Cignal AI Raises Forecast for Asia Optical Hardware Market while NA declined for 8th consecutive quarter

|

|

|

Optical Vendor Summary Reports

A new feature of the Optical Hardware Report this quarter are Optical Vendor Summary Reports which examine in depth the most recent quarterly results and items of interest about vendors in the optical market. Reports this quarter cover ADVA, Ciena, Fujitsu, Huawei, Infinera/Coriant and Nokia.

About the Optical Hardware Report

The Cignal AI Optical Hardware Report is published quarterly and includes market share and forecasts for optical transport hardware used in optical networks worldwide. The analysis includes an Excel database as well as PDF and PowerPoint summaries. Subscribers to the Optical Hardware Report also have access to Cignal AI’s real-time news briefs on current market events, Active Insight.

The report examines revenue for metro WDM, long-haul WDM and submarine (SLTE) equipment in six global regions and includes detailed port shipments by speed. Vendors in the report include Adtran, ADVA, Ciena, Cisco, Coriant, ECI, Ekinops, Fiberhome, Fujitsu, Huawei, Infinera, Juniper Networks, Mitsubishi Electric, MRV, NEC, Nokia, Padtec, Tejas, Xtera and ZTE.

Full report details, as well as articles and presentations, are available on the Cignal AI website.

Ericsson: Global 5G subs to reach 1.5 billion by 2024; mobile broadband subs growing 15% YoY

Global 5G subscriptions are set to reach 1.5 billion by the end of 2024, when the technology will be available to more than 40 percent of the world’s population, according to the latest of Ericsson’s semi-annual mobility report. North America and northeast Asia are expected to lead the 5G uptake, with US service providers already beginning to offer 5G services this year or in 2019, rising to 55 percent of mobile subscriptions by the end of 2024. In northeast Asia, the corresponding forecast figure is over 43 percent. That would make 5G the fastest-growing generation of cellular technology to ever be rolled out globally.

The first commercial 5G subscriptions in Europe are expected next year, with the technology set to account for some 30 percent of mobile subscriptions in the region by end of 2024, said the report. Total mobile subscriptions are forecast to rise to 8.9 billion at the end of 2024, up from 5 billion at the end of this year.

Global mobile data traffic, meanwhile, grew 79 percent year-on-year in Q3 2018, the highest rate since 2013. Increased data-traffic-per-smartphone in northeast Asia, above all China, pushed the global figure notably higher, said Ericsson, adding that the region now has the second highest data traffic per smartphone at 7.3GB per month. North America still has the highest data traffic per smartphone, set to reach 8.6GB per month by the end of this year.

“As 5G now hits the market, its coverage build-out and uptake in subscriptions are projected to be faster than for previous generations. At the same time, cellular IoT continues to grow strongly. What we are seeing is the start of fundamental changes that will impact not just the consumer market but many industries,” said Fredrik Jejdling, Ericsson executive vice president and head of business area networks.

…………………………………………………………………………………………………………………………………………………………

Ericsson states that the total number of mobile subscriptions was around 7.9 billion in Q3 2018, with 120 million new subscriptions added during the quarter. The number of mobile subscriptions grew at 3 percent year-on-year and currently totals 7.9 billion. China had the most net additions during the quarter (+37 million), followed by India (+31 million) and Indonesia (+13 million). The high subscription growth in China continues from Q1 and Q2, and is likely the result of intense competition among communications service providers.

The number of mobile broadband subscriptions is growing at 15 percent year-on-year, increasing by 240 million in Q3 2018. The total is now 5.7 billion.

References:

https://www.ericsson.com/en/mobility-report/reports/november-2018

https://www.telecompaper.com/news/global-5g-subs-to-reach-15-billion-by-2024-ericsson–1270919

Verizon’s “5G” FWA Progess in Sacramento vs Huawei’s Home Broadband System

Verizon’s “5G” FWA Progresses in Sacramento, CA:

Sacramento Chief Innovation Officer Louis Stewart said in an interview with Government Technology that the California state capital became one of the first four cities nationally to debut Verizon’s (proprietary) “5G” fixed wireless access (FWA) network, along with Los Angeles, Houston and Indianapolis on October 1st. The purpose of this and other FWA broadband networks is to deliver residential triple play services.

More “5G” offerings should arrive in Sacramento during 2019:

• Sacramento is on schedule to be one of the nation’s first 11 cities that will have the infrastructure needed to underpin “5G” and a connected future. That includes: in-ground fiber to link light poles and traffic signals and materials to support free Wi-Fi via kiosks in 27 parks. Much of this should arrive in early 2019, the innovation officer said, calling the digital kiosks “not on hold indefinitely,” implying “the conversation is still happening.”

• Emilie Cameron, public affairs and communications director for Downtown Sacramento Partnership (DSP), the nonprofit that manages the assessment for the property-based improvement district, said the city reached out to the group in late 2017 with “high-level” information about the Verizon partnership. But she described the conversation as “conceptual.” She described the response to the kiosks as generally positive but agreed district members are interested to learn where the devices will be located, what they’ll look like and what content and services will be offered. “You don’t want anything to be in conflict with the streetscape,” Cameron said.

• Stewart said a great deal of coordination must happen to enable deployment of infrastructure and services in 2019, which he described as “a fairly heavy lift.” Sacramento, the innovation executive said, wants to ensure the project is “done right” for the community whether in the parks or in the downtown corridor, to enable “the right user experience.” Much content development for the kiosks’ digital displays remains to be completed, he said, but officials are currently in the “ideation phase.”

“If the future that everybody’s looking at is how do you build, ultimately, a connected city, kiosks fit into that, whether it be providing additional connectivity to connect the cars and autonomous cars as they essentially geolocate, driving down the streets. They could provide other smart city solutions, be they charging stations or power down the road, in some kind of way,” Stewart said.

……………………………………………………………………………………………………………………………………………………………………….

Huawei’s 5G Home Broadband System:

Huawei and U.K. carrier Three showcased a 5G home broadband demonstration using Three’s 100 megahertz of C-Band spectrum last week at the Huawei’s Global Mobile Broadband Forum in London, which IEEE Techblog has been reporting on this week and last.

