Ericsson-Cisco partnership for "networks of the future" stops short of a merger

On Monday, Ericsson and Cisco announced a multi-faceted partnership to create the networks of the future – and through this, shape the direction of the industry. Ericsson, a leader in wireless network equipment, and Cisco, which dominates the market for Internet gear, will work together to integrate existing equipment. They will combine some sales and consulting efforts and, ultimately, may jointly develop entirely new hardware and services.

Both companies have invested a lot of time in designing this partnership over the past year, according to Ericsson’s CEO (see quote below).

Cisco brings their leading position in IP and a strong presence in enterprise. Ericsson brings leadership in mobile networks, strength in global services, and strong relationships with the world’s leading service providers.

Ericsson and Cisco together hold more than 56,000 patents, invest $11 billion annually in research and development, and operate more than 76,000 services professionals serving customers in more than 180 countries.

Hans Vestberg, President & CEO of Ericsson:

“The strength of this partnership lies not just in its scale, but in the depth of the solutions Ericsson and Cisco can now provide to the networking market. It is a market in transition – increasingly mobile, cloud-based, and digital – and customers are seeking end-to-end solutions to reach their full potential. We have evaluated the impact of acquisitions, our own development, and other strategic opportunities – and this partnership is by far the best way forward. We believe that this partnership will create the most value both for our customers and for Ericsson and Cisco.

For Ericsson, this partnership also fortifies the IP strategy we have developed over the past several years, and it is a key step forward in our own transformation. It will start generating revenues for Ericsson as soon as 2016, ramping up to USD 1 billion by 2018 and building from there.”

Both companies are coping with challenges that include a slowdown in the smartphone market, a longtime driver of revenues for the telecom companies that are their biggest customers. They also face heightened competition from Huawei, as well as a new threat created by the pending €15.6 billion ($16.8 billion) takeover of Alcatel-Lucent SA by Nokia Corp. Those rivals have expertise in both wireless and Internet technologies, a combination that Cisco and Ericsson hope to now match, said Pierre Ferragu, an analyst at Sanford C. Bernstein.

At the same time, the deal underscores a widening recognition of the downsides of large mergers, particularly cross-border transactions that can face regulatory scrutiny in many countries.

“Neither Ericsson or Cisco really believe that these large mergers typically work,” Chuck Robbins, Cisco’s chief executive, said in an interview.

Analysts don’t expect formal reviews by antitrust authorities, but politicians on both sides of the Atlantic may take a close look. Governments have been eager to closely monitor suppliers of equipment regarded as highly sensitive for security and privacy reasons. Huawei has been essentially shut out of the U.S. market after a congressional report deemed it a risk to national security.

For Ericsson, the alliance could help retain its position as the world’s biggest telecom-equipment supplier by sales, just as its Nordic rival Nokia regains strength. Nokia’s takeover of Alcatel-Lucent could create a powerful challenger to both Ericsson and Cisco.

To find new revenues, analysts said, Cisco and Ericsson must develop new products to cope with changes in the networks operated by mobile and wireline carriers—as well as exploit a trend called the “Internet of Things,” which will connect more everyday devices to one another.

The other problem is Huawei, which recently overtook Ericsson in the market for mobile infrastructure equipment, according to analysts at Dell’Oro Group. Huawei received 30% of revenues in that market during the first half of 2015, according to the research firm, compared with 27% for Ericsson and 25% for the combination of Nokia and Alcatel-Lucent.

Ericsson’s core business of supplying equipment has suffered from price competition and from the relatively slow rollout of broadband wireless networks, known by the acronym 4G, by its carrier customers.

Cisco also faces pressure from Huawei. Dell’Oro estimates that the Chinese company accounts for 13% of the global router business—Cisco has 49%—but Huawei has displaced Cisco as No. 1 in China.

In the short term, one benefit of the alliance is for Ericsson to resell Cisco networking gear. The Swedish company also has 65,000 service personnel that help advise carriers on how to build networks. Cisco, which has 11,000 service workers, can take advantage of the Ericsson staff, Mr. Robbins said.

Ericsson, which has around 116,240 employees, reported revenue last year of 228 billion Swedish kronor ($26.3 billion). Cisco, which employs 70,000 people, reported revenue of $49.2 billion in its latest fiscal year, which ended in July.

The companies sell some competing equipment, but the overlap is small. Cisco accounted for 1% of the wireless infrastructure market in the first half, while Ericsson accounted for 1% of the routing market, Dell’Oro Group estimates.

An added wrinkle of the partnership concerns patents. Ericsson, a wireless pioneer, claims 37,000 patents to Cisco’s 19,000. The companies said they expected to complete a patent cross-license agreement under which Cisco would pay an unspecified amount to Ericsson for use of its patents.

From Fortune on line magazine:

What exactly the partnership will do is obscured by scores of words of gobbledygook (that’s a technical term) issued by both companies. These refer to a “multifaceted relationship” focused on “networks of the future” that will facilitate the cross-selling of both companies’ “end-to-end product and services portfolio.” (Fortune’s Jonathan Vanian has details here.)

The companies weren’t prepared to discuss much about the commercial nature of their “non-deal deal.” They said neither company is taking an ownership position in the other, but they predict the combination will result in incremental revenues of $1 billion to each company by 2018.

There was one concrete type of reference to money: Cisco is paying Ericsson a licensing fee for the use of its patents. Cisco’s stock declined a bit, and Ericsson’s rose about the same amount, percentage-wise.

