Samsung

SKT-Samsung Electronics to Optimize 5G Base Station Performance using AI

SK Telecom (SKT) has partnered with Samsung Electronics to use AI to improve the performance of its 5G base stations in order to upgrade its wireless network. Specifically, they will use AI-based 5G base station quality optimization technology (AI-RAN Parameter Recommender) to commercial 5G networks.

The two companies have been working throughout the year to learn from past mobile network operation experiences using AI and deep learning, and recently completed the development of technology that automatically recommends optimal parameters for each base station environment. When applied to SKT’s commercial network, the new technology was able to bring out the potential performance of 5G base stations and improve the customer experience.

Mobile base stations are affected by different wireless environments depending on their geographical location and surrounding facilities. For the same reason, there can be significant differences in the quality of 5G mobile communication services in different areas using the same standard equipment.

Accordingly, SKT utilized deep learning, which analyzes and learns the correlation between statistical data accumulated in existing wireless networks and AI operating parameters, to predict various wireless environments and service characteristics and successfully automatically derive optimal parameters for improving perceived quality.

Samsung Electronics’ ‘Network Parameter Optimization AI Model’ used in this demonstration improves the efficiency of resources invested in optimizing the wireless network environment and performance, and enables optimal management of mobile communication networks extensively organized in cluster units.

The two companies are conducting additional learning and verification by diversifying the parameters applied to the optimized AI model and expanding the application to subways where traffic patterns change frequently.

SKT is pursuing advancements in the method of improving quality by automatically adjusting the output of base station radio waves or resetting the range of radio retransmission allowance when radio signals are weak or data transmission errors occur due to interference.

In addition, we plan to continuously improve the perfection of the technology by expanding the scope of targets that can be optimized with AI, such as parameters related to future beamforming*, and developing real-time application functions.

* Beamforming: A technology that focuses the signal received through the antenna toward a specific receiving device to transmit and receive the signal strongly.

SKT is expanding the application of AI technology to various areas of the telecommunications network, including ‘Telco Edge AI’, network power saving, spam blocking, and operation automation, including this base station quality improvement. In particular, AI-based network power saving technology was recently selected as an excellent technology at the world-renowned ‘Network X Award 2024’.

Ryu Tak-ki, head of SK Telecom’s infrastructure technology division, said, “This is a meaningful achievement that has confirmed that the potential performance of individual base stations can be maximized by incorporating AI,” and emphasized, “We will accelerate the evolution into an AI-Native Network that provides differentiated customer experiences through the convergence of telecommunications and AI technologies.”

“AI is a key technology for innovation in various industrial fields, and it is also playing a decisive role in the evolution to next-generation networks,” said Choi Sung-hyun, head of the advanced development team at Samsung Electronics’ network business division. “Samsung Electronics will continue to take the lead in developing intelligent and automated technologies for AI-based next-generation networks.”

SK Telecom and Samsung Electronics researchers discussing verification of AI-based 5G base station quality optimization technology.

SK Telecom and Samsung Electronics researchers discussing verification of AI-based 5G base station quality optimization technology.

SK Telecom and Samsung Electronics researchers discussing verification of AI-based 5G base station quality optimization technology.

SK Telecom and Samsung Electronics researchers discussing verification of AI-based 5G base station quality optimization technology.

…………………………………………………………………………………………………………………………………….

SKT said it is expanding the use of AI to various areas of its communications network, such as “Telco Edge AI,” network power reduction, spam blocking and operation automation, including basestation quality improvement.

…………………………………………………………………………………………………………………………………….

References:

SK Telecom (SKT) and Nokia to work on AI assisted “fiber sensing”

South Korea has 30 million 5G users, but did not meet expectations; KT and SKT AI initiatives

SKT Develops Technology for Integration of Heterogeneous Quantum Cryptography Communication Networks

India Mobile Congress 2024 dominated by AI with over 750 use cases

IDC: Worldwide Smartphone Shipment +7.8% YoY; Samsung regains #1 position

According to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, global smartphone shipments increased 7.8% year over year to 289.4 million units in the first quarter of 2024 (1Q24). This marks the third consecutive quarter of smartphone shipment growth, a strong indicator that a recovery is well underway.

“As expected, smartphone recovery continues to move forward with market optimism slowly building among the top brands,” said Ryan Reith, group vice president with IDC’s Worldwide Mobility and Consumer Device Trackers. “While Apple managed to capture the top spot at the end of 2023, Samsung successfully reasserted itself as the leading smartphone provider in the first quarter. While IDC expects these two companies to maintain their hold on the high end of the market, the resurgence of Huawei in China, as well as notable gains from Xiaomi, Transsion, OPPO/OnePlus, and vivo will likely have both OEMs looking for areas to expand and diversify. As the recovery progresses, we’re likely to see the top companies gain share as the smaller brands struggle for positioning.”

