Patents awarded

Huawei and Ericsson renew global patent cross-licensing agreement

The top two global RAN equipment makers, Huawei and Ericsson, have announced the renewal of a multi-year global patent cross-licensing agreement, which enables each to use the other’s standardized (3GPP, ITU, IEEE, and IETF standards for 3G, 4G, and 5G cellular technologies) and patented technologies. The patent sharing agreement includes network infrastructure, as well as endpoint devices.

“We are delighted to reach a long-term global cross-licensing agreement with Ericsson,” said Alan Fan, Head of Huawei’s Intellectual Property Department. “As major contributors of standard essential patents (SEPs) for mobile communication, the companies recognize the value of each other’s intellectual property, and this agreement creates a stronger patent environment. It demonstrates the commitment both parties have forged that intellectual property should be properly respected and protected.”

“Both companies are major contributors to mobile communication standards and recognize the value of each other’s intellectual property. This agreement demonstrates the commitment of both parties that intellectual property should be respected and rewarded, and that leading technological innovations should be shared across the industry. A balanced approach to licensing ensures that the interests of both patent holders and implementers are served fairly, driving healthy, sustainable industry development for the benefit of consumers and enterprises everywhere.”

Over the past 20 years, Huawei has been a major contributor to mainstream ICT standards, including those for cellular, Wi-Fi, and multimedia codecs. In 2022, Huawei topped the European Patent Office’s applicant ranking for number of patent applications filed, with 4,505 applications.

“Our commitment to sharing leading technological innovations will drive healthy, sustainable industry development and provide consumers with more robust products and services,” added Fan.

Huawei is both a holder and implementer of SEPs and seeks to take a balanced approach to licensing. Through the signing of this agreement, it is both giving and receiving access to key technologies. Fan said, “This agreement is the result of intensive discussions that ensured the interests of both patent holders and implementers are served fairly.”

Christina Petersson, Ericsson’s chief IP officer said, “This agreement demonstrates the commitment of both parties that intellectual property should be respected and rewarded, and that leading technological innovations should be shared across the industry. A balanced approach to licensing ensures that the interests of both patent holders and implementers are served fairly.”

The last time the two companies extended a cross-licensing agreement was in 2016. Over the past few years, both companies have actively contributed to developing key mobile standards.

Earlier this year, the European Patent Office published the EPO Patent Index 2022: with 4,505 patents filed, Huawei was the top contributor, while Ericsson came in fifth with 1,827. Currently, according to the Financial Times, Huawei owns 20% of global patents which makes it the world’s largest 5G patent owner. Ericsson says they’ve been granted 60,000 patents.

Both Huawei and Ericsson are part of the Avanci patent pool, although the Chinese company is a recent addition following Avanci’s launch of a 5G vehicular programme earlier this month, which it says will “simplify the licensing of the cellular technologies used in next generation connected vehicles.”

Other Avanci patent licencees include Samsung, Philips, Panasonic and ZTE.

However, while Huawei and Ericsson have not engaged in active patent litigation, towards the end of last year Huawei demonstrated an intention to be more litigious over its patent portfolio. This included filing lawsuits against car manufacturer Stellantis over mobile phone patents, as well as launching a series of lawsuits over Wi-Fi 6 patents against Amazon, Netgear and AVM.

Around the same time, in the midst of a US FRAND trial, Ericsson and Apple signed a global patent licence agreement. This ended one of the largest disputes over implementation patents and SEPs in recent years, which spanned the US, Germany, the Netherlands, Belgium, the UK, Colombia and Brazil.

References:

Nikkei Asia: Huawei demands royalties from Japanese companies

Chinese companies’ patents awarded in the U.S. increased ~10% while U.S. patent grants declined ~7% in 2021

Huawei or Samsung: Leader in 5G declared Standard Essential Patents (SEPs)?

