Uncategorized

Dell’Oro: Market for disaggregated WDM systems increased 142% YoY in 1Q-2018

A new report from market research firm Dell’Oro Group states the market for disaggregated WDM platforms increased at a 142% year-over-year (YoY) growth in sales in the first quarter of this year. This high growth was driven by the adoption of disaggregated WDM systems expanding beyond web-scale companies and data center interconnect (DCI).

“Small form factor, disaggregated WDM systems were developed for the hyperscalers,” said Jimmy Yu, Vice President at Dell’Oro Group. “And for a long period of time, they were the only large purchasers. However, now we see a growing number of buyers that include cable operators and wholesale carriers. We think this is just the start of a good thing, and expect demand for these disaggregated systems will continue to grow at a hyper-scale rate,” added Yu.

Disaggregated WDM systems reached an annualized revenue run-rate of $800 million in the first three months of this year and Dell’Oro projects the run rate will exceed $925 million for full-year 2018. Ciena and Infinera currently have enjoyed the most success in this niche, with a combined market share of approximately 60% for the trailing four quarters ending in 1Q-2018.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Author’s Note: The move towards disaggregated network equipment started in the Open Compute Project (OCP) Networking and Telco groups. It’s now being propelled forward by the the Telecom Infra Project (TIP) which aims to create greater innovation and flexibility through disaggregation of traditional (vendor specific/proprietary) network equipment. TIP is also attempting to disaggregate optical line terminal equipment (e.g. OLT) and transmission systems such as those that use mmWave frequencies. We first wrote about this disaggregation mega-trend almost three years ago in this article.

Here’s a schematic of an open line system (OLS), which allow transponders from many different suppliers to share a single line system:

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Dell’Oro Group’s “Optical Transport Quarterly Report” provides tables stating manufacturers’ revenue, average selling prices, and unit shipments (by speed, including 40 Gbps, 100 Gbps, 200 Gbps, and 400 Gbps). The report tracks DWDM long-haul terrestrial, WDM metro, multiservice multiplexers (SONET/SDH), optical switches, optical packet platforms, and data center interconnect (metro and long haul).

To purchase this report, call Daisy Kwok at +1.650.622.9400 x227 or email [email protected].

About Dell’Oro Group

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

Smart Cities Week Silicon Valley: Lots of Progress in Many Areas

Introduction:

Smart Cities Week Silicon Valley was held May 7-9, 2018 at the Santa Clara Convention Center. In addition to highlighting the many new technologies deployed, practicalities such as financing, procurement, stakeholder engagement and program management were also discussed. For example, projects become a much easier sell if an agency can find alternative funding methods. Panelists outlined five of those methods: Monetizing infrastructure, Revenue sharing, Monetizing data, Fees and fare collection, Cost savings.

This article presents just a few highlights of this outstanding conference which should be a must attend for city officials everywhere.

………………………………………………………………………………………………………………………………………………………………….

Summary of Selected Sessions:

May 7th Workshop: Industry Exchange: Smart City Technology and Planning Standards; Moderator: Zack Huhn – Founder, Venture Smarter

Standards and guidance documents play a critical role in describing good practice and clearly set out what needs to be done to comply with specified outcomes. They help in the planning, design, manufacturing, procurement and management processes to ensure goods and services supplied are fit for purpose. This workshop discussed the emerging IEEE standard on developing a technology and process framework for planning a smart city.

IEEE PROJECT 2784 – Guide for the Technology and Process Framework for Planning a Smart City

This guide will provide a framework that outlines technologies and the processes for planning the evolution of a smart city. Smart Cities and related solutions require technology standards and a cohesive process planning framework for the use of the internet of things to ensure interoperable, agile, and scalable solutions that are able to be implemented and maintained in a sustainable manner. This framework provides a methodology for municipalities and technology integrators to use as a tool to plan for innovative and technology solutions for smart cities.

Approval Date: 28-Sep-2017 PAR Expiration Date: 31-Dec-2021 Status: PAR for a New IEEE Standard 1.1 Project Number: P2784 1.2 Type of Document: Guide

“We have been working to create agile, secure, interoperable and financially sustainable technology standards and planning guidelines for municipal leaders to support the vision of building smart cities and connected communities – regardless of socioeconomic or geographical barriers.” — ZACK HUHN

–>Much more in a forthcoming article about this IEEE Smart Cities Standards Project.

…………………………………………………………………………………………………………………

May 8th Panel Session- Transportation Investments: the Building Blocks for Tomorrow’s City

Transportation officials addressed the progress city, regional and state agencies are making towards planning for the future of mobility through investments in transportation infrastructure. With objectives such as increasing transportation options, enhancing the quality of life and improving sustainability, practitioners will address how planning, coordination with other departments to bring a range of services, creative financing and public-private partnerships that modern mobility possible.

Moderator

Jason Goldman – Vice President, ITSA

Speakers

Roger Millar – Secretary, Washington State Department of Transportation

Stefano Landi – Global Sales, Business Development & Partnerships, Verizon

Dan McElhinney – District 4 Chief Deputy District Director, CalTrans

Some characteristics and attributes of smart cities are: intelligent lighting and energy, smart traffic management, traffic data collection, driver aware parking, public safety, and intersection control through safety analytics.

Verizon is partnering with cities to provide connectivity solutions including small cells, fiber backhaul, 4G/5G/WiFi, and NB-IoT.

CALTRANS District 4 (SF Bay Area) is trying to control traffic congestion by ramp metering which is key element of the state’s Transportation Management System (TMS). They are also working on Smart Corridors like Contra Costa I-80.

CALTRANS/CHP goal is to clear major highway accidents withing <=90 minutes of occurrence. That objective was achieved in 75% of such incidents in Fiscal Year 2015/2016 (the latest year for which figures were available).

Somewhat surprisingly, CALTRANS is putting in a lot more fiber optic communications near roads and highways- mainly because of its reliability and future proof bandwidth capacity.

A vision of the CALTRANS Intelligent Transportation System is depicted in the following figure:

Image courtesy of CALTRANS

……………………………………………………………………………………………………………………………………………..

Future Ready — Growing an Innovation Ecosystem in your Community — Learn from Experienced Practitioners:

Through governance, regulation and investment, the public sector can create an environment in which innovation occurs. Cities, counties, states and other units offer access to technology and data, set policies that support startups through simplified regulations and licensing, and host incubators and accelerators. In this session, you will hear from practitioners from the San Diego region, the state of California and an Australian NGO about their efforts to create a climate of innovation and entrepreneurship.

