GSA

Mobile Core Network (MCN) growth to slow due to slow roll-out of 5G SA networks

The slow uptake of 5G Standalone (SA) networks is decreasing the growth for the overall Mobile Core Network (MCN), which also includes IMS Core and 4G Core (EPC). Dell’Oro Group [1.] forecasts worldwide MCN 5-year growth will be at a 3% compounded annual growth rate (CAGR).

- 5G MCN, IMS Core, and Multi-Access Network Computing (MEC) will have positive growth rates for the forecast period while 4G MCN will experience negative growth.

- By 2026, 99% of the revenue for network functions will be from cloud native Container-based CNFs.

Via email, Dave wrote: The journey for network virtualization started in 2015 with ETSI NFV. We went from Physical Network Functions (PNFs) to Virtual Network Functions (VNFs) to cloud-ready VNFs, to Cloud- Native VNFs (CNF), to Container-Based Cloud-Native VNFs. Container-Based (CNF) enable microservices.

…………………………………………………………………………………………………………………

Separately, the Global mobile Suppliers Association (GSA) recently wrote that only 99 operators in 50 countries are investing in 5G standalone (SA) core network, which includes those planning/testing and launched 5G SA networks.

The GSA said at least 20 network operators (Dell’Oro says 13) in 16 countries or territories are believed to have launched public 5G SA networks. Another five have deployed the technology, but not yet launched commercial services or have only soft-launched them. So only 20.6% of the 481 5G network operators (investing in 5G licenses, trials or deployments of any type) have deployed 5G and that percentage is lower if you go by Dell’Oro’s 13 5G SA network operators.

From GSA’s The Power of Standalone 5G – published 19th January 2022:

Importantly, the 5G standalone core is cloud-native and is designed as a service-based architecture, virtualizing all software network functions using edge computing and providing the full range of 5G features. Some of these are needed in the enterprise space for advanced uses such as smart factory automation, smart city applications, remote control of critical infrastructure and autonomous vehicle operation. However, 5G standalone does mean additional investment and can bring complexity in running multiple cores in the network.

This will be a potential source of new revenue for service providers, as digital transformation — with 5G standalone as a cornerstone — will enable them to deliver reliable low-latency communications and massive Internet of things (IoT) connectivity to customers in different industry sectors. The low latency and much higher capacity needed by those emerging service areas will only be feasible with standalone 5G and packet core network architecture.

In addition, the service-based architecture opens up the ability to slice the 5G network into customized virtual pieces that can be tailored to the needs of individual enterprises, while maximizing the network’s operational efficiency. Advanced uses for 5G NR aren’t backward- compatible with LTE infrastructure, so all operators will eventually need to get to standalone 5G.

Standalone 5G metrics:

- Volume: Gbps per month

- Speed: Mbps (peak), Mbps (guaranteed)

- Location: Network Slice, service per location

- Latency per service or location (dependent on URLLC in the 5G RAN and 5G Core)

- Reliability or packet loss

- Number of devices per square km

- Dynamic service-level agreements per location

- Full end-to-end encryption and authentication

Source: CCS Insight

……………………………………………………………………………………………………………….

Note 1. Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

………………………………………………………………………………………………………………….

Feb 8, 2022 Update from Dave Bolan of Dell’Oro Group:

As of December 31, 2021 there were 21 known 5G SA eMBB networks commercially deployed.

|

5G SA eMBB Network Commercial Deployments |

|

|

Rain (South Africa) |

Launched in 2020 |

|

China Mobile |

|

|

China Telecom |

|

|

China Unicom |

|

|

T-Mobile (USA) AIS (Thailand) True (Thailand) |

|

|

China Mobile Hong Kong |

|

|

Vodafone (Germany) |

Launched in 2021 |

|

STC (Kuwait) |

|

|

Telefónica O2 (Germany) |

|

|

SingTel (Singapore) |

|

|

KT (Korea) |

|

|

M1 (Singapore) |

|

|

Vodafone (UK) |

|

|

Smart (Philippines) |

|

|

SoftBank (Japan) |

|

|

Rogers (Canada) |

|

|

Taiwan Mobile |

|

|

Telia (Finland) |

|

|

TPG Telecom (Australia) |

|

References:

Slow Uptake for 5G Standalone Drags on Mobile Core Network Growth, According to Dell’Oro Group

Why It’s Important: Rakuten Mobile, Intel and NEC collaborate on containerized 5G SA core network

T-Mobile US: 5G SA Core network to be deployed 3Q-2020; cites 5G coverage advantage

Heavy Reading: “The Journey to Cloud Native” – Will it be a long one?

GSA forms new 4G and 5G Fixed Wireless Access Forum; FWA Market Review & Analysis

The Global mobile Suppliers Association (GSA) today announced the establishment of the GSA 4G-5G Fixed Wireless Access Forum to bring together leading chipset, module, and terminal vendors – as well as other telecommunications industry representatives, who wish to promote 4G and 5G Fixed Wireless Access (FWA) technology, products and services – to report on progress of FWA deployments, identify use cases and encourage global adoption.

The GSA 4G-5G FWA Forum will build on the work done by the recently formed GSA Fixed Wireless Access Working Group to coordinate industry initiatives to deliver fixed wireless broadband services based on LTE and 5G access networks. The founding members of the FWA Working Group are Ericsson, Huawei, Nokia, Samsung and ZTE. Membership to GSA Working Groups is open to all GSA Executive and Ordinary Members.

