SNS Telecom & IT

SNS Telecom & IT: Private LTE & 5G Network Ecosystem – CAGR 22% from 2025-2030

SNS Telecom & IT’s latest research report, “Private LTE & 5G Network Ecosystem: 2025 – 2030” indicates that the private LTE and 5G network market is estimated to be worth $7.2 billion by the end of 2028 and continues to grow as private 5G deployments overtake LTE across many vertical industries. This steady, strong growth stands in contrast to the tepid pace of infrastructure spending in the much larger but relatively stagnant public mobile network market, where standalone 5G core investments are growing but RAN (Radio Access Network) sales remain flat following a sharp decline last year.

Against this backdrop, the real-world impact of private networks – spanning both facility/campus-based and wide area deployments – is clearly visible across a diverse range of customers, from manufacturers, port operators, and airlines to sports clubs and public sector organizations.

Among many other impactful examples, Tesla, LG Electronics, and Hyundai have eliminated connection-related AGV (Automated Guided Vehicle) stoppages at their production facilities; Peel Ports Group has experienced a tenfold increase in network performance at the Port of Liverpool’s metal-heavy environment, which previously hindered Wi-Fi connectivity; Lufthansa has achieved a 75% improvement in operational process speed at its LAX cargo facility; partially sighted fans are able to experience football matches in exceptional detail using private 5G-connected headsets at Crystal Palace Football Club’s Selhurst Park stadium; and police forces in Ontario’s Peel-Halton Region have had uninterrupted in-vehicle data access – especially during outages affecting public mobile operator services – since adopting their independent public safety broadband network, which has recently undergone a 5G core upgrade.

While these practical and tangible benefits are already compelling, another sign of the market’s positive momentum is how customers are increasingly incorporating private 5G networks as a key component of their new facilities. A recent case in point is GDC’s (Georgia Department of Corrections) new state prison project, which also involves the implementation of a secure and physically isolated private 5G network using Band n48 (3.5 GHz) CBRS spectrum to provide indoor and outdoor coverage at a greenfield prison campus with 13 buildings covering 800,000 square feet across 200 acres. Examples of other facilities where private 5G networks have been or are being deployed from the outset include Hitachi Rail’s Hagerstown factory, Hyundai Motor’s HMGMA electrified vehicle plant, Los Angeles Chargers’ El Segundo training facility, Formula 1’s Las Vegas complex, Cleveland Clinic’s Mentor Hospital, CHI’s (Children’s Health Ireland) New Children’s Hospital, Port of Aberdeen’s South Harbour, NEC’s Kakegawa plant; Pegatron’s Batam smart factory, PATTA’s low-carbon Renwu factory, and Jacto’s Paulópolis production facility.

