Samsung

KDDI claims world’s first 5G Standalone (SA) Open RAN site using Samsung vRAN and Fujitsu radio units

Japan’s KDDI is claiming to have turned on the world’s first commercial 5G Standalone (SA) Open Radio Access Network (Open RAN) site, using equipment and software from Samsung Electronics and Fujitsu. KDDI used O-RAN Alliance compliant [1.] technology, including Samsung’s 5G virtualized CU (vCU) and virtualized DU (vDU) as well as Fujitsu’s radio units (MMU: Massive MIMO Units).

Note 1. O-RAN Alliance specifications are being used for RAN module interfaces that support interoperation between different Open RAN vendors’ equipment.

The first network site went live in Kawasaki, Kanagawa today. KDDI, together with its two partners, will deploy this Open RAN network in some parts of Japan and continue its deployment and development, embracing openness and virtualization in KDDI’s commercial network. Note that both Rakuten-Japan and Dish Network/Amazon AWS have promised 5G SA Open RAN but neither company seems close to deploying it.

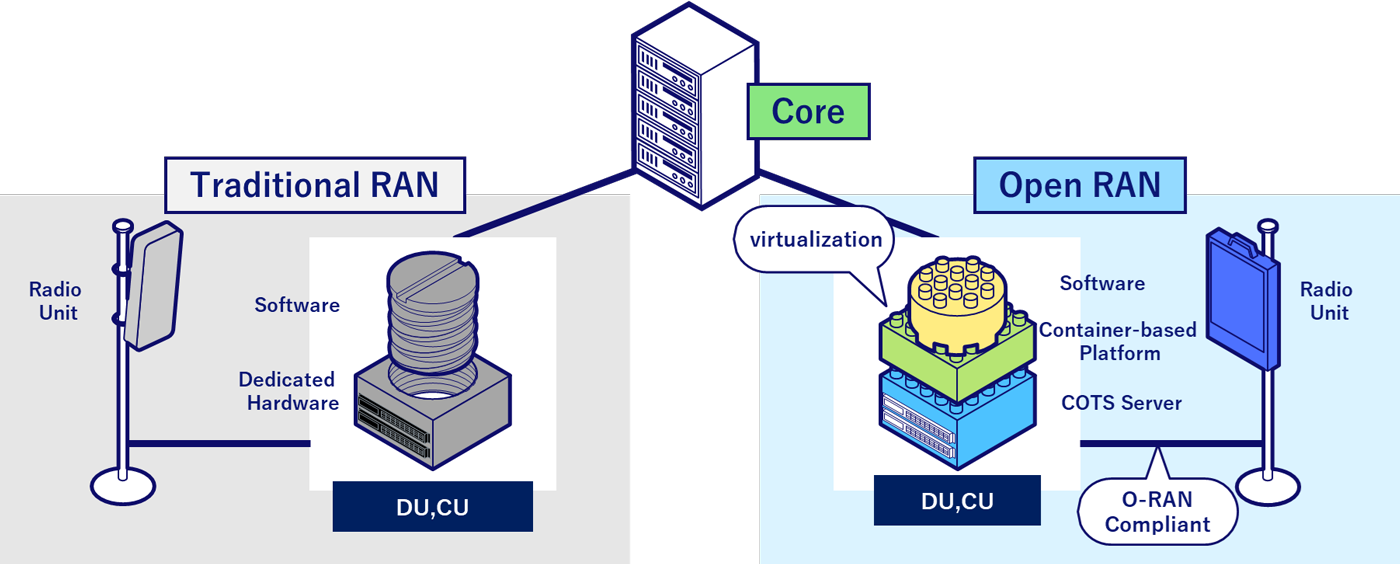

Virtualization and O-RAN technology replaces dedicated hardware with software elements that can run on commercial off-the-shelf (COTS) servers. This brings flexibility and agility to KDDI’s network, allowing the operator to offer enhanced mobile services to its users. KDDI says this architecture will deliver reliability, while accelerating deployment of Open RAN throughout Japan, including in rural areas. Meanwhile, 5G SA will deliver superior performance, higher speeds and lower latency and make possible advanced services/applications, such as network slicing, automation, service chaining and Multi-access Edge Computing (MEC).

Traditional RAN vs. Open RAN Configuration. Source: KDDI

Characteristics of this site:

This Open RAN site leverages fully-virtualized RAN software, provided by Samsung, that runs on commercial off-the-shelf (COTS) servers. Furthermore, by pursuing an open network approach between radio units and baseband unit, KDDI used Samsung’s baseband and Fujitsu’s Massive MIMO Units, which are connected with an open interface.

- Fully-virtualized 5G RAN software can be swiftly deployed using existing hardware infrastructure, which brings greater flexibility in deployment. New 5G SA technologies―such as network slicing, Multi-access Edge Computing (MEC) and others―powered by 5G vRAN, will deliver superior performance, higher speeds and lower latency, allowing KDDI users to experience a range of new next-generation services and immersive applications.

- Using an open interface between radio units and baseband unit, Open RAN not only ensures security and reliability but also enables operators to implement best-of-breed solutions from different partners and build an optimal network infrastructure for maximized performance.

- The virtualized network allows the use of general-purpose hardware (COTS servers) across the country, which will greatly increase deployment efficiencies. Additionally, by leveraging system automation, fully-virtualized RAN software can reduce deployment time, enabling swift nationwide expansion, including rural areas.

Comments from Kazuyuki Yoshimura, Chief Technology Officer, KDDI Corporation:

“Together with Samsung and Fujitsu, we are excited to successfully develop and turn on the world’s first commercial 5G SA Open RAN site powered by vRAN. Taking a big step, we look forward to continue leading network innovation and advancing our network capabilities, towards our vision of delivering cutting-edge 5G services to our customers.”

Comments from Woojune Kim, Executive Vice President, Head of Global Sales & Marketing, Networks Business at Samsung Electronics:

“Leveraging our industry-leading 5G capabilities, we are excited to mark another milestone with KDDI and Fujitsu. Samsung stands out for its leadership in 5G vRAN and Open RAN with wide-scale commercial deployment experiences across the globe. While KDDI and Samsung are at the forefront of network innovation, we look forward to expanding our collaboration towards 5G SA, to bring compelling 5G services to users.”

