Nokia

Omdia: Huawei increases global RAN market share due to China hegemony

Due to China’s enormous mobile network market (where foreign vendors are mostly shut out), Huawei remained the world’s largest vendor of radio access network (RAN) equipment – a market worth about $35 billion last year – according to Omdia (an Informa owned company). In 2023, the Chinese behemoth had a 31.3% share of the global RAN market. Omdia says Huawei’s market share was up by an unspecified amount in 2024, due to “a more favorable regional mix as well as market share gains in emerging markets,” according to Remy Pascal, principal analyst at Omdia.

Huawei recently reported a 22% increase in sales last year, to 860 billion Chinese yuan (US$ 118.6 billion), and it looks in better shape than its ailing western rivals. Its share of the global 5G networks market appears to have grown, according to the market research firm.

Omdia’s findings seems further to highlight the futility of U.S. sanctions against Huawei, originally imposed by Donald Trump in his first term as U.S. President and then expanded by President Joe Biden.

Image Credit: Huawei

China still lacks the ability to make the most advanced chips featuring the tiniest transistors. But technical workarounds or loopholes in trade rules have enabled Huawei to revive its smartphone business and remain competitive in networks. Late last year, telco executives who spoke on condition of anonymity said there had been no discernible impact on the quality of its products. And Ericsson continues to regard Huawei as its chief rival.

……………………………………………………………………………………………………………………………………….

“After two years of significant acceleration and exceptionally high investment in 2021 and 2022, and two years of steep decline in 2023 and 2024, Omdia expects 2025 to be a year of stabilization for the RAN market,” said Remy Pascal of Omdia. “Different regions will follow different trajectories, but at a global level, the market is expected to be flattish. North America has returned to growth in 2024 and we expect this to continue, we also expect a positive trajectory in some emerging markets.”

……………………………………………………………………………………………………………………………..

Other results and forecasts from Omdia:

- The total global RAN market (which includes hardware and software but not services) was just over $35 billion last year, which represented a 12 percent decline on the previous year.

- There was a very slight drop in the aggregate market share of the top five RAN equipment vendors – Huawei, Ericsson, Nokia, ZTE and Samsung. In 2023, Omdia had that figure at about 95%. In 2024, it was roughly 94%.

- Ericsson was one of the main gainers last year thanks to its huge AT&T (non) OpenRAN contract.

- As a result, Nokia lost market share in the U.S., but claims that its global RAN footprint grew by 18,000 sites in 2024.

- Tejas Networks, an Indian RAN equipment vendor (not in the top five) that landed a large 4G contract with state-owned BSNL was another winner.

- Global RAN revenue will be “essentially flat” this year and marked by “low single digit percentage growth” outside China.

- A “positive trajectory” in emerging Asian markets as well as Africa, the Middle East and Latin America is forecast. Europe risks falling behind other parts of the world in mobile network markets.

Top RAN vendors, full year 2024 RAN revenue:

|

Global |

Global ex-China |

|---|---|

|

Huawei |

Ericsson |

|

Ericsson |

Nokia |

|

Nokia |

Huawei |

|

ZTE |

Samsung |

|

Samsung |

ZTE |

Top RAN vendors, full year 2024 RAN revenue, top 3 by region:

|

North America |

Asia & Oceania |

Europe |

Middle East and Africa |

Latin America & the Caribbean |

|---|---|---|---|---|

|

Ericsson |

Huawei |

Ericsson |

Huawei |

Huawei |

|

Nokia |

ZTE |

Nokia |

Nokia |

Ericsson |

|

Samsung |

Ericsson |

Huawei |

Ericsson |

……………………………………………………………………………………………………………………………………….

Dell’Oro Group’s most recent RAN report a few weeks ago stated that the global RAN market is expected to improve slightly over the short term, but the long-term outlook remains subdued. “The underlying message we have communicated for some time has not changed,” said Stefan Pongratz, Vice President for RAN market research at Dell’Oro Group. “Regional imbalances will impact the market dynamics over the short term while the long-term trajectory remains flat. This is predicated on the assumption that new RAN revenue streams from private wireless and FWA, taken together with MBB-based capacity growth, are not enough to offset slower MBB coverage-based capex,” said Dell’Oro’s Stefan Pongratz.

References:

https://www.lightreading.com/5g/huawei-defies-us-to-grow-market-share-as-ran-decline-ends-omdia

RAN Equipment Market to Remain Uninspiring, According to Dell’Oro Group

Network equipment vendors increase R&D; shift focus as 0% RAN market growth forecast for next 5 years!

Telco spending on RAN infrastructure continues to decline as does mobile traffic growth

vRAN market disappoints – just like OpenRAN and mobile 5G

Mobile Experts: Open RAN market drops 83% in 2024 as legacy carriers prefer single vendor solutions

Nokia and Google Fiber trial 50G PON – first in the U.S.

Nokia and Google Fiber have tested 50Gb/s PON over Google’s fiber optic network. The partners say it’s the first live network demonstration of that technology in the US. The trial comes after last year’s partnership between Nokia and Google Fiber to enhance broadband services with 25G PON.

As fiber facility based network operators continue to push for increased speeds and reliability from their broadband networks, 50G PON acts as a catalyst to meet connectivity demands – unleashing further opportunity for growth and innovation. Capable of being easily built upon existing 25G PON solutions, it also enables flexibility for the operators to add future 50Gb/s with the fiber in place.

Nokia claims to be the only vendor that can support all next-generation PON options, with 10G and 25G products available today, 50G in trials, and 100G PON as a technology demonstrator.

With Nokia’s Lightspan fiber access platform, operators can choose a PON solution that best meets a specific use case or business need. The 50G PON trial with Nokia showcases how Google Fiber is looking at the future and what’s needed for new broadband services that foster innovation and growth. Leveraging Nokia’s fiber solution, Google Fiber was able to simultaneously run 10/25G PON along with 25/50G PON broadband service over its fiber network. This showcased the network flexibility and scalability it can deliver to keep pace with the growing demand for multi-gigabit services in the future. Google Fiber is already at the forefront of the multi-gigabit evolution, having launched the first 25G PON commercial services with Nokia in 2023.

Liz Hsu, Senior Director, Product & Billing, at Google Fiber, said: “We are always looking for ways to push the capabilities of our fiber network to deliver the best possible experience to our customers. This test with Nokia builds on the 25G PON deployment we announced together last year, paving the way for future improvements to our network that enhance customer experience in terms of speed, reliability, innovation and support for future business cases that have yet to be defined.”

Geert Heyninck, vice president of broadband networks at Nokia, said: “Service providers need to be able to select the right technology, based on their needs and business case. It is why we already offer 10G and 25G today, are trialing 50G, and developing 100G – ultimately leading to a full range of PON technologies that can be mixed and matched on the same platform and the same fiber. Our expansive toolkit of fiber solutions allows Google Fiber to future-proof their network and flexibly address their evolving network demands.”

