Gartner

Gartner: Gen AI nearing trough of disillusionment; GSMA survey of network operator use of AI

Global IT spending is expected to total $5.61 trillion in 2025, an increase of 9.8% from 2024, according to the latest forecast by Gartner, Inc.

“While budgets for CIOs are increasing, a significant portion will merely offset price increases within their recurrent spending,” said John-David Lovelock, Distinguished VP Analyst at Gartner. “This means that, in 2025, nominal spending versus real IT spending will be skewed, with price hikes absorbing some or all of budget growth. All major categories are reflecting higher-than-expected prices, prompting CIOs to defer and scale back their true budget expectations.”

GenAI will Influence IT Spending, but IT Spending Won’t Be on GenAI Itself:

Segments including data center systems, devices and software will see double-digit growth in 2025, largely due to generative AI (GenAI) hardware upgrades (see Table 1). However, these upgraded segments will not differentiate themselves in terms of functionality yet, even with new hardware.

Table 1. Worldwide IT Spending Forecast (Millions of U.S. Dollars)

2024 Spending |

2024 Growth (%) |

2025 Spending |

2025 Growth (%) |

|

| Data Center Systems | 329,132 | 39.4 | 405,505 | 23.2 |

| Devices | 734,162 | 6.0 | 810,234 | 10.4 |

| Software | 1,091,569 | 12.0 | 1,246,842 | 14.2 |

| IT Services | 1,588,121 | 5.6 | 1,731,467 | 9.0 |

| Communications Services |

1,371,787 |

2.3 | 1,423,746 | 3.8 |

| Overall IT | 5,114,771 | 7.7 | 5,617,795 | 9.8 |

Source: Gartner (January 2025)

“GenAI is sliding toward the trough of disillusionment which reflects CIOs declining expectations for GenAI, but not their spending on this technology,” said Lovelock. “For instance, the new AI ready PCs do not yet have ‘must have’ applications that utilize the hardware. While both consumers and enterprises will purchase AI-enabled PC, tablets and mobile phones, those purchases will not be overly influenced by the GenAI functionality.”

Spending on AI-optimized servers easily doubles spending on traditional servers in 2025, reaching $202 billion dollars.

“IT services companies and hyperscalers account for over 70% of spending in 2025,” said Lovelock. “By 2028, hyperscalers will operate $1 trillion dollars’ worth of AI optimized servers, but not within their traditional business model or IaaS Market. Hyperscalers are pivoting to be part of the oligopoly AI model market.”

Gartner’s IT spending forecast methodology relies heavily on rigorous analysis of the sales by over a thousand vendors across the entire range of IT products and services. Gartner uses primary research techniques, complemented by secondary research sources, to build a comprehensive database of market size data on which to base its forecast.

More information on the forecast can be found in the complimentary Gartner webinar “IT Spending Forecast, 4Q24 Update: GenAI’s Impact on a $7 Trillion IT Market.”

………………………………………………………………………………………………………….

Gartner’s 2025 forecast for IT spending is consistent with the market research firm’s predictions from late last year that the move to AI is driving a surge in spending on data center infrastructure and IT services in Europe. IT spending across the continent will come in at US$1.28 trillion in 2025 they said. Presumably it takes a little longer to gather up the data necessary for predictions across the whole world.

……………………………………………………………………………………………………

Separately, Citi analysts expect 2025 growth to be largely driven by continued AI spending as data center capital expenditure for the biggest cloud service providers is forecasted to increase by 40% this year.

……………………………………………………………………………………………………

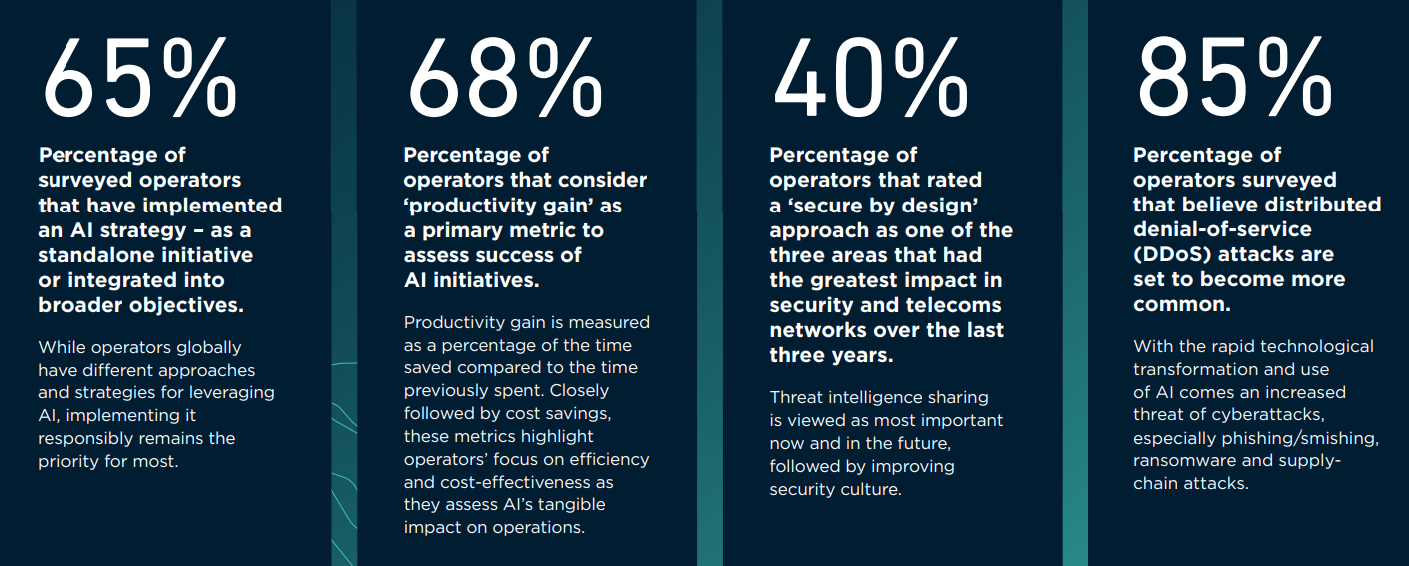

In a recent survey of network operators, GSMA found that telcos are allocating more resources to in-house and out-of-house AIs capabilities and projects, but only a subset are spending more than 15% of their digital budgets on AI. Nearly half of operators are dedicating 5% to 15% of their digital budgets towards AI, covering a range of categories, including data systems, large language models and infrastructure upgrades, the GSMA survey found. That AI money is also being allocated toward AI teams, tools and partnerships, said GSMA. The association, which primarily represents mobile operators, has been asked for more details about the size, scope and methodology of its latest study.