“The smartphone market is emerging from the turbulence of the last two years both stronger and changed,” said Nabila Popal, research director with IDC’s Worldwide Tracker team. “Firstly, we continue to see growth in value and average selling prices (ASPs) as consumers opt for more expensive devices knowing they will hold onto their devices longer. Secondly, there is a shift in power among the Top 5 companies, which will likely continue as market players adjust their strategies in a post-recovery world. Xiaomi is coming back strong from the large declines experienced over the past two years and Transsion is becoming a stable presence in the Top 5 with aggressive growth in international markets. In contrast, while the Top 2 players both saw negative growth in the first quarter, it seems Samsung is in a stronger position overall than they were in recent quarters.”

| Top 5 Companies, Worldwide Smartphone Shipments, Market Share, and Year-Over-Year Growth, Q1 2024 (Preliminary results, shipments in millions of units) | |||||

| Company | 1Q24 Shipments | 1Q24 Market Share | 1Q23 Shipments | 1Q23 Market Share | Year-Over-Year Change |

| 1. Samsung | 60.1 | 20.8% | 60.5 | 22.5% | -0.7% |

| 2. Apple | 50.1 | 17.3% | 55.4 | 20.7% | -9.6% |

| 3. Xiaomi | 40.8 | 14.1% | 30.5 | 11.4% | 33.8% |

| 4.Transsion | 28.5 | 9.9% | 15.4 | 5.7% | 84.9% |

| 5. OPPO | 25.2 | 8.7% | 27.6 | 10.3% | -8.5% |

| Others | 84.7 | 29.3% | 79.0 | 29.4% | 7.2% |

| Total | 289.4 | 100.0% | 268.5 | 100.0% | 7.8% |

| Source: IDC Quarterly Mobile Phone Tracker, April 15, 2024 | |||||

Notes:

• Data are preliminary and subject to change.

- Company shipments are branded device shipments and exclude OEM sales for all vendors.

- The “Company” represents the current parent company (or holding company) for all brands owned and operated as a subsidiary.

- Figures represent new shipments only and exclude refurbished units.

References:

https://www.idc.com/getdoc.jsp?containerId=prUS52032524

AST SpaceMobile: “5G” Connectivity from Space to Everyday Smartphones

Huawei reports 1% YoY revenue growth in 3Q-2023; smartphone sales increase in China

Samsung and VMware Collaborate to Advance 5G SA Core & Telco Cloud

Samsung and VMware are continuing their collaboration to offer a powerful and comprehensive 5G solution—combining Samsung 5G Core and VMware Telco Cloud Platform 5G [1.]. This partnership makes it easier for telecom operators using the VMware platform to deploy Samsung’s 5G components. The validation supports Samsung’s ongoing attempts to boost its 5G core market share and further enhances VMware’s telecom efforts.

Note 1. VMware’sTelco cloud is a next-generation network architecture that combines software-defined networking, network functions virtualization, and cloud native technology into a distributed computing network. Since the network and the computing resources are distributed across sites and clouds, automation and orchestration are required.

………………………………………………………………………………………………………………………..

Joining Samsung’s expertise in 5G Core with the power of the VMware Telco Cloud, the combined 5G solution improves the performance and reliability of core networks. In addition, the collaboration offers increased agility and scalability for network infrastructure, enabling operators to rapidly adapt to changing market conditions and customer demands.

The companies have been involved in continuous testing, certification and validation efforts to ensure that Samsung’s 5G Core network functions are fully compatible with VMware Telco Cloud Platform 5G. After validation, Samsung received certification for its 5G Core network functions by the VMware Ready for Telco Cloud program, ensuring compatibility and reliability with VMware technology.

VMware Ready for Telco Cloud certification has been granted to Samsung’s Core network functions, including UPF, NSSF, SMF, AMF, and NRF. The Ready for Telco Cloud certification ensures that network functions are ready for deployment and lifecycle operations with VMware technology. These certified network functions will deliver improved performance, enhanced security features and increased agility and scalability for core networks.

VMware initially rolled out its overarching Telco Cloud Platform in early 2021, which itself was an expansion of its reorganized and repacked stack of technologies for network operators. It has since updated that specific platform as well as expanded its reach into other 5G markets like private 5G and mobile edge compute.

Specific to its work with Samsung, VMware began those efforts in late 2020. That move called for Samsung to integrate its network core, edge, and radio access network (RAN) offerings with VMware and for Samsung to extend its support for cloud-native architecture by adapting its suite of products for containerized network functions (CNFs) and virtual network functions (VNFs) on VMware’s software stack and network automation services.

earlier this year announced the first commercial collaboration with Samsung, which involved integrating Samsung’s virtualized RAN (vRAN) with VMware’s Telco Cloud Platform as part of Dish Network’s ongoing 5G network deployment.

That work built on Dish Network’s plan to deploy 24,000 Samsung open RAN-compliant radios and 5G vRAN software systems running on VMware’s platform that underlines Dish Network’s nascent 5G network.

The companies’ continued collaboration will accelerate the advancement of 5G Core networks and help operators to introduce innovative services that will lead to revenue growth and enhanced customer experiences.