Resources and additional information:

Video: Nokia and GFiber Labs trial 50G PON on live network

Website: Nokia Altiplano Access Controller

Website: Nokia Lightspan MF

Website: Accelerating to gigabit with fiber

Website: Fiber for Everything

- GFiber Labs is the second 50G PON trial Nokia has run globally in the past 4 months and the first to occur in the U.S.

- Nokia is the first vendor to show all PON technologies (10G, 25G & 50G) in a live fiber network.

- Nokia is the number one vendor for XGS-PON technology globally according to 2023 market share figures from Dell’Oro and Omdia.

- There are more than 12 operators around the world who are already gaining the benefits of 25G PON, and the eco-system is maturing with more than 5 ONT vendors bringing 25G PON solutions to the market.

- Some operators currently deploying 25G PON include Google Fiber, EPB, Vodafone Qatar and OGI.

- The ecosystem for 25G PON is mature, with more than 60 operators, system vendors, chipset, and optical suppliers part of an MSA focused on standardizing and accelerating the technology.

- Nokia is a key contributor to 50G PON industry standard and introduced the industry’s first true 50G platform in 2020 with the Lightspan MF platform.

- Once the 50G PON industry matures, the step to 100G is straight forward.

………………………………………………………………………………………………………………

In March, Türk Telekom and ZTE carried out their own 50G PON trial in Turkey, which clocked speeds in excess of 50 Gbps in the downstream over a single fibre. It was apparently done so in a way that was compatible with existing PON generations already deployed in Türk Telekom’s network.

Meanwhile In April, Australia’s NBN demoed Nokia 100G PON tech to reach 83 Gbps on its live full fibre access network, eclipsing the previous trial the October before which achieved symmetrical throughput of 21 Gbps and was a new speed record for PON in Australia at the time.

………………………………………………………………………………………………………………

References:

https://www.telecoms.com/fixed-networks/nokia-and-google-fiber-trial-50g-pon-in-us

Google Fiber planning 20 Gig symmetrical service via Nokia’s 25G-PON system

Nokia and Hong Kong Broadband Network Ltd deploy 25G PON

Nokia’s launches symmetrical 25G PON modem

Orange and Nokia demo 600Gb/sec transmission over a 914 km optical network; Nokia 25G PON

Nokia to acquire Infinera for $2.3 billion, boosting optical network division size by 75%

Nokia has agreed to buy optical networking equipment vendor Infinera in a deal worth $2.3 billion. 70% of the sum will be paid in cash, the remaining 30% in Nokia shares. Nokia said it will accelerate its share buyback program to offset the dilution.

The acquisition will grow the size of its Optical Networks division by 75%, enabling the company to accelerate its product roadmap and increase its exposure to webscale customers, which account for around 30% of Infinera’s revenue.

Nokia and Infinera see a significant opportunity in merging to improve scale and profitability, enabling the combined business to accelerate the development of new products and solutions to benefit customers. The transaction aligns strongly with Nokia’s strategy, as it is expected to strengthen the company’s technology leadership in optical and increase exposure to webscale customers, the fastest growing segment of the market.

- Creates a highly scaled and truly global optical business with increased in-house technology capabilities and vertical integration.

- Strengthens Nokia’s optical position, specifically in North America.

- Accelerates Nokia’s customer diversification strategy, expanding webscale presence.

- Targeted net comparable operating profit synergies of EUR 200 million by 2027.

Nokia believes the transaction has compelling financial and strategic merit. The combination with Infinera is projected to accelerate Nokia’s journey to a double-digit operating margin in its Optical Networks business. Nokia targets to achieve EUR 200 million of net comparable operating profit synergies by 2027. This transaction along with the recently announced sale of Submarine Networks will create a reshaped Network Infrastructure built on three strong pillars of Fixed Networks, IP Networks and Optical Networks. Nokia targets mid-single digit organic growth for the overall Network Infrastructure business and to improve its operating margin to mid-to-high teens level.

The combined Nokia and Infinera will have a global market share of around 20%, broadly equal to Ciena (which acquired Nortel’s optical network division in November 2009 for $769 billion) but lagging behind Huawei’s 31%, according to J.P. Morgan analyst Samik Chatterjee.

“Ciena is less likely to make a competing bid given complexity in integrating competing optical portfolios as well as hurdles in regulatory approval given Ciena’s majority (51%) share of the North America market,” wrote Chatterjee in a research note.

Omdia (Informa) expects optical networking market sales to rise at a compound annual growth rate of 5% between now and 2029. A well-executed takeover may, then, give Nokia a growth story during a period of difficulty for its large mobile business group, responsible for about 44% of total sales last year.

The transaction is expected to be accretive to Nokia’s comparable EPS in the first year post close and to deliver over 10% comparable EPS accretion by 2027*, with a return on invested capital (RoIC) comfortably above Nokia’s weighted average cost of capital (WACC).

Pekka Lundmark, President and CEO of Nokia, said:

“In 2021 we increased our organic investment in Optical Networks with a view to improving our competitiveness. That decision has paid off and has delivered improved customer recognition, strong sales growth and increased profitability. We believe now is the right time to take a compelling inorganic step to further expand Nokia’s scale in optical networks. The combined businesses have a strong strategic fit given their highly complementary customer, geographic and technology profiles. With the opportunity to deliver over 10% comparable EPS accretion, we believe this will create significant value for shareholders.”

Federico Guillén, President of Network Infrastructure at Nokia, said: “Today, Network Infrastructure offers a unique portfolio across the fixed access, optical and IP networks domains built on leading technology innovation and a strong customer focus. This acquisition will further strengthen the optical pillar of our business, expand our growth opportunities across all our target customer segments and improve our operating margin. I am extremely pleased that we are bringing together these two talented and dedicated teams. Separately, we have long respected each other as competitors. Together, we find the logic of combination irresistible.”

David Heard, CEO of Infinera, said: “We are really excited about the value this combination will bring to our global customers. We believe Nokia is an excellent partner and together we will have greater scale and deeper resources to set the pace of innovation and address rapidly changing customer needs at a time when optics are more important than ever – across telecom networks, inter-data center applications, and now inside the data center. This combination will further leverage our vertically integrated optical semiconductor technologies. Furthermore, our stakeholders will have the opportunity to participate in the upside of a global leader in optical networking solutions.”

Compelling strategic benefits for Nokia, Infinera and customers:

- Improving global scale and product roadmap: The combination will increase the scale of Nokia’s Optical Networks business by 75%, enabling it to accelerate its product roadmap timeline and breadth; providing better products for customers and creating a business that can sustainably challenge the competition.

- The combined business will have significant in-house capabilities, including an expanded digital signal processor (DSP) development team, expertise across silicon photonics and indium phosphide-based semiconductor material sciences, and deeper competency in photonic integrated circuit (PIC) technology. The result will be a strong innovative player with a deep and diverse pool of optical networking talent and expertise.

- Gaining scale in North America optical market: The two companies have limited customer overlap, putting the combined business in a strong position in all regions (excluding China). Infinera has built a solid presence in the North America optical market, representing ~60% of its sales, which will improve Nokia’s optical scale in the region and complement Nokia’s strong positions in APAC, EMEA and Latin America.

