New Mobile Virtual Network Operator Service Agreement & Other Wireless Telco News

Wireless communications service providers are licensing their network infrastructure to mobile virtual network operators. Telco Cuba, Inc. (OTC: QBAN), a U.S. based mobile telecom and data connectivity service provider, announced today that it has immediately begun offering mobile voice and data services to consumers and corporations as a result of a Mobile Virtual Network Operator (MVNO) agreement with Next Mobility.

TelcoCuba now provides high-quality voice and data services to consumers and enterprises utilizing LTE, 4G, and 3G networks. Telco Cuba mobile services will be available in other countries via roaming agreements and services with other mobile service providers. Telco Cuba and its wholly owned subsidiary Amgentech, Inc. are already well established in the local market for Voice over IP (VOIP) services and communications technology. Amgentech, Inc. has provided services to multiple network operators, constructed its own highly reliable network to enable communications worldwide, and has built highly reliant networks for its client base. Going forward, it will now offer extra-flexible solutions that combine mobile voice and data communication services with existing services for blended communication solutions that include mobile voice and data, mobile VoIP, VoIP, International Dialing, top-off prepaid phone service, international roaming, and much more.

The MVNO agreement signed with Next Mobility is a major first milestone for Telco Cuba. It affords Telco Cuba the ability to enter the cell phone service provider market with a drastically reduced startup cost, allowing Telco Cuba to use its budget where it matters – customer acquisition and marketing. Speed to market is the single most important factor in the digital age. Next Mobility is a well-established entity in the space and our contracted services will afford Telco Cuba a time to market of just under 60 days.

—>Apple is reportedly in talks with telecom companies in the U.S. and Europe to let customers pay the Cupertino-based tech giant for wireless service directly, rather than going through wireless firms like AT&T or Verizon. The company is conducting private trials of the service in the U.S. and has engaged in discussions with European companies to offer a similar service there, Business Insider reports. Also see related RCR Wireless article.

MVNO – Mobile Virtual Network Operator is a term coined to describe a company that setups a platform for the resell of mobile phone services from one of the big three cell phone providers in the United States of America or elsewhere in the world. AT&T, T-Mobile & Sprint are the biggest of the Mobile Virtual Network Enablers.

In other wireless and telecommunications news and developments:

- Verizon recently announced Grid Wide Utility Solutions, a new Internet of Things (IoT) platform service offering utility companies an easy on-ramp to grid modernization. Now available in the U.S., Grid Wide offers electric utility companies an integrated solution for smart metering, demand response, meter data management and distribution monitoring and control. With 147 million electric meters in the U.S. today, Verizon’s Grid Wide aims to transform the delivery and consumption of energy nationwide for investor-owned, cooperative and municipal utilities and their customers. Designed to maximize the benefits of smart meters, the solution comes equipped with a wide range of cloud-based applications intended to help utility companies drive incremental revenue, reduce operating costs, increase efficiency and improve customer experience.

- AT&T is promoting a $200 monthly cellphone and TV Everywhere bundle that it plans to offer throughout the U.S. — marking the first fruits of its merger with DIRECTV. Starting Aug. 10, the carrier will provide four phone lines with unlimited voice and texting, along with 10 gigabytes of sharable data. On the video side, AT&T will hook up four TVs with HD and DVR features and the ability to watch on any mobile device. The New York Times (free-article access for SmartBrief readers) (8/3), CNET (8/2)

- Vonage Holdings Corp, a leading provider of cloud communications services for consumers and businesses, today announced results for the second quarter ended June 30, 2015. Second Quarter Consolidated Financial Results – “We continue to drive market-leading growth at Vonage Business, while increasing profitability in Consumer Services,” said Alan Masarek, Chief Executive Officer of Vonage. “At Vonage Business, we delivered 118% revenue growth fueled by the successful execution of our acquisition strategy coupled with strong organic growth. We also made significant investments in our sales infrastructure, brand and leadership team to enhance our position in the rapidly growing Unified Communications-as-a-Service (UCaaS) market.”

- T-Mobile US Inc last week reported second quarter 2015 results reflecting continued strong momentum, industry-leading growth, and continued low churn. The Company again outperformed the competition in both customer and financial growth metrics. T-Mobile generated 2.1 million total net customer additions, marking the ninth consecutive quarter that T-Mobile has delivered over one million total net customer additions. Additionally, the Company delivered 14% total revenue growth and 25% growth in adjusted EBITDA compared to the second quarter of 2014.

“While the carriers continue to use gimmicks to confuse consumers, T-Mobile continues to listen to customers and respond with moves that blow them away,” said John Legere, President and CEO of T-Mobile. “On top of adding 2.1 million new customers in the second quarter, we delivered 14% year-over-year revenue growth and 25% year-over-year Adjusted EBITDA growth. Overall, I think our results speak for themselves.”

- U.S. Cellular to launch LTE roaming in next 60-90 days: CEO Ken Meyers said U.S. Cellular has completed its first LTE roaming agreement, though he declined to reveal the carrier partner. He said the companies are in the implementation phase of the deal and the respective engineering teams of the companies are working together. U.S. Cellular customers will be able to start benefiting from expanded LTE roaming in the next 60 to 90s days, he said. The partner is likely a Tier 1 carrier, so U.S. Cellular customers will get access to a more robust and nationwide LTE network. Meyers said he expects U.S. Cellular customers to see benefits more than he expects U.S. Cellular to reap inbound roaming revenue. Meyers said that the agreement is the first of multiple LTE roaming deals the company is working on.

IHS-Infonetics: MSOs Plan Massive DOCSIS Deployments; Shift to Remote/Distributed Access & HFC Optical Nodes

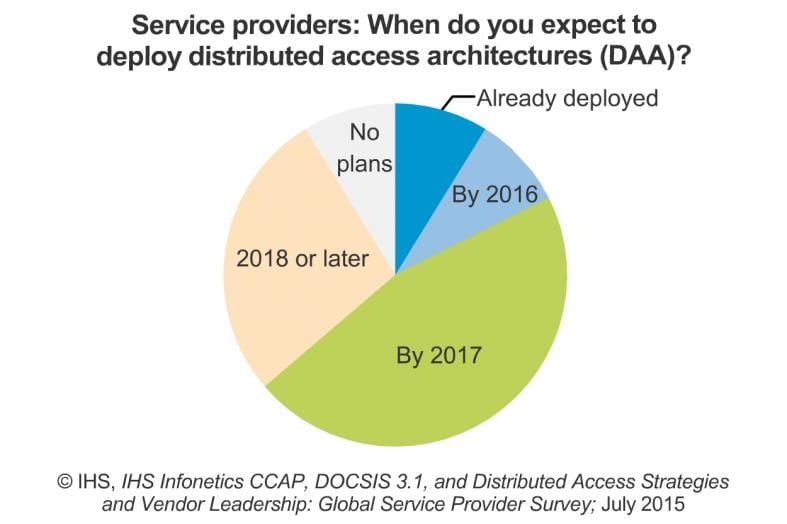

1. IHS-Infonetics conducted in-depth interviews with cable operators (MSOs) across the globe that collectively control 87 percent of the world’s cable capex and found that 42 percent of them plan to deploy a distributed access architecture (DAA) by 2017.

