5G SA networks (real 5G) remain conspicuous by their absence

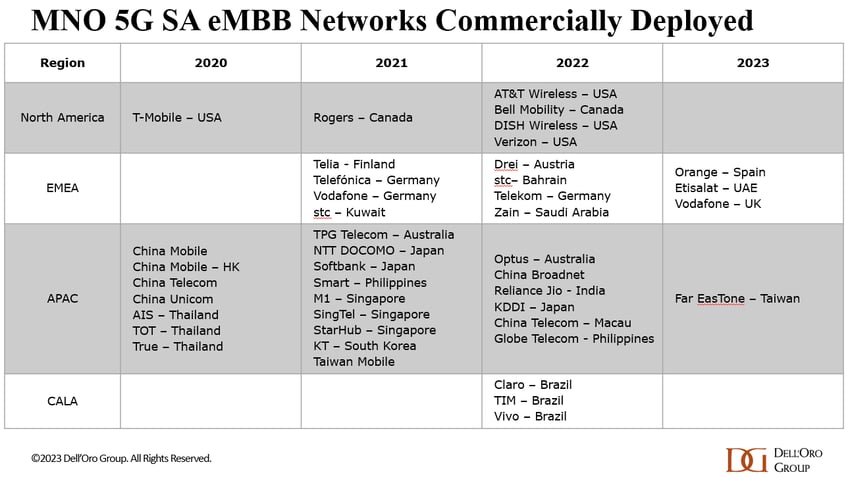

According to a May 2023 report from the Global mobile Suppliers Association (GSA), just 35 network operators in 24 countries and territories “are now understood to have launched or deployed public 5G SA networks.” That’s out of approximately 240 service providers which have now launched commercial 5G services, as per the recent Ericsson Mobility Report.

Dell’Oro’s Dave Bolan said, “Currently we count 43 live 5G SA networks for eMMB [enhanced mobile broadband]. For 2023, four [mobile network operators] have launched 5G SA networks,” he added. It should be noted that Dell’Oro doesn’t factor in fixed wireless access (FWA) or private 5G networks in its SA totals.

In Europe, Vodafone UK and Telefónica Spain join what remains a small set of network operators that have launched 5G SA, including Orange Spain and Vodafone Germany. Spain should provide an interesting study of what happens when two rival operators launch 5G SA service.

There are some glimmers of hope that 5G SA launches will accelerate soon. GSA (aka GSMA) has identified at least 1,063 announced devices with declared support for standalone 5G in sub-6GHz bands, 864 of which are commercially available. Furthermore, it said 116 operators in 53 countries and territories are now investing in 5G SA, including those that have actually deployed a public network. “This equates to 22.1% of the 524 operators known to be investing in 5G licenses, trials or deployments of any type,” the GSA said.

Separately, analysts say that 5G SA branding by network operators is quite confusing (we agree). Vodafone UK’s decision to use 5G Ultra for its 5G SA branding vs Telefonica using 5G+ are examples of that.

Gabriel Brown of Heavy Reading said, “customers don’t really know what it means, other than it denotes some form of technical advance.” He points out that 5G SA “requires a lot of investment and deep engineering expertise; this makes it a useful proxy for network quality. Operators need to take all the technical marketing opportunities they can get.”

“What happens when BT launches? Are they going to call it 5G+ or 5G Super Ultra or something like that? That’s going to make it even more confusing,” said Kester Mann, an analyst with CCS Insight. At the same time, he agrees that 5G standalone is a significant network upgrade and it makes sense that operators would want to gain a marketing edge over rivals that have yet to launch the service.

Notably, neither Vodafone nor Telefónica is charging extra for the more advanced 5G service, and both have focused on the improved speeds and reliability it will bring. They also emphasize eco-friendly aspects, such as lower energy consumption. However, Mann questioned Vodafone’s claim that customers with an eligible 5G Ultra device can expect up to 25% longer battery life. “Twenty-five percent faster than what?” he asked. “It’s a bit unclear.” However, such a claim would certainly be welcome news to consumers. “In a lot of our consumer research, battery life comes out as one of the common bugbears among people using mobile phones,” said Mann.