Note: Samsung released its first 5G vRAN portfolio in early 2021 following its blockbuster RAN deal with Verizon, which was the first operator to commercially deploy the new equipment. Samsung also gained a foothold in Vodafone’s plan to deploy 2,500 open RAN sites in the southwest of England and most of Wales. Samsung’s open RAN compliant vRAN hardware and software were previously deployed in 5G NSA commercial networks in Japan and Britain, but this is the first 5G SA deployment. We wonder if it is “cloud native?” Hah, hah, hah!

Comments from Shingo Mizuno, Corporate Executive Officer and Vice Head of System Platform Business (In charge of Network Business), Fujitsu Limited:

“The Open RAN-based ecosystem offers many exciting possibilities and this latest milestone with KDDI and Samsung demonstrates the innovative potential of next-generation mobile services with Massive MIMO Units. Fujitsu will continue to enhance this ecosystem, with the goal of providing advanced mobile services and contributing to the sustainable growth of our society.”

The companies will continue to strengthen virtualized and Open RAN leadership in this space, bringing additional value to customers and enterprises with 5G SA.

……………………………………………………………………………………………………………………………………………………………………………………………………………..

Addendum: As of December 31, 2021 there were only 21 known 5G SA eMBB networks commercially deployed.

|

5G SA eMBB Network Commercial Deployments |

|

|

Rain (South Africa) |

Launched in 2020 |

|

China Mobile |

|

|

China Telecom |

|

|

China Unicom |

|

|

T-Mobile (USA) AIS (Thailand) True (Thailand) |

|

|

China Mobile Hong Kong |

|

|

Vodafone (Germany) |

Launched in 2021 |

|

STC (Kuwait) |

|

|

Telefónica O2 (Germany) |

|

|

SingTel (Singapore) |

|

|

KT (Korea) |

|

|

M1 (Singapore) |

|

|

Vodafone (UK) |

|

|

Smart (Philippines) |

|

|

SoftBank (Japan) |

|

|

Rogers (Canada) |

|

|

Taiwan Mobile |

|

|

Telia (Finland) |

|

|

TPG Telecom (Australia) |

|

SOURCE: Dave Bolan, Dell’Oro Group.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://news.kddi.com/kddi/corporate/english/newsrelease/2022/02/18/5896.html

Samsung Electronics wins $6.6B wireless network equipment order from Verizon; Galaxy Book Flex 5G

Mobile Core Network (MCN) growth to slow due to slow roll-out of 5G SA networks

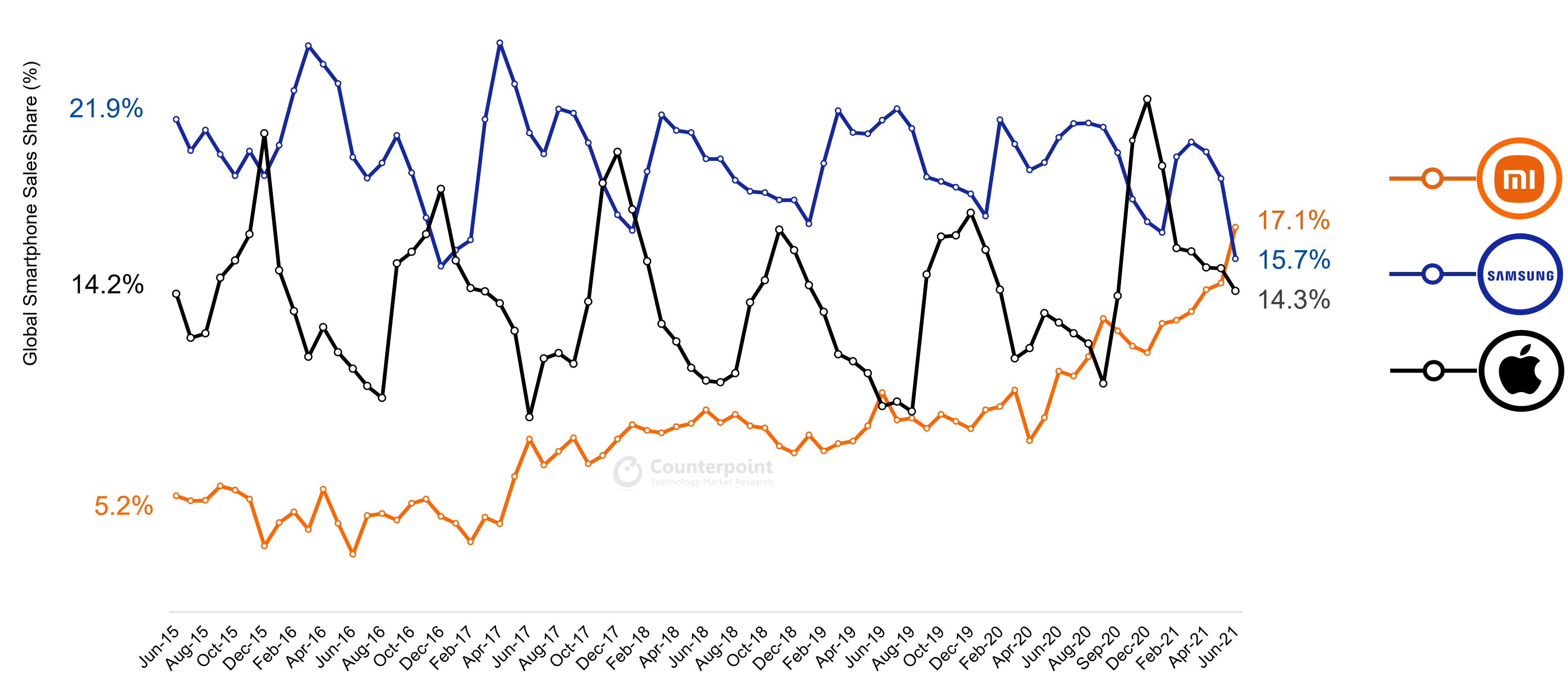

Counterpoint: Xiaomi #1 in global smart phone sales for 1st time

Chinese smartphone maker Xiaomi surpassed Samsung and Apple in June 2021 after a 26% month-on-month increase in sales to become the number one smartphone brand in the world for the first time ever, according to Counterpoint Research’s monthly Market Pulse Service.

Xiaomi was also the number two brand globally for Q2 2021 in terms of sales, and cumulatively, has sold close to 800 million smartphones since its inception in 2011, the report underlined.

Research Director Tarun Pathak noted that Xiaomi has been on a war footing to fill the gap created by the decline of Huawei.