AI Status at Network Operators:

References:

Will billions of dollars big tech is spending on Gen AI data centers produce a decent ROI?

Canalys & Gartner: AI investments drive growth in cloud infrastructure spending

AI Echo Chamber: “Upstream AI” companies huge spending fuels profit growth for “Downstream AI” firms

AI wave stimulates big tech spending and strong profits, but for how long?

Telco spending on RAN infrastructure continues to decline as does mobile traffic growth

Gartner Forecast: Worldwide Public Cloud End-User Spending ~$679 Billion in 2024; GenAI to Support Industry Cloud Platforms

Worldwide end-user spending on public cloud services is forecast to grow 20.4% to total $678.8 billion in 2024, up from $563.6 billion in 2023, according to the latest forecast from Gartner, Inc.

“Cloud has become essentially indispensable,” said Sid Nag, Vice President Analyst at Gartner. “However, that doesn’t mean cloud innovation can stop or even slow. The tables are turning for cloud providers as cloud models no longer drive business outcomes, but rather, business outcomes shape cloud models.”

“For example, organizations deploying generative AI (GenAI) services will look to the public cloud, given the scale of the infrastructure required. However, to deploy GenAI effectively, these organizations will require cloud providers to address nontechnical issues related to cost, economics, sovereignty, privacy and sustainability.

Hyperscalers that support these needs will be able to capture a brand-new revenue opportunity as GenAI adoption grows.” All segments of the cloud market are expected see growth in 2024. Infrastructure-as-a-service (IaaS) is forecast to experience the highest end-user spending growth in 2024 at 26.6%, followed by platform-as-a-service (PaaS) at 21.5% (see Table 1).

Table 1. Worldwide Public Cloud Services End-User Spending Forecast (Millions of U.S. Dollars)

| 2022 | 2023 | 2024 | |

| Cloud Application Infrastructure Services (PaaS) | 119,579 | 145,320 | 176,493 |

| Cloud Application Services (SaaS) | 174,416 | 205,221 | 243,991 |

| Cloud Business Process Services (BPaaS) | 61,557 | 66,339 | 72,923 |

| Cloud Desktop-as-a-Service (DaaS) | 2,430 | 2,784 | 3,161 |

| Cloud System Infrastructure Services (IaaS) | 120,333 | 143,927 | 182,222 |

| Total Market | 478,315 | 563,592 | 678,790 |

BPaaS = business process as a service; IaaS = infrastructure as a service; PaaS = platform as a service; SaaS = software as a service

Note: Totals may not add up due to rounding.

Source: Gartner (November 2023)

……………………………………………………………………………………………………………………………………………………………

Another key trend driving cloud spending is the continued rise of industry cloud platforms. Industry cloud platforms address industry-relevant business outcomes by combining underlying software-as-a-service (SaaS), PaaS and IaaS services into a whole-product offering with composable capabilities. Gartner predicts that by 2027, more than 70% of enterprises will use industry cloud platforms to accelerate their business initiatives, up from less than 15% in 2023.

“GenAI adoption will also support the growth in industry cloud platforms,” said Nag. “GenAI models that are applicable across diverse industry verticals might require significant customization, affecting scalability and cost-effectiveness. Public cloud providers can position themselves as partners in the responsible and tailored adoption of GenAI by building on the same approaches applied to industry clouds, sovereign clouds and distributed clouds.”

Gartner previously forecast that Public Cloud services spending to hit $1.35 trillion in 2027. The U.S. will be the largest geographic public cloud market and will reach $697 billion in 2027. Western Europe is predicted to be in second place with $273 billion, followed by China at $117 billion in 2027. IDC forecasts that software-as-a-service (SaaS) applications to be the largest cloud computing category, garnering about 40% of all public cloud spending. Next largest is infrastructure as a service (IaaS) with a CAGR of 23.5%, followed by platform as a service (PaaS) with a five-year CAGR of 27.2%.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.idc.com/getdoc.jsp?containerId=prUS51179523

IDC: Public Cloud services spending to hit $1.35 trillion in 2027

Gartner: Public Cloud End-User Spending to approach $500B in 2022; $600B in 2023

Gartner: Global public cloud spending to reach $332.3 billion in 2021; 23.1% YoY increase

Gartner clients can learn more in “Forecast: Public Cloud Services, Worldwide, 2021-2027, 3Q23 Update.”

………………………………………………………………………………………………………………………………………………………………………………………………………….

Gartner IT Infrastructure, Operations & Cloud Strategies Conference:

Gartner analysts will provide additional analysis on cloud strategies and infrastructure and operations trends at the Gartner IT Infrastructure, Operations & Cloud Strategies Conferences taking place November 20-21 in London, December 6-8 in Las Vegas and December 12-13 in Tokyo. Follow news and updates from these conferences on X using #GartnerIO.

About Gartner for High Tech:

Gartner for High Tech equips tech leaders and their teams with role-based best practices, industry insights and strategic views into emerging trends and market changes to achieve their mission-critical priorities and build the successful organizations of tomorrow. Additional information is available at www.gartner.com/en/industries/high-tech.

Gartner: SASE tops Gartner list of 6 trends impacting Infrastructure & Operations over next 12 to 18 months

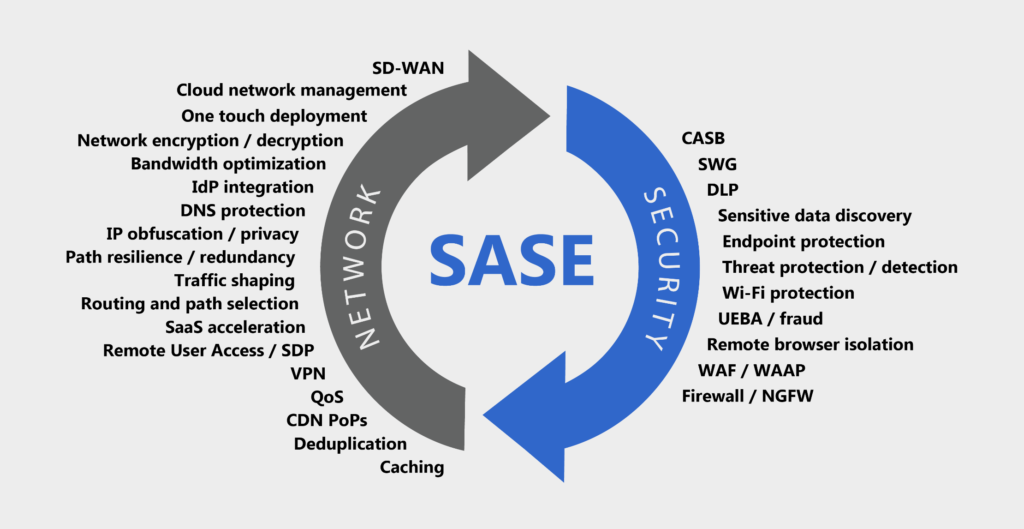

At its IT Infrastructure, Operations & Cloud Strategies Conference this week, Gartner identified six trends anticipated to have a significant impact on infrastructure and operations (I&O) over the next 12 to 18 months. Secure Access Service Edge (SASE) topped the list with Sustainable technology coming in second and Wireless Value Innovation (see below) in third place.