References:

https://www.vmware.com/in/topics/glossary/content/telco-cloud.html

Samsung-Mediatek 5G uplink trial with 3 transmit antennas

Samsung Electronics and MediaTek have successfully conducted 5G standalone (SA) uplink tests, using three transmit (3Tx) antennas instead of the typical two, to demonstrate the potential for improved upload experiences with current smartphones and customer premise equipment (CPE).

Until recently, most talk about 5G SA industry firsts have focused on the downlink. However, the demands on uplink performance are increasing with the rise of live streaming, multi-player gaming and video conferences. Upload speeds determine how fast your device can send data to gaming servers or transmit high-resolution videos to the cloud. As more consumers seek to document and share their experiences with the world in real-time, enhanced uplink experiences provide an opportunity to use the network to improve how they map out their route home, check player stats online and upload videos and selfies to share with friends and followers.

While current smartphones and customer premise equipment (CPEs) can only support 2Tx antennas, this industry-first demonstration validated the enhanced mobile capability of 3Tx antenna support. This approach not only improves upload speeds but also enhances spectrum and data transmission efficiency, as well as overall network performance.

The test was conducted in Samsung’s lab, based in Suwon, Korea. Samsung provided its industry-leading 5G network solutions, including its C-Band Massive MIMO radios, virtualized Distributed Unit (vDU) and core. The MediaTek test device featuring its new M80-based CPE chipset began with one uplink channel apiece at 1,900MHz and 3.7GHz, but added an extra uplink flow using MIMO on 3.7GHz. Both companies achieved a peak throughput rate of 363Mbps, an uplink speed that is near theoretical peak using 3Tx antennas.

Source: ZTE

“We are excited to have successfully achieved this industry breakthrough with MediaTek, bringing greater efficiency and performance to consumer devices,” said Dongwoo Lee, Head of Technology Solution Group, Networks Business at Samsung Electronics. “Faster uplink speeds bring new possibilities and have the potential to transform user experiences. This milestone further demonstrates our commitment to improving our customers’ networks using the most advanced technology available.”

“Enhancing uplink performance using groundbreaking tri-antenna and 5G UL infrastructure technologies will ensure next-generation 5G experiences continue to impress users globally,” said HC Hwang, General Manager of Wireless Communication System and Partnership at MediaTek. “Our collaboration with Samsung has proved our combined technical capabilities to overcome previous limits, enhancing network performance and efficiency, opening up new possibilities for service providers and consumers to enjoy faster and more reliable 5G data connectivity.”

“With demands on mobile networks rising, enhancing upload performance is essential to improving consumer and enterprise connectivity, as well as application experiences,” said Will Townsend, VP & Principal Analyst at Moor Insights & Strategy. “Samsung and MediaTek have achieved an important 5G Standalone milestone in a demonstration which underscores a tangible network benefit and does so in a way that can help operators maximize efficiency.”

Samsung has pioneered the successful delivery of 5G end-to-end solutions, including chipsets, radios and core. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio, from virtualized RAN and Core to private network solutions and AI-powered automation tools. The company currently provides network solutions to mobile operators that deliver connectivity to hundreds of millions of users worldwide.

References:

Ericsson and MediaTek set new 5G uplink speed record using Uplink Carrier Aggregation

Nokia achieves extended range mmWave 5G speed record in Finland

Huawei and China Telecom Jointly Release 5G Super Uplink Innovation Solution

https://www.telecomhall.net/t/5g-uplink-enhancement-technology-by-zte-white-paper/20183

Charter Communications selects Nokia AirScale to support 5G connectivity for Spectrum Mobile™ customers

Nokia will deliver its AirScale portfolio, including 5G Radio Access Network (RAN), to support Charter Communications’ 5G rollout in trial markets. It marks Nokia’s first win in the cablecos/MSO space for large-scale wireless 5G deployments. Charter will use Nokia’s 5G RAN solutions to deliver wireless 5G connectivity, faster speeds, and increased network capacity to Spectrum Mobile customers in its trial markets in the United States.

Up until now, cablecos have been MVNO rather than actually deploying their own wireless networks. All of the cable companies in the U.S. with mobile aspirations have had to partner with an existing mobile network operator – Verizon, AT&T or T-Mobile – to sell mobile services. And those MVNO partnerships are not cheap. For example, the financial analysts at Wells Fargo estimate that Charter and Comcast pay Verizon $12-$13 per month for each of their mobile customers.

Cable operators have spent more than $1 billion on Citizens Broadband Radio Service (CBRS) spectrum with the intention to build 5G networks to offload traffic from their leased mobile networks and to deliver the fastest wireless service. Using compact and lightweight small cell products, cable operators can more easily and cost-effectively provide 5G wireless connectivity by leveraging their existing DOCSIS infrastructure without having to build additional cell sites.

With 6 million customer lines as of Q1-2023, Charter’s Spectrum Mobile is the nation’s fastest growing mobile network provider. Charter offers its Spectrum Mobile service through an MVNO deal with Verizon but touts its ability to combine that with its Wi-Fi network. It’s also using Citizens Broadband Radio Service (CBRS) spectrum to offload mobile traffic from the leased network. Charter spent more than $464 million in the CBRS auction in 2020.