Rather than merging and all the headaches that would ensue, they reached multiple agreements, terms undisclosed, to work more closely together. Centerview Partners, an investment bank, advised on the partnership, according to a news release. That means money is involved.

Why be so cryptic? The kinds of equipment Ericsson and Cisco sell tend to make governments nervous. Nervous governments like to bless mergers before they happen. No merger, no blessing, no problem.

Fortune’s Stacey Higginbotham has a different take on this deal.

The partnership comprises a series of agreements spanning everything from reselling and joint sales, to technology cross-licensing, co-innovation and joint professional services, and should it aims at boosting each company’s annual revenues significanly.

“Given Ericsson’s annual revenues of more than USD26 billion and Cisco’s of more than USD49 billion, and opportunities in new enterprise-driven communications and IoT services, we think each company’s goal of driving USD1 billion in new revenues by 2018 based on this strategic partnership is achievable,” said Dana Cooperson, Research Director at global telecoms specialist Analysys Mason

Ericsson’s nearly USD5 billion and Cisco’s over USD 0.7 billion in telecom software professional services is one possible area ripe for growth.

The agreement is described by analysts as an aggressive move positioning Ericsson and Cisco against competitors, like Huawei, HP, and Nokia –Alcatel-Lucent , for dominance as the partners of choice for communication service providers that want to become digital service providers as well.

In fact, the announcement was well received by several high-profile executives of companies like Vodafone , AT&T and Verizon. For Robert Gurnani, Verizon’s Chief Information and Technology Architect, it even “has the potential to reshape the industry.”

However, according to Cooperson, to make the agreement work, the Swedish and American multinationals will have to abide to certain preconditions. Their ability to pre-integrate solutions based on a common, robust, architecture will have to be of sufficient value in time and money to be compelling to customers.

Clients will need to be comfortable that Ericsson and Cisco are not just strengthening their leading positions in mobile infrastructure, professional services and IP infrastructure to create de facto lock-in. Finally, “the companies will need to show that they are not too big to move quickly to create joint solutions,” Cooperson said.

OPEX Reductions Expected in 2nd Year of Data Center SDN Deployment- why not?

Introduction:

IHS-Infonetics conducted in-depth interviews with service providers that have deployed or plan to deploy or evaluate software-defined networking (SDN) by the end of 2016. They discovered that 85% of survey respondents expect data center network operating expenses (OPEX) to decrease significantly by the second year of SDN deployment.

Author’s note: Of course, that was one of the driving forces behind moving to SDN in the first place!

“Service providers expect SDN to deliver a positive return on investment. Our data center SDN study found that providers expect significant OPEX cost reductions within two years of deploying SDN. CAPEX reductions are also expected, and respondents acknowledge they need to invest in equipment and operational processes to get started with SDN,” said Cliff Grossner, Ph.D., research director for data center, cloud and SDN at IHS. “In supplying SDN to service providers, open source vendors have the largest opportunity with orchestration software and applications,” Grossner added.

DATA CENTER SDN SURVEY HIGHLIGHTS:

· Service provider respondents named Cisco, Alcatel-Lucent/Nuage and VMware as top SDN vendors. Note that none of those use the pure SDN/Open Flow model!

· Service providers that are scaling up their data centers—investing significant CAPEX in physical servers and virtualization technology—are most likely to deploy SDN

· Expectations for SDN are clear: simplified network provisioning, network automation, rapid application deployment and interoperability with existing equipment

· The top data center SDN use cases among operators surveyed are a cloud architecture for the data center, automated application deployment and hybrid cloud.

DATA CENTER SDN SURVEY SYNOPSIS:

For the 35-page 2015 IHS Infonetics Data Center SDN Strategies: Global Service Provider Survey, IHS interviewed purchase-decision makers with detailed knowledge of their organization’s data center SDN plans and strategies about plans to evolve their data centers and adoption of new technologies over the next two years. Respondents were asked about SDN deployment drivers, barriers and timing; expected CAPEX and OPEX changes with SDN; use cases; switching technologies; applications; vendors; and more.

To purchase research, please visit:

www.infonetics.com/contact.asp

RELATED RESEARCH

-

Bare Metal Switches a $1 Billion Market by 2019, Software-Defined WAN Rising

-

Storage Area Network Market Declining as Off-Premise Cloud Services Rise

-

Enterprises Plan to Spend 1/3 of IT Budget on Off-Premise Cloud Services by 2016

-

Cloud Services for IT Infrastructure and Applications to Top $230 Billion by 2019

-

Carriers on Track to Spend $5.7B on SDN Hardware, Software & Services by 2019

-

Network Operators Reveal SDN Plans, Timing & Challenges in New Survey

References:

http://press.ihs.com/press-release/technology/operators-expect-opex-reductions-2nd-year-data-center-sdn-deployment

Raj Jain, PhD: The key characteristics of SDN are programmability that allows policies to be changed on the fly. This allows orchestration (ability of manage a large number of devices), automation of operation, dynamic scaling, and service integration. Combined with virtualization, this also allows multi-tenancy and all of the above benefits to individual tenants as well.

