Layoffs

184K global tech layoffs in 2025 to date; ~27.3% related to AI replacing workers

As of October, over 184,000 global tech jobs were cut in 2025, according to a report from Silicon Valley Business Journal. 50,184 were directly related to the implementation of artificial intelligence (AI) and automation tools by businesses. Silicon Valley’s AI boom has been pummeling headcounts across major companies in the region — and globally. U.S. companies accounted for about 123,000 of the layoffs.

These are the 10 tech companies with the most significant mass layoffs since January 2025:

- Intel: 33,900 layoffs. The company has cited the need to reduce costs and restructure its organization after years of technical and financial setbacks.

- Microsoft: 19,215 layoffs. The tech giant has conducted multiple rounds of cuts throughout the year across various departments as it prioritizes AI investments.

- TCS: 12,000 layoffs. As a major IT firm, Tata Consultancy Services’ cuts largely affected mid-level and senior positions, which are becoming redundant due to AI and evolving client demands.

- Accenture: 11,000 layoffs. The consulting company reduced its headcount as it shifts toward greater automation and AI-driven services.

- Panasonic: 10,000 layoffs. The Japanese manufacturer announced these job cuts as part of a strategy to improve efficiency and focus on core business areas.

- IBM: ~17,000 to 19,700 layoffs as part of a restructuring effort to shift some roles to India and align the workforce with areas like AI and hybrid cloud. The layoffs were reportedly concentrated in certain teams, including the Cloud Classic division, and impacted locations such as Raleigh, New York, Dallas, and California.

- Amazon: 14,000 layoffs in October 2025. Cuts have impacted various areas, including the Amazon Web Services (AWS) cloud unit and the consumer retail business.

- Salesforce: 5,000 layoffs. Many of these cuts impacted the customer service division, where AI agents now handle a significant portion of client interactions.

- STMicro: 5,000 cuts in the next three years, including 2,800 job cuts announced earlier this year, its chief executive said on Wednesday. Around 2,000 employees will leave the Franco-Italian chipmaker due to attrition, bringing the total count with voluntary departures to 5,000, Jean-Marc Chery said at a June 4th event in Paris, hosted by BNP Paribas.

- Meta: 3,720 layoffs. The company has made multiple rounds of cuts targeting “low-performers” and positions within its AI and virtual reality divisions. More details below.

……………………………………………………………………………………………………………………………………………………………………..

Image Credit: simplehappyart via Getty Images

……………………………………………………………………………………………………………………………………………………………………..