As Charter continues to grow its mobile customers, the company needed a 5G wireless connectivity solution to offload traffic from its leased mobile network. Charter will deploy Nokia’s 5G RAN products, including strand mounted radios for CBRS, baseband units, and a newly developed 5G CBRS Strand Mount Small Cells All-in-One portfolio on the company’s assets, which will help Charter continue to deliver mobile traffic in strategic locations across its 41-state footprint while providing customers with the best possible 5G service experience.

Justin Colwell, EVP, Connectivity Technology at Charter Communications, said: “Charter is committed to providing our customers a fully converged connectivity experience that combines high value plans with the fastest wired and wireless speeds throughout our footprint. Incorporating Nokia’s innovative 5G technology into our advanced wireless converged network will help us ensure that Spectrum customers in areas with a high concentration of mobile traffic continue to receive superior mobile connectivity, including the nation’s fastest wireless speeds.”

Shaun McCarthy, President of North America Sales at Nokia, said: “This news builds on our more than 20-year relationship working with Charter to enhance its network. We are excited to expand its current trial to additional select metropolitan markets in the US, enabling an enhanced user experience for Spectrum Mobile subscribers. This win strengthens Nokia’s leadership position in the MSO space for 5G wireless deployments.”

Nokia in the U.S.

Nokia is supplying 5G technologies across its portfolio to the major service providers and leading operators, as well as hyperscalers, enterprises, and government organizations in the US. The company has an unrivaled track record of innovation in the U.S. including Nokia Bell Labs, which pioneered many of the fundamental technologies that are being used to develop 5G and broadband standards. Today, more than 90 percent of the U.S. population is connected by Nokia network solutions.

*Based on year end 2022 subscriber data among top 3 cellular carriers.

………………………………………………………………………………………………………………………………………………………

Nokia may have competition in the CBRS/MSO space. Samsung will be introducing a new solution within its already existing CBRS portfolio: a new 5G CBRS Strand Small Cell. Designed to be easily deployed on the MSOs aerial strand assets, it enables use of their existing infrastructure, helping them save on deployment costs.

References:

Samsung bets on software centric network architectures supporting virtualized services

Kim Woojune, President and General Manager of Samsung Networks [1.] asserted that software capabilities will change the telecommunications landscape, as the South Korean tech giant bets on virtualized services. Kim said that future networks will be transformed more into software-centric architecture, versus the hardware-based networks the world has built and relied upon for about 150 years.

Note 1. Kim was appointed president and general manager of Samsung’s Networks business in December 2022

“Software has become a key driver of innovation, and this transition to software is also a natural shift in the networks industry,” Kim said in a speech at Nikkei’s Future of Asia forum. “Software brings more flexibility, more creativity and more intelligence,” he added.

Kim said the next transition in the network business has already started, as global telecom operators such as Verizon in the U.S., and KDDI and Rakuten in Japan are building their virtualized networks.

In February, Samsung announced that it was selected by KDDI to provide its cloud-native 5G Standalone (SA) Core network for the operator’s commercial network across Japan. The company said that this will usher in a new generation of services and applications available to KDDI’s consumers and enterprise customers — including smart factories, automated vehicles, cloud-based online gaming and multi-camera live streaming of sports events. Samsung and KDDI also successfully tested network slicing over their 5G SA Core network.

The Samsung executive asked global governments to embrace the shift, saying their role “should be to maximize the benefit of this extra use.”

Samsung is also winning contracts with cable providers, like Comcast, where it’s working to deploy 5G RAN solutions to support its efforts to deliver 5G access to consumers and business customers in the U.S. using CBRS and 600 MHz spectrum, Kim noted. Comcast is the first operator to use Samsung’s new 5G CBRS Strand Small Cell, a compact and lightweight solution designed to be installed on outdoor cables. It consists of a radio, baseband, cable modem and antennas, all in one form factor. The solution is also equipped with Samsung’s in-house designed chipset, a second-generation 5G modem SoC, which delivers increased capacity and performance.

References:

Samsung and KDDI complete SLA network slicing field trial on 5G SA network in Japan

KDDI claims world’s first 5G Standalone (SA) Open RAN site using Samsung vRAN and Fujitsu radio units

Samsung announces 5G NTN modem technology for Exynos chip set; Omnispace and Ligado Networks MoU

Samsung in OpenRAN deal with NTT DOCOMO; unveils 28GHz Radio Unit (RU)

Samsung achieves record speeds over 10km 5G mmWave FWA trial in Australia

https://www.fiercewireless.com/tech/samsungs-woojune-kim-reflects-vran-leadership-us-inroads

Samsung announces 5G NTN modem technology for Exynos chip set; Omnispace and Ligado Networks MoU

Samsung Electronics, a leader in advanced semiconductor technology, today announced that it has secured standardized 5G non-terrestrial networks (NTN) [1.] modem technology for direct communication between smartphones and satellites, especially in remote areas. Samsung plans to integrate this technology into the company’s Exynos modem solutions, accelerating the commercialization of 5G satellite communications and paving the way for the 6G-driven Internet of Everything (IoE) era. That’s noteworthy considering Samsung’s latest flagship smartphone, the Galaxy S23, does not use Samsung’s Exynos platform and instead only uses Qualcomm’s Snapdragon chipset.

