Uncategorized

Dell’ Oro Group: WLAN market bifurcation drag on IEEE 802.11ax; 400 Gbps Shipments to Surpass 15M Switch Ports by 2023

WLAN market bifurcation drag on IEEE 802.11ax

According to a newly released market forecast report by Dell’ Oro Group, the Enterprise WLAN market bifurcation is expected to drag down the IEEE 802.11ax adoption rate. The report also anticipates subscription license sales to more than double by 2023.

“We see a clear segmentation unfolding in the Enterprise WLAN market,” said Ritesh Patel, Industry Analyst at Dell’ Oro Group. “One segment is a group of performance-seeking users who are willing to pay a premium for higher performance. The other, is the price-sensitive segment—a group of users who prefer to purchase older technology at a lower price. Our analysis shows that the performance-seeking segment adopts new technology at a faster rate than the price-sensitive segment. We forecast this phenomenon to impact the overall adoption rate for 802.11ax (Wi-Fi 6),” added Patel.

“Another trend unfolding is the growing popularity of subscription licenses, which is adding significantly to market revenue. Performance-seeking users are purchasing licenses for applications such as predictive analytics, visibility into the network for troubleshooting, and enhanced security,” said Patel.

The WLAN 5-Year Forecast Report highlights other key trends, including:

- Enterprise WLAN market revenues to surpass $9 B by 2023.

- Access Point average prices rising in the near-term.

- 11ax access points to sustain a price premium for an extended period.

The Dell’Oro Group Wireless LAN 5-Year Forecast Report offers a complete overview of the industry, covering Enterprise Outdoor and Indoor markets, with tables containing manufacturers’ revenue, average selling prices, and unit shipments by the following wireless standards: 802.11ax, 802.11ac Wave 1 vs. Wave 2, 802.11n, and historic IEEE 802.11 standards. It includes forecasts for regions of the world and for Cloud-managed vs. Premises-managed. To purchase these reports, please contact us by email at [email protected]

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

400 Gbps shipments to surpass 15M Switch Ports by 2023

Dell’Oro revealed in a separate report, that 400 Gbps switch ports are forecast to surpass 15M by 2023. The 100 Gbps ports are expected to peak in 2020 but still comprise more than 30 percent of data center switch ports in the next five years.

“The first wave of 400 Gbps switch systems based on 12.8 Tbps chips were introduced in the market in 2H 2018,”said Sameh Boujelbene, Senior Director at Dell’Oro Group. “However, we do not expect material adoption of 400 Gbps until 2020 due to the lack of high volume, low cost 400 Gbps optics. The only Cloud Service Provider (SP) that started deploying 400 Gbps was Google, which opted for special 400 Gbps optics with an earlier time-to-market. Meanwhile, we expect other Cloud SPs, for instance Amazon, Facebook or Microsoft, to keep deploying 100 Gbps, and to probably consume the 12.8 Tbps chips in the form of high–density 100 Gbps switch systems to reduce cost,” added Boujelbene.

The Ethernet Switch – Data Center 5-Year Forecast Report provides more details about the timing of 100/200/400/800 Gbps and how the use cases may vary depending on the SerDes lane and market segment driving the speed.

The Dell’Oro Group Ethernet Switch – Data Center Five Year Forecast Report provides a comprehensive overview of market trends and include tables covering manufacturers’ revenue, port shipments, and average selling price forecasts for various technologies: Modular and Fixed by Port Speed; Fixed Managed and Unmanaged by Port Speed. We forecast the following port speeds: 1000 Mbps; 10 Gbps; 25 Gbps; 40 Gbps; 50 Gbps; 100 Gbps; 200 Gbps; 400 Gbps. To purchase these reports, please contact us by email at [email protected].

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Who else has announced or deployed 400G?

We’ve spent a lot of time searching for answers to that question but have found little. In particular, Amazon has been very secretive in their AWS inter data center deployments which one would expect to have used 400G optics (probably 4 x 100G lanes).

Last October, Cisco announced its first set of 400G data center network switches. Two of the switches were aimed at hyperscale cloud platforms, while the other two are for tech-savvy enterprises, and service providers. The two new Cisco Nexus 3400-S switches are for hyperscalers with high-bandwidth needs for things like video streaming, while the two new Nexus 9000 switches are for high-end enterprises taking advantage of artificial intelligence and machine learning and service providers building 5G networks, Thomas Scheibe, VP of product management for Cisco Data Center Switching, told Data Center Knowledge. Arista Networks announced plans for its first 400G switches last week, while Juniper Networks released details of its forthcoming 400GbE switches in July 2018.

“Everybody who sells to hyperscalers – whether that be Cisco, Juniper, Arista, or the white-box ODMs – will need to have 400GbE data center switches in their portfolio in 2019,” Brad Casemore, IDC’s VP for data center networks, told Data Center Knowledge. “There’s really no alternative, and that’s why you’ve seen a succession of 400GbE announcements from Juniper, Arista, and Cisco respectively. From a sales standpoint, they will all reach market at about the same time, but nobody wants to get outmaneuvered by a competitor.”

In an IEEE techblog post summarizing Facebook’s F16 Switch announcement at OCP 2019 Summit, we said that “Facebook built the F16 fabric out of 16 128-port 100G switches, achieving the same bandwidth as four 128-port 400G switches would.” So they achieved effective 400G switch ports using 16 times as many 100G switch ports.

In its second quarter earnings call last month, Juniper Networks CEO Rami Rahim said that Juniper has started shipping its first merchant and custom silicon-based 400-gig capable products and that it plans additional 400G products throughout the course of this year and next. Rahim said that 400G won’t really take off until 400G optics are available, which Juniper will ramp up in the first half of next year. Rahim also said the while the cloud providers will be the first big 400G customers, he expects service providers to be next in line.

Hyperscalers have been the primary drivers for 400G demand, he said. But other segments of the market, including telecommunications service providers rolling out 5G networks and high-end enterprises in verticals such as financial services, will also adopt the technology. “Hyperscalers will be first, and they will buy in the greatest volumes, creating the sort of economies of scale that will make 400G more affordable for subsequent buyers,” Casemore said.

Here’s a good reference on Trends in 400G Optics for the Data Center.

Virgin Media Experimenting with 10 Gbps mmWave backhaul in UK fixed broadband FTTP trial

UK’s Virgin Media has been exploring possibilities of delivering backhaul traffic over the air (OTA) in a small village in the English countryside. Although this is something which Virgin Media has been doing for years, this time the company is experimenting with mmWave as opposed to microwave.

“As we invest to expand our ultra-fast network we’re always looking at new, innovative ways to make build more efficient and connect premises that might currently be out of reach,” said Jeanie York, Chief Technology and Information Officer at Virgin Media. “While presently this is a trial, it’s clear that this technology could help to provide more people and businesses with the better broadband they deserve.”

The challenge which seems to be addressed here is combining the complications of deploying infrastructure and the increasing data appetite of the consumer. As you can see below, the trial makes use of mmWave to connect two ‘trunk’ points over 3 km with a 10 Gbps signal. The signal is converted at the cabinet, before being sent through the last-mile on a fiber connection.