Underpinning the work of the new GSA 4G-5G FWA Forum is GSA’s research and role as the voice of the mobile ecosystem. GSA publishes regular industry reports and market data determine the extent and nature of fixed wireless access broadband service availability based on LTE or 5G around the world. As part of its industry advocacy,

GSA’s research team will share its latest global fixed wireless access update in its next GSA Snapshot Webinar on 24 November (16:00 GMT). Details on how to register for and attend the free webinar are available here https://gsacom.com/webinar-fixed-wireless-access/

Joe Barrett, President, Global mobile Suppliers Association, commented: “In a relatively short space of time, fixed wireless broadband access has become a mainstream service. Today we see hundreds of operators selling LTE-based fixed wireless access services around the world, and dozens more already live with 5G FWA services for home or business broadband. In addition, fixed wireless access device vendors have grown to over 100 globally and against this backdrop of real and significant market demand, the onus is on the FWA community to work together to drive business success.

“GSA has an unrivalled track record and experience in bringing together vendors, regulators and operators from across the 4G and 5G ecosystems and the formation of the new GSA 4G-5G FWA Forum will bring this experience to Fixed Wireless Access to help accelerate its development globally,” Barrett continued.

The scope of the new GSA 4G-5G FWA Forum includes:

· Sharing trends in the industry, identifying directions in technical development, accumulating and promoting successful experiences

· Improving the 4G and 5G FWA technologies required to provide wireless broadband connection solutions with increased performance and cost-effectiveness

· Fostering collaboration among FWA suppliers to improve the industry’s ecosystem and ensure business success

· Promoting the success of the FWA industry to accelerate the provisioning of broadband access to anyone, anywhere

The new GSA 4G-5G FWA Forum and Fixed Wireless Access Working Group is a key pillar of GSA’s growing industry advocacy; this work also includes the GSA Spectrum Group, the largest single spectrum advocacy team in the mobile industry representing the vendor ecosystem in 4G and 5G spectrum discussions with governments, regulators and other policy makers.

Membership and participation in the GSA 4G-5G FWA Forum is open to chipset, module, and terminal vendors, together with industry representatives from across the telecommunications ecosystem who wish to promote Fixed Wireless Access (FWA) technology, products and services.

For more information or a GSA 4G-5G FWA Forum Application Forum, please email [email protected].

………………………………………………………………………………………………………………………………………………………………………………….

About GSA:

GSA is the voice of the global mobile ecosystem representing companies engaged in the supply of infrastructure, semiconductors, test equipment, devices, applications and mobile support services. The organization plays a central role in promoting 3GPP technology, advocating spectrum policies and stimulating IMT industry development. The association is a single source of information for industry reports and market intelligence

The GSA GAMBoD database is a unique search and analysis tool that has been developed to enable searches of LTE and 5G devices and new global data on Mobile Broadband Networks, Technologies and Spectrum (NTS). Results are presented as a list or in charts. Charts may be inserted into documents or presentations, subject to accreditation of GSA as the source.

GAMBoD is a resource dedicated to promoting the success and growth of the Mobile Broadband (MBB) industry and ecosystem and is fully available to all employees of GSA Executive and Ordinary Member companies and GSA Associates who subscribe to the service.

- More information on GAMBoD is available at: https://gsacom.com/gambod/

- Press Release for New GSA FWA Forum: https://gsacom.com/press-release/new-gsa-fwa-forum/

………………………………………………………………………………………………………………………………………………………………………………….

STL Partners — FWA Market Review and Analysis:

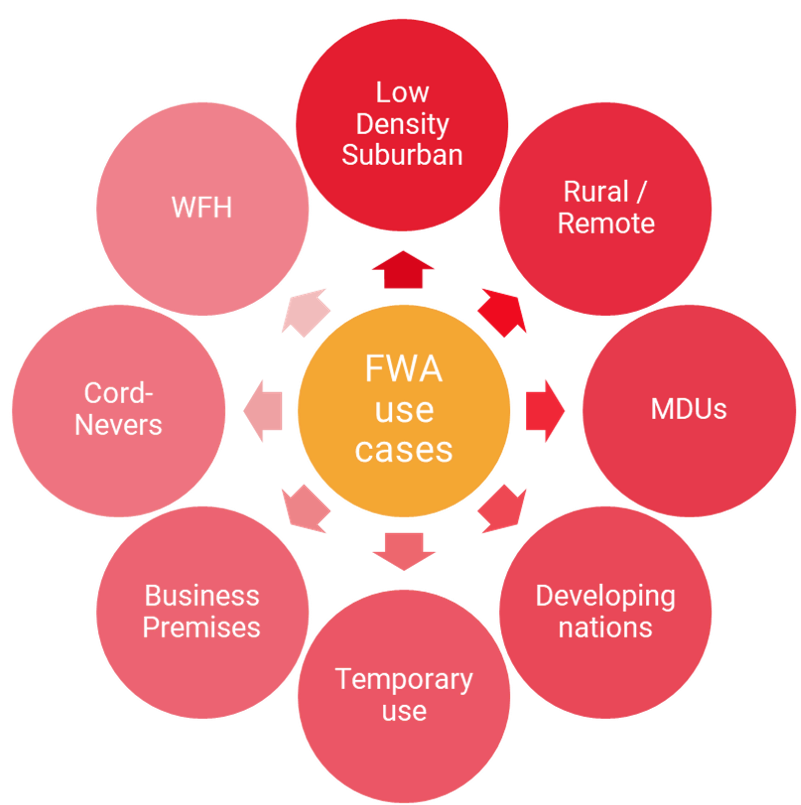

Today, fixed-wireless access (FWA) is used for perhaps 8-9% of broadband connections globally, although this varies significantly by definition, country and region. There are various use cases (see below), but generally FWA is deployed in areas without good fixed broadband options, or by mobile-only operators trying to add an additional fixed revenue stream, where they have spare capacity.

FWA via 4G -LTE using licensed spectrum has already experienced rapid growth of in numerous markets, such as South Africa, Japan, Sri Lanka, Italy, and the Philippines. This past week, T-Mobile announced an expansion of their 4G FWA called Home Internet service.