Moderator

Emma Hendry – CEO, Hendry

Speakers

Marty Turock – Strategic Projects Consultant, Clean Tech San Diego

Erik Stokes – Manager, Energy Deployment and Market Facilitation Office California Energy Commission

Johanna Pittman – Program Director, CityConnect

It seems like the city of San Diego has made tremendous progress in intelligent clean tech and micro-grids, which may have replaced the “smart grid” so many experts were talking about several years ago.

Meanwhile, the California Energy Commission established BlueTechValley as part of a major $60 million initiative Commission launched about 18 months ago to really try to create a state-wide ecosystem to support clean energy entrepreneurship across the state.

“As part of this initiative, we created four regional innovation clusters to manage a network of incubator-type services that can encourage clean tech entrepreneurs in the region and really try to help make what can be a very tough road towards commercialization a little bit easier,” Erik Stokes said.

“BlueTechValley and their partners were selected to be the Central Valley cluster. A big reason for that was their strength and expertise in the food and agricultural sector,” he explained. One of the focus areas of the incubator is to find areas in farming to save costs and minimize greenhouse gases. “We really want to focus on those technologies that can help both reduce water use, as well as energy use,” Stokes added.

In a private chat, Erike opined that a lot of the “smart grid” platform vendors had migrated their offerings to data analytics for energy consumption and prediction of future usage trends.

Future Ready Cities — The Robust Mobile Network and Why You Need it Now:

Cities depend on mobile networks for day-to-day operations and delivery of citizen services, and this dependence is growing rapidly. In this session, mobile operators and local government officials will address the critical role of IoT applications for not only transportation, public safety and sustainability, but also for stimulating entrepreneurship, innovation and economic growth.

Speakers

David Witkowski – Executive Director of Civic Technologies, Joint Venture Silicon Valley

Peter Murray – Executive Director, Dense Networks

Rebecca Hunter – External Affairs, Corporate Development & Strategy, Crown Castle

Geoff Arnold – CTO, Verizon Smart Communities

Dolan Beckel – Smart City Lead, City of San Jose

……………………………………………………………………………………….

Closing Quotes:

“We need to be talking about smart regions, not smart cities” -Joy Bonaguro, Chief Data Officer, City of San Francisco.

“Most cities measure performance and miss the boat on measuring effectiveness. You can quantify subjective well-being and should” – Shanna Draheim, Michigan Municipal League Policy Director.

“The idea that we have to disrupt to move forward has poisoned our thinking. We should not discount incremental steps toward a solution. We should ask ourselves – what are the small changes we can make that over time lead to significant outcomes?” – Deb Socia, Executive Director of Next Century Cities – a public interest initiative helping cities that want fast, affordable, reliable broadband.

“The first-ever Smart Cities Readiness Hub at Smart Cities Week Silicon Valley paired cities that are starting their efforts with those who have already blazed a trail — and all gained useful insights.” – Smart Cities Council. Watch the video here.

…………………………………………………………………………………………………

About Smart Cities Council:

The Smart Cities Council, envisions a world where digital technology and intelligent design are harnessed to create smart, sustainable cities with high-quality living and high-quality jobs. A leader in smart cities education, the Council is comprised of more than 120 partners and advisors who have generated US$2.7 trillion in annual revenue and contributed to more than 11,000 smart cities projects.

…………………………………………………………………………………………………

Addendum: Smart Cities Market:

Global Smart Cities industry was valued at approximately $343 billion in 2016 and is anticipated to grow at a rate of more than 24.4% from 2017-2025 according to Research for Markets. The increasing demands for integrated security, safety systems improving public safety and the rising demand for system integrators are the key drivers for this market. Recent technological advancements in smart cities can also be included as a key driver.

Some of the important manufacturers involved in the Smart Cities market are Hewlett Packard Enterprise, Ericsson, General Electronics, Delphi, IBM Co., CISCO Systems Inc., Schneider Electric SE, and Accenture Plc. Those companies are investing in smart grid technologies. A major part of this is going into upgrading the outdated energy infrastructure with new and advanced infrastructure. Acquisitions and effective mergers are some of the strategies adopted by the key manufacturers.

GM and Toyota back DSRC to link connected cars to “smart” traffic lights; Ford, BMW, other auto makers favor “5G”

by Chester Dawson

Excitement around “5G” is eclipsing the prospects for a competing technology that General Motors Co. and Toyota Motor Corp. are backing, potentially giving rivals a leg-up in the race to debut vehicles with state-of-the-art internet connectivity.

The U.S. government has invested hundreds of millions of dollars in Wi-Fi-based technology known as DSRC (dedicated short-range communications)[1], that allows cars to link to “smart” traffic lights designed to smooth congestion and provide warnings about accidents or poor weather conditions ahead.

Note 1. DSRC (Dedicated Short Range Communications) is a two-way short- to- medium-range wireless communications capability that permits very high data transmission critical in communications-based active safety applications.

……………………………………………………………………………………………………………………………………………………………………………………………………

GM and Toyota strongly support DSRC technology. But Ford Motor Co., BMW AG and other auto makers are pressing the Trump administration to allow them to leapfrog that system by fast-tracking fifth-generation cellular broadband in automobiles. “5G” will transmits data at up to 10 times the speed of current broadband and improves reliability by potentially shrinking a self-driving car’s ability to stop to one inch, from one yard with today’s network.

The showdown between the Wi-Fi-based and 4G or 5G cellular-based standards for connected cars echoes winner-take-all format wars in other industries, and is a sign of how software is emerging as a new battleground for auto makers. The stakes are high as U.S. motor-vehicle deaths have risen in recent years. Car makers say vehicle-to-vehicle communication will ease congestion and improve safety.

Speeding up adoption of new technology is a priority for an industry that has lagged behind mobile-phone makers when it comes to connecting devices to the internet. The global market for connected cars is forecast to grow nearly threefold by 2022 with more than 125 million new internet-connected cars shipped over that five-year period, according to Counterpoint Research.

Current broadband, known as 4G, has enabled Wi-Fi hot spots and streaming, allowing passengers to surf the internet or watch videos in cars. The next wave of cellular technology will usher in new entertainment and safety features, enabling cars to access cameras on other vehicles that could alert them to accidents, obstacles and driving conditions.

Ultimately, drivers might even be able to order a Starbucks drink from their dashboard or take a nap while artificial intelligence operates the vehicle. Companies like BMW say faster data transmission through next-generation broadband is critical to accelerating this push.

“We are on a broader scale pushing the telecommunication companies to roll out 5G as quickly as they can,” said BMW management board member Peter Schwarzenbauer.