“Ever since the decline of Huawei commenced, Xiaomi has been making consistent and aggressive efforts to fill the gap created by this decline. The OEM has been expanding in Huawei’s and HONOR’s legacy markets like China, Europe, Middle East and Africa. In June, Xiaomi was further helped by China, Europe and India’s recovery and Samsung’s decline due to supply constraints.” Pathak wrote.

Senior Analyst Varun Mishra stated, “China’s market grew 16% MoM in June driven by the 618 festival, with Xiaomi being the fastest growing OEM, riding on its aggressive offline expansion in lower-tier cities and solid performance of its Redmi 9, Redmi Note 9 and the Redmi K series. At the same time, due to a fresh wave of the COVID-19 pandemic in Vietnam, Samsung’s production was disrupted in June, which resulted in the brand’s devices facing shortages across channels. Xiaomi, with its strong mid-range portfolio and wide market coverage, was the biggest beneficiary from the short-term gap left by Samsung’s A series.” the COVID-19 pandemic in Vietnam, Samsung’s production was disrupted in June, which resulted in the brand’s devices facing shortages across channels. Xiaomi, with its strong mid-range portfolio and wide market coverage, was the biggest beneficiary from the short-term gap left by Samsung’s A-series,” Mishra commented on Samsung’s performance.

Going forward, the market research firm expects Samsung’s production to be affected if the situation in Vietnam does not improve while Xiaomi will continue to gain share from the Korean brand.

Exhibit: Global Monthly Smartphone Sales Share Trends (%)

Some of our other smartphone market analyses for Q2 2021:

- Apple Achieves Record June Quarter Shipments, Xiaomi Becomes the Second-Largest Smartphone Brand Globally

- India Smartphone Market Stays Resilient During Second COVID-19 Wave, Crosses 33 Million Shipments

- China Smartphone Market Sees Lowest Q2 Sales Since 2012; vivo Leads as Huawei Plummets

- Podcast: How Xiaomi, Qualcomm are Delivering 5G, AI-based Experiences to Consumers

- Q2 2021: Europe Smartphone Market’s Bumpy Road to Recovery

- MEA Smartphone Market Sees Best Q2 on Record; Samsung Leads but TECNO, Xiaomi Close Gap

- Chinese Players Capture Half of Vietnam Smartphone Market in Q2 2021

Background:

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (Technology, Media and Telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

References:

Monthly Pulse: Xiaomi Becomes #1 Smartphone Brand Globally for First Time Ever

Samsung’s Voice over 5G NR (VoNR) Now Available on M1’s 5G SA Network

The VoNR call service fully utilizes 5G SA architecture for an improved high definition quality call experience, while providing 5G speeds for data-driven activities throughout the duration of the voice calls In comparison to calls made on the 5G non-standalone (NSA) network, which rides on existing 4G networks, the VoNR service boasts faster call setup time and seamless voice call continuity, presenting M1 customers with the true 5G experience. M1 customers will be able to enjoy the benefits of VoNR service as M1 gears up for its 5G SA market trial launch on the 27th of July.

The two companies said that VoNR service will open up numerous 5G SA-enabled data services and provide the baseline for quality video conferencing or augmented and virtual reality features, offering a glimpse into the possible connectivity solutions 5G SA will enable M1 to bring to its subscribers. This author is quite skeptical of that claim.

The underlying technology relies on the network having a 5G Core and IMS architecture (IP Multimedia Subsystem, a standard used for voice over LTE (VoLTE) and now voice over 5G networks). M1 also said it was the world’s first to implement VoNR, although that claim also was made by Deutsche Telekom, who implemented VoNR using multiple 5G vendors.

According to M1, VoNR offers faster call setup times, more seamless voice call continuity, and an improved high definition quality call experience when compared to calls made via 5G non-standalone (5G NSA) networks. [5G NSA technology relies on a 4G- LTE anchor for everything except data transmission.]

The new VoNR feature will be available as an over-the-air update to compatible 5G Samsung devices on M1’s 5G Booster Plan, on top of getting data speeds “almost five times faster than 4G.”

Samsung Galaxy S21 Ultra, S21+ and S21 customers on M1 network will be amongst the first in the world to enjoy the benefits of the VoNR network via an over-the-air software update on M1’s 5G Booster Plan. Customers can also look forward to seamless connectivity with an ultra-fast data speed rate that is almost five times faster than 4G. Furthermore, paired with Samsung’s 5G compatible devices, multi-tasking is possible with remarkable productivity improvement.

“We have once again reached a groundbreaking milestone in our 5G SA journey – to be the first in the world to successfully support VoNR service on our 5G SA network. We are glad to work with a like-minded partner like Samsung to achieve high quality call and better 5G experience for our customers. With M1’s imminent market trial of the 5G SA network, we are excited to leverage 5G SA’s low latency, ultra-responsive, highly secured and high-throughput mobile connectivity to deliver high performance and reliable 5G services for our consumers and enterprises. This step in our 5G implementation journey is in line with the Keppel Group’s Vision 2030, which includes enhancing connectivity for communities,” said Mr. Denis Seek, Chief Technical Officer, M1.

“Samsung is proud to play a pioneering role in placing Singapore at the forefront of network technology innovation, turning on next-generation service in the country. Committed to inspiring the world and shaping the future with transformative ideas and technologies, we are taking a meaningful step in realising the full potential of 5G for consumers and industries. With VoNR, we look forward to delivering more transformative experiences to customers and businesses with M1,” said Ms. Sarah Chua, Vice-President, IT and mobile, Samsung Electronics Singapore.

Samsung partners with GBL to deploy 5G testbed for U.S. Army

Samsung has teamed up with GBL Systems Corporation [1.] to deploy new 5G testbeds at U.S. Army military bases for Augmented Reality/Virtual Reality. The testbeds are part of a broader initative announced by the Department of Defense in October, which awarded $600 million in contracts for 5G testing at several US military test sites. GBL and Samsung have been contracted to support one of the largest testbeds, demonstrating the use of AR and VR over 5G networks for training applications.

Note 1. GBL Systems Corporation (GBL) is a leading provider of systems engineering, software services, advanced technology solutions to the U.S. Department of Defense (DoD)

Under the deal, GBL will be responsible for prototype creation, technology integration, and aligning the system with DoD requirements. Samsung will deliver its 5G end-to-end system and technical expertise, including network products such as its Massive MIMO Radios, cloud-native 5G Standalone (SA) Core, and Galaxy 5G mobile devices. The goal is to deploy a scalable, resilient and secure 5G network for AR/VR-based mission planning and training.

