Kenneth Research

Dell’Oro Group, Kenneth Research and Heavy Reading’s optimistic forecasts for Open RAN

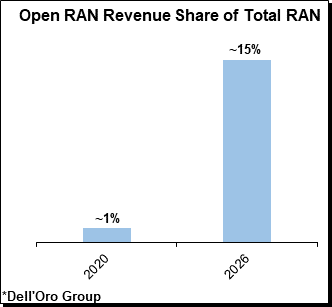

Dell’Oro Group recently published the January 2022 edition of its Open RAN report. Preliminary findings suggest that total Open RAN revenues, including O-RAN and OpenRAN radio and baseband, surprised on the upside both in 2020 and during 2021, bolstering the thesis that Open RAN is here to stay and the architecture will play an important role before 6G (this author disagrees).

- The Asia Pacific region is dominating the Open RAN market in this initial phase and is expected to play a leading role throughout the forecast period, accounting for more than 40 percent of total 2021-2026 revenues.

- Risks around the Open RAN projections remain broadly balanced, though it is worth noting that risks to the downside have increased slightly since the last forecast update.

- The shift towards Virtualized RAN (vRAN) is progressing at a slightly slower pace than Open RAN. Still, total vRAN projections remain mostly unchanged, with vRAN on track to account for 5 percent to 10 percent of the RAN market by 2026.

-Market.jpg)

The global open radio access network (O-RAN) market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Amongst the market in these regions, the market in the Asia Pacific generated the largest revenue of $70 Million in the year 2020 and is further expected to hit $8200 Million by the end of 2028. The market in the region is further segmented by country into Japan, South Korea, India, and the Rest of Asia Pacific. Amongst the market in these countries, the market in India is expected to grow with the highest CAGR of 102% during the forecast period, while the market in Japan is projected to garner the second-largest revenue of $1900 Million by the end of 2028. Additionally, in the year 2020, the market in Japan registered a revenue of $60 Million.

The market in North America generated a revenue of $50 Million in the year 2020 and is further expected to touch $7000 Million by the end of 2028. The market in the region is further segmented by country into the United States and Canada. Out of these, the market in the United States is expected to display the highest market share by the end of 2028, whereas the market in Canada is projected to grow with the highest CAGR of 137% during the forecast period.

Key companies covered in the Open Radio Access Network (O-RAN) Market Research Report are: Metaswitch Networks, Mavenir, NTT DOCOMO, INC., Sterlite Technologies Limited, Huawei Technologies Co., Ltd., Radisys Corporation, Casa Systems, VIAVI Solutions Inc., Parallel Wireless, Inc., NXP Semiconductors, and other key market players.

Reference:

https://www.kennethresearch.com/report-details/open-radio-access-network-o-ran-market/10352259

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………

The latest Heavy Reading Open RAN Operator Survey indicates a positive outlook with real signs of momentum over the past year. Network operators and the wider RAN ecosystem are making steady progress, according to the survey results.

The first question in the survey was designed to help understand how operator sentiment toward open RAN has changed over the past year, in light of better knowledge of the technology, experience from trials, the increased maturity of solutions and changes in the policy environment. The figure below shows just over half (54%) of survey respondents say their company has not changed the pace of its planned open RAN rollout in the past year. There has been movement in the other half, split between those accelerating their plans (20%) and those slowing down (27%). This volatility essentially cancels out, and the overall finding is therefore that operators as a group are working at a steady, measured pace toward open RAN.

A steady outlook is a positive outlook at this stage of the market because it recognizes that open RAN is a major change in RAN architecture and is a long-term, multiyear exercise. After several years of inflated expectations, it is encouraging to see a measured perspective on open RAN coming to the fore.

n=82 Source: Heavy Reading

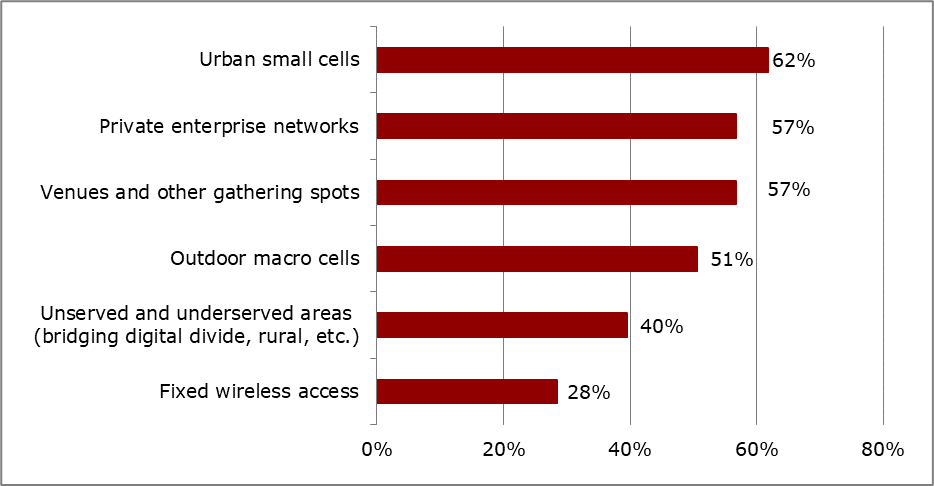

Another area of interest that helps gauge sentiment toward open RAN development relates to operators’ preferred use cases. The figure below reveals that operator intentions for how they will use open RAN are varied. Asked to select their top three use cases, 81 respondents representing 39 operators placed a total of 294 votes for an average of 3.6 per respondent, showing that there is no single open RAN use case or deployment scenario that stands out. Urban small cells (62%), private enterprise networks (57%) and venues and other gathering spots (also 57%) lead the responses.

n=81 Source: Heavy Reading

A positive way to interpret this finding is that open RAN is being pursued across a broad base of mobile communication scenarios. Once these models solidify and become “product ready,” then the market might see widespread adoption. Over time, open RAN could become the predominant mode of operation.

A less positive analysis, but one nevertheless worth considering, is that open RAN is a technology still in search of a solution. That is, the industry has committed to open RAN, and now it needs to find ways to make it work. Pursuing a diversity of use cases will help identify which are most promising and warrant investment and deployment at a wider scale.

It is notable that operator preferences for open RAN use cases have not changed much since Heavy Reading’s first survey in 2018; the same three use cases also led at that time. This reinforces the key message that open RAN progress is steady and consistent.

To download a copy of the 2021 Heavy Reading Open RAN Operator Survey, click here.

— Gabriel Brown, Principal Analyst, Heavy Reading

Reference:

https://www.lightreading.com/open-ran-steady-as-she-goes-/a/d-id/774765?