The demonstration leveraged Huawei’s latest 5G-based home broadband routers to allow forum attendees to experience ultra-high-speed 5G broadband services such as cloud gaming and 4K video streaming, Huawei said. The world’s #1 network equipment vendor highlighted that the 5G broadband service will deliver a maximum download speed of 2 Gbps, with an average of 1 Gbps for a single user.

Huawei and Three U.K. carried out a pre-commercial network test of this technology earlier this year. The two companies plan to carry out further 5G service tests in the U.K. in the coming months, which are expected to be released to the public in densely-populated urban areas and train stations, paving the way for the full commercial use of 5G networks in 2019.

“The 5G trials we carried out today demonstrate the opportunity this technology brings to the home broadband market. Huawei will continue to work with Three UK to bring customers more market-leading commercial applications of 5G,” said Yang Chaobin, President of Huawei 5G Product Line.

“Huawei is the only true 5G supplier right now,” said Neil McRae, chief architect at British Telecom. “Others need to catch up. I’ve been to Shenzhen recently and there’s nowhere else in the world where you can see” the kind of 5G technology developments that Huawei has achieved. Other suppliers need to learn from Huawei. Others are held back by old telco issues,” McRae added.

In the UK, Three, EE and BT have all said they’re launching a 5G network in some form in 2019 (that’s 1 year before IMT 2020 standard will be completed and with no standards for virtual RAN, Cloud RAN, network slicing, scheduling, OA&M, etc). EE has announced which cities will be first to get its 5G service.

………………………………………………………………………………………………………………………………………………………….

Analysis:

Some pundits say that 5G FWA networks have the potential to complement fiber to the home (FTTx) deployments by providing an alternative “last-mile” solution consumer and business services. In both urban and suburban regions, the ability to deploy 5G FWA will help reduce costs for operators and increase accessibility of high speed broadband for residential FWA customers. 5G FWA networking equipment also requires a much smaller footprint than traditional mobile networks, reducing requirements for government approvals of new tower locations.

Market research firm Ovum has this assessment of Huawei’s “5G” FWA strategy:

Huawei has gradually built its WTTx fixed wireless access (FWA) business into a key component of its wireless broadband portfolio. At the Huawei Global Analyst Summit earlier this month, the vendor reported significant successes for WTTx and high expectations for its future development. Although still small in scale relative to mobile broadband services, the FWA market is experiencing rapid growth, even outpacing FTTx and copper for new subscription additions in many world markets, according to Huawei’s figures. WTTx is central to Huawei’s wireless broadband strategy.

Even though other large network equipment vendors including Nokia and Ericsson provide their own fixed wireless broadband solutions, Huawei is arguably more aggressive in its public backing of FWA. Huawei’s work with WiMAX has given it more experience with fixed wireless and it has existing FWA operator relationships it can leverage. Huawei’s FWA strategy also differs from that of competitors such as Nokia in that it places WTTx as part of its mobile products line rather than part of its fixed broadband offering.

Huawei already claims a substantial installed base for its WTTx fixed wireless offering, with 200 WTTx commercial networks in service and 50 million households connected as of end-2017. The vendor says 82 operators launched WTTx for home broadband in 2017 alone, and it expects to see a surge in demand over the next two years.

The future growth of FWA will depend on a number of factors, including the ability to deliver efficient and sustainable home broadband services to underserved and unconnected communities more economically than fiber alternatives. Huawei has identified the following four major deployment models where it believes WTTx can provide a fiber-like experience to complement fixed broadband:

-

As a home fixed broadband service for mobile operators to deliver triple-play services

-

As a complement to wireline broadband services for converged operators

-

As a DSL upgrade for wholesale broadband providers

-

As a 5G-oriented fixed wireless broadband service.

Along with a maturing WTTx ecosystem, a number of factors support the expansion of fixed wireless services. On the network side, spare cell capacity arising from the uneven traffic distribution associated with smartphones can be used more efficiently by operators introducing FWA services. On the equipment side, advances in self-install CPE, along with performance and efficiency gains from the incorporation of multiple receiver and antenna technologies and the use of massive MIMO and 256QAM at the eNodeB, is helping to deliver a high-capacity equivalent to evolved LTE. This will support the evolution toward 5G FWA.

Even so, the business case for FWA is likely to be challenging, particularly in emerging markets where population densities and ARPU are low. Huawei believes governments and regulators can promote the benefits of universal network coverage by providing more practical encouragement and financial stimulus to local mobile operators. It offers a business operation and management platform as part of its WTTx pre-sales service suite, which helps operators evaluate the potential opportunity for a fixed wireless solution based on aspects such as network capacity trends and coverage gaps in existing FTTx and wireline networks.

Ultimately, the success of fixed wireless broadband will depend on the scope it provides for operators to monetize services.

Huawei’s “All Bands Go to 5G” Strategy Explained; Partnership with China Telecom Described

Huawei unveiled its “All Bands Go to 5G” strategy for the evolution towards a 5G wireless network at its Global Mobile Broadband Forum 2018 in London last week. This strategy provides suggestions for future development of the wireless network in three key aspects: simplified site, simplified network, and automation.

Huawei Launches the Evolution Strategy for 5G-oriented Wireless Target Network

……………………………………………………………………………………………………………………………………………………………………………

I. Global commercial use of 5G networks has now entered the fast lane.

Massive wireless connectivity has become an inevitable trend. Data traffic on global mobile broadband (MBB) networks has increased rapidly. By 1st half of 2018, the data of usage (DOU) for a number of global operators has exceeded 10 GB, and that in certain Middle East regions has even reached 70 GB. Releasing data traffic helps to promote a positive MBB business cycle in the global wireless industry and ushers in a new era of traffic operation.

By October 2018, new fixed wireless access (FWA) services have been put into commercial use on about 230 networks. About 75 million families can now enjoy the benefits of FWA-based home broadband (HBB) services. In the future, the larger bandwidth capability of 5G will provide fiber-like HBB user experience and enable diverse home entertainment applications such as 4K/8K UHD video and AR/VR. At the same time, new IoT connections are becoming a new source of potential growth for operators. LTE NB-IoT is undergoing rapid development and has seen 58 commercial networks around the world, with industry applications providing millions of connections such as smart gas, water, white goods, firefighting, and electric vehicle tracking. 5G technologies will offer more reliable connection capabilities with shorter latency. Massive wireless connectivity has become an inevitable trend.

