HughesNet and Viasat

GEO satellite internet from HughesNet and Viasat can’t compete with LEO Starlink in speed or latency

GEO satellite internet providers provide reliable connectivity across large land masses, but their distance from Earth presents challenges to delivering low-latency and high-speed satellite Internet services. HughesNet and Viasat operate stationary satellites 22,000 miles above Earth, whereas LEO satellite operators such as Starlink have satellites orbiting a mere 340 miles above Earth. GEO satellites are also less ubiquitous than LEO satellites – GEO operators have fewer satellites in their constellations.

According to Ookla, GEO satellite providers HughesNet and Viasat can’t compete with Starlink when it comes to latency and download speeds. HughesNet and Viasat are best-known for providing consistent coverage across large land masses. But because they operate in geostationary orbit rather than low-Earth orbit (LEO) and because they have fewer satellites in their constellations, they struggle with speed limitations and latency, making it difficult for them to compete with LEO providers such as SpaceX’s Starlink.

HughesNet and Viasat have three satellites each in their fleet delivering fixed broadband service. Viasat plans to launch its Viasat-3 F2 satellite later this year and the Viasat-3 F3 in 2026. In addition, it owns a fleet of satellites from the company’s Inmarsat acquisition in May 2023 which are primarily used in maritime and mission-critical applications.

The challenges facing these GEO satellite providers have become more pronounced over the past few years, particularly as Starlink has moved aggressively into the U.S. market with promotions such as its recent offer to provide free equipment to new customers in states where it has excess capacity.

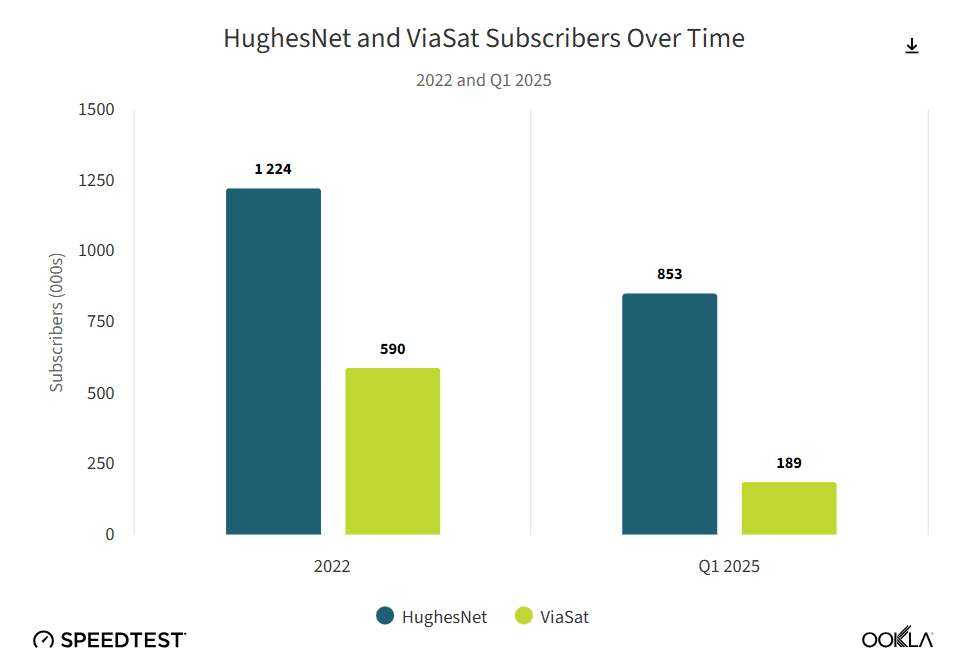

“HughesNet and Viasat are losing subscribers at a rapid rate thanks to competition from LEO satellite provider Starlink with its lower latency and faster download speeds,” according to Sue Marek, editorial director and analyst with Ookla.

Ookla’s Key Takeaways:

- HughesNet saw its median multi-server latency improve from 1019 milliseconds (ms) in Q1 2022 to 683 ms in Q1 2025. Viasat’s median latency increased slightly over that time period from 676 ms in Q1 2022 to 684 ms in Q1 2025. But neither are remotely close to matching Starlink with its median latency of just 45 ms in Q1 2025.