This growth has been driven by the combined impact of mobile network operators (MNOs) commercialising FWA services to households in underserved urban areas, the slow pace of fibre roll-out in some countries, government subsidies for rural broadband, and improvements in network planning tools and customer premise equipment with easier self-install options.According to STL Partners’ latest research and market forecasts, 5G is likely to have a major impact for operators in the coming years, especially from 2022 onwards as more spectrum becomes available to more operators, and equipment prices fall.

Nonetheless, 4G – LTE will continue to be more important than 5G in the FWA market overall at a global level over the next 5 years; the technology is much further down the cost- and experience curve, as well as using existing network infrastructure and spectrum.

Historically, most FWA has required an external antenna and professional installation on each individual house, although it also gets deployed for multi-dwelling units (MDUs, i.e. apartment blocks) as well as some non-residential premises like shops and schools. More recently, self-installed indoor CPE with varying levels of price and sophistication has helped broaden the market, enabling customers to get terminals at retail stores or delivered direct to their home for immediate use.

Looking forward, the arrival of 5G mass-market equipment and larger swathes of mmWave and new mid-band spectrum – both licensed and unlicensed – is changing the landscape again, with the potential for fibre-rivalling speeds, sometimes at gigabit-grade.

STL believes that the biggest changes and opportunities catalysed by 5G FWA will be:

• Alternative source of gigabit broadband in urban areas without fibre, or with poor competition and pricing.

• Mobile-only operators will target attractive demographic or sub-regional niches that fit with their existing and planned 5G footprint.

• Fixed and fixed-mobile converged broadband providers will use 5G FWA as a backup or enhancement for fixed-line services.

• The growing democratisation of 5G, with better support of unlicensed spectrum, plus cloud-delivered core networks and edge offload, will broaden its range beyond traditional MNOs to some wireless internet service providers (WISPs), cable operators, and others.

• Local licensing and new tranches of unlicensed spectrum will create options for municipalities, education agencies, and other public-sector bodies to offer 5G FWA for home-schooling, telemedicine, and other applications.

• In the longer term (2023 onwards) improved mmWave technology, including repeaters and other forms of signal-booster, could expand the addressable market for gigabit FWA.

FWA Use Cases…. Source STL Partners

………………………………………………………………………………………………………………………………………………………………………………….

References:

T‑Mobile expands Home Internet to over 130 additional cities

GSA: Over 250 5G devices announced with 67 commercially available

The Global mobile Suppliers Association (GSA) today reported that the number of announced 5G devices has broken the 250 barrier, spurred by a surge in 5G phone announcements. In January 2020, the number of announced 5G devices exceeded 200 for the first time; by early March[1] over 250 devices had been announced with GSA identifying 253 announced devices, of which at least 67 are commercially available today.

‘‘We are at a fascinating turning point in the industry where the whole ecosystem is embracing, pushing and delivering new 5G spectrum, networks and devices,” commented Joe Barrett, President of GSA. ‘‘The rate at which new 5G devices are being announced and the diversity of form factors points to continued rapid deployment and uptake of new 5G services. Based on vendors’ statements, we can expect more than 50 additional announced devices to become commercially available before the end of June 2020, and at GSA we’ll will be tracking and reporting regularly on these 5G device launch announcements for the industry as we continue to take the temperature of the 5G ecosystem.”

As more devices become commercially available, GSA is tracking vendor data on spectrum support. The latest market data reveals that just over two-thirds (68.0%) of all announced 5G devices are identified as supporting sub-6 GHz spectrum bands and just under one-third (30.8%) are understood to support mmWave spectrum. Just under 25% of all announced devices are known to support both mmWave and sub-6 GHz spectrum bands. The bands known to be most supported by announced 5G devices are n78, n41, n79 and n77.

Part of the GSA Analyser for Mobile Broadband Devices (GAMBoD) database, the GSA’s 5G device tracking reports global device launches across the 5G ecosystem and contains key details about device form factors, features and support for spectrum bands. Access to the GAMBoD database is only available to GSA Members and to GSA Associates subscribing to the service.

The March 2020 5G Ecosystem Report containing summary statistics can be downloaded for free from GSA’s website:

https://gsacom.com/paper/5g-devices-ecosystem-executive-summary-march-2020/?utm=devicereports5g

By mid-March 2020, GSA had identified:

- 16 announced form factors

- 81 vendors that had announced available or forthcoming 5G devices

- 253 announced devices (including regional variants, and phones that can be upgraded using a separate adapter, but excluding prototypes not expected to be commercialised and operator-branded devices that are essentially rebadged versions of other phones), including at least 67 that are commercially available:

o 87 phones, (up 25 from end January), at least 40 of which are now commercially available (up from 35 at end January). Includes three phones that are upgraded to offer 5G using an adapter.

o 76 CPE devices (indoor and outdoor, including two Verizon-spec compliant devices not meeting 3GPP 5G standards), at least 13 of which are now believed to be commercially available

o 43 modules

o 17 hotspots (including regional variants), at least nine of which are now commercially available

o 5 laptops (notebooks)

o 5 industrial grade CPE/routers/gateways

o 3 robots

o 3 televisions

o 3 tablets

o 3 USB terminals/dongles/modems

o 2 snap-on dongles/adapters

o 2 drones

o 2 head-mounted displays

o 1 switch

o 1 vending machine.

GAMBoD is a unique search and analysis tool that has been developed by GSA to enable searches of mobile broadband devices and new global data on Mobile Broadband Networks, Technologies and Spectrum (NTS). The 5G devices database contains details about device form factors, features, and support for spectrum bands. Results are presented as a list or in charts. Charts may be inserted into documents or presentations, subject to accreditation of GSA as the source.

GAMBoD is a resource dedicated to promoting the success and growth of the Mobile Broadband (MBB) industry and ecosystem and is fully available to all employees of GSA Executive and Ordinary Member companies and GSA Associates who subscribe to the service.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Availability of information about spectrum support is improving as a greater number become commercially available.