It is important to know what SDN is not. SDN is not separation of control and data plane or centralization of control or OpenFlow. These are all one way to do SDN but alternatives are equally good. Networks can be programmed and policies can be changed without separation of data and control plane, without centralization of control, and without OpenFlow.

http://www.jisajournal.com/content/6/1/22

http://www.prnewswire.com/news-releases/sdn-to-drive-down-service-provider-capex–opex-heavy-reading-finds-246142961.html

http://sites.ieee.org/sdn4fns/files/2013/11/SDN4FNS_panel_presentation_Bram_Naudts.pdf

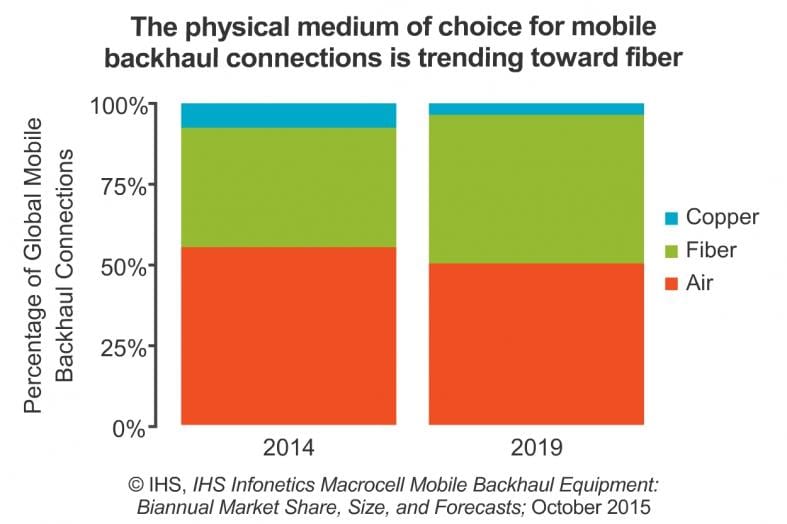

IHS-Infonetics Report: Microwave Radio still dominates Mobile Backhaul but Fiber Increasing

The recently released IHS Infonetics Macrocell Mobile Backhaul Equipment report tracks equipment used to transport mobile traffic. In the report, IHS Technology forecasts a cumulative $45 billion to be spent on macrocell mobile backhaul equipment worldwide over the 5 years from 2015 to 2019.

MOBILE BACKHAUL MARKET HIGHLIGHTS:

· Worldwide macrocell mobile backhaul equipment revenue declined slightly (-0.6 percent) in 2014 from 2013, to $8.5 billion

· Demand remains solid from LTE deployment, 3G network expansion and backhaul capacity enhancement, but increasing pressure on equipment pricing is inhibiting revenue growth

· IP/Ethernet clearly remains the driver of the mobile backhaul equipment market, required to do the heavy lifting for ever-growing mobile bandwidth usage

· Microwave radio was the largest spending category in 2014, at 47 percent of global mobile backhaul gear revenue, though this segment is projected to decline as more fiber and wireline Ethernet come into play

· Toward 2019, 5G backhaul demand starts to drive the market, pushing the microwave segment back to modest year-over-year revenue growth

Analyst Quote:

“While the market has experienced something of a plateau of late as many operators are approaching late-phase LTE deployment having already upgraded their backhaul, renewed growth is definitely on the horizon,” said Richard Webb, research director for mobile backhaul and small cells at IHS. “Developing countries later to the LTE party, such as India, will drive steady growth over the next few years, which will gain extra momentum from early 5G adopters.”

MOBILE BACKHAUL REPORT SYNOPSIS:

The biannual IHS Infonetics Macrocell Mobile Backhaul Equipment report provides worldwide and regional market share, market size, forecasts through 2019, analysis and trends for macrocell mobile backhaul equipment, connections and installed cell sites by technology. Companies tracked: Accedian, Actelis, Adtran, Adva, Alcatel-Lucent, Aviat Networks, Canoga Perkins, Ceragon, Ciena, Cisco, DragonWave, E-band, Ericsson, FibroLan, Huawei, Intracom, Ipitek, Juniper, MRV, NEC, Overture, RAD, SIAE, Telco Systems, Tellabs, ZTE, others. To purchase research, please visit www.infonetics.com/contact.asp.

WEBINAR: SDN AND NFV FOR SMALL CELLS AND BACKHAUL:

Join analyst Richard Webb Oct. 29 at 11:00 AM ET for Leveraging SDN and NFV for Small Cells and Backhaul, an event examining the challenges and opportunities for combining SDN and NFV in the backhaul network. Register here.

RELATED RESEARCH:

- NEC and Alcatel-Lucent Claim Lead in IHS Microwave Equipment Scorecard

- Plateau for Microwave Equipment Market until 5G Gets Underway in 2017

- Operators Forging Ahead with SDN in Macrocell Backhaul Networks

- Mobile Backhaul Market Plateau Will Be Short Lived, IHS Says

- Mobile Operators Turning to Ethernet Microwave for Voice and Data Backhaul

Verizon Petitions FCC to provide Wi-Fi calling with TTY waiver

Verizon is taking steps to enable Wi-Fi voice on its wireless network. The carrier has submitted a petition to the FCC requesting that the regulatory body grant it a waiver identical to the one it gave to AT&T earlier this month for WiFi calling without TTY service.

Enabling Wi-Fi voice calling is problematic for the FCC, because the underlying technology doesn’t reliably support TTY (teletypewriter), a decades-old service used by the hearing impaired. AT&T complained to the FCC last month that competitors T-Mobile and Sprint merely disregarded the rules around TTY support when they launched Wi-Fi calling.

Verizon plans to research and deploy RTT (real-time text) technology, a successor to TTY. However, the company maintains that it’s not ready to roll out the technology across its network just yet. It hopes to do so during the period that its requesting the waiver for—through 2017, or the same length of a waiver that AT&T was granted.