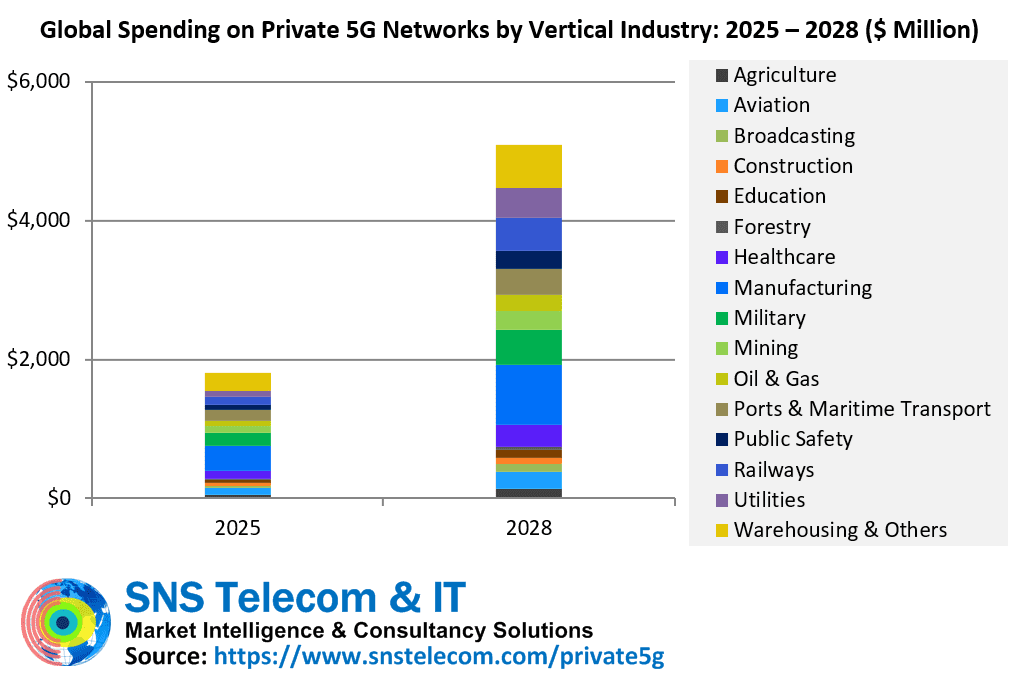

SNS Telecom & IT’s “Private LTE & 5G Network Ecosystem: 2025 – 2030” report projects that global spending on private LTE and 5G network infrastructure for vertical industries will grow at a CAGR of approximately 22% between 2025 and 2028, eventually exceeding $7.2 billion by the end of 2028. More than 70% of these investments – an estimated $5.1 billion – will be directed towards the buildout of standalone private 5G networks, which are well-positioned to become the predominant wireless connectivity medium for Industry 4.0 applications in manufacturing and process industries, as well as critical communications over mission-critical broadband networks for sectors such as public safety, defense, utilities, and transportation. This unprecedented level of growth is likely to transform the private RAN, mobile core, and transport network segments into an almost parallel equipment ecosystem to public mobile operator infrastructure in terms of market size by the late 2020s. By 2030, private networks could account for as much as a fourth of all mobile network infrastructure spending.

About SNS Telecom & IT:

SNS Telecom & IT is a global market intelligence and consulting firm with a primary focus on the telecommunications and information technology industries. Developed by in-house subject matter experts, our market intelligence and research reports provide unique insights on both established and emerging technologies. Our areas of coverage include but are not limited to 6G, 5G, LTE, Open RAN, vRAN, small cells, mobile core, xHaul transport, network automation, mobile operator services, FWA, neutral host networks, private 4G/5G cellular networks, public safety broadband, critical communications, MCX, IIoT, V2X communications, and vertical applications.

………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.snstelecom.com/private-lte

Private 5G networks move to include automation, autonomous systems, edge computing & AI operations

SNS Telecom & IT: Private 5G Market Nears Mainstream With $5 Billion Surge

SNS Telecom & IT: Private 5G and 4G LTE cellular networks for the global defense sector are a $1.5B opportunity

SNS Telecom & IT: $6 Billion Private LTE/5G Market Shines Through Wireless Industry’s Gloom

SNS Telecom & IT: Private 5G Network market annual spending will be $3.5 Billion by 2027

SNS Telecom & IT: Q1-2024 Public safety LTE/5G report: review of engagements across 86 countries, case studies, spectrum allocation and more

SNS Telecom & IT: Shared Spectrum 5G NR & LTE Small Cell RAN Investments to Reach $3 Billion

SNS Telecom & IT: CBRS Network Infrastructure a $1.5 Billion Market Opportunity

SNS Telecom & IT: Private LTE & 5G Network Infrastructure at $6.4 Billion by end of 2026

SNS Telecom & IT: Open RAN Intelligent Controller, xApps & rApps to reach $600 Million by 2025

SNS Telecom & IT: Shared Spectrum to Boost 5G NR & LTE Small Cell RAN Market

SNS Telecom & IT: Private 5G Market Nears Mainstream With $5 Billion Surge

SNS Telecom & IT’s latest research report indicates that private 5G networks are on the verge of mainstream adoption, with annual spending projected to reach $5 billion by 2028. Their real-world impact is becoming increasingly visible through accelerated investments by industrial giants and other end user organizations to support diverse applications such as autonomous transport systems, mobile robots, remote-controlled machinery, and high-definition video transmission, while reducing reliance on unlicensed wireless and hard-wired connections.

Private LTE networks are a well-established market and have been around for more than a decade, albeit as a niche segment of the wider cellular infrastructure sector. Here are a few examples: iNET’s (Infrastructure Networks) 700 MHz LTE network in the Permian Basin, Tampnet’s offshore 4G infrastructure in the North Sea, Rio Tinto’s private LTE network for its Western Australia mining operations, and other initial installations date back to the early 2010s.

However, private cellular networks or NPNs (Non-Public Networks) based on 3GPP-defined 5G specifications (there are no ITU-R standards/recommendations for private cellular networks or “IMT”) are just on the cusp of becoming a mainstream technology, with a market potential exceeding that of private LTE. Over the last 12 months, there has been a noticeable increase in production-grade deployments of private 5G networks by household names and industrial giants such as Airbus, Aker BP, Boliden, CIL (Coal India Limited), Equinor, Etihad, Ford, Hutchison Ports, Hyundai, Jaguar Land Rover, John Deere, LG Electronics, Lufthansa, Newmont, POSCO, Tesla, Toyota, and Walmart, paving the way for Industry 4.0 and advanced application scenarios.

Compared to LTE technology, private 5G networks – also referred to as 5G MPNs (Mobile Private Networks), 5G campus networks, P5G, local 5G, or e-Um 5G systems depending on geography – can address far more demanding performance requirements in terms of throughput, latency, reliability, availability, and connection density. In particular, 5G’s URLLC (Ultra-Reliable, Low-Latency Communications) and mMTC (Massive Machine-Type Communications) capabilities, along with a future-proof transition path to 6G networks in the 2030s, have positioned it as a viable alternative to physically wired connections for industrial-grade communications between machines, robots, and control systems.