- Just over two-thirds (68.0%) of all announced 5G devices are identified as supporting sub-6 GHz spectrum bands and just under one third (30.8%) are understood to support mmWave spectrum. Just under 25% of all announced devices are known to support both mmWave and sub-6 GHz spectrum bands.

- Only 17 of the commercially available devices (25.4% of them) are known to support services operating in mmWave spectrum.

- 83.6% of the commercially available devices are known to support sub-6 GHz spectrum.

The bands known to be most supported by announced 5G devices are n78, n41, n79 and n77. We can expect the device ecosystem to continue to grow quickly and for more data to become available about announced devices as they reach the market. Based on vendors’ statements, we can expect more than 50 additional announced devices to become commercially available before the end of June 2020. GSA will be tracking and reporting regularly on these 5G device launch announcements. Its GAMBoD database contains key details about device form factors, features and support for spectrum bands. Summary statistics are released in this regular monthly publication.

About GSA

GSA is the voice of the mobile vendor ecosystem representing companies engaged in the supply of infrastructure, semiconductors, test equipment, devices, applications and mobile support services. GSA actively promotes the 3GPP technology road-map – 3G, 4G, 5G – and is a single source of information resource for industry reports and market intelligence. The GSA Executive board comprises of Ericsson, Huawei, Intel, Nokia, Qualcomm, and Samsung.

GSA Membership is open to all companies participating in the mobile ecosystem and operators, companies and government bodies can get access to GAMBoD by subscribing as an Associate. More details can be found at https://gsacom.com/gsa-membership

GSA: Number of 5G devices has doubled in last 5 months!

Global mobile Suppliers Association (GSA) today reported that the number of announced 5G devices has broken the 200 barrier for the first time. With 208 5G devices now announced from 78 vendors, the number of commercial devices has more than doubled in the last five months, having surpassed the milestone of 100 devices from 41 vendors in August 2019.

“During 2019, the number of announced 5G devices grew rapidly, starting with a few announcements and then gathering pace as operators in various parts of the world launched their first commercial 5G services,” commented Joe Barrett, President, GSA.

“This growth has continued into 2020 with the number of announced 5G devices exceeding 200 for the first time. Not only is this a symbolic milestone, but it also means we are starting to be able to identify trends in spectrum support and form factors. The diversity of both further reinforces how the industry is working hard to deliver on the 5G promise to markets and operators around the globe.”

- The latest market data reveals that over two-thirds (66.8%) of all announced 5G devices are identified as supporting sub-6 GHz spectrum bands.

- Only 17 of the commercially available devices (around 29% of them) are known to support services operating in mmWave spectrum.

- Slightly more than 27% of all announced devices are known to support both mmWave and sub-6 GHz spectrum bands. The bands known to be most supported by announced 5G devices are n78, n41, n79 and n77.

Part of the GSA Analyzer for Mobile Broadband Devices (GAMBoD) database, the GSA’s 5G device tracking reports global device launches across the 5G ecosystem and contains key details about device form factors, features and support for spectrum bands. Access to the GAMBoD database is only available to GSA Members and to GSA Associates subscribing to the service.

The January 2020 5G Ecosystem Report containing summary statistics can be downloaded for free from https://gsacom.com/paper/5g-device-ecosystem-report-february-2020/?utm=devicereports5g.

By the end of January 2020, GSA had identified:

o 69 CPE devices (indoor and outdoor, including two Verizon-spec compliant devices not meeting 3GPP 5G standards) at least 12 of which are now believed to be commercially available

o 62 phones, at least 35 of which are now commercially available.

o 35 modules

o 14 hotspots (including regional variants), at least nine of which are now commercially available

o 5 laptops (notebooks)

o 4 routers

o 3 robots

o 3 televisions

o 3 tablets

o 2 snap-on dongles/adapters

o 2 drones

o 2 head-mounted displays

o 2 USB terminals/dongles

o 1 switch

o 1 vending machine

GAMBoD is a unique search and analysis tool that has been developed by GSA to enable searches of mobile broadband devices and new global data on Mobile Broadband Networks, Technologies and Spectrum (NTS). The 5G devices database contains details about device form factors, features, and support for spectrum bands. Results are presented as a list or in charts. Charts may be inserted into documents or presentations, subject to accreditation of GSA as the source.

GAMBoD is a resource dedicated to promoting the success and growth of the Mobile Broadband (MBB) industry and ecosystem and is fully available to all employees of GSA Executive and Ordinary Member companies and GSA Associates who subscribe to the service.

About GSA

GSA is the voice of the mobile vendor ecosystem representing companies engaged in the supply of infrastructure, semiconductors, test equipment, devices, applications and mobile support services. GSA actively promotes the 3GPP technology road-map – 3G, 4G, 5G – and is a single source of information resource for industry reports and market intelligence. The GSA Executive board comprises of Ericsson, Huawei, Intel, Nokia, Qualcomm, and Samsung.

GSA Membership is open to all companies participating in the mobile ecosystem and operators, companies and government bodies can get access to GAMBoD by subscribing as an Associate. More details can be found at https://gsacom.com/gsa-membership

News/updates: RSS Feed: https://gsacom.com/rss-feeds/

GSA LinkedIn group: www.linkedin.com/groups?gid=2313721

Twitter: www.twitter.com/gsacom

GSA Report: Spectrum Above 6 GHz & related FCC Activity

Executive Summary:

GSA’s latest report provides a snapshot of the global status of national usage of spectrum above 6 GHz for 5G services. It is part of a series of reports which separately also cover spectrum bands below 1 GHz and between 1 GHz and 6 GHz. This report reflects a market that is in constant flux (which this author has repeatedly stated would be the case till the most important IMT 2020 recommendations have been approved by ITU-R and ITU-T).

Key statistics:

- Sixty-seven operators in 13 countries hold licences enabling operation of 5G networks using mmWave spectrum.

- Fourteen operators are known to be deploying 5G networks using mmWave spectrum.