In the study, CCAP, DOCSIS 3.1, and Distributed Access Strategies and Vendor Leadership: Global Cable Operator Survey, respondent operators say their primary choices for distributed access are R-PHY, R-MACPHY and R-CCAP.

CABLE SURVEY HIGHLIGHTS:

- The operational benefits cable operators are reaping from moving from CMTS (cable modem termination system) to CCAP (converged cable access platform) are just the first step in a long-term transition to distributing data processing capabilities throughout the network

- Survey respondents, on average, say that about 1/3 of their residential subscribers will be passed by DOCSIS 3.1 (CableLabs spec) enabled headends by April 2017

- By 2017, nearly half of respondents will have return path (upstream) frequencies of 86–100MHz, while a quarter will have 101–200MHz of return path spectrum

“Cable operators are clearly committed to both DOCSIS 3.1 and distributed access architectures to increase bandwidth in their access networks. Though there is no consensus yet on which distributed access technology most will use, there’s no question they will distribute some portion of the DOCSIS layer to their optical nodes,” said Jeff Heynen, research director for broadband access and pay TV at IHS.

Definitions:

● Remote PHY (R-PHY): in this scenario, the entire DOCSIS PHY modulation is moved into the node while the MAC layer remains in the headend.

● R-CMTS: in this scenario, the DOCSIS MAC and PHY are removed from the headend and placed in the node

● R-CCAP: in this scenario, the DOCSIS MAC and PHY and video QAM capabilities are removed from the headend and placed in the node.

ABOUT THE REPORT:

The 29-page IHS Infonetics study, led by IHS analyst Jeff Heynen, focuses on DOCSIS 3.1, converged cable access platforms (CCAPs) and distributed access architectures, and how and when cable operators will deploy these technologies and architectures to improve their broadband and IP service offerings over the next 2 years.

The study includes operator ratings of CCAP and distributed access equipment suppliers (Arris, Casa Systems, Cisco, Gainspeed, Harmonic, Huawei and Pace/Aurora) on 9 criteria. Note from Jeff Heynen: “These are really the primary suppliers of node-based products. There are a number of Chinese ODMs. But they are really only present in China proper.”

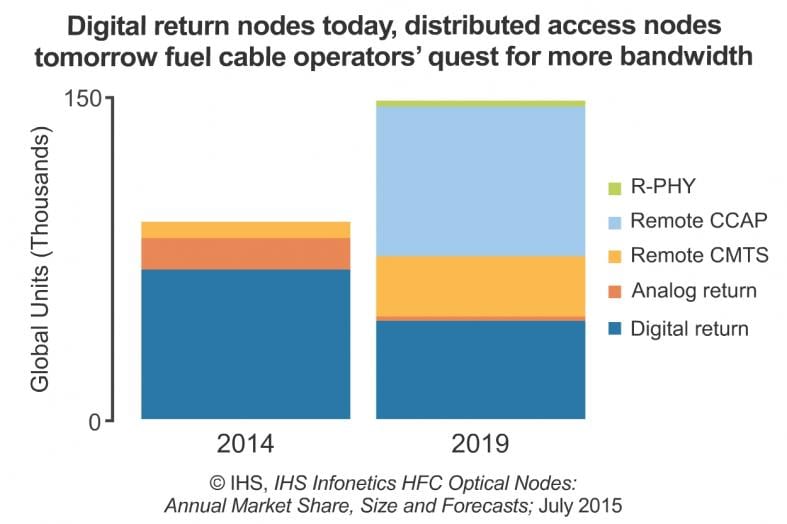

2. In a related report, IHS-Infonetics forecasts global hybrid fiber-coaxial (HFC) optical node shipments to more than double in the 5 years from 2014 to 2019, jumping from 92,000 to 200,000. Driving the boost are cable operators upgrading their networks with optical fiber cable, taking advantage of its high-bandwidth, low-noise, low-interference characteristics to deliver broadband video, data and voice services to homes and businesses.

“Optical nodes have rapidly become important platforms for cable operators to grow their broadband capabilities. By way of increased node splitting today for increased bandwidth and a transition to distributed access in the coming years, optical nodes will see significant unit growth and innovation,” said Jeff Heynen, research director for broadband access and pay TV at IHS.

OPTICAL NODE MARKET HIGHLIGHTS:

- Globally, HFC optical node revenue reached $356 million in 2014, up 14 percent from 2013

- In 2014, 80 percent of worldwide optical node revenue came from digital return nodes, and 15 percent from analog return nodes

- By 2019, IHS expects 35 percent of new physical nodes to be remote CCAP devices, 27 percent to be R-PHY units, and 23 percent to be traditional digital return nodes

- Arris led optical node global revenue and physical node unit shipments for the full-year 2014

ABOUT THE HFC OPTICAL NODE REPORT:

The 23-page IHS Infonetics HFC Optical Nodes market share and forecast report provides worldwide and regional market size, vendor market share, forecasts through 2019 and in-depth analysis for hybrid fiber-coaxial optical nodes. The annual market research service tracks physical node units, logical node segments and revenue for optical node types including analog and digital return, and remote PHY, converged cable access platform (CCAP) and cable modem termination system (CMTS).

RELATED RESEARCH:

- Biggest Trend among Cable Operators: Massive DOCSIS Deployments and a Shift to Remote/Distributed Access

- Broadband CPE Market Up 3 Percent from a Year Ago in 1Q15

- Reliable WiFi for Multiscreen TV Is Powering Growth in WiFi Extender Market

- Cable Broadband Equipment Market Off to Mixed Start in 2015

- 14 Percent Increase for Broadband Equipment Market from a Year Ago

- Pay TV Providers Embrace OTT Video, ‘Skinny’ Bundles to Stave Off Cord-Cutting

To buy Infonetics reports, visit: http://www.infonetics.com/contact.asp

My perspective on ONS 2015, SDN & Open Networking

The 2015 Open Networking Summit (ONS) was hosted on June 14th to June 18th in Silicon Valley. It featured a rich set of speakers, open networking panels and a wide audience base comprised of network service providers, network hardware and software vendors, web giants and the academia. ONS 2015 was the first of the fifth annual summit that I participated in. To this onlooker it provided an insight into the future direction of networking. The conference was a showcase of the solutions and challenges in achieving the goal of Software Defined Networking (SDN): to make the network programmable.

As Chair of the IEEE Communications Society Santa Clara Valley (SCV) chapter, I’ve had the opportunity to host several technical sessions on Open Networking and also track the rapid pace of change towards SDN. I am thrilled and enthused by the changes that SDN can provide. It opens up significant opportunities for new and existing players. However, I am equally skeptical of when and how SDN will become a mainstream technology, available to any enterprise data center or any end network consumer.

The basic idea of Software Defined Networking is to make the network user programmable. Sounds simple? It depends on how one defines the network:

- Is it a home network, enterprise Local Area Network (LAN) network, ISP / telco / carrier network, a web giant network, Cloud Service Provider Network or a Wide Area Network (WAN)?

- Is it a private network (located inside an enterprise and accessible only to an internal audience) or a public network (located on a premise not owned by the enterprise)?

- Is it a physical network (network functionality achieved using dedicated hardware) or a virtual network (network functionality achieved by using software and white box hardware)?