- Building on Nokia’s commitment to investment in U.S. based manufacturing and advanced testing and packaging capabilities.

- Accelerating Nokia’s expansion into enterprise and particularly webscale: The combination of these two businesses is also expected to accelerate Nokia’s strategic goal of diversifying its customer base and growing in enterprise. Internet content providers (ICP or webscale as Nokia typically calls this segment) make up over 30% of Infinera’s sales. With recent wins in line systems and pluggables, Infinera is well established in this fast-growing market. Infinera has also recently been developing high-speed and low-power optical components for use in intra-data center (ICE-D) applications and which are particularly suited to AI workloads which can become a very attractive long-term growth opportunity. Overall, the acquisition offers an opportunity for a step change in Nokia’s penetration into webscale customers.

- Net comparable operating profit synergies of EUR 200 million: The combination is expected to deliver EUR 200 million of net comparable operating profit synergies by 2027*. Approximately one third of the synergies are expected to come from cost of sales due to supply chain efficiencies and the remainder from operating expenses due to portfolio optimization and integration along with reduced product engineering costs and standalone entity costs. Nokia expects one-time integration costs of approximately EUR 200 million related to the transaction.

- Creating value for shareholders: The transaction is expected to be accretive to Nokia’s comparable operating profit and EPS in year 1 and to deliver more than 10% comparable EPS accretion in 2027*. Nokia also expects the deal to deliver a return on invested capital (RoIC) comfortably above Nokia’s weighted average cost of capital (WACC). In addition, Infinera’s investors will have the opportunity to participate in the exciting upside of investing in a global leader in optical networking solutions.

Transaction details:

Under the terms of the definitive agreement, Nokia is acquiring Infinera for $6.65 per share, which equates to an enterprise value of $2.3 billion. For each Infinera share, Infinera shareholders will be able to elect to receive either: 1) $6.65 cash, 2) 1.7896 Nokia shares, or 3) a combination of $4.66 in cash and 0.5355 Nokia shares for each Infinera share. All Nokia shares will be issued in the form of American Depositary Shares. The definitive agreement includes a proration mechanism so that the Nokia shares issued in the transaction do not exceed an amount equal to approximately 30% of the aggregate consideration that may be paid to Infinera shareholders.

References:

https://www.barrons.com/articles/infinera-stock-price-buy-sell-nokia-ciena-658c7898

https://www.infinera.com/press-release/nokia-to-acquire-infinera/

LightCounting: Q1 2024 Optical Network Equipment market split between telecoms (-) and hyperscalers (+)

Infinera, DZS, and Calnex Successfully Demonstrate 5G Mobile xHaul with Open XR

Orange Deploys Infinera’s GX Series to Power AMITIE Subsea Cable

Infinera trial for Telstra InfraCo’s intercity fiber project delivered 61.3 Tbps between Melbourne and Sydney, Australia

Nokia (like Ericsson) announces fresh wave of job cuts; Ericsson lays off 240 more in China

- Nokia Oyj’s Q1 2024 results showed a 26% decrease in net sales and a decrease in operating margins from Network Infrastructure.

- Nokia Technologies saw a doubling of net sales, benefiting from licensing deals and aiming to raise annual net sales to EUR 1.4-1.5 billion.

- Mobile Networks experienced a nearly 40% decrease in net sales, with speculation that telecom firms will prioritize debt repayment over equipment spending.

On a call with reporters today, Nokia said it will cut ~11,500 jobs and end up with a workforce of approximately 74,500 employees at the end of 2026. Like Ericsson, it has responded to the global telecom market contraction by announcing a fresh wave of job cuts. Having already eliminated 16,000 jobs since 2016 (the year of that Alcatel-Lucent acquisition), Nokia last year said up to 14,000 jobs would disappear, and no fewer than 9,000, by the end of 2026. The aim is to save between €800 million ($854 million) and €1.2 billion ($1.3 billion) in annual expenses. That newest layoff round follows Ericsson’s announcement that it will lay off ~1,200 employees in Sweden as part of cost-cutting measures announced earlier this year as telco customers reduce their spending on 5G network equipment.

“We are progressing toward this target and currently looking at somewhere around the midpoint of that range,” Lundmark said when asked by Light Reading if there is now more certainty about the ultimate size of the company at the end of the program. “That will then finally depend on the development of the market situation.”

North American customers that previously gorged on supplies have seen little need in the last year to replenish inventory. The pace of a 5G rollout in India has dramatically slowed. Denied the opportunity to consolidate, European telcos still underinvest in 5G, complain vendors. After managing a €137 million ($146 million) mobile operating profit for the first quarter of 2023, Nokia slid a year later to a €42 million ($45 million) loss.

Nokia’s network infrastructure business group – including fixed residential, optical and Internet Protocol activities – sales were down 26%, to less than €1.7 billion ($1.8 billion). An engine of sales growth during Lundmark’s first years in charge, it registered a 42% fall in operating income, to €82 million ($88 million). At cloud and network services, meanwhile, revenues dropped 14%, to €652 million ($696 million), and losses widened 35%, to €27 million ($29 million).

“We have said that we are continuously doing active portfolio management – you have seen some our recent moves that we did last year,” Lundmark said. Disposals included the €185 million ($198 million) sale of a device management business to Canada’s Lumine Group and the earlier transfer of about 350 employees working on cloud platforms to IBM-owned Red Hat.

“We are pleased with the strategy that we have in place in mobile networks,” said Lundmark. “We have a strong value proposition there, we have increased our market share in recent years, and we have a good strategy to deliver value to our shareholders,” he added.

After Intel’s failure to deliver 10-nanometer microprocessors, Nokia resorted to field programmable gate arrays (FPGAs) and its competitiveness suffered. But Nokia’s Mobile Networks boss Tommi Uitto subsequently introduced the well-regarded Broadcom and Marvell Technology as chip suppliers alongside Intel, and the FPGAs have now been replaced. Outside China and the U.S., Nokia’s market share has recently grown, say independent analysts.

In mobile, the full-year outlook remains relatively bleak, even if the second half brings some improvement. “The market has been really, really weak, which is not a Nokia issue,” said Lundmark, in his detailed answer to that question about a sale of mobile assets. “It is an industry issue. It has to be a matter of time before operators again will have to start investing, and, once that happens, we will be in a strong position,” he concluded.

……………………………………………………………………………………………………………………………………………………………………………

Update: Ericsson has laid off 240 employees in China, part of a restructuring in the country that will affect one of its largest research hubs globally. Ericsson said the positions would be cut in line with the company’s effort to diversify its research and development footprint to better align with its sales globally. The employees impacted would be in its core network R&D division in China, a spokesman said.

The Swedish telecommunications-equipment company told employees at an internal meeting in early March that it was embarking on a transformation of its China operations that would continue into 2025, several people who attended the meeting told The Wall Street Journal. The company has plans to reduce headcount further in the coming months, people familiar with the company said. One of the people said the R&D team recently had been excluded from working on at least two large projects in the U.S. and Australia.

Ericsson’s market share has been dwindling in China in the 5G era amid intensified competition from local players like Huawei and heightened geopolitical tensions. In its 2023 annual report, Ericsson cautioned that a further escalation of trade tensions between the U.S. and China could hurt its operations in China.

