Pay TV status

América Móvil: 5G deployment 1H-2022; pay-TV service in Mexico under discussion by IFT

América Móvil will begin this year the deployment of its 5G network in Mexico and all the countries in the Latin American region where it operates, with the exception of Colombia, said Daniel Hajj, CEO of the company.

The company, owned by magnate Carlos Slim, will invest around eight billion dollars this year, said the executive in a conference call with analysts. América Móvil expects to have 5G connectivity ready in 90 percent of its markets.

Hajj pointed out that although there is no specific date for the launch of the 5G network, he expects it to take place during the first half of this year. “I don’t have a specific date, but all over the year we’re working on a launch. I hope we can do it in the first semester of this year,” said Hajj said about 5G on a call with investors.

America Movil operates in at least 10 markets, mainly in Latin America.

The company on Tuesday reported that its fourth-quarter net profit more than tripled from the year-ago period, boosted by its sale of its TracFone wireless unit to Verizon Communications Inc. It posted a net profit of 135.6 billion pesos ($6.6 billion), compared with 37.3 billion pesos a year earlier.

The CEO also referred to the company’s plans to offer pay-TV service in Mexico, a request that is under discussion at Mexico’s telecom regulator- the Federal Telecommunications Institute (IFT).

At the end of January, the Plenary of the IFT reversed a project that denied the concession of a pay TV channel to Claro TV, a subsidiary of América Móvil, which postponed the decision on the request made by Carlos Slim‘s company more than three years ago.

However, Hajj said that they expect to have positive news on the matter and assured that the request before the regulator complies with all the regulations in force, in addition to the fact that it would benefit consumers.

“It is clear that competition would be good for consumers and the sector, and we believe that Claro and América Móvil is a clear alternative, so that will have to be determined by the IFT, and we expect positive news on that front,” a company executive said.

References:

Leichtman Research Group: Top U.S. Broadband Providers Add; PayTV Providers Lose Subscribers in 2020

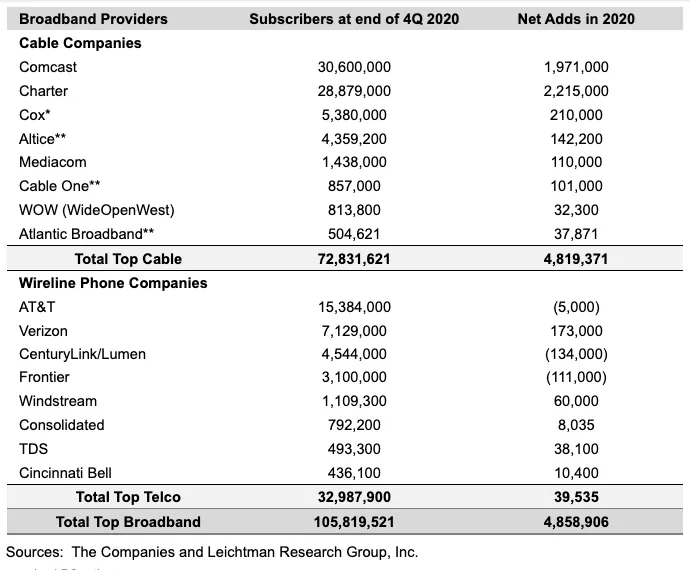

Leichtman Research Group reports that largest U.S. broadband network providers added almost twice as many fixed subscribers in 2020 as they did the previous year, largely due to the Covid-19 pandemic. However, some large broadband providers (like AT&T) lost customers.

The largest cable and wireline phone providers in the U.S. – representing about 96% of the market – acquired about 4,860,000 net additional broadband Internet subscribers in 2020, compared to a pro forma gain of about 2,550,000 subscribers in 2019.

These top broadband providers now account for 105.8 million subscribers, with top cable companies having 72.8 million broadband subscribers, and top wireline phone companies having 33 million subscribers.

Comcast and Charter accounted for 4.19 million, or 86%, of the total number of net additions, with the other six cablecos’ adds coming in significantly lower, ranging from 210,000 for Cox to just under 38,000 for Atlantic Broadband.

For wireline telcos, the best performance came from Verizon, which added a fairly respectable 173,000 fixed broadband customers, but three of the eight posted net customer losses. In particular, AT&T’s net broadband losses came in at 5,000 while CenturyLink and Frontier both lost well over 100,000 customers.