Each network type has it’s own set of solution pieces offered by multiple vendors, which consist of hardware and software components that are provisioned and maintained by a Service Provider (data center, telco WAN, enterprise/campus, cloud computing/storage, etc). Each network also has its own set of operational requirements. There are a wide range of issues and concerns, including: security, availability, provisioning, power, cost and serviceability.

The Open Network Foundation (ONF), which is progressing Open Flow based SDN, has a herculean task of bringing all these pieces under a single umbrella. Achieving SDN in an an “open,” “vendor agnostic” and “inter-operable” way is a challenge the purist can compare to finding extra terrestrial life.

Google’s Fellow and Technical Lead for Networking Amin Vahdat was an impressive keynote speaker at ONS2015. For the first time in company’s history, Amin disclosed Google’s internal Data Center Network. It’s design is based on the principles of Software Defined Networking, leverages CLOS topology, uses merchant silicon and has a single central administrative domain. A few statistics that are indicative of this massive network are that it handles 3.5 billion search results per day and has 300 hours of video uploaded every minute! Let’s pause for a minute and extrapolate, at roughly 5MB bandwidth consumption per minute for a 480p video – it translates into about 50 Petabytes of network traffic to watch the video content uploaded over a period of year (18000 years of uninterrupted viewing content stored and generated every year).

Microsoft’s Mark Russinovich, the CTO of the company’s Azure public cloud was also a keynote speaker. He talked about how Microsoft has embraced SDN into the Azure wide area network. That network can host millions of compute instances, and has exabyte scale storage and a Petabit capacity (Pbps) network.

Note that both Microsoft and Google are competing with Amazon’s AWS (Amazon Web Services) – a cloud-compute service provider platform.

Given the scale out requirement to handle the data generated by the human race today, one thing is clear: SDN is not an option – it is the solution. That’s because large networks that have to rapidly increase the number of users and the aggregate data capacity (e.g. Amazon’s AWS, Microsoft Azure public cloud, Google’s customer facing and backbone network, NTT and AT&T WANs, etc) require a software based approach with centralized domain specific control to scale out. The traditional hop by hop routing with expensive, closed, proprietary routers won’t make the grade.

AT&T’s SVP John Donovan, was another keynote speaker. He highlighted the journey of transformation which AT&T is pursuing with Open Networking, SDN and Open Source software. AT&T is on a grandiose mission to replace the traditional telephony network, based on Time Division Multiplexing (TDM) to an all Ethernet network by 2020.

The ONS2015 was spread over a week and had several panels on various important topics of SDN Adoption, Use Cases, Experiences, Hot Startups & VC investments, SDN WAN, Network Functions Virtualization (NFV), SDN for Optical Networks, OpenStack. The ONS2015 also had an expo floor, comprised of sponsor solution and demo booths from various companies like NEC, ADVA, AT&T, Dell, Brocade, Huawei, Cisco, and Broadcom.

There is a rapid pace of technology advancement, tremendous amount of energy and resources are being invested in this “second life of networking”. One pundit called it “a new epoch.” While there is market fragmentation and chaos, I see that as a positive sign. The industry is moving forward, asking new questions, facing new challenges. Consolidation is far ahead. Let’s continue to build and play by the ONF vision to build, promote and adopt SDN through open standards and open source software development.

I will close by a quote from Kitty Pang (Network Architect, Alibaba). It is bold and provocative, yet real:

“We want to run faster and faster. It does not matter if it’s hardware or software, open or closed, we choose low cost and high efficiency.”

Bonus:

Watch an insightful interview, where Alan Weissberger talks to ONF’s Dan Pitt on ONF’s path towards Open SDN: http://bit.ly/1erGes1

Editor’s Note:

Saurabh Sureka is the Chair of IEEE ComSoc Santa Clara Valley (SCV), which is by far the leading ComSoc chapter in the world in terms of both membership and technical programs. He joined the leadership team in 2011 as Treasurer and diligently continued to volunteer each year since then as a ComSocSCV officer. Saurabh is a Sr Product Manager at Emulex (now Avago Technologies) in San Jose, CA.

Related articles:

Highlights of 2015 Open Network Summit (ONS) & Key Take-Aways

Pica8 Open Networking OS/Protocol Stacks on Bare Metal Switches

FCC Approves AT&T-Direc-TV; Imposes Conditions to Improve Broadband Competition?

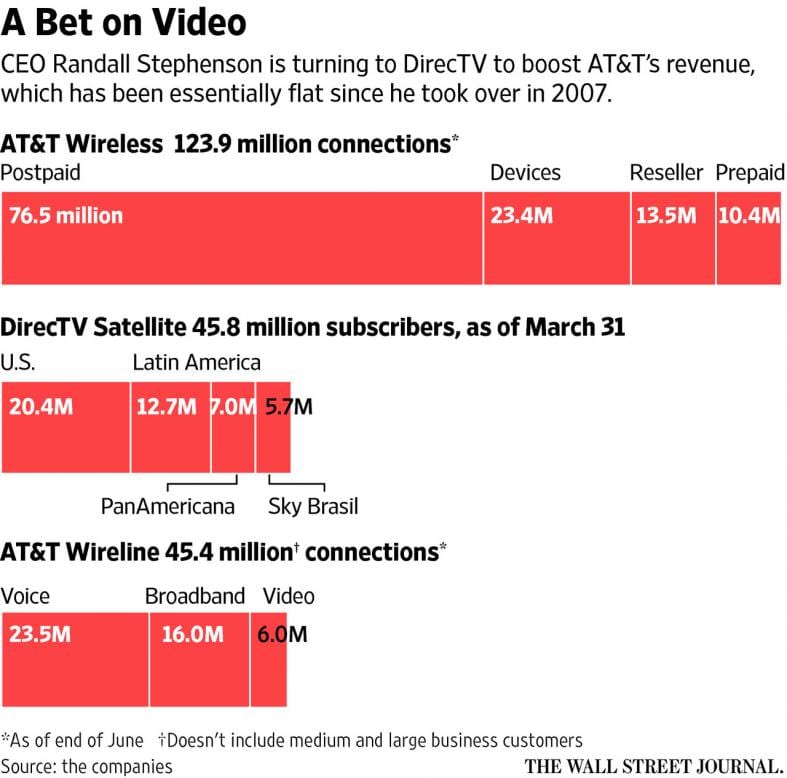

After almost one year of regulatory review, AT&T closed its $49 billion acquisition of DirecTV which makes it the largest U.S. pay-TV company. As expected, the Federal Communications Commission announced on Friday that it’s approved AT&T’s merger with DirecTV, attaching conditions intended to address the potential harms of the merger. Earlier this week, the U.S. Justice Department announced that it would not challenge the acquisition.

“The conditions also ensure that the benefits of the merger will be realized,” the FCC said in a news release. Federal regulators were reviewing the deal to determine whether it would serve the public interest or stifle competition. Those regulators have said they’re more worried about providing choice in Internet access and new, online video options than they are about concentration in the declining pay TV business (go-go cord-cutters!).

–>We strongly feel it’s the latter- less choice of providers leads to less competition and ultimately higher prices!

“We’re now a fundamentally different company,” AT&T Chief Executive Randall Stephenson in a press release. The company said it will serve more than 26 million U.S. customers and more than 19 million in Latin America, making it the world’s biggest pay-TV company.