The development of the global 5G industry is accelerating in 2018. According to the 5G spectrum report published by GSA in November 2018, the UK, Spain, Latvia, Korea, and Ireland have officially released spectrum resources dedicated for 5G by August 2018. In addition, 35 countries have scheduled related plans. The 5G industry supply chain is steadily growing more and more mature.

Huawei claims to have released 5G commercial CPEs in 2018 (???), and multiple 5G smartphones will be launched in 2019. According to the report released by GSMA, 182 global operators are conducting tests on 5G technologies and 74 operators have announced plans for 5G commercial deployment. Global commercial use of 5G networks has now entered the fast lane, according to Huawei (but not this author).

5G development will enable more commercial application scenarios and promote the continuous development of a digital society. Under such circumstances, Huawei has proposed a new eMBB (enhanced Mobile Broad Band) industry vision for Cloud X featuring smart terminals, broad pipes, and cloud applications. For example, Huawei has shifted the most complex processes of rendering, real-time computing, and service content to the cloud. Thanks to transmission data streams using large bandwidth and ultra-low latency on the 5G network, as well as encoding and decoding technologies that match the cloud and terminals, applications such as Cloud AR/VR can be deployed anywhere anytime, according to the company.

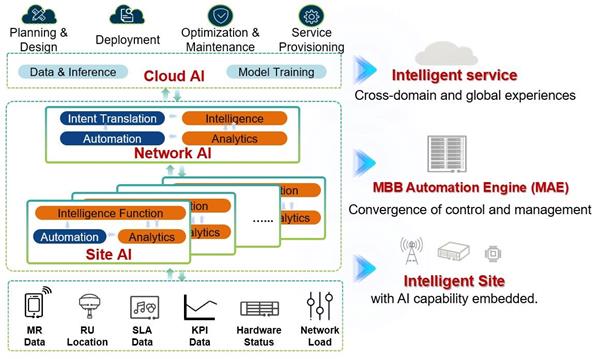

Huawei believes that AI technologies can be adopted in the communication industry. AI-based automation of network planning, deployment, optimization, and service provisioning will enable network O&M to be simplified, unleash network potential, and make networks more intelligent.

II. “LTE Evolution+5G NR” is gaining industry’s consensus for 5G wireless networks.

In the 5G era, wireless spectrum evolution is divided into two phases:

Phase 1: Sub-3 GHz spectrum resources evolve to LTE and 5G non stand alone (based on 3GPP release 15 NR) high frequency bands are introduced.

Phase 2: Sub-3 GHz spectrum resources evolve to 5G NR. “LTE Evo+NR” is realized on the target network.

Therefore, target network evolution in the 5G era can be summarized as “LTE Evolution+5G NR.” In the process of achieving this goal, the global wireless network faces the following challenges:

1. OPEX increases year by year. From 2005 to 2017, global operators’ OPEX/revenue percentage is increased from 62% to 75%. In the future, the coexistence of 2G, 3G, 4G, and 5G will increase the complexity of network O&M. In particular, site TCO is high. Site deployment still faces several issues such as difficult site acquisition, high engineering costs, and high site rentals.

2. 4G-LTE basic services fall back to 2G or 3G. Generally, insufficient 4G network coverage causes VoLTE services to fall back to 2G or 3G, deteriorating voice experience. NB-IoT/eMTC services also require better 4G network coverage. As a result, it is difficult for operators to shut down 2G and 3G networks.

–>The coexistence of four RAN technologies leads to more complex network operation and presents difficulties in reducing OPEX.

III. 5G-oriented simplified networks are built to effectively meet challenges and promote 5G business success.

Peter Zhou, CMO of Huawei Wireless Network Product Line, illustrated the evolution strategy for 5G-oriented wireless target network. This strategy aims to help operators resolve the preceding challenges and commercialize 5G. The evolution strategy includes three key aspects: simplified site, simplified network, and automation.

Simplified site enables full outdoor base stations and facilitates site acquisition, deployment, and TCO saving.

Along with the development of Moore’s Law, the 7 nm technology has enjoyed widespread commercial adoption throughout the chip manufacturing industry, and BBUs are becoming more and more integrated. In recent years, lithium battery technology has seen rapid development, and the energy density of lithium batteries is far more superior to that of lead-acid batteries. The development of new technologies makes full outdoor wireless base stations a reality. Peter Zhou pointed out, “Using componentized outdoor BBUs, blade power modules, and blade batteries, full outdoor macro base stations can be deployed on poles without shelters or cabinets. This greatly reduces the upgrade cost of existing sites, decreases the difficulty and cost of obtaining new sites, and helps operators reduce TCO by 30% and above.”

Antenna reconstruction is required for 5G deployment on the C-band. Currently, 70% urban sites cannot deploy new antennas due to insufficient antenna space. In order to resolve this problem, Huawei proposes the “1+1” antenna solution. That is, one multi-band antenna is used to support all sub-3 GHz bands, and one Massive MIMO AAU is used to support C-band NR. In total, two antennas are able to support all operator’s frequency bands. This solution greatly simplifies site space, reduces site OPEX, and realizes 5G NR deployment with insufficient antenna space.

Simplified network realizes the construction of an LTE full-service foundation network and ensures “Zero Fallback” for three basic services.

In the 5G era, the coexistence of multiple RAN technologies (2G/3G/4G/5G) results in complex networks and high O&M costs. Therefore, basic voice, IoT, and data services need to be migrated to the LTE network so that the LTE network becomes the bearer network for basic services and 2G and 3G networks enter the life cycle development phase. Huawei’s Peter Zhou emphasized that, “The LTE network needs to be built as a full-service foundation network to achieve ‘Zero Fallback’ for basic services such as voice, IoT, and data. Therefore, LTE must be planned based on the coverage of basic services rather than the traditional population coverage.”

“Simplified site, simplified network, and automation help operators reduce TCO, simplify the network architecture, reduce operation costs, and fully unleash the network potential. This lays a solid foundation for the successful commercial use of 5G networks and helps the industry to identify the goal and direction for future network evolution. Huawei also wishes to work more closely with industry partners to innovate continuously, build a 5G business ecosystem, and finally achieve a better connected digital society.”

……………………………………………………………………………………………………………………………………………….