- Fourteen countries have announced formal (date-specified) plans for allocating frequencies above 6 GHz between now and end-2021.

- Fifty-nine announced 5G devices explicitly support one or more of the 5G spectrum bands above 6 GHz (though note that details of spectrum support is patchy for pre-commercial devices). Eleven of those devices are known to be commercially available.

5G deployments in bands above 6 GHz:

Spectrum bands above 6 GHz are being explicitly opened up to enable provision of 5G services. GSA is aware of the following usage for 5G. The 24250–29500 MHz range covering the overlapping bands n257 (26500–29500 MHz), n258 (24250–27500 MHz) and n261 (27500–28350 MHz) has been the most-used 5G mmWave spectrum range to date:

- 113 operators in 39 countries are investing in pre-standard 5G (in the form of trials, licences, deployments or operational networks) across this spectrum range.

- 66 operators are licensed to deploy 5G in this range.

- 12 operators are understood to be actively deploying 5G networks using spectrum above 6 GHz.

- Eight operators in seven countries have reported running 5G tests/trials at 15 GHz.

- One operator has reported running 5G tests/trials at 18 GHz.

- Band n260, covering 37–40 GHz, is also already being used, with three companies in the USA actively deploying networks using this spectrum.

- Thirteen operators in eleven countries have been evaluating/ testing/trialling 5G using spectrum from 66 GHz to 76 GHz.

- GSA has identified four operators that have run tests/trials using spectrum from 81 GHz to 87 GHz.

Figure 1: Use of 5G spectrum between 24.25 GHz and 29.5 GHz, countries plotted by status of most advanced operator activities

At WRC-2019 in November, delegates identifi ed several new frequency ranges for IMT and IMT-2020 (5G). These encompassed many of the existing 3GPP specified bands plus some new spectrum ranges:

• 24.25–27.5 GHz

• 37–43.5 GHz

• 45.5–47 GHz

• 47.2–48.2 GHz

• 66–71 GHz.

Other spectrum being considered by national regulators and international standards bodies, or that has been used in operator trials, is between the 71–86 GHz range.

………………………………………………………………………………………

5G device support for bands above 6 GHz:

5G device support for spectrum bands above 6 GHz is still at an early stage. GSA’s GAMBoD database includes 59 announced 3GPP compliant 5G devices that do or will support mmWave spectrum bands. Eleven of those are commercially available. The numbers of devices identified as supporting specific bands is much lower, as details of spectrum support is patchy for pre-commercial devices.

………………………………………………………………………………………………..

USA (Federal Communications Commission (FCC)):

In the USA, any bands already used for mobile service can also be deployed for 5G; FCC doesn’t require any particular technology and the choice is driven by carriers. This means multiple historic auctions are relevant for 5G including but not limited to those for spectrum at 28 GHz (March 1998 and May 1999) and 39 GHz (May 2000).

The FCC is currently undertaking a range of activities with a view to opening up extra spectrum for mobile use. In 2016, the FCC adopted its Upper Microwave Flexible Use Rules to make spectrum at 28 GHz, upper 37 GHz and 39 GHz available (including for 5G). Then the new Spectrum Frontier order dated 16 November 2017 put in place plans to open up an additional 1.7 GHz of mmWave spectrum in the 24 GHz and 47 GHz bands for fl exible terrestrial wireless use. FCC also enabled use of spectrum between 64 GHz and 71 GHz by unlicensed devices (subject to restrictions).

In October 2018, the Commission issued a notice of proposed rules that would open up the 5.925–6.425 GHz and 6.425–7.125 GHz bands for unlicensed use, subject to establishing a mechanism to prevent interference with incumbent services. It specifi cally anticipates – depending upon the part of the spectrum concerned – the use of low or standard power WiFi or variants of LTE for indoor or outdoor use.

The FCC has been running auctions of spectrum in the 24 GHz and 28 GHz bands. The auction of spectrum at 28 GHz (27.5–28.35 GHz) completed in January 2019, with bids totalling more than $700 million. Thirty-three bidders won 2965 licences.

The auction of spectrum at 24 GHz (24.25–24.45 GHz and 24.75–25.25 GHz) ended in May 2019 raising $2.02 billion in net bids. Twenty-nine bidders won 2904 licences.

In June 2018, FCC announced that it is also considering making an additional 2.75 GHz of the 26 GHz and 42 GHz bands available for 5G. In December 2018, FCC announced an incentive auction (Auction 103) covering spectrum at 37 GHz (37.6–38.6 GHz), 39 GHz (38.6–40 GHz) and 47 GHz (47.2–48.2 GHz) in order to free up more spectrum for 5G. Under the incentive auction, existing rights holders in those bands can choose either to relinquish their rights in exchange for a share of the auction revenue or alternatively receive modifi ed licences after the auction consistent with a new band plan and service rules.

Auctions for 37 GHz, 39 GHz and 47 GHz bands are planned by the end of 2019. Procedures for reconfiguring the 39 GHz band, enabling existing licensees to relinquish or modify their licences were published in March 2019. Technical guides for bidding procedures were published in April 2019, along with the announcement of a process for sharing the spectrum at 37 GHz with the Department of Defense. Timelines for the reconfiguration of existing rights were published in June 2019.

……………………………………………………………………………………………

Planned 5G auctions and their dates:

Fourteen countries have announced formal (date-specifi ed) plans for allocating mmWave frequencies between now and end-2021. A few other auctions/ allocations are timetabled to happen from 2022 onwards. Many countries are still deciding whether and when to hold auctions/ allocations for spectrum above 6 GHz.

Summary:

Spectrum above 6 GHz, and in particular mmWave spectrum, has rapidly become important for mobile telecoms. It is clear, with the number of spectrum awards expected over the coming years, and the agreement of new mmWave spectrum bands at WRC-19, the investment in these spectrum bands by operators and commitments to launch compatible devices by vendors, that the importance of spectrum above 6 GHz is going to continue to grow. GSA will continue to track this trend. This report will be next updated in early 2020.