Furthermore, despite its relatively higher cost of ownership, 5G’s wider coverage radius per radio node, scalability, determinism, security features, and mobility support have stirred strong interest in its potential as a replacement for interference-prone unlicensed wireless technologies in IIoT (Industrial IoT) environments, where the number of connected sensors and other endpoints is expected to increase significantly over the coming years.

China remains the most mature national market thanks to state-funded directives aimed at accelerating the adoption of 5G connectivity in industrial settings such as factories, warehouses, mines, power plants, substations, oil and gas facilities, and ports. To provide context, the largest private 5G installations in China can comprise hundreds to even thousands of dedicated RAN (Radio Access Network) nodes supported by on-premise or edge cloud-based core network functions depending on specific latency, reliability, and security requirements. Several Chinese private 5G adopters – including State Grid, Midea, and Wanhua Chemical – are also among the front-runners in utilizing cost-efficient 5G RedCap (Reduced Capability) modules, primarily to support video surveillance and IoT sensor use cases. In addition, some of the most technically advanced features of 5G-Advanced – 5G’s next evolutionary phase – have been implemented over private wireless installations in the country. For example, steel manufacturer Baosteel is leveraging DetNet (Deterministic Networking) enhancements for real-time coordination of multiple automated processes within its factories; China Huaneng Group relies on a tri-band (700 MHz, 2.6 GHz & 4.9 GHz) 5G-Advanced network to connect a fleet of 100 autonomous electric mining trucks at its Yimin open pit coal mine in Inner Mongolia; and automaker Great Wall Motor is using an indoor 5G-Advanced network for time-critical industrial control within a car roof production line to prevent wire abrasion in mobile application scenarios – an issue that had previously resulted in production interruptions averaging 60 hours of downtime per year. Recently, Chinese mobile operators and vendors have expanded beyond their domestic market in pursuit of private 5G business opportunities abroad, from Thailand’s manufacturing sector to mining in South Africa.

As end user organizations in the United States, Canada, Germany, United Kingdom, France, Japan, South Korea, Taiwan, Australia, Brazil, and other countries ramp up their digitization and automation initiatives, private 5G networks are progressively being implemented to support use cases as diverse as wirelessly connected machinery for the rapid reconfiguration of production lines, distributed PLC (Programmable Logic Controller) environments, AMRs (Autonomous Mobile Robots) and AGVs (Automated Guided Vehicles) for intralogistics, connected workers with mobile and paperless workflows, AR (Augmented Reality)-assisted guidance and troubleshooting, machine vision-based quality control, wireless software flashing of manufactured vehicles, remote-controlled cranes, unmanned mining equipment, digital twin models of complex industrial systems, virtual visits for parents to see their infants in NICUs (Neonatal Intensive Care Units), live broadcast production in locations not easily accessible by traditional solutions, operations-critical communications during major sporting events, precision agriculture and livestock farming, BVLOS (Beyond Visual Line-of-Sight) operation of drones, ATO (Automatic Train Operation), video analytics for railway crossing and station platform safety, remote visual inspections of aircraft engine parts, real-time collaboration for flight line maintenance, XR (Extended Reality)-based training, autonomous and remote operations at military bases, and missile field communications.

With non-smartphone device availability, end user conservatism, and other teething problems continuing to wane, early adopters are affirming their faith in the long-term potential of private 5G by investing in networks built in collaboration with specialist integrators, through traditional mobile operators, or independently via direct procurement from 5G equipment suppliers – made possible by the availability of new shared and local area licensed spectrum options in many national markets. As SNS Telecom & IT highlighted last year, some private 5G installations have progressed to a stage where practical and tangible benefits – particularly efficiency gains, cost savings, and worker safety – are becoming increasingly evident. Notable examples, featuring new additions this year, include but are not limited to:

- Tesla’s deployment of a private 5G network at its Gigafactory Texas facility in Austin has eliminated AGV (Automated Guided Vehicle) stoppages, previously caused by unstable Wi-Fi connections, within the 12 million square foot facility. Another private 5G implementation on the shop floor of its Gigafactory Berlin-Brandenburg plant in Germany has helped in overcoming up to 90% of the overcycle issues for a particular process in the factory’s GA (General Assembly) shop. The electric automaker is integrating private 5G network infrastructure to address high-impact use cases in production, intralogistics, and quality operations across its global manufacturing facilities.

- Rival luxury automaker Jaguar Land Rover’s installation of a private 5G network at its Solihull plant in England, United Kingdom, has established connectivity for sensors and data within the plant’s five-story paint shop, which had previously been left unconnected due to the cost and complexity of wired Ethernet links. The network has also resolved Wi-Fi-related challenges, including limited device connections, poor signal penetration in the metal-heavy environment, and unstable handovers between access points along the production line.

- Lufthansa’s private 5G network at its LAX (Los Angeles International Airport) cargo facility has resulted in a 60% reduction in processing time per item by eliminating latency spikes and dropped connections from Wi-Fi and public cellular networks, which had previously delayed logistics operations and forced an occasional return to manual pen-and-paper processes. Another 5G campus network at the Lufthansa Technik facility in Hamburg, Germany, has removed the need for civil aviation customers to physically attend servicing by providing reliable, high-resolution video access for virtual parts inspections, and borescope examinations at both of its engine overhaul workshops. Previous attempts to implement virtual inspections using unlicensed Wi-Fi technology proved ineffective due to the presence of large metal structures.