GM and Toyota, meanwhile, have models already equipped with DSRC, and are urging the Trump administration to support a 2016 proposal that would require auto makers to start phasing it into new cars as of 2021. The Transportation Department has yet to make a final ruling on that Obama-era proposal, even as auto makers are already well into the design phase of 2021 model year vehicles.

“Getting the rest of the industry to follow has been tough sledding,” said Steve Schwinke, director of GM’s advanced development and connected services.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

One issue with the technology backed by GM and Toyota is cost. Telecom companies plan to pay for upgraded cell towers and roadside antennas for 5G to service their existing networks. To fully deploy DSRC, billions of dollars in government-funded infrastructure is required, according to a U.S. Transportation Department estimate.

That short-range technology also would add about $300 to the price of a vehicle for dedicated equipment, the National Highway Traffic Safety Administration estimates. Most new vehicles come installed with cellular modems, so there would be little additional cost to drivers for 5G.

GM and Toyota alone account for about one-third of the new cars sold in the U.S., and roughly 20% of the vehicles sold world-wide. Toyota has delivered more than 100,000 cars equipped with DRSC in Japan and will offer it on most of its lineup in the U.S. by the mid-2020s in addition to cellular modems.

GM and Toyota see their Wi-Fi-based technology as a bridge to 5G, which has yet to be fully tested in vehicles and may take years to be fully deployed.

Critics say the government shouldn’t force car makers to use older Wi-Fi-based technology some say is out of sync with fast-evolving cellular broadband. Last month, Audi and Ford demonstrated cellular-based safety technology called C-V2X in what they said was the world’s first application of it using vehicles from different manufacturers.

“You will have, for the first time, cars speaking together and it’s important for them to speak the same language,” said Christoph Voigt, head of R&D connectivity for Audi. As chairman of 5GAA, a trade group supporting automotive 5G, Mr. Voigt petitioned federal regulators to avoid “directly or indirectly pick[ing] technology winners and losers” because he is confident 5G will become the de facto standard on its own merits.

Even as Volkswagen AG is aligning its premium Audi brand with 5G in the U.S. and China, it is hedging its bets by deploying a version of DSRC on VW branded vehicles in Europe starting next year. A representative for VW said the German auto maker currently has no plans to introduce that technology to its lineup in the U.S. market.

The Trump administration, pointing to the expected proliferation of 5G, this year blocked the takeover of U.S. chip maker Qualcomm Inc. by Singapore-based Broadcom Ltd. on national-security grounds. Qualcomm is negotiating chip supply contracts with at least half a dozen auto makers for coming models.

Industry experts say 5G smartphones will debut next year and the first cars with 5G modems will appear as soon as 2020. That is about twice as fast as the transition for current 4G technology, which was introduced for smartphones in 2011 but didn’t show up in cars until GMintegrated it into its latest version of OnStar remote communications in 2014.

“There is going to be 5G in every single next-generation car design,” said Nakul Duggal, the head of Qualcomm’s automotive business.

Write to Chester Dawson at [email protected]

References:

https://www.wsj.com/articles/auto-makers-at-odds-over-talking-car-standards-1525608000

https://www.its.dot.gov/factsheets/pdf/JPO-034_DSRC.pdf

https://www.its.dot.gov/factsheets/dsrc_factsheet.htm

https://en.wikipedia.org/wiki/Dedicated_short-range_communications

T-Mobile, Sprint Combo Bypasses Dish; With spectrum plus linear and OTT subscribers, satellite provider was seen as a logical partner

By Michael Farrell of Multichannel News

The announced merger of T-Mobile and Sprint, the third- and fourth-largest wireless carriers in the nation, answers many of the scale questions that have dogged the two companies over the past several years. But in creating a carrier with about 100 million customers and valued at a combined $146 billion, the deal bypasses what many had considered to be T-Mobile’s more perfect match: Dish Network.

With a large swath of wireless spectrum, 11 million satellite TV subscribers and 2.2 million customers for its over-the-top video service Sling TV, Dish was seen by many to be a logical target for T-Mobile. Combining the No. 3 wireless carrier, which has obvious video aspirations through its January purchase of Layer3 TV, with Dish would in many minds have created a strong competitor in the ongoing wireless-OTT-traditional video wars.

Investors apparently believed so too. Shares in Dish fell 3% ($1.19 each) to $33.55 per share on April 30, the first trading day after T-Mobile and Sprint announced their deal. The stock has continued to slip in subsequent trading, closing at $33.09 on May 3.

Video Plans ‘Ratchet Up’

On a conference call to discuss first-quarter results shortly after the Sprint deal was announced, T-Mobile chief financial officer Braxton Carter said the transaction “ratchets up” the wireless provider’s video plans by allowing the combined company to provide customers with an IPTV service via wireline and wireless broadband.

“So T-Mobile’s in the position as a new T-Mobile to be able to offer a quad play, if that’s what the market wants,” Carter said on the call.

The combined company will be controlled by T-Mobile management: CEO John Legere will continue that role in the new entity, as will T-Mobile chief operating officer Mike Sievert. T-Mobile parent Deutsche Telekom will own 42% of the combined company, with Sprint parent Softbank owning 27% and the remaining 31% held by the public. The deal is expected to close in the first half of next year.

This is the two companies’ third time on the merger dance floor together. They scrapped talks in 2014 over regulatory concerns and in 2017 over control issues. While the two have managed to work out their control issues, some analysts are skeptical that the current deal will sail easily through the regulatory process.

BTIG telecom analyst Walt Piecyk gave the merger a less than 40% chance of passing regulatory muster, primarily because he didn’t believe the deal, which will reduce the number of wireless competitors to three from four, will pass the antitrust smell test.

“It doesn’t look like a competitive market right now, and that’s what the regulator may focus on,” Piecyk told CNBC.

Columbia Law professor Tim Wu wrote an op-ed piece for The New York Times urging regulators to block the deal, adding that having four separate competitors has been most beneficial to wireless customers, leading to free unlimited data plans and lower prices. Transforming the wireless business into a “triopoly” like the airline business will only serve to raise prices and lower service.

“Competition has actually worked the way economists say it is supposed to, forcing firms to improve quality or face elimination,” Wu wrote in the Times. “But it takes competitors to compete, which is where blocking mergers comes in.”

Pivotal Research Group CEO and senior media & communications analyst Jeff Wlodarczak has said in research notes over the past year that pairing Dish and T-Mobile would “immediately vault the most disruptive U.S. wireless player into the leading U.S. spectrum position,” and at worst would force rival wireless company Verizon Communications to pay more for the satellite asset. For now, though, it looks like Dish will remain on its own. Other scenarios see the satellite company being acquired either by another wireless service provider, like Verizon, or even by the new T-Mobile. The latter scenario wouldn’t take place for at least another year. Dish has struggled over the past several quarters as the satellite business has dwindled. In the fourth quarter the company lost more than 100,000 satellite-TV subscribers and added 160,000 Sling TV customers.