5G Specifications (3GPP), 5G Radio Standard (IMT 2020) and Standard Essential Patents

GreyB study: Huawei undisputed leader in 5G Standard Essential Patents (SEPs)

Nikkei Asia: Huawei demands royalties from Japanese companies

Huawei Technologies is seeking patent licensing fees from roughly 30 small to midsize Japanese companies for the use of patented technology, Nikkei Asia has learned. That indicates the sanctions-hit Chinese telecommunication giant’s growing reliance on such revenue. A source at Huawei’s Japan unit revealed that “talks are currently underway with about 30 Japanese telecom-related companies.”

The telecom equipment and phone maker is believed to be stepping up royalty collection in Southeast Asia as well. It is highly unusual for a major manufacturer to directly negotiate with smaller clients regarding patent fees. Huawei is facing an increasingly tough business environment as U.S. sanctions stemming from data security concerns have made it difficult to sell products overseas.

Huawei is seeking fees from manufacturers and others that use components called wireless communication modules. Sources at several Japanese companies said businesses as small as just a few employees to startups with over 100 workers have received requests from Huawei.

Requested payment levels range from a fixed fee of 50 yen (35 cents) or less per unit to 0.1% or less of the price of the system.

“The level is on par with international standards,” said Toshifumi Futamata, a visiting researcher at the University of Tokyo.

Huawei holds a high share of so-called standard-essential patents that are crucial to using such wireless communications standards as 4G or Wi-Fi. Equipment made by other companies compatible with those IEEE 802.11/ITU-R standards also use Huawei’s patented technology. This means if Huawei demands it, many companies using related internet-connected devices will have to pay patent royalties.

Even Japanese companies that do not use Huawei products could incur unexpected expenses. Furthermore, many small and medium-sized companies are unfamiliar with patent negotiations, raising concerns about signing contracts with unfavorable terms.

“Depending on the content of the contracts, it could lead to data leaks for Japanese companies,” Futamata warned. “They need to enlist lawyers and other experts for help to avoid signing disadvantageous contracts.”

Contracts that include authorization to access the communication module’s software pose risk of data leaks, Futamata added.

Negotiations over telecommunications technology patents are generally conducted between major equipment manufacturers. Such negotiations are time-consuming and selling their own products is far more profitable.

But Huawei’s profit has plunged as U.S. sanctions have cut its access to American technology and goods. Without access to Google’s Android, for example, it has struggled to sell devices overseas. Growing U.S.-China tensions have prompted Japanese companies to avoid adopting Huawei products.

As patent royalties are not subject to trade restrictions, this could be a source of stable income for Huawei. The company established an intellectual property strategy hub in Japan to oversee its IP business in the Asia-Pacific region, including Singapore, South Korea, India and Australia.

Japanese automaker Suzuki Motor agreed with Huawei by the end of 2022 to license standard essential patents related to 4G communications technology used for connected cars. More Japanese companies could face payments demands from Huawei. Wireless communication modules using Huawei’s patented technology are indispensable for connected Internet of Things (IoT) networks, according to Tokyo-based research company Seed Planning. The technology is being adopted in autonomous driving, automated factories, medicine, power and logistics.

References:

Huawei forecast to increase mobile phone shipments despite Android ban

UAE’s Du demonstrates 5G VoNR with Huawei and Nokia

Huawei says 5.5G is necessary with fully converged cloud native core network

Huawei’s blueprint to lay the foundation for 5.5G and the “intelligent world”

Huawei reinvents itself via 5G-enabled digitalized services to modernize the backbone of China’s industrial sectors

Chinese companies’ patents awarded in the U.S. increased ~10% while U.S. patent grants declined ~7% in 2021