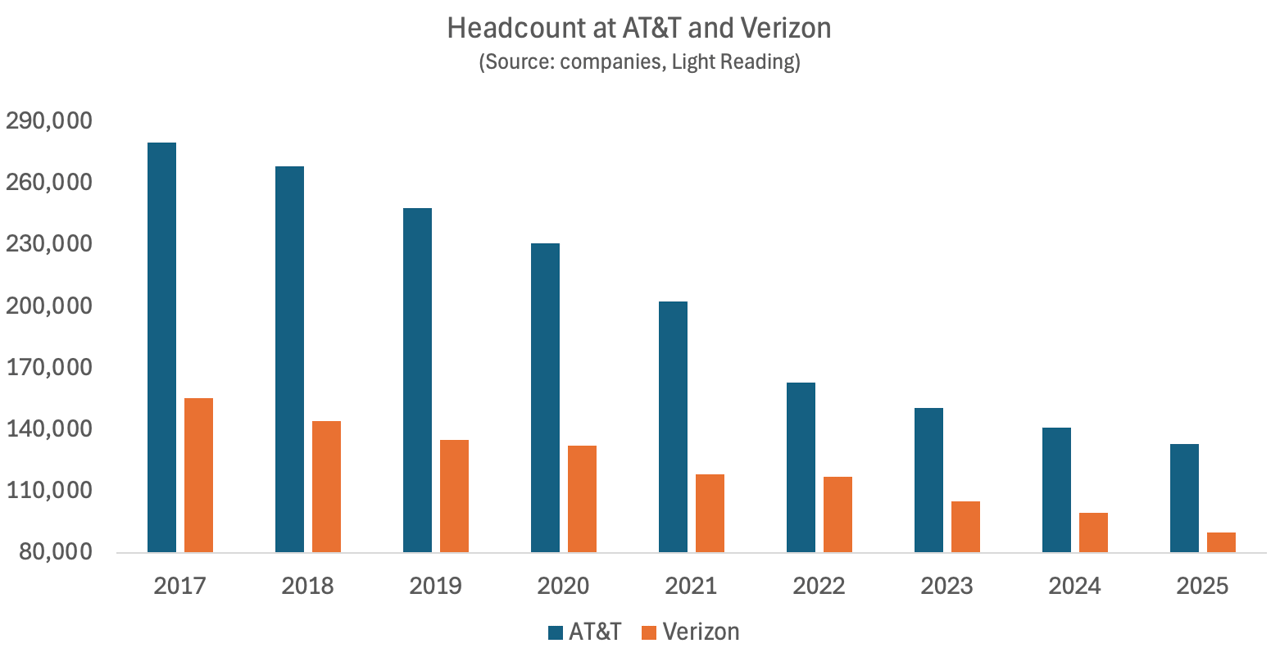

Feb 3, 2026 Update from Light Reading:

- Verizon’s new CEO Dan Schulman in October said that 13,000 employees would soon be laid off. When results were published last week, as reported by Light Reading, they showed that 10,300 jobs had been cut from the total in the final three months of the year, leaving Verizon with 89,900 employees on New Year’s Eve.

- AT&T eliminated about 8,000 jobs in 2025, finishing the year with 133,000 employees.

- That total net loss of 17,700 jobs at AT&T and Verizon was equal to about 7% of the combined workforce at the end of 2024.

Last year’s job losses were not an isolated event but the continuation of a decade-old trend that has gutted the telco workforce. At its high point for staff numbers in 2017, AT&T employed as many as 280,000 people, including those it would acquire with its $85 billion takeover of Time Warner. Around 147,000 jobs have subsequently disappeared, showing the workforce has more than halved in just eight years.

Pie Chart Credit: Light Reading

…………………………………………………………………………………………………………………………………………………………………………….

In a direct contradiction in August, Cisco announced layoffs of 221 employees in the San Francisco Bay Area, affecting roles in Milpitas and San Francisco. This occurred despite strong financial results and the CEO’s previous statement that the company would not cut jobs in favor of AI. The cuts, which included software engineering roles, are part of the company’s broader strategy to streamline operations & focus on AI.

About two-thirds of all job cuts — roughly 123,000 positions — came from U.S.-based companies, with the remainder spread across mainly Ireland, India and Japan. The report compiles data from WARN notices, TrueUp, TechCrunch and Layoffs.fyi through Oct. 21st.

- Shift to AI and automation: Many companies are restructuring their workforce to focus on AI-centric growth and are automating tasks previously done by human workers, particularly in customer service and quality assurance.

- Economic headwinds: Ongoing economic uncertainty, inflation, and higher interest rates are prompting tech companies to cut costs and streamline operations.

- Market corrections: Following a period of rapid over-hiring, many tech companies are now “right-sizing” their staff to become leaner and more efficient.

References:

Report: Broadcom Announces Further Job Cuts as Global Tech Layoffs Approach 185,000 in 2025

Tech layoffs continue unabated: pink slip season in hard-hit SF Bay Area

HPE cost reduction campaign with more layoffs; 250 AI PoC trials or deployments

High Tech Layoffs Explained: The End of the Free Money Party

Massive layoffs and cost cutting will decimate Intel’s already tiny 5G network business

Big Tech post strong earnings and revenue growth, but cuts jobs along with Telecom Vendors

Telecom layoffs continue unabated as AT&T leads the pack – a growth engine with only 1% YoY growth?

Cisco restructuring plan will result in ~4100 layoffs; focus on security and cloud based products

Cloud Computing Giants Growth Slows; Recession Looms, Layoffs Begin

Big Tech post strong earnings and revenue growth, but cuts jobs along with Telecom Vendors

Tech companies have been consistently laying off employees since late 2022. As of April 25th, some 266 tech companies have laid off nearly 75,000 workers in 2024, according to the independent layoff-tracking site layoffs.fyi. A total of 262,682 workers in tech lost their jobs in 2023 compared with 164,969 in 2022. The volume of layoffs in 2023 — a total of 1,186 companies — also surpassed 2022, when 1,061 companies in tech laid off workers — and that total was more than in 2020 and 2021 combined.