The testbeds will support AR for live field military training exercises. Simulated scenarios include virtual obstacles found in the combat theater, and overlays of data and instruments relied on by military personnel. Testing will start in a lab environment using Samsung’s mmWave and mid-band 5G radios. Field testing will then follow at two U.S. Army training bases that will support a live and simulated Army brigade.

Samsung Networks and GBL Systems deploy 5G testbeds for the U.S. Department of Defense, enabling evaluation of AR/VR applications in mission planning and training. U.S. Army trainees will use AR/VR goggles to see enhanced digital content overlaid onto real-world environments.

……………………………………………………………………………………………………………………………………………………….

“GBL is excited to work with Samsung to rapidly field a 5G network that is scalable, resilient, and secure to create a prototype test bed in support of a new DoD 5G-enabled AR/VR training capability,” said Jim Buscemi, CEO. “This effort has the potential to revolutionize how the DoD performs distributed training exercises that are more combat-like to significantly advance warfighter readiness.”

“Samsung is pleased to collaborate with GBL to deliver a reliable, resilient and secure 5G network for the DoD to evaluate new capabilities for our U.S. troops,” said Imran Akbar, Vice President and Head of New Business Team, Networks Business, Samsung Electronics America. “We believe in the transformative power of 5G and look forward to assisting the U.S. Department of Defense as they use this technology to increase training safety and strengthen the Nation’s defense capabilities.”

Samsung’s 5G solution enables quality, real-time imagery to be shared by many participants simultaneously. The Army trainees will use AR/VR goggles to see enhanced digital content overlaid onto the real world, and can use this digital imagery to interact with and acquire information about their real environment. This expands what’s possible in military training today, and provides a competitive advantage against adversaries.

Samsung pioneered the successful delivery of the first 5G end-to-end solutions in 2018, including chipsets, devices, radios, and the core network. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from fully virtualized RAN and Core to private network solutions and Artificial Intelligence (AI) powered automation tools. The company is currently providing network solutions to mobile operators that deliver connectivity to hundreds of millions of users worldwide, including customers of leading U.S. operators.

References:

https://www.telecompaper.com/news/samsung-gbl-to-deploy-5g-testbed-for-us-army–1390248

Singtel starts limited deployment of 5G SA; only 1 5G SA endpoint device; state of 5G SA?

Singtel 5G SA:

Singtel is boasting that it is the first operator to launch a 5G standalone (5G SA) network in Singapore. Their 5G SA is in partnership with South Korean-based vendor Samsung.

The operator said it has deployed over a thousand 5G sites across Singapore in strategic locations such as Orchard Road, the Central Business District, Marina Bay, Harbourfront and Sentosa, as well as major residential areas including Sengkang, Punggol, Pasir Ris, Jurong East, Woodlands, and more.

However, it appears that service availability will be fairly limited at first. Indeed, Singtel indicated that only “selected customers” are being given “early access” to the new 5G SA network. The ONLY 5G SA device currently available is the Samsung Galaxy S21 Ultra 5G smartphone, said to be running a “Singtel-exclusive beta release of Samsung’s 5G SA software.”

“We are thrilled to introduce supercharged connectivity on Singapore’s most powerful 5G network. Our customers will be among the first in the world to enjoy the benefits that 5G SA can deliver. Wherever they are, consumers can stream 4K videos seamlessly, share favorite photos and moments with friends instantaneously, and enjoy lag-free gameplay and video conferencing. 5G SA will also fuel new innovations, being a key enabler of the digital transformation across industry sectors,” said Ms. Anna Yip, CEO, Consumer Singapore, Singtel.

Customers can register their interest at www.singtel.com/5GSAearlyaccess to be one of the first customers to experience Singtel’s 5G SA network. Customers with creative entries on how 5G will transform their lives will be selected to receive a “5G Power Up” kit that comprises a 5G SA SIM card, a Samsung Galaxy S21 Ultra 5G handset and cool accessories.

Winners who receive the 5G Power Up Kit will need to perform just TWO tasks to be eligible to exchange their test phone for a brand New Samsung Galaxy S21 Ultra 5G:

- Test the Samsung Galaxy S21 Ultra 5G SA-ready handset on Singtel 5G and provide feedback at singtel.com/5gfeedback

- Post a video of yourself on either Facebook or Instagram with a caption on how Singtel 5G transforms the way you live, work and play. Remember to make the post public, tag @singtel and hashtag #FirstonSingtel5GSA #galaxy5G #Galaxy5GxSingtel

Since September 2020, Singtel claims to have been operating Singapore’s fastest 5G NSA network under a market trial, offering 5G speeds of up to 1.2 Gbps. Within a year of receiving its 5G licence, Singtel has now turned on 5G SA and deployed over a thousand 5G sites across Singapore in strategic locations such as Orchard Road, the Central Business District, Marina Bay, Harbourfront and Sentosa, as well as major residential areas including Sengkang, Punggol, Pasir Ris, Jurong East, Woodlands, and more. It is the only telco in Singapore to roll out in-building 5G, covering popular malls such as VivoCity and Ngee Ann City, and will continue to expand its indoor 5G footprint in the coming months.

Singtel is focused on accelerating 5G innovation and 5G adoption in enterprises, launching Genie, the world’s first portable 5G-in-a-box platform and expanding its 5G ecosystem with 5G Multi-access Edge Compute trials in collaboration with Microsoft Azure and Amazon Web Services.

Samsung’s 5G Core Network has been developed and verified in a cloud native environment. Designed based on ‘Micro-services’, ‘Containers’ and ‘Stateless’ architectures,’ it will take full advantage of the cloud, acting as the key enabler for the rapid realization of 5G innovation. Samsung says it will boost 5G Core network function development and verification capabilities as well as enable automatic service upgrades and deployments for optimized operational efficiency.

Samsung vCore for 5G SA:

Image courtesy of Samsung

…………………………………………………………………………………………………………………………..

Other 5G SA networks coming to Singapore:

Antina Pte. Ltd. (Antina), the #2 mobile operator in Singapore has selected Nokia for its 5G SA network deployment. Antina is a very new telco which was incorporated on September 3 , 2020 in Singapore. It has been operating for 256 days before that.

Nokia has already laid claim to launching the first 5G RAN and SA network for the M1-StarHub Joint Venture, although the commercial deployment of the network has not yet been announced.