[As per the report below, AT&T’s DirecTV lost more than 3.26 million subscribers which was ~60% of all U.S. pay TV losses in 2020.]

Notes:

* LRG estimate

** Includes recent small acquisitions/sales and LRG pro forma estimates

^ Frontier’s total for 4Q 2020 is an LRG estimate due to later year-end reporting

TDS includes 283,900 wireline broadband subscribers, and 209,400 cable broadband subscribers

…………………………………………………………………………………….

Key findings for the year 2020 include:

- Overall, broadband additions in 2020 were 190% of those in 2019, and more than in any year since 2008

- Top cable and wireline phone companies represent approximately 96% of all subscribers

- The top cable companies added about 4,820,000 subscribers in 2020 – compared to about 3,145,000 net adds in 2019, and the most in any year since 2006

- Charter’s 2,215,000 net broadband additions in 2020 were more than any company had in a year since 2006

- The top wireline telecom companies added about 40,000 subscribers in 2020 – compared to a loss of about 590,000 subscribers in 2019

- Telcos had positive net annual broadband adds for the first year since 2014

- At the end of 2020, cable had a 69% market share vs. 31% for Telcos

“With the impact of the coronavirus pandemic, there were more net broadband additions in 2020 than in any year since 2008,” said Bruce Leichtman, president and principal analyst for Leichtman Research Group, Inc (LRG). “The top cable and Telco broadband providers in the U.S. cumulatively added about 4,860,000 subscribers in 2020, compared to about 5,100,000 subscribers in 2018 and 2019 combined.”

Separately, LRG found that the largest pay-TV providers in the U.S. – representing about 95% of the market – lost about 5,120,000 net video subscribers in 2020, compared to a pro forma net loss of about 4,795,000 in 2019.

The top pay-TV providers now account for about 81.3 million subscribers – with the top seven cable companies having 43.9 million video subscribers, satellite TV services having about 21.8 million subscribers, the top telephone companies having 7.9 million subscribers, and the top publicly reporting Internet-delivered (vMVPD) pay-TV services having 7.7 million subscribers.

AT&T had a net loss of about 3,260,000 subscribers across its four pay-TV services (DIRECTV, AT&T U-verse, AT&T TV, and AT&T TV NOW) in 2020 – compared to a net loss of about 4,095,000 subscribers in 2019.

AT&T “Premium TV” services (not including the vMVPD service AT&T TV NOW) lost 15.3% of subscribers in 2020 – compared to a 4.6% loss among all other traditional pay-TV services.

Key findings for the year include:

- Satellite TV services lost about 3,440,000 subscribers in 2020 – compared to a loss of about 3.700,000 subscribers in 2019

- The top seven cable companies lost about 1,915,000 video subscribers in 2020 – compared to a loss of about 1,560,000 subscribers in 2019

- The top telco TV companies lost about 405,000 video subscribers in 2020 – compared to a loss of about 630,000 subscribers in 2019

- The top publicly reporting Internet-delivered (vMVPD) services (Hulu + Live TV, Sling TV, AT&T TV NOW, and fuboTV) added about 640,000 subscribers in 2020 – compared to about 1,095,000 net adds in 2019

- Traditional pay-TV services (not including vMVPDs) lost about 5,765,000 subscribers in 2020 – compared to a net loss of about 5,890,000 in 2019

“Net pay-TV losses of over 5 million subscribers in 2020 were slightly higher than in 2019, and more than in any previous year,” said Bruce Leichtman, president and principal analyst for Leichtman Research Group, Inc. “Overall, the top pay-TV providers lost 5.9% of subscribers in 2020, compared to 5.2% in 2019.”

About Leichtman Research Group, Inc.

Leichtman Research Group, Inc. (LRG) specializes in research and analysis on broadband, media and entertainment industries. LRG combines ongoing consumer surveys with industry tracking and analysis, to provide companies with a richer understanding of current market conditions, and the potential impact and adoption of new products and services. For more information about LRG, please call (603) 397-5400 or visit www.LeichtmanResearch.com.

References:

https://www.leichtmanresearch.com/about-4860000-added-broadband-from-top-providers-in-2020/

https://www.leichtmanresearch.com/major-pay-tv-providers-lost-about-5120000-subscribers-in-2020/

https://telecoms.com/508907/pandemic-provided-a-shot-in-the-arm-for-us-fixed-broadband/