Ericsson had 9,950 employees in China last year, down from 13,783 in 2019, according to company data.

References:

https://www.lightreading.com/5g/nokia-ceo-bids-to-revive-loss-making-mobile-unit-amid-sale-rumors

https://www.wsj.com/tech/ericsson-lays-off-more-than-200-employees-in-china-f4ab7db3″ rel=”noopener” target=”_blank”>https://www.wsj.com/tech/ericsson-lays-off-more-than-200-employees-in-china-f4ab7db3

Nokia’s launches symmetrical 25G PON modem

Nokia today announced the launch of a new symmetrical 25G PON [1.] fiber modem. Helping to further accelerate 25G PON deployments, the compact solution can easily be installed on a wall, inside a building, or in an outdoor enclosure to immediately deliver internet speeds that are 20x faster than current gigabit solutions. Once deployed, operators can leverage their existing fiber network to offer new premium residential, business, or anyhaul services that unlock additional revenue streams.

Note 1. 25G PON, also known as 25GS PON, is a next-generation PON that offers a number of benefits. It can provide 10Gb/s services or higher, premium enterprise services, and 5G transport.

Demand for high-speed broadband access is accelerating with end-users increasingly seeking quality multi-gigabit services to power their homes and businesses. From the Metaverse and cloud gaming to cyber security, and Industry 4.0 applications, users want multi-gigabit services that can meet their evolving broadband needs.

Nokia’s new 25G PON fiber modem allows operators to establish a future-ready network that can immediately address the growing demand for more capacity and enhanced broadband services. The new 25G PON solution enables operators to quickly upgrade their existing GPON or XGS PON network to deliver true 10Gbs speeds and beyond with unprecedented ease. For enterprises, this can help significantly improve business productivity and enhance connectivity to the cloud or value-added applications located in data centers. For consumers and power users, the solution provides immediate access to additional capacity needed to support bandwidth-hungry applications such as AI, gaming, or security.

25G PON Wavelength Plan:

Image Credit: Nokia

……………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Geert Heyninck, General Manager of Broadband Networks at Nokia, said: “The 25G PON eco-system is growing and with it, the technology that continues to bring concrete business benefits to customers. The market for 25G PON is here and with the new fiber modem, we have a very efficient 25G solution that can support all types of services and applications in the fiber-for-everything era. 25G PON continues to be the easiest, most cost-effective and power-efficient way for services providers to upgrade and maximize the use of their existing fiber network to deliver ultra-fast broadband access.”

Jeff Heynen, Vice President, Broadband Access and Home Networking at Dell’Oro Group, said: “25G PON deployments and the 25GS-PON MSA (Multi-Source Agreement) Group has grown substantially over the past year. One of the driving factors for the growing interest in 25GS-PON is its ability to coexist with GPON and XGS-PON without having to deploy additional feeder fiber, splitters, or other ODN elements. This past year we’ve seen large operators like Google indicate plans to make 25G PON service available to its customers while the MSA continues to expand, encompassing a diverse range of service providers, equipment vendors, and component suppliers.”

The new 25G PON fiber modem complements Nokia’s growing 25G PON portfolio, which includes the Lightspan FX, DF and MF fiber access platforms (OLTs) and the industry’s first 25G PON sealed fiber access node designed for cable operators.

25G PON ONT product details:

- Coexistence with GPON, XGS-PON and 50G PON on the same ODN

- Hardened and compact design for various deployment practices and environments

- Symmetrical 25 Gb/s throughput using pluggable optics

- Frequency and time-of-day synchronization functions for mobile transport

- Can be used to connect cell sites to transport mobile traffic over PON network in plug-and-play mode, delivering the required capacity, latency and synchronization required for 5G networks.

- Supports demarcation point functions for enterprise and wholesale services.

- Nokia has shipped more than one million 25G PON ready ports to date.

- 25G PON is ready to be activated in more than 150 networks worldwide.

- The eco-system for 25G PON is mature with more than 60 operators, system vendors, chipset and optical suppliers part of a MSA focused on standardizing and accelerating the technology.

- Some of the operators currently deploying 25G PON include Google Fiber, EPB, Vodafone Qatar and OGI.

- There are more than 30 operators trialing 25G PON for residential, mobile fronthaul and business connectivity applications.

References and additional information:

Nokia 25G ONT

Lightspan FX

Lightspan SF-8M sealed fiber access node

Lightspan MF fiber platform

25G PON

Google Fiber planning 20 Gig symmetrical service via Nokia’s 25G-PON system

Orange and Nokia demo 600Gb/sec transmission over a 914 km optical network; Nokia 25G PON

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

Passive Optical Network (PON) technologies moving to 10G and 25G

Nokia and Proximus (Belgium) demonstrate 1st implementation of 25GS-PON

Nokia utilizes Intel technology to drive greater 5G SA core network energy savings

Nokia and Intel today announced that they are targeting greater energy efficiency improvements in 5G networks by using Xeon processors and power management software from Intel that will power Nokia’s cloud-native 5G Core solutions [1.] The two companies’ advances, building on years of innovation, will give communication service providers (CSPs) more leverage in reducing electricity usage and costs in their networks.

Note 1. The Nokia packet core provides key components needed for a webscale-class evolved packet core (EPC) and 5G core system (5GC). With its virtualized, cloud-native disaggregated and state-efficient design, it is well suited for multi-cloud environments. It is also infrastructure agnostic and independent of the underlying cloud infrastructure used for orchestration, lifecycle management (LCM) and infrastructure resource management.

…………………………………………………………………………………………………………………….

In testing demonstrations, Nokia achieved approximately 40% runtime power savings using Nokia’s cloud-native 5G Core, integrated with Intel Infrastructure Power Manager (IPM) software and 4th Gen Intel Xeon Scalable Processors*, while maintaining key network performance metrics.

Such energy savings are achieved through the careful integration of Nokia’s Core with Intel’s power modulation capabilities, which result in the energy consumption of the chips being proportional to the amount of traffic on the network – which varies considerably during any 24-hour period. Nokia intends to deliver these energy savings capabilities to the market as early as the second half of 2024, starting with Nokia’s Cloud Packet Core. Nokia and Intel will demonstrate these capabilities at MWC Barcelona at Intel’s booth 3E31.

The announcement underscores Nokia’s ongoing broader efforts to help CSPs and other network-dependent industries reduce their environmental footprint, become more resource efficient, and drive increased value from their networks. Nokia has set its key greenhouse gas (GHG) emissions reduction target through the Science Based Targets (SBT) initiative, which is aligned with the goal of limiting global warming to 1.5°C. Nokia was the first telecoms equipment vendor to have a science-based target accepted by the SBT initiative in 2017.

Marcelo Madruga, Head of Technology and Platforms, Products & Engineering, Cloud and Network Services at Nokia, said: “I am very pleased with the brilliant work that Nokia and Intel are doing to deliver very meaningful reductions in the energy footprint of 5G networks. Network data and computation usage only continues to grow, with the clear implication that has for continued energy demand growth. What we are doing today demonstrates not only superior software and technology but delivering on our broader commitments to cut carbon emissions across value chains.”