SASE is a single-vendor product that is sold as an integrative service which enables digital transformation. This trend connects and secures users, devices, and locations as they work to access applications from anywhere. Gartner forecasts that total worldwide end-user spending on SASE will reach $9.2 billion in 2023, a 39% increase from 2022. Gartner coined SASE as a technology framework for the convergence of network access and security in cloud-native environments. Earlier this year, Gartner released its first Market Guide for Single-Vendor SASE, revealing to I&O leaders that interest in the framework has exploded since its introduction in 2019 – and particularly toward single-vendor solutions.

Gartner VP Analyst Jeffrey Hewitt attributed the fast adoption of SASE to “the need to secure the access of devices and elements at the edge,” as well as hybrid work and a “relentless shift to cloud computing.” Hewitt noted the primary benefits of the framework are that it allows users to securely connect to applications and improves the efficiency of management. “Hybrid work and the relentless shift to cloud computing has accelerated SASE adoption,” said Hewitt. “SASE allows users to connect to applications in a secure fashion and improves the efficiency of management. I&O teams implementing SASE should prioritize single-vendor solutions (1.) and an integrated approach.”

Note 1. Single-vendor SASE means the selected service provider owns and delivers all the essential SASE components—software-defined WAN (SD-WAN), secure web gateway (SWG), cloud access security broker (CASB), network firewalling, and zero trust network access (ZTNA)—using a cloud-centric architecture, according to Gartner, which created the term SASE. The service is meant to address shortcomings of legacy methods of securing access to enterprise resources.

Source: Lanner

“Leaders are going to be looking at this and saying, we want to implement this,” Hewitt told SDxCentral. “They’re going to be assessing and determining what providers can offer.” I&O teams implementing SASE should prioritize single-vendor solutions, Hewitt added.

Hewitt noted SASE is still an “immature” market and technology framework. “It’s not something that you can just run out and have a large list of vendors – at this point – that you could select from,” he said. While many vendors still can only supply components of SASE, Gartner recognizes nine that offer complete solutions with both networking and Secure Service Edge (SSE) capabilities – Cato Networks, Cisco, Citrix, Forcepoint, Fortinet, Netskope, Palo Alto Networks, Versa Networks, and VMware.

The biggest benefits of a single-vendor solution are improved security posture, administrative simplicity with fewer consoles to manage and troubleshoot, and traffic efficiency due to single-pass encryption and optimal routing decisions instead of needing to integrate between two pieces, Analyst Andrew Lerner told SDxCentral in an earlier interview. Lerner recommended I&O leaders look for single-vendor SASE offerings that provide single-pass scanning, a single unified console, and data lakes covering all functions to improve user experience and staff efficacy.

By 2025, Gartner predicts 65% of enterprises will have consolidated individual SASE components into one or two explicitly partnered SASE vendors, up from 15% in 2021.

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Regarding Wireless Value Innovation, Gartner wrote: I&O can leverage multiple wireless technologies to extend business disruption opportunities beyond connectivity. Overlaps between various technologies including Wi-Fi, 5G, Bluetooth and high frequency (HF) facilitates connectivity solutions and creates innovation opportunities.

Hewitt said, “Wireless value innovation creates a scalable return on wireless investment and makes networks a strategic innovation platform. However, there is significant complexity at play and several new skills that are required to achieve this innovation, such as wireless integration capabilities and wireless tracking implementation experience.”

At its recent IT Symposium/Xpo 2022 Gartner included wireless among in its 10 top strategic technology trends for 2023. In that report, Gartner stated that no single wireless technology will dominate, but enterprises will use a variety of them to support a range of environments, including Wi-Fi in the office, services for mobile devices, low-power protocols, and even radio connectivity, Gartner stated. Gartner predicts that by 2025, 60% of enterprises will be using five or more wireless technologies simultaneously.

“We’re going to see a spectrum of solutions in the enterprise—that includes 4G, 5G, LTE, WIFI 5, 6, 7—all of which will create new data enterprises can use in analytics, and low-power systems will harvest energy directly from the network,” Gartner stated.

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Gartner’s top six trends impacting I&O in 2023:

Trend No. 1: Secure Access Service Edge (SASE)

Trend No. 2: Sustainable Technology

Trend No. 3: Platform Engineering

Trend No. 4: Wireless Value Innovation

Trend No. 5: Industry Cloud Platforms

Trend No. 6: Heated Skills Competition

………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.sdxcentral.com/articles/news/sase-tops-gartners-io-trends-for-2023/2022/12/

Secure Access Service Edge – SASE Appliances Enable the Most Agile Edge Security

Dell’Oro: Secure Access Service Edge (SASE) market to hit $13B by 2026; Gartner forecasts $14.7B by 2025; Omdia bullish on security

MEF survey reveals top SD-WAN and SASE challenges

New Findings in Aryaka’s 2022 State of the WAN Report: Cloud Adoption, Hybrid Workplaces, Convergence of Network and Security with SASE

Shift from SDN to SD-WANs to SASE Explained; Network Virtualization’s important role

Enterprises Deploy SD-WAN but Integrated Security Needed

MEF New Standards for SD-WAN Services; SASE Work Program

Dell’Oro: Secure Access Service Edge (SASE) market to hit $13B by 2026; Gartner forecasts $14.7B by 2025; Omdia bullish on security

The secure access service edge (SASE) market is expected to triple by 2026, exceeding $13 billion, representing a very healthy CAGR, according to a new forecast by Mauricio Sanchez, Research Director at the Dell’Oro Group. The report further divides the total SASE market into its two technology components, Security Service Edge (SSE) and SD-WAN with SSE expected to double the SD-WAN revenue for SASE. The report further breaks down the SSE market into FWaaS, SWG, CASB, and ZTNA.