“Verizon plans to meet the same conditions enumerated in the AT&T Waiver Order. Specifically, Verizon agrees to inform its customers through multiple channels that TTY is not supported on these services for calls to 911 and inform customers of alternative means to reach 911 services. Verizon will also inform the Commission and customers of its progress toward the deployment of RTT as described in the AT&T Waiver Order. And Verizon is seeking a waiver for the same duration as that granted to AT&T,” according to Verizon’s petition.

“Because Verizon is seeking a waiver identical to the waiver granted to AT&T and committing to the same conditions that were fully considered by the Commission on a well-developed record, there is no need for the Commission to seek additional public comment here and the Commission should promptly grant this petition.”

If Verizon can get its TTY waiver, then it will be able to support “true” Wi-Fi calling on both iOS and Android devices which would both be able to make calls over Wi-Fi through their native dialers rather than a separate mobile app.

References:

http://www.theverge.com/2015/10/25/9611746/verizon-wi-fi-calling-feature-seeks-fcc-approval

http://www.pcmag.com/article2/0,2817,2493836,00.asp

http://appleinsider.com/articles/15/10/06/att-granted-fcc-waiver-to-activate-wi-fi-calling-amid-tiff-with-t-mobile-sprint

http://apps.fcc.gov/ecfs/document/view?id=60001330537

http://transition.fcc.gov/Daily_Releases/Daily_Business/2015/db1006/DA-15-1141A1.pdf

FCC takes steps to facilitate mobile broadband & nex gen wireless technologies above 24 GHZ

The FCC has issued a Notice of Proposed Rulemaking (NPRM) that proposes new rules for wireless broadband operating in frequencies about 24 GHz. The NPRM proposes to create new flexible use service rules in the 28 GHz, 37 GHz, 39 GHz, and 64-71 GHz bands. It proposes to make these bands available using a variety of authorization schemes, including traditional wide area licensing, unlicensed, and a shared approach that provides access for both local area and wide area networks.

These proposed rules are an opportunity to move forward on creating a regulatory environment in which these emerging next-generation mobile technologies – such as so-called 5G mobile service – can potentially take hold and deliver benefits to consumers, businesses, and the U.S. economy.

“Building off of years of successful spectrum policy, this NPRM proposes to create new flexible use service rules in the 28 GHz, 37 GHz, 39 GHz, and 64-71 GHz bands. The NPRM proposes to make these bands available using a variety of authorization schemes, including traditional wide area licensing, unlicensed, and a shared approach that provides access for both local area and wide area networks.

In addition, the NPRM provides a path for a variety of platforms and uses, including satellite uses, to coexist and expand through market-based mechanisms,” the FCC wrote in a press release.

http://transition.fcc.gov/Daily_Releases/Daily_Business/2015/db1022/DOC-335993A1.pdf

CTIA vice president of Regulatory Affairs Scott Bergmann called the NPRM an “important step” towards clearing additional spectrum. He wrote in a statement:

“Today’s action also reminds us that the diversity of 5G applications will require a broad range of spectrum types, including low and medium band spectrum, below 3 GHz and between 3 – 6 GHz, as well as streamlined infrastructure siting and more backhaul. The move to bring to market high band spectrum in bands above 24 GHz offers the potential for increased capacity and speeds, lower lag time and high density connections to unleash the Internet of Things. We look forward to working with the Commission to address a flexible framework for service in these bands that encourages continued investment and innovation to deliver the next waves of connected wireless applications.“

Diminishing Outlook for a DISH Spectrum Deal As Small Cell Deployments Gain Momentum, by David Dixon, FBR

Attribution: This blog post was written by David Dixon of FBR and edited by Alan J Weissberger

Executive Summary:

Competition is dampening returns, but VZ’s strategy is on track. Though behind on IoT, densification is helping to address 75% YOY data traffic growth; usage per customer should help augment revenue growth. Chicago and New York should benefit from the launch of unlicensed LTE in 2016 at relatively low cost, with AWS 3 spectrum utilized in 2017/2018. While DISH spectrum leasing provides a free option, VZ is also well positioned to leverage more low-cost capacity spectrum via 150 MHz of 3.5 MHz spectrum (70 MHz of priority access + 80 MHz of unlicensed spectrum).

The industry has rallied around the 3.5 GHz spectrum to build an effective ecosystem that should allow the spectrum to be put into use quickly. This, combined with refarming opportunities in the 850 MHz and 1.9,Ghz bands, has VZ well positioned on the spectrum front. We still think a DISH spectrum acquisition is unlikely, but a leasing agreement could be a useful Plan B, should VZ’s small cell strategy run into speed bumps.

Key Points:

■ 3Q15 earnings recap. Consolidated revenue of $33.2B (+5.0% YOY) was ahead of consensus’ $33.0B but below our $33.5B estimate, driven by a 5.4% YOY increase in wireless revenue, partially offset by a 2.3% YOY decline in wireline revenue. Consolidated EBITDA of $11.5B were below our Street-comparable estimate of $11.8B. Retail postpaid net adds were 1,289,000, with churn of 0.93% and a retail prepaid net loss of 80,000. The 3Q15 adjusted EPS of $1.04, after a $0.05 non-cash pension re-measurement adjustment, compared to our Street-comparable estimate of $1.02.