Separately, China Telecom announced it had partnered with Huawei for investment in 5G innovation and has begun researching how to commercialize 5G technology. Both parties intend to leverage their advantages to develop the 5G service innovation base, build an industry ecosystem alliance, and research the usage scenarios and business models of 5G services. Huawei Wireless X Labs in Shenzhen, simulates 5G technologies and usage scenarios, and works with upstream and downstream industry partners to jointly develop industry standards and plans. China Telecom leverages the resources of 5G trial networks and existing industry customers to develop new 5G applications, driving the development of the entire 5G industry and improving China Telecom’s influence in the 5G field.

Application Models

Based on the first of six 5G trial network, China Telecom Shenzhen is exploring 5G application models. During the 5G Unmanned Aerial Vehicle (UAV) flight test and inspection demonstration, remote control personnel experienced VR capabilities and remote HD video transmission over a low-latency 5G network. Both the maiden test flight and inspection were completed successfully, demonstrating the ability of 5G to support UAV applications. This means that aerial photography, unattended inspection, logistics transportation, security identification, and other industrial applications will be driven by the rapid development of 5G in the telecom sector, creating a strong foundation for China Telecom to explore new vertical industries. In tests on Gbps-level experience buses, 5G provided an average speed of more than 1 Gbps and a peak rate of 3 Gbps, allowing passengers to experience mobile 4K IPTV, 16-channel HD video streams, and VR applications while traveling. This paves the way for China Telecom’s plans of 5G and IPTV convergence.

To achieve its goal of connecting 50 5G sites by the end of 2018 while constructing its transport network, China Telecom Shenzhen upgraded its existing IP RAN to deploy and verify 5G technologies, enabling the co-existence of both 4G and 5G. In addition, the operator gained valuable engineering experience and developed scenario-based solutions for subsequent 5G construction.

Addressing 5G challenges for the smooth evolution of live networks

While bringing a wide variety of services, 5G also brings challenges in terms of bandwidth, latency, connections, and the slicing of transport networks. GNodeBs, however, deliver five to ten times more bandwidth than eNodeBs. 5G services such as Internet of Vehicles (IoV) require the latency to be one-tenth of what they are with 4G. In terms of connections, the cloudification of wireless and core networks brings full-mesh connections, requiring flexible scheduling on the transport network. In addition, 5G’s differentiated services require network slicing, with a focus on isolation and the automated management of network slices on transport networks. To cope with these challenges, China Telecom Shenzhen assessed the existing IP RAN, opting to upgrade and expand core and aggregation devices and replace specific access devices for 5G transport. To quickly deploy 5G services and fully reuse the existing network, China Telecom Shenzhen implemented the smooth evolution solution for the transport network in pilot areas.

Network upgrade for co-existence of 4G and 5G

The co-deployment of eNodeB and gNodeB is the optimal choice for transport networks, and China Telecom Shenzhen verified different co-existence solutions. Access ring devices can be upgraded and expanded to satisfy the requirements of 50GE ring networking and allow 4G and 5G services to share the same access ring. When access devices need to be replaced, China Telecom Shenzhen can establish a new 5G access ring, which can share the core and aggregation layer to achieve unified service bearing.

E2E large capacity to meet HD video transmission requirements

As China Telecom continues to explore 5G services, the convergence of 5G and IPTV has become its focus. To meet the requirements of 4K IPTV video transmission using 5G, the transport network must have large bandwidth transmission capabilities. China Telecom Shenzhen upgraded the access layer from an eNodeB GE ring to a 50GE ring, and upgraded the core and aggregation layer from a 10GE network to a 100GE network, allowing high-bandwidth connections between base stations and the core network.

References:

https://techblog.comsoc.org/2018/11/06/gsma-5g-spectrum-guide-vs-wrc-2019/

OpenSignal: Cellular networks getting faster than Wi-Fi; but not in U.S.