Although this trial only connected 12 homes in the village of Newbury, Virgin Media believes this process could support delivery of residential services to 500 homes. This assumption also factors in a 40% average annual growth in data consumption. With further upgrades, the radio link could theoretically support a 20 Gbps connection, taking the number of homes serviced to 2,000.

The advantage of this approach to delivering broadband is the ability to skip over tricky physical limitations. There are numerous villages which are experiencing poor connections because the vast spend which would have to be made to circumnavigate a valley, rivers or train lines. This approach not only speeds up the deployment, it simplifies it and makes it cheaper.

Looking at the distance between the two ‘trunks’, Virgin Media has said 3km is just about as far as it can go with mmWave. This range takes into account different weather conditions, the trial included some adverse conditions such as 80mph winds and 30mm rainfall, but radios chained together and used back-to-back could increased this coverage and scope of applications.

Virgin Media has unveiled the results of a new trial using wireless to deliver broadband to customers in remote locations.

………………………………………………………………………………………………………………………………………………………………………………………………………

With alt-nets becoming increasingly common throughout the UK, new ideas to make use of mmWave and alternative technologies will need to be explored. Traditional network operators will find revenues being gradually eroded if a new vision of connectivity is not acquired.

Of course, use of mmWave for fixed broadband internet is common in the U.S., but it is proprietary to the equipment vendor (no standards) and line of sight is required from the network operators equipment to an antenna mounted on the rooftop of the home being served.

………………………………………………………………………………………………………………………………………………………………………

Reference:

http://telecoms.com/498170/virgin-media-to-take-a-mmwave-approach-to-full-fibre/

Pre-Pub Version of ITU-T G.9701-2019: Fast access to subscriber terminals (G.fast) – Physical layer for copper wire or coax cables

Overview of ITU-T G.9701-2019 (as of May 24, 2019):

Summary:

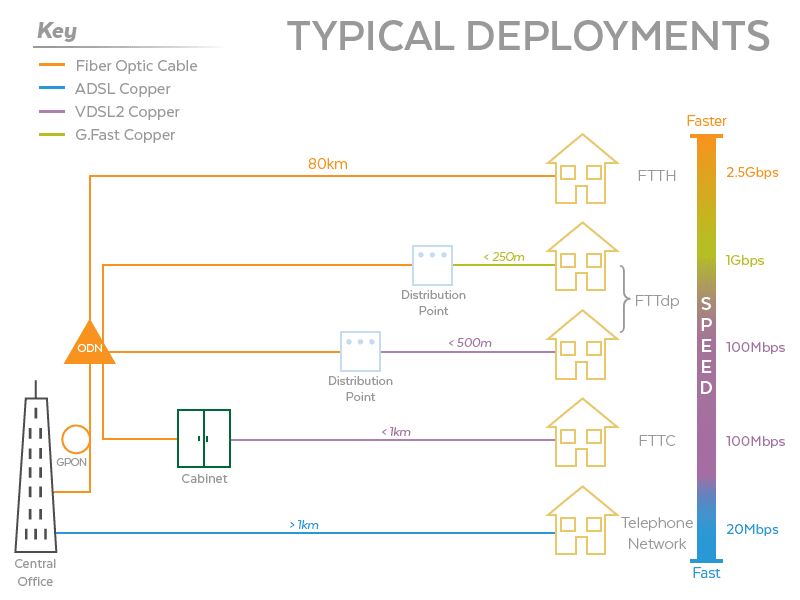

1. Previous version: Recommendation ITU-T G.9701-2014 specifies a gigabit broadband access technology that exploits the existing infrastructure of copper wire-pairs that were originally deployed for plain old telephone service (POTS) services. Equipment implementing this Recommendation can be deployed from fibre-fed distribution points (fibre to the distribution point, FTTdp) located very near the customer premises, or within buildings (fibre to the building, FTTB). This Recommendation supports asymmetric and symmetric transmission at an aggregate net data rate up to 1 Gbit/s on twisted wirepairs using spectrum up to 106 MHz and specifies all necessary functionality to support far-end crosstalk (FEXT) cancellation between multiple wire-pairs, and facilitates low power operation.

2. Recommendation ITU-T G.9701-2019 integrates ITU-T G.9701-2014 and all of its corrigenda and amendments, and adds support for the following new functionality: LPM classes, optional extension of probe sequence length, short CLR/CL messages, Annex R – Showtime reconfiguration, and Appendix IV – Targeted generalized vectoring with active G.9701 supporting lines (TGVA). It also adds several clarifications, and fixes various errors and inconsistencies including ANDEFTR support, SRA triggering and PMS-TC parameter requirements, and conditions for an rtx-uc anomaly.

Scope:

This Recommendation specifies the operation of a broadband access technology that exploits the existing infrastructure of wire-pairs that were originally deployed for plain old telephone service (POTS) and, with Amendment 3, adds support for operation over coaxial cables.

This Recommendation supports transmission at an aggregate net data rate (the sum of upstream and downstream rates) up to approximately 2 Gbit/s.

While asymmetric digital subscriber line transceivers 2 (ADSL2) – extended bandwidth (ADSL2plus) uses approximately 2 MHz of the spectrum, and very high speed digital subscriber line transceivers 2 (VDSL2) uses up to 35 MHz of the spectrum, this Recommendation defines profiles using spectrum up to 106 MHz and 212 MHz and specifies all necessary functionality to support the use of far-end crosstalk (FEXT) cancellation between ITU-T G.9701 transceivers deployed on multiple wire-pairs. The availability of spectrum up to 106 MHz or 212 MHz allows ITU-T G.9701 transceivers to provide reliable high data rate operation on very short loops. This Recommendation can be deployed from fibre-fed distribution points located very near the customer premises, or within the buildings. This Recommendation is optimized to operate over wire-pairs up to approximately 250 m of 0.5 mm diameter. However, it is capable of operation over wire-pairs up to at least 400 meters of 0.5 mm diameter, subject to some performance limitations.

This Recommendation defines a wide range of settings for various parameters (such as spectral usage and transmitter power) that may be supported by a transceiver. Therefore, this Recommendation specifies profiles to allow transceivers to support a subset of the allowed settings and still be compliant with the Recommendation. The specification of multiple profiles allows vendors to limit the implementation complexity and develop implementations that target specific service requirements. This edition of the Recommendation specifies transmission profiles for inband spectral usage of up to 212 MHz and maximum transmit power up to +8 dBm. This Recommendation operates in compliance with the power spectral density (PSD) specification in [ITU-T G.9700].

As per ITU-T Recommendations in the ITU-T G.99x series, this Recommendation uses [ITU-T G.994.1] to initiate the transceiver training sequence. Through negotiation during the handshake phase of the initialization, the capability of equipment to support this Recommendation and/or ITU-T G.99x series Recommendations (e.g., [ITU-T G.993.2] defining VDSL2) is identified. For reasons of interoperability, equipment may support multiple Recommendations such that it is able to adapt to the operating mode supported by the far-end equipment.