■ Divestitures and accounting changes drive lower EPS growth in 2016. Specifically: (1) Converting from a subsidized to installment wireless phone model increased earnings in 2015, as 100% of the equipment sale was recorded as revenue. However, 30% of the base is now not on subsidized pricing (expected to increase to 50% in 2016), normalizing the earnings impact); (2) divested Frontier properties are classified as discontinued operations, driving a $0.13–$0.14 EPS lift from discontinued depreciation expense; (3) a loss of higher-margin properties with stranded centralized costs, with some of the cost savings realized after the labor agreement; (4) losses for start-up businesses.

■ Estimate changes; lower price target. We lower our FY15 and FY16 estimates to account for divestitures, accounting impacts, and lower phone sales volume in 4Q (anniversary of iPhone 6 launch in 4Q14). FY15 revenue/EBITDA/ EPS estimates decline to $131.1B/$46.2B/$3.95, from $131.8B/$46.5B/$3.96; FY16 revenue/EBITDA/EPS estimates decline to $133.0B/$47.2B/$4.03, from $137.1B/$48.4B/$4.12.

Our Thoughts – Time Frames for Impact:

1. Aside from being well positioned on spectrum for the macro network, how what is the small cell opportunity as an alternative to more macro network spectrum going forward?

A change in the industry network engineering business model is underway toward using small cells on dedicated spectrum to manage more of the heavy lifting associated with data congestion. Verizon demonstrated this shift during the AWS3 auction: It modeled a lower-cost small cell network for Chicago and New York. We expect CEO Lowell McAdam to manage this shift from the top down to mitigate execution risk due to cultural resistance from legacy outdoor RF design engineers, whose roles are at risk as the macro network is de-emphasized.

Enablers include the advent of LTE, increased spectrum supply across multiple spectrum bands including LTE licensed, unlicensed (500 MHz of 5 GHz spectrum) and shared frequencies (150 MHz of 3.5 GHz spectrum), amid a fundamental FCC spectrum policy shift from exclusive spectrum rights to usage-based spectrum rights, which should dramatically increase LTE spectrum utilization (similarly to WIFI).

Previously, outdoor small cells co-channeled with the macro network proved challenging: While they can carry substantial load, they also destroy equivalent capacity on the macro network due to mis-coordination and interference, so the macro network carries less traffic but still looks fully loaded. AT&T discovered this in its St. Louis trials that, in part, steered it toward buying $20 billion of AWS3 spectrum.

However, the industry trend is toward LTE underlay networks, where small cells are put into other shared or unlicensed spectrum with supervision from and/or carrier aggregation with the macro network. It still requires good coordination across all cells for this to work; while Verizon initial proposals for 5 GHz are downlink only, we think uplink will also be used longer term because uplink needs more spectrum resources for a given throughput; we see higher uplink usage trends in the Asian enterprise segment and from Internet of Things (security cameras).

Time frame:12 to 18 Months

2. Does Verizon have sufficient spectrum depth to drive revenue growth longer term? Or does it need to aggressively acquire spectrum in future spectrum auctions or in the secondary market (DISH)?

The short answer is yes. Verizon carries 80% of data traffic on 40% of its spectrum portfolio; its combined nationwide CDMA and LTE spectrum depth is 115 MHz, ranging from 88 MHz (Denver) to 127 MHz (NYC). We expect AWS3 capacity spectrum to be deployed in 2017/18. Investors may not be crediting Verizon with potential to source more LTE spectrum from refarming of CDMA to LTE (22 MHz to 25 MHz) used today for CDMA data (22 MHz to 25 MHz).

Critically, network performance data show Verizon network close to the required performance threshold for a VoLTE-only service, suggesting there is additional refarming potential for the 850 MHz band (25 MHz) used today for CDMA voice and text. This band is likely to be transitioned in 5 MHz x 5 MHz LTE slivers to run parallel with the expected linear (voluntary) ramp, versus exponential (forced) ramp in VoLTE service.

More low-band spectrum is key for the surging IoT and M2M segments, which are proving to be more thirsty than “bursty.”

Time frame: 2 Years+

Millward Brown global survey: On line (OTT) video just as popular as conventional TV

This is a follow on to the recent post noting opposition to the FCC reclassifying linear OTT suppliers as pay tv providers.

A Millward Brown global survey of 13,500 multiscreen viewers concludes that the lure of online video extends to adults of all ages. The survey polled people who own a TV and either a smartphone or tablet—in 42 countries on what they think about video advertising. People are spending as much time watching online video as they spend watching TV, The survey also found an average online viewing time of 204 minutes a day for people ages 16 to 45, split evenly between TV and online.

Forty-nine percent of people liked mobile-app videos that reward people with virtual incentives like points for playing games, and 31 percent of consumers responded favorably to skippable mobile preroll ads. Only 14 percent of people said that they liked mobile pop-ups, the ads that take over a screen, and 15 percent tolerated nonskippable video ads.

http://www.adweek.com/news/technology/young-or-old-everyone-seems-online-video-much-tv-now-167541

Lot of new OTT players, competing with Netflix.

Source: “Premium Prospects for OTT in the USA” study from MTM, Ooyala and Vindicia

Opposition Mounts: Should FCC regulate linear OTT service providers as pay TV operators (MVPDs)?

Introduction:

FCC chairman Tom Wheeler has said there’ll be a final vote this fall on his proposal to define real time (AKA date/time or “linear”) over-the-top video services as pay TV services that are delivered by multichannel video programming distributors (MVPDs).

Regulation of MVPDs stems from the 1992 Cable Act (approved despite veto of President Bush Sr). The act was created in order to amend the Communications Act of 1934 to provide increased consumer protection and to promote increased competition in the cable television and related markets, and for other purposes.