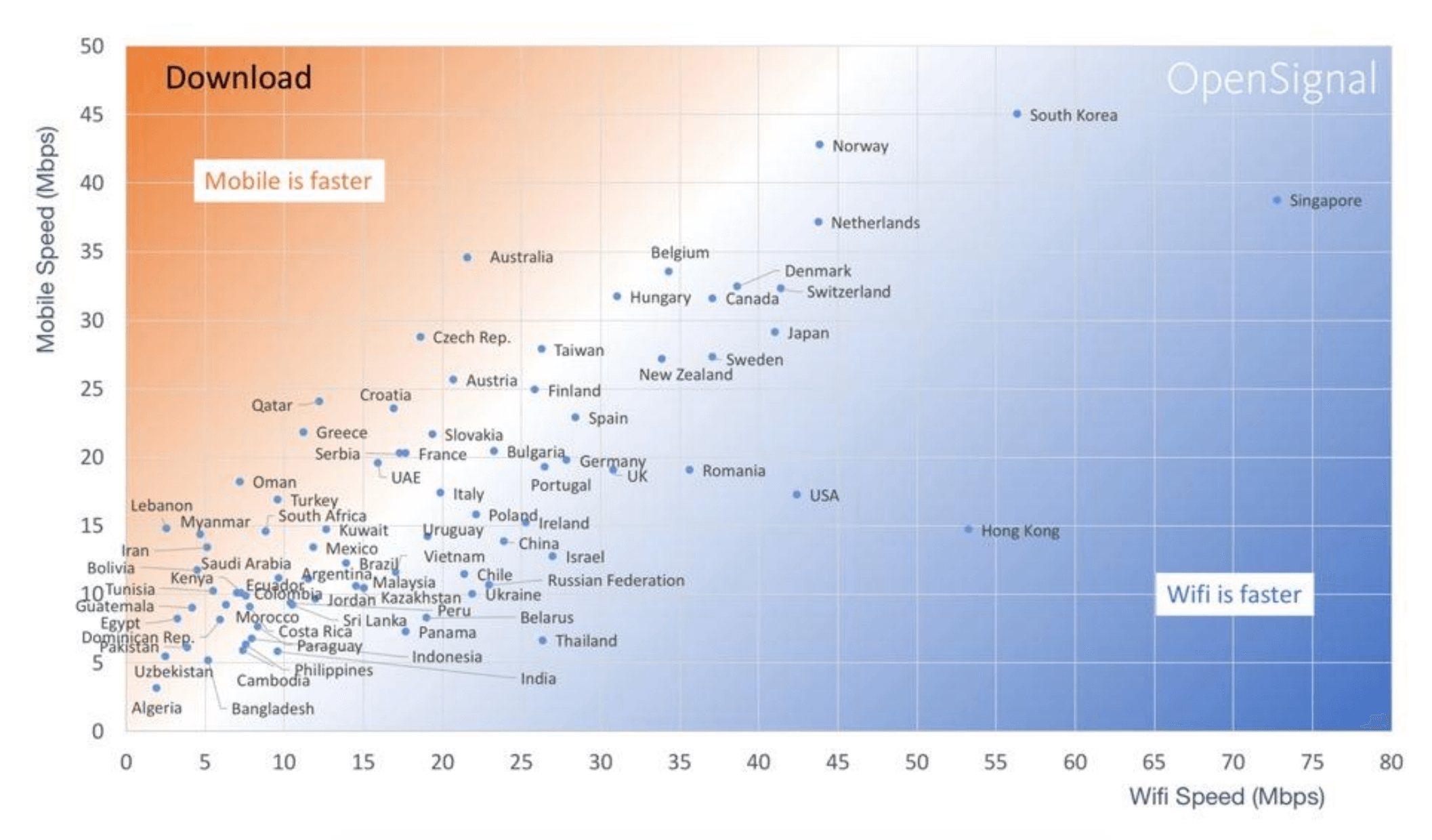

According to a new report by OpenSignal, cellular network speeds have gotten faster and often greater than average Wi-Fi speeds. In 33 countries, smartphone users now experience faster average download speeds using a mobile (cellular) network than using Wi-Fi. The upshot is that cellular networks (some type of LTE) are no longer inferior to Wi-Fi in every country and the mobile industry must change a number of design decisions as a result.

Australia smartphone users experienced the biggest advantage with average download speeds 13 Mbps faster on mobile networks than on Wi-Fi. The mobile network advantage for a few other countries: France (+2.5 Mbps); Qatar (+11.8 Mbps); Turkey (+7.3 Mbps); Mexico (+1.5 Mbps) and South Africa (+5.7 Mbps).

In sharp contrast to the above, U.S. Wi-Fi is still 25Mbps faster than mobile networks on average. Same is true for Hong Kong, South Korea, and Singapore.

Hong Kong’s mobile networks deliver average speeds that are 38.6Mbps lower than that experienced over Wi-Fi. Hong Kong’s mobile users experience an average speed over Wi-Fi of nearly 55Mbps, compared to just 15Mbps for its mobile network.

In China by contrast, average Wi-Fi speeds were recorded at 23.9Mbps, compared to overall mobile download speeds of 13.8Mbps.

Of the Asia-Pacific countries studied, only Japan, South Korea and Singapore recorded faster Wi-Fi compared to mobile speeds, and the difference between the two was a lot closer in each market. South Korea recorded the fastest average mobile speeds of around 45Mbps, compared to 56Mbps for Wi-Fi, while Singapore had the fastest Wi-Fi speeds of 73Mbps, compared to around 39Mbps over Wi-Fi.

OpenSignal states that telecom operators in markets where there is little difference between mobile and Wi-Fi speeds are using fixed wireless networks effectively to support their cellular networks. They also experience greater mobile network consumption as consumers in the market have little incentive to switch networks.

With 5G coming in various flavors, cellular networking speeds are bound to get faster and better. However the next generation of Wi-Fi – IEEE 802.11ax or Wi-Fi 6 is designed for cellular data offloading to a fixed broadband wireless network. Hence, both technologies are meant to be complementary.

Another interesting observation from the study is a mobile device’s tendency to favor Wi-Fi over cellular, even if the Wi-Fi connection is not as good (that’s my experience with a Samsung smart phone). With the exception of smart phones made by Huawei, most cellular devices will automatically switch from cellular networks to Wi-Fi without performing a speed test. Huawei phones will switch from a slow Wi-Fi link to a faster cellular connection where appropriate. We think the entire mobile phone industry should do this type of speed test and wireless network switching in both directions (Wi-Fi to cellular and cellular to Wi-Fi).

References:

https://www.theregister.co.uk/2018/11/23/mobile_v_wifi_speed_report/

https://www.techspot.com/news/77559-opensignal-mobile-networks-getting-faster-than-wi-fi.html

https://www.cw.com.hk/it-hk/hong-kong-mobile-networks-significantly-slower-than-wi-fi

Huawei has 22 commercial 5G contracts; U.S. government warns allies about the company

1. Huawei has signed 22 commercial contracts for 5G as operators prepare for the commercial launch of the new technology.

The company’s executive director and president of carrier business group Ryan Ding made the announcement during a keynote speech at the Global Mobile Broadband Forum (MBBF) in London.

During his speech, Ding noted that a number of operators are expediting 5G commercial deployment in order to secure the first mover advantage. Major countries representing a third of the global population are among the first adopters of the technology.

“So far, we have signed 22 commercial contracts for 5G, and we are working with over 50 carriers on 5G commercial tests,” Ding said.

“Through heavy investment and continuous innovation, we are committed to helping carriers deploy 5G networks easily, rapidly, and cost-effectively. And we are ready to work with all stakeholders to drive robust development of the 5G industry.”

Ding spoke of the technical capabilities of Huawei’s 4G/5G kit, such as an uplink and downlink decoupling that can achieve co-coverage of 4G and 5G using C-band spectrum, and the ability to offer end-to-end solutions meant it was an ideal partner for operators.Ding added that the first 5G smartphones will be available next year, and phone makers are expected to launch budget 5G phones priced at around $100 soon after the commercial roll-out of 5G networks.

He also mentioned the relatively small size and lightweight of Huawei’s wireless networking equipment. This will appeal to operators struggling to add more equipment to mobile sites, especially in urban areas

“Every new generation of network comes with new challenges, and this applies to 5G commercial deployment, too,” said Ding. “We take complexity and deliver simplicity. That means we will provide innovative solutions to address challenges in 5G commercialization. Our close collaboration with carriers will help them find the easy way to 5G.

“Huawei has earned customer recognition for our leading 5G end-to-end capabilities and innovative products and solutions. So far, we have signed 22 commercial contracts for 5G, and we are working with over 50 carriers on 5G commercial tests. Through heavy investment and continuous innovation, we are committed to helping carriers deploy 5G networks easily, rapidly, and cost-effectively. And we are ready to work with all stakeholders to drive robust development of the 5G industry.”