- At VINCI Airports’ Lyon-Saint Exupéry Airport in the southeast of France, Stanley Robotics is using a standalone private 5G network to provide reliable and low-latency connectivity for autonomous valet parking robots, which have increased parking efficiency by 50%. Efforts are also underway to leverage 5G’s precise positioning capabilities to further enhance the localization accuracy of the robots’ control system.

- Since adopting a private 5G network for public safety and smart city applications, the southern French city of Istres has reduced video surveillance camera installation costs from $34,000 to less than $6,000 per unit by eliminating the need for ducts, civil works, and other infrastructure-related overhead costs typically associated with fiber-based connections in urban environments.

- HavelPort Berlin has increased its annual weighing capacity by up to 60% through automated weighing processes managed via tablets in lorry cabs using an Open RAN-compliant private 5G network. The network also supports drone-based inventory control for bulk goods monitoring and autonomous transportation within the inland port in Wustermark (Brandenburg), Germany.

- John Deere is steadily progressing with its goal of reducing dependency on wired Ethernet connections from 70% to 10% over the next five years by deploying private 5G networks at its industrial facilities in the United States, South America, and Europe. Two of the most recent deployments are at the heavy machinery giant’s 2.2 million square foot Davenport Works manufacturing complex in Iowa and its Horizontina factory in Rio Grande do Sul, Brazil, which is in the midst of continued expansion. In a similar effort, automotive aluminum die-castings supplier IKD has replaced 6 miles of cables connecting 600 pieces of machinery with a private 5G network, thereby reducing cable maintenance costs to near zero and increasing the product yield rate by 10%.

- Newmont’s implementation of one of Australia’s first production-grade private 5G networks at its Cadia gold-copper underground mine in New South Wales has enabled remote-controlled operation of its entire dozer fleet across the full 2.5 kilometer width of the mine’s tailings works construction area. Previously, the mining company was unable to connect more than two machines at distances of no more than 100 meters over Wi-Fi, with unstable connectivity causing up to six hours of downtime per shift. Newmont plans to leverage private 5G connectivity to roll out more teleremote and autonomous machines in its tier-one underground and surface mines worldwide.

- The U.S. Marine Corps’ private 5G network at MCLB (Marine Corps Logistics Base) in Southwest Georgia has significantly improved warehouse management and logistics operations, including 98% accuracy in inventory reordering, a 65% increase in goods velocity, and a 55% reduction in labor costs. Currently under a $6 million sustainment contract for the next three years, the purpose-built 5G network was deployed to enhance automation and overcome the challenges posed by complex fiber optic installations and unreliable Wi-Fi systems in the logistics hub’s demanding physical environment.

- The Liverpool 5G Create network in the inner city area of Kensington has demonstrated substantial cost savings potential for digital health, education and social care services, including an astonishing $10,000 drop in yearly expenditure per care home resident through a 5G-connected fall prevention system and a $2,600 reduction in WAN (Wide Area Network) connectivity charges per GP (General Practitioner) surgery – which represents $220,000 in annual savings for the United Kingdom’s NHS (National Health Service) when applied to 86 surgeries in Liverpool.

- The EWG (East-West Gate) Intermodal Terminal’s private 5G network has increased productivity from 23-25 containers per hour to 32-35 per hour and reduced the facility’s personnel-related operating expenses by 40% while eliminating the possibility of crane operator injury due to remote-controlled operation with a latency of less than 20 milliseconds.

- NEC Corporation has improved production efficiency by 30% through the introduction of a local 5G-enabled autonomous transport system for intralogistics at its new factory in Kakegawa (Shizuoka Prefecture), Japan. The manufacturing facility’s on-premise 5G network has also resulted in an elevated degree of freedom in terms of the factory floor layout, thereby allowing NEC to flexibly respond to changing customer needs, market demand fluctuations, and production adjustments.

- A local 5G installation at Ushino Nakayama’s Osumi farm in Kanoya (Kagoshima Prefecture), Japan, has enabled the Wagyu beef producer to achieve labor cost savings of more than 10% through reductions in accident rates, feed loss, and administrative costs. The 5G network provides wireless connectivity for AI (Artificial Intelligence)-based image analytics and autonomous patrol robots.

- CJ Logistics has achieved a 20% productivity increase at its Ichiri center in Icheon (Gyeonggi), South Korea, following the adoption of a private 5G network to replace the 40,000 square meter warehouse facility’s 300 Wi-Fi access points for Industry 4.0 applications, which experienced repeated outages and coverage issues.

- Delta Electronics – which has installed private 5G networks for industrial wireless communications at its plants in Taiwan and Thailand – estimates that productivity per direct labor and output per square meter have increased by 69% and 75% respectively following the implementation of 5G-connected smart production lines.