Currently, the MVPDs include cable, satellite, and telecom companies that offer pay TV service. However, real time (date and time or linear) Internet based video services like Dish Networks Sling TV, HBO Go, ESPN3, etc aren’t considered to be MVPDs under the current law. The FCC has proposed changing that law for linear OTT, but not for Video On Demand (VoD) providers.

Wheeler’s stated goal is to insure non-discriminatory access to programming for both cable and broadcast. To do that he is seeking to read out the “facilities-based” requirement in the definition of MVPD. Cable operators and over-the-top services alike have registered reservations about that move (see For and Against below).

Backgrounder:

U.S. law requires that pay TV distributors (like Comcast, Time Warner Cable, and DirecTV) and programmers (like NBC, ESPN, and CNN) negotiate “in good faith” over the rights to broadcast content to customers. The distributors have to pay for the content, and the programmers aren’t allowed to indiscriminately withhold those rights.The law established a cumbersome term for pay TV service providers (MVPDs).

The Federal Communications Commission released a Notice of Proposed Rulemaking (NPRM) proposing to classify over-the-top (OTT) video programming providers as MVPDs if they delver “linear” programming. The FCC proposes that it will facilitate the availability of cable and broadcast television programming to OTT providers and enhance consumer choice and competition in the video market.

The reclassification would require OTT providers to carry certain programming and to comply with other regulations currently imposed on MVPDs like cable providers. The proposal would also give OTT video providers certain legacy negotiating and carriage rights with respect to both cable and broadcast programming.

The most important implication of that rule change is that programmers would then be forced to negotiate with Internet TV services just as they have to negotiate with cable companies.Services like Dish’s Sling TV and Sony’s PlayStation Vue currently offer small bundles of channels from companies with which they have been able to strike deals. The same is expected of Apple’s widely expected (but unannounced) Internet TV service. However, if the definition of MVPD is changed to include these new services, they could have access to many more channels, and thus offer a more diverse programming line-up.

The exact implications of reclassification aren’t yet clear, since these Internet-only services are intentionally offering fewer channels than traditional pay TV packages. It’s also worth noting that the rule change wouldn’t affect Netflix and other subscription services that only offer on-demand video; it only applies to live television services. Still, the prospect of a rule change clearly has many companies nervous.

For and Against:

1. The TV network affiliates of ABC, CBS, Fox, and NBC, which aren’t owned by the larger companies of the same name, filed their own comment in favor of the rule change. They’re excited because it would require that internet TV services gain their consent for retransmitting their broadcasts, just like cable companies have to under the 1992 Cable Act.

2. Disney, Fox, and CBS filed a joint comment to the FCC explaining that they were firmly against changing the definition of MVPD to include internet TV. “The proposal to expand the definition of MVPD raises significant and complex questions that could jeopardize the nascent state of the over-the-top market,” the companies said.Essentially, they argue that market forces have created a healthy environment for internet video to thrive, and that more government regulation is not only unnecessary, but could, as they put it, “limit the opportunity for consumers to obtain their desired video programming in a variety of new manners.” Other programmers, like AMC, and many cable companies, like Cablevision, are against the rule change for similar reasons.

Opinions:

1. Rep. Frank Pallone (D-N.J.), in his first media policy speech as ranking member of the House Energy & Commerce Committee, recently advised the FCC to “hit the pause button on regulating streaming video…In the case of defining online video providers as cable companies, I do not think we can say yes,” he said. Pallone added: “Some have urged the FCC to help prop up some video business models through additional regulation. The companies that first asked for help claimed that new entrants must be defined as cable companies if they are to get access to content. They were essentially worried that they could not compete with traditional cable companies without importing cable regulations to the online world.But consumer demand since then has driven the market to create new business models and new ways to distribute programming.”

2. Ajit Pai was one of two FCC commissioners to state his reservations about the proposed rule change after it was announced by Wheeler. Speaking at a Churchill Club breakfast on Friday July 17th, he made his position to the rule change official: “This morning I’d like to make it clear I strongly oppose this proposal.” Pai went on to lay out the reasoning behind his decision. He said it was important to perpetuate an environment where: “21st century entrepreneurial spirit isn’t saddled with 20th century rules and regulations.”

Mr. Pai claims the benefits provided to OTT video providers covered by the rule change are illusory. He said that even with the rule change, OTT providers would not fit the definition of a pay TVprovider being used by the patent office. So, it is likely the online companies would still not be able to benefit from the statutory license which allows MVPDs to carry local TV channels. However, hewarned that this would create a burden on OTT providers, because if a local programmer wanted carriage on their service the OTT provider would be required to negotiate with them. Further, Pai saidonline providers might end up facing other MVPD regulations on pricing, ad volume, employment practices, and even on the wiring inside a customer’s home; though it is unclear what these MVPD regulations mean in the OTT world.

3. Assistant Attorney General Bill Baer remarks on October 9, 2015 Keynote Address at the Future of Video Competition and Regulation Conference Hosted by Duke Law School:

“With respect to video programming, the streaming option is transformative. Programmers now have the Internet as an alternative to distribution over traditional broadcast, satellite and cable networks. Over the top programming via broadband Internet connections increasingly competes with what consumers used to access solely from their cable or satellite provider.

In 2009, there were two scripted original series delivered exclusively through online services – by 2014, there were 27. This new distribution option also lowers barriers to entry for non-traditional content, like YouTube and e-sports, and allows established programmers to deliver more tailored services. Networks can offer content a la carte, like CBS All Access and HBO Now/Go, or expand programming through services like ESPN3.