It is the intention of this Recommendation to provide, by negotiation during the initialization, U interface compatibility and interoperability between transceivers complying with this Recommendation, including transceivers that support different combinations of options. The technology specified in this Recommendation provides the following key application features:

• Best aspects of fibre to the home (FTTH): up to 2 Gbit/s aggregate net data rate;

• Best aspects of ADSL2: customer self-install and operation in the presence of bridged taps, avoiding operator truck-rolls to the customer premises for installation and activation of the broadband access service;

• Coexistence with ADSL2 and VDSL2 on adjacent wire-pairs;

• Low power operation and all functionality necessary to allow transceivers to be deployed as part of reverse powered (and possibly battery operated) network equipment and to adapt to environmental conditions (e.g., temperature);

• Management capabilities allowing transceivers to operate in a zero touch deployment, avoiding truck-rolls to the network equipment for installation and activation of new or upgraded broadband access service;

• Control of the upstream vs downstream transmission time to adapt net data rates to the needs of the business and the residential customers;

• Vectoring (self-crosstalk cancellation) for increased net data rates on wire-pairs that experience far-end crosstalk from ITU-T G.9701 transceivers in the same vectored group operating on other wire-pairs in the same cable or operating on other wire-pairs originating from the same network equipment;

• Network timing reference (NTR) and time-of-day (ToD) transport for network frequency and time synchronization between network and customer premises equipment;

• Configuration of spectrum use, including configuration of the transmit power spectral density (PSD) limitations and notches to meet electromagnetic compatibility (EMC) requirements.

The technology specified in this Recommendation uses the following key functionalities and capabilities:

• Transparent transport of data packets (e.g., Ethernet packets) at an aggregate (sum of upstream and downstream) data rate of up to 2 Gbit/s;

• In-band spectral usage up to 212 MHz;

• Configurable start and stop frequencies, PSD shaping and notching;

• Discrete multitone (DMT) modulation (2 048/4 096 subcarriers with 51.75 kHz subcarrier

spacing);

• Time-division duplexing (sharing time between upstream and downstream transmission);

• Low latency retransmission, facilitating impulse noise protection (INP) between the V and T reference points at all data rates to deal with isolated erasure events at the U reference point of at least 10 ms, without loss of user data;

• Forward error correction based on Trellis coding and Reed-Solomon coding;

• Vectoring (self-FEXT cancellation), where this edition of the Recommendation uses linear precoding;

• Discontinuous operation where not all of the time available for data transmission is used;

• Online reconfiguration (OLR) for adaptation to changes of the channel and noise characteristics, including fast rate adaptation (FRA).

With these functionalities and capabilities, the technology specified in this Recommendation targets the following aggregate net data rates over a 0.5 mm straight wire-pair for 106 MHz profiles:

• 500 to 1000 Mbit/s on a wire-pair shorter than 100 m;

• 500 Mbit/s at 100 m;

• 200 Mbit/s at 200 m;

• 150 Mbit/s at 250 m;

• 500 Mbit/s at 50 m, while operating in the band above 17 MHz.

References:

The following ITU-T Recommendations and other references contain provisions which, through reference in this text, constitute provisions of this Recommendation. At the time of publication, the editions indicated were valid. All Recommendations and other references are subject to revision; users of this Recommendation are therefore encouraged to investigate the possibility of applying the most recent edition of the Recommendations and other references listed below. A list of the currently valid ITU-T Recommendations is regularly published. The reference to a document within this Recommendation does not give it, as a stand-alone document, the status of a Recommendation.

[ITU-T G.117] Recommendation ITU-T G.117 (2007), Transmission impairments due to speech Processing.

[ITU-T G.994.1] Recommendation ITU-T G.994.1 (2018), Handshake procedures for digital subscriber line transceivers.

[ITU-T G.997.2] Recommendation ITU-T G.997.2 (2019), Physical layer management for ITU-T G.9701 transceivers.

[ITU-T G.9700] Recommendation ITU-T G.9700 (2019), Fast access to subscriber terminals (G.fast) – Power spectral density specification.

[ITU-T O.9] Recommendation ITU-T O.9 (1999), Measuring arrangements to assess the degree of unbalance about earth.

[ITU-T T.35] Recommendation ITU-T T.35 (2000), Procedure for the allocation of ITU-T defined codes for non-standard facilities.

[ISO 8601] ISO 8601:2000, Data elements and interchange formats – Information interchange – Representation of dates and times.

………………………………………………………………………………………………………………………………………………………………………………………………..

The complete document is available to ITU-T members with a TIES account.

Berg Insight: China driving global cellular IoT adoption via NB-IoT; 5G-IoT coming in late 2020

A new report from the IoT analyst firm Berg Insight estimates that the global number of cellular IoT (e.g. NB-IoT, LTE-M, LTE, 2G, 3G, etc) subscribers increased by 70 percent during 2018 to reach 1.2 billion. IoT growth was driven by “exceptional adoption” in China.

The market research firm forecasts that there will be 9 billion IoT devices connected to cellular networks worldwide by 2023.

China, which accounted for 63% of the global installed base in 2018, is expected to continue to be the key driver for IoT adoption, as the Chinese government is actively driving adoption as a tool for achieving domestic and economic policy goals.

“China is deploying cellular IoT technology at a monumental scale”, said Tobias Ryberg, principal analyst and author of the report.

According to data from the Chinese mobile operators, the installed base in the country increased by 124% year-on-year to reach 767 million at the end of 2018.

China has overtaken Europe and North America in penetration rate with 54.7 IoT connections per 100 inhabitants, Ryberg said.

He said the role of the government is the main explanation for why China is ahead of the rest of the world in the adoption of IoT.

“The most distinctive characteristic of the Chinese IoT market is however the way that the government is systematically using new technology to implement its vision for urban life in the 21st century,” Ryberg said.

“At the same time the private sector also implements IoT technology to improve efficiency and drive innovation.”

China has witnessed widespread adoption of connected cars, fleet management, smart metering, asset monitoring and as well as new consumer services like bike sharing.

The report also analyses the IoT business KPIs (Key Performance Indicators) released by mobile operators in different parts of the world and found significant regional differences.

While China has the world’s highest IoT penetration rate, Europe seems is doing better job in terms of monetizing the IoT business.

According to the report, the monthly ARPU for cellular IoT connectivity services in China was only €0.22 ($0.25), compared to € 0.70 in Europe.

Global revenues from cellular IoT connectivity services increased by 19% in 2018 to reach €6.7 billion. The ten largest players had a combined revenue share of around 80%.

………………………………………………………………………………………………………………….

Editor’s Note: The most popular cellular IoT network in China is NB-IoT. China Telecom Offers NB–IoT Nationwide. ChinaTelecom has built the world’s largest NB–IoT network so far by upgrading 310,000 base stations acrossChina to support NB–IoT. … It is using the 800MHz spectrum band, which is being refarmed for 4G in China and enables good in-building penetration and very wide coverage.

A GSMA case study illustrates how China Mobile, China Telecom and China Unicom enable consumers and businesses to benefit from better services using NB-IoT, while opening up new business models for mobile operators and their partners.

Supporting extensive coverage and low power consumption, NB-IoT is making it feasible to securely remotely monitor and control very large volumes of everyday devices, appliance, machines and vehicles. Both consumers and businesses in China are now benefiting from greater convenience, better reliability, and improved safety and security.

Above image courtesy of GSMA

……………………………………………………………………………………………………………………………….

In a separate report, Berg Insight says 5G will reach the IoT market in late 2020.