Dish Misses Out on Buildout Relief

For Dish, a purchase by a wireless carrier would mean relief from its obligation to build its own wireless network. As a result of its success in bidding on spectrum in several of the government’s wireless auctions, Dish faces a March 2020 deadline to build out wireless service in 70% of the market territories it won.

Dish chair Charlie Ergen has said the company will spend about $1 billion on that initial phase, which will be more geared toward IoT services.

For T-Mobile, a Dish purchase would give it an instant video base through the satellite-TV offering, programming contracts with cable networks and the largest OTT service in the country, Sling TV.

But not all analysts believe that a T-Mobile-Dish deal is more palpable. In a research note in November, after T-Mobile and Sprint ended merger talks, MoffettNathanson principal and senior analyst Craig Moffett wrote that he never saw any synergies in combining those companies, other than as a source of additional spectrum.

The argument that the dissolution of the merger was bad news for Dish is equally compelling in that, if Dish does build its wireless network, it would become the fifth player in an already-crowded market, he added.

“However bad one might have imagined the ROI (Return on Investment) for network building, it has to be worse if the industry is more fragmented than expected,” Moffett wrote in November.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Dish’s Spectrum Yet to be Deployed:

Dish has quietly worked to cobble together a significant amount of spectrum via spectrum auctions and secondary-market transactions. The company’s first spectrum purchase was made through EchoStar’s relatively minor purchase of E Block licenses for $700 million in the FCC’s 700 MHz spectrum auction in 2008. But Dish in 2011 spent $2.77 billion to acquire 40 MHz of S-band satellite spectrum from bankrupt TerreStar and DBSD North America. Then, in 2014, Dish was the only bidder in the FCC’s H Block spectrum auction, essentially walking away uncontested with 10 MHz for around $1.6 billion. In 2015, Dish spent roughly $8 billion on AWS-3 spectrum licenses, and then just two years later it committed a whopping $6.2 billion to buy 486 licenses in the FCC’s 600 MHz incentive auction.

Dish recently outlined plans to build a NB-IoT network using its spectrum to provide connectivity to a wide range of devices other than traditional tablets and smartphones. Some analysts remain skeptical, though, believing that Dish plans to either sell or lease its spectrum, or partner with an existing service provider to join the wireless market.

Dish has to comply with Federal Communications Commission requirements that a network using the spectrum it owns be deployed by 2020, Josh Yatskowitz, an analyst at Bloomberg Intelligence, said last November.

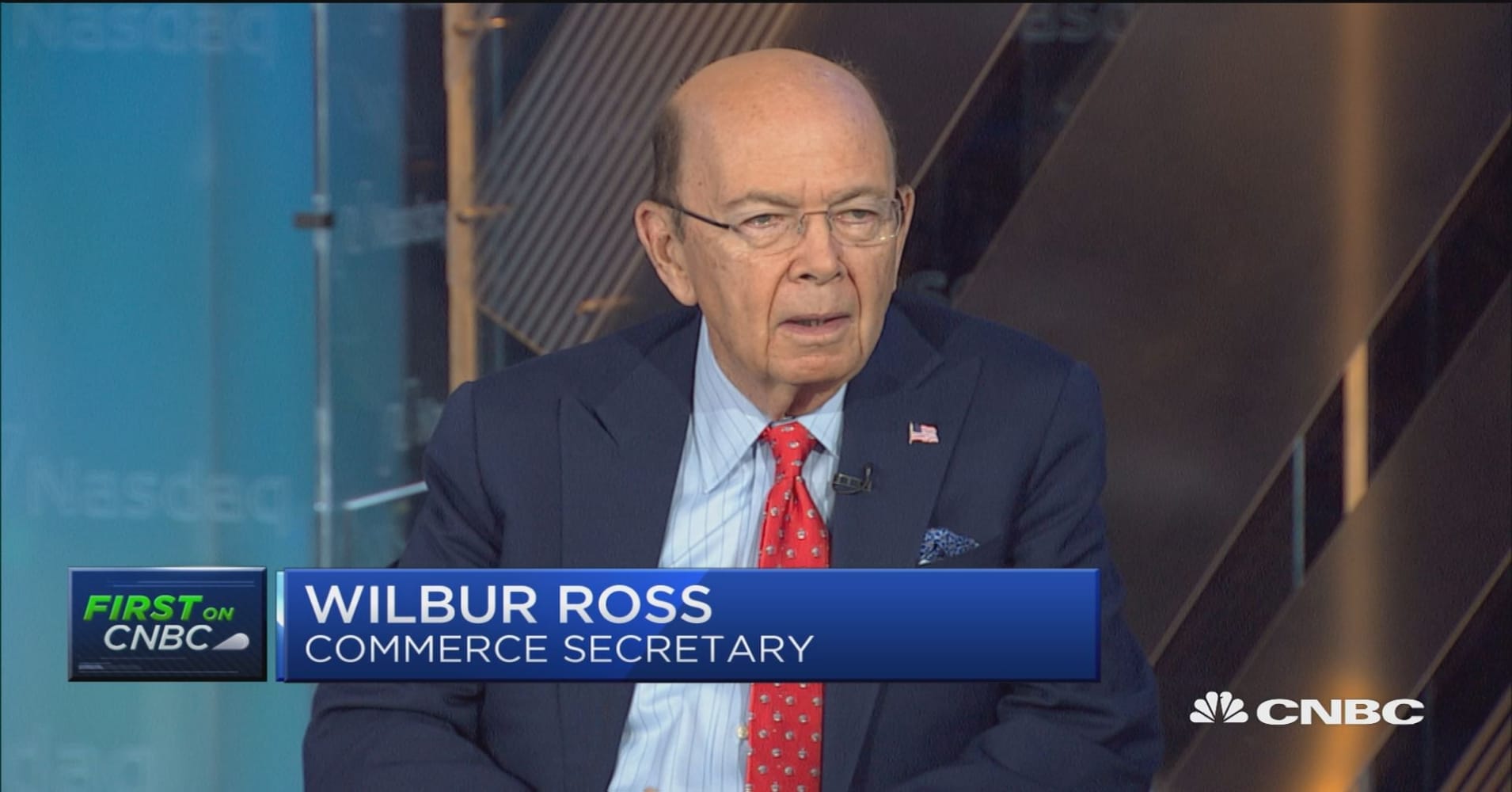

U.S. Commerce Secretary Talks Up 5G Implying T-Mobile/Sprint Merger Would Accelerate 5G Deployments in U.S.