[AT&T reported its earnings on Thursday. Profits dropped 14% to $3.04 billion. The company said integration related expenses from prior deals weighed on the results. Revenue edged up to $33.02 billion- an increase of only 1.4%. The number of new mainstream wireless subscribers fell by 60%. AT&T’s annual revenue growth since 2007 has averaged a miniscule 1.6%, according to data from FactSet.]

AT&T Chief Strategy Officer John Stankey will be chief executive of a new division called AT&T Entertainment & Internet Services, which includes DirecTV and the division that also includes AT&T’s broadband and video business. As the biggest pay-TV provider, AT&T could have more bargaining power with content companies.

“We are more confident than ever about the opportunity this transaction brings,” AT&T Chief Financial Officer John Stephens said on a conference call Thursday.

“We’ll now be able to meet consumers’ future entertainment preferences, whether they want traditional TV service with premier programming, their favorite content on a mobile device, or video streamed over the Internet to any screen,” Randall Stephenson, chairman and chief executive of AT&T, said in a statement.

Conditions Imposed on the 2nd “new AT&T”:

Note: the 1st “new AT&T” was when SBC acquired AT&T in 2006 and kept the AT&T name/

Approval of the deal came with a number of conditions, including some aimed at introducing more competition into the broadband Internet market, an issue emphasized by FCC commissioner Tom Wheeler in his comments earlier this week.The FCC is requiring AT&T to expand its high-speed, fiber-optic broadband Internet service to 12.5 million customer locations and eligible schools and libraries. That’s about 10 times its current size. The FCC said this addresses the concern that the merger would eliminate one choice for television service in the areas where AT&T and DirecTV previously competed. By expanding Internet service, the commission said, consumers will have more options to use services that rely on broadband to deliver video, such as Netflix, Amazon and Hulu. AT&T also will be required to offer broadband services to people with low incomes at discounted rates.

The company also will be required to submit its carrier inter-connection agreements for review by the FCC. Those agreements include “paid peering,” which allow a video streaming company like Netflix to pay a fee to a distributor, like Comcast or AT&T, for better service, when they create a lot of traffic for the network. The commission said that the condition recognized the importance of those agreements to online video service and said that it would monitor them to make sure that AT&T would not deny or impede access to its networks in anti-competitive ways.

The conditions remain in effect for four years after the merger closes. The FCC also required AT&T to retain an internal compliance officer and an independent, external compliance officer to make sure that the company abides by the deal conditions.

A serious concern about the deal is that AT&T is the only major Internet Service Provider whose customers face “data caps” for wireline broadband Internet access1. The merger could increase the incentive of AT&T to deploy such usage-based pricing to limit access to online video in favor of its own traditional television service. As a condition of the deal, regulators forbade AT&T from deploying discriminatory practices that would disadvantage online video services.

Note 1. AT&T Data Caps: “Residential AT&T High Speed Internet service includes 150 gigabytes (GB) of data each billing period, and most residential AT&T U-verse High Speed Internet service (up to 75 Mbps) includes 250GB of data each billing period.”

Public Interest Groups Weigh In:

Some public interest groups, though, were disappointed. “I thought after the Comcast-Time Warner Cable deal that maybe the commission was going to travel down a little different road in consolidation and begin to say no to some of these deals,” said Michael Copps, a former Democratic member of the FCC and a special adviser to the Common Cause public interest group.

“What they are basically saying is you have to treat everybody like you treat yourself, and so I think that is probably the most important protection against anticompetitive practices,” said Gene Kimmelman, the chief executive of Public Knowledge, a consumer advocacy group, and a former antitrust official at the Justice Department.

More Media Mergers Ahead?

The combination of AT&T, one of the country’s two largest wireless/wire-line telco and Internet Service Providers (via AT&T-Yahoo), and DirecTV, the country’s largest satellite TV provider, is the biggest media merger this year and will create the country’s largest television distributor with about 26 million subscribers, surpassing Comcast, the current leader.

“The fact that this deal closed with probably pretty reasonable conditions gives a little bit more confidence that Charter and Time Warner Cable would close, and maybe down the road opens the door for other deals,” said Amy Yong, a media analyst with Macquarie Group.

IHS-Infonetics: True 4G (LTE Advanced) is Finally Happening; SPs What’s 5G?

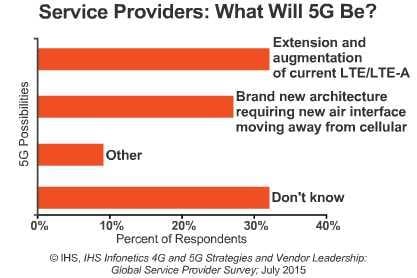

IHS-Infonetics today released excerpts from its 2015 IHS Infonetics 4G and 5G Strategies and Vendor Leadership: Global Service Provider Survey, for which operators were interviewed about their LTE network deployment plans, challenges and service offerings. Half of respondents participating in the study say they have already deployed LTE-Advanced (LTE-A) in their LTE networks.

4G AND 5G STRATEGIES SURVEY HIGHLIGHTS:

- Inter-band carrier aggregation is the most common and very first LTE-Advanced feature deployed by respondent operators.

- Commercial voice over LTE (VoLTE) service is taking off slowly and ramping this year and next.

- 4G network functions virtualization (NFV) migration won’t happen any time soon because the bulk of LTE networks are brand new and, therefore, mobile operators are not ready to undertake migration that soon.

- Ericsson, Huawei and Nokia (in alphabetical order) are perceived by survey respondents as the top LTE equipment manufacturers.

Analyst Comments:

“We are slowly but surely moving to true 4G, and that’s good news. However, most users already believe they are on 4G, and that’s the bad news because the experience is far from consistent and is falling short of expectations. How many times does your smartphone display LTE or 4G and you still see the infamous spinning wheel?” said Stéphane Téral, research director for mobile infrastructure and carrier economics at IHS.

“The 5G debate has started with great fanfare, hype and confusion, but little substance about what it is exactly and what it is not. For now, the mindset is still locked into mobile broadband as we know it with LTE, so it’s good that the ITU has just stepped in to define 5G in its brand new IMT-2020,” Téral said.

Author’s Notes:

1. What survey respondents think 5G will be at this time is anyone’s guess. That’s because ITU-R hasn’t even finalized the 5G vision or architecture recommendations. Please refer to this post for the status of all the 5G work in progress:

2. One huge problem for “true 4G” users is there is no set of minimum service requirements a wireless carrier has to implement to claim compliance with LTE Advanced. It seems that a higher data rate than LTE along with Carrier Aggregation is what most wireless operators are implementing or planning. See Appendix for LTE Advanced Requirements.

In a July 23rd email, Stephane Teral corroborates the above problem:

Hi Alan, I agree and this is exactly what’s looming for 5G if no one, including the ITU, does not step in to call for the clear cut! At this point, everyone implementing carrier aggregation can claim true 4G (IMT-Advanced), which is much better than saying LTE is 4G when it is defined in the IMT2000 as a 3G technology!