Note 1. There are no ITU or ETSI standards for 5G NTN– only for 5G terrestrial networks. It is not even under consideration for the next revision o the 5G RAN standard– ITU-R M.2150-1.

NTN is a communications technology that uses satellites and other non-terrestrial vehicles to bring connectivity to regions that were previously unreachable by terrestrial networks, whether over mountains, across deserts or in the middle of the ocean. It will also be critical in assuring operability in disaster areas and powering future urban air mobility (UAM) such as unmanned aircraft and flying cars.

Source: Samsung

“This milestone builds on our rich legacy in wireless communications technologies, following the introduction of the industry’s first commercial 4G LTE modem in 2009 and the industry’s first 5G modem in 2018,” said Min Goo Kim, Executive Vice President of CP (Communication Processor) Development at Samsung Electronics. “Samsung aims to take the lead in advancing hybrid terrestrial-NTN communications ecosystems around the world in preparation for the arrival of 6G.”

By meeting the latest 5G NTN specifications defined by the 3rd Generation Partnership Project (3GPP Release 17), [2.] Samsung’s NTN technology will help ensure interoperability and scalability among services offered by global telecom carriers, mobile device makers and chip companies.

Note 2. 3GPP Release 17 contains specs for 5G-NR over Non terrestrial Networks (NTN) and NB-IoT over NTN,

Impacts on 5GC of Satellite NG-RAN used as new RAN 3GPP access

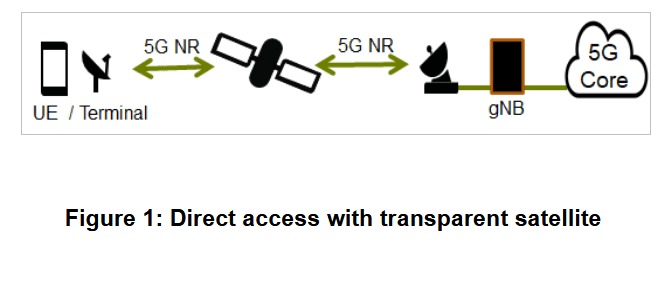

In 3GPP Rel-17, only direct access with transparent satellite is considered, as shown in following figure:

Source: 3GPP

……………………………………………………………………………………………………………………………………………..

For highly reliable NTN communication with low Earth orbit (LEO) satellites, Samsung has developed and simulated 5G NTN standard-based satellite technology using its Exynos Modem 5300 reference platform to accurately predict satellite locations and minimize frequency offsets caused by the Doppler shift. Based on this technology, Samsung’s future Exynos modems will support two-way text messaging as well as high-definition image and video sharing. That would be an important development considering today’s phone-to-satellite services generally support only slow-speed emergency messaging (e.g. Apple iPhone 14). An offering that supports high-bandwidth services like video calling would presumably require far more satellites than today’s services use – and it could also pose a challenge to terrestrial mobile network operators looking to make profits from offering high-bandwidth services in remote or rural areas.

Additionally, Samsung said it plans to secure a standardized NB-IoT NTN technology for use in its next-generation modem platforms. With integrated satellite connectivity, Samsung’s NB-IoT solutions will eliminate the need for a separate high-power wireless antenna chip inside smartphones, providing mobile device makers with much greater design flexibility.

……………………………………………………………………………………………………………………………………………………………….

Samsung has not disclosed when the company might begin offering satellite services in its 5G NTN equipped phones, how much the service might cost, and which satellite operators might support the offering.

…………………………………………………………………………………………………………………………………………………………….

In a related development, Omnispace and Ligado Networks today announced a new Memorandum of Understanding (MoU) to combine their respective spectrum holdings in order to offer “space-based, direct-to-device (D2D) solutions for global voice, text and data connectivity.”

The companies pledged to merge Ligado’s 40MHz of L-band satellite spectrum in the U.S. and Canada with Omnispace’s 60MHz of S-band satellite spectrum. “The combination of L- and S-band spectrum is a unique opportunity to expand the ecosystem of D2D applications and technologies, enhance user experience and extend service globally. For consumer smartphones, the offering will have enough bandwidth to go beyond emergency satellite texting by offering ubiquitous roaming mobile coverage with two-way voice, messaging and data capabilities,” according to the companies’ press release.

However, there are plenty of obstacles to the companies’ ambitions. For example, Ligado has spent years working to free its spectrum of interference concerns, and its financial footing remains a question. “Ligado has no cash and an overwhelming debt load,” tweeted analyst Tim Farrar with TMF Associates following the announcement from Ligado and Omnispace.

