Telecom Regulation

Omdia: Regulatory activity to impact telecom in 2022; Global 5G status

According to market research dynamo Omdia, 2022 will be rife with regulatory activity that will impact the telecommunications market for years to come.

“As technology evolves, regulation will become more important than ever in the TMT industry,” said Sarah McBride, senior analyst for regulation at Omdia.

Omdia identified several trends it says will be “at the heart of regulatory activity” next year, including spectrum licensing, fiber networks, the digital divide and 6G (even though 5G spectrum has not been standardized by ITU-R in a revision to M.1036).

Regarding the digital divide (between the broadband haves and have nots), Omdia says “governments should learn from the pandemic and recognize the need for these broadband services to be affordable to all.”

The Omdia analysts say that governments must define a “comprehensive national digital strategy that includes providing state-aid tools to improve broadband availability and affordability.”

Such a strategy should go beyond deployment to “ensure citizens can use connectivity transformatively to bring about innovation and growth.” Doing so will encourage more deployment and investment, writes Omdia.

However, to avoid too much government intervention, Omdia also stresses the need for cooperation by service providers.

“Experience shows that market-led development, not a reliance on government intervention, is the most effective model for effective allocation of resources. However, economic viability is lower in some rural and sparsely populated areas than in populous areas,” Omdia said. The firm recommends that network operators collaborate by sharing infrastructure to reduce deployment costs and create shared wireless networks to “remove the need for regulators to set ambitious coverage obligations as part of spectrum licenses or universal service obligations.”

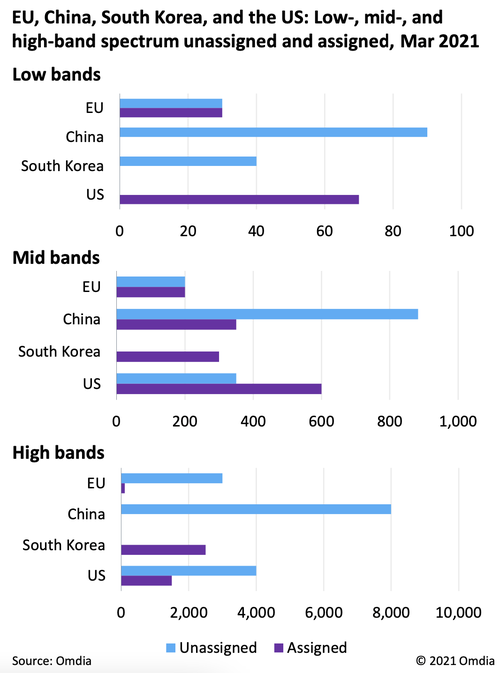

According to Omdia’s tracker for 5G networks, more than 150 5G networks have been launched around the world to date, which the research firm says will continue to drive demand for more spectrum.

“5G will profoundly affect society because of its ultrafast speeds, low latency, and high reliability, which enable digital transformation and support new use cases,” writes Omdia.

Regulators need to effectively manage spectrum allocation, “allowing access to the right amount of internationally harmonized spectrum (e.g., 700MHz, 3.6GHz, and 26GHz bands in the EU) in a timely manner to keep costs down.”

As operators continue to build out their 5G networks, Omdia tells policymakers it’s important to plan ahead on 6G standards, given the role these networks will play in the digital economy and the danger posed by a lack of cohesion.

Specifically, the firm warns against further splintering the telecom and Internet ecosystem, or what it calls “the splinternet.”

“It is especially important that regulators and policymakers prepare for future network generations by ensuring agreement is reached on 6G standards. A fragmentation of standards must be avoided to prevent any further separation of the telecoms and internet ecosystem, a ‘splinternet’,” writes Omdia.

Acknowledging that plans for 6G are in their infancy, Omdia further tells policymakers to begin identifying appropriate spectrum bands, though it notes that such plans “will need to be balanced with the need to release spectrum for 5G.”

Part of the rush to deploy high-speed internet everywhere includes a migration to fiber, whether through new builds or upgrades of existing cable networks. Omdia says that as network operators migrate to fiber, regulators should focus on promoting competition, pricing strategies and raising awareness amongst consumers about fiber access.

The firm further states that regulators should include fiber access in wholesale obligations, “once sufficient fiber coverage is reached.”

It’s important for network operators to collaborate with regulators on network upgrade plans and give wholesale customers advance warning to avoid disruption.

“Operators need to give their wholesale customers a sufficient notice period when withdrawing copper networks. This includes providing formal notifications that outline the timeframes involved, the replacement products on offer, and the new price terms,” writes Omdia.

……………………………………………………………………………………………..

In a separate report titled, 2022 Trends to Watch: Global 5G, Omdia says that 5G network rollouts are still in the early stages, especially in developing regions.

“But there are compelling reasons for telcos to commit to 5G so they can differentiate around an improved network experience, as well as realize network efficiencies and lower operating costs. Moreover, 5G’s enhancements over 4G – most noticeably speed and latency – will come to be appreciated by consumers more next year as an increasing number of data-intensive services and applications become popular in the mass market,” the research firm said.

“A surprise to many next year may be the rapid emergence of satellite to augment telcos’ terrestrial network coverage,” Omdia observed.

“A key driver for hybrid satellite-cellular deployments is the need for ubiquitous high-speed data coverage, something which telcos can greatly benefit from if their rivals’ 5G network coverage remains patchy.”

Major telcos including BT, Deutsche Telekom, Telecom Italia and Verizon signed significant deals with satellite internet providers in 2021 to offer a hybrid approach to targeted residential, enterprise and industrial markets.

Omdia believes that the likely success of these satellite internet initiatives could jump-start a flurry of new activity in this area in 2022.

“Although most end users aren’t rushing to buy 5G, the quality of their network experience in terms of reliability, speed, and coverage is increasingly important to them. As such, 5G offers telcos a better opportunity than 4G to differentiate, especially for ones that can claim they offer the best-in-market network experience,” Omdia said.

Omdia thinks that partnership strategies will be even more important for telco 5G success in 2022.

“How good telcos are at partnering, whether for content, service, or technology development, will increasingly define how successful they are in consumer, enterprise, and industrial markets. Because of its enhanced capabilities over 4G, 5G enables telcos to offer much more, and they will have to partner effectively to capitalize on this.”

“Except for 5G MEC (really ?), the ecosystem and markets for advanced 5G technologies are still in their infancy. However, 5G front-runners are already launching them, placing them in a strong position to gain a first-mover advantage when the market is ready to adopt them,” Omdia said.

References:

https://www.broadbandworldnews.com/document.asp?doc_id=774240&

https://techblog.comsoc.org/2021/12/18/etsi-mec-standard-explained-part-ii/