The FCC also took smart and measured action to protect competition with its recent Open Internet Order. That Order set out some simple, bright-line rules: broadband providers may not block access to lawful content; they may not throttle lawful content; and they may not take money to favor some lawful content over others. The Order, which the Justice Department is proud to help defend in court, effectuates the public policy Congress mandated in 1996 by ensuring that cable companies or other broadband providers don’t disadvantage competitors offering consumers video services via their broadband connections. This helps protect consumer choices and ensures that incumbents that sell both video and broadband internet do not use their control over broadband to suppress competition in video.

Sometimes the concern with undue restrictions on competition stems from incumbents seeking laws and regulations that would impede opportunities for rivals to challenge their control over the pipeline. We see that debate playing out in efforts by some internet service providers to seek state laws precluding local communities from encouraging alternatives to local broadband monopolies. The FCC, through its Municipal Broadband Order, targets those obstacles in order to allow municipalities to expand broadband availability. This helps bring greater competition to exactly the part of the industry that needs it the most.

The future of video competition should be left for the market to decide. Our role as antitrust enforcers and competition advocates is not to pick winners or losers. Our job is to make sure that existing bottlenecks are eliminated, that mergers don’t create new ones, and that our enforcement and policy efforts let competition thrive and innovation continue for consumers’ benefit.”

What’s Your Take?

Readers are invited to weigh in with their opinions via the comment box below this article. Alternatively, you can email the author at: [email protected]

Comment from Ken Pyle of Viodi View:

Excellent summary. This has been a long time coming. This 2008 obscenity ruling foreshadowed the long reach of the FCC into the Internet using video as its Trojan Horse. http://viodi.com/2008/06/24/fcc/

References:

https://apps.fcc.gov/edocs_public/attachmatch/FCC-14-210A1.pdf

http://www.broadcastingcable.com/news/washington/pallone-fcc-dont-redefine-otts-cable-ops/144861

http://www.justice.gov/opa/speech/assistant-attorney-general-bill-baer-delivers-keynote-address-future-video-competition

http://qz.com/375566/the-really-important-policy-affecting-the-future-of-tv-that-no-one-is-talking-about/

http://www.nscreenmedia.com/fcc-commissioner-says-no-to-ott-mvpd-regulation-change/

https://apps.fcc.gov/edocs_public/attachmatch/DOC-334437A1.pdf

http://www.broadcastingcable.com/news/washington/fccs-wheeler-ott-report-and-order-fall/142159

https://en.wikipedia.org/wiki/Cable_Television_Consumer_Protection_and_Competition_Act_of_1992

China’s Subsidized Broadband Investments Boosts Growth in Global CPE Market (IHS & China State Council)

IHS-Infonetics raised its outlook for the broadband customer premises equipment (CPE) market, which includes DSL, cable, fiber-to-the-home (FTTH), residential gateways and mobile broadband CPE. In a September 2015 report, the firm noted it increased its 2019 worldwide broadband CPE forecast by 8 percent, to US$12.4 billion.

BROADBAND CPE MARKET HIGHLIGHTS:

- The big story this quarter is FTTH optical network terminals (ONTs) in China, unit shipments of which more than doubled year-over-year, from 9.8 million to over 20 million from 2Q14 to 2Q15

- In 2Q15, the global broadband CPE market grew 5 percent from the previous quarter, to $2.9 billion; unit shipments grew 11 percent, to 61 million

- Worldwide total broadband CPE revenue is up 7 percent from the year-ago second quarter, when it was just under $2.7 billion

- Quarter-over-quarter, from 1Q15 to 2Q15:

- DSL CPE unit shipments were down 1 percent to 23 million, with VDSL IADs posting the highest growth (+11 percent)

- Cable CPE units were up 1 percent to 11.6 million (90% of which were WiFi-enabled), with DOCSIS 3.0 modems posting the highest growth (+13 percent)

- Fixed LTE CPE shipments grew 4 percent

Analyst Comments:

“The primary source for raising our global broadband CPE forecast is the massive investment currently ongoing in China. Despite reported economic headwinds, the Chinese government continues to subsidize telco investments in fiber infrastructure to expand accessibility and throughput. The result is heavy spending on GPON and EPON ONTs,” said Jeff Heynen, research director for broadband access and pay TV at IHS.

“At the same time, the shift from fiber-to-the-building (FTTB) to FTTH architecture is well underway in China. A primary reason for this architectural shift is that FTTB plus ADSL take-rates at China Telecom have been disappointing; consumers aren’t interested in a connection that offers only a marginal improvement over what they already have. If they are to subscribe to a home broadband service, it needs to provide a minimum of 8MB to 10MB speeds,” Heynen said.

BROADBAND CPE REPORT SYNOPSIS:

The quarterly IHS Infonetics PON, FTTH, Cable, DSL, and Wireless Broadband CPE market research report tracks DSL, cable and FTTH CPE; mobile broadband routers; and residential gateways. The research service provides worldwide and regional market size, vendor market share, forecasts through 2019, analysis and trends. Companies tracked include Alcatel-Lucent, Arris, AVM, Cisco, Comtrend, D-Link, Dasan Networks, Fiberhome, Hitron, Huawei, Mitsubishi, Netgear, OF Networks, Pace, Sagemcom, SMC Networks, Sumitomo, Telsey, Technicolor, TP-Link, Ubee Interactive, Zhone, ZTE, ZyXel, and others.