- Yawata Electrode has improved the efficiency of its goods transportation processes – involving the movement of raw materials, semi-completed goods, and finished products between production floors – by approximately 24% since adopting a private 5G network for autonomous mobile robots at its electrode manufacturing plant in Nakhon Ratchasima, Thailand.

- An Open RAN-compliant standalone private 5G network in Taiwan’s Pingtung County has facilitated a 30% reduction in pest-related agricultural losses and a 15% boost in the overall revenue of local farms through the use of 5G-equipped UAVs (Unmanned Aerial Vehicles), mobile robots, smart glasses and AI-enabled image recognition.

- JD Logistics – the supply chain and logistics arm of online retailer JD.com – has achieved near-zero packet loss and reduced the likelihood of connection timeouts by an impressive 70% since migrating AGV communications from unlicensed Wi-Fi systems to private 5G networks at its logistics parks in Beijing and Changsha (Hunan), China.

- Risun Group has deployed a private 5G network at its Risun Zhongran Park facility in Hohhot (Inner Mongolia), China, to provide industrial-grade wireless connectivity for both wheeled and rail-mounted transport machinery, typically measuring tens of meters in height and length. Since transitioning from Wi-Fi to private 5G, the coke producer has increased production efficiency by nearly 20% and reduced labor costs by approximately 30%.

- Baosteel – a business unit of the world’s largest steelmaker China Baowu Steel Group – credits its 43-site private 5G deployment at two neighboring factories with reducing manual quality inspections by 50% and achieving a steel defect detection rate of more than 90%, which equates to $7 million in annual cost savings by reducing lost production capacity from 9,000 tons to 700 tons.

- Dongyi Group Coal Gasification Company ascribes a 50% reduction in manpower requirements and a 10% increase in production efficiency – which translates to more than $1 million in annual cost savings – at its Xinyan coal mine in Lvliang (Shanxi), China, to private 5G-enabled digitization and automation of underground mining operations.

- Sinopec’s (China Petroleum & Chemical Corporation) explosion-proof 5G network at its Guangzhou oil refinery in Guangdong, China, has reduced accidents and harmful gas emissions by 20% and 30% respectively, resulting in an annual economic benefit of more than $4 million. The solution is being replicated across more than 30 refineries of the energy giant.

- Since adopting a hybrid public-private 5G network to enhance the safety and efficiency of urban rail transit operations, the Guangzhou Metro rapid transit system has reduced its maintenance costs by approximately 20% using 5G-enabled digital perception applications for the real-time identification of water logging and other hazards along railway tracks.

Although the vast majority of the networks referenced above have been built using 5G equipment supplied by traditional wireless infrastructure players – from incumbents Ericsson, Nokia, Huawei, and ZTE to the likes of Samsung and NEC – alternative suppliers are continuing to gain traction in the private 5G market. Noteworthy examples include:

- Celona – whose 5G LAN solution has been deployed by over 100 customers;

- Globalstar – which has developed a 3GPP Release 16-compliant multipoint terrestrial RAN system optimized for dense private wireless deployments in Industry 4.0 automation environments;

- Airspan Networks – a well-known Open RAN and small cell technology provider;

- Mavenir – an end-to-end provider of Open RAN and converged packet core solutions;

- JMA Wireless – an American RAN equipment vendor;

- GXC – a private cellular technology provider recently acquired by Motive Companies;

- Baicells – a 4G and 5G NR access equipment manufacturer;

- Siemens – which has developed an in-house private 5G network solution for use at its own plants as well as those of industrial customers;

- HFR Mobile – the private 5G business unit of Korean telecommunications equipment maker HFR;

- Ataya – a private 5G startup focused on unifying and simplifying enterprise connectivity;

- Moso Networks – a U.S.-based provider of private 5G radio products backed by Taiwanese small cell pioneer Sercomm;

- Abside Networks – an American manufacturer of military-grade 5G infrastructure;

- Radisys – a RAN software vendor for many private network deployments;

- Druid Software – whose mobile core platform has been deployed for private networks worldwide;

- HPE (Hewlett Packard Enterprise) – which is transitioning from a mobile core specialist to end-to-end private 5G network provider;

- Cisco Systems – a mobile core and transport network technology provider for both public and private 5G networks;

- Pente Networks – a mobile core and orchestration solution provider;

- Highway 9 Networks – which has developed a cloud-based platform to simplify private 5G deployments;

- Neutroon Technologies – another private 5G orchestration specialist;

- Qucell – a Korean manufacturer specializing in 5G small cell equipment;

- Askey Computer – a Taiwanese telecommunications equipment manufacturer;

- QCT (Quanta Cloud Technology) – a Taiwanese data center and 5G solutions provider;

- G REIGNS – a business unit of HTC specializing in portable private 5G network solutions;

- Pegatron – a Taiwanese manufacturer that has recently entered the Open RAN-compliant 5G infrastructure market;

- AsiaInfo Technologies – a Chinese provider of lightweight mobile core software and end-to-end private 5G solutions;

- Firecell – a French startup specializing in industrial-grade private 5G solutions;

- CampusGenius – which has developed a customizable 5G core solution for small and medium-sized enterprises;

- Blackned – a German developer of tactical core middleware for defense communications;

- Cumucore – a provider of mobile core software for private networks;

- Accelleran – a Belgian provider of Open RAN software solutions;

- IS-Wireless – a Polish Open RAN software vendor;

- Benetel – an Irish Open RAN radio developer; and Wireless Excellence – a British 5G equipment vendor.