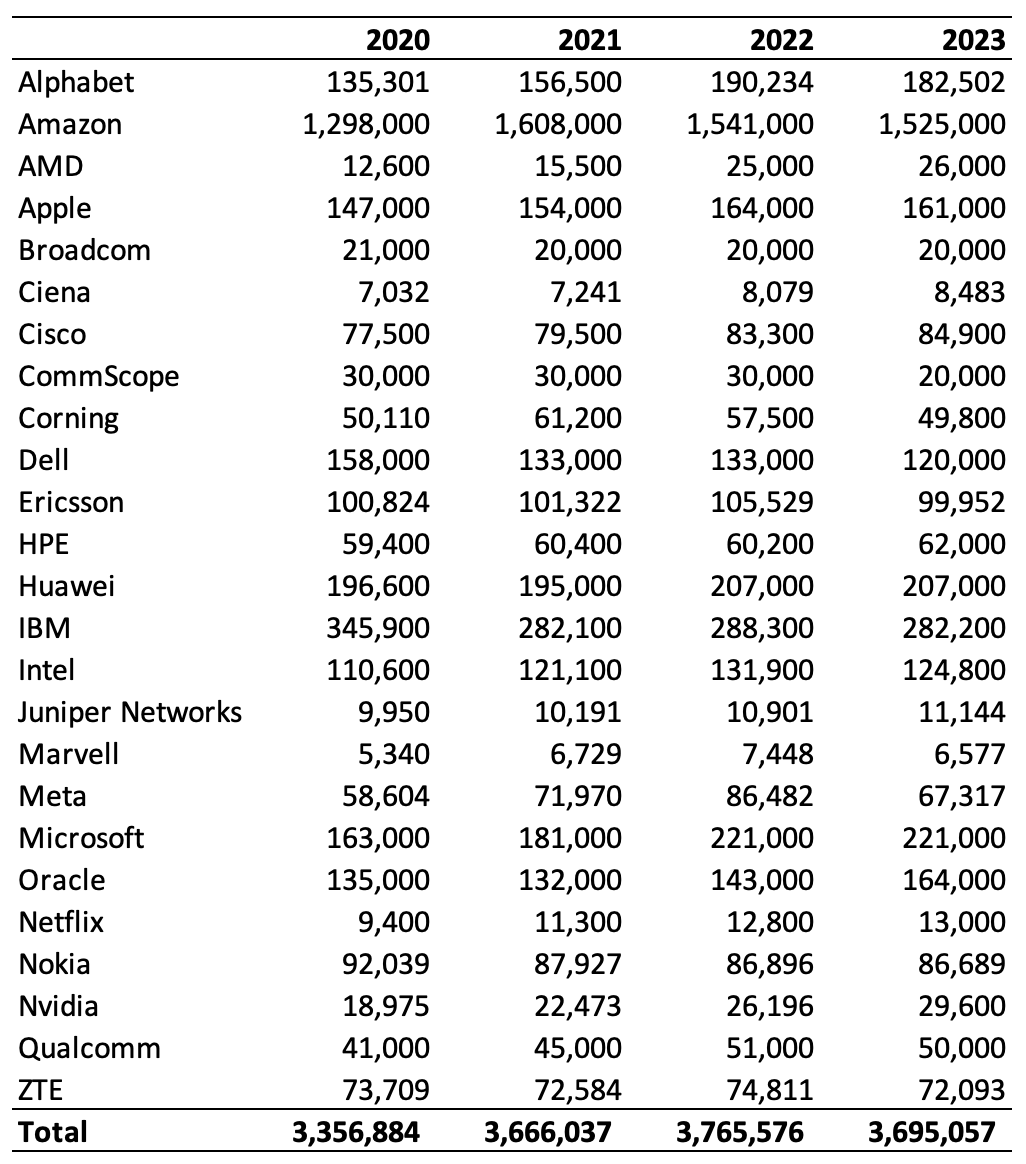

Big Tech companies Alphabet (Google’s parent), Amazon, Apple, Meta, Microsoft and Netflix, collectively cut nearly 45,500 jobs in their most recent full fiscal year. Since 2020, however, they have added more than 358,500, bringing total headcount to nearly 2,170,000. Excluding Amazon, which accounts for 70% of that figure, job numbers fell by around 29,700 last year but have grown by 131,500 since 2020 (data from earnings reports and SEC filings – see chart below).

- Today, Amazon reported better-than-expected earnings and revenue for the first quarter, driven by growth in advertising and cloud computing. Operating income soared more than 200% in the period to $15.3 billion, far outpacing revenue growth, the latest sign that the company’s cost-cutting measures and focus on efficiency is bolstering its bottom line. AWS accounted for 62% of total operating profit. Net income also more than tripled to $10.4 billion, or 98 cents a share, from $3.17 billion, or 31 cents a share, a year ago. Sales increased 13% from $127.4 billion a year earlier.