The first 5G cellular IoT modules will become available to developers this year, enabling early adopters to create the first IoT devices based on the standard. Based on the experience of previous introductions of new standards, 5G will however not be an instant hit. By 2023, Berg Insight forecasts that 5G will account for just under 3 percent of the total installed base of cellular IoT devices.

“5G still has some way to go before it can become a mainstream technology for cellular IoT”, says Tobias Ryberg, Principal Analyst and author of the report.

“Just like 4G when it was first introduced, the initial version of 5G is mostly about improving network performance and data capacity. This is only relevant for a smaller subset of high-bandwidth cellular IoT applications like connected cars, security cameras and industrial routers. The real commercial breakthrough will not happen until the massive machine type communication (mMTC) use case has been implemented in the standard.”

mMTC is intended as an evolution of the LTE-M/NB-IoT enhancements to the 4G standard. Since NB-IoT has only just started to appear in commercial products, there is no immediate demand for a successor. Over time, fifth generation mobile networks will however become necessary to cope with the expected exponential growth of IoT connections and data traffic. The report identifies homeland security as an area where 5G cellular IoT can have a major impact already in the early 2020s.

“5G enables the deployment of high-density networks of AI-supported security cameras to monitor anything form security-classified facilities to national borders or entire cities”, says Mr. Ryberg.

“How this technology is used and by whom is likely to become one of the most controversial issues in the next decade.”

……………………………………………………………………………………………………………..

References:

http://www.berginsight.com/News.aspx?m_m=6&s_m=1

https://www.gsma.com/iot/nbiot-iot-commercial-case-study-china/

https://www.telecomasia.net/content/berg-insight-china-driving-global-cellular-iot-adoption

WDM-PON to Enable 5G+FTTH Converged Gigaband Access

SOURCE: ZTE

Introduction:

5G networks will be distinctly different then 4G-LTE networks, even though all so called “5G” pre-standard deployments use 3GPP Rel 15 5G-NR NSA (Non Stand Alone) for the data plane, with a heavy LTE anchor for: signaling, network management and mobile packet core (EVC). ITU-R will specify the radio related standards for 5G, while ITU-T will standardize the non radio aspects, as reported NUMEROUS times on this techblog website.

Several market research firms forecast that 5G base stations installed in China will be two to three times as many as 4G- LTE base stations. GSMA forecasts that from launch in 2020, Chinese 5G connections will scale rapidly over time, to reach 428 million by 2025. Beyond this date, further growth will be determined by incremental network rollout (and the ability of operators to earn ROI), and the price point at which 5G devices are available.

……………………………………………………………………………………………………………

Definitions: C-RAN, DUs, and AAUs:

The Centralized Radio Access Network (C-RAN) mode where the Distributed Units (DUs) for many Active Antenna Units (AAUs) are placed at a centralized location significantly increases the fronthaul distance between DUs and AAUs. If all DU-AAU connections are through fiber, the amount of fiber required will rise by 10-fold. That entails heavy civil works and enormous investments.

25Gbps WDM-PON is Ideal for 5G Fronthaul:

WDM-PON is a passive optical networking technology that can be used to address the fiber deployment challenges. A WDM-PON design can be used to separate optical-network units (ONUs) into several virtual point-to-point connections over the same physical infrastructure, a feature that enables efficient use of fiber compared to point-to-point direct fiber connection and offers lower latency than TDM-based technologies. A notable benefit of this technology is high bandwidth, low latency, and fiber savings. 5G fronthaul based on 25Gbps WDM-PON technology has the following technical advantages:

- Support for CPRI and eCPRI standards as well as 4G/5G hybrid networking.

- 25Gbps high bandwidth per wavelength, which can smoothly evolve to 50Gbps in the future.

- Up to 20 pairs of wavelengths on a single trunk fiber.

- Colorless ONU technology allows flexible wavelength allocation and wavelength routing.

- In the future, a colorless Small Form-Factor Pluggable (SFP) ONU can be directly inserted into the AAU for easy installation.

- The Arrayed Waveguide Grating (AWG) incurs a power loss of about 5.5 dBm, which is lower than that of the optical splitter.

5G+FTTH Converged Gigaband Access Solution

WDM-PON is a key innovation that enables 5G+FTTH converged gigaband access. Compared with direct fiber connections between DU and AAU, the WDM-PON based fronthaul mode saves trunk fibers by more than 90 percent (shown as Figure 1). Another advantage of WDM- PON is that wavelengths can be flexibly allocated and resources can be remotely, centrally managed.

WDM PON enriches and perfects 5G fronthaul technology, giving operators more options by allowing for 5G+FTTH converged gigaband access in dense urban areas.

Based on the above principles, ZTE and China Telecom jointly launched the 5G+FTTH Converged Gigaband Access solution. The solution has unique advantages in trunk fiber, equipment space and power savings. Specifically, it:

- Cuts 95 percent trunk fiber by allowing up to 20 AAUs to share the same trunk fiber.

- Saves 10 percent power and shrinks space through OLT reuse.

- Reduces overall investments by 50 percent.

In addition to the high-density WDM-PON cards, the OLT also innovatively provides TDM-like channels to ensure a processing latency of less than 7µs in the OLT. If the distance between OLT and ONU is 5 kilometers, a transmission latency of 25µs will ensue over the fiber. Consequently, the total end-to-end latency is less than 32μs, which is 68 percent lower than the 5G URLLC requirements. The TDM-like channel handles traffic sent from 5G AAUs in real time without the queuing, buffering, forwarding, routing and searching processes. The resulting low-latency forwarding meets the stringent latency requirements of 5G fronthaul for URLLC applications.

Industry’s First WDM-PON for 5G Fronthaul Validation:

In December 2018, ZTE and the Technology Innovation Department and Optical Access Research Department of China Telecom jointly completed the industry’s first validation of Nx25Gbps WDM-PON for 5G fronthaul on the live network of China Telecom Suzhou Branch. The validation demonstrated that 25Gbps WDM-PON could carry 5G fronthaul services stably and transparently, with the data rate and end-to-end latency equal to those in a point-to-point direct fiber connection.

Achievements in WDM-PON Standards and Technologies:

ZTE and China Telecom collaborate to actively participate in the standardization of WDM-PON. The collaboration has produced numerous achievements including:

- Editor of “ITU-T G.Sup66 : 5G wireless fronthaul requirements in a passive optical network context” in October 2018.

- Submitted five proposals to the ITU-T, applied for 23 patents and released two papers.

3) Co-led the formulation of the “Nx25Gbps WDM-PON for 5G Mobile Fronthaul” series standards of China Communications Standards Association (CCSA).

4) Formulated the industry’s first enterprise standard on Nx25Gbps WDM-PON management channels for China Telecom.

5) Proposed the concept of SFP ONUs, which has been accepted by CCSA and is being incorporated into its standards.

Besides the achievements in WDM-PON standards, ZTE has also made breakthroughs in key WDM-PON technologies, including:

1) Developed 25Gbps WDM-PON optical modules with low cost, low power consumption, and high transmission power.

2) Developed the technology of ultra-low latency forwarding of CPRI/eCPRI traffic based on cell switching.

