by some hefty subsidies for rural build, particularly in the USA. Those cablecos that have not already started will have to brace themselves for programs of replacement of HFC/DOCSIS by FTTP/xPON.

•We expect only limited uplift for 5G SA/5G Advanced. This is in part because some operators will not be able to justify a further upgrade after 5G NSA, in part because of slack demand, and in part because the sums involved will be lower than for the roll-out of 5G NSA.

•6G will not be capex-intensive. There is little appetite in free-market economies without centralised planning (and perhaps not so much even there) for a capex-intensive generational upgrade to 6G. There will be no cyclical uplift.

•There will be more outsourcing, i.e. replacement of capex by an opex line. This occurs mainly in infrastructure, but also in migrations of operations (IT capex) to the cloud. Yet this does not mean that capex is simply shifting from one class of business to another; infra companies exist in a world with similar constraints.

•In these circumstances there is a clear case for capex investment in anything that maximizes the efficient (and sustainable) use of the physical assets as they stand, and unlocks any opportunities that exist in new business-models. This is prominent in many operator outlooks.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

William Webb, an independent consultant and former executive at UK telecom regulator Ofcom, forecasts an S-curve flattening by 2027. In a forthcoming book called “The end of telecoms history,” Webb returns to predictions he first made in 2016 to gauge their accuracy. Using recent historical data from Barclays, he was able to show a close alignment with the S-curve he drew about eight years ago. If this behavior continues, growth rates “will fall to near zero by around 2027, with significant variations by country,” says Webb in his book, giving a sneak preview to Light Reading.

Webb’s broad rationale is that there is an upper limit on daily gigabyte consumption, just as there is only so much the average person can eat or drink. All Webb had to do was assume there will be some future gorging by customers on high-quality video, the most calorific meal for any smartphone. “Once they are watching video for all their free moments while downloading updates and attachments there is little more that they could usefully download,” he writes.

What of future services people do not currently enjoy? Outside virtual reality – which, for safety reasons, will probably always happen in a fixed-line environment – no app seems likely to chew through gigabytes as hungrily as moving images do in high definition. Webb clearly doubts the sort of artificial intelligence (AI) services being advertised by Apple will have much impact whatsoever.

“There may be substantially more traffic between data centers as models are trained but this will flow across high-capacity fiber connections which can be expanded easily if needed,” he told Light Reading by email. “At present AI interactions are generally in the form of text, which amounts to miniscule amounts of traffic.”

“Indeed, if time is diverted from consuming video to AI interactions, then AI may reduce the amount of network traffic,” he continued. Even if AI is used in future to create images and videos, rather than words, it will probably make no difference given the amount of video already consumed, merely substituting for more traditional forms of content, said Webb.

For those confident that data traffic growth stimulates investment, the other problem is the lack of any correlation between volumes and costs. Advanced networks are designed to cope with usage up to a certain high threshold before an upgrade is needed. Headline expenses have not risen in lockstep with gigabytes.

References:

https://www.lightreading.com/5g/ericsson-and-nokia-may-be-stuck-with-skinflint-customers-for-years

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

U.S. Network Operators and Equipment Companies Agree: 5G CAPEX slowing more than expected

Dell’Oro: Optical Transport, Mobile Core Network & Cable CPE shipments all declined in 1Q-2024

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

Where Have You Gone 5G? Midband spectrum, FWA, 2024 decline in CAPEX and RAN revenue

“The “5G Train Wreck” we predicted five years ago has come to pass. With the possible exception of China and South Korea, 5G has been an unmitigated failure- for carriers, network equipment companies, and subscribers/customers. And there haven’t been any significant performance advantages over 4G.”

U.S. fiber rollouts now pass ~52% of homes and businesses but are still far behind HFC

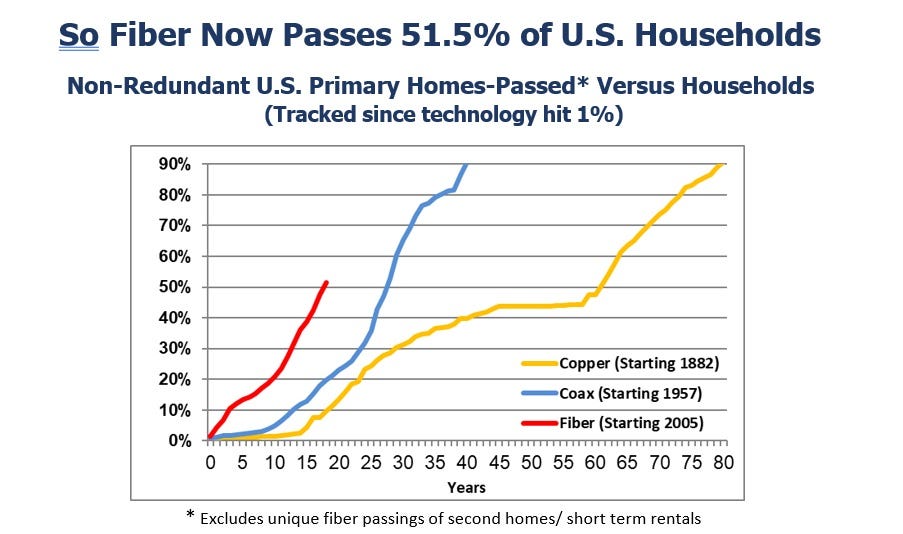

Fiber optic network deployments have reached a milestone as they now pass more than 50% of U.S. households, according to recent report from the Fiber Broadband Association (FBA) [1.] and RVA Market Research and Consulting. Fiber broadband deployment set a new historical record in 2023, passing nine million new homes at a growth rate of 13% year-over-year. The 2023 North America Fiber Provider Survey, sponsored by the FBA, concluded that 77.9 million U.S. homes were passed with fiber, with nearly 52% of all the nation’s unique homes and businesses passed.