The 5G contracts could also be viewed as a vote of confidence in Huawei. It has effectively been frozen out of the U.S. and Australian markets due to national security fears, specifically that the use of its equipment risks the possibility of Chinese government backdoors.

–>The effort to ban Huawei is further described in 2. below.

………………………………………………………………………………………………………………….

2. U.S. Asks Allies to Drop Huawei – worried about potential Chinese meddling in 5G networks, but foreign carriers may balk

WSJ article front page lead story on 23 November 2018

The U.S. government has initiated an extraordinary outreach campaign to foreign allies, trying to persuade wireless and internet service providers in these countries to avoid telecommunications equipment from China’s Huawei Technologies Co., according to people familiar with the situation.

American officials have briefed their government counterparts and telecom executives in friendly countries where Huawei equipment is already in wide use, including Germany, Italy and Japan, about what they see as cybersecurity risks, these people said. The U.S. is also considering increasing financial aid for telecommunications development in countries that shun Chinese-made equipment, some of these people say.

One U.S. concern centers on the use of Chinese telecom equipment in countries that host American military bases, according to people familiar with the matter. The Defense Department has its own satellites and telecom network for especially sensitive communications, but most traffic at many military installations travels through commercial networks.

Officials familiar with the current effort say concerns about telecom-network vulnerabilities predate the Trump era and reflect longstanding national-security worries.

The overseas push comes as wireless and internet providers around the world prepare to buy new hardware for 5G, the coming generation of mobile technology. 5G promises superfast connections that enable self-driving cars and the “Internet of Things,” in which factories and such everyday objects as heart monitors and sneakers are internet-connected.

U.S. officials say they worry about the prospect of Chinese telecom-equipment makers spying on or disabling connections to an exponentially growing universe of things, including components of manufacturing plants.

“We engage with countries around the world about our concerns regarding cyberthreats in telecommunications infrastructure,” a U.S. official said. “As they’re looking to move to 5G, we remind them of those concerns. There are additional complexities to 5G networks that make them more vulnerable to cyberattacks.”

The briefings are aimed at dissuading governments and telecom executives from using Huawei network components in both government and commercially operated networks. A core focus of the briefings is Beijing’s ability to force Chinese corporations to comply with government requests from government authorities, a U.S. official said.

The talking points also emphasize how wireless and internet networks in a few years could be more susceptible to cyberattacks or espionage, people familiar with the briefings said. Today’s cellular-tower equipment, for instance, is largely isolated from the “core” systems that transfer much of a network’s voice and data traffic. But in the 5G networks telecom carriers are preparing to install, cellular-tower hardware will take over some tasks from the core—and that hardware could potentially be used to disrupt the core via cyberattacks. For that reason, U.S. officials worry that Huawei or ZTE cellular-tower equipment could compromise swaths of a telecom network.

Huawei is the world’s No. 2 smartphone maker behind Samsung Electronics Co. It is the global leader for telecom equipment, such as the hardware that goes into cellular towers, internet networks and other infrastructure that enables modern communication.

Huawei has long said it is an employee-owned company and isn’t beholden to any government, and has never used its equipment to spy on or sabotage other countries. It said its equipment is as safe as that of Western competitors, such as Finland’s Nokia Corp. and Sweden’s Ericsson , because all manufacturers share common supply lines.

In a statement Friday, Huawei said it has its customers’ trust and was “surprised by the behaviors of the U.S. government” detailed in this article. “If a government’s behavior extends beyond its jurisdiction, such activity should not be encouraged,” it said.

The Trump administration and Congress this year initiated a multipronged push to tighten up restrictions on Huawei and other Chinese telecom-equipment manufacturers, including ZTE Corp. The Federal Communications Commission, for instance, moved to restrict federal subsidies to some carriers if they buy Chinese gear.

Even without U.S. business, Huawei dominates the world’s telecom-equipment market. Last year, the company held a 22% share globally, according to research firm IHS Markit Ltd. Nokia had 13%, Ericsson had 11% and ZTE was in fourth at 10%. Dell’Oro Group says Huawei has a 38% revenue market share in Asia Pacific, a 30% share in Europe, but only a 2% share in North America.

Some other members of the “Five Eyes,” a five-member intelligence pact among English-speaking countries that includes the U.S., have also publicly challenged Huawei. The Australian government in August banned Huawei and ZTE from its 5G networks. In October, U.K. authorities said they were reviewing the makeup of its telecom-equipment market, a move industry leaders said was clearly aimed at Huawei.

Still, there is a big hitch to U.S. efforts to curb Huawei overseas: The company is already popular among carriers in allied countries, including some of America’s closest military partners. Some major carriers in these places say Huawei offers the most products and often customizes them to fit a carrier’s needs. They also cite lower costs and high quality.

In an effort to narrow that advantage in some countries, Washington is considering ways to increase funding from various U.S. government sources to subsidize the purchase and use of non-Chinese equipment, according to people familiar with the matter. Countries buying Chinese telecommunications equipment would be ineligible for such subsidies.

In the past year, U.S. officials, including representatives from the National Security Council and Commerce, Defense and State departments, worked together to produce briefing notes about why they believe Chinese telecom equipment poses national-security risks, people familiar with the matter said. One U.S. government official said they focused on Huawei but also included ZTE, a Chinese rival with a much smaller business outside China. A ZTE representative declined to comment on the U.S. effort.

Washington has circulated the notes to national-security officials as well as to embassies, with the idea that they can deliver the message to foreign officials and telecom executives, some of the people said.

A spokesman for the Commerce Department said it would “remain vigilant against any threat to U.S. national security.” Spokesmen for the National Security Council and the State Department declined to comment. The Defense Department didn’t return a request for comment.

U.S. officials have briefed counterparts in Germany, which has signaled a new wariness toward Huawei, according to people familiar with the matter. Huawei this month opened a lab in Germany similar to one it already operates in Britain, where Huawei products are inspected for security flaws. The U.K. government said in July it found shortcomings in the process.

Germany’s Federal Office for Information Security declined to comment.

American officials have also briefed Japanese officials about Huawei, people familiar with the matter said. A Japanese government official said “we share various information with the U.S.,” but declined to comment on specifics. Japanese officials in August said they were studying restrictions on Huawei.