GSA Report: Evolution of LTE to 5G also includes NB-IoT and LTE-M

Pre-standard “5G” roll outs continue and the latest Evolution of LTE to 5G report from GSA identifies 884 operators actively investing in LTE, with 769 operational LTE networks in 225 countries, 194 VoLTE capable networks and 296 operators in 100 countries investing in 5G with 39 – 3GPP Release 15 (5G NR NSA) compliant 5G networks launched – some with limited service.

High end devices are also growing in popularity with more CAT-12 and above devices coming to market and 100 5G devices now announced. GSA expects 5G to be deployed much faster than 4G which took 7 years to reach 100 million subscriptions. We expect 5G to reach 100 million subscriptions in less than 5 years.

GSA Market Research Findings:

• 884 operators actively investing in LTE, including those evaluating/ testing and trialling LTE and those paying for suitable spectrum licences (excludes those using technology neutral licences exclusively for 2G or 3G services).

• 769 operators running LTE networks providing mobile and/or FWA services in 225 countries worldwide.

• 194 commercial VoLTE networks in 91 countries and a total of 262 operators investing in VoLTE in 120 countries.

• 304 launched or launched (limited availability) LTE-Advanced networks in 134 countries. Overall, 335 operators are investing in LTE-Advanced technology in 141 countries.

• Ten launched networks that support user equipment (UE) at Cat-18 DL speeds within limited geographic areas, and one supporting Cat-19 (in a limited area).

• 228 operators with TDD licences and at least 164 operators with launched LTE-TDD networks.

• 151 operators investing in NB-IoT in 72 countries; of these, 98 NB-IoT networks are deployed/launched in 53 countries. 62 operators are investing in LTE-M/Cat-M1 in 36 countries; of these, 38 LTE-M/Cat-M1 networks are deployed/commercially launched in 26 countries. • 296 operators in 100 countries have launched with limited availability, deployed, demonstrated, are testing or trialling, or have been licensed to conduct field trials of mobile 5G or FWA 5G.

• 56 operators in 32 countries have announced the deployment of 5G within their live network.

• 39 operators have announced 3GPP 5G service launches (or limited service launches).

LTE deployments:

The drivers of LTE, LTE-Advanced, LTE-Advanced Pro and increasingly 5G, for operators are more capacity, enhanced performance and improved efficiencies to lower delivery cost. Compared with 3G, LTE offered a big step up in the user experience, enhancing demanding apps such as interactive TV, video blogging, advanced gaming and professional services. Deployment of LTE-Advanced technologies – and particularly carrier aggregation – takes performance to a new level and is a major current focus of the industry. Interest in LTE-Advanced Pro is high too, bringing with it new, globally standardised LPWA solutions – LTE Cat-M1 (LTE-M, eMTC) and Cat-NB1 (NB-IoT) – and new business opportunities. And while LTE-Advanced and LTE-Advanced Pro solutions have yet to be deployed by the majority of operators, vendors and network operators are already looking towards 5G and its potential to meet future capacity, connectivity and service requirements.

Spectrum for LTE deployments:

Pressure for spectrum is high and operators need to deploy the most efficient technologies available. LTE, LTE-Advanced and LTE-Advanced Pro services can be deployed in dozens of spectrum bands starting at 450 MHz and rising to nearly 6 GHz. The most-used bands in commercial LTE networks are 1800 MHz (Band 3), which is a mainstream choice for LTE in most regions; 800 MHz (Band 20 and regional variations) for extending coverage and improving in-building services; 2.6 GHz (FDD Band 7) as a major capacity band; and 700 MHz (with variations in spectrum allocated around the world) again for coverage improvement. The now-completed LTE standards enable the possibility to extend the benefits of LTE-Advanced to unlicensed and shared spectrum.

There are several options for deploying LTE in unlicensed spectrum. The GSA report LTE in Unlicensed and Shared Spectrum: Trials, Deployments and Devices gives details of market progress in the use of LAA, eLAA, LTE-U, LWA and activity in the CBRS band.

Many recent allocations/auctions of spectrum have focused on licensing unused spectrum – including pockets of spectrum in the 2 to 4 GHz range, but also at lower frequencies – for LTE and future 5G services. This spectrum is sometimes dedicated to LTE, sometimes to 5G and sometimes allocated on a technology-neutral basis.

VoLTE global status:

In total GSA has identified 262 operators investing in VoLTE in 120 countries, including 194 operators that have launched VoLTE voice services in 91 countries. There have been recent launches in India, Hungary, Iran, Maldives, Kenya, Mexico, Tuvalu, Ireland, New Zealand and Nieu.

GSA is aware of at least 30 operators deploying VoLTE and nearly 40 other operators planning VoLTE or are testing/trialling the technology. The GSA report VoLTE and ViLTE: Global Market Update, published in August 2019, gives more detail.

LTE-Advanced global status:

Investment in LTE-Advanced networks continues to grow. By July 2019, there were 304 commercially launched LTE-Advanced networks in 134 countries. Overall, 335 operators are investing in LTE-Advanced (in the form of tests, trials, deployments or commercial service provision) in 141 countries.

Many operators with LTE-Advanced networks are looking to extend their capabilities by adding 3GPP Release 13 or Release 14 LTE-Advanced Pro features, e.g. those making use of carrier aggregation of large numbers of channels, or carriers across TDD and FDD modes, LAA, massive MIMO, Mission-Critical Push-to-Talk, LTE Cat-NB1/NB-IoT or LTE-M/Cat-M1.

The GSA report LTE in Unlicensed and Shared Spectrum: Trials, Deployments and Devices tracks the progress of LAA/eLAA, LWA and LTE-U. By July 2019, there were 37 operators investing in LAA (including eight deployed/launched networks), 11 operators investing in LTE-U (including three launched/deployed networks) and three investing in LWA (including one launched network). One operator had undertaken trials of eLAA.