Nokia will provide equipment from its comprehensive AirScale portfolio and CloudRAN solution to build the Radio Access Network (RAN) for the 5G SA infrastructure, utilizing the 3.5GHz spectrum band. Nokia will supply 5G base stations and its small cells solution for indoor coverage, as well as other radio access products. Nokia’s 5G SA technology will provide Singaporean enterprises with the opportunity to explore multiple new use cases due to the network’s higher bandwidth, higher uplink speeds and lower-latency.

M1 and StarHub plan to jointly build a 5G network but will offer services independently. In April 2020, the Singapore regulator awarded two 5G licenses to Singtel and Antina, the joint venture (JV) between the second- and third-largest telcos, StarHub and M1.

Singtel and the JV were assigned 100MHz of 3.5GHz spectrum, while Singtel, StarHub and M1 each received 800MHz of mmWave spectrum for “localized coverage.”

All three operators nevertheless decided to offer 5G NSA in the meantime, in order to give users an early taste of 5G services.

………………………………………………………………………………………………………………………………………..

State of 5G SA Networks:

5G SA network rollouts remain scarce and underwhelming (e.g. T-Mobile US) as most operators around the world are initially focusing on the less complicated 5G NSA.

That’s really a no brainer: 5G NSA is based on 4G LTE core network (EVC), signaling and network management, while 5G SA. 5G Core Network implementation has not been standardized and there is no definitive spec that will lead to similar implementations. Hence, 5G SA/5G Core network is proprietary to each network operator and requires a UNIQUE 5G SA software update for each 5G endpoint (smartphone, tablet, laptop, IoT, robot, etc). Most 5G network operators say they will implement 5G SA in a “cloud native core network,” whatever that is?

According to a March 2021 update from the Global Mobile Suppliers Association (GSA), about 68 operators in 38 countries have been investing in public 5G SA networks in the form of trials, planned or actual deployments. This compares with over 400 operators known to be investing in 5G licenses, trials or deployments, the GSA said.

………………………………………………………………………………………………………………………………

References:

https://www.samsung.com/global/business/networks/products/core/cloud-core/

https://www.lightreading.com/asia/singtel-trumpets-launch-of-standalone-5g/d/d-id/769752?

Cloud Service Providers Increase Telecom Revenue; Telcos Move to Cloud Native

https://www.sgpbusiness.com/company/Antina-Pte-Ltd

NEC and Cisco in Global Systems Integrator Agreement for 5G IP Transport

NEC Corp and Cisco today announced they have entered into a Global System Integrator Agreement (GSIA) to expand their partnership for accelerating the deployment of innovative 5G IP transport network solutions worldwide.

[Will any other protocol besides IP operate over 5G data plane?]

Under the agreement, the companies will jointly drive new business opportunities for 5G. NEC group companies will work closely with Cisco to complement NEC’s ecosystem with optimized IP metro/access transport and edge cloud computing solutions. Cisco will support NEC’s customer engagements by offering best-in-class products, proposals and execution support.

The new agreement underlines NEC’s successful track record as a Cisco Gold Partner over two decades, and its proven engineering capabilities to provide Cisco products to its global customer base across multiple regions.

“We believe 5G is fueling the internet for the future, and accelerating our customers’ digital transformations,” said Jonathan Davidson, Senior Vice President and General Manager, Mass-Scale Infrastructure Group, Cisco. “Together with NEC, we are creating a powerful force to drive the critical changes needed in networking infrastructure to carry the internet into the next decade.”

“Collaboration across the network solution ecosystem is essential for continued success in meeting diversified customer requirements and establishing a win-win relationship,” said Mayuko Tatewaki, General Manager, Service Provider Solutions Division, NEC Corporation. “This powerful partnership strengthens our global competitiveness as a network integrator that drives the customer journey with innovative solutions.”

NEC and Cisco say they will make collaborative efforts to further enhance their joint solution portfolio and to optimize regional activities for advancing the digital transformation of customers across the globe. Indeed, NEC has a long history of working with Cisco stretching back more than two decades. This includes the two working together on 4G LTE equipment that combined NEC’s RAN and backhaul assets with Cisco’s network equipment.

The two firms last year bolstered efforts in ensuring the security of their networking equipment. This involved using NEC’s blockchain technologies and Cisco’s fraud detection technologies to confirm the authenticity of network equipment used for security and critical industrial infrastructure before it was shipped to a customer, during the construction of those networks, and during operation.

NEC also participated in Rakuten Mobile’s 4G-LTE network deployment in Japan. NEC has so far gained the most from that deployment as it’s been tapped to provide a standalone (SA) 5G core network based on the specification it wrote with Rakuten Mobile.

NEC recently established an Global Open RAN Center of Excellence in the UK, which aims “to accelerate the global adoption of Open RAN and to further strengthen its structure for accelerating the global deployment of 5G.”

The company also developed (with Samsung) and demonstrated an O-RAN Alliance compliant 5G base station baseband unit (5G-CU/DU) on NTT DOCOMO’s commercial 5G network.

Source: NEC Corp.

………………………………………………………………………………………………………………………………….

Cisco was initially part of Rakuten Mobile’s 4G-LTE deployment, but has been conspicuously absent from the Japanese carrier’s more recent 5G plans. Cisco has been steadily bolstering its 5G focus with updates to its routing and networking equipment. This includes updates earlier this year to its router portfolio, and scoring a deal late last year with AT&T to assist with disaggregated IP routing technology for an edge routing platform.

Cisco has also been working with Japanese carrier KDDI on its 5G and network virtualization efforts. This included a proof-of-concept (PoC) last year that demonstrated cloud-native software with Cisco’s Ultra Packet Core platform.

Nonetheless, Cisco continues to lag behind the more established telecom vendors in providing 5G equipment. They don’t make cellular base stations which limits their offerings to routers with 5G interfaces.

A recent Dell’Oro Group report placed Cisco a distant No. 5 among overall telecom equipment vendors, with its market share having shrunk by 1% from 2019 to 2020 to only 6%.

| Top 7 Suppliers | Year 2019 | Year 2020 |

| Huawei | 28% | 31% |

| Nokia | 16% | 15% |

| Ericsson | 14% | 15% |

| ZTE | 9% | 10% |

| Cisco | 7% | 6% |

| Ciena | 3% | 3% |

| Samsung | 3% | 2% |

Source: Dell’Oro Group

………………………………………………………………………………………….