References:

https://portal.3gpp.org/desktopmodules/Specifications/SpecificationDetails.aspx?specificationId=3937

https://www.3gpp.org/specifications-technologies/releases/release-17

Samsung and KDDI complete SLA network slicing field trial on 5G SA network in Japan

Samsung Electronics and KDDI announced the successful demonstration of Service Level Agreements (SLA) assurance network slicing in a field trial conducted in Tokyo, Japan. For the first time in the industry, the companies proved their capabilities to generate multiple network slices using a RAN Intelligent Controller (RIC) on a live commercial 5G Standalone (SA) network. The RIC, provided by Samsung in this field trial, is a software-based component of the Open RAN architecture that optimizes the radio resources of the RAN to improve the overall network quality.

Network slicing (which requires a 5G SA core network) enables multiple virtual networks to be created within a single physical network infrastructure, where each slice is dedicated for a specific application or service — serving different purposes. For instance, 5G SA network operators can create a low latency slice for automated vehicles, an IoT slice for smart factories and a high bandwidth slice for live video streaming — all within the same network. This means that a single 5G SA network can support a broad mix of use cases simultaneously, accelerating the delivery of new services and meeting the tailored demands of various enterprises and consumers.

“Network slicing will help us activate a wide range of services that require high performance and low latency, benefitting both consumers and businesses,” said Toshikazu Yokai, Managing Executive Officer, General Manager of Mobile Network Technical Development Division at KDDI. “Working with Samsung, we continue to deliver the most innovative technologies to enhance customer experiences.”

Through this field trial conducted in Q4 of 2022, KDDI and Samsung proved their capabilities of SLA assurance to generate multiple network slices that meet SLA requirements, guaranteeing specific performance parameters — such as low latency and high throughput — for each application. Samsung also proved the technical feasibility of multiple user equipment (UE)-based network slices with quality assurance using the RIC, which performs advanced control of RAN as defined by the O-RAN Alliance.

“Network slicing will open up countless opportunities, by allowing KDDI to offer tailor-made, high-performance connectivity, along with new capabilities and services, to its customers,” Junehee Lee, Executive Vice President, Head of Global Sales & Marketing, Networks Business at Samsung Electronics. “This demonstration is another meaningful step forward in our efforts to advance technological innovation and enrich network services. We’re excited to have accomplished this together with KDDI and look forward to continued collaboration.”

For more than a decade, the two companies have been working together, hitting major 5G networks milestones that include: KDDI’s selection of Samsung as a 5G network solutions provider, end-to-end 5G network slicing demonstration in the lab, 5G network rollout on 700MHz and the deployment of 5G vRAN on KDDI’s commercial network.

Samsung has pioneered the successful delivery of 5G end-to-end solutions including chipsets, radios and core. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from virtualized RAN and Core to private network solutions and AI-powered automation tools. The company is currently providing network solutions to mobile operators that deliver connectivity to hundreds of millions of users around the world.

References:

Ericsson and Nokia demonstrate 5G Network Slicing on Google Pixel 6 Pro phones running Android 13 mobile OS

Nokia and Safaricom complete Africa’s first Fixed Wireless Access (FWA) 5G network slicing trial

Deutsche Telekom demos end to end network slicing; plans ‘multivendor’ open RAN launch in 2023

Is 5G network slicing dead before arrival? Replaced by private 5G?

Telefonica in 800 Gbps trial and network slicing pilot test

5G Network Slicing Tutorial + Ericsson releases 5G RAN slicing software

Network Slicing and 5G: Why it’s important, ITU-T SG 13 work, related IEEE ComSoc paper abstracts/overviews

Samsung in OpenRAN deal with NTT DOCOMO; unveils 28GHz Radio Unit (RU)

Samsung Electronics announced the company is supplying a variety of 5G radios to support NTT DOCOMO’s Open Radio Access Network (Open RAN) expansion. Samsung will now provide a range of Open RAN-compliant 5G radios covering all of the Time Division Duplex (TDD) spectrum bands held by the operator.

This builds upon the two companies’ 5G agreement previously-announced in March 2021, in which NTT DOCOMO selected Samsung as its 5G network solutions provider. Samsung now adds new radios — including 3.7GHz, 4.5GHz and 28GHz — to its existing 3.4GHz radio support for NTT DOCOMO.

This expanded portfolio from Samsung will enable NTT DOCOMO to leverage its broad range of spectrum across Japan to build a versatile 5G network for diversifying their services offered to consumers and businesses. The companies have also been testing the interoperability of these new radios with basebands from various vendors in NTT DOCOMO’s commercial network environment.

“We have been collaborating with Samsung since the beginning of 5G and through our Open RAN expansion, and we are excited to continue extending our scope of vision together,” said Masafumi Masuda, Vice President and General Manager of the Radio Access Network Development Department at NTT DOCOMO. “Solidifying our global leadership, we will continue to build momentum around our Open RAN innovation and to provide highly scalable and flexible networks to respond quickly to the evolving demands of our customers.”