Alex Quach, Vice President & GM, Wireline and Core Network Division at Intel, said: “This is another solid proof point in the long-standing Intel-Nokia collaboration that highlights the strength of our teams in empowering CSPs with innovative solutions. Integrating the Intel Infrastructure Power Manager into Nokia’s widely deployed packet core software will help deliver the power savings CSPs require and strengthens network operations through intelligent resource allocation.”

Stéphane Demartis, VP Telco Cloud Infrastructure at Orange, said: “We are delighted to start a collaboration with Nokia and Intel to optimize our power consumption. This will provide a major step forward in delivering energy efficient solutions in the core network infrastructure. Orange is looking forward to working with Nokia and Intel to explore implementation of these innovations for a sustainable 5G Core network through the #Sylva project.”

References:

https://www.nokia.com/networks/core-networks/cloud-packet-core/

https://www.intel.com/content/www/us/en/newsroom/resources/2024-mwc-barcelona.html#gs.5dbwdb

https://www.nokia.com/events/mobile-world-congress/

Nokia and du (UAE) complete 5G-Advanced RedCap trial; future of RedCap?

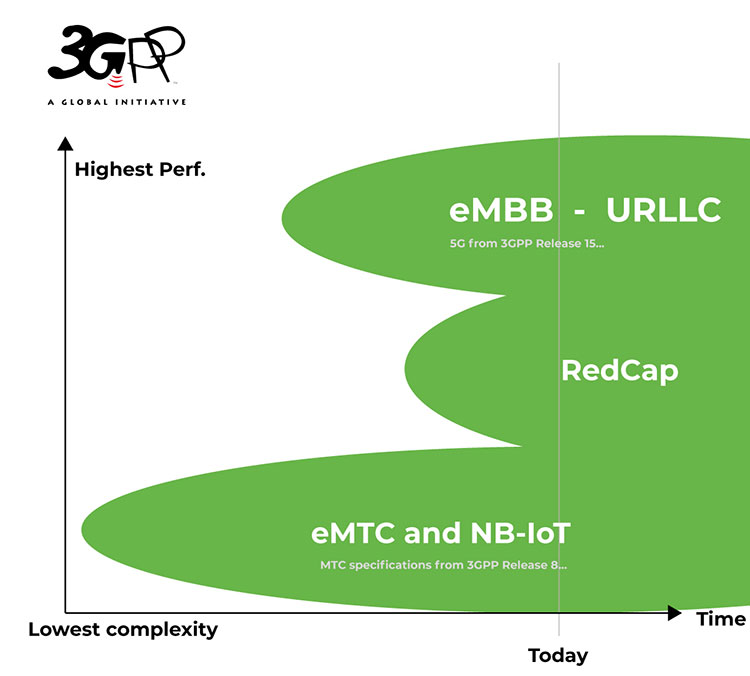

Nokia and United Arab Emirates (UAE) telco du announced the conclusion of what it claimed to be UAE’s first 5G-Advanced 5G Reduced Capability (RedCap) trial over a commercial network. Nokia said that this recent trial showcased the readiness of du’s 5G network for innovative use cases in areas such as the Internet of Things (IoT), wearables and Industry 4.0 to address 5G monetization challenges.

RedCap, sometimes referred to as (3GPP) 5G NR Light, is a reduced set of 5G capabilities intended for devices like wearables and low-cost hotspots that have low battery consumption, lower costs and lower bandwidth requirements. Introduced with 3GPP Release 17, 5G RedCap is designed for devices currently served by LTE CAT-4 but provides equivalent or better in performance with up to 150 Mbps theoretical maximum downlink throughput. This technology helps reduce the complexity, cost and size of 5G devices. The RedCap specification will be included in ITU-R M.2150-1.

……………………………………………………………………………………………………………………………………………………………………………………….

The trial participants used MediaTek’s T300 series RedCap test equipment in du’s 5G Standalone (SA) Radio Access Network (RAN) built with Nokia’s AirScale radio products, leveraging the existing mid-band Spectrum. This will follow extending RedCap over low band frequencies, ensuring extreme coverage and connectivity. Notably, the low band in 600MHz, is a vital connectivity band currently under discussion at the World Radio Conference WRC-23 taking place in Dubai.

With RedCap devices expected to be commercially available from 2024, it will significantly augment du’s diversified use case portfolio to include cost-efficient 5G home wireless, wearables, video surveillance, and wireless industrial sensors.

5G devices commonly feature intricate hardware and energy-intensive capabilities, resulting in higher cost, size, and power consumption. RedCap technology is dedicated to streamlining 5G devices, specifically targeting compact IoT devices like wearables and health trackers, as well as ruggedized routers and sensors for environmental or condition-based monitoring. These devices exhibit lower demands for battery life and reduced bandwidth requirements. RedCap ensures they sustain performance while optimizing their power efficiency. Nokia has been instrumental in driving the evolution of RedCap IoT functionality in collaboration with the telecommunications industry.

Saleem Alblooshi, Chief Technology Officer at du, said: “This collaboration introduces the revolutionary 5G-Advanced RedCap functionalities, enabling seamless connectivity of RedCap devices to cutting-edge 5G networks. Nokia’s unparalleled innovation simplifies and pioneers the development of 5G devices, particularly wearables and small IoT devices, significantly enhancing LTE-CAT4 performance and optimizing energy efficiency. These remarkable technological advancements are pivotal in propelling Industry 4.0 revolution.”

Mikko Lavanti, Senior Vice President at Nokia MEA, said: “This new collaboration between du and Nokia represents not only a significant step forward in the monetization of 5G technology but also solidifies the UAE’s position as a pioneer in the evolution of 5G use cases for society and enterprises. As the collaboration progresses, both companies are poised to revolutionize the way we experience and interact with 5G technology, unlocking unprecedented possibilities for innovation and connectivity.”

Dr. Ho-Chi Hwang, General Manager of Wireless Communication System and Partnerships at MediaTek, said: “It’s essential to bring new capabilities of 5G to the UAE, and this trial is an important step in that direction. We are proud to have provided our RedCap devices to further develop the ecosystem for 5G monetization. We hope, by pioneering the technology in the Middle East and Africa region, MediaTek will be able to assure our customers of more innovative 5G products and services coming their way.”

…………………………………………………………………………………………………………………………………………………………………

Future of RedCap:

Counterpoint Research expects that 5G RedCap modules will make up 18% of total cellular IoT module shipments by 2030—what it describes as “significant market potential, particularly in developing nations where the cost is key to wide technology adoption for digital transformation.”