References:

https://www.nec.com/en/press/202104/global_20210408_01.html

https://www.sdxcentral.com/articles/news/cisco-nabs-nec-to-expand-5g-reach/2021/04/

https://www.delloro.com/key-takeaways-total-telecom-equipment-market-2020/

Samsung and Marvell develop SoC for Massive MIMO and Advanced Radios

Korean electronics giant Samsung Electronics said it has developed a new System-on-Chip (SoC) for its Massive MIMO and other advanced radios in partnership with U.S. chipmaker Marvell. It is expected to be available in Q2 2021 for use in equipment sold to Tier-One network operators.

The SoC is designed to help implement new technologies, which improve cellular radios by increasing their capacity and coverage, while decreasing power consumption and size. The new SoC is equipped to support both 4G and 5G networks simultaneously and aims to improve the capacity and coverage of cellular radios. It is claimed to save up to 70 percent in chipset power consumption compared to previous solutions.

“We are excited to extend our collaboration with Marvell to unveil a new SoC that will combine both companies’ strengths in innovation to advance 5G network solutions,” said Junehee Lee, Executive Vice President and Head of R&D, Networks Business at Samsung Electronics. “Samsung prioritizes the development of high-impact 5G solutions that offer a competitive edge to our operators. We look forward to introducing this latest solution to the market shortly.”

Samsung and Marvell have been working closely to deliver multiple generations of leading network solutions. Last year, the companies announced a collaboration to develop new 5G products, including innovative radio architectures to address the compute power required for Massive MIMO deployments.

“Our collaboration with Samsung spans multiple generations of radio network products and demonstrates Samsung’s strong technology leadership. The joint effort includes 4G and 5G basebands and radios,” said Raj Singh, Executive Vice President of Marvell’s Processors Business Group. “We are again honored to work with Samsung for the next generation Massive MIMO radios which significantly raise the bar in terms of capacity, performance and power efficiency.”

“Marvell and Samsung are leading the way in helping mobile operators deploy 5G with greater speed and efficiency,” said Daniel Newman, Founding Partner at Futurum Research. “This latest collaboration advances what’s possible through SoC technology, giving operators and enterprises a distinct 5G advantage through optimized performance and power savings in network deployments.”

Samsung has pioneered the successful delivery of 5G end-to-end solutions including chipsets, radios, and core. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from fully virtualized RAN and Core to private network solutions and AI-powered automation tools. The company is currently providing connectivity to hundreds of millions of users around the world.

……………………………………………………………………………………………………………………………………………….

On the network equipment side, Samsung Electronics recently won a 5G contract with Japanese telco NTT DOCOMO, as it seeks to challenge incumbents like Huawei, Ericsson, and Nokia in the telecom equipment business, according to media reports.

In India, Samsung Electronics is likely to apply for a production-linked incentive (PLI) scheme for telecom equipment manufacturing, benefiting from India’s program to locally make 4G and 5G gear and other equipment – for sales both in India and overseas, ET recently reported.

Samsung would then join other global manufacturers such as Cisco, Jabil, Flex and Foxconn, besides European telecom equipment vendors Nokia and Ericsson in applying for the PLI scheme that seeks to boost local production of telecom equipment and reduce imports.

References:

https://telecom.economictimes.indiatimes.com/news/samsung-marvell-develop-soc-for-5g-radios/81720284

Samsung Boosts the Performance of Massive MIMO

Samsung Collaborates With NTT DOCOMO on 5G

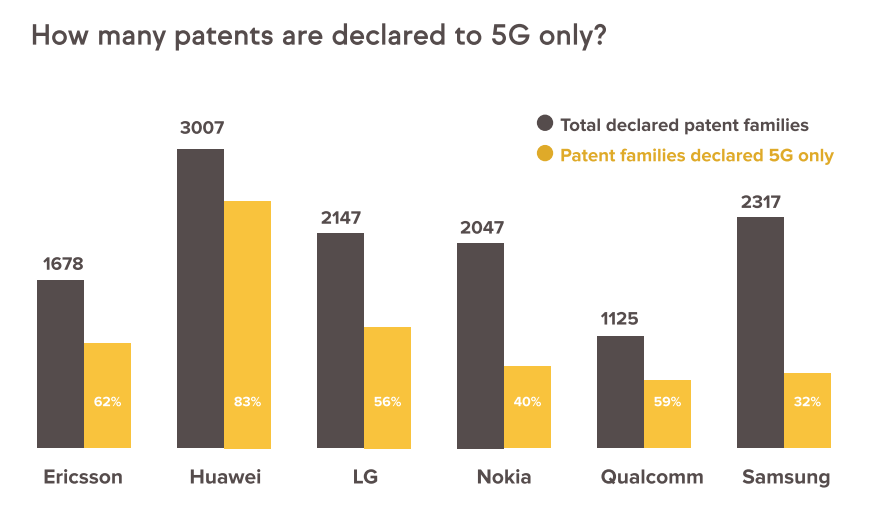

Huawei or Samsung: Leader in 5G declared Standard Essential Patents (SEPs)?

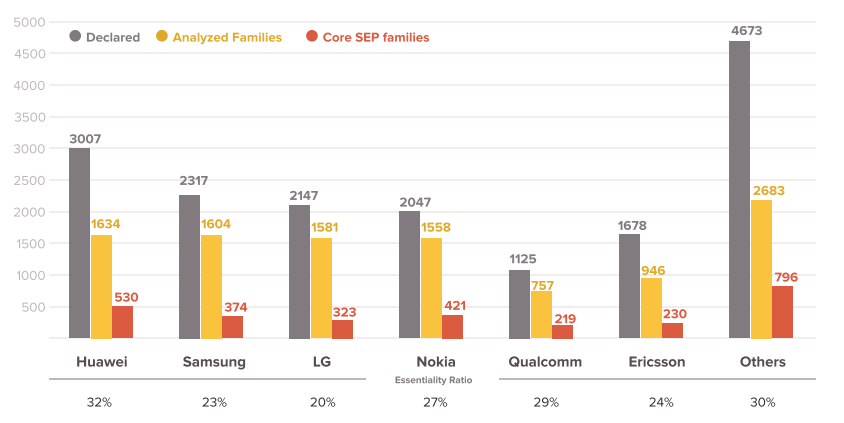

A new report, jointly released by IP consulting and analysis companies, Amplified and GreyB, disclosed that the top 6 companies (Huawei, Samsung, LG, Nokia, Ericsson, Qualcomm) account for 64.9% in 18,887 declared patent families. In granted 10,763 declared patent families, 2,893 families have been identified as core SEPs where top 6 companies account for 72.5%.