Sanchez wrote in a blog post:

“Today, enterprises are thinking differently about networking and security. Instead of considering them as separate toolsets to be deployed once and infrequently changed, the problem and solution space is conceptualized along a continuum in the emerging view. The vendor community has responded with a service-centric, cloud-based technology solution that provides network connectivity and enforces security between users, devices, and applications.

SASE utilizes centrally-controlled, Internet-based networks with built-in advanced networking and security-processing capabilities. By addressing the shortcomings of past network and security architectures and improving recent solutions—in particular, SD-WAN and cloud-based network security—SASE aims to bring networking and security into a unified service offering.

While the networking technologies underpinning SASE are understood to be synonymous with well-known SD-WAN, the security facet of SASE consists of numerous security technologies, such as secure web gateway (SWG), cloud access security broker (CASB), zero-trust network access (ZTNA), and firewall-as-a-service (FWaaS). Recently, a new term, security services edge (SSE), emerged to describe this constellation of cloud-delivered network security services that is foundational in SASE.”

As noted above, Dell’Oro divides the total SASE market into two technology components: Security Service Edge (SSE) and SD-WAN with SSE. Security features such as Firewall-as-a-Service (FWaaS), Secure Web Gateway (SWG), Cloud Access Security Broker (CASB) and Zero Trust Network Access (ZTNA) fall under the umbrella of SSE, according to Dell’Oro. In addition, Dell’Oro predicts that the security component to SASE “will increasingly be the driver and lead SASE’s SSE to exhibit over twice the growth of SASE’s SD-WAN.”

Dell’Oro’s Sanchez wrote, “We see SASE continuing to thrive independent of the ongoing macro-economic uncertainty as enterprises strategically invest for the new age of distributed applications and hybrid work that need a different approach to connectivity and security. We anticipate that security will increasingly be the driver and lead SASE’s SSE to exhibit over twice the growth of SASE’s SD-WAN.”

Additional highlights from SASE and SD-WAN 5-Year Forecast Report:

- Within SSE, Secure Web Gateway (SWG) and Cloud Access Security Broker (CASB) are expected to remain the most significant revenue components over the five-year forecast horizon, but Zero Trust Network Access (ZTNA) and Firewall-as-a-Service (FaaS) are estimated to flourish at a faster rate.

- Unified SASE is expected to exceed disaggregated SASE by almost 6X.

- Enterprise access router revenue is expected to decline at over 5 percent CAGR over the forecast horizon.

Dell’Oro expects that under the umbrella of SSE, Secure Web Gateway and Cloud Access Security Broker will continue as the most significant revenue components over the five-year forecast horizon. However, Zero Trust Network Access and Firewall-as-a-Service are expected to grow at a faster rate.

Unified SASE, which Dell’Oro qualifies as the portion of the market that delivers SASE as an integrated platform, is expected to exceed disaggregated SASE by almost a factor of six over the next five years. The disaggregated type is defined as a multi-vendor or multi-product implementation with less integration than unified type. Dell’Oro also predicts that enterprise access router revenue could decline at over 5% CAGR by 2026.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Gartner has a more optimistic forecast of SASE revenue, predicting the market to reach $14.7 billion as early as 2025. “Gartner predicts that global spending on SASE will grow at a 36% CAGR between 2020 and 2025, far outpacing global spending on information security and risk management,” reported VentureBeat last month. According to Gartner, top SASE vendors include Cato Networks, Fortinet, Palo Alto Networks, Versa Networks, VMware and Zscaler.

These disparate predictions could be a result of the nascent nature of the SASE market, a convergence of networking and security services coined by Gartner in 2019. To address the varying definitions for SASE and resulting confusion on the part of enterprise customers, industry forum MEF plans to release SASE (MEF W117) standards this year. MEF started developing its SASE framework in 2020 to clarify service attributes and definitions. (See MEF adds application, security updates to SD-WAN standard and MEF’s Stan Hubbard on accelerating automation with APIs.)

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Omdia’s [1.]research also shows security is a major driver for SASE adoption, according to Fernando Montenegro, senior principal analyst with Omdia. “Our own research indicates that end-user organizations value secure web browsing use cases (SWG, CASB, browsing isolation) particularly as they go further into their deployments of SASE projects,” said Montenegro in an email to Light Reading.

Note 1. Omdia and Light Reading are owned by Informa in the UK

Security is critical for organizations in what Omdia calls the age of “digital dominance” and by how the “demands on security teams – both in terms of time and expertise – make the delivery of security functionality via a services model particularly attractive,” Montenegro said.

SASE services also provide “good performance characteristics” when compared to enterprises utilizing their own VPN headends, and especially when hybrid work continues to be popular, added Montenegro.

References:

Total SASE Market to Nearly Triple by 2026, According to Dell’Oro Group

https://start.paloaltonetworks.com/gartner-2022-report-roadmap-for-sase-convergence.html

Gartner: Public Cloud End-User Spending to approach $500B in 2022; $600B in 2023

Gartner forecasts that public cloud end user spending will reach nearly $600 billion by the end of 2023. The market research firm says public cloud services will continue in 2022, and nearly capture $494.7 billion in global spending this year – up from $410.9 billion in 2021. That represents a 20.4% increase in spending from 2021.

“Cloud is the powerhouse that drives today’s digital organizations,” said Sid Nag, research vice president at Gartner. “CIOs are beyond the era of irrational exuberance of procuring cloud services and are being thoughtful in their choice of public cloud providers to drive specific, desired business and technology outcomes in their digital transformation journey.”

Infrastructure-as-a-service (IaaS) is forecast to experience the highest end-user spending growth in 2022 at 30.6%, followed by desktop-as-a-service (DaaS) at 26.6% and platform-as-a-service (PaaS) at 26.1% (see Table 1). The new reality of hybrid work is prompting organizations to move away from powering their workforce with traditional client computing solutions, such as desktops and other physical in-office tools, and toward DaaS, which is driving spending to reach $2.6 billion in 2022. Demand for cloud-native capabilities by end-users accounts for PaaS growing to $109.6 billion in spending.