- Google parent Alphabet also posted robust profits, with net income in the latest quarter soaring 57% to $23.7 billion while revenue grew 15% in the quarter. That’s despite job cuts of 12,115 and net headcount reduction of ~8,000 in 2023.

- Microsoft last week managed 20% year-over-year growth in third-quarter net income, to around $21.9 billion, on 17% growth in sales, to $61.9 billion. The number of Microsoft employees was unchanged in 2023 from the previous year, despite the company laying off 11,158 employees. Future headcount reductions may be necessary to help pay for Microsoft’s multi-billion-dollar splurge on AI and the data centers needed to train the Large Language Models and associated generative AI technology. But few expect job cuts to slow Microsoft down.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

As expected, telecom vendors, which have many fewer employees, than Big Tech had a higher percentage of job reductions. CommScope, Corning, Dell, Ericsson, and Nokia, suppliers to some of the world’s biggest telcos, shed nearly 36,500 jobs last year as large IT customers spent less on new equipment.

The following table shows the total number of jobs per year for many vendors/cloud service providers.

Source: Light Reading & company reports/SEC filings

Huawei was the exception to the telecom vendor layoff craze (even ZTE reduced its workforce in 2023). Despite U.S. sanctions and a European backlash against the company, Huawei gained 12,000 employees in 2022, giving it a workforce of 207,000 that year. The number was unchanged in 2023, according to its recently published annual report. Restrictions have not been as effective at hindering Huawei’s progress as the U.S. had hoped.

On the semiconductor side, Intel experienced a net workforce reduction of 7,100 jobs. Profits have tanked because of market share losses, a downturn in customer spending on equipment (explained partly by the earlier build-up of inventory that happened after the pandemic) and investments in new foundries designed to challenge the Asian giants of TSMC and Samsung. Big Tech moves to build in-house AI augmented processor chips that can substitute for Intel’s microprocessors are among the problems the company faces. Intel’s profits have collapsed, just as they have at the mobile networks business group of silicon customer Nokia, and it is at risk of displacement by chip rivals in important markets.

These big tech layoffs are a peculiar outlier in an otherwise strong employment environment: The unemployment rate has hovered between 3.4% and 3.8% since Feb. 2022, bureau data shows. And quit rates, which reflect a lack of worker confidence, this year are consistently at some of the highest levels in more than 20 years, according to the Federal Reserve Bank of St. Louis.

In summary, Big Tech companies continue to thrive financially, but they are also making strategic adjustments, including job cuts, as they navigate the evolving landscape of technology and generative AI. The emphasis on AI development, large language models, and cloud services remains a key driver for their growth and profitability. Telecom vendors are facing tremendous pain due to continued reduction in telco CAPEX which may persists for many years.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.nerdwallet.com/article/finance/tech-layoffs

US cable and telecom network operators feel the pain

Bloomberg: Higher borrowing costs hurting indebted wireless companies; industry is 2nd largest source of distressed debt

Telecom layoffs continue unabated as AT&T leads the pack – a growth engine with only 1% YoY growth?

High Tech Layoffs Explained: The End of the Free Money Party

Inside AT&T’s newly expanded $8 billion cost-reduction program and huge layoffs

As its stock price (“T”) trades at 30+ year lows, AT&T is under severe pressure to cut costs. Its wireless subscriber growth is slowing, new fiber take rates are lower, debt has increased by $6 billion to $143.3 billion, while the company faces a potentially costly ($B+) lead cable cleanup.

AT&T recently announced they will cut another $2 billion in expenses over the next three years, even after reaching a $6 billion cost reduction plan early. Largely through what AT&T called “surplussings,” rounds of layoffs have been conducted on a department level on nearly a monthly basis to reduce costs.

The Dallas-based company’s employment has shrunk this decade from a peak of 281,000 to less than 160,000 through the first half of this year. Since the beginning of 2021, AT&T has cut 74,130 employees, including through divestitures, or 32% of its total staff through June 30th.

The company added fewer customers than analysts’ expected in the second quarter of 2023. In the three months ended June 30th, AT&T added 326,000 mobile phone subscribers. AT&T has been offering free phones in order to fuel customer growth for several quarters. The appeal of those promotions may be wearing out. The company cautioned last month that the pace of subscriber gains had slowed due to competition from rivals and cable TV companies.