Summary and Prospects:

25Gbps WDM-PON is ideal for 5G fronthaul. It is a key innovation to enable 5G+FTTH converged gigaband access in an economical way. ZTE is currently extending WDM-PON based fronthaul from outdoor AAUs to a 5G indoor distribution system. When indoor 5G fronthaul is combined with the Passive Optical LAN (POL), 5G+FTTO (Fiber To The Office) converged dual-gigabit rates can be achieved in industrial parks.

References:

https://www.gsmaintelligence.com/research/?file=67a750f6114580b86045a6a0f9587ea0&download

AT&T FirstNet Makes Great Progress; Deal with Mutualink increases Inter-operability

FirstNet is a dedicated LTE network for public safety users, which passed 600,000 “connections” earlier this month. It has been built by AT&T and has has engagements with more than 7,000 public safety agencies.

FirstNet is built in public-private partnership with the First Responder Network Authority (FirstNet Authority). This helps to ensure that the FirstNet communications platform and service offerings meet the short- and long-term needs of the public safety community.

FirstNet is improving communications to allow for improved response times and outcomes for first responders from coast-to-coast, in rural and urban areas, inland and on boarders – leading to safer, and more secure communities. It provides innovation and dedicated capacity so public safety can take advantage of advanced technologies, tools and services during emergencies, such as:

- Applications that allow first responders to reliably share videos, text messages, photos and other information during incidents in near real-time

- Devices configured to meet the focused needs of public safety

- Improved location services to help with mapping capabilities during rescue and recovery operations

- Deployables available for planned and unplanned emergency events

……………………………………………………………………………………………………………………………….

Speaking this past week at the MoffettNathanson’s 6th Annual Media & Communications Summit in New York City, AT&T Senior Executive Vice President and Chief Financial Officer John Stephens discussed how the carrier’s deployment of FirstNet is progressing rapidly and laying the groundwork for 5G.

According to AT&T, FirstNet is 25% faster than any domestic commercial network. That claim is based on Ookla test data covering average download speeds in Q1 2019.

The FirstNet build-out is instrumental to AT&T 5G deployment plans, Stephens said. “The FirstNet contract, which is enabling us to go through a process from an LTE to evolve into a 5G network, is really working. We’re getting dramatic speed uptakes. If you look at the two fastest networks in the United States right now, they’re both ours…That’s what’s driving the business. That’ll drive innovation, that’ll drive opportunity.”

As AT&T upgrades its cell sites to deploy Band 14 [1] for FirstNet, crews are upgrading other equipment to support the 5G New Radio specification. Stephens said the operator is working toward “national coverage of 5G” by the “middle of the next year.”

Note 1. Band 14 is the spectrum licensed to the First Responder Network Authority (FirstNet) to create a nationwide public-safety wireless broadband network. Band 14represents 20 MHz of highly desirable spectrum in the 700 MHz band that provides good propagation in urban and rural areas and decent penetration into buildings.

……………………………………………………………………………………………………………………………..

This week, AT&T announced it would resell Mutualink to enhance interoperable communications for public safety. This new relationship will allow AT&T to bring Mutualink’s Interoperable Response and Preparedness Platform (IRAPP) to first responders and supporting agencies using services provided over FirstNet public safety communications platform.

Mutualink states on their website: “This network is the largest nationwide network of public safety agencies, critical infrastructure, schools and private enterprise security. The IRAPP is transport agnostic, device agnostic and media agnostic. It leverages your current communications assets and incorporates new devices as needed. Connect to the IRAPP network via public or private LTE, satellite or terrestrial broadband.”

“FirstNet brings public safety one, nationwide platform for consistent, reliable communications across agencies and jurisdictions,” said Chris Sambar, senior vice president, FirstNet Program at AT&T. “As apps and mobile data increasingly become critical components of the public safety response, we want to help make sure the flow of information that FirstNet provides remains seamless. Our agreement with Mutualink aims to do just that, taking the interoperability that FirstNet provides to the next level.”

FirstNet already facilitates multi-agency communications to aid in incident response and resolution. The agreement with Mutualink builds upon this, expanding the reach, reliability and capability of FirstNet services today. FirstNet subscribers can use the Mutualink IRAPP solution to enhance their ability to easily and quickly communicate across systems and applications, sharing voice, data, video and more in a highly secure environment.

By bringing the Mutualink solution to the FirstNet platform, first responders using Mutualink’s IRAPP will be able to simultaneously take advantage of key FirstNet capabilities – like First Priority™, which enables priority and, for first responders, preemption.

“Adding Mutualink’s Interoperable Response and Preparedness Platform to the FirstNet communications platform will increase the level of interoperability for public safety, especially with respect to on-demand cross-agency interoperability. Our solution enables highly secure sharing of video and data across systems and integration with smart sensor and IoT systems,” Mark Hatten, chief executive officer and chairman, Mutualink. “This will help FirstNet subscribers scale up their access to emerging information as the situation unfolds, creating a common operating picture for all involved.”

……………………………………………………………………………………………………………………….

“FirstNet is helping first responders solve long-standing interoperability challenges and arming them with the information they need to coordinate action plans and make critical decisions. We’re pleased to see AT&T form innovative collaborations that will help foster a new era of situational awareness for public safety,” said FirstNet Authority Acting CEO Edward Parkinson.

………………………………………………………………………………………………………………………

References:

https://www.firstnet.gov/network

https://about.att.com/story/2019/att_and_mutualink.html

https://mutualink.net/our-solution/

http://mutualink.net/wp-content/uploads/2017/03/1-National-Vision-White-Paper-3-17-17.pdf

https://www.rcrwireless.com/20190516/5g/att-5g-national-coverage

2019 IoT World: T-Mobile is Changing the Game for Massive IoT via NB-IoT

Introduction:

T-Mobile USA was the first U.S. wireless carrier to provide nationwide NB-IoT coverage last July. The “uncarrier” is very proud to have 81 million cellular customers and a very low churn rate. The company has invested billions of dollars in the last five years to modernize and transform its wireless network. As of February 7, 2019, T-Mobile’s LTE network now covers 325 million people, according to a recent earning report..

During his May 14th 2019 IoT World keynote, Balaji Sridharan, VP of IoT & M2M at T-Mobile US, described the challenges to overcome to realize massive IoT at scale and T-Mobile’s wireless networks that might be used for three different classes of IoT connectivity. Balaji also enumerate key features and attributes of NB-IoT and showed an interesting comparison chart of LPWANs. He said its 600 MHz spectrum is deployed throughout the U.S. [1]

Note 1. During its April 2019 earnings call, CTO Neville Ray said: “we have over 1 million square miles of 600 megahertz LTE rolled out. It’s working in 44 states and Puerto Rico. And we have a 100 million covered PoPs on 600 megahertz LTE. So we’ve said that in 2020, we’ll have a nationwide footprint on 5G.

…………………………………………………………………………………………

IoT Classification and Characteristics [from Ericsson white paper]:

Massive IoT: Connecting billions of devices, small amounts of data volumes, (mostly) sent infrequently, low power required for long battery life (years not days, weeks or months).

Broadband IoT will need high throughput and/or low latency.; large data volumes.

Critical IoT will require ultra high reliability/availability and very low latency. Industrial automation (and robotic surgery) will require time sensitive information delivery and precise positioning of devices.