To purchase the report, please visit www.infonetics.com/contact.asp

From a May 2015 BBC report titled China reveals ambitious broadband plan:

China is to accelerate the development of its high-speed broadband network to raise speeds but cut prices, its State Council has said. Fewer than half of the country’s population has internet access and those who do can often experience slow connections. The country’s premier also urged telecoms companies to cut fees, including data roaming charges. It was not revealed how much money would be invested.

Besides the government investment, Premier Li Keqiang also urged telecoms companies to cut their prices and up their speeds, according to China’s cabinet the State Council. He also said they should cut data roaming charges for Chinese tourists, although he acknowledged that it was ultimately for the market to decide. He did, however, announce a round of investment infrastructure improvements to the same end.

“China has more cell-phone users than any other country, but its internet service speed ranks below 80th in the world due to underdeveloped information infrastructure,” the premier said, according to a release from the State Council.

He added that “speeding up the construction of information infrastructure will boost investment and support” in China, as well as helping “mass innovation.”

Mr Li did not say how much investment would be needed, but officials have previously earmarked around 2tn yuan ($322bn, £204bn) to improve China’s broadband infrastructure by 2020.

China’s internet penetration rate was only 47.9% last year, with connectivity especially low in smaller cities and rural areas. This compares with about 75% of people in the United States. In the UK, 73% of households have broadband access, Ofcom said in December 2014.

The Chinese cabinet’s statement added that the nation would look to open up the telecoms market and encourage increased competition, including through expanding a pilot scheme for broadband services this year.

“There is still not enough competition, which has led to telecoms fees being relatively high while there is still a lot of room to improve the quality of service,” the statement said, citing an official at China’s official State Information Centre.

http://www.bbc.com/news/technology-32736199

IHS-Infonetics CABLE WEBINAR:

Join analyst Jeff Heynen Sept. 29 at 11:00 AM ET for Delivering Cable Services in the Cloud Era, a free, live event that examines how virtualization will impact the MSO network and takes a look at key residential and commercial offerings enabled by NFV and SDN. Register here.

Positive Verizon Commentary Masks Negative Implications from Spectrum Supply Shift, by David Dixon

by David Dixon, FBR & Co., edited by Alan J Weissberger (emphasis added in BOLD font)

We believe there is a supply shift in (cellular) capacity spectrum coupled with an increase in spectrum utilization beginning with 150MHz of 3.5GHz LTE spectrum to be auctioned by the FCC in late 2016.

Last week, Verizon CEO Lowell McAdam provided an update on the company’s thoughts on DISH spectrum. More specifically, CEO McAdam noted for the first time that he would be interested in leasing spectrum from DISH, but was also quick to point out that he is not interested in acquiring DISH for access to the spectrum. Many believe this opens the door for more dialogue with DISH that could lead to a deal, but we believe this is simply a wise, short-term insurance option exercised by Verizon as it develops the 3.5GHz ecosystem in parallel. Both Verizon and T-Mobile plan to deploy LTE-Unlicensed (LTE-U) and LTE Assisted Access (LAA) at 5GHz and our checks indicate solid interest in 3.5GHz spectrum for LAA or autonomous use for indoor capacity.

We believe urban network designs are changing and industrywide support of 3.5 GHz is moving quicker than expected, which should continue to weigh on DISH spectrum value.

■ 3.5 GHz support moving quickly. The FCC issued an Order in April 2015 where it proposed to introduce the 3.5 GHz band (currently occupied by the Department of Defense) to create a Citizens Broadband Radio Service (CBRS) with a three-tiered spectrum sharing system on 70MHz of the total 150MHz. Tier 1 access will be made available to radar systems for the U.S. Navy which currently uses this band. Tier 2 will be priority access licensees (PAL) which will likely be wireless carriers who will acquire 10 MHz licenses for a renewable short term through auction (in late 2016). PAL users will agree to protect government users from interference, but receive no protection from government users. Tier 3 provides general authorized access (GAA) to all public users, including carriers, enterprises, or unlicensed users, which suggests utilization will closely match the Wi-Fi ecosystem today. Our checks show the 3.5 GHz spectrum works and the ecosystem is developing very quickly with broad support from carriers and manufacturers of chipsets, handsets, and radios (i.e., T-Mobile US, Verizon, Alcatel, Nokia, Intel, Qualcomm, iconectiv (Ericsson), and Federated Wireless).

■ Deciphering VZ comments. While DISH spectrum is most aligned with VZ’s spectrum portfolio, we do not believe VZ views wholesale access to DISH spectrum as a long-term solution to capacity management. We think Verizon views a potential spectrum leasing deal with DISH as a nearterm spectrum insurance play as development, testing, and support for 3.5 GHz continues. VZ has been the most aggressive proponent of 3.5 GHz spectrum and is in the forefront of 4G small cell implementation amongst all carriers.

Important Information: FBR is the global brand for FBR & Co. and its subsidiaries.This report has been prepared by FBR Capital Markets & Co. (FBRC), a subsidiary of FBR & Co.FBRC is a broker-dealer registered with the SEC and member of FINRA, the NASDAQ Stock Market and the Securities Investor Protection Corporation (SIPC). The address for FBRC is 1300 North 17th Street Suite 1400, Arlington, VA 22209.All references to FBR & Co. mean FBR Capital Markets & Co. (FBRC) and its affiliates.

Company-Specific Disclosures: FBR acts as a market maker or liquidity provider for the company’s securities: DISH Network Corporation For up-to-date company disclosures including price charts, please click on the following link or paste URL in a web browser: www.fbr.com/disclosures.aspx