Best wishes,

Stéphane

4G/5G SURVEY SYNOPSIS:

For the 38-page 2015 4G and 5G Strategies and Vendor Leadership: Global Service Provider Survey, IHS interviewed purchase-decision makers at 22 mobile, incumbent, competitive and cable operators from EMEA, Asia, North America and Latin America. The study covers LTE network build-out plans; challenges and drivers; migration scenarios; LTE features, services and suppliers; and operator ratings of LTE manufacturers (Alcatel-Lucent, Cisco, Ericsson, Huawei, Nokia, Samsung, ZTE) on 9 buying criteria.

The service providers participating in the study represent about one-third of the world’s telecom capex and revenue.

To purchase the report, please visit: www.infonetics.com/contact.asp

RELATED RESEARCH:

Mobile Services Market Dragged by Europe Again:

http://www.infonetics.com/pr/2015/Mobile-Services-Subscribers-Market.asp

LTE Peaking at $6 Billion a Quarter – Not Enough to Offset 2G/3G Decline:

http://www.infonetics.com/pr/2015/1Q15-Mobile-Infrastructure-Market-Highlights.asp

Operators Spent $67B Outsourcing Network Tasks to Equipment Vendors in 2014:

http://www.infonetics.com/pr/2015/Service-Provider-Outsourcing-Highlights.asp

Telecom Carrier Spending Entering New Era Marked by Diverse Regional Trends:

http://www.infonetics.com/pr/2015/2H14-SP-Capex-Rev-Capex-by-Eqpmt-Highlights.asp

Mobile Operators Using EDGE, HSPA+ to Improve User Experience on Road to LTE:

http://www.infonetics.com/pr/2015/IP-RAN-3GPP-Strategies-Survey-Highlights.asp

Appendix: LTE Advanced Requirements:

General Requirements

- LTE-Advanced is an evolution of LTE

- LTE-Advanced shall meet or exceed IMT-Advanced requirements within the ITU-R time plan

- Extended LTE-Advanced targets are adoptedSystem

System Performance Requirements

- Peak data rate

– 1 Gbpsdata rate will be achieved by 4-by-4 MIMO and transmission bandwidth wider than approximately 70 MHz

- Peak spectrum efficiency

– DL: Rel. 8 LTE satisfies IMT-Advanced requirement

– UL: Need to double from Release 8 to satisfy IMT-Advanced requirement

- Capacity and cell-edge user throughput

– Target for LTE-Advanced was set considering gain of 1.4 to 1.6 from Release 8 LTE performance

Other Important Requirements

- Spectrum flexibility

– Actual available spectra are different according to each region or country

– In 3GPP, various deployment scenarios for spectrum allocation are being taken into consideration in feasibility study

– Support for flexible deployment scenarios including downlink/uplink asymmetric bandwidth allocation for FDD and nonâ€contiguous spectrum allocationTotal

- LTE-Advanced will be deployed as an evolution of LTE Release 8 and on new bands.

- LTE-Advanced shall be backwards compatible with LTE Release 8 in the sense that

– a LTE Release 8 terminal can work in an LTE-Advanced NW,

– an LTE-Advanced terminal can work in an LTE Release 8 NW

- Increased deployment of indoor eNBand HNB in LTE-Advanced.

FBR & Co: Verizon Wireless Market Comments + Verizon’s Mobile Video Service & "skinny bundles"

From FBR’s David Dixon:

“Verizon has a sustainable industry leading (wireless) network, an excellent spectrum position, and surging growth opportunities in mobile video, Internet of Things, and telematics.”

“We expect T-Mobile US to continue affecting AT&T to a greater extent than it effects Verizon. Sprint will remain weak as it delays spending amid a network strategy, driven by a weak balance sheet.”

Editor’s Note: Verizon is the first big telecom company to report its earnings for the 2nd quarter. It has faced tougher competition as such rivals as T-Mobile USInc. and Sprint Corp. have offered generous deals to subscribers to switch.

1. Aside from being well positioned on spectrum for the macro network, how should investors assess the small cell opportunity as an alternative to more macro network spectrum going forward?

A change in the industry network engineering business model is underway toward using small cells on dedicated spectrum to manage more of the heavy lifting associated with data congestion. Verizon demonstrated this shift during the AWS3 auction: It modeled a lower-cost small cell network for Chicago and New York. We expect VZ CEO Lowell McAdam to manage this shift from the top down to mitigate execution risk due to cultural resistance from legacy outdoor RF design engineers, whose roles are at risk as the macro network is de-emphasized.

Enablers include the advent of LTE, increased spectrum supply across multiple spectrum bands including LTE licensed, unlicensed (e.g., 500 MHz of 5 GHz spectrum) and shared frequencies (e.g., 150 MHz of 3.5 GHz spectrum, amid a fundamental FCC spectrum policy shift from exclusive spectrum rights to usage-based spectrum rights, which should dramatically increase LTE spectrum utilization similarly to WiFi.

Previously, outdoor small cells co-channeled with the macro network proved challenging: While they can carry substantial load, they also destroy equivalent capacity on the macro network due to mis-coordination and interference. So the macro network carries less traffic, but still looks fully loaded. AT&T discovered this in its St. Louis trials that in part steered it toward buying $20 billion of AWS3 spectrum. However, the industry trend is toward LTE underlay networks, where small cells are put in other shared or unlicensed spectrum with supervision from and/or carrier aggregation with the macro network.

It still requires good coordination across all cells for this to work; while Verizon s initial proposals for 5 GHz are downlink only, we think uplink will also be used longer term because the uplink needs more spectrum resources for a given throughput and we are seeing higher uplink usage trends in the Asian enterprise segment and from Internet of Things (security cameras).

2. Does Verizon have sufficient spectrum depth to drive revenue growth longer term? Or does it need to aggressively acquire spectrum in future spectrum auctions or in the secondary market (e.g., DISH)?

The short answer is yes. Verizon carries 80% of data traffic on 40% of its spectrum portfolio; its combined nationwide CDMA and LTE spectrum depth is 115 MHz, ranging from 88 MHz (Denver) to 127 MHz (NYC). We expect AWS3 capacity spectrum to be deployed in 2017/18.

Investors may not be crediting Verizon with potential to source more LTE spectrum from refarming of CDMA to LTE (22 MHz to 25 MHz) used today for CDMA data (22 MHz to 25 MHz). Critically, network performance data show Verizon network close to the required performance threshold for a VoLTE-only service, suggesting there is additional refarming potential for the 850 MHz band (25 MHz) used today for CDMA voice and text. This band is likely to be transitioned in 5 MHz x 5 MHz LTE slivers to run parallel with the expected linear (voluntary) ramp, versus exponential (forced) ramp in VoLTE service. More low-band spectrum is key for the surging IoT and M2M segments, which are proving to be more thirsty than “bursty.

Verizon’s CFO Shammo talks up mobile-first video service

Verizon Communications plans to offer a limited menu of content when it initially launches its mobile-first streaming video service late this summer, Chief Financial Officer Fran Shammo said after the telecom announced earnings Tuesday. The service is expected to use LTE Multicast technology. RCR Wireless News (7/21), CNET (7/21)

Shammo added that interest in Verizon’s FiOS skinny TV channel bundles exceeded the company’s expectations as one-third of gross customer additions chose the skinny bundle and some existing customers migrated to it as well. Verizon added a net 26,000 FiOS video subscribers in the three months ended June 30, and a net 72,000 subscribers to its FiOS Internet service.