Note 1. The FBA is an all-fiber trade association that provides resources, education, and advocacy for companies, organizations, and communities that want to deploy fiber networks. The FBA’s goal is to raise awareness and provide education about the fiber deployment process, safe worksites, and effective fiber installs.

Image Credit: The Fiber Broadband Association (FBA)

………………………………………………………………………………………………………………………………………………………………………………………….

The last $10 billion U.S. Treasury American Rescue Plan (ARP) funding for infrastructure projects such as broadband networks is being distributed this year. The $42.5 billion in NTIA BEAD funding available over the next few years will significantly contribute to enabling and upgrading communities across America with the high-speed, low-latency broadband necessary for participation in today’s 21st-century society. We are seeing a steady stream of NTIA approvals and expect the first states to make BEAD awards in the second half of 2024.

Here’s how the growth of fiber has risen in recent years compared to coax cable (or hybrid fiber/coax, HFC) and the long history of copper.

“Thanks to this latest surge, fiber lines now pass nearly 78 million U.S. homes, up 13% from a year ago,” Alan Breznick, Heavy Reading analyst and the cable/video practice leader at Light Reading, explained in recorded opening remarks here at Light Reading’s 17th’s annual Cable Next-Gen event. Almost 69 million of those locations are “unique” fiber homes, meaning that about 9 million are passed by more than one fiber provider, Breznick added.

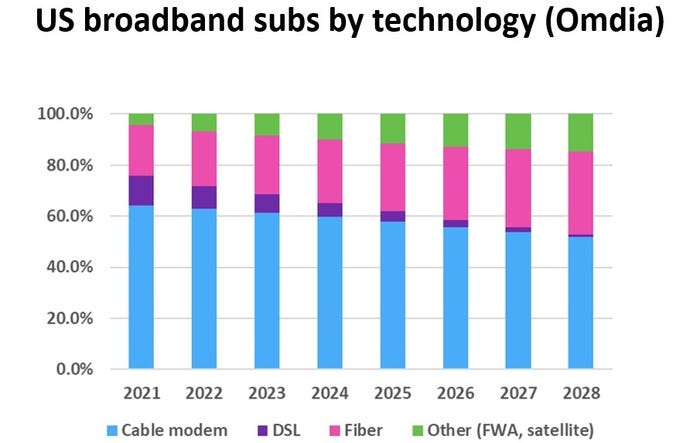

The share of broadband technology is also evolving. While HFC remains the primary way of delivering broadband, fiber-to-the-premises (FTTP) and fixed wireless access (FWA) will continue to make their presence felt in the coming years. Omdia (owned by Informa) expects cable’s share of that mix to drop over the next four years, hitting about 55% by 2028, while fiber’s share is expected to rise to 30% by that time, Breznick explained.

For the cable industry, fiber and FWA are not solely about competition. Many operators are also using FTTP extensively in greenfield deployments and subsidized rural buildouts. They are deploying it on a targeted basis via a new generation of nodes that can support multiple access technologies, including HFC and wireless.

CableLabs has put fiber-to-the-premises on the front burner via a pair of new working groups. A recent survey from Omdia shows that more than one-third of cable operators have already deployed passive optical networking (PON) in some form. That number will “undoubtedly keep rising” thanks to initiatives such as the Broadband Equity Access and Deployment (BEAD) program, Breznick said. Omdia expects spending on next-gen cable technologies to tick up in 2024 and 2025 and then reach a relatively steady annual state through 2029.

Meanwhile, operators such as Mediacom Communications have tapped into FWA to extend the reach of broadband in rural areas. Combined, they demonstrate some of the reasons why the industry has been shedding the “cable” label via rebranding efforts and name changes in recent years.

Cable’s broadband challenge is to grow broadband subscribers as it faces more broadband competition combined with historically low churn and a slow housing move market. “If it feels like an uphill battle for cable, maybe that’s because it is. But that doesn’t mean it has to be a losing battle,” Breznick said. “That’s because the cable industry still has plenty of tricks left up its sleeve.”

Those tricks include the use of next-generation DOCSIS 3.1 (sometimes called DOCSIS 3.1+ or extended DOCSIS 3.1) that can bump up speeds as high as 8 Gbit/s by opening up new orthogonal frequency division multiplexing (OFDM) channels. Some operators, including Comcast, Charter Communications, Rogers Communications, Cox Communications and Cable One, have begun to deploy DOCSIS 4.0 or have put it squarely on their network upgrade roadmaps.

And though cable operators’ network spending is expected to be down in the first half of 2024, vendors are optimistic that the spigots will start to open up again in the second half of the year as operators pick up the pace.

References:

https://www.lightreading.com/fttx/us-fiber-rollouts-reach-tipping-point-but-are-still-far-behind-hfc

Fiber Connect 2023: Telcos vs Cablecos; fiber symmetric speeds vs. DOCSIS 4.0?