Table 1. Worldwide Public Cloud Services End-User Spending Forecast (Millions of U.S. Dollars)

| 2021 | 2022 | 2023 | |

| Cloud Business Process Services (BPaaS) | 51,410 | 55,598 | 60,619 |

| Cloud Application Infrastructure Services (PaaS) | 86,943 | 109,623 | 136,404 |

| Cloud Application Services (SaaS) | 152,184 | 176,622 | 208,080 |

| Cloud Management and Security Services | 26,665 | 30,471 | 35,218 |

| Cloud System Infrastructure Services (IaaS) | 91,642 | 119,717 | 156,276 |

| Desktop as a Service (DaaS) | 2,072 | 2,623 | 3,244 |

| Total Market | 410,915 | 494,654 | 599,840 |

BPaaS = business process as a service; IaaS = infrastructure as a service; PaaS = platform as a service; SaaS = software as a service. Note: Totals may not add up due to rounding. Source: Gartner (April 2022)

“Cloud native capabilities such as containerization, database platform-as-a-service (dbPaaS) and artificial intelligence/machine learning contain richer features than commoditized compute such as IaaS or network-as-a-service,” said Nag. “As a result, they are generally more expensive which is fueling spending growth.”

SaaS remains the largest public cloud services market segment, forecasted to reach $176.6 billion in end-user spending in 2022. Gartner expects steady growth within this segment as enterprises take multiple routes to market with SaaS, for example via cloud marketplaces, and continue to break up larger, monolithic applications into composable parts for more efficient DevOps processes.

Emerging technologies in cloud computing such as hyperscale edge computing and secure access service edge (SASE) are disrupting adjacent markets and forming new product categories, creating additional revenue streams for public cloud providers.

“Driven by maturation of core cloud services, the focus of differentiation is gradually shifting to capabilities that can disrupt digital businesses and operations in enterprises directly,” said Nag. “Public cloud services have become so integral that providers are now forced to address social and political challenges, such as sustainability and data sovereignty.

“IT leaders who view the cloud as an enabler rather than an end state will be most successful in their digital transformational journeys,” said Nag. “The organizations combining cloud with other adjacent, emerging technologies will fare even better.”

Gartner clients can read more in Forecast: Public Cloud Services, Worldwide, 2020-2026, 1Q22 Update. Lean more in the complimentary Gartner webinar Cloud Computing Scenario: The Future of Cloud.

References:

Gartner: Accelerated Move to Public Cloud to Overtake Traditional IT Spending in 2025

Strong growth for global cloud infrastructure spending by hyperscalers and enterprise customers

Gartner: Global public cloud spending to reach $332.3 billion in 2021; 23.1% YoY increase

Gartner: AWS, Azure, and Google Cloud top rankings for Cloud Infrastructure and Platform Services

Gartner’s latest Magic Quadrant report for cloud infrastructure and platform services (CIPS) ranks Amazon Web Services (AWS), Microsoft Azure, and Google Cloud as the top cloud service providers.

Beyond the top three players, Gartner placed Alibaba Cloud in the “visionaries” box, and ranked Oracle, Tencent Cloud, and IBM as “niche players,” in that order.

The scope of Gartner’s Magic Quadrant for CIPS includes infrastructure as a service (IaaS) and integrated platform as a service (PaaS) offerings. These include application PaaS (aPaaS), functions as a service (FaaS), database PaaS (dbPaaS), application developer PaaS (adPaaS) and industrialized distributed cloud offerings that are often deployed in enterprise data centers (i.e. private clouds).

Figure 1: Magic Quadrant for Cloud Infrastructure and Platform Services

……………………………………………………………………………………………..

……………………………………………………………………………………………..

1. Gartner analysts praise Amazon AWS for its broad support of IT services, including cloud native, edge compute, and processing mission-critical workloads. Also noteworthy is Amazon’s “engineering prowess” in designing CPUs and silicon. This focus on owning increasingly larger portions of the supply chain for cloud infrastructure bolsters the No. 1 cloud provider’s long-term outlook and earns it advantages against competitors, according to the Gartner report.

“AWS often sets the pace in the market for innovation, which guides the roadmaps of other CIPS providers. As the innovation leader, AWS has materially more mind share across a broad range of personas and customer types than all other providers,” the analysts wrote.

AWS, which recently achieved $59 billion in annual revenues, contributed 13% of Amazon’s total revenue and almost 54% of its profit during second-quarter 2021.

AWS’s future focus is on attempting to own increasingly larger portions of the supply chain used to deliver cloud services to customers. Its operations are geographically diversified, and its clients tend to be early-stage startups to large enterprises.

……………………………………………………………………………………

2. Microsoft Azure, which remains the #2 Cloud Services Provider, sports a 51% annual growth rate. It earned praise from Gartner for its strength “in all use cases, which include the extended cloud and edge computing,” particularly among Microsoft-centric organizations.

The No. 2 public cloud provider also enjoys broad appeal. “Microsoft has the broadest set of capabilities, covering a full range of enterprise IT needs from SaaS to PaaS and IaaS, compared to any provider in this market,” the analysts wrote.

Microsoft has the broadest sets of capabilities, covering a full range of enterprise IT needs from SaaS to PaaS and IaaS, compared to any provider in this market. From the perspective of IaaS and PaaS, Microsoft has compelling capabilities ranging from developer tooling such as Visual Studio and GitHub to public cloud services.

Enterprises often choose Azure because of the trust in Microsoft built over many years. Such strategic alignment with Microsoft gives Azure advantages across nearly every vertical market.

“Strategic alignment with Microsoft gives Azure advantages across nearly every vertical market,” Gartner said. However, Gartner criticized Microsoft for very complex licensing and contracting. Also, Microsoft sales pressures to grow overall account revenue prevent it from effectively deploying Azure to bring down a customer’s total Microsoft costs.

Microsoft Azure’s forays in operational databases and big data solutions have been markedly successful over the past year. Azure’s Cosmos DB and its joint offering with Databricks stand out in terms of customer adoption.

………………………………………………………………………………………

3. Google Cloud Platform (GCP) is strong in nearly all use cases and is slowly improving its edge compute capabilities. Google continues to invest in being a broad-based provider of IaaS and PaaS by expanding its capabilities as well as the size and reach of its go-to-market operations. Its operations are geographically diversified, and its clients tend to be startups to large enterprises.

The company is making gains in mindshare among enterprises and “lands at the top of survey results when infrastructure leaders are asked about strategic cloud provider selection in the next few years,” Gartner analysts wrote. Google is also closing “meaningful gaps with AWS and Microsoft Azure in CIPS capabilities,” and outpacing its larger competitors in some cases, according to the report.

The analysts also noted that Google Cloud “is the only CIPS provider with significant market share that currently operates at a financial loss.” The No. 3 public cloud provider reported a 54% year-over-year revenue increase and a 59% decrease in operating losses during Q2.

………………………………………………………………………………..