“Japan is home to one of the world’s most densely populated areas with numerous skyscrapers and complex infrastructure. Samsung’s industry-leading 5G radios portfolio meets the demands of low-footprint, low-weight solutions, while also ensuring reliable service quality,” said Satoshi Iwao, Vice President and Head of Network Division at Samsung Electronics Japan. “As NTT DOCOMO continues to accelerate its Open RAN innovation, we look forward to working together to deliver a richer experience to consumers and generating new business opportunities.”

With this announcement, Samsung introduces its new 28GHz Radio Unit (RU) for the first time — as a new addition to its portfolio of leading mmWave solutions. This RU, which weighs less than 4.5kg (~10lbs), features a light and compact form factor with very low power consumption, enabling flexible deployments in various scenarios. Additionally, Samsung’s 3.4GHz, 3.7GHz and 4.5GHz radios are also Open RAN-compliant and designed to deliver high performance and reliability.

Last month, Samsung won a contract with NTT East to provide cloud-native 5G core and RAN equipment to the provider’s private 5G network platform. That deal followed on an agreement earlier this year for Samsung to power the operator’s private 5G network services in the east areas of Japan, and followed trials of Samsung’s 5G standalone (SA) network core in test environments.

Samsung also secured a deal with Comcast to activate the cable giant’s deep spectrum holdings and become an infrastructure-owning 5G cellular operator targeting market heavyweights Verizon, AT&T, and T-Mobile US. Comcast will use Samsung’s 5G RAN equipment for its Xfinity Mobile service, including a newly developed 5G Strand Small Cell that is designed to be mounted on Comcast’s existing aerial cable lines. This all-in-one piece of equipment is central to the deployment as it will allow Comcast to mount cellular antennas where it’s already running cable connections for wireless backhaul.

A recent Dell’Oro Group report noted the vendor has been gaining RAN market share at the expense of its China-based rivals Huawei and ZTE outside of their home country. This could accelerate as the U.S. Federal Communications Commission adopted new rules prohibiting domestic telecommunication operators from acquiring and using networking and other equipment from China-based vendors, including Huawei.

“While commercial Open RAN revenues continue to surprise on the upside, the underlying message that we have communicated now for some time now has not changed and remains mixed,” said Stefan Pongratz, Vice President with the Dell’Oro Group. “Early adopters are embracing the movement towards more openness but at the same time, there is more uncertainty when it comes to the early majority operator and the implications for the broader RAN supplier landscape now with non-multi vendor deployments driving a significant portion of the year-to-date Open RAN market,” continued Pongratz.

Additional Open RAN highlights from the Dell’Oro’s 3Q 2022 RAN report:

- Top 4 Open RAN revenue suppliers for the 1Q22-3Q22 period include Samsung, Fujitsu, NEC, and Mavenir.

- Trials are on the rise globally, however, North America and the Asia Pacific regions are still dominating the commercial revenue mix over the 1Q22-3Q22 period, accounting for more than 95 percent of the market.

- More than 80 percent of the year-to-date growth is driven by the North America region, supported by large scale non-Massive MIMO and Massive MIMO macro deployments.

- The rise of Open RAN has so far had a limited impact on the broader RAN (proprietary and Open RAN) market concentration. The data contained in the report suggest that the collective RAN share of the top 5 RAN suppliers (Huawei, Ericsson, Nokia, ZTE, and Samsung) declined by less than one percentage point between 2021 and 1Q22-3Q22.

- Short-term projections have been revised upward to reflect the higher baseline – Open RAN is now projected to account for 6 to 10 percent of the RAN market in 2023. Open RAN growth rates, however, are expected to decelerate next year, reflecting the likelihood that the sum of new brownfield deployments will be able to offset more challenging comparisons with the early adopters.

Samsung says they have pioneered the successful delivery of 5G end-to-end solutions including chipsets, radios and core. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from virtualized RAN and Core to private network solutions and AI-powered automation tools. The company is currently providing network solutions to mobile operators that deliver connectivity to hundreds of millions of users around the world.

………………………………………………………………………………………………………………………………………………………

NTT DOCOMO began commercial 5G services in early 2020, and included open RAN-compliant equipment provided by Fujitsu, NEC, and Nokia. The carrier more recently signed a partnership with South Korea’s SK Telecom (SKT) to develop new 5G and 6G cellular technologies and deployment plans taking advantage of open and virtualized RAN (vRAN) technology.

NTT DOCOMO is Japan’s leading mobile operator with over 85 million subscriptions, is one of the world’s foremost contributors to 3G, 4G and 5G mobile network technologies. Beyond core communications services, DOCOMO is challenging new frontiers in collaboration with a growing number of entities (“+d” partners), creating exciting and convenient value-added services that change the way people live and work. Under a medium-term plan toward 2020 and beyond, DOCOMO is pioneering a leading-edge 5G network to facilitate innovative services.