Huawei was first with 530 patent families and a ratio 18.3%. Nokia and Samsung were ranked No. 2 and No. 3 with 14.6% and 12.9%. respectively.

The report is an update of the previous report “Exploration of 5G Standards and Preliminary Findings on Essentiality” released on May 26, 2020.

………………………………………………………………………………………………………………………………

Separately, Samsung Electronics Co., Ltd. announced on March 10th that it has ranked first in 5G Standard Essential Patent (SEP)¹ shares according to a patent essentiality study conducted by IPlytics2, a Berlin-based market intelligence firm comprised of economists, scientists and engineers. The findings were published in IPlytics’ recent report: “Who is leading the 5G patent race? A patent landscape analysis on declared SEPs and standards contributions.”

Samsung also ranked second in two other categories: share of 5G granted3 and active patent4 families5, and share of 5G granted and active patent families with at least one of them granted by the EPO (European Patent Office) or USPTO (United States Patent and Trademark Office).

Last year, Samsung also led in 5G patents as a result of its research and development of 5G standards and technologies.

the top 10 companies own more than 80% of all granted 5G patent families, while the top 20 own more than 93% of all 5G granted patent families. These numbers confirm that there are only a few major large 5G patent owners, but looking at overall 5G declarations, the IPlytics Platform database identified more than 100 independent companies, which have declared ownership of at least one 5G patent.

The 5G patent family statistics presented in Table 1 are not based on verified SEP families. Neither ETSI nor the declaring companies have published independent assessments of the essentiality or validity of the declared 5G patents. Thus, the 5G patent families presented are only potentially essential. Many well-known SEP studies estimate that between 20% and 30% of all declared patents are essential. However, the essentiality rate differs across patent portfolios. To better understand the essentiality rate across portfolios, IPlytics created a data set of 1,000 5G-declared patent families (EPO/USPTO granted), which independent experts have mapped to 5G specifications. Here, the experts mapped the patents for six hours in a first check and then EPO/USPTO patent attorneys double-checked the mapping for a further three hours.

Table 1. Top 5G patent declaring companies (with >1% share)

| Current Assignee | 5G families | 5G granted and active families | 5G EPO/USPTO granted and active families | 5G EPO/USPTO granted and active families not declared to other generations |

| Huawei (CN) | 15.39% | 15.38% | 13.96% | 17.57% |

| Qualcomm (US) | 11.24% | 12.91% | 14.93% | 16.36% |

| ZTE (CN) | 9.81% | 5.64% | 3.44% | 2.54% |

| Samsung Electronics (KR) | 9.67% | 13.28% | 15.10% | 14.72% |

| Nokia (FN) | 9.01% | 13.23% | 15.29% | 11.85% |

| LG Electronics (KR) | 7.01% | 8.7% | 10.3% | 11.48% |

| Ericsson (SE) | 4.35% | 4.59% | 5.25% | 3.79% |

| Sharp (JP) | 3.65% | 4.62% | 4.66% | 5.50% |

| Oppo (CN) | 3.47% | 0.95% | 0.64% | 1% |

| CATT Datang Mobile (CN) | 3.44% | 0.85% | 0.46% | 0.68% |

| Apple (US) | 3.21% | 1.46% | 1.66% | 2.15% |

| NTT Docomo (JP) | 3.18% | 1.98% | 2.25% | 1.9% |

Source: IPlytics

………………………………………………………………………………………………………………………………..

Superscript Notes:

[1] “A patent that protects technology essential to a standard”, European Commission report – “Setting out the EU approach to Standard Essential Patents”, p1, November 2017.

[2] “IPlytics derived the “essential rate” by creating a random data set of 1,000 5G-declared patent families (EPO/USPTO granted) and mapping it to 5G specifications.” . Available : https://www.iam-media.com/who-leading-the-5g-patent-race-patent-landscape-analysis-declared-seps-and-standards-contributions

[3] “a patent that is granted by at least one of patent offices”, IPlytics report – “who is leading the 5G patent race”, p5, November 2019.

[4] “in active status, which means it has not lapsed, been revoked or expired”, IPlytics report – “who is leading the 5G patent race”, p3, November 2019.

[5] “a collection of patent applications covering the same or similar technical content”, . Available: https://www.epo.org/searching-for-patents/helpful-resources/first-time-here/patent-families.html

…………………………………………………………………………………………………………………………………………….

References:

https://www.amplified.ai/news/

https://www.greyb.com/5g-patents/

https://news.samsung.com/us/samsung-extends-leadership-5g-patents/

Apple is new smartphone king, but market declined 5% in 4Q 2020

Apple doesn’t report unit sales for its devices. However, the company said revenue from iPhones grew by 17% in the fourth quarter of calendar 2020 on a year-over-year basis to $65.6 billion. Apple’s business is seasonal, and the quarter ending in December is usually the company’s biggest in terms of sales.

“The sales of more 5G smartphones and lower-to-mid-tier smartphones minimized the market decline in the fourth quarter of 2020,” said Anshul Gupta, senior research director at Gartner. “Even as consumers remained cautious in their spending and held off on some discretionary purchases, 5G smartphones and pro-camera features encouraged some end users to purchase new smartphones or upgrade their current smartphones in the quarter.”

Table 1. Worldwide Top 5 Smartphone Sales to End Users by Vendor in 4Q20 (Thousands of Units)

| Vendor | 4Q20

Sales |

4Q20 Market Share (%) | 4Q19

Sales |

4Q19 Market Share (%) | 4Q20-4Q19 Growth (%) |

| Apple | 79,942.7 | 20.8 | 69,550.6 | 17.1 | 14.9 |

| Samsung | 62,117.0 | 16.2 | 70,404.4 | 17.3 | -11.8 |

| Xiaomi | 43,430.3 | 11.3 | 32,446.9 | 8.0 | 33.9 |

| OPPO | 34,373.7 | 8.9 | 30,452.5 | 7.5 | 12.9 |

| Huawei | 34,315.7 | 8.9 | 58,301.6 | 14.3 | -41.1 |

| Others | 130,442.8 | 33.9 | 145,482.1 | 35.8 | -10.3 |

| Total | 384,622.3 | 100.0 | 406,638.1 | 100.0 | -5.4 |

Due to rounding, some figures may not add up precisely to the totals shown.