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Nokia’s launches symmetrical 25G PON modem

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

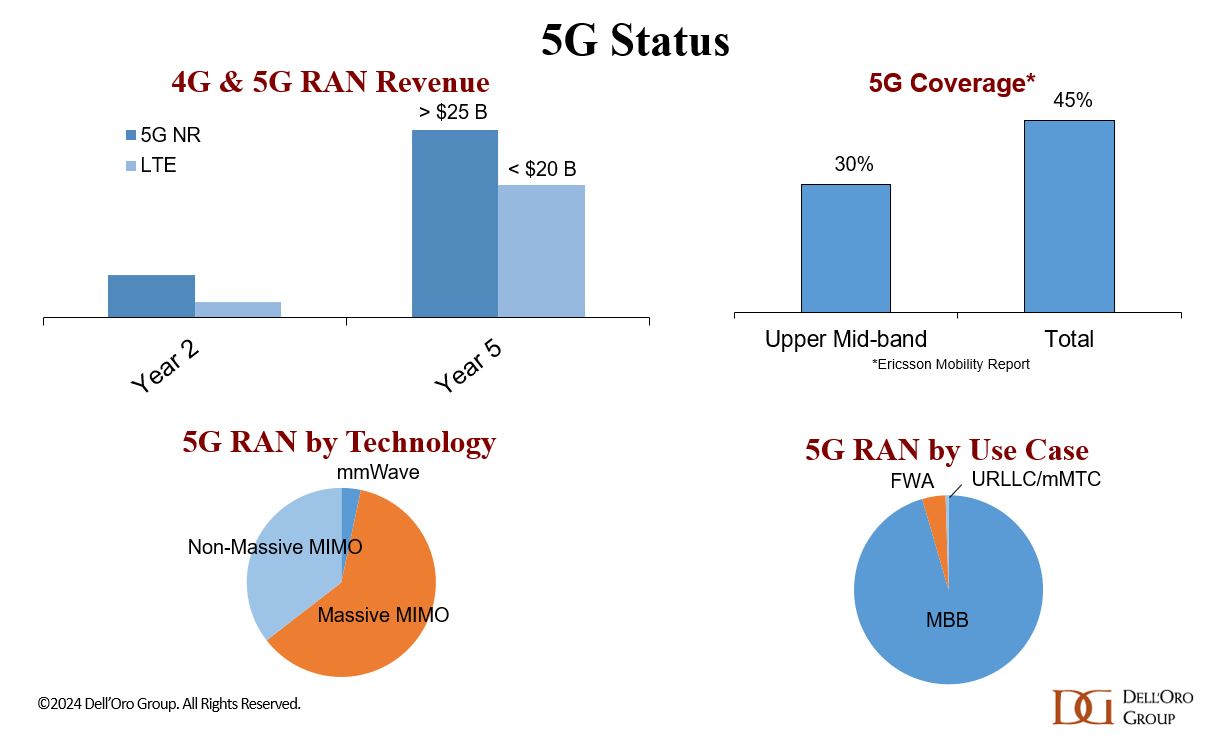

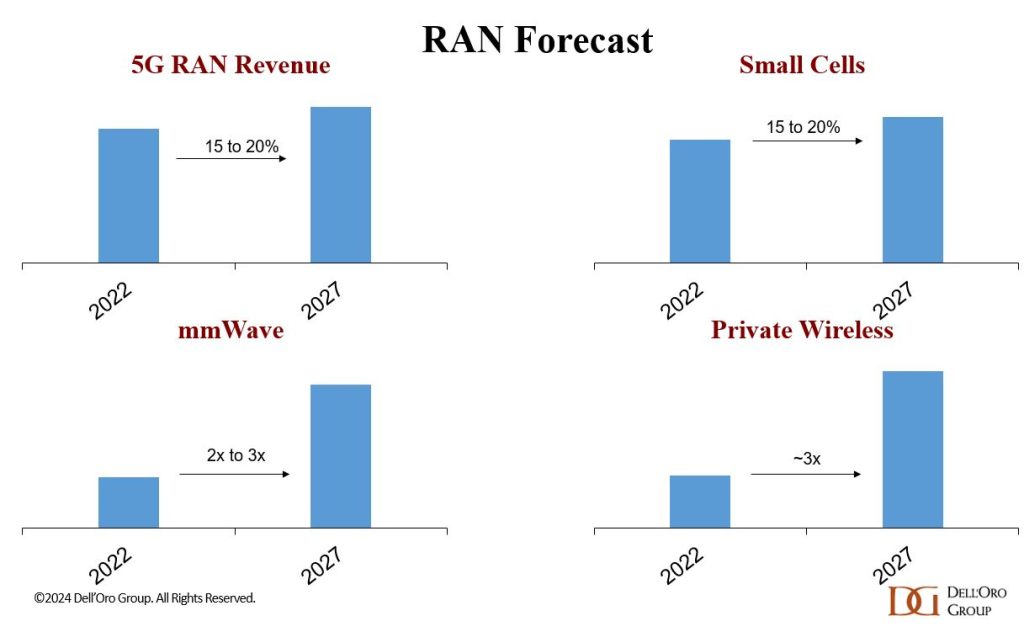

A new report from the Dell’Oro Group reveals that the global Radio Access Network (RAN) market concluded the year with another difficult quarter, resulting in a global decrease of nearly $4 billion in RAN revenues for the full year of 2023. However, despite these challenges, the results for the quarter exceeded expectations, partly due to robust 5G deployments in China.

“Following the intense rise between 2017 and 2021, it’s clear that the broader RAN market is now experiencing a setback, as two out of the six tracked regions are facing notable declines,” said Stefan Pongratz, Vice President for RAN market research at the Dell’Oro Group. “In addition to challenging conditions in North America and Europe, the narrowing gap between advanced and less advanced operators (e.g. India) in this first 5G wave, compared to previous technology cycles, initially had a positive impact but is now constraining global 5G and broader RAN growth prospects,” Pongratz added.