The Trump administration is placing a high priority on building 5G mobile networks, Commerce Secretary Wilbur Ross told CNBC in a discussion of T-Mobile’s proposed merger with Sprint. According to a CNBC provided transcript of the interview, Ross said:

“You never know who is really ahead or behind (in 5G) until it is truly perfected. Nobody has 5G totally perfected yet. I think the pitch that Sprint and T-Mobile are making is an interesting one that their merger would propel Verizon and AT&T into more active pursuit of 5G. Whoever pursues it, whoever does it, we’re very much in support of 5G. We need it. We need it for defense purposes. We need it for commercial purposes. We (the U.S.) really need to be the player in 5G.”

A video of the interview can be watched here.

……………………………………………………………………………………………………………………………………………………………………………………….

The Federal Communications Commission (FCC) said in February it planned new auctions of high-band spectrum starting later this year to speed the launch of next-generation 5G networks. Carriers have spent billions of dollars acquiring spectrum and are beginning to develop and test 5G networks, which are expected to be at least 100 times faster than current 4G networks and cut latency, or delays, to less than one-thousandth of a second from one-hundredth of a second in 4G, the FCC has said.

Policymakers and mobile phone companies have said the next generation of wireless signals needs to be much faster and far more responsive to allow advanced technologies like virtual surgery or controlling machines remotely. T-Mobile Chief Executive John Legere met with two FCC commissioners in Washington on Tuesday to discuss the merits of the deal.

………………………………………………………………………………………………………………………………………………………………………………………..

Sprint is beginning to train its employees on what to say regarding the merger.

A memo has leaked out, courtesy of XDA-Developers, that shows the talking points that Sprint wants its customers to focus on. According to the document, Sprint employees are supposed to say that the company is very excited that the two companies have agreed to merge. And add that “this is terrific news for customers.” As well as assuring customers that the new T-Mobile will have “a faster, more reliable network at lower prices and with better value.” Which is basically what Sprint and T-Mobile said on Sunday and on Monday during their press tour with different news sites and TV networks.

Columnist Alexander Maxham wrote: “It is definitely important for Sprint to begin training its employees on what to say to customers regarding this merger, as there are bound to be a ton of questions regarding the merger in the coming weeks and months. T-Mobile is likely also training its employees on what to say about the merger – and many of the talking points are likely very similar if not exactly the same. Though T-Mobile’s memo has not leaked just yet. The two companies believe that merging together, they’ll be able to provide the best 5G network in the US, and also be able to better compete with AT&T and Verizon, both of which are more than twice the size of T-Mobile, and almost three times the size of Sprint.”

Huawei’s growth due to increased smartphone sales (but not in U.S.); China to lead world in 5G handsets

In an annual business report meeting with journalists in late March at the company’s Shenzhen, China headquarters, Huawei reported that its total revenue grew 15.7%, to $92.5 billion, in 2017. More impressive, net profit grew 28.1%, to $7.3 billion, a huge improvement over 2016’s 0.4% rate. Privately owned Huawei gets most of its revenue now from selling telecom/network equipment, which generated roughly $47 billion over the past year. While that was only a 3% growth rate, the Chinese company enjoyed a 35.1% growth in its enterprise business unit, which includes cloud computing and big data, though the overall revenue of $8.7 billion is relatively small.

Until 2020 (or later), when”5G” is deployed by carriers using Huawei base stations, the company’s fastest growing and most visibly prominent area is and will be its smartphones.

Huawei’s Deputy Chairwoman and Chief Financial Officer Sabrina Meng, along with CEO Ken Hu, recently told reporters how the company managed to increase net profits and net profit margins at a rate higher than total revenue growth. The company became more efficient at growing smartphone sales. “In 2016, one of the biggest areas that dragged consumer business group profits down were the high cost of components,” said Meng. “So we developed a better supply management chain and improved our working relationships with vendors.” Hu added that whether it’s brand image with consumers or phone units sold, Huawei made significant improvements in 2017. According to data released to the media, Huawei and sub-brand Honor combined to sell 153 million handsets in 2017, generating $37.85 billion in sales. The smartphone market is arguably the most competitive industry in all of consumer business with many players jockeying for a small market share behind kingpins Samsung and Apple.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Ben Sin of Forbes recently wrote, “the Huawei P20 Pro is the new low light photography king (of smartphones), and it’s not even close right now.” It’s even better than the Samsung Galaxy S9+ which received excellent reviews from journalists that tested it. The Huawei P20 Pro. Photo courtesy of Forbes.com:

The Huawei P20 Pro has a 6.1-inch display with an 18.7:9 aspect ratio. The screen’s unusually tall aspect ratio makes the phone very easy to hold and reach across, and the panel is an OLED from Samsung, so it’s very good. The resolution here is just 1080p so technically it isn’t as crisp as the Quad HD found on other Android flagships, but frankly it doesn’t matter. What does matter is that the OLED panel on the P20 Pro just doesn’t get as bright as the panel on the Galaxy S9. I suspect Huawei’s Samsung OLED panel is a generation behind the ones used on the S9. The back of the handset is crafted out of glass, and it attracts fingerprints just as much as Samsung or LG phones. The P20 Pro ships in colors that are a bit different from the norm, including an eye-catching Twilight color with a gradient finish. The phone also comes in black or this pinkish gold color.

The triple camera set-up includes: a 40-megapixel RGB lens, 20-megapixel monochrome lens, and an 8-megapixel telephoto lens. Huawei has used the RGB+monochrome combo for its phones since 2016, so the new addition here is the telephoto lens, which offer lossless optical zoom. The optical lens is a 3X zoom compared to the Apple iPhone X’s 2X zoom.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

U.S. Market Difficult to Enter for Huawei, ZTE and other China based Companies:

As the U.S. government, and more recently AT&T and Verizon, have taken numerous steps over the years to prevent Huawei from entering its market. Xiang Ligang, a telecom veteran and CEO of the industry website Cctime, said it has become increasingly challenging for Chinese telecom companies to do business in the U.S. amid heightened concerns over national security.

“The U.S. is a market Chinese companies must conquer if they want to become global players. But now politics rather than technology or products is playing a bigger role in their business prospects in the U.S.,” Xiang said. He also opined that China’s handset producers have an edge in developing 5G terminal devices compared with their U.S. competitors. “In terms of the research and innovation ability, the global top four telecom equipment suppliers are Huawei, Ericsson, ZTE and Nokia… two out of the four are Chinese technology giants and we could barely name a U.S. company,” he said. “Without 5G-capable terminal devices, you cannot access a 5G network.” Xiang believes this year will be a watershed for China’s 5G technology development. He thinks the final testing of “basic 5G” technologies will be completed (this author disagrees and things that won’t be before 2021), paving the way for the next phase of development – 5G products such as terminal devices (e.g. smartphones, other handsets, IoT devices, etc).