Verizon’s 2Q 2015 Earnings Report:

IHS-Infonetics: NFV Market to Grow More than 500% Through 2019; Alan Disagrees!

IHS-Infonetics released excerpts from its IHS Infonetics NFV Hardware, Software, and Services report, which forecasts the global network functions virtualization (NFV) hardware, software and services market to reach $11.6 billion in 2019, up from $2.3 billion in 2015.

NFV MARKET HIGHLIGHTS:

- Service providers are still early in the long-term, 10- to 15-year transformation to virtualized networks

- Revenue from outsourced services for NFV projects is projected to grow at a 71% compound annual growth rate (CAGR) from 2014 to 2019

- Revenue from software-only video content delivery network (CDN) functions for managing and distributing data is forecast by IHS to grow 30-fold from 2015 to 2019

Analyst Quote:

“NFV represents operators’ shift from a hardware focus to software focus, and our forecasts show this. We believe NFV software will comprise over 80 percent of the $11.6 billion total NFV revenue in 2019,” said Michael Howard, senior research director for carrier networks at IHS. “The software is always a much larger investment than the server, storage and switch hardware, representing about $4 of every $5 spent on NFV,” Howard said.

NFV REPORT SYNOPSIS:

The 2015 IHS Infonetics NFV Hardware, Software, and Services market research report tracks outsourced services for network functions virtualization (NFV) projects as well as service provider NFV hardware, including NFV infrastructure (NFVI) servers, storage and switches; and NFV software split out by service management and orchestration (NFV MANO) software and virtual network function (VNF) software, including virtual routers (vRouters) and the software-only functions of mobile core and EPC, IMS, PCRF and DPI, security, video content delivery networks (CDN), and other VNF software. The research service provides worldwide and regional market size, forecasts through 2019, in-depth analysis and trends.

To purchase the report, please visit:www.infonetics.com/contact.asp

NFV WEBINAR:

Watch analyst Michael Howard’s July 2015 webinar, SDN and NFV: Accelerating PoCs to Live Commercial Deployment, an event detailing how operators can validate VNFs, NFVI and network services to speed up commercial deployments. Log in to view:

http://w.on24.com/r.htm?e=1005675&s=1&k=826E5A0182C2844918E03AD1DC23AC11

Alan’s DIssenting View of NFV:

There’ve been many times in the last three or four decades where network operators were wildly enthusiastic about a new technology, which never really gained marrket traction. In the mid 1980’s, ISDN was to replace the PSTN phone system and usher in new world of data communicaitons. In the early 1990s it was SMDS (Switched Multi-Megabit Data Service) that never really saw the light of day. In the mid 1990s, ATM was going to take over the world. 10 years later, many operators including SPRINT believed that WiMAX would be the 4G technology of choice. Didn’t happen!

Now we have major telecom carriers all excited over NFV with many forecasts of huge growth of that market. We don’t think that will happen in the next five years or maybe ever. Here’s what’s missing from NFV:

- Implementable standards for exposed physical interfaces and APIs for virtual appliances1 implemented as software running on a generic/commodity compute server.

- Procedures and protocols for virtual appliances to communicate with physical box (legacy, non-virtual) appliances already deployed in carrier networks (otherwise known as backward compatibility with the installed base). An ETSI NFV Use Cases document states in section 7.4. Coexistance of Virtualized and Non-Virtualized Network Functions: “The communications with virtual network functions shall be based on standardized interfaces.” Yet those interfaces haven’t been standardized yet.

- New security methods and procedures to isolate and quarantine compromised virtual appliances so that all appliances running on the same compute server are not locked down.

- Hardware assists, possibly NICs for compute servers, to guarantee latency and throughput of virtual appliances running on commodity compute servers.

- Standardized Management & Orchestration (MANO) software, including “service chaining,” which will work with different virtual appliances from multiple software vendors. Standardized software interfaces (like APIs) will be required for this, perhaps as part of an open source MANO software package (from OPNFV?)

- Element Management Systems (EMSs) that are integrated into MANO. For decades, physical box network vendors provided their own proprietary EMSs which configured, managed, monitored and controlled their equipment. EMSs need to be converted to software modules within MANO or accessible to MANO via software interfaces.

- The ability of MANO or other software to manage, control, schedule appliances/services, etc from BOTH virtual appliances and physical box appliances. Note that both types of appliances will be used in telco central offices/data centers for many years.

- Procedures for testing, monitoring, OA&M, fault isolation, repair & restoration, etc are urgently needed.

- Open Source NFV software, perhaps from the OPNFV consortium. IMHO, this is the best hope for NFV being a commercial success/real market.

- There’s a lot of hype about virtualizing the LTE Evolved Packet Core (EPC) via NFV but that is nonsense because operators are not going to put in a new infrastructure after recently spending lot of money to install EPC equipment and software. Further, there are no standards for vEPC. Yet we see many blog posts/article that say the time is now for vEPC. Here’s one of many NFV -vEPC hype to Pluto blog posts:

http://www.rcrwireless.com/20150223/opinion/reader-forum-dont-wait-and-see-on-nfv-for-epc-tag1

Note 1. Examples of virtual appliances include: session border controllers, load balancers, deep packet inspection agents, firewalls, intrusion detection devices, and WAN accelerators.

Here’s an interesting quote from a Spirent white paper on NFV:

“Traditionally, the burden of validating the core functions is shouldered by the network equipment (box) vendors. Today’s NFV landscape shifts some of this burden to operators deploying NFV topologies while not absolving the need for network vendors to validate NFV software within different hardware (compute platforms, physical switching tiers) and software infrastructures (hypervisor, holistic cloud stacks public clouds, etc).”

Tom Nolle on Fixing NFV:

In a New IP blog post, Tom Nolle wrote:

“What’s needed in NFV is something like “NFVI plug-and-play,” meaning that any hardware that can be used to provide hosting or connectivity for virtual functions should be capable of being plugged into MANO and supporting deployment and management.”

Nolle goes on to elaborate on fixes for CAPEX, OPEX and business case. He concludes with this remark:

“If the ETSI NFV ISG, or Open Platform for NFV Project Inc. , or the New IP Agency, are serious about moving NFV optimally forward, I’d suggest this is the way to start.”

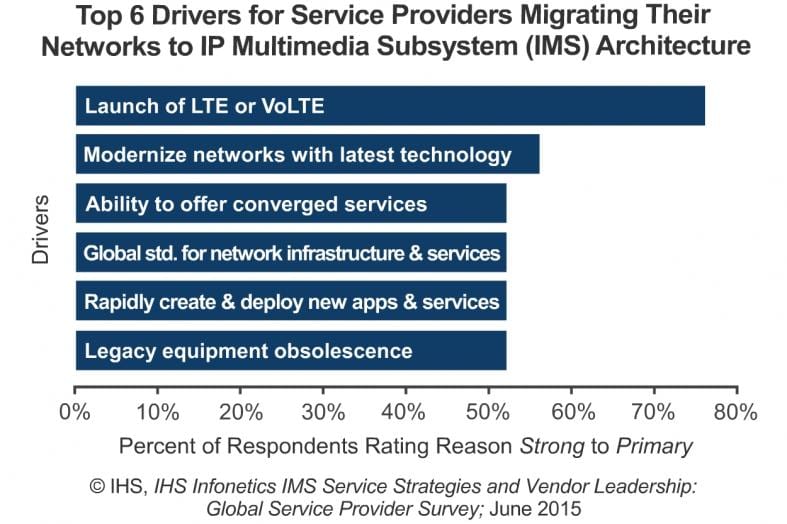

IMS (IP Multimedia Subsystem) Market Assessment & Vendor Scorecard from IHS-Infonetics

2015 IHS – Infonetics IMS (IP Multimedia Subystem) Vendor Scorecard profiles and analyzes the six top revenue producers of core IP Multimedia Subsystem network solutions: Alcatel-Lucent, Ericsson, Huawei, Mavenir, Nokia Networks and ZTE.