Separately, Dell’Oro Group Research Director Baron Fung recently said that hyperscalers make up a big portion of the overall IT market, with the 10 largest cloud-service providers, including AWS, Google, and Alibaba, accounting for up to 40% of global data center spending, and “some of these companies can have really tremendous weight on the ecosystem.”

The Dell’Oro report noted that some providers have deployed accelerated servers using internally developed artificial intelligence (AI) chips, while other cloud providers and enterprises have commonly deployed solutions based on graphics processing units (GPUs) and FPGAs.

Fung explained that this model has also spilled over into those cloud providers also building their own servers and networking equipment to better fit their needs while “moving away from the traditional model in which users are buying equipment from companies like Dell and [Hewlett Packard Enterprise]. … It’s really disrupting the vendor landscape.”

Certain applications—such as cloud gaming, autonomous driving, and industrial automation—are latency-sensitive, requiring Multi-Access Edge Compute, or MEC, nodes to be situated at the network edge, where sensors are located. Unlike cloud computing, which has been replacing enterprise data centers, edge computing creates new market opportunities for novel use cases.

…………………………………………………………………………………

References:

https://www.gartner.com/doc/reprints?id=1-26YXE86I&ct=210729&st=sb

Gartner: Worldwide 5G Network Infrastructure Revenues to Grow 39% in 2021

Worldwide 5G network infrastructure revenue is on pace to grow 39% to total $19.1 billion in 2021, up from $13.7 billion in 2020, according to the latest forecast by Gartner, Inc.

Communications service providers (CSPs) in mature markets accelerated 5G development in 2020 and 2021 with 5G representing 39% of total wireless infrastructure revenue this year.

“The COVID-19 pandemic spiked demand for optimized and ultrafast broadband connectivity to support work-from-home and bandwidth-hungry applications, such as streaming video, online gaming and social media applications,” said Michael Porowski, senior principal research analyst at Gartner.

5G is the fastest growing segment in the wireless network infrastructure market (see Table 1). Of the segments that comprise wireless infrastructure in this forecast, the only significant opportunity for investment growth is in 5G. Investment in legacy wireless generations is rapidly deteriorating across all regions and spending on non-5G small cells is poised to decline as CSPs move to 5G small cells.

Table 1: Wireless Network Infrastructure Revenue Forecast, Worldwide (Millions of U.S. Dollars)

| Segment | 2020 Revenue | 2021 Revenue | 2022 Revenue |

| 5G | 13,768.0 | 19,128.9 | 23,254.6 |

| LTE and 4G | 17,127.8 | 14,569.1 | 12,114.0 |

| 3G and 2G | 3,159.6 | 1,948.2 | 1,095.2 |

| Small Cells Non-5G | 6,588.5 | 7,117.9 | 7,113.9 |

| Mobile Core | 5,714.6 | 6,056.2 | 6,273.3 |

| Total | 46,358.5 | 48,820.2 | 49,851.0 |

Source: Gartner (August 2021)

Regionally, CSPs in North America are set to grow 5G revenue from $2.9 billion in 2020 to $4.3 billion in 2021, due, in part, to increased adoption of dynamic spectrum sharing and millimeter wave base stations. In Western Europe, CSPs will prioritize on licensing spectrum, modernizing mobile core infrastructure and navigating regulatory processes with 5G revenue expected to increase from $794 million in 2020 to $1.6 billion in 2021.

Greater China is expected to maintain the No.1 global position in global 5G revenue reaching $9.1 billion in 2021, up from $7.4 billion in 2020. With China’s government funding 5G development for the three state owned carriers, that’s no surprise.

The big beneficiaries of China’s 5G infrastructure spending will be its domestic equipment makers, Huawei, ZTE, and (state owned) Datang Telecom. Despite clamoring for Sweden to permit Huawei 5G equipment to be deployed, Ericsson only received 3% of a joint 5G radio contracts from China Telecom, China Unicom and 2% from China Mobile, according to Reuters. Nokia, which was expected to take away Ericsson’s market share in China, did not receive any share, according to a tender document published by the Chinese companies.

In a way that’s a win for the Swedish vendor – and a brief share price hike backs up that statement – which won just 2% of an earlier deal from China Mobile. But if they want to secure their share of the multiple billions of dollars of global 5G infrastructure revenues forecast by Gartner, the likes of Ericsson and Nokia will need to keep winning contracts in their home markets.

5G Coverage in Tier-1 Cities Will Reach 60% in 2024:

While 10% of CSPs in 2020 provided commercialized 5G services, which could achieve multiregional availability, Gartner predicts that this number will increase to 60% by 2024, which is a similar rate of adoption for 4G- LTE in the past.

“Business and customer demand is an influencing factor in this growth. As consumers return to the office, they will continue to upgrade or switch to gigabit fiber to the home (FTTH) service as connectivity has become an essential remote work service,” said Porowski. “Users will also increasingly scrutinize CSPs for both office and remote work needs.”

This rapid shift in customer behavior is driving growth in the global passive optical network (PON) market as a preferred technology. The 10-Gigabit-capable symmetric-PON (XGS-PON) is not a new technology and with the price difference with other technologies narrowing, CSPs are willing to invest in XGS-PON to differentiate themselves in customer experience and network quality. Gartner estimates that by 2025, 60% of Tier-1 CSPs will adopt XGS-PON technology at large-scale to deliver ultrafast broadband services to residential and business users, up from less than 30% in 2020.

Gartner clients can learn more in the reports “Forecast Analysis: Communications Service Provider Operational Technology, Worldwide” and “Forecast: Communications Service Provider Operational Technology, Worldwide, 2019-2025, 2Q21 Update.”

…………………………………………………………………………………………

Small Cells?

While Gartner did not split out small cells’ contribution to the overall 5G infrastructure segment, evidence thus far suggests the market is progressing more slowly than many had once believed.

Last month, Crown Castle increased its guidance for the second time this year due to a strong cell towers market, but halved the number of small cells it expects to deploy in 2021 to 5,000. The company noted that wireless network operators have focused on tower-based 5G rollouts at the expense of small cells.

References:

5G network kit revenues to near $20 billion this year — report

Gartner: Market Guide for Small Cells- 5G, virtualization, disaggregation and Open RAN

Introduction:

Small cells are increasingly used to boost network densification and expand coverage for both private and public networks. They will be increasingly important in the deployment of 5G mmWave networks because of the very short propagation distances which require many small cells for adequate coverage in a given geographical area.