Additional highlights from the 4Q 2023 RAN report:

- Overall concentration in the RAN market showed signs of improvement in 2021 and 2022, but this progress slowed down in 2023.

- While full-year RAN rankings remained mostly unchanged for major suppliers, revenue shares within the RAN market showed more variability, with Huawei and ZTE enhancing their global revenue shares. Similarly, Huawei and Nokia saw improvements in their revenue shares outside of China.

- The top 5 RAN suppliers based on worldwide revenues are Huawei, Ericsson, Nokia, ZTE, and Samsung.

- Regional projections are mostly unchanged, with market conditions expected to remain tough in 2024 due to difficult comparisons in India. Nevertheless, the base-case scenario anticipates a more moderate pace of decline this year.

…………………………………………………………………………………………………………………………

Source: Dell’Oro Group

…………………………………………………………………………………………………………………………

Separately, Rémy Pascal of Omdia says that global RAN revenues (including both hardware and software) declined by 11% last year to just over $40 billion. The worst performing region by far was North America, which almost halved, but this should be viewed in the context of a relatively strong 2022.

India and China were been the best performing countries for new RAN deployments. This partly explains why Huawei continues to be the top RAN vendor despite attempts by the U.S. and its allies to prevent that, but as the Omdia table below shows, the Chinese vendor is still doing well in many other regions too. We’re told this table looked pretty much the same last year.

Top RAN vendors by region, full year 2023:

|

North America |

Asia & Oceania |

Europe, Middle East and Africa |

Latin America & the Caribbean |

|

Ericsson |

Huawei |

Ericsson |

Huawei |

|

Nokia |

ZTE |

Nokia |

Ericsson |

|

Samsung |

Ericsson |

Huawei |

Nokia |

Source: Omdia

Omdia expects the RAN market size to decrease by around 5% compared to 2023. That’s an improvement on the 11% 2022-23 decline but still not good news for the RAN industry.

For all the talk of Open RAN, it clearly has yet to inspire significant capex from operators. The same goes for private 5G or programmable networks. Less than halfway through the presumed 5G cycle, spending has stalled and it’s not at all clear what will restart it.

Dell’Oro Group’s RAN Quarterly Report offers a complete overview of the RAN industry, with tables covering manufacturers’ and market revenue for multiple RAN segments including 5G NR Sub-7 GHz, 5G NR mmWave, LTE, macro base stations and radios, small cells, Massive MIMO, Open RAN, and vRAN. The report also tracks the RAN market by region and includes a four-quarter outlook. To purchase this report, please contact us by email at [email protected].

References:

RAN Market Shows Faint Signals of Life in 4Q 2023, According to Dell’Oro Group

https://www.telecoms.com/wireless-networking/global-ran-market-declined-by-11-in-2023

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

https://www.silverliningsinfo.com/5g/ericsson-nokia-and-state-global-ran-2024

LightCounting: Open RAN/vRAN market is pausing and regrouping

Omdia: China’s 5G network co-sharing + cloud will create growth opportunities for Chinese service providers

After building the world’s largest 5G network with 2.3 million 5G base stations by the end of 2022, China is on track add over 600,000 5G base stations and reach 2.9 million by the end 2023, according to new Omdia market research (owned by Informa). A key milestone in terms of China’s co-building and co-sharing 5G networks recently took place in May 2023, through the 5G network collaboration between all the four service providers in China. Under the organization and guidance of the Ministry of Industry and Information Technology (MIIT), the four major mobile operators in China – China Mobile, China Telecom, China Unicom, and China Broadnet, jointly announced the launch of what they claimed as the world’s first 5G inter-network roaming service trial. The service enables customers to access other telecom operators’ 5G networks and continue using 5G services when outside the range of their original operators’ 5G network.

Ramona Zhao, Research Manager at Omdia said: “Omdia expects inter-network roaming to improve operators’ 5G network coverage particularly in rural areas. Driven by better 5G network coverage, 5G will overtake 4G’s leading position and become the largest technology in China’s mobile market by 2026. By the end of 2028, we anticipate 5G will account for 65.1% of the total mobile subscriptions (including IoT connections).”

An advertisement for 5G mobile service at Shanghai Pudong International Airport. Image Credit: DIGITIMES

Omdia deems China as a 5G pioneer in terms of many areas, including technology innovation, network deployment, and 5G use cases. Driven by the increasing 5G adoption, Chinese service providers’ mobile service revenue and reported mobile (non-IoT) ARPU have all achieved year-on-year (YoY) growth in 2022. China Telecom reported an increase of 3.7% in its mobile service revenue; China Unicom‘s mobile service revenue saw a YoY increase of 3.6%; while China Mobile’s mobile service revenue also increased by 2.5% YoY.

Owing to the digital transformation demand from various state-owned enterprises, cloud services are also considered a growing business for Chinese service providers.

“Omdia recommends that Chinese service providers innovate more applications through the integration of cloud and the 5G network. This will be vital to enable the digital transformation of various industries and the acquisition of new revenue streams,” concludes Zhao.

According to a previous GSMA report, dubbed “The Mobile Economy China 2023”, 5G technology will add $290 billion to the Chinese economy in 2030, with benefits spread across industries.

“Mainland China is the largest 5G market in the world, accounting for more than 60% of global 5G connections at the end of 2022. With strong takeup of 5G among consumers, the focus of operators is now increasingly shifting to 5G for enterprises. This offers opportunities to grow revenues beyond connectivity in adjacent areas such as cloud services – a segment where operators in China have recently made significant progress,” the GSMA report reads.