“If we want to tackle some of these interesting business cases and really get the price point so the business can take off, then we need to provide the right types of options,” said Paul Harris, principal architect in the Office of the CTO at Viavi Solutions. “People don’t want to be paying for chipsets that are too performant in the wrong types of devices.” Harris also noted that standards work on RedCap continues, with a series of recommendations on reducing RedCap’s performance even further with support of just five megahertz of bandwidth, even lower data rates and reduced peak data rates as well as additional power savings in the form of Extended Discontinuous Reception (allowing longer periods during which a device can power off). While that work on “eRedCap” is still taking shape in Release 18 and additional features may be available to scale down RedCap further in Release 19. “It’s still kind of a moving target and probably will continue to be, but there will probably be different categories that get introduced of RedCap as it goes on,” he said. Harris goes on to offer up a potential vision of a RedCap market where there is a gradual progression into some parts of the market addressed with the initial Rel. 17 RedCap options, and that by Rel. 19, a scaled-back RedCap market could open up for even lower-complexity, lower data-rate devices that then leads to an explosion of 5G sensor devices.

“5G is absolutely the directional technology,” said Bill Stone, VP of technology development and planning at Verizon. “I do think it’s inevitable that we’ll be seeing all of IoT evolve over time, and it’s going to be starting as soon as next year. We’re going to see all of the IoT device community moving over to 5G, because that’s where—with 5G NR SA—we’re going to see the potential for much longer lifecycles [and] the ability to support that, to make commitments for longer-term support of IoT devices.”

References:

Standards leadership in action: How Nokia convinced the 5G world that less is more

Ericsson, Vodafone and Qualcomm: 1st Reduced Capability 5G data call in Europe

https://www.3gpp.org/technologies/redcap

ITU-R M.2150-1 (5G RAN standard) will include 3GPP Release 17 enhancements; future revisions by 2025

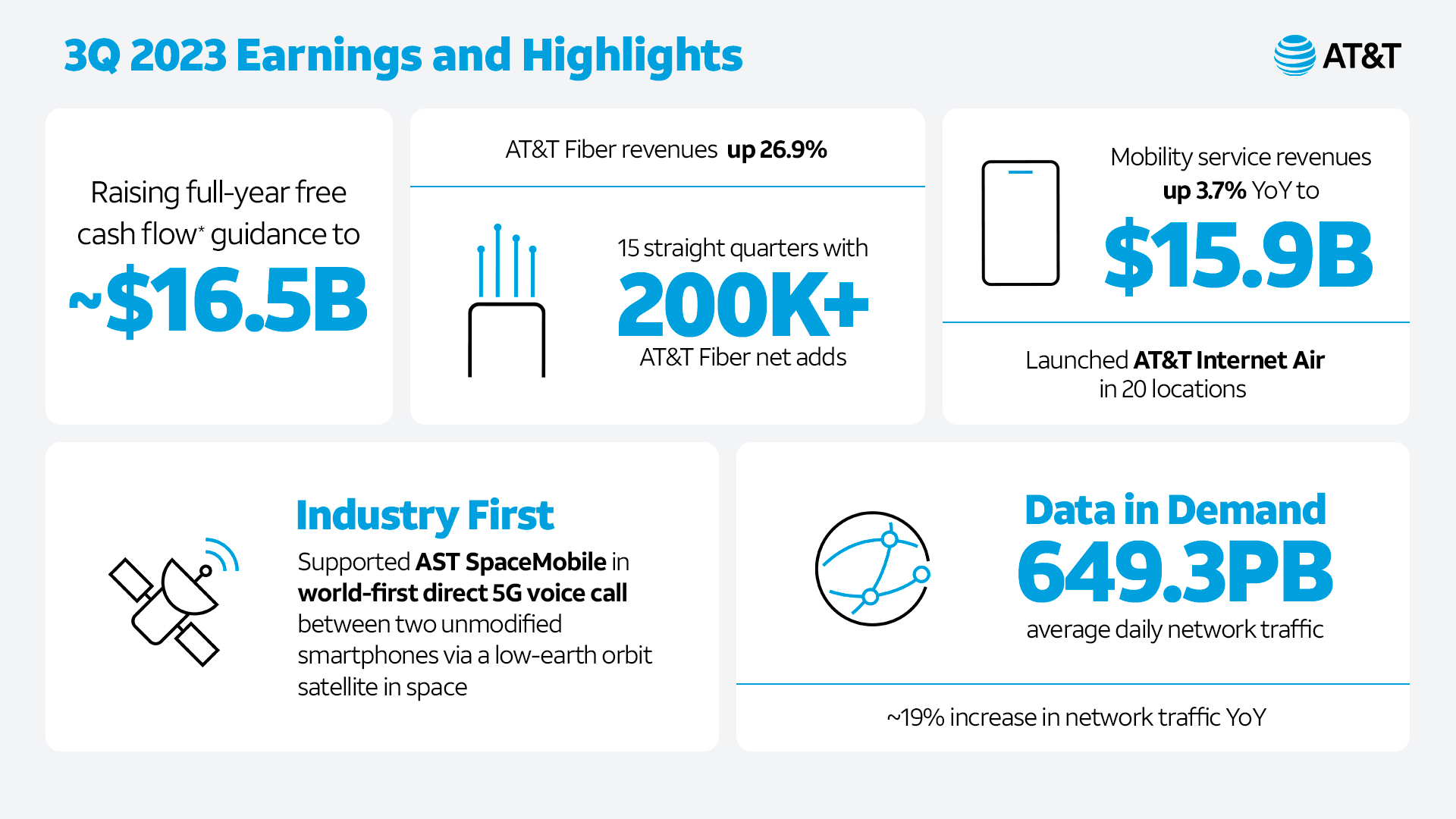

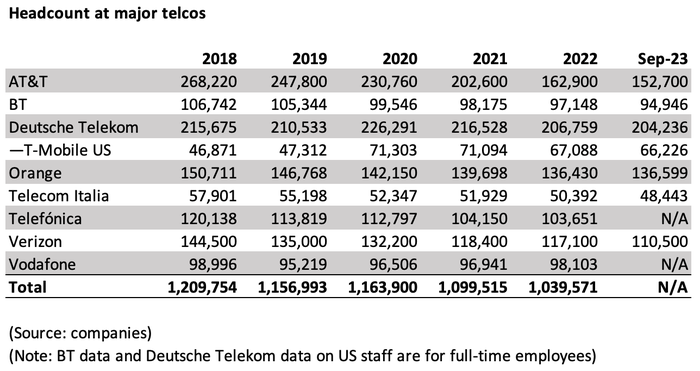

Telecom layoffs continue unabated as AT&T leads the pack – a growth engine with only 1% YoY growth?

As we have repeatedly stated, the entire telecom industry is in a funk and the 2024 outlook is looks just as gloomy as this year. MTN claims that telecom is a zero growth industry (see References below) and that certainly seems to be true. Let’s start with AT&T – the largest telco in the U.S. with 229.2M wireless subscribers as of Q2-2022.

In the first nine months of 2023, AT&T has shed 10,200 employees, including nearly 4,000 in the recent third quarter alone. AT&T cut many more jobs – 39,700 in total – in 2022 when it was in the process of spinning out Warner Media to Warner Brothers Discovery (the deal closed on April 8, 2022).

AT&T’s CEO told reporters last week that the U.S. based teclo plans to reduce costs by another $2 billion over the next three years. That’s after Stankey boasted that the company has cut costs by $6 billion in the last three and in an “inflationary environment.”