Industrial Automation is tailored for advanced industrial automation in conjunction with the other cellular IoT segments. It includes Radio Access Network (RAN) capabilities to facilitate the support of deterministic networks which, together with ethernet-based protocols and other industrial protocols, will enable many advanced industrial automation applications.

These applications have extremely demanding connectivity requirements and require very accurate indoor positioning and distinct architecture and security attributes. Industrial Automation IoT reinforced by Critical IoT connectivity is the key enabler for the full digitalization of Industry 4.0 for the world’s manufacturers, the Oil and Gas sectors as well as smart grid components for energy distribution companies.

Above chart courtesy of Ericsson.

……………………………………………………………………………………………

T-Mo has wireless networks to meet all of the above IoT market segmants. In particular, NB-IoT, 4G-LTE, and (soon) 5G.

……………………………………………………………………………………………

Challenges to overcome for Massive IoT:

- Support billions of devices at scale (that includes provisioning and (re) configuration).

- Long battery life (via low power consumption of devices/things)

- Coverage enhancements

- Global reach

……………………………………………………………………………………………

NB-IoT meets the requirements for Massive IoT:

Operates in guard bands of T-Mobile’s LTE network. [2]

Wide range of devices to be connected to the Internet using existing mobile networks (rather then new network infrastructure).

Key benefits include: better battery life (again via low power consumption for connectivity), cheaper device costs ($5 certified NB-IoT module is now available), optimized data usage, reduced IP header and ability to transmit/receive non-IP data (which results in 30% to 40% less data transmission than if traditional IP was used), enhanced security via GSMA standards, licensed spectrum (no interference),, SIM based, and encryption.

Balaji said: “Improved network coverage is achieved via repetitions, which are used to enhance coverage.” [3.]

Note 2. NB-IoT can also be implemented in “standalone” for deployments in dedicated spectrum.

Note 3. From an IEEE published paper titled: Enhancing Coverage in Narrow Band-IoT Using Machine Learning:

NB-IoT needs only a small portion of the existing available cellular spectrum to operate without interfering with it. Hence, NB-IoT provides more reliability and more quality of service (QoS) as it operates in regulated spectrum. Moreover, NB-IoT uses existing cellular network infrastructure, which reduces the deployment costs.

However, since repeating transmission data and control signals has been selected as a major solution to enhance coverage of NB-IoT systems, this leads to reducing the system throughput and thereby a spectral efficiency loss.

…………………………………………………………………………………………………………………….

Here’s a comparison chart showing: 2G, licensed spectrum NB-IoT vs unlicensed band Sigfox and LoRa (WAN):

Chart courtesy of T-Mobile USA

…………………………………………………………………………………………………………………….

Balaji highlighted several Massive IoT applications that could effectively use NB-IoT for connectivity. Those include: asset tracking, smart metering, smart lighting, equipment monitoring, smart packaging, and intelligent waste management.

In addition to the $5 NB-IoT modules now available Balaji revealed T-Mo has a $5/year NB-IoT service plan.

T-Mo hosted the U.S.’ first NB-IoT Hackathon to develop IoT applications that would leverage NB-IoT as a viable wireless network. Sensing the presene of forest fires was an example he provided.

T-Mo partnered with Twillio to get NB-IoT to market. They created a new development kit that allowed Hackathon participants to access the NB-IoT network. [4.]

Note 4. More than 100 new and seasoned developers descended on T-Mobile HQ to help shape the future of NB-IoT at the Hackathon. 20 creative and unique IoT concepts for prospective IoT solutions emerged that could leverage the low cost and power efficiency of NB-IoT and its reliability over long distances.

……………………………………………………………………………………………………………………………

U.S. Carrier Comparison for NB-IoT Deployments:

T-Mobile launched its NB-IoT network last July. AT&T’s NB-IoT network went live two weeks ago. Sprint said it is testing NB-IoT technology, but it plans to merge with T-Mobile in the not-too-distant future so may not roll out its own NB-IoT offering.

…………………………………………………………………………………………………………………………

NB-IoT Chipset Forecast:

Research & Markets predicts the NB-IoT chipset market is expected to grow from USD 272 million in 2019 to USD 2,002 million by 2024 at a CAGR of 49.1%.

…………………………………………………………………………………………………………………………

References:

https://www.t-mobile.com/news/americas-first-narrowband-iot-network

https://iot.t-mobile.com/narrowband/

https://www.gsma.com/iot/wp-content/uploads/2018/04/NB-IoT_Deployment_Guide_v2_5Apr2018.pdf

https://iot.t-mobile.com/hackathon/

2019 IoT World: Award Winners in 11 Categories; Senet for Connectivity Solution

Winners of the first-ever IoT World Awards were named May 15th at the 2019 Internet of Things World conference. The awards program highlighted exemplary IoT projects, products and people in 11 categories, with 51 entries named as finalists.

A mix of editors, analysts, researchers, consultants and others participated in the judging process for the non-personal IoT World awards. The personal awards were chosen based on votes by nearly 5,000 industry professionals.

Here are the winners:

- Startup of the Year: Apana. Five-year-old Apana won in the startup category for its intelligent water management system, which helps to reduce water waste and optimize its use for industrial and commercial customers. Apana’s LoRa-based technology is installed as a retrofit kit and sends real-time water use data to the cloud. The service analyzes the data to identify patterns and sends information about water misuse to frontline workers, who could then take action to stop the waste.

- Enterprise IoT Deployment: Avis Budget Group. Avis Budget Group took home this prize in recognition of its multiyear program to connect its 600,000 vehicles to its IoT platform and mobile app. In 2018, partnerships with vehicle manufacturers such as Toyota and Ford, hardware companies such as ID Systems and technology providers such as Continental figured prominently in its plan to connect more than 100,00 vehicles. In Kansas City, it showcased connectivity of all 5,000 vehicles in its regional fleet there. Late last year, it announced its tech platform would be hosted on AWS Connected Vehicle Cloud. Avis Budget Group touts benefits of the program, both for the company and its customers. Internally, Avis has reduced operational costs and cut revenue loss from fuel and vehicle recovery. Externally, it says, customer satisfaction associated with the mobile app has increased in the double digits, measured by Net Promoter Scores.

-

Achievements in IoT Integration: Siemens MindSphere integration efforts. According to the company, its integration differentiators fall into three categories:

- Connectivity. Siemens provides connectivity to a range of assets and systems, including industrial and enterprise systems, data historians, supervisory control and data acquisition (SCADA), distributed control systems (DCS), manufacturing execution system (MES), manufacturing operations management (MOM), product lifecycle management (PLM), enterprise resource planning (ERP), quality management (QM) and supply chain management (SCM) systems and service platforms.

- Digital twin capability. Siemens said its digital twin platform integrates operational asset data; data from product, production and performance twins; and industrial IoT analytics.

- Ecosystem support. The company’s integration services encompass devices and systems (including on-premises and cloud-based systems) from Siemens as well as other manufacturers.

According to Siemens, its R&D team’s efforts related to integration focus on data lakes, data contextualization and data connectors for additional data integration within MindSphere. The company boasts of a benchmark it recently completed at an automotive company, with all integration and analytics work completed in two weeks — after two competitors spent five weeks without finishing either the integration or analytics work, it said.