In addition to compatible terminal devices, China’s investment in 5G infrastructure also bodes well for its position in the intensifying global competition. Under the guidelines of the National Development and Reform Commission, the country’s three State-owned network operators – China Mobile, China Unicom and China Telecom – have each announced plans to begin building 5G networks this year in at least five cities. China Mobile said in February that it may be able to offer a full 5G service by the end of 2019, a year ahead of the 2020 goal, thanks to a technology known as “slicing packet networks,” which help operators to manage network architectures, bandwidth, traffic, latency and time synchronization, said another Xinhua report.

Huawei, failed to get its smartphones sold in the local carrier retailing channel, which accounts for a majority of smartphone sales in the US. Verizon Communications Inc has dropped all plans to sell Huawei’ s phones, while AT&T Inc also walked away from a similar deal at the last minute under pressure from the U.S. government, according to a Bloomberg report.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Sidebar: Top Smartphone Makers

Currently, Chinese companies account for 7 of the world’s top 10 smartphone vendors (see top 10 below), but in the U.S., only one Chinese brand stood out – ZTE Corp grabbing a market share of 12 percent. “Such contrast is a result of multiple factors, and political concern is certainly one of them,” Xiang said. As a result, Huawei will likely focus on increasing smartphone sales in Asia, Europe and Latin America.

According to marketing91, the top 10 smart phone makers in 2017 were: 1) Samsung 2) Apple 3) Huawei 4) Lenovo 5) Xiaomi 6) LG 7) ZTE 8) Oppo 9) Alcatel 10) Vivo

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Looking for Future Growth:

This year marks Huawei‘s 30th birthday. Following the general Chinese idea that age 30 is when a boy truly becomes a man, the company is looking for new growth opportunities.

“As we look to 2018, emerging technologies like the Internet of Things, cloud computing, artificial intelligence and 5G will soon see large-scale application,” said Hu. “Throughout this process, Huawei will . . . pay special attention to the practical challenges that our customers face as they go digital. Our job is to help them overcome these challenges and achieve business success. Ultimately, we aim to bring digital to every person, home and organization for a fully connected, intelligent world.”

Mozilla Foundation: Internet is NOT Healthy! FB Google, Amazon and Tencent Hold Too Much Power

The Mozilla Foundation has published its 2018 Internet Health Report, specifically citing consolidation of control as a concerning issue. Other areas of concern include web literacy, “digital inclusion,” openness, and personal privacy and security. “Fake news,” IoT security weakness and hacking are symptoms of larger problems.

Mozilla Foundation Executive Director Mark Surman explained the harm done by Facebook’s failure to enforce its privacy policy. In a blog post today, he described the process of creating the 2018 Internet Health Report. As Surman and foundation fellows were discussing how to examine the topic of “fake news,” he wrote, “I sketched out a list on a napkin to help order our thoughts:”

What the napkin said:

Collecting all our data

+ precision targeted ads

+ bots and fake accounts

+ FB dominates news distribution

+ not enough Web literacy

= fuel for fraud and abuse, and very bad real world outcomes

…………………………………………………………………………………………………….

Edited by Solana Larsen and written by Mozilla Foundation research fellows, the Internet Health report is an evaluation of “what’s helping and what’s hurting the Internet,” and it focuses on five broad areas of concern—personal privacy and security, decentralization, openness, “digital inclusion,” and general Web literacy. And Facebook’s part in the health of the Internet is writ large across the report.

Of particular concern were three issues:

- Consolidation of power over the Internet, particularly by Facebook, Google, Tencent, and Amazon.

- The spread of “fake news,” which the report attributes in part to the “broken online advertising economy” that provides financial incentive for fraud, misinformation, and abuse.

- The threat to privacy posed by the poor security of the Internet of Things.

The foundation’s report isn’t all bad news—it highlights progress in affordable access and the adoption of cryptography. But the cautionary notes outweigh the optimistic ones, especially on the topic of consolidation of control over Internet content and collection of personal data. While the data collected and transformed into intelligence by the big social media and e-commerce vendors is vast, the Mozilla Foundation report warns, “The network control of major Internet services is only part of the grip they hold on our lives. Through sheer size and diverse holdings, a few companies including Google, Facebook, and Amazon—or if you live in China, Baidu, Tencent and Alibaba—have become intertwined not only with our daily lives, but with all aspects of the global economy, civic discourse, and democracy itself… they are too big. Through monopolistic business practices that are specific to the digital age, they undermine privacy, openness, and competition on the Web.”

That impact extends into the realm of “fake news,” as the report points out, because “most people are getting at least some of their news from social media now.” This enabled the Russia-based Internet Research Agency’s efforts to distort reality by creating dozens of ‘fake’ Facebook pages, including “BlackMattersUS” and “Heart of Texas,” as the report cites—using the language of US political movements to attract followers and spread misinformation—as well as organizing actual protests, “and once even a protest and a counter protest at the same time,” the report notes.

At the same time, thousands of “fake news” stories were created entirely to generate revenue from advertising—many of them created by people in one town in Macedonia. Social media platforms allowed these fraudulent articles to generate hundreds of thousands of dollars in revenue for their creators.

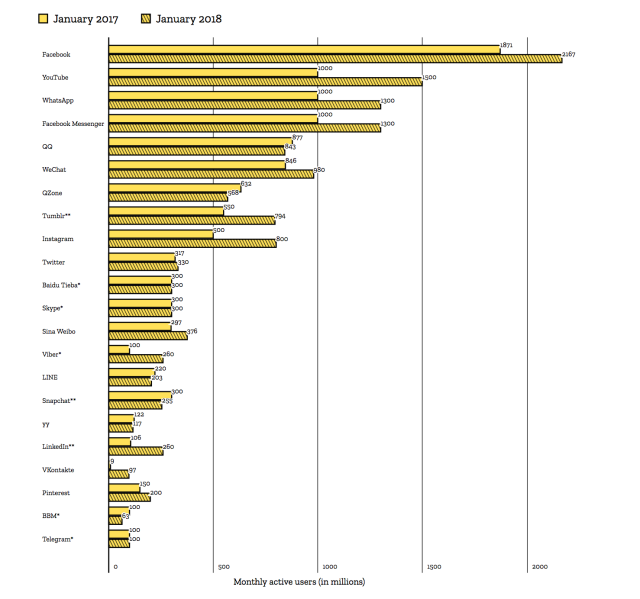

Social media sites are a natural platform for this sort of deception and fraud, because it’s where the eyeballs are. The reach of social media companies has continued to expand, as the report shows in this chart of monthly active users, in millions, for each social media platform. During 2017, Facebook managed to expand its monthly active user base from 1.87 billion to 2.17 billion, while expanding its reach into users’ lives as millions more adopted Facebook’s Messenger application and WhatsApp (each of which now has approximately 1.3 billion monthly active users).