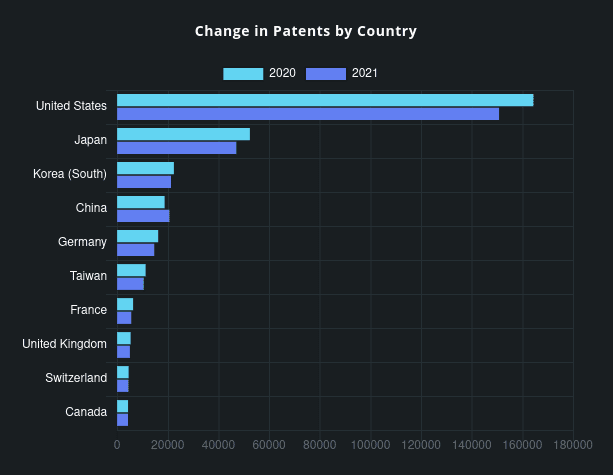

Chinese companies’ patents granted in the United States surged last year, even as total patent awards in the U.S. trended downward, according to a renowned U.S. patent service provider. Data from IFI Claims (more below) showed that Chinese companies’ patents earned in the U.S. increased ~10% to 20,679 in 2021, up from 18,792 in 2020.

The progress came as total U.S. patent grants declined about 7% from 2020 to 327,329 awards last year, the most precipitous drop in the past decade, said IFI Claims.

Several Chinese companies are now among the Top 50 in U.S. patent rankings, including world’s #1 chip maker Taiwan Semiconductor Manufacturing Co (TSMC) at No 4, telecom giant Huawei at No 5, display maker BOE at No 11, tech heavyweight Oppo at No 49, while China’s Advanced New Technologies was ranked #43. Oppo was granted 719 patents in the U.S. last year, marking a surge of 33% year-on-year.

When it comes to total global patents held, China possesses 29% of the global 250 patent families – collections of patent applications covering the same or similar technical content – compared to the U.S. (24%) and Japan (19%), said IFI Claims.

A deeper analysis shows that the U.S. and Japanese portfolios are stronger and more mature. Nevertheless, it is clear that China has stimulated a research and development culture that is serious about intellectual property, said Mike Baycroft, CEO of IFI Claims Patent Services in a statement (see below).

The progress comes as Chinese companies increasingly strengthen their R&D push. Huawei, for instance, invested 141.9 billion yuan ($22.3 billion) in R&D in 2020, accounting for about 15.9% of its revenue.

Jason Ding, head of the intellectual property department at Huawei, said earlier that the company has become one of the world’s largest patent holders through investment in innovation.

Oppo is also beefing up its R&D push. Chen Mingyong, CEO of Oppo, said earlier that the company aims to be a tech pioneer by increasing R&D spending.

“We’ve been working hard for many years to ramp up our products,” Chen said. So far, Oppo has filed for patents in more than 40 countries and regions around the world as it accelerates efforts to expand its global business. As of Dec 31, 2021, Oppo had filed 75,000 patent applications globally, and its global number of authorized patents exceeds 34,000, the company said.

For more information, email: [email protected]

…………………………………………………………………………………………………………………………….

IFI Claims Patent Services – China Surges, as Others Decline:

In a year that saw U.S. patent grants decrease anywhere from 8 to 12% among worldwide corporations, China-based companies stood out with an increase of 10 percent, going from 18,792 awards in 2020 to 20,679 during the past year. A total of four Chinese companies are now in the U.S. Top 50 including Huawei at #5, BOE at #11, Advanced New Technologies at #43, and Guangdong Oppo at #49. US company grants were down commensurate with the worldwide total decline, 8%.

“Last year saw the steepest decline in patent grants in the past decade. There could be many reasons for this – and clearly some are pandemic-related – but what we’re seeing is that corporations are still innovating at an impressive clip despite a challenging environment, particularly U.S. and Asia-based entities,” said Mike Baycroft, CEO of IFI CLAIMS Patent Services.

Consistent with the overall decline in U.S. patent activity from 2020 to 2021, all regions except China had a negative growth rate Year over Year (2021 vs 2020). That is depicted on this chart:

Source: IFI Claims Patent Services

………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://mobile.chinadaily.net.cn/cn/html5/2022-01/14/content_013_61e07f4ced500fb050170922.htm