Telstra completes “5G” data call using Qualcomm chipset

Telstra says it has successfully conducted a live “5G” data call using a commercial chipset on the telco’s wireless network. Australia’s largest network operator made a 3GPP Release 15 (not 5G according to 3GPP) compliant data call using its 3.5GHz spectrum, Ericsson’s latest 5G network software and Qualcomm’s commercial 5G Snapdragon chipset in a form factor device.

The operator also said it turned on two 5G-enabled base stations in the state of Tasmania. In August it switched on its first 5G-compatible cell sites to enable testing of pre-commercial devices, with aims to deploy more than 200 sites across Australia by the year-end. Telstra plans a commercial 5G launch in 2019 and is engaged in various trials at its 5G Innovation Centre in Australia’s Gold Coast (see pic below), which it opened in February. That Centre, supported by Ericsson, has since been home to several world and Australian firsts including the world’s first precinct of 5G-enabled WiFi hotspots, Australia’s first 5G Connected Car, the world’s first end-to-end 5G non-standalone data call on a commercial mobile network, and the launch of over 50 5G-enabled sites around the country.

Although the form factor device used for the so called “5G” test is larger than most mobile handsets, it bears a far closer resemblance to a commercially available smartphone than the 200kg, fridge-like prototype 5G device that Telstra was employing for tests just a few months ago.

“Today’s announcement is a significant milestone as it signals that commercial 5G devices are getting closer and closer,” he added.

“Field testing in our real-world mobile network with this chipset over our commercial spectrum moves the verification well and truly from the lab into the street,” Seneviratne said. “The team will continue testing over the coming months to improve data rates and overall performance in readiness for device availability.”

Telstra’s chief executive, Andy Penn, has said that he expects the transition from 4G to 5G to be even swifter than the migration from 3G to 4G.

In July this year Telstra said that it had successfully conducted a 5G data call over its network using Intel’s 5G Mobile Trial Platform. In August the company announced that it had started progressively declaring its mobile sites ‘5G-ready’ — a move that rival telco Optus dismissed as a marketing stunt.

The Australian Communication and Media Authority is currently auctioning off spectrum in the 3.6GHz band, which will play a key role in early 5G services.

References:

https://www.computerworld.com.au/article/649902/telstra-gets-ready-put-5g-your-pocket/

GSMA, China Telecom & Huawei on 5G; GSMA says 40% of the world’s population will be on 5G by 2025

Mats Granryd, the Director General of the telecom trade organisation GSMA talked up 5G and AI in a keynote speech on “intelligent connectivity” at Huawei’s MBB 2018 event at London’s ExCel. Granryd said those two emerging technologies will be key enablers for what the telecom industry has to offer in the years to come. Granryd discussed the potential of 5G to drive inclusion, growth and sustainable development, especially in the developing world. He also touched on the impact of “smart” capabilities like artificial intelligence and network capabilities, and how such networks and technologies must be secure to drive the growth not only of smart cities, but all cities. He said intelligent management will be key with “the development of a rich and vibrant digital economy.”

In addition to predicting that 70% of the world’s population, or roughly 6 billion people will be on mobile internet, GSMA forecast 40% of the world population will be on 5G networks. When it comes to AI, on top of improving individual experience (e.g. Personal Assistants) and serving new industry needs (e.g. network slicing), Granryd highlighted what the combined AI capabilities can do for society. The GSMA’s “Big Data for Social Good” initiative has launched in seven countries around the world. Mobile operators in those markets have worked with local partners to enable air pollution warning, malaria spreading prediction, and natural disaster preparedness, using big data and machine learning and prediction capabilities.

Guiqing Liu, EVP of China Telecom, the world’s largest integrated operators in the world by subscriber number, then took the stage to share what China Telecom saw as the biggest opportunity for telecom operators to undertake the digital transformation, especially with the ascendancy of industry markets. Liu included four key capabilities the industry in particular the operators need to master to succeed in the transformation. They are:

- End-to-end slicing to cater to different user and industry needs;

- FMC (Fixed to Mobile Convergence) edge computing to deliver seamless experience;

- 5G+Cloud based network and services to provide flexible and special customization; and

- 5G+AI to both optimise service delivery and network management.

Liu also outlined the key challenges the industry is facing before 5G can become a real commercial success. He conceded that use cases now are still very much focused on eMBB, and the industry has not thought through how to change business models in the new era, including how to bill customers for the new use cases. On network challenges, in addition to the CAPEX and OPEX and skill gap, Liu also pointed the indoor coverage weakness intrinsic of the high frequency bands most 5G networks will be built on. For 5G to truly be transformative and improve people’s lives, Liu said that companies will need to work together and collaborate – even if they’ve traditionally been rivals.

Ken Hu, deputy and rotating chairperson of Huawei stressed the importance 5G was already playing in shaping the future of not only business, but humanity, adding Huawei has been working on 5G for more than 10 years. “We believe 5G will make a big contribution to our society.” Hu also said 5G was leading to the integration of previously separate technologies and services not unlike individual pieces of Lego bricks being combined to make something larger – fundamentally changing the definition of what a telco or technology company is. The user experience will be redefined by 5G.”

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Outside the main presentation halls, a number of booths showcased both Huawei technologies and those from Huawei partners. A “5G bus” drove people around the surrounding Docklands area. The demo drive showed that 5G connections, download speeds and more could all be achieved while physically moving across large distances at a high speed and in poor weather (this being London, it was fittingly rainy, windy and cold). Tents erected outside ExCel London were also stuffed with 5G use case demonstrations.

References:

http://telecoms.com/493703/40-of-the-worlds-population-on-5g-by-2025-says-gsma/

5G Pre-Commercial Deployments from Finland’s Telia Networks and Vietnam; Thailand 5G Trial?

1. Telia Finland launches pre-commercial 5G network in Oulu

Telia Company has announced the launch of launching a pre-commercial 5G network in the city of Oulu by its Finnish subsidiary, claiming that the development constitutes one of the world’s first industrial 5G environments. This 5G network was done in partnership with network equipment vendor Nokia,

In a press release on the development, Janne Koistinen, 5G Programme Director at Telia Finland, said:

“Oulu’s strong ecosystem and the operators’ open-mindedness in the introduction of new technologies accelerated our decision to continue the deployment of 5G in Oulu.”