- HughesNet more than doubled its median download speeds from 20.87 Mbps in Q1 2022 to 47.79 Mbps in Q1 2025 while Viasat increased its median download speeds from 25.18 Mbps to 49.12 Mbps during that same time period.

- Upload speeds are another area where GEO satellite constellations struggle to compete with Starlink and other low-Earth orbit systems. HughesNet has increased its median upload speeds from 2.87 Mbps in Q1 2022 to 4.44 Mbps in Q1 2025 but that is still far lower than Starlink, which has a median upload speed of 14.84 Mbps in Q1 2025. Viasat saw its median upload speeds decline over that same time period from 3.06 Mbps in Q1 2022 to 1.08 Mbps in Q1 2025.

- HughesNet and Viasat are losing subscribers at a rapid rate thanks to competition from LEO satellite provider Starlink with its lower latency and faster download speeds.

Meanwhile, Starlink has nearly 8,000 satellites in low earth orbit (LEO) as part of its mega-constellation, according to Space.com. Starlink’s median download speeds, according to data from Ookla’s Speedtest users, almost doubled from 53.95 Mbit/s in Q3 2022 to 104.71 Mbit/s in Q1 2025. These latest average download speeds are also nearly twice that of HughesNet and Viasat.

In addition to network performance, Starlink has made strides in the U.S. market with promotions and distribution of free equipment to “new customers in states where it has excess capacity,” said Marek. In May, Starlink offered its Standard Kit, priced at $349, for free to consumers in select areas who agree to a one-year service commitment. But, “high demand” areas would still need to pay a one-time, upfront “demand surcharge” of $100, the company said.

Starlink is making headway teaming up with terrestrial service providers on direct-to-device (D2D) services, which connect smartphones and mobile devices directly to satellite networks in areas of spotty wireless service. Canada’s Rogers Communications launched a beta D2D service this week that initially supports text messaging via Starlink LEO satellites. The Canadian operator is also working with Lynk Global in a multi-vendor approach to D2D. Starlink announced this week that it has over 500,000 customers across Canada.

T-Mobile’s D2D service, T-Satellite with Starlink, will be commercially available later this month and will include SMS texting, MMS, picture messaging and short audio clips. In October, T-Satellite will add a data service to its Starlink-based satellite offering.

However, T-Mobile announced it would bump up the launch of T-Satellite to areas impacted by the recent flooding in central Texas. During a number of recent natural disasters, Starlink has offered free services and/or satellite equipment kits to affected communities.

Starlink is providing Mini Kits, which support 50 gigabyte and unlimited roaming data subscriptions, for search and rescue efforts in central Texas, in addition to one month of free service to customers in the areas impacted by recent flooding. In January, the satellite operator offered about a month of free service to new customers and a one-month service credit to existing customers in areas affected by the Los Angeles wildfires.

Starlink could be facing increasing competition from Project Kuiper, Amazon’s LEO satellite broadband service, as it ramps up deployment of a planned LEO constellation of over 3,000 satellites. However, Project Kuiper has fallen far behind schedule in meeting the FCC’s deadline of having more than 1,600 LEO satellites in orbit by the summer of 2026. Since its initial launch in April, Amazon only has a total of 78 satellites in orbit, according to CNBC. Meanwhile, Starlink has launched over 2,300 satellites in the past year alone.

References:

https://www.ookla.com/articles/hughesnet-viasat-performance-2025

https://www.space.com/space-exploration/launches-spacecraft/spacex-starlink-15-2-b1093-vsfs-ocisly

KDDI unveils AU Starlink direct-to-cell satellite service

Telstra selects SpaceX’s Starlink to bring Satellite-to-Mobile text messaging to its customers in Australia

One NZ launches commercial Satellite TXT service using Starlink LEO satellites

SpaceX launches first set of Starlink satellites with direct-to-cell capabilities

FCC: More competition for Starlink; freeing up spectrum for satellite broadband service

U.S. BEAD overhaul to benefit Starlink/SpaceX at the expense of fiber broadband providers

Starlink’s Direct to Cell service for existing LTE phones “wherever you can see the sky”

ABI Research and CCS Insight: Strong growth for satellite to mobile device connectivity (messaging and broadband internet access)

AST SpaceMobile completes 1st ever LEO satellite voice call using AT&T spectrum and unmodified Samsung and Apple smartphones

PCMag Study: Starlink speed and latency top satellite Internet from Hughes and Viasat’s Exede