The precision with which these platforms can be used to target particular types of users and to effectively distort their perception of the world around them makes the dominance of the Internet by Facebook and others even more dangerous, the researchers asserted.

The emerging Internet of Things poses its own sort of danger to the privacy and security of individuals. With 30 billion Internet-connected devices expected by 2020, the report’s authors expressed concern about both the privacy impact of those devices and the threat posed by malware like the Mirai botnet that struck the Internet last year. The report warns that “the risk of all these insecure ‘things’ still exists, and the scale grows bigger with every new connected device.”

………………………………………………………………………………………………………………………

Here’s the link to an excellent webinar that analyzes the crux of the Facebook/Cambridge Analytica fiasco. The bottom line is Facebook didn’t enforce its stated privacy policies and there was no regulatory oversight to hold them accountable. This author asked the first question towards the end of the webinar at 56:05. The presenter said “That’s a very weighty question but I’d appreciate it.”

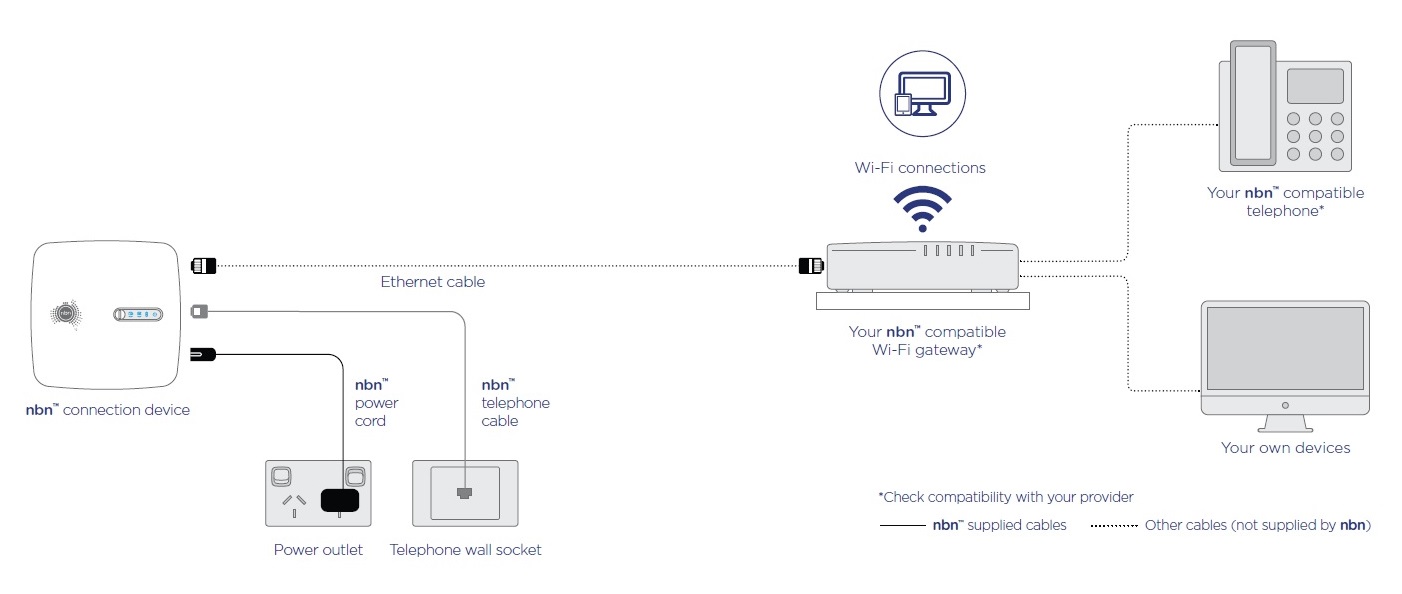

New FTTC technology to be deployed in Australia under NBN rollout

More than 1000 homes and businesses in North Melbourne and Sydney’s south will be the first to benefit from new technology under the NBN rollout that will deliver faster broadband speeds. NBN Co is providing a limited release of its fiber-to-the-curb (FTTC) technology that will connect to a telecom pit near a driveway outside a home or business rather than a junction box down the street, with a larger release due in the second half of this year. Fiber-optic cable is connected to the pit outside the home or business, with existing copper lines used to connect the Internet to the premise. [That’s the same topology used by AT&T’s U-verse in the U.S.]

NBN Co‘s chief network engineering officer Peter Ryan labelled the Australian-made technology a “breakthrough:”

“It allows us to deliver a lot of the benefits of fiber-to-the-premise (FTTP) without the inconvenience of digging front lawns of Australians,” he told reporters. “It allows us to deploy the NBN faster and at a lower cost and complete the network by 2020,” he added.

Testing has seen download speeds of over 100 Mbps and more than 40 Mbps uploads. That could reach a gigabit per second with the addition of new “copper acceleration technology”, which is planned in selected areas by the end of the year.

About one million premises are expected to be connected by 2020, Communications Minister Mitch Fifield said, although that could change. “This is really good news and a further development in the evolution of the NBN,” he told reporters alongside Treasurer Scott Morrison at the launch in Miranda, in Sydney’s south, on Sunday.

nbn™ Fibre to the Curb (FTTC) equipment

For more information, please visit: https://www.nbnco.com.au/learn-about-the-nbn/network-technology/fibre-to-the-curb-explained-fttc.html

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

NBN Co will decide what other locations will get the FTTC broadband access, based on what technology “makes sense” in any given area, Mr. Fifield said. FTTC can deliver the same 100Mbps speeds as fiber-to-the-premise, but at a lower cost, in much less time and with far less disruption to people’s property, he added. Mr Fifield guaranteed all premises would get at least 25 Mbps, with 90 per cent above 50 and 72 per cent at 100 Mbps. “The Turnbull government is keeping broadband bills down and taxes lower by rollout the NBN sooner and more affordably,” he said.

NBN Co’s chief customer officer for residential, Brad Whitcomb, said new “copper acceleration technology” known as G.fast could deliver even faster speeds in selected areas by the end of the year.

Mr Whitcomb said NBN has been working closely with service providers to test the new FTTC over the past few months.