AT&T is hardly a growth company and has tons of debt. In the 3rd quarter of 2023, AT&T reported revenues of $30.4 billion, up only 1% year over year. Yet Stankey had the audacity to say in a press release, “Our investments in best-in-class 5G and fiber connectivity are fueling our growth engine. We’re gaining profitable customer relationships and becoming more efficient. This is powering our strong business performance.”

Today, LightReading announced the departure of a key AT&T executive. Jason Inskeep, previously the senior assistant VP for AT&T’s 5G Center of Excellence and focusing on the operator’s work in private wireless networking and edge computing, recently left the company for a senior director position at consulting firm Slalom.

Iain Morris of LightReading wrote on October 20th, “The future AT&T is conceivably a cohort of antenna-carrying robots, some AI that writes code and Stankey with his feet up on the table, providing the only whiff of humanity.”

AT&T is not the only U.S. telco reducing its workforce. Earlier this year, T-Mobile announced that it will be laying off ~5,000 workers or around 7% of its workforce. This latest job cutting move will primarily impact employees in corporate, back-office, and technology roles, while those in retail or customer care positions will not be affected.

……………………………………………………………………………………………………………………………….

Network Equipment Vendors Layoffs and Gloomy Outlook:

Last week, Nokia said the company plans to cut at least 9,000 jobs and as many as 14,000 over the next three years. That’s mainly due to weak 5G equipment demand. Nokia CEO Pekka Lundmark told reporters that Nokia’s sales have plummeted in North America (sales were down 40%) and that India’s 5G rollout is now slowing down as expected.

Over the next three years, his latest target is to reduce annual costs by between €800 million (US$843 million) and €1.2 billion ($1.3 billion). It’s a move that will reduce Nokia’s headcount by at least 9,000 roles from its current level of roughly 86,000. And at the upper end of the range, it will see an exodus of 14,000 employees, more than 16% of the total.

Ericsson CEO Borje Ekholm cautioned of persistent macroeconomic uncertainty into 2024 which it expects will impact customers’ investment ability, as the wireless network equipment vendor reported a year-on-year net loss of SEK30.5 billion ($2.8 billion) from net income of SEK5.4 billion in Q2 2022, due to a SEK32 billion charge related to the acquisition of cloud company Vonage in 2022. In February, Reuters reported that Ericsson will lay off 8,500 employees globally as part of its plan to cut costs, a memo sent to employees.

……………………………………………………………………………………………………………………..

Semiconductor Layoffs:

Wireless network chip maker Qualcomm is slashing 1,258 jobs in California, including nearly 200 in the Bay Area, in the latest tech layoffs to hit the region. Qualcomm said in state filings that it will lay off approximately 194 workers in its Santa Clara offices and another 1,094 employees at its San Diego headquarters. The cuts are slated to begin Dec. 13th, based on a notice submitted to state officials this week. The job cuts represent roughly 2.5% of Qualcomm’s workforce and mark the second round of layoffs for the wireless semiconductor company this year.

The Qualcomm layoff news comes about a month after the company announced a deal with Apple to provide 5G chips through at least 2026. Qualcomm is also the chip supplier for the newly announced Meta Quest 3. It is only 1 of 2 companies that sell 5G end point silicon on the merchant market (Taiwan based MediaTek is the other one).

It’s not a pretty picture to say the least for telecom industry employees.

References:

https://www.lightreading.com/ai-machine-learning/at-t-seems-on-a-mission-to-be-a-zero-employee-telco

https://www.lightreading.com/private-networks/at-t-s-private-wireless-chief-departs

https://about.att.com/story/2023/q3-earnings.html

Inside AT&T’s newly expanded $8 billion cost-reduction program & huge layoffs

High Tech Layoffs Explained: The End of the Free Money Party

MTN Consulting’s Network Operator Forecast Through 2027: “Telecom is essentially a zero-growth industry”

BT, Nokia and Qualcomm demonstrate 2CC CA on uplink of a 5G SA network

UK incumbent telco BT announced today that it has successfully demonstrated two component carrier aggregation (2CC CA) on the uplink of a 5G SA network at its Adastral Park research centre. The 5G SA technology was supplied by Nokia and Qualcomm.

BT also simultaneously achieved 4CC CA on the downlink, and claims it is the first telco in Europe to have demonstrated 5G SA uplink and downlink carrier aggregation at the same time. In terms of throughput, BT recorded a peak download speed of 1 Gbps and peak upload of 230 Mbps.

- BT Group and Nokia demonstrated enhanced 5G SA uplink performance through aggregation of two spectrum carriers in field trial in live network spectrum

- Aggregation of two frequency bands for uplink boosts performance for EE’s future 5G SA network, key to supporting growing customer use-cases such as gaming and live-streaming

- BT Group first in Europe to achieve both 2CC CA uplink and 4CC CA downlink simultaneously

When BT detailed its wideband FDD trial, it noted that the 5G SA specification from 3GPP is currently based on a single uplink carrier, so why try and aggregate uplink carriers? BT said that uplink carrier aggregation is something to have handy in future, when data demand inevitably calls for ever more uplink capacity.

5G Carrier Aggregation over a 5G SA network, which combines several transmission bands into one connection, is a key capability to deliver the high-performance 5G service that customers expect. Every new carrier added allows for higher capacity and speed directly to customer devices.

Last year, BT and Nokia announced 5G SA 4CC CA downlink. Now, by achieving both 5G SA 2CC CA uplink and 4CC CA downlink simultaneously, BT can deliver significant uplift in connections performance from the device to the network by increasing throughput and capacity, as well as unlocking scope to push uplink performance further in the future.

The tests were conducted at BT Group’s facility in Adastral Park, UK, using Nokia’s 5G AirScale portfolio and a device powered by a Snapdragon® 5G Modem-RF System from Qualcomm Technologies, Inc., following initial lab-based trials.* Speeds of over 230 Mbps in the uplink were reached — including the wider 5G FDD carrier at 40 MHz in 2600 MHz — as well as over 1 Gbps in the downlink. The demonstration was conducted with 15, 30 and 40 MHz NR2600 carrier independently aggregated with a 40 MHz NR3500 carrier component.

The work is part of BT Group’s efforts to ensure that, when 5G SA services are launched over EE, it maintains its unbeatable 5G network for customers.**

Greg McCall, Chief Networks Officer, BT Group, commented: “Carrier aggregation will be key to delivering the very best 5G experience to our customers, with this latest trial in partnership with Nokia demonstrating significant performance increases in terms of uplink speeds. This builds on last year’s success of achieving 4CA in 5G SA downlink, and we look forward to achieving further milestones in this space as we continue to progress towards 5G SA.”

Mark Atkinson, SVP, Radio Access Networks PLM at Nokia, said: “This successful trial with our long-standing partner BT, is another great example of Nokia’s unrivalled leadership in 5G carrier aggregation technology. Multi-component carrier aggregation helps mobile operators to maximise their radio network assets and provide the highest 5G data rates to subscribers in more locations.”