-

IoT Merger/Acquisition of the Year: IBM and Oniqua. IBM acquired Oniqua, a maintenance, repair and operations (MRO) company focused on the mining, oil and gas, utilities, process manufacturing, and transportation industries, in June 2018 and then folded it into the Global Business Services and Watson IoT business units. IBM intends to leverage Oniqua to enhance its software as a service (SaaS) offerings aimed at digital transformation of asset-intensive industries, giving clients the ability to monitor, manage and proactively maintain their assets; minimize operational downtime; and optimize inventory costs. According to IBM, Oniqua gives the company the ability to improve its asset optimization portfolio, which includes Maximo enterprise asset management, predictive maintenance and prescriptive repair.

IBM says that Oniqua provides an ROI of between 100% and 400% in the first year of deployment; 15% to 50% reduction in inventory; 30% to 50% reduction in stock-out risk; 15% to 40% reduction in maintenance budgets; and 20% to 25% improvement in supplier performance.

-

Consumer IoT Solution: Phyn Plus Smart Water Assistant + Shutoff. According to the Phyn, the product gives homeowners an unprecedented understanding of their water use, toward the goal of avoiding leaks, conserving water and saving money. It monitors a home’s entire plumbing system from a single location on the water line, measuring changes in water pressure 240 times a second. It alerts homeowners immediately upon detection of a leak, diagnosing potential problems before they wreak havoc. The Phyn Plus Smart Water Assistant + Shutoff develops a “fingerprint” of each plumbing fixture in the home to be able to ID the source of a leak. If a home experiences a sudden large leak, the Phyn Plus can automatically turn off the water.

The product has a mobile app that allows remote monitoring of water usage, remote control of water use in up to six properties, and integration with Alexa for voice queries and commands.

-

Edge Computing Solution: Dell Technologies’ “open edge” software stack. The “open edge” approach consists of commercially supported versions of the open source EdgeX Foundry framework. It runs on Photon OS, is managed by VMware’s Pulse IoT Center and has builds available for Dell Gateway hardware or other ARM reference boards. The company describes the stack as modular and open, able to work with any device, hardware, app or cloud service. It has integrated device management and pre-built software connectors (to sensors and devices as well as to the cloud) that help accelerate the implementation, deployment and operation of IoT projects. Its open architecture allows developers to quickly move between projects without having to learn custom code, and components can be reused in multiple projects.

Best Edge Computing Solution shortlisted entries: Dell Technologies, EdgeX Foundry, FogHorn, Itron Inc., Lantronix Inc. and Relayr.

-

IoT Security Solution: AWS’ IoT Device Defender. This product audits device-related resources (such as X.509 certificates and client IDs) for compliance with best practices, such as the principle of least-privilege. It detects unusual behavior by continuously monitoring security metrics from the device and AWS IoT Core, and it reports devices that are out of compliance. It also facilitates mitigation steps, such as revoking permissions or rebooting a device.

The company cites customers across vertical markets, from industrial to consumer to enterprise.

-

IoT Connectivity Solution: Senet’s Low Power Wide Area Virtual Network. Senet said it takes a “revolutionary approach to providing IoT connectivity.”

Senet connects all customer network and gateway deployments through its Low Power Wide Area Network Virtual Network (LVN), where participating connectivity providers have access to the largest global LoRaWAN network and benefit from a revenue share model based on the role they play in the larger network ecosystem.

Senet’s LVN, Managed Network Services for IoT (MNSi) and public network are powered by its proprietary Network Operating System, which is built on a common cloud-based services architecture. The Senet operating system provides extremely efficient, scalable and secure options to connect and manage low-power, low-cost sensors at massive scale and simplifies historically complex operations related to application and device registration, message accounting and settlements.

The Low Power Wide Area Virtual Network allows device connectivity on any LoRaWAN network using Senet’s OSS and BSS platforms, which eliminates the need for roaming contracts and delivers low-cost connectivity. According to Senet, third parties can build IoT-related services on top of the Senet network. The company points to distribution partnerships with SenRa (India) and Inland Cellular (Northwest U.S.) and to deployments by New York City (LoRaWAN gateways on city-owned buildings in all five boroughs) and propane and oil tank monitoring company WESROC.

Best IoT Connectivity Solution shortlisted entries: Emnify, MediaTek, Nordic Semiconductor, PTC and Senet.

-

Industrial IoT Solution: IBM Watson IoT Platform. This service (available across public or private cloud or in a hybrid cloud deployment model) aims to simplify the process for industrial shops in a variety of markets to capture and explore data from IoT devices, equipment and machines. The service comprises three components:

- IoT Platform Connection Service. This service helps to securely register and connect resources to IoT Platform.

- IoT Platform Analytics Service. This service focuses on visualizing and analyzing IoT data, enabling AI-driven predictions about the assets connected to IoT Platform.

- IoT Platform Blockchain Service. This service aims to validate transactions among IoT resources within IoT Platform, delivering the ability to track and trace assets as, for instance, they move through a supply chain.

IBM touts the impact of IoT Platform across a range of industrial verticals, including cosmetics manufacturing, mineral mining, home appliance manufacturing, the shipping industry, railways, energy supply companies and offshore drilling operations.

-

Enterprise CxO of the Year: Joanna Sohovich. The CEO of access control and smart home integration company Chamberlain Group snagged this award based on her work on Chamberlain’s myQ technology, which enables users to control or monitor garage access via smartphone.

Lutz Beck, CIO at Daimler Trucks North America, took second place, and Arthur Orduna, CIO at Avis Budget Group, came in third.

-

Solution Provider CxO of the Year: Kevin Brown. Kevin, senior vice president of innovation and CTO in the Secure Power Division at Schneider Electric, is known for creating high-impact strategies and teams to maximize revenue, profit and competitive advantage.

Anthony Bartolo, chief product officer at Tata Communications, took the silver medal, and Bask Iyer, CIO at VMware, claimed third-place honors.

……………………………………………………………………………………………………………………………

IoT World Awards Winners Announced

FCC: White spaces on hold till Microsoft and TV broadcasters have consensus

The Federal Communications Commission (FCC) will put aside its work freeing up TV white spaces until Microsoft and broadcasters reach an accord on sharing the spectrum for wireless broadband, FCC Chairman Ajit Pai told the House Communications Subcommittee. He cited “tricky” technical and policy matters the agency needs to address even as Microsoft and TV stations try to find middle ground on the band’s use.

Pai was asked by Rep. Morgan Griffith (R-Va.) about the status of the white spaces “experiment,” who said that probably every part of his district has such white spaces. Pai said he had seen the promise of white spaces technology in places like South Boston, Va., a town in rural southern Virginia,

The chairman said there had been a lot of “tricky” technical issues and policy issues the commission had been hammering out (a number of them involving how to use that spectrum without interfering with licensed broadcast transmissions nearby).

The FCC in March resolved a number of petitions to reconsider the remote sensing database works, which is how unlicensed mobile devices can use the spectrum without–hopefully–interfering with TV station signals. So far broadcasters have questioned the efficacy of that process.

The FCC is permitting the use of white space devices (notably computers), both fixed and mobile, in unused channels, ch. 37, guard bands between broadcast and wireless spectrum and between uplink and downlink spectrum in the 600 MHz band–which they are sharing after the incentive auction.