In the U.S., T-Mobile is the only network operator that’s deployed a 5G SA network. AT&T and Verizon have been talking about it for years, but the time frame for deployment has been pushed back several times.

Deloitte Global said it expects the number of mobile network operators investing in 5G SA networks via trials, planned deployments or rollouts to grow from more than 100 operators in 2022 to at least 200 by the end of this year.

One reason why there are relatively few 5G SA networks deployed is there are no implementation standards. 3GPP 5G Architecture specs, rubber stamped by ETSI, provide several options to realize a 5G cloud-native core network which leads to different implementations. 3GPP decided NOT to liaise their 5G non-radio aspects specs (including 5G Architecture and 5G Security) to ITU-T.

Here are the key 3GPP 5G system specs:

- TS 22.261, “Service requirements for the 5G system”

- TS 23.501, “System architecture for the 5G System (5GS)”

- TS 23.502 “Procedures for the 5G System (5GS)”

- TS 32.240 “Charging management; Charging architecture and principles”

- TS 24.501 “Non-Access-Stratum (NAS) protocol for 5G System (5GS); Stage 3”

The latest 3GPP 5G Architecture spec is System architecture for the 5G System (5GS) (3GPP TS 23.501 version 17.9.0 Release 17), published by ETSI on July 5, 2023.

Source: 3GPP

Hence, the ITU JCA on IMT2020 and Beyond is dependent on other organizations for inputs to their roadmap. “The scope of JCA-IMT2020 is coordination of the ITU-T IMT-2020 standardization work with focus on non-radio aspects and beyond IMT2020 within ITU-T and coordination of the communication with standards development organizations, consortia and forums also working on IMT2020 and beyong IMT-2020 related standards.”

References:

https://www.silverliningsinfo.com/5g/5g-sa-springs-action

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

Orange-Spain deploys 5G SA network (“5G+”) in Madrid, Barcelona, Valencia and Seville

Counterpoint Research: Ericsson and Nokia lead in 5G SA Core Network Deployments

Tech Mahindra and Microsoft partner to bring cloud-native 5G SA core network to global telcos

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

https://urgentcomm.com/2023/01/19/standalone-5g-progress-remains-a-disappointment/

https://www.3gpp.org/technologies/5g-system-overview

https://www.itu.int/en/ITU-T/jca/imt2020/Pages/ToR.aspx

5 thoughts on “5G SA networks (real 5G) remain conspicuous by their absence”

Comments are closed.

The standalone (SA) version of the technology, dubbed “real 5G” by some overexuberant marketers, comes with new core network technology, promising benefits its older, non-standalone (NSA) sibling cannot support. Never would be going too far, but the new variant remains conspicuous by its absence in many countries.

“The reason it is taking quite a while to roll out the 5G core is that’s a sea change in the underlying infrastructure,” said Howard Watson, BT’s chief technology officer, at a recent press conference more than three years since the UK incumbent launched NSA 5G.

BT is one of various European operators whose progress toward SA 5G has been halting. After Mavenir this week boasted about a 5G core deal with Deutsche Telekom, Europe’s biggest operator revealed it was only in “friendly user trials” with the US software company. A commercial launch will not happen until customer benefits are more obvious and “enough devices” can support SA technology, a spokesperson told Light Reading.

https://www.lightreading.com/5g/the-slow-march-to-standalone-5g/d/d-id/780443

July 13 Light Reading Update:

The arrival of 5G SA in Europe has been slow so far and, although momentum is building, the technology is unlikely to fully take hold this year. Nevertheless, Telefónica Spain and Vodafone UK have recently made their own 5G SA announcements.

Vodafone claimed to be the first to launch a hybrid private 5G network in December last year for Porsche in Italy. As Pablo Tomasi, principal analyst for private networks at Light Reading’s sister company Omdia, wrote earlier this year, service providers are likely to increasingly push hybrid private 5G networks. This is because the success of pure private networks could prompt governments to “liberalize prime spectrum for direct use by enterprises.” He further notes that the “push towards hybrid will be one of the main threats to the fully dedicated private network ecosystem.”

https://www.lightreading.com/broadband/orange-business-uses-5g-sa-for-french-hybrid-private-network/d/d-id/785651

LightCounting Update:

Stéphane Téral, chief analyst for LightCounting, noted 5G SA cores were part of only 40 of the 255 5G commercial networks launched at the end of the first quarter. This was barely more than what the analyst firm had seen 18 months ago when it found just 20 5G SA cores as part of the at-then 200 commercial 5G network deployments.