Source: Gartner (February 2021)

Full Year 2020 Results:

Samsung experienced a year-on-year decline of 14.6% in 2020, but this did not prevent it from retaining its No. 1 global smartphone vendor position in full year results. It faced tough competition from regional smartphone vendors such as Xiaomi, OPPO and Vivo as these brands grew more aggressive in global markets. In 2020, Apple and Xiaomi were the only two smartphone vendors of the top five ranking to experience growth.

Huawei recorded the highest decline among the top five smartphone vendors which made it lose the No. 2 position to Apple in 2020 (see Table 2). The impact of the ban on use of Google applications on Huawei’s smartphones was detrimental to Huawei’s performance in the year and negatively affected sales.

Table 2. Worldwide Top 5 Smartphone Sales to End Users by Vendor in 2020 (Thousands of Units)

| Vendor | 2020

Sales |

2020

Market Share (%) |

2019

Sales |

2019

Market Share (%) |

2020-2019

Growth (%) |

| Samsung | 253,025.0 | 18.8 | 296,194.0 | 19.2 | -14.6 |

| Apple | 199,847.3 | 14.8 | 193,475.1 | 12.6 | 3.3 |

| Huawei | 182,610.2 | 13.5 | 240,615.5 | 15.6 | -24.1 |

| Xiaomi | 145,802.7 | 10.8 | 126,049.2 | 8.2 | 15.7 |

| OPPO | 111,785.2 | 8.3 | 118,693.2 | 7.7 | -5.8 |

| Others | 454,799.4 | 33.7 | 565,630.0 | 36.7 | -19.6 |

| Total | 1,347,869.8 | 100.0 | 1,540,657.0 | 100.0 | -12.5 |

Due to rounding, some figures may not add up precisely to the totals shown.

Source: Gartner (February 2021)

“In 2021, the availability of lower end 5G smartphones and innovative features will be deciding factors for end users to upgrade their existing smartphones,” said Mr. Gupta. “The rising demand for affordable 5G smartphones outside China will boost smartphone sales in 2021.”

SK Telecom, Samsung, HPE and Intel MOU for 5G NFV Technology Evolution; ETSI ISG-NFV?

Who needs the ETSI ISG on NFV? Apparently, no one BUILDING 5G INFRASTRUCTURE! Founded in November 2012 by seven of the world’s leading telecoms network operators, ETSI ISG NFV became the home of the definition and consolidation for Network Functions Virtualization (NFV) technologies. Yet there is very little, if any, commercial deployments based on their specifications. In particular, the greatly promoted ETSI NFV management and orchestration (NFV-MANO).

SK Telecom today announced that it signed a Memorandum of Understanding (MOU) with Samsung Electronics, Hewlett Packard Enterprise (HPE) and Intel for cooperation in the commercialization of an evolved 5G network functions virtualization (NFV) platform.

Under the MOU, the four companies will jointly develop evolved NFV technologies for 5G network infrastructure, establish a standardized process for adoption of NFV, and develop technologies that can harness the capabilities of the virtualized network. Together, the companies will be able to reduce the time required to validate and integrate technologies from various vendors as well as verify them within the network. This will result in a more rapid introduction of new innovative technologies that enhance end user experience.

Mobile operators will be able to benefit from a significantly reduced time-to-market for the latest 5G services such as augmented reality (AR) and virtual reality (VR) through the NFV platform. Previously, they had to install each new hardware equipment or upgrade existing ones to introduce a new service.

The four companies will realize an evolved 5G NFV platform by applying Samsung’s 5G solution based on technologies from Intel and HPE to SK Telecom’s 5G network. To this end, Intel will provide its latest technologies, including Intel Xeon Processors, Ethernet 800 Series Network Adapters and Solid State Drives, and HPE will provide HPE ProLiant Servers to Samsung Electronics for early development and verification purposes. SK Telecom plans to establish a process for 5G network virtualization, which includes interconnecting its 5G core network to Samsung’s virtualized 5G solutions.

“Through this global cooperation, we will secure a solid basis for commercialization of an evolved 5G NFV platform and provide more innovative services to our customers,” said Kang Jong-ryeol, Vice President and Head of ICT Infrastructure Center of SK Telecom. “Going forward, we will continue to develop new technologies for 5G NFV evolution to play a leading role in realizing communication services of the future.”

“Together with SK Telecom, HPE and Intel, Samsung will lay the groundwork for network virtualization to allow SK Telecom to swiftly apply Samsung’s virtualized solutions on partner hardware platforms. As more operators look to virtualized networks, this collaboration will serve as an exemplar of transforming legacy networks to virtual networks,” said Roh Wonil, Senior Vice President and Head of Product Strategy, Networks Business at Samsung Electronics. “With proven success in 5G commercialization, we will continue to extend our 5G leadership, allowing customers to experience immersive 5G services.”

“Industry collaboration is essential to accelerate the rollout of 5G networks,” said Dan Rodriguez, corporate vice president and general manager of the Intel Network Platforms Group. “The joint work between SK Telecom, Intel, HPE and Samsung will be instrumental in helping SK Telecom implement the latest technologies and new capabilities in a faster and more agile way, ultimately delivering new innovative services to their end users.”

“We are pleased to be providing telco optimized infrastructure for this collaboration with SK Telecom, Samsung and Intel”, said Claus Pedersen, vice president, Telco Infrastructure Solutions, HPE. “HPE believes that the future of 5G lies in open, interoperable software and hardware innovation from different vendors. This is yet another proof point that HPE is the leading open infrastructure provider for 5G, helping telcos to deploy 5G services faster, on secure telco optimized platforms.”

About SK Telecom

SK Telecom is Korea’s leading ICT company, driving innovations in the areas of mobile communications, media, security, commerce and mobility. Armed with cutting-edge ICT including AI and 5G, the company is ushering in a new level of convergence to deliver unprecedented value to customers. As the global 5G pioneer, SK Telecom is committed to realizing the full potential of 5G through ground-breaking services that can improve people’s lives, transform businesses, and lead to a better society.

SK Telecom says they have attained unrivaled leadership in the Korean mobile market with over 30 million subscribers, which account for nearly 50 percent of the market. The company now has 47 ICT subsidiaries and annual revenues approaching KRW 17.8 trillion.

References:

For more information, please contact [email protected] or visit our Linkedin page www.linkedin.com/company/sk-