5G small cell market is gaining momentum due to the higher bands like mmWave limitation, in-depth in-building coverage requirement and strategic area densification. However, despite the hype surrounding 5G, 3G/4G deployments are expected to remain the dominant technology in terms of volume shipments until 2022 when 5G small cell deployment will overtake 3G/4G. Therefore, because small cell densification is moving forward, integrated small cell platforms supporting both 5G and 4G radio are essential for the next five years.

Small cells deployed in strategic areas have also accelerated the new virtualized and disaggregated architecture adoption, aiming for greater cost-efficiency and flexibility. Together with edge computing, they are enablers for enterprise digital services such as manufacturing applications, smart harbor/terminal, local contextual applications and IoT services.

Definition of Small Cells:

-

Femtocells

-

Picocells

-

Carrier-grade Wi-Fi

Gartner’s Key Findings:

-

The small cell solution is shifting from delivering in-build coverage to enable large-scale network densification. Increasing 5G and private network deployments further accelerate the trend.

-

In the small cell market, variety and diversity are replacing uniformity. Introduction of new spectrums, types of cells and architectures, vertical industries use cases, and business models like neutral host act as accelerators in this respect.

-

In addition, diversity increases the cost and complexity of small cell deployment and management, not just access points but also potentially edge computing, localized core and distributed radio units.

-

Traditional proprietary small cell systems are challenged by disaggregated, virtualized architecture. Communications service providers (CSPs) are looking for a more flexible, multivendor, cost-effective solution through breaking apart basebands and radio heads, and virtualizing some or all of the baseband functions in software.

Gartner’s Recommendations for Small Cell Deployment:

-

Build your small cell deployment strategy beyond coverage through prioritized investment in network densification and related digital services. Include 5G small cell and private networking requirements in your product plans.

-

Address diversity challenges through a multivendor approach. There is no one size fits all in the future small cell market, and a scenario-oriented product evaluations process needs to be implemented.

-

Reduce complexity and improve cost-efficiency through prioritizing the deployment feasibility as well as operation intelligence and automation.

-

Work closely with emerging suppliers and establish an objective and structured process to thoroughly evaluate and develop quick prototypes using disaggregated and virtualized architectures.

Small Cells Will Be at the Forefront of Virtualization and Open RAN:

The economic success of 5G is reliant on interoperable multi-vendor networks, which require open interfaces at both the silicon and network levels. Therefore, many CSPs are continually exploring the possibility of moving away from the proprietary hardware to more modern open and interoperable systems.

To support these, CSPs will need to adopt new network topologies such as cloud-RAN, virtualized RAN (vRAN) or open RAN (ORAN), together with integrated edge compute.The key to the open network lies in disaggregation — separating the key elements such as centralized units (CUs) and distributed units (DUs) — and the open reconfiguration — combining components from any suppliers because they are all interconnected in the same way.

For 5G, those central processes will usually be virtualized (run as software on off-the-shelf servers).The move to open network has been more advanced in small cell layer than macro network, and several suppliers already offer architectures in which a number of small cells are clustered around a centralized, virtualized controller. But there are two potential barriers to achieving a real multivendor environment: the need to be in agreement on where the network should be split between the central and the local elements and the need to be a single common interface between the elements in each preferred split.

Split RAN/SC architectures have multiple options, as identified by 3GPP. Of these, 3GPP has focused on Option-2 (RLC-PDCP), ORAN on Option-7.2 (PHY-PHY) and Small Cell Forum (SCF) on Option-6 (PHY-MAC). SCF will develop a 5G version of its networked FAPI spec, which will enable a split MAC and PHY in a disaggregated small cell network, supporting the 3GPP Option-6 split over Ethernet fronthaul and targeting, in particular, cost-effective indoor scenarios. SCF’s work on open interfaces such as nFAPI will play an important role in the market, alongside the work of partners such as O-RAN Alliance and Telecom Infra Project.

Many CSPs expect to take their first steps in their small cell layer, providing valuable experience of how to manage and orchestrate a network in which multiple radio units share common baseband functions, some of them deployed on cloud infrastructure. While there are still challenges in this domain, the disaggregation and virtualized architecture reduce the technology barrier to market and introduce new players into the market including software players as well as OEMs and ODMs.

……………………………………………………………………………………………………………………………………………………….

Small Cell Hardware and Software Vendors:

The table below may be used as a quick reference guide to representative vendors and their 5G small cell solutions. It includes the major vendors who have a long history providing small cell, DAS solutions and also some new emerging vendors who are providing software-based small cell solutions.

Table of Small Cell Vendors:

|

Small Cell Software

|

|

|

Air5G

|

|

|

Virtualized RAN Software

|

|

|

M-RAN Virtual Small Cell

|

|

|

5G Open Platform Small Cell

|

|

|

ONECELL

|

|

|

Enterprise Radio Access Network (E-RAN)

|

|

|

Radio Dot System, Micro Radio, Lightpole Site

|

|

|

LampSite Family, BookRRU, Easy Macro

|

|

|

Viper Platform

|

|

|

Massive MIMO AAS Radio Unit

|

|

|

Flexi Zone, AirScale Indoor Radio system (ASiR), AirScale Micro Remote Radio Head (mRRH), AirScale mmWave Radio (ASMR), Smart Node Femtocells

|

|

|

CellEngine

|

|

|

Samsung 5G Small Cell

|

|

|

Qcell, 5G iMicro, 5G Pad RRU

|

Gartner: 4 “Cool Vendors” for Communications Service Provider Network Operations

-

Cool Vendors for communications service provider (CSP) operational technology (OT)create new value by developing faster and more cost-effective solutions, as well as embedding open and API-driven architecture to accelerate ecosystem creation.

-

These vendors provide network- and vendor-agnostic solutions that CSPs can use to gain network-related insights, modernize their operations and automate to enhance operations efficiency.

-

Cool Vendors tend to be more aligned to CSPs’ transformation objectives as compared with many established vendors, because Cool Vendors are not guided by any legacy business.