SNS Telecom & IT forecasts that annual investments in private 5G networks for vertical industries will grow at a CAGR of approximately 41% between 2025 and 2028, eventually surpassing $5 billion by the end of 2028. Much of this growth will initially be driven by highly localized 5G networks covering geographically limited areas for Industry 4.0 applications in manufacturing and process industries. Industrial giants experiencing patchy Wi-Fi coverage, cabling-related inflexibility, and network scalability limitations at their facilities are championing the private 5G movement for local area networking. Additionally, sub-1 GHz wide area critical communications networks for public safety, utility, and railway communications are anticipated to accelerate their transition from LTE, GSM-R, and other legacy narrowband technologies to 5G towards the latter half of the forecast period, as 5G-Advanced technology reaches commercial maturity. Among other features for mission-critical networks, 3GPP Release 18 – which defines the first set of 5G-Advanced specifications – adds support for 5G NR equipment operating in dedicated spectrum with less than 5 MHz of bandwidth, paving the way for private 5G networks operating in sub-500 MHz, 700 MHz, 850 MHz, and 900 MHz bands for public safety broadband, smart grid modernization, and FRMCS (Future Railway Mobile Communication System).

The “Private 5G Market: 2025 – 2030 – Opportunities, Challenges, Strategies & Forecasts” report presents an in-depth assessment of the private 5G network market, including the value chain, market drivers, barriers to uptake, enabling technologies, operational and business models, vertical industries, application scenarios, key trends, future roadmap, standardization, spectrum availability and allocation, regulatory landscape, case studies, ecosystem player profiles, and strategies. The report also presents global and regional market size forecasts from 2025 to 2030. The forecasts cover three infrastructure submarkets, 16 vertical industries, and five regional markets.

The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report, as well as a database of over 8,300 global private cellular engagements – including more than 3,700 private 5G installations – as of Q3’2025.

Key Findings

The report has the following key findings:

- SNS Telecom & IT projects that annual investments in private 5G networks for vertical industries will grow at a CAGR of approximately 41% between 2025 and 2028, eventually surpassing $5 billion by the end of 2028. Much of this growth will initially be driven by highly localized 5G networks covering geographically limited areas for Industry 4.0 applications in manufacturing and process industries.

- Industrial giants experiencing patchy Wi-Fi coverage, cabling-related inflexibility, and network scalability limitations at their facilities are championing the private 5G movement for local area networking. Additionally, sub-1 GHz wide area critical communications networks for public safety, utility, and railway communications are anticipated to accelerate their transition from LTE, GSM-R, and other legacy narrowband technologies to 5G towards the latter half of the forecast period, as 5G-Advanced – 5G’s next evolutionary phase – reaches commercial maturity.

- Enterprises and industrial customers – depending on their specific connectivity needs – are adopting private 5G networks both as a complement to and as a replacement for Wi-Fi solutions. Kyushu Electric Power, for instance, leverages a local 5G network to provide outdoor coverage and backhaul for an indoor Wi-Fi 6 network at its Matsuura thermal power plant. Similarly, KHNP (Korea Hydro & Nuclear Power), Hyundai Motor, and John Deere are pursuing a multi-technology wireless access strategy that integrates private 5G with Wi-Fi. Others – including Airbus, LG Electronics, Tesla, Toyota, Newmont, Prinzhorn Group, Chevron, BD SENSORS, CJ Logistics, Del Conca, and Wonderful Citrus – have deployed private cellular networks with a relatively small number of radio nodes to replace dozens of Wi-Fi access points, which had previously failed to deliver reliable coverage in large facilities.

- As end user organizations ramp up their digitization and automation initiatives, some private 5G installations have progressed to a stage where practical and tangible benefits are becoming increasingly evident. Notably, private 5G networks have resulted in productivity and efficiency gains for specific manufacturing, quality control, and intralogistics processes in the range of 20 to 90%, labor cost savings of 55% at a warehousing facility, up to 40% lower operating expenditures at an intermodal rail terminal, reductions in worker accidents and harmful gas emissions by 20% and 30% respectively at an oil refinery, and a 50% decrease in manpower requirements for underground mining operations.