5G will overtake 4G in 2024 to become the dominant mobile technology in China, according to the report. “4G and 5G dominance in China means legacy networks are now being phased out. While most users have been migrated to 4G and 5G, legacy networks continue to support various IoT services. However, some estimates suggest that legacy networks could be almost entirely shut down in China by 2025,” the study reads.

Chinese vendor Huawei Technologies has secured over half of a major contract to deploy 5G mobile base stations for local carrier China Mobile, according to recent reports by Chinese media.

Huawei obtained over 50% of the total of China Mobile’s centralized procurement program in 2023.

The report also stated that Huawei will provide 5G base stations for different frequency bands. The bands ranging from 2.6 GHz to 4.9 GHz will have around 63,800 stations, divided into two projects, while the number of base stations to operate in the 700 MHz band will be 23,100, divided into three projects. ZTE was the second-biggest winner in terms of base stations, followed by Datang Mobile Communications Equipment, Ericsson and Nokia Shanghai Bell.

References:

Omdia: China Mobile tops 2023 digital strategy benchmark as telcos develop new services

Telecom operators around the world are embracing digital transformation and developing services in new sectors (beyond connectivity) to facilitate that megatrend. Omdia’s Service Provider Digital Strategy Benchmark report, which scores the digital strategies of 12 major global operator, identified the leaders as: China Mobile, SK Telecom, NTT DoCoMo, and Deutsche Telekom. With telecom operators all making a fair amount of noise about digital transformation, it’s useful to have a way of ranking their efforts and cutting through the marketing hype.

China Mobile scored 27.5 points out of a maximum of 35. It scored so highly due to the scale at which it has deployed high-speed broadband and subsequently used that infrastructure as platform to develop new services, Omdia explained.

“East Asian operators account for three of the top-four places in the benchmark, demonstrating that service providers in the region are among the most advanced in the world. China Mobile is showing a particularly impressive speed of change, with digital transformation services now accounting for more than 25% of service revenues,” said Dario Talmesio, Research Director, Service Provider Strategy & Regulation, at Omdia. “China Mobile is rapidly turning itself into a TechCo operator with an array of digital services beyond connectivity,” he added.

China Mobile reported a 30% year-on-year increase in digital transformation revenue for full-year 2022 to 207.6 billion yuan (US$29 billion), while overall telecommunications services revenues came in at CNY812.1 billion ($114 billion), up by 8.1%.

The China state owned telco itself attributed the growth in digital transformation revenue to “the rapid expansion of 5G applications, mobile cloud, digital content, smart home and other businesses,” and talked up its “remarkable results” in that area. “These services have become a key growth driver contributing to a more balanced, stable and healthy overall revenue structure,” it said in its annual results announcement.

SK Telecom’s position at number two in the ranking is based on its drive to reinvest itself as an AI company and its work to develop services in areas including the metaverse and urban air mobility, Omdia said.

When SK Telecom chief executive took the reins just over 18 months ago, he outlined plans to drive a 20% revenue hike between 2020 and 2025 essentially by transforming the telco into an AI and digital infrastructure company. Amongst other things, that meant turning the firm’s ifland metaverse into an open platform, and a year later the telco was able to announce that its metaverse platform had gone global.

It is working with a number of other operators on metaverse content and technology, including Singtel and NTT DoCoMo, the latter also performing well on digital transformation. Fairly generally, Omdia talks up DoCoMo’s strength in technology and digital services.

Omdia also picks out e& – the operator formerly known as Etisalat – for particular mention. The United Arab Emirates-based telco group ranks fifth in the benchmark.

“e&’s strong showing is based on its new strategy, unveiled in early 2022, of transforming itself into a global technology and investment group—a strategy that it is pursuing vigorously,” said Matthew Reed, Chief Analyst, Service Provider Markets, at Omdia.

The UAE telco reorganised itself under four pillars. The first covers its existing telecoms operations, but the second and third, E& life and e& enterprise, are responsible for new digital services and experiences in the consumer and business markets respectively. The fourth is about investment. The firm made many headlines with its decision to adopt e& as its new brand; the rebrand arguably overshadowed the strategic shift. But with that ampersand essentially standing for all the new sectors in addition to telecoms – next-gen technologies, digital experiences, financial services, the cloud, IoT, AI and so forth – it does make sense, and clearly e& is doing something right to find itself scoring 22 in the Omdia benchmark.

Bharti Airtel is ranked seventh in the 2023 benchmark, up from ninth place in 2022 following Airtel’s launch of 5G in India in late 2022 and as Airtel continues to develop its sizeable portfolio of digital services.

ABOUT OMDIA:

Omdia, part of Informa Tech, is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

References:

https://telecoms.com/522182/east-asian-telcos-ahead-on-digital-transformation/

Omdia: Consumer Telco Opportunity Challenged by Global Tech Giants

Omdia Surveys: PON will be a key part of network operator energy reduction strategies

Omdia forecasts weaker 5G market growth in near term, 4G to remain dominant

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

Big 5 Event: wireless connectivity use cases for healthcare, network slicing, security and private networks

Emerging use cases for wireless telecommunications technology was discussed at the Big 5G event in Austin, TX last week in a panel session titled, “Future connectivity use cases and the Holy Grail: Private networks, metaverse, 6G and beyond.” The questions addressed included:

- Who is monetizing private networks and what are we learning from their experiences?