Carrier aggregation has been the dominant feature of LTE-Advanced networks. Varying numbers of carriers and varying amounts of total bandwidth have been aggregated in trials and demos, but in commercial networks, the greatest number of carriers aggregated (where we have data) is five. Some trials and demos have also aggregated up to ten carriers, for instance SK Telecom’s trial in South Korea.

Pre-standard 5G global status:

GSA has identified 296 operators in 100 countries that have launched (limited availability or non-3GPP networks), demonstrated, are testing or trialling, or have been licensed to conduct field trials of 5G-enabling and candidate technologies (up from 235 operators in May 2019).

Detailed analysis of speeds and spectrum used for 5G trials to date is available in the report Global Progress to 5G – Trials, Deployments and Launches on the GSA website. Operators continue to provide clarity about their intentions in terms of launch timetables for 5G or pre-standards 5G. GSA has identified 56 operators in 32 countries that have stated that they have activated one or more 5G sites within their live commercial network (excludes those that have only deployed test sites).

The number that have announced the launch of commercial services remains much lower however, as operators have had to await the availability of 5G devices. These have now started to appear, removing the market blockage.

GSA has identified 100 announced devices (excluding regional variants and prototypes) and a handful of these are now available for customers to buy and use. See GSA’s report 5G Device Ecosystem, published monthly, for more details.

GSA knows of 39 operators who have (as of 6 August 2019) announced 3GPP compatible 5G service launches (either mobile or FWA, some with limited availability): we understand there are ten operators with FWA-only services, 15 with mobile-only services, and 14 with both mobile and FWA services. All services are initially restricted in terms of either geographic availability, devices availability, or the types and numbers of customers being provided with services.

Among recent service launches (or limited service launches) are those by three operators in Kuwait (Viva, Zain and Ooredoo), Batelco in Bahrain, T-Mobile and Vodafone in Germany, Vodafone in the UK, Digi Mobile in Romania, Monaco Telecom and Dhiraagu in the Maldives.

Cellular LPWANs for IoT:

The start of 2019 has continued to see strong growth in the number of cellular IoT networks based on NB-IoT and LTE-M. By July 2019, there were 151 operators investing in NB IoT in 72 countries, up from 148 operators in 71 countries in May 2019. The number of deployed/launched NB-IoT networks was 98 in 53 countries, up from 78 operators in 45 countries in January 2019. There are 62 operators investing in LTE-M networks in 36 countries, up from 57 operators in 34 countries in January 2019. Thirty-eight operators have deployed/launched LTE-M networks in 26 countries, up from 30 operators in January 2019. Orange Spain launched its LTE-M network in June 2019.

Altogether 55 countries now have at least either a launched NB-IoT network or a launched LTE-M network and 24 of those countries have both network types.

…………………………………………………………………………………………………….

GSA will continue tracking the progress of 5G deployments worldwide. GSA reports are compiled from data stored in the GSA Analyser for Mobile Broadband Devices/Data (GAMBoD) database, which is a GSA Member and Associate benefit.

Much of the GSA activity is working on spectrum and the upcoming WRC-19 conference in October/November. If you would like to meet up with GSA in Sharm el-Sheikh, Egypt at the conference, please email [email protected]

GSA Update and Analysis: 5G Devices Ecosystem – August 2019

- The GSA Research team has identified 100 announced 5G devices in total, excluding regional variants and prototypes not expected to be commercialised.In the first half of 2019, the number of announced 5G devices grew rapidly, starting with a few announcements and then gathering pace as operators in various parts of the world launched their first commercial 5G services. We can expect the device ecosystem to continue to grow quickly and GSA will be tracking and reporting regularly on 5G device launch announcements. Its GAMBoD database will contain key details about device form factors, features and support for spectrum bands. Summary statistics are released in this regular publication. By the first week of August, GSA had identified:

- Thirteen announced form factors (phones, hotspots, indoor CPE, outdoor CPE, laptops, modules, snap-on dongles/adapters, enterprise routers, IoT routers, drones, a switch, a USB terminal and robot).

- Forty-one vendors that had announced available or forthcoming 5G devices, including sub-brands separately (plus four in partnership with Sunsea).

- One hundred announced devices, up from 90 at the end of June (excluding regional variants, re-badged devices, phones that can be upgraded using a separate adapter, and prototypes not expected to be commercialised):

- 26 phones (plus regional variants); at least nine of which are now commercially available

- eight hotspots (plus regional variants); at least three of which are now commercially available

- 26 CPE devices (indoor and outdoor, including two Verizon-spec compliant devices) at least eight of which are now believed to be commercially available

- 28 modules

- two snap-on dongles/adapters

- two routers,

- two IoT routers

- two drones

- one laptop

- one switch

- one USB terminal

- one robot

Here are the commercially available 5G devices as listed in the GSA’s latest report August 2019:

- HTC 5G Hub (hotspot)

- Huawei 5G CPE 2.0 (indoor and outdoor customer premises equipment, or CPE)

- Huawei 5G CPE Win (outdoor and window CPE)

- Huawei 5G CPE Pro (indoor CPE)

- Huawei Mate X (phone)

- Huawei Mate 20x 5G (phone)

- Inseego R1000 Home Router/MiFi IQ 5G (fixed wireless indoor CPE)

- Inseego MiFi M1000 5G Mobile Hotspot (hotspot)

- LG V50 ThinQ (phone)

- Motorola 5G Moto Mod Snap-on (dongle)

- Netgear Nighthawk M5 Fusion MR5000 (aka Nighthawk 5G Mobile Hotspot) (hotspot)

- Nokia Fastmile 5G Gateway CPE (indoor/ outdoor CPE)

- OnePlus OnePlus 7Pro 5G (phone)

- Oppo Reno 5G (phone)

- Percepto Drone-in-abox (drone)

- Samsung SFG-D0100 (indoor CPE)

- Samsung Galaxy S10 5G (phone)

- SIMCom Wireless SIM8200- EA-M2 (module)

- SIMCom Wireless SIM8200G (module)

- Xiaomi Mi Mix 3 5G (phone)

- ZTE Axon 10 Pro 5G (phone)

- ZTE 5G Indoor CPE MC801 (indoor CPE)

……………………………………………………………………………………

What versions of 5G have been deployed/announced?