AT&T raised rates on its premium mobile plan to help boost revenue and is in the process of restructuring operations by reducing 350 offices across the U.S. to nine core locations with the main hubs in Dallas and Atlanta. The telco has told 60,000 managers that they need to show up in person to one of these locations, and some will face relocation decisions or be fired.

Chief executive John Stankey recently informed employees in an email about the departure of HR chief Angela Santone. She is one of only three female top executives at AT&T. During her tenure, Santone developed an internal “culture of connection” program. The idea was to echo one of Stankey’s themes of “connectivity,” the new simplified mission for the company as it returned to its telecommunications roots after a $100 billion ill-fated attempt to transform the company into a media rival of Walt Disney Co. and Netflix Inc.

“On behalf of AT&T’s leadership, I’d like to thank her for her support and commitment to driving these initiatives during a very challenging and important time of transition,” Stankey wrote in the email, which was confirmed by Bloomberg. AT&T declined to comment on Santone’s departure.

……………………………………………………………………………………………………………………

High Tech Layoffs Explained: The End of the Free Money Party

Thanks to the Federal Reserve Board’s “free money party” (aka Quantitative Easing/QE and Zero Interest Rate Policy/ZIRP) from 2009-March 2022, investors desperate for returns sent their money to Silicon Valley, which pumped it into a wide range of start-ups that might not have received any funding in other times. Extreme valuations of both public and private companies made it easy to issue stock or take on loans to expand aggressively or to offer sweet deals to potential customers that quickly boosted market share.

“The whole tech industry of the last 15 years was built by cheap money,” said Sam Abuelsamid, principal analyst with Guidehouse Insights. “Now they’re getting hit by a new reality, and they will pay the price.”

Cheap money funded many of the tech acquisitions that were a substitute for internal growth. Two years ago, as the pandemic raged and many office workers were confined to their homes, Salesforce bought the office communications tool Slack for $28 billion, a sum that some analysts thought was way too high. Salesforce borrowed $10 billion to do that deal. This month, Salesforce said it’s laying off 8,000 employees, about 10% of its staff, many of them from Slack.

More than 46,000 workers in U.S.-based tech companies have been laid off in mass job cuts so far in 2023, according to a Crunchbase News tally. Last year, more than 107,000 jobs were slashed from public and private tech companies Here are just a few:

- Amazon is laying off 18,000 office workers and shuttering operations that are not financially viable. More below.

- Google parent Alphabet is cutting 12,000 jobs.

- Microsoft, which has been riding high on cloud revenues for years, is eliminating 10,000 jobs.

- Cisco plans to cut 5% of workforce – approximately 4,100 people will lose their jobs.

- Facebook parent Meta announced in November that it plans to eliminate 13% of its staff, which amounts to more than 11,000 employees.

- Shortly after closing his $44 billion purchase of Twitter in late October, new owner Elon Musk cut around 3,700 Twitter employees.

- IBM said today it would eliminate about 1.5% of its global workforce, which amounts to a “ballpark” figure of 3,900 job cuts.

The easy money era (which started shortly after the Lehman Brothers bankruptcy in September 2008) had been well established when Amazon decided it had mastered e-commerce enough to take on the physical world. Its plans to expand into bookstores was a rumor for years and finally happened in 2015. The media went wild. According to one well-circulated story, the retailer planned to open as many as 400 bookstores. Instead, the eRetail and cloud computing leader closed 68 stores last March, including not only bookstores but also pop-ups and so-called four-star stores. It continues to operate its Whole Foods grocery subsidiary, which has 500 U.S. locations, and other food stores. Amazon said in a statement that it was “committed to building great, long-term physical retail experiences and technologies.”

“High rates are painful for almost everyone, but they are particularly painful for Silicon Valley,” said Kairong Xiao, an associate professor of finance at Columbia Business School. “I expect more layoffs and investment cuts unless the Fed reverses its tightening.”

Addendum (Feb 26, 2023):

Ericsson will lay off 8,500 employees globally as part of its plan to cut costs, according to a memo sent to employees and seen by Reuters. “The way headcount reductions will be managed will differ depending on local country practice,” Chief Executive Borje Ekholm wrote in the memo. “In several countries the headcount reductions have already been communicated this week,” he said. “It is our obligation to take this cost out to remain competitive,” Ekholm said in the memo. “Our biggest enemy right now may be complacency.”

Ericsson to lay off 8,500 employees as part of cost cutting plan

References:

https://news.crunchbase.com/startups/tech-layoffs/

The Rise of New Tech Companies – Fiendbear Unicorns, FANGs, and the Nifty Nine