- Should telcos move past targeting only large enterprise customers for 5G services?

- When will the metaverse take off?

- How are telcos gearing up for 6G and what are the expectations?

Jodi Baxter, vice president for 5G and IoT connectivity at Telus, described the numerous emerging applications of 5G in healthcare. One example is a connected ambulance project carried out with Alberta Health Services, where, thanks to 5G, doctors can remotely issue authorizations necessary for stroke medication, which needs to be administered within a narrow time window.

Some of the applications developed for the healthcare sector can also be included in telcos’ offerings to corporate customers. Baxter said Telus has included remote doctor and nurse consultations in 5G bundles for small businesses, which can help their staff retention rates. Healthcare companies are also looking at more specific applications, with Baxter citing the example of a healthcare company that would wish to track hip and knee replacements with 5G.

While sustainability is often seen as an unprofitable endeavor, Baxter argued technology can help customers see a return on investment. One of Telus’s projects in this area uses drones and 5G for reforestation.

…………………………………………………………………………………………………………………………………..

Omdia’s research has shown that about a fifth of midsized to large enterprises “want to invest in 5G network slicing in the next two years, but most people cannot find a commercial offer,” said Camille Mendler, chief analyst of enterprise services at Omdia. “[It’s] not there yet, which is a problem, right?” she added. Note that 5G network slicing requires a 5G SA core network, which most 5G service providers have yet to deploy.

Baxter noted that network slicing will be a game changer for security and transportation of critical data. The panel pointed to autonomous vehicles as another potential application that will require its own slice. She also said slicing will be important for ensuring applications from private 5G networks also have a macro capability.

Lori Thomas, senior vice president for strategic engagement and transformation at MetTel, pointed out that a lot of government agencies are currently looking to bring specific functionalities from the private network onto the public network, and make them accessible in edge devices such as laptops and tablets.

…………………………………………………………………………………………………………………………………..

William Britton, vice president for information technology and CIO at California Polytechnic State University, said it is not always easy to figure out how products offered by telecom companies apply to specific use cases. The university has been told to “go elsewhere” by providers when it has approached them about possible 5G applications, as the solutions on offer did not meet requirements, he said.

Speaking about the particular needs of his university, he highlighted the significant demand for bandwidth during limited events, such as course registration, as well as ad hoc scenarios like high data throughput during online gaming events.

A big concern for universities in general is cybersecurity. Britton points out that the education sector has become a massive target for cyberattacks, such as malware and ransomware. Indeed, research suggests that attacks on educational organizations grew by 44% in 2022, while data from endpoint protection firm Emsisoft suggests that the number of individual schools impacted by ransomware attacks also grew.

Security is a major priority for organizations everywhere, not just in the education sector. Thomas points to IoT, where vast amounts of data travel at high speeds, which is particularly attractive for bad actors. Once 5G can be coupled with blockchain, she noted, data security will improve.

One way to look at specific use cases is through innovation labs, with Thomas saying in the short term these can accelerate the time to revenue. She pointed to MetTel’s partnership with SpaceX and VMware, which saw the latter company’s software-defined wide area network deployed over Starlink to bring high-bandwidth communications to remote areas.

Thomas also said demand for more bandwidth was one of the key trends in the public sector. Customers are, according to her, looking at technologies including 5G fixed wireless access (FWA) and satellites to secure it.

A lot of innovation has focused on private networks, but the “real money” lies outside of them, said Mendler. No further details were provided.

Omdia’s Camille Mendler says companies cannot find commercial network slicing.

Source: JLeitner Photography

……………………………………………………………………………………………………………………………….

References:

Omdia Surveys: PON will be a key part of network operator energy reduction strategies

Omdia (owned by Informa) surveys have found a “very high” number of telcos regarded PON as a key part of their energy savings programs. Omdia’s chief analyst Julie Kunstler said PON technology is fiber-asset efficient, easy to upgrade, and highly secure.

Speaking at a Light Reading webinar Thursday, Kunstler said another large cohort of network operator execs said they believed PON would play some role in their energy reduction strategies. “PON is energy efficient and this is definitely gaining attention.” Kunstler said “a very strong movement” by operators was underway toward next gen PON, in particular XGS PON. “But perhaps more importantly, PONs are also supporting other types of customers and applications.” She also noted PON technology was fiber-asset efficient, easy to upgrade, highly secure and allowed operators to choose when to upgrade. But she cautioned that in many telcos PON faced organizational obstacles because of the belief that it was for consumer services only and because of the silos between residential and business.

Anuradha Udunuwara, a senior enterprise solutions architect at Sri Lanka Telecom, said energy costs had become a bigger concern in the past 12 months following sharp hikes in power tariffs. He agreed that PON “definitely has an advantage… it is passive, so there is no energy consumption there.”

Udunuwara described PON as an “architectural option” that could support FTTX deployment. He said it was a myth about PON that it was for FTTH only. “It’s not confined to any of the variations of FTTX.” He expected that in the long run services would converge on to a single access technology.

“Oftentimes, sales and marketing teams don’t feel comfortable about PON, simply because they don’t understand it,” Kunstler said. “Many believe its point to multipoint topology is for residential only and that it’s simply best effort and there’s no technical ability to support enterprise services.”

“A lot of education is needed within some operators to explain to the sales and marketing team that PON is not just best effort and that you can actually commit to rates,” she pointed out.

“Not all enterprises need point to point. They don’t all need their own dedicated fiber, and many of them really don’t want to have to pay for dedicated fiber.”