Enrico Salvatori, Senior Vice President and President, Qualcomm Europe/MEA, Qualcomm Europe Inc, said: “We are proud of our continued collaboration with BT to bring our latest 5G technologies to consumers. 2CC uplink carrier aggregation is expected to improve uplink speeds by up to 2X, to give a better user experience overall. Consumers would potentially be able to upload and share higher quality videos faster online, such as when attending concerts and when watching and streaming games online. We look forward to the future and what else is to come with our continued collaboration with BT.

* Snapdragon is a trademark or registered trademark of Qualcomm Incorporated.

** ‘Unbeatable 5G network’: Based on analysis from the RootMetrics® UK RootScore® Report, H1 (Jan – June) 2023. Tested at locations across the UK with the best commercially available smartphones on 4 national mobile networks across all available network types. Your experiences may vary. The RootMetrics award is not an endorsement of EE. Visit ee.co.uk/claims for more details.

BT Group is the UK’s leading provider of fixed and mobile telecommunications and related secure digital products, solutions and services. We also provide managed telecommunications, security and network and IT infrastructure services to customers across 180 countries.

BT Group consists of three customer-facing units: Business covers companies and public services in the UK and internationally; Consumer serves individuals and families in the UK; Openreach is an independently governed, wholly owned subsidiary wholesaling fixed access infrastructure services to its customers – over 650 communications providers across the UK.

British Telecommunications plc is a wholly owned subsidiary of BT Group plc and encompasses virtually all businesses and assets of the BT Group. BT Group plc is listed on the London Stock Exchange.

For more information, visit www.bt.com/about

References:

https://telecoms.com/523289/bt-and-nokia-reach-new-5g-sa-carrier-aggregation-milestone/

BT tests 4CC Carrier Aggregation over a standalone 5G network using Nokia equipment

https://telecoms.com/523069/bt-teases-5g-sa-progress-with-wideband-fdd-trial/

Ericsson and MediaTek set new 5G uplink speed record using Uplink Carrier Aggregation

T-Mobile US achieves speeds over 3 Gbps using 5G Carrier Aggregation on its 5G SA network

Nokia, China Mobile, MediaTek speed record of ~3 Gbps in 3CC carrier aggregation trial

Nokia will manufacture broadband network electronics in U.S. for BEAD program

Nokia has become the first telecom company to announce the manufacturing of fiber-optic broadband network electronics products and optical modules in the U.S. for use in the Broadband Equity, Access and Deployment (BEAD) program.

Using thin strands of glass to transmit data with light, fiber-optic networks have become the backbone of today’s digital economy and are used to connect everything to fast, reliable gigabit data services. Seventy percent of fiber broadband lines in North America are powered by Nokia. Now, partnering with Sanmina Corporation, Nokia will manufacture in the U.S. several fiber-optic broadband products at Sanmina’s state-of-the-art manufacturing facility located in Pleasant Prairie, Kenosha County, Wisconsin, bringing up to 200 new jobs to the state.

By manufacturing fiber-optic technology in the U.S., Nokia will be able to supply its products and services to critical projects like BEAD that are focused on narrowing the digital divide, helping to further contribute to the nation’s economic growth and job creation. Having access to technology that is built in the U.S. is an important requirement for states and infrastructure players seeking to participate in BEAD and the $42.45bn of available funding allocated for broadband rollouts to unserved and underserved communities.

Pekka Lundmark, President and CEO of Nokia, said: “At Nokia, we create technology that helps the world act together. We are committed to connecting people and communities. However, many Americans still lack adequate connectivity, leaving them at a disadvantage when it comes to accessing work, education and healthcare. Programs like BEAD can change this. By bringing the manufacturing of our fiber-optic broadband access products to the U.S., BEAD participants will be able to work with us to bridge the digital divide. We look forward to bringing more Americans online.”

Vice President of the United States, Kamala Harris, said: “President Biden and I are delivering on our promise to strengthen our economy by investing in working people, expanding domestic manufacturing, empowering small business owners, and rebuilding our nation’s infrastructure—today’s announcement is a direct result of this work. Our investments in broadband infrastructure are creating jobs in Wisconsin and across the nation, and increasing access to reliable, high-speed internet so everyone in America has the tools they need to thrive in the 21st century.”

U.S. Secretary of Commerce, Gina Raimondo, said: “President Biden promised to bring high-speed internet to every corner of America, and to do it with American workers and American-made equipment. This announcement is proof that he’s delivering on that promise. When we invest in American manufacturing and American jobs, there’s no limit to what we can achieve. Thanks to the President’s leadership, we’re going to connect everyone in America and create a strong and equitable economy that’s built for the future.”

Jure Sola, Chairman and CEO of Sanmina, said: “Sanmina has been manufacturing in the U.S. for more than forty years and we are excited to partner with Nokia to support their efforts to build robust and resilient high-tech fiber broadband networks that will connect people and societies. By continuing to invest in domestic manufacturing, Nokia and Sanmina will be able to help create a sustainable future for the industry, one that drives job growth and ensures the fiber products produced embody the quality and excellence associated with American manufacturing.”

Nokia fiber-optic broadband products manufactured in the U.S. will include:

- Optical Line Termination card for a modular Access Node

- A small form factor OLT

- OLT optical modules

- An “outdoor-hardened” Optical Network Terminal (ONT)

Resources and additional information

- Seven out of ten fiber broadband connections in North America are made through Nokia equipment.

- Nokia is the top supplier of fiber-optic broadband technology for service providers in the U.S.

- Nokia is the number one vendor for XGS-PON technology globally and in the U.S. market. XGS-PON can deliver up to 10 Gbps (Gigabits-per-second) broadband speeds to end-users. With 10 Gbps, you can download a 4K movie in less than 30 seconds or stream around 1,700 movies simultaneously.

- Nokia was the first to deploy 1, 10 and 25 Gigabit fiber-optic broadband networks in the U.S. with the Electric Power Board (EPB) in Chattanooga, Tennessee.

- Website: More about funding opportunities and Nokia broadband solutions

- Infograph: Why Fiber Broadband is Essential

- Article: U.S. Broadband Infrastructure Funding explained

- Video: Explaining the limitless speeds for fiber broadband

- https://www.nokia.com/about-us/news/releases/2023/08/03/nokia-first-to-announce-manufacturing-of-broadband-network-electronics-products-for-bead-program-in-us/

……………………………………………………………………………………………………………………..

August 16, 2023 Addendum:

Nokia announced today its partnership with Fabrinet to become the first telecom vendor to manufacture fiber broadband optical modules in the U.S. for use in the Broadband Equity, Access and Deployment (BEAD) program.

Starting in 2024, Nokia’s next generation, multi-rate optical modules for Optical Line Terminals (OLTs) will be produced at Fabrinet’s state-of-the- art manufacturing facility located in Santa Clara, California, bringing high-tech innovation and additional jobs to the country.

This news builds on Nokia’s recent announcement that they will produce fiber-optic broadband network electronic products in Kenosha, Wisconsin – expanding Nokia’s list of products and solutions for networks rollouts using BEAD or other funding to help bridge the digital divide.