Rauno Jokelainen, VP, Smart Radio Development Unit, Mobile Networks at Nokia, added:

“Oulu is one of the key locations for research and development of Nokia 5G technology and mobile network products globally. The strong start-up culture of the Oulu region and close cooperation between the city, the university and the businesses in the region have enabled a unique ecosystem to be created in Oulu. Among other things, the ecosystem built an open 5G test network where companies in the area collaborate to generate new products and services,”

Oulu has extensive plans to develop its industry and business activities, along the lines of the city’s strong technological tradition.

“The City of Oulu has pioneered the development and innovative use of various urban networks in cooperation with Nokia and different operators. Cooperation in 5G networks continues this culture and once again offers a platform for the development of new services and business models,” says Janne Mustonen from BusinessOulu.

The ecosystem built an open 5G test network where companies in the area collaborate to generate new products and services.

Telia opened a pre-commercial 5G network in Helsinki in early September

Telia, Nokia and Intel brong 5G to the factory floor

2. Vietnam plans to test 5G next year

Vietnam is set to award 5G test licences to the nation’s mobile operators in January next year, with a view to launching commercial networks in 2020. ‘Vietnam should be among the first nations to launch 5G services in order to move up in global telecom rankings,’ Nikkei Asian Review cites the Minister of Information and Communications, Nguyen Manh Hung, as saying. Pilot 5G services will be carried out in Hanoi and Ho Chi Minh City, with plans to upgrade mobile networks nationwide over the next couple of years.

TeleGeography’s GlobalComms Database states that Vietnam is home to five mobile network operators: military-run Viettel; state-owned MobiFone and VNPT-Vinaphone; Vietnamobile, which is a joint stock company between Hanoi Telecom Company (HTC) and Hutchison Asia Telecom; and GTel Mobile (Gmobile), owned by state-run investment vehicles.

3. Thailand may conduct 5G trials using 26 GHz spectrum

Thai regulator NBTC has indicated it will decide on Thursday whether to assign idle 26 GHz spectrum to AIS and True Corp to conduct 5G trials.

If approved, the NBTC plans to assign the spectrum for testing in two locations during the period between November 22 and December 15, the Nation reported, citing remarks from the regulator’s secretary general Takorn Tantasith at a recent 5G seminar.

AIS plans to conduct 5G testing using Nokia Networks equipment at the Emporium shopping mall in Bangkok, while True Corp intends to test Huawei equipment at the city’s EmQuartier mall. Dtac also plans to apply to conduct 5G testing using the same spectrum.

Thailand’s operators are taking a cautious approach to the introduction of 5G, according to executives who spoke at the seminar and were quoted in the Nation’sreport.

True Corp has urged the regulator to ensure 5G rollouts are sustainable by limiting the price of spectrum, while Dtac has called on Thailand’s public and private sector to collaborate on the development of an effective and sustainable 5G strategy.

With no 5G standard (IMT 2020) China is working on 6G!

Consumers can’t buy 5G phones yet. But China is already talking about what comes next: 6G. The concept of 6G is still very much unkown, but experts expect speeds in the range of 1 Tbps. Researchers have already achieved mobile speeds of 1 Tbps during lab trials.

The head of China’s Ministry of Industry and Information Technology’s (MIIT) 5G technology working group, Su Xin, told local media he also expects 6G to deliver improvements across the same three areas as 5G will deliver – improved bandwidth, low latency and wide connection areas.

Su Xin, head of 5G technology working group at China’s Ministry of Industry and Information Technology, said that China is starting research into 6G concepts this year. The country first started looking into 6G in March, making it one of the first countries to do so.

Su said that the actual development of 6G will officially begin in 2020, but commercial use will most likely have to wait until 2030.

The arrival of 5G has been touted as a big deal. It’s not just because it promises to bring fast mobile internet, it should also enable us to connect with machines – like gadgets, industrial machines and autonomous vehicles. For those Rip Van Winkle readers, “5G” is the name of the next-generation wireless technology that promises far faster internet access than 4G-LTE. Experts predict it will begin to take off in 2019, well in advance of the IMT 2020 standard from ITU-R. So what is 6G supposed to bring that 5G can’t, especially for ordinary folks?

For one thing, it could make mobile internet speeds of 1 TB per second mainstream. This means you could download around 100 films in less than a second. (It’s worth noting that researchers at the University of Surrey in England have already achieved that with 5G… but only inside a lab.)

Of course, 2030 is a long way away, so the actual applications of this technology may be hard to imagine. As Verizon executive Andrea Caldini pointed out at this year’s Mobile World Congress, nobody expected Snapchat while developing 4G – it’s the increased speeds that made it happen.

According to Su, 6G could connect our devices more efficiently than 5G, expanding internet coverage to much wider areas.

“5G has three application scenarios: large bandwidth, low latency, and wide connection – I think 6G can achieve better application in all three scenarios,” Su told local media, noting that 6G could increase transmission rates by more than 10 times. “It may revolutionize the structure of the whole wired and wireless network.”

If this sounds vague to you, it’s because there is still no definition for the technology. And according to industry insiders, it is too early to talk about 6G. It took 5G ten years to develop its set of standards, and despite commercial deployment this year, they are still not fully settled. So is 6G even a thing?

Roberto Saracco, professor at the University of Trento in Italy, believes that 5G is still a fuzzy set of promises that will take time, probably ten years, before being fulfilled. As for the next generation of connectivity, “marketing will need 6G as soon as 5G is deployed,” writes Saracco. Researchers will need a term to mark the novelty of what they are doing or to put technologies that do not fit into 5G standards into another box.

The vagueness of the term has not stopped countries to start looking into the concept. Finland’s University of Oulu launched an 6G research program called 6Genesis. Aside from futuristic phrases like “interoperability sensing based ops” and “intelligent personal edge,” one of the applications mentioned on their site is wireless augmented reality/virtual reality.

It’s worth noting that this might be an application for 5G, judging by Tencent boss Pony Ma’s suggestion that the technology could enable WeChat VR.

The new 6G movement in China could also be a way to rub their tech advancement in other people’s faces. The country is already way ahead of US in deploying 5G, according to Deloitte. Since 2015, China outspent the US by approximately $24 billion in wireless communications infrastructure (with $400 billion more coming) and built 350,000 new cell phone tower sites – while the US is still stuck at less than 30,000.