Kunstler said selling business services over PON increased the ROI over that access infrastructure. “With 10G PON, you can easily support one gig symmetrical, two gig symmetrical five gig symmetrical and so forth, and 50 GPON, which will be here within a couple of years, can even support more bandwidth.

By using that optical distribution network for more than just residential, operators were already moving to a converged access approach. “You have more revenues over a single access network. You have a single network to upgrade. You have improved optics and you have improved energy savings.”

References:

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

AT&T to deploy FTTP network based on XGS-PON in Amarillo, TX

ZTE PON ONT obtains EasyMesh R3 certification from WiFi Alliance

Dell’Oro: PONs boost Broadband Access; Total Telecom & Enterprise Network Equipment Markets

Omdia forecasts weaker 5G market growth in near term, 4G to remain dominant

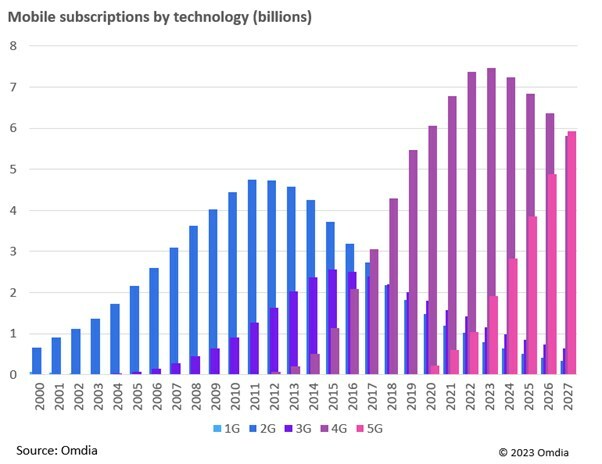

Multiple factors have slowed down the transition to 5G such as lower handset sales driven by cost-of-living crisis and inflation, poor network coverage, low performance gain perception, and lack of 5G specific applications. Furthermore, an increasing portion of mobile connections – approximately 30% – are not handsets and will be slower to convert to 5G (e.g., IoT, connected tablets/laptops, wearables).

Omdia Senior Market Forecaster, Garinder Shankrowalia, said: “5G subscription reporting in 2022 has led us to reduce our 2023 forecast by 7.2% -approximately 150 million subscriptions. We anticipate the industry will regain this loss from 2025, once global market conditions are improved.”

Omdia believes it is important for mobile operators to continue investing in next generation mobile networks to enable the application emergence and the overall digital economy to grow. However, having multiple cellular technologies running concurrently on mobile networks is having an adverse effect on operators whereby launching 5G increases complexity and cost for little return in the short term.

Omdia Research Director Ronan de Renesse said: “There needs to be a ‘net-zero’ approach to network development, removing the old as the new gets deployed. Operators are already starting to move capital from next generation network deployment to 3G decommission projects and digital transformation. Key stakeholders should remain realistic about the prospects for 5G and re-evaluate the business case before moving on to the next step.”

Omdia forecasts 5G will account for 5.9 billion subscriptions in 2027 equivalent to a population penetration of 70.9%.

Another Opinion: 5G Fails to Deliver on Promises and Potential

5G is a big letdown and took a “back seat” at CES 2023; U.S. national spectrum policy in the works

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

Introduction:

Telco cloud has evolved from the much hyped (but commercially failed) NFV/Virtual Network Functions or VNFs and classical SDN architectures, to today’s more robust platforms for managing virtualized and cloud-native network functions that are tailored to the needs of telecom network workloads. This shift is bringing many new participants to the rapidly evolving telco cloud [1.] landscape.

Note 1. In this instance, “telco cloud” means running telco network functions, including 5G SA Core network on a public, private, or hybrid cloud platform. It does NOT imply that telcos are going to be cloud service providers (CSPs) and compete with Amazon AWS, Microsoft Azure, Google Cloud, Oracle Cloud, IBM, Alibaba and other established CSPs. Telcos gave up on that years ago and sold most of their own data centers which they intended to make cloud resident.

………………………………………………………………………………………………………………………………………………………………………………..

In its recent Telco Cloud Evolution Survey 2022, Omdia (owned by Informa) found that both public and private cloud technology specialists are shaping this evolution. In July 2022, Omdia surveyed 49 senior operations and IT decision makers among telecom operator. Their report reveals their top-of-mind priorities, optimism, and strategies for migrating network workloads to private and public cloud.

Transitioning from VNFs to CNFs:

The existing implementations of telco cloud mostly take the virtualization technologies used in datacenter environments and apply them to telco networks. Because telcos always demand “telco-grade” network infrastructure, this virtualization of network functions is supported through a standard reference architecture for management and network orchestration (MANO) defined by ETSI. The traditional framework was defined for virtual machines (VMs) and network functions which were to be packaged as software equivalents (called network appliances) to run as instances of VMs. Therefore, a network function can be visualized as a vertically integrated stack consisting of proprietary virtualization infrastructure management (often based on OpenStack) and software packages for network functions delivered as monolithic applications on top. No one likes to admit, but the reality is that NFV has been a colossal commercial failure.

The VNFs were “lift & shift” so were hard to configure, update, test, and scale. Despite AT&T’s much publicized work, VNFs did not help telcos to completely decouple applications from specific hardware requirements. The presence of highly specific infrastructure components makes resource pooling quite difficult. In essence, the efficiencies telcos expected from virtualization have not yet been delivered.