- In addition to deployments at existing sites, organizations are increasingly incorporating on-premise 5G connectivity into the building plans of new greenfield projects. For example, Future Technologies Venture and iBwave Solutions used CAD (Computer-Aided Design) files to design the Band n48 (3.5 GHz CBRS) private 5G network for automaker Hyundai Motor’s HMGMA (Hyundai Motor Group Metaplant America) electrified vehicle plant near Savannah, Georgia. Other examples of new facilities with private 5G networks integrated from the outset include but are not limited to the Los Angeles Chargers’ El Segundo training facility; Formula 1’s Las Vegas complex; Cleveland Clinic’s Mentor Hospital; CHI’s (Children’s Health Ireland) New Children’s Hospital; Port of Aberdeen’s South Harbour; NEC’s Kakegawa plant; Pegatron’s Batam smart factory; PATTA’s low-carbon Renwu factory; and Jacto’s Paulópolis production facility.

- Spectrum liberalization initiatives – particularly shared and local spectrum licensing frameworks for mid-band 5G NR frequencies such as n40 (2.3 GHz), n38 (2.6 GHz), n48 (3.5 GHz), n78 (3.3-3.8 GHz), n77 (3.8-4.2 GHz), and n79 (4.6-4.9 GHz) – are playing a pivotal role in accelerating the adoption of private 5G networks. Telecommunications regulators in multiple national markets – including the United States, Canada, Germany, United Kingdom, Ireland, France, Spain, Netherlands, Belgium, Switzerland, Finland, Sweden, Norway, Poland, Slovenia, Lithuania, Moldova, Bahrain, Japan, South Korea, Taiwan, Hong Kong, Australia, and Brazil – have released or are in the process of granting access to shared and local area licensed spectrum.

- By capitalizing on their extensive licensed spectrum holdings, infrastructure assets, and cellular networking expertise, national mobile operators have continued to retain a significant presence in the private 5G network market, even in countries where shared and local area licensed spectrum is available. With an expanded focus on vertical B2B (Business-to-Business) opportunities in the 5G era, mobile operators are actively involved in diverse projects extending from localized 5G networks for secure and reliable wireless connectivity in industrial and enterprise environments to sliced hybrid public-private networks that integrate on-premise 5G infrastructure with a dedicated slice of public mobile network resources for wide area coverage.

- With channel sales accounting for over two-thirds of all private 5G contracts, global system integrators and new classes of private network service providers have also found success in the market. Notable examples include but are not limited to NTT, Fujitsu, Accenture, Capgemini, Kyndryl, Booz Allen Hamilton, Lockheed Martin, Oceus Networks, Future Technologies Venture, STEP CG, Kajeet, TLC Solutions, 4K Solutions, Lociva, Tampnet, iNET (Infrastructure Networks), Ambra Solutions, PMY Group, Vocus, Aqura, Federated Wireless, Betacom, InfiniG, Ballast Networks, Hawk Networks (Althea), Airtower Networks, Fortress Solutions, HALO Networks, Ramen Networks, Meter Cellular, Sigma Wireless, IONX Networks (formerly Dense Air), MUGLER, Opticoms, COCUS, TRIOPT, Xantaro, Alsatis, Axians, Axione, Hub One, SPIE Group, TDF, Weaccess Group, ORAXIO Telecom Solutions, Unitel Group, Numerisat, Telent, Logicalis, Telet Research, Citymesh, RADTONICS, Grape One, NS Solutions, OPTAGE, Wave-In Communication, LG CNS, SEJONG Telecom, CJ OliveNetworks, Megazone Cloud, Nable Communications, Qubicom, NewGens, and Comsol. Also active in this space are the private 5G business units of Boldyn Networks, American Tower, Boingo Wireless, Freshwave, Shared Access, Digita, and other neutral host infrastructure providers; cable operators’ enterprise divisions such as Comcast Business and Cox Private Networks; and global IoT connectivity providers Onomondo, Monogoto, and floLIVE.

- Although the vast majority of existing private 5G networks have been built using equipment supplied by traditional wireless infrastructure players – from incumbents Ericsson, Nokia, Huawei, and ZTE to the likes of Samsung and NEC – alternative suppliers are continuing to gain traction in the market. There is much greater OEM (Original Equipment Manufacturer) and vendor diversity than in the public mobile network segment with other players making their presence known in markets as far afield as the United States, Canada, Germany, France, United Kingdom, Saudi Arabia, Brazil, Japan, South Korea, Taiwan, China, and Australia.

- Examples include Celona, Globalstar, Airspan Networks, Mavenir, GXC, Baicells, Telrad Networks, BLiNQ Networks, JMA Wireless, Ataya, Moso Networks (Sercomm), Abside Networks, SEMPRE, Eridan Communications, Ubiik, Star Solutions, Expeto, Druid Software, HPE (Hewlett Packard Enterprise), Cisco Systems, Pente Networks, A5G Networks, Radisys, Wilson Connectivity, Nextivity, SOLiD, HFR Mobile, Qucell, Askey Computer, QCT (Quanta Cloud Technology), G REIGNS, Pegatron, AsiaInfo Technologies, AI-LINK, FLARE SYSTEMS, Hytec Inter, Siemens, Firecell, Obvios, Eviden, Kontron, BubbleRAN, Amarisoft, CampusGenius, Blackned, Cumucore, Accelleran, IS-Wireless, Effnet, Node-H, SRS (Software Radio Systems), Benetel, AttoCore, cellXica, JET Connectivity, Neutral Wireless, Wireless Excellence, Antevia Networks, ASOCS, ASELSAN, PROTEI, and Trópico.