The only report of its kind, IHS’ IMS scorecard evaluates the leading IMS vendors on criteria using actual data and metrics, including market presence (market share, financials, solution breadth and buyer feedback on product reliability and service/support) and market momentum (market share momentum, NFV intensity, buyer feedback on vendors’ technology innovation). The report includes a Leadership Landscape Graph that classifies vendors as “Leader,” “Established” or “Challenger” based on their scores in these criteria. This approach eliminates subjectivity and ensures vendors are assessed accurately and fairly.

Quotes from Diane Myers, research director for VoIP, UC and IMS at IHS-Infonetics:

“IMS has been chosen by mobile operators as the core network for VoLTE deployments which has ramped shipments over the past 2 years as operators in the US, Japan, and South Korea ramped up for their launches. The IMS has been steadily growing for a number of years as operators worldwide, including cable MSOs, utilized it for fixed-line VoIP services but the sales volumes are significantly larger with VoLTE. The IMS market including SBCs grew 72% in CY13 as sales related to VoLTE kicked in and took volumes to a whole new level and grew 18% in CY14. We expect sales of IMS and SBCs to be $3.6B in CY15.”

IMS VENDOR SCORECARD HIGHLIGHTS:

- Ericsson’s market share, strong customer perceptions and deep relationships with mobile operators is helping it take advantage of the voice over LTE opportunity.

- Huawei has built market share through fixed-line VoIP networks using IMS and is positioned to capture the next wave of IMS spending related to VoLTE.

- Long a top vendor in the service provider VoIP market, Nokia Networks should further boost market presence via its merger with Alcatel-Lucent.

- Alcatel-Lucent is the third-largest IMS vendor, has above-average market share, scores above average for product reliability and service and support by service providers, and is at the forefront of developing IMS virtualized network functions.

- The smallest IMS vendor in the group, Mavenir is viewed by service providers as a top innovator that’s been able to steadily gain market share by focusing almost exclusively on mobile operators.

- Well established in its home country of China, ZTE has built a growing IMS business with cost-effective solutions that are appealing to operators in developing countries.

UPCOMING IHS INFONETICS SCORECARDS:

IHS is publishing 15 vendor scorecards in 2015 on markets ranging from telecom and enterprise networking equipment to carrier WiFi, network security, LTE infrastructure, cloud unified communications and more.

To purchase reports, please visit www.infonetics.com/contact.asp, or learn more about the scorecards at www.infonetics.com/research.asp?cvg=Equipmentvendorscorecards.

RELATED RESEARCH:

Service Providers Optimistic about Moving IMS Networks to NFV, Rate Vendors:

http://www.infonetics.com/pr/2015/IMS-Survey-Highlights.asp

IHS-Infonetics conducted in-depth interviews with global service providers that have IP multimedia subsystem (IMS) core equipment in their networks or will by the end of 2017 and discovered that only 8 percent are running IMS network elements in a network functions virtualization (NFV) environment today.

“Though only a small number of service providers who took part in our IMS strategies survey are currently running IMS in a virtualized environment, more are on the path by starting to utilize software running on commercial off-the-shelf hardware as a stepping stone to full NFV,” said Diane Myers, research director for VoIP, UC and IMS at IHS.

“One of the biggest drivers for NFV is the ability to scale services up and down quickly and introduce new network services more efficiently and in a timely manner, which makes IMS a good early fit for NFV,” Myers said.

Carrier Voice-over-IP Market Off to Strong Start in 2015:

http://www.infonetics.com/pr/2015/1Q15-Service-Provider-VoIP-and-IMS-Market-Highlights.asp

To purchase IHS-Infonetics report(s), please visit www.infonetics.com/contact.asp

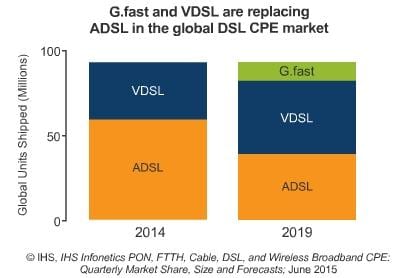

IHS-Infonetics on Broadband CPE Market: G.fast and VDSL Replacing ADSL

Worldwide broadband CPE revenue dropped to $2.8 billion in the first quarter of 2015 (1Q15), decreasing 2% sequentially, while unit shipments stayed flat at 54 million as service providers continued to expand their fixed broadband service capabilities in the highly-competitive customer premises equipment market, according to IHS-Infonetics.

“Overall, the CPE market remains strong, with revenue up 3 percent year-over-year. We expect both DOCSIS 3.1 and G.fast to help add momentum to the cable and DSL CPE market segments and FTTH to continue at its current pace, driven by deployments in China, North America and EMEA,” said Jeff Heynen, research director for broadband access and pay TV at IHS-Infonetics.

Author’s Note on G.fast:

In December 2014, the ITU-T approved the G.9701 (G.fast) specification, which is designed to provide gigabit broadband connection speeds (up to 1 Gbps) over a single twisted pair cable in an existing copper infrastructure. It allows faster deployment of services by enabling the introduction of plug-and-play remote DPUs and G.fast CPE devices self-installed by customers at home.

The Broadband Forum completed its G.fast equipment plugfest last month, as part of its ongoing program to drive widespread G.fast certification. Held at the University of New Hampshire InterOperability Laboratory’s (UNH-IOL) facilities in Durham, New Hampshire, the G.fast plugfest gave vendors developing remote Distribution Point Units (DPUs) and Customer Premises Equipment (CPEs) an opportunity to test and benchmark the interoperability of their products prior to full certification testing.

The forum said that a total of 14 chipset and equipment vendors participated in the event, illustrating the growing level of interest in G.fast technologies following the approval of the ITU-T’S G.fast standard in December 2014.

Participants included ADTRAN GmbH, Alcatel-Lucent, ARRIS, AVM GmbH, Broadcom, Calix Inc., Huawei, Ikanos, JDSU, Lantiq GmbH & Co. KG, Metanoia, Realtek Semiconductor Corporation, Sckipio Technologies and Technicolor. Sparnex Instruments and Telebyte provided additional test and measurement equipment for the event.

AT&T, BT, France Telecom/Orange, Swisscom and Deutsche Telekom are among many network operators planning to deploy G.fast to deliver broadband Internet access over copper.

BROADBAND MARKET HIGHLIGHTS:

- On a year-over-year basis, global broadband CPE unit shipments were up 9% in 1Q15 as operator investments in premium CPE continued.