The move to cloud native network functions (CNFs) aims to solve this problem. The softwardized network functions are delivered as modern software applications that adhere to cloud native principles. What this means is applications are designed independent of the underlying hardware and platforms. Secondly, each functionality within an application is delivered as a separate microservice that can be patched independently. Kubernetes manages the deployment, scaling, and operations of these microservices that are hosted in containers.

5G Core leads telcos’ network workload containerization efforts:

The benefits of cloud-native are driving telcos to implement network functions as containerized workloads. This has been realized in cloud native 5G SA core networks (5G Core), the architecture of which is specified in 3GPP Release 16. A key finding from the Telco Cloud Evolution Survey 2022, was that over 60% of the survey respondents picked 5G core to be run as containerized workloads. The vendor ecosystem is maturing fast to support the expectations of telecom operators. Most leading network equipment providers (NEPs) have built 5G core as cloud-native applications.

Which network functions do/will you require to be packaged in containers? (Select all that apply):

This overwhelming response from the Omnia survey respondents is indicative of their growing interest in hosting network functions in cloud environments. However, there remain several important issues and questions telcos need to think about which we now examine:

The most challenging and frequent question is whether telcos should run 5G core functions and workloads in public cloud (Dish Network and AT&T) or in their own private cloud infrastructure (T-Mobile)? The choice is influenced by multiple factors including understanding the total cost of running network functions in public vs private cloud, complying with data regulatory requirements, resilience and scalability of infrastructure, maturity of cloud platforms and tools, as well as ease of management and orchestration of resources across distributed environments.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Ericsson says the adoption of cloud-native technology and the new 5G SA Core network architecture will impact six strategic domains of a telco network, each of which must be addressed and resolved during the telco’s cloud native transformation journey: Cloud infrastructure, 5G Core, 5G voice, automation and orchestration, operations and life cycle management, and security.

In the latest version of Ericsson’s cloud-native 5G Core network guide (published December 6, 2022), the vendor has identified five key insights for service providers transitioning to a cloud native 5G SA core network:

- Cloud-native transformation is a catalyst for business transformation. Leading service providers make it clear they view the transformation to cloud-native as a driver for the modernization of the rest of their business. The company’s ability to bring new products and solutions to market faster should be regarded as being of equal importance to the network investment.

- Clear strategy and planning for cloud-native transformation is paramount. Each individual service provider’s cloud-native transformation journey is different and should be planned accordingly. The common theme is that the complexity of transforming at this scale needs to be recognized, and must not be underestimated. For maximum short-and-long-term impact tailored, effective migration strategies need to be in place in advance. This ensures that investment and execution in this area forms a valuable element of an overall transformation strategy and plan.

- Frontrunners will establish first-mover advantage. Time should be a key factor in driving the plans and strategies for change. Those who start this journey early will be leading the field when they’re able to deploy new functionalities and services. A common frontrunner approach is to start with a greenfield 5G Core deployment to try out ideas and concepts without disrupting the existing network. Additionally, evolving the network will be a dynamic process, and it is crucial to bring application developers and solution vendors into the ecosystem as early as possible to start seeing faster, smoother innovation.

- Major potential for architecture simplifications. The standardization of 5G Core has been based on architecture and learnings from IT. The telecom stack should be simplified by incorporating cloud native principles into it – for example separating the lifecycle management of the network functions from that of the underlying Kubernetes infrastructure. While any transformation needs to balance both new and legacy technologies, there are clear opportunities to simplify the network and operations further by smart investment decisions in three major areas. These are: simplified core application architecture (through dual-mode 5G Core architecture); simplified cloud-native infrastructure stack (through Kubernetes over bare-metal cloud infrastructure architecture); and Automation stack.

- Readiness to automate, operate and lifecycle manage the new platform must be accelerated. Processes requiring manual intervention will not be sufficient for the levels of service expected of cloud-native 5G Core. Network automation and continuous integration and deployment (CI/CD) of software will be crucial to launch services with agility or to add new networks capabilities in line with advancing business needs. Ericsson’s customer project experience repeatedly shows us another important aspect of this area of change, telling us that the evolution to cloud-native is more than a knowledge jump or a technological upgrade – it is also a mindset change. The best platform components will not deliver their full potential if teams are not ready to use them.

Monica Zethzon, Head of Solution Area Core Networks, Ericsson said: “The time is now. Service providers need to get ready for the cloud-native transformation that will enable them to reach the full potential of 5G and drive innovation, shaping the future of industries and society. We are proud to be at the forefront of this transformation together with our leading 5G service providers partners. With this guide series we want to share our knowledge and experiences with every service provider in the world to help them preparing for their successful journeys into 5G.”

Ericsson concludes, “The real winners of the 5G era will be the service providers who can transform their core networks to take full advantage of what 5G Standalone (SA) and cloud-native technologies can offer.”

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Omdia says another big challenge telcos need to manage is the fragmentation in cloud-native tools and approaches adopted by various technology providers. Again, this is nothing new as telcos have faced and lived through similar situations while evolving to the NFV era. However, the scale and complexity are much bigger as network functions will be distributed, multi-vendor, and deployed across multiple clouds. The need for addressing these gaps by adopting clearly defined specifications (there are no standards for cloud native 5G core) and open-source projects is of utmost importance.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

Overcoming the challenges telcos face on their journey to containerized network functions

https://omdia.tech.informa.com/OM023495/Telco-Cloud-Evolution-Survey–2022

https://www.ericsson.com/en/news/2022/10/ericsson-publishes-the-cloud-native

https://www.t-mobile.com/news/network/t-mobile-lights-up-standalone-ultra-capacity-5g-nationwide