After downloading and reading the GSA report, I noticed a huge omission: the version of 5G is not disclosed for any of the “pre-IMT 2020 standard 5G” deployments. Most are likely to be based on 3GPP release 15 “5G NR” for the data plane NSA (LTE signaling and EPC). However, many of the 5G fixed wireless deployments (like Verizon’s and C-Spire) are proprietary.

5G silicon?

Also of note is that within the 5G devices, there are only four 5G silicon vendors chipsets – Qualcomm is by far the largest selling 5G SoC’s/IP, then Mediatek selling on the merchant market, whereas Huawei and Samsung design their own silicon for their 5G terminals/handsets and base stations.

Note while there is not yet any “Intel inside” 5G, Intel has sold its 5G smartphone modem silicon business to Apple recently for $1B.

If 5G were truly such a hot market, why aren’t there other semiconductor vendors pursuing it?

GSA May Update: Gigabit LTE – Global Status

Editor’s Note:

Gigabit LTE will be the backbone of support for (3GPP Release 15) 5G NR-NSA as it’s used for signaling, evolved packet core (EPC), and network management. 5G with low latency, signaling and a 5G mobile packet core won’t be deployed in mass till IMT 2020 standard has been completed.

INVESTMENT IN GIGABIT LTE NETWORK TECHNOLOGIES WORLDWIDE:

- At the end of February 2019, GSA has identified 101 operators in 60 countries or territories investing in all the three core LTE-Advanced features for Gigabit LTE (defined as Carrier Aggregation, 4×4 MIMO or higher, and 256 QAM modulation in the downlink)

- 53 operators have deployed all three of these technologies and / or launched commercial services based on them

- 313 operators in 133 countries are investing in at least one of the key technologies

DISTRIBUTION OF GIGABIT LTE NETWORKS AND DOWNLINK SPEEDS OF THE FASTEST NETWORKS:

Gigabit LTE does not always equal Gigabit speed. Some networks capable of delivering 1 Gbps downstream do so without using all three key LTE-Advanced (AKA IMT Advanced in ITU-R) features; some networks using all three features do not achieve 1 Gbps

The fastest networks in the GSA database are:

- KDDI, SK Telecom, Swisscom, Telus, Turkcell: 1.2 Gbps

- KT: 1.167 Gbps(achieved using MPTCP to combine LTE with 3CA and WiFi)

- China Unicom: 1.156 Gbps

- Bell Mobility: 1.15 Gbps

- 3 Hong Kong, Singtel: 1.1 Gbps

- Optus: 1.03 Gbps

- Vodafone Italy: 1.023 Gbps

- AT&T Mobility, China Mobile Hong Kong, CYTA, Dialog Axiata, DNA, Elisa, HKT, Inwi(Wana), O2 Czech Republic, Ooredoo Qatar, Smartone, Sprint, StarHub, Telenor Denmark, TeliaSonera Denmark, Telstra, Vodafone Germany, Vodafone Ziggo: 1 Gbps

This data is taken from Gigabit LTE Networks: Analysis of Deployments Worldwide (May 2019) published by GSA and available from www.gsacom.com.

……………………………………………………………………………………………………………………………………………………………………..

LTE FAST FACTS: LTE IN UNLICENSED SPECTRUM (DATA AS OF END-APRIL 2019):

- 8 LAA (License Assisted Spectrum) [1] deployments/launches:

- AT&T (US), T-Mobile (US), AIS (Thailand), MTS (Russia), Smartone(Hong Kong), TIM (Italy), Turkcell, Vodafone Turkey (deployed)

- 28 LAA trials and deployments in progress in 18 countries

- The latest include MOTIV and Vimpelcomin Russia, and 3 Indonesia

- 1 eLAAtrial (SK Telecom)

- 3 LTE-U network deployments/launches

- T-Mobile (US) – though it is now switching focus to LAA, AIS (Thailand), Vodacom (South Africa)

- 8 LTE-U trials or pilots in progress

- 1 LWA launch …

- Chunghwa Taiwan and 2 others are trialing the technology (in Singapore and South Korea)

- 1 commercial launch of a private LTE network using CBRS

- 16 operators investing in CBRS trials in the US

- The latest are Altice, CDE Lightband, CoxCommnications, Extenet, Mobilitieand Windstream

- 21 commercially available modem/platform chipsets supporting unlicensed access

- 133 devices announced supporting LTE in unlicensed spectrum or shared spectrum using CBRS (including regional variants)

Note 1. A variant of LTE-Unlicensed is Licensed Assisted Access (LAA) and has been standardized by the 3GPP in Rel-13. LAA adheres to the requirements of the LBT protocol, which is mandated in Europe and Japan. It promises to provide a unified global framework that complies with the regulatory requirements in the different regions of the world.

- 3GPP Rel-13 defines LAA only for the downlink (DL).

- 3GPP Rel-14 defines enhanced-Licensed Assisted Access (eLAA), which includes uplink (UL) operation in the unlicensed channel.

- 3GPP Rel-15 The technology continued to be developed in 3GPP’s release 15 under the title Further Enhanced LAA (feLAA).

LTE Fast Facts are taken from the GSA report “LTE in Unlicensed Spectrum: Trials, Deployments and Devices April 2019”available from www.gsacom.com.

GSA reports are compiled from data stored in the GSA Analyser for Mobile Broadband Devices/Data (GAMBoD) database.