It is part of the FCC’s focus on freeing up more spectrum for advanced wireless and closing the rural digital divide, which computer companies argue “white spaces” play a key role.

Pai praised Microsoft, the prime mover behind a white spaces rural broadband project, and the National Association of Broadcasters, who have agreed on a number of outstanding issues, though not on Microsoft’s desire to use adjacent channels, which NAB has argued is too close for comfort.

“If there is a consensus that allows us to move forward, we would like to do so,” he said, though he could not provide a timeline.

Huawei to compete in global consumer electronics market with world’s first “5G” TV

Huawei is reportedly preparing to produce the world’s first 5G TV as a way to challenge Apple and Samsung in the global consumer electronics market. The TV would include a “5G” modem [1] and 8K display resolution, allowing users to download high-resolution programming over cellular connections. Huawei would then be able to use some type of non standard “fixed 5G” network to download data-heavy content, such as 360 degree videos in which viewers can watch in every direction, and virtual reality programs. There are questions, however, over how soon the wider ecosystem for such services will be available.

Note 1. This author has no idea what fixed broadband network or frequencies will be used for this version of so called “5G.” Can’t emphasize enough that residential broadband Internet access and/or TV are NOT IMT 2020 use cases and are not being standardized by any accredited standards body.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Huawei’s first attempt to make TV sets is fueled by a desire to complete its “ecosystem” of consumer electronics — which already includes everything from smartphones to wearable devices — even as analysts voice doubts over the strength of its brand image. Among the potential benefits of a 5G TV is the fact it would not require the fiber optics or cable boxes that traditional cable or satellite broadcast services do. The TV could also act as a router hub for all other electronic devices in a home. The ultrahigh-definition 8K resolution, meanwhile, represents the most advanced TV screen on the market, with 16 times more pixels than the standard 1080 pixel high-definition. Indeed, 8K video is also shaping up as an important battlefield. Research company IHS Markit forecasts that shipments of 8K TVs will increase from less than 20,000 sets last year to 430,000 this year and to 2 million next year.

Huawei is the world’s biggest telecom equipment maker and in the first quarter of this year it overtook Apple to become the second-largest smartphone maker by shipments, just behind Samsung. It has signalled its determination to stay ahead in the 5G era. Besides 5G base stations, Huawei has already unveiled a 5G foldable smartphone and several home-use 5G routers that will be available later this year.

Samsung is currently the world’s biggest TV maker and just started shipping its own 8K TV without 5G capability starting at $4,999 this spring. Apple introduced the Macintosh TV in 1993, but it was not a hit, and the California tech giant has not released its own TV set since. It did, however, introduce a digital streaming box dubbed Apple TV in 2006 and has updated it several times to incorporate third-party applications, including Netflix. This March, the company unveiled Apple TV plus, a subscription service for original Apple content starring superstars such as Oprah Winfrey, Jennifer Aniston and Reese Witherspoon.

Many leading TV and camera makers are planning to roll out 8K products by 2020, as Japanese broadcaster NHK is set to broadcast the 2020 Tokyo Olympics in ultrahigh-definition. Samsung, LG Electronics, Sharp, China’s TCL, and Hisense all showcased 8K TVs at the Consumer Electronics Show earlier this year.

Huawei is not a total newcomer in the television business. The Chinese company’s chip arm Hisilicon Technologies is the world’s second-largest provider of TV chipsets after Taiwan’s MediaTek, and supplies to various local brands such as Hisense, Skyworth and Changhong, as well as Sharp. It also builds its own 5G modem chips in-house. Modem chips are a crucial component that help determine the speed of data transfers and the quality of phone calls. Although Huawei could secure large TV displays from local vendors BOE Technology Group and China Star Optoelectronics Technology, the supply of large, high-quality 8K displays is still dominated by Samsung Display, Samsung’s panel-making arm, analysts said.

“Compared with existing TV makers, Huawei likely has the most resources and knowledge related to 5G … so it’s very natural at the moment it would want to get into the sector,” said Eric Chiu, an analyst at WitsView. “It’s not yet known whether Huawei could quickly grab market share, but such a move could definitely help the Chinese company expand its brand into a new market and boost its ecosystem.”

C.Y. Yao, a tech analyst at the Taipei-based TrendForce, said there are still many challenges ahead for 5G-capable 8K TVs. “In addition to 5G base stations, you also need small-cell stations in the region, and there needs to be an ecosystem for 8K, including cameras, and 8K TV processors, encoders and decoders to broadcast 8K content, which are not yet mature.”

Cooperation with telecom operators to support the 5G service is also needed, which would disrupt current cable broadcasters, Yao added.

Huawei wants to complete is consumer electronics “ecosystem” and tie users more closely to its smartphones. © Reuters

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

In addition to getting into TVs, Huawei has also set a goal of becoming a top five PC maker by 2021 and target to triple shipments in that segment for 2019, a source told Nikkei. Though Huawei relies heavily on Intel for processor chips for laptops, the Chinese company is developing its own central processing units, or CPUs, for its computer product line, the person said.

Huawei is a latecomer to this market, having introduced its first laptop computer in late 2017. It shipped some 1 million units last year in the overall PC market of about 259 million units, according to research company IDC. Apple — whose MacBook line of laptops served as the inspiration for Huawei’s MateBook and MagicBook — is the world’s No. 4 PC maker, shipping some 18 million units last year.

President Linford Wang of Tablet&PC Product Line of Huawei Consumer Business Group told Nikkei that his company is making computers in hopes of completing its consumer electronics ecosystem. “But if we are able to expand our market share, that’s very welcome too.”

Joey Yen, an analyst at IDC, said Huawei’s emerging PC business is doing well in China, its home market, grabbing a nearly 4% share last year despite its recent entry and could gradually put some pressure on smaller PC makers such as Acer and Asustek Computer. “It also has chances to expand in emerging markets first,” said Yen.

While she was less confident about Huawei’s ability to challenge Apple’s strong brand image, she noted the thinking behind the company’s strategy. “It will surely hope that building key consumer electronics products such as laptops, smart speakers, earphones, and TVs will help consumers stay inside its ecosystem and be more loyal to Huawei’s phones.”

Huawei’s consumer electronics unit has become the company’s biggest revenue contributor for the very first time in 2018, making up 48.4% of annual sales of 721.2 billion yuan ($105.2 billion).

Its flagship telecom equipment business, however, experienced headwinds in many markets since last year as the U.S. has been lobbying allies to ban the use of the Chinese company’s equipment in crucial network infrastructure, citing cyber espionage concerns.

Huawei has consistently denied all the allegations and sued the American government on March 7 over being blocked from the U.S. Huawei has already rolled out a wearable product line including smart watches and wristbands, similar to Apple Watch and Fitbit’s offering. It also makes wireless earphones FreeBuds and FlyPods from its diffusion line Honor, to compete against Apple’s AirPods. The company’s AI speaker unveiled last October as an answer to Apple’ voice-activated Homepod. For 2018, it shipped 206 million units of smartphone and ranked as the world’s third largest vendor, just behind Samsung and Apple.

References:

https://www.techradar.com/news/huawei-is-developing-a-5g-8k-tv-because-thats-apparently-a-thing-now