Table 1: Cool Vendors in CSP Operational Technology

|

Vendor

|

Approach to Create New Value

|

Solve a Difficult Problem

|

Provide Cost-Efficiency

|

|

Actility

|

Provides tools, platforms and an ecosystem for monetization of IoT beyond just connectivity

|

Enables scaling up of IoT deployments up to national level networks

|

Reduces M2M application development overhead with ThingPark IoT management platform and LoRaWAN IoT support

|

|

DriveNets

|

Provides disaggregated, cloud-native software that runs the routing on white boxes using merchant silicon chipsets

|

Provides economics and flexible scale. Simplifies network operations, and reduces time to market of services.

|

Reduces TCO for router capacity scale

|

|

Federated Wireless

|

Provides novel shared-spectrum ecosystem by harnessing cloud-native software solution

|

Provides reliable connectivity without expertise and resources

|

Reduces spectrum acquisition costs

|

|

Sensat

|

Creates 3D map and digital twin of physical environment for infrastructure planning

|

Applies ML to physical network design to achieve spatial optimization and network efficiency

|

Reduces network design costs

|

|

IoT = Internet of Things; LoRaWAN = long-range wide-area network; M2M = machine-to-machine; ML = machine learning; TCO = total cost of ownership

|

|||

-

Innovation in infrastructure by disaggregation, virtualization and cloud native:

-

Actility, DriveNets and Federated Wireless

-

-

Innovation in operations by resource optimization, platform operations and network automation:

-

Sensat

-

Gartner: Top 10 Trends for Communications Service Providers (CSPs) in 2020

Key Findings:

-

Compared with previous cellular generations, the multilayered architecture of 5G creates opportunities for CSPs to expand beyond connectivity-centric solutions. However, disaggregation also allows new entrants to join incumbent CSPs in the 5G ecosystem.

-

Increasingly, network-based CSPs are exploring options to spin off network-related infrastructure into a separate entity, thereby unlocking funds needed for network upgrades and expansion while still meeting shareholder dividend commitments.

-

As live streaming of TV, games and e-sports enters the mainstream, the need to reduce latency and lower cost is driving hyperscale cloud providers, device manufacturers and developers to expand their influence out to the edge of CSPs’ networks.

-

Data, analytics and artificial intelligence (AI) now play an expansive and critical role in generating new business value, lowering costs and improving customer advocacy.

-

Cloud-native CSPs are emerging as aggressive challengers, and leading incumbent CSPs are expanding on efforts to virtualize their networks and adopt cloud-native capabilities.

Recommendations:

-

Pursue new capabilities and partnerships for 5G and streaming content by investigating how ecosystem approaches could be employed to meet business strategy goals.

-

Accelerate migration to cloud-native capabilities by appointing leaders who understand the business and technical implications that will arise.

-

Facilitate organizational alignment to become data-driven by establishing executive-level accountability and cross-functional oversight for data intelligence activities.

-

Maintain free cash flow from traditional telecommunications services by adopting automation, analytics and AI to improve operational efficiency and drive down costs.

Discussion:

Among the topics Gartner has observed as top of mind for CSPs include network virtualization and artificial intelligence. These are embellished in sections Becoming Data-Driven Becomes Critical and Cloud-Native as a Network Foundation, which explain the imperative needed to address what are becoming foundational capabilities. AI Enters the Workforce addresses the people context of AI, and how the move to automated provisioning and operations can, in the midterm, lead to augmentation, rather than wholesale replacement.

In the consumer market, digital content is well and truly dominating the strategy agenda. Livestreaming of TV, games, e-sports and other digital content is now mainstream. The need to improve performance and lower cost is driving the ecosystem of hyper-scale cloud providers, device manufacturers and developers to expand its influence into what was previously the exclusive domain of network-based CSPs.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

5G Assessment:

5G is viewed by mobile-network-based CSPs as a significant opportunity for growth, particularly in B2B. It also presents a challenge in terms of the level of investment required for coverage and capacity demands. At the same time, digital ecosystems are increasingly dominating the way industries function and, subsequently, how technology solutions are defined. This presents compelling opportunities for competitive market entrants looking to exploit opportunities to reinvent processes and define new operating models for industries.

-

Compared with previous cellular generations, the multilayered architecture of 5G (network plus software and services) creates opportunities for CSPs to expand beyond connectivity-centric solutions. However, disaggregation also allows new entrants to join incumbents in the 5G ecosystem.

-

CSPs aspire to derive value from 5G through enterprise solutions that expand the mobile ecosystem to new industries, enabling opportunities to participate in concepts such as factory of the future, autonomous transportation, remote healthcare, agriculture, digitized logistics and retail.

-

CSPs have found it difficult to identify strong monetization and operation efficiency opportunities for enterprise 5G, partly because of a lack of insight into key vertical markets.

5G improves drastically on previous generations of mobile cellular connectivity (3G and 4G), with peak data speeds of up to 20 Gbps, much higher network capacity and significantly lower latency. As such, 5G-capable handsets and smart devices will give rise to new experiences for consumers, such as gaming, esports, content streaming and virtual reality (VR), to name a few.

However, for CSPs, the enterprise segment will be key to monetizing higher-margin opportunities. To be successful, it will require a significant shift from 3G or 4G, where the focus was on delivering horizontal product and service offerings related to connectivity. By taking a platform approach to 5G, CSPs can potentially unlock new value through delivering industry-specific solutions.

The software-centric approach of disaggregating hardware and software (e.g. Open RAN) creates opportunities for new providers to offer solutions or services in the 5G ecosystem. It will enable enterprises to procure services from multiple providers in the ecosystem, enabling service flexibility and diversity, rather than being locked in with a single CSP.

The concept of 5G as a platform leverages a broad range of capabilities (beyond those related to connectivity, such as edge computing and network slicing). It also encompasses the use of data analytics, AI and machine learning, data aggregation, and service orchestration. Security will play an important role. Thus, the concept of 5G as a platform includes horizontal capabilities (common across industries) and vertical capabilities (specific to industries) that can enable CSPs to participate in emerging digital ecosystems.

Since the technology specifics of 5G are still a work in progress, there will be shifts in product or service offerings. Technology alliances and partnerships between diverse stakeholders are likely to arise. Such a nebulous market can be confusing for enterprises and participants, especially in the context of evolving standards.

An industry-platform-centric approach to 5G has the potential to enhance a CSP’s ability to deliver better business outcomes to their enterprise customers. However, new operating practices are required. The isolationist nature of processes, systems and methodologies within the network and IT will also need to be addressed (see “Unlocking the Value of Network and IT Fusion in CSPs”).

Most CSPs have begun implementing some of the foundational capabilities for treating 5G as a platform, such as software-defined networking and network function virtualization (NFV). These provide for the ability to divide services into smaller, software-driven functions, which allows businesses, operators and cloud providers to deploy and configure these services in a more-flexible manner. But again, these solutions and networks often lack interoperability.

Although it’s still early days for the 5G private network opportunity, regulators and standards bodies are beginning to put initiatives in place targeting this opportunity. CSPs have the potential to deliver turnkey network solutions into the industrial space. Equipment vendors would also have the option to do this directly.