- Looking at the product segments, the top performers in 1Q15 were EPON and fixed LTE, which both saw double-digit percentage increases in unit shipments.

- Regional pockets of growth include EPON ONTs and video gateways for cable operators in North America, GPON ONTs in Europe and VDSL CPE in Latin America.

- As service providers use mobile broadband to complement fixed broadband deployments, use cases for mobile broadband routers are anticipated to grow considerably, sending unit shipments to over 622,000 in 2019.

BROADBAND REPORT SYNOPSIS:

The quarterly IHS Infonetics PON, FTTH, Cable, DSL, and Wireless Broadband CPE market research report tracks DSL, cable and FTTH CPE; mobile broadband routers; and residential gateways. The research service provides worldwide and regional market size, vendor market share, forecasts through 2019, analysis and trends. Companies tracked include Alcatel-Lucent, Arris, AVM, Cisco, Comtrend, D-Link, Dasan Networks, Fiberhome, Hitron, Huawei, Mitsubishi, Netgear, OF Networks, Pace, Sagemcom, SMC Networks, Sumitomo, Telsey, Technicolor, TP-Link, Ubee Interactive, Zhone, ZTE, ZyXel, others.

To purchase the report, please visit www.infonetics.com/contact.asp

Meanwhile, DSL Reports says that AT&T’s ‘Fiber’ Expansion Possibly G.Fast DSL, Still Over-Hyped

“…the press (and Wall Street) are likely dramatically over-estimating the real impact AT&T’s plans are going to have. AT&T’s constantly-reduced fixed-line CAPEX budget makes it perfectly clear that the company’s tip priority is, and will continue to be, wireless.”

In an interesting twist, BTR says that G.FAST MAY SEE MORE NORTH AMERICAN USE IN BUILDINGS THAN OUTSIDE OF THEM.

“North American carriers increasingly see G.fast’s first role as a way to provide high-speed broadband over in-building copper as part of a fiber-to-the-building (FTTB) deployment. This growing consensus calls into question how soon – if at all – North American cable operators will see G.fast deployed to single-family homes in response to their upcoming DOCSIS 3.1 roll outs.”

SDN Standards Activities in ITU-T and other SDOs

The Joint Coordination Activity on Software-Defined Networking (JCA-SDN), was approved by ITU-T TSAG in June 2013. Mr. Takashi Egawa (NEC, Japan) was appointed as the Chairman and Ms Ying Cheng (China Unicom, China) as the vice chair of JCA-SDN, which will report its progress to TSAG.

From the ITU-T’s SDN Portal:

SDN is considered a major shift in networking technology which will give network operators the ability to establish and manage new virtualized resources and networks without deploying new hardware technologies. ICT market players see SDN and network virtualization as critical to countering the increases in network complexity, management and operational costs traditionally associated with the introduction of new services or technologies. SDN proposes to decouple the control and data planes by way of a centralized, programmable control-plane and data-plane abstraction. This abstraction will usher in greater speed and flexibility in routing instructions and the security and energy management of network equipment such as routers and switches.

Terms of Reference for the Joint Coordination Activity on Software-Defined Networking (JCA-SDN) is at:

http://www.itu.int/en/ITU-T/jca/sdn/Documents/ToR-JCA-SDN.pdf

The JCA-SDN found many SDN-related activities are ongoing in various Study Groups (SGs) of ITU-T and in other Standard Development Organizations (SDOs).

In ITU-T, items shown below are under study, listed by Study Group:

l ITU-T Study Group 13 (lead SG of SDN)

- Y.3300 (Framework of Software-Defined Networking)

- Y.3320 (Requirements for applying formal methods to software-defined networking)

- Y.3012 (Requirements of network virtualization for future networks)

- Y.3321 (Requirements and capability framework for NICE implementation making usage of software-defined networking technologies)

- Y.FNvirtarch (Functional architecture of network virtualization for future networks)

- Y.Sup-SDN-usecases (Use cases of Telecom SDN)

- Y.SDN-req (Functional requirements of software-defined networking)

- Y.SDN-arch (Functional architecture of software-defined networking)

- Y-NGNe-VCN-Reqts (Requirements of VCN (Virtualization of Control Network-entities) for NGN evolution)

From the latest draft of the ITU-T SDN Architecture spec:

“The functional architecture of SDN is based on [ITU-T Y.3300] which provides the framework of SDN. The key properties of the framework are logically centralized network control which allows for controlling and managing network resources by software, support for network virtualization, and network customization, for efficient and effective network deployments and operations.

The requirements for SDN include: separation of SDN control from the network resources, programmability of network resources; abstraction of network resources, by means of standard information and data models and support for orchestration of network resources and SDN applications.”

Here’s the Mother of all cop-out disclaimers:

“The ITU-T framework description is a high level one which enables inclusion of many present and future SDN approaches [b-ETSI NFV][b-IETF I2RS][b-IETF RFC3746][b-ONF][b-OpenDayLight] which share the same objectives to provide the programmability of network resources.”

Note that there is no mention of the network virtualization/overlay model, favored by VMWare, Nuage Networks, and many other vendors.

l ITU-T Study Group 5

They informed JCA-SDN that their deliverables for energy saving and energy efficiency topics can be considered of interest for SDN.

l ITU-T Study Group 11

- Q.3315 (Signalling requirements for flexible network service combination on Broadband Network Gateway)

- Q.SBAN (Scenarios and signaling requirements for software-defined BAN (SBAN))

- Q.Supplement-67 (Framework of signaling for SDN)

- Q.IPv6UIP (Scenarios and signaling requirements of unified intelligent programmable interface for IPv6)

l ITU-T Study Group 15

- G.asdtn (Architecture for SDN control of Transport Networks)

- G.cca (Common Control Aspects)

- G.gim (“Generic Information Model”)

l ITU-T Study Group 16

- H.Sup.OpenFlow (Protocol evaluation – OpenFlow versus H.248)

- H.VCDN-RA (Functional requirements and architecture model for virtual content delivery network)

l ITU-T Study Group 17

- X.sdnsec-1 (Security services using the software defined network)

- X.sdnsec-2 (Security requirements and reference architecture for Software-Defined Networking)

Other SDN Standards Activity:

Regarding other standards bodies outside of ITU-T, JCA-SDN learned that there are SDN standardization activities in: ATIS, Broadband Forum (BBF), China Communications Standards Association (CCSA), Internet Engineering Task Force (IETF), Internet Research Task Force (IRTF), and Open Networking Foundation (ONF).

—>Why is ONF listed last?

SDN-related activities can also be found in 3GPP, ETSI ISG Network Function Virtualization (NFV) and IEEE P1903 (Next Generation Service Overlay Network (NGSON)).

JCA-SDN also learned that Open Source Software (OSS) projects are becoming important players in standardization ecosystem by providing reference implementations, providing feedbacks to specifications, demonstrate proof of concept, and others. In SDN arena OpenDaylight is playing an important role, and OpenStack and OPNFV in SDN-related area.

The details of each activity is shown in the latest version of JCA-SDN D.1 (SDN standards roadmap):

http://www.itu.int/en/ITU-T/jca/sdn/Documents/deliverable/Free-download-sdn-roadmap.docx