“As with the introduction of any new technology, we will continue to gain insights as we navigate the complexity of the build as well as potential issues which can arise when people connect to the network,” he said in a statement.

Mr. Fifield is confident the network will meet the speed needs of Australians once completed in 2020, but noted NBN Co would pursue upgrade options if needed. “I think the experience people are having today is, overwhelmingly, a good one,” he said.

https://thenewdaily.com.au/news/state/nsw/2018/04/08/nbn-fttc-sydney-melbourne/

OCP – Linux Foundation Partnership Accelerates Megatrend of Open Software running on Open Hardware

“From 1876 to 2013 telecom and network equipment design was proprietary….We are now in the 3rd phase of open networking transformation,” said Arpit Joshipura, Linux Foundation GM of Networking at the 2018 OCP Summit. The network equipment design transformation is shown in the figure below:

During his OCP Summit keynote speech, Arpit announced a partnership between OCP and the Linux Foundation to further the development of software and hardware-based open source networking. The organizations will work together to create stronger integration and testing, new open networking features, more scalability, a reduction in CAPEX/OPEX, greater harmonization with switch network operating systems, and increased interoperability for network functions virtualization (NFV) network transformation.

Virtualization of network functions and the resulting disaggregation of hardware and software have created interest in open source at both layers. OCP provides an open source option for the hardware layer, and The Linux Foundation’s OPNFV project integrates OCP along with other open source software projects into relevant NFV reference architectures. Given this alignment, OCP and OPNFV already have been collaborating on activities such as plugfests and joint demos. Now they have committed to expanded collaborative efforts which will accelerate the megatrend of totally open networking.

“It’s exciting to see the principles of open source software development come to hardware, and OCP has already made a substantial contribution to some Linux Foundation project plugfests and demos,” said Arpit Joshipura in the referenced press release. “We see OCP as an integral partner as we explore new opportunities for NFV deployments, performance, features, and footprint. Global network operators agree and ranked OCP very high on a list of the most important projects for OPNFV in a recent survey. We look forward to continued and intensified collaboration across ecosystems.”

The key market disruptors- virtualization of equipment functions, software defined networking and disaggregation of equipment are shown below with the applicable software and hardware entities on the left, and sample open source projects on the right of the figure below.

Arpit said the drivers behind this huge move to open source software running on open source hardware are 5G and the Internet of Things (IoT). Mandatory automation of functions (e.g. provisioning and configuration) are (and will be) required to support the high speeds/low latency of 5G and the huge number of IoT endpoints.

The Linux Foundation Networking (LNF) group’s vision includes automating cloud services, network infrastructure, and IoT services as shown in this illustration:

The Linux Foundation Open Source Networking activities include participants from telecom carriers, cloud computing, and enterprises. As shown in the illustration below, 9 out of 10 of the most important projects of participants will use open source software with all 10 of the largest network equipment vendors actively involved and 60% of global subscribers represented. Shared innovation and a 15 minute “new service creation time” are selected goals of the LFN projects.

The .Linux Foundation is leading the way forward to harmonize open source software efforts and get them into the community. In the figure below, the services, software and infrastructure are shown on the left, the various open source projects are shown in the center, and the various standards organizations (but not the actual standards) are shown on the right. It should be duly noted that there are no official standards bodies working on open networking specifications to provide multi-vendor interoperability of exposed interfaces or even APIs within a single piece of equipment.

To clarify that point, Arpit wrote via email: “LFN (which hosts ONAP), is working on de-facto automation open source aspects independent of 5G/4G. The 5G services mandate automation due to IOT and new services that are coming up. The specific specs of 5G are out of scope for Networking Automation. OCP and LFN partnership is limited to what I spoke at the OCP Summit keynote.”

Note: There are more than 20 open source projects for networking currently active at the Linux Foundation (see above illustration). LF also has expanded lately into areas as diverse as software for IoT devices, storage and blockchain. It remains to be seen if the OCP – LNF partnership will create defacto standards (e.g. for virtualization of functions in 5G or IoT) or try to enforce interoperability through certification programs. The current motivation seems to come from carriers like AT&T which are demanding open source software on open source hardware to lower their CAPEX/OPEX and to improve automation of network functions.

…………………………………………………………………………………………………………………………………………………………………………………………………………………

Mr. Joshipura asserted that the LFN+OCP partnership would produce the very best of Open Source Software & Hardware. The total community collaboration will include: Hardware Vendors + Silicon Vendors + OEM/Manufacturers + Software Vendors, Systems Integrators + End Users.

…………………………………………………………………………………………………………………………………………………………………………………………………….

Arpit provided a strong conclusion via email:

“Open source networking software is creating de-facto platforms that result in faster innovation across many IT communities. Collaboration between the leaders in open hardware (OCP) and Open Source Software (Linux Foundation Networking) will help propel this even further and broaden the scope of true open networking. This industry collaboration allows faster deployment, but still offers innovation on top.”

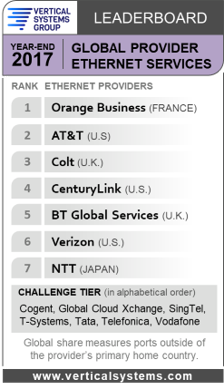

Vertical Systems Group 2017 Global Ethernet Service Provider Leaderboard

France’s Orange remained first while AT&T improved its position to second place in Vertical Systems Group’s (VSG) newly released 2017 Global Ethernet Leaderboard report. UK’s Colt was third while CenturyLink made its first appearance in the rankings finishing in fourth place. VSG said slim margins separated the leaders.

“With very slim margins separating the leading global service providers, Orange remains in first position, AT&T advances to second, and CenturyLink makes its debut,” Rick Malone, principal at Vertical Systems Group said in a press release. “To serve this specialized global market, key providers are increasing deployments of higher speed Ethernet connectivity to MPLS, VPLS and cloud services, while transitioning customers to more dynamic, advanced SDN-based hybrid WAN and SD-WAN offerings.”

VSG also noted that the Global provider Leaderboard companies that have received MEF 3.0 certification are AT&T, Colt, CenturyLink and Verizon. Challenge tier companies attaining the distinction are SingTel, T-Systems, Tata, Telefonica and Vodafone.

…………………………………………………………………………………………….

Last month, VSG said that CenturyLink, AT&T, Verizon, Spectrum Enterprise, Comcast, Windstream and Cox were, in that order, the top finishers in the U.S. Ethernet Leaderboard last year. The results are noteworthy because it was the first time since 2005 that AT&T did not finish as the leading provider.

References:

https://www.verticalsystems.com/2018/03/22/2017-global-provider-leaderboard/

Global Ethernet Service Provider Leaderboard: CenturyLink Makes its Debut