Téral linked the continued slog to ongoing use case and technical concerns. “The lack of compelling 5G business cases beyond enhanced mobile broadband (eMBB) and fixed-wireless access (FWA), combined with some network architecture issues related to the complexity of cloud-native computing, continue to inhibit 5G SA core rollouts,” Téral wrote. “As a result, communications service providers are just sweating their [evolved packet core/virtualized EPC], saying there is no race, no rush to SA after all.”

“So far, the ‘killer app’ has just been the gain of operating cost efficiencies rather than anything else,” Téral explained. “But now, the market dynamics are changing: more devices support 5G SA, the 5G RAN investment peak is behind, CSPs are seriously looking at their 5G SA plans and the number of 5G SA core [requests for proposals] is swelling.”

LightCounting’s numbers were corroborated by research firm Dell’Oro Group, which noted that only four new 5G SA networks were launched in the first half of this year compared to six in the first half of 2022. Dell’Oro Group Research Director Dave Bolan tied the tepid progress to several macroeconomic and geopolitical issues.

“Mobile network operators (MNOs) are concerned about inflation, a possible recession and political conflicts,” Bolan wrote. “They are therefore being restrained in their capital expenditures, another factor weighing in on a more conservative forecast.”

“Standalone 5G will probably have its greatest impact in the enterprise market, enabling technologies such as network slicing or supporting applications in areas like private mobile networks,” CCS Insight’s Kester Mann wrote in a recent research note tied to Vodafone’s recent consumer-focused 5G SA core launch in the United Kingdom. “It’s therefore interesting that — once again — the consumer market has formed the initial focus of marketing efforts. Given that the non-standalone version of 5G has proved something of a damp squib so far, I’ll be keeping a close watch on how customers perceive what many believe is the start of the real 5G journey.”

LightCounting noted Ericsson and Nokia “are poised to benefit the most from the market pickup,” with NEC, Mavenir, Microsoft Azure for Operators, Oracle and Samsung “showing strong market momentum.”

https://www.sdxcentral.com/articles/analysis/standalone-5g-continues-its-slow-simmer/2023/07/

Light Reading: Overall the global 5G industry’s shift to SA 5G has been slow, even though SA 5G promises to support a wide range of new and innovative services like network slicing. Some operators like Dish Network and T-Mobile quickly launched SA 5G, but most relied on their non-standalone (NSA) 5G networks as they expanded 5G coverage.

Part of the problem is the sheer complexity of SA 5G technology. “It’s difficult,” according to one operator.

“The reason it is taking quite a while to roll out the 5G [SA] core is that’s a sea change in the underlying infrastructure,” explained BT CTO Howard Watson last year.

https://www.lightreading.com/the-core/the-inside-story-of-uscellulars-move-to-standalone-5g/a/d-id/785774?

T-Mobile has been building on its early move to 5G SA with other services ranging from carrier aggregation to private networks. At the same time, T-Mobile has been working to streamline its core network architecture

T-Mobile this week announced that software developers can use network slicing on its standalone (SA) 5G network to build video calling applications with more consistent uplink and downlink speeds and lower latency. The result, the company said, could be more reliable video calls that may not freeze or skip.

T-Mobile noted that companies like Dialpad Ai, Google, Webex by Cisco, Zoom and others have signed up to test out its new capability.

Analysts generally cheered the move.

“This is another important step in making sure 5G lives up to the promise of delivering new and user-centric services for consumer and business users,” wrote analyst Jack Gold on LinkedIn. “While some have questioned the promise of 5G improvements over current systems as functional improvements have been slow to appear, this move shows that forward-looking providers can achieve breakthroughs that advance the capabilities and usefulness of 5G for both businesses and consumers.”

The launch “is a big deal,” added Recon Analytics Founder Roger Entner on X (formerly Twitter).

https://www.lightreading.com/service-provider-cloud/programmable-5g-gets-little-more-real/a/d-id/785926?