References:

https://news.samsung.com/global/samsung-electronics-expands-5g-radio-support-for-ntt-docomo

https://www.sdxcentral.com/articles/news/docomo-deepens-samsung-5g-ran-drive/2022/12/

https://www.docomo.ne.jp/english/

Samsung achieves record speeds over 10km 5G mmWave FWA trial in Australia

South Korea’s Samsung Electronics says it has achieved record-setting average downlink speeds of 1.75 Gbps and uplink speeds of 61.5 Mbps over a 10 km (6.2 miles) 5G mmWave network in a recent field trial conducted with Australia’s NBN Co. As the farthest 28 GHz 5G mmWave Fixed Wireless Access (FWA) connection recorded by Samsung, this milestone demonstrates the expanded reach possible with this powerful spectrum, and its ability to efficiently deliver widespread broadband coverage across the country.

Source: Accton

To achieve average downlink speeds of 1.75 Gbps at such extended range, the trial by Samsung and NBN utilized eight component carriers (8CC), which is an aggregation of 800MHz of mmWave spectrum. The potential to support large amounts of bandwidth is a key advantage of the mmWave spectrum and Samsung’s beamforming technology enables the aggregation of such large amounts of bandwidth at long distance. At its peak, the company also reached a top downlink speed of 2.7Gbps over a 10km distance from the radio.

“The results of these trials with Samsung are a significant milestone and demonstrate how we are pushing the boundaries of innovation in support of the digital capabilities in Australia,” said Ray Owen, Chief Technology Officer at NBN Co. “As we roll out the next evolution of our network to extend its reach for the benefit of homes and businesses across the country, we are excited to demonstrate the potential for 5G mmWave. nbn will be among the first in the world to deploy 5G mmWave technology at this scale, and achievements like Samsung’s 10km milestone will pave the way for further developments in the ecosystem.”

There’s a total of AUD $750 million investment in the nbn Fixed Wireless network (made up of AUD $480 million from the Australian Government and supported by an additional AUD $270 million from nbn). NBN will use software enhancements and advances in 5G technology, and in particular 5G mmWave technology, to extend the reach of the existing fixed wireless footprint by up to 50 percent and introduce two new wholesale high-speed tiers. The nbn FWA network covers nearly 650,000 premises in the country. The company wants to add at least 120,000 locations in Australia that are currently served by a satellite-based service.

“This new 5G record proves the massive potential of mmWave technology, and its ability to deliver enhanced connectivity and capacity for addressing the last mile challenges in rural areas,” said Junehee Lee, Executive Vice President and Head of R&D, Networks Business at Samsung Electronics. “We are excited to work with nbn to push the boundaries of 5G technology even further in Australia and tap the power of mmWave for customer benefit.”

As demonstrated in the trials, 5G mmWave spectrum is not only viable for the deployment of high-capacity 5G networks in dense urban areas, but also for wider FWA coverage. Extending the effective range of 5G data signals on mmWave will help address the connectivity gap, providing access to rural and remote areas where fiber cannot reach.

For the trial, Samsung used its 28GHz Compact Macro and third-party 5G mmWave customer premise equipment (CPE). Samsung’s Compact Macro is the industry’s first integrated radio for mmWave spectrum, bringing together a baseband, radio and antenna into a single form factor. This compact and lightweight solution can support all frequencies within the mmWave spectrum, simplifying deployment, and is currently deployed in commercial 5G networks across the globe, including Japan, Korea and the U.S.

Since launching the world’s first 5G mmWave FWA services in 2018 in the U.S., Samsung has been leading the industry, offering an end-to-end portfolio of 5G mmWave solutions — including in-house chipsets and radios — and advancing the 5G mmWave momentum globally.

The nbn® network is Australia’s digital backbone that helps deliver reliable and resilient broadband across a continent spanning more than seven million square kilometers. nbn is committed to responding to the digital connectivity needs of people across Australia, working with industry, governments, regulators and community partners to increase the digital capability of Australia.

Samsung has pioneered the successful delivery of 5G end-to-end solutions including chipsets, radios and core. Through ongoing research and development, Samsung drives the industry to advance 5G networks with its market-leading product portfolio from RAN and Core to private network solutions and AI-powered automation tools. The company is currently providing network solutions to mobile operators that deliver connectivity to hundreds of millions of users around the world.

Nokia had previously announced it was supplying 5G FWA mmWave CPE equipment for nbn’s efforts that also operates in the 28 GHz band with similar performance characteristics stated by Samsung for its test, including a range of up to 6.2 miles from the transmission tower. However, Samsung said that Nokia’s equipment was not part of its test.

Nokia noted that its CPE includes an antenna installed on the roof of a premises that is linked using a 2.5 Gb/s power over Ethernet (PoE) connection to an indoor unit that powers the on-premises internet connectivity.

Related Articles:

- Samsung Electronics Supports NTT East’s Continued Expansion of Private 5G Networks in Japan

- Samsung Electronics Tapped To Support Comcast’s 5G Connectivity Efforts

- Samsung Electronics To Deliver Private 5G Network Solutions to Korea’s Public and Private Sectors

References:

https://www.sdxcentral.com/articles/news/samsung-nokia-power-5g-mmwave-potential/2022/11/