- There is a growing focus on private 5G security solutions enabling device management, network visibility, traffic segregation, access control, and threat prevention across both IT (Information Technology) and OT (Operational Technology) domains. Some of the key players in this segment include OneLayer, Palo Alto Networks, Fortinet, Trend Micro’s subsidiary CTOne, and Thales. Network orchestration and management is another area garnering considerable interest, with solutions from companies like Highway 9 Networks, Neutroon Technologies, Nearby Computing, NEC’s Netcracker division, and Weaver Labs.

- As the market moves toward mainstream adoption, funding is ramping up for private 5G infrastructure and connectivity specialists. For example, Celona has raised over $135 million in venture funding to date, and Druid Software recently secured $20 million in strategic growth capital to expand into verticals such as defense, shipping, and utilities. Firecell and Highway 9 Networks raised $7.2 million and $25 million, respectively, in seed funding last year, while Monogoto secured $27 million in a Series A round. More recently, SEMPRE closed its $14.3 million Series A funding round to support deployments of secure and resilient 5G infrastructure products across defense and commercial markets. Also worth noting is Boldyn’s completion of a $1.2 billion debt financing deal to expand its private wireless and neutral host infrastructure footprint throughout the United States.

- Although greater vendor diversity is beginning to be reflected in infrastructure sales, an atmosphere of acquisitions persists as highlighted by recent deals such as the divestiture of Corning’s small cell RAN and DAS portfolio to Airspan Networks, Motive Companies’ acquisition of private cellular technology provider GXC, Riedel Communications’ buyout of former Nokia spinoff and 5G campus network specialist MECSware, Rheinmetall’s share purchase agreement for majority ownership of tactical core middleware developer Blackned, and Nokia’s acquisition of tactical communications technology provider Fenix Group to strengthen its position in the defense sector. An earlier example is HPE’s acquisition of Italian mobile core technology provider Athonet two years ago.

- The service provider segment is not immune to consolidation either. For example, Boldyn Networks recently acquired SML (Smart Mobile Labs), a German provider of bespoke private 5G networks and turnkey applications. This follows Boldyn’s 2024 takeover of Cellnex’s private networks business unit, which largely included Edzcom – a private 4G/5G specialist with installations in Finland, France, Germany, Spain, Sweden, and the United Kingdom.

- Another recent development is Day Wireless Systems’ acquisition of Sigma Wireless, a leading private 5G system integrator in Ireland. Consolidation activity has also been underway in other national markets. In Australia, for instance, Vocus acquired Challenge Networks in 2023 and Telstra Purple took over Aqura Technologies in 2022 — both well-known pioneers in industrial private wireless networks.

- Hyperscalers have scaled back their ambitions in the hypercompetitive private 5G market as they pivot towards AI and other high-growth opportunities better served by their cloud infrastructure and service ecosystems. Amazon has recently discontinued its AWS (Amazon Web Services) Private 5G managed service, while Microsoft’s Azure Private 5G Core service is set to be retired by the end of September 2025.

References:

https://www.snstelecom.com/p5g

https://www.celona.io/the-state-of-private-wireless-market-4g-5g

SNS Telecom & IT: Private 5G and 4G LTE cellular networks for the global defense sector are a $1.5B opportunity

SNS Telecom & IT: $6 Billion Private LTE/5G Market Shines Through Wireless Industry’s Gloom

SNS Telecom & IT: Private 5G Network market annual spending will be $3.5 Billion by 2027

SNS Telecom & IT: Q1-2024 Public safety LTE/5G report: review of engagements across 86 countries, case studies, spectrum allocation and more

SNS Telecom & IT: Shared Spectrum 5G NR & LTE Small Cell RAN Investments to Reach $3 Billion

SNS Telecom & IT: CBRS Network Infrastructure a $1.5 Billion Market Opportunity

SNS Telecom & IT: Private LTE & 5G Network Infrastructure at $6.4 Billion by end of 2026

SNS Telecom & IT: Q1-2024 Public safety LTE/5G report: review of engagements across 86 countries, case studies, spectrum allocation and more

SNS Telecom & IT’s Q1-2024 Public safety LTE/5G report is a significant update from previous versions. The “Public Safety LTE & 5G Market: 2023 – 2030” report features a database of over 1,300 global public safety LTE/5G engagements – as of Q1’2024, in addition to detailed market analysis and forecasts for public safety broadband infrastructure, devices, applications and connectivity services.

Along with other unique content, the report covers a comprehensive review of public safety LTE/5G engagements across 86 countries, detailed case studies of 18 nationwide public safety broadband projects and additional case studies of 50 dedicated, hybrid, secure MVNO/MOCN and commercial operator-supplied systems, public safety spectrum allocation and usage, 3GPP standardization and commercial availability of critical communications-related features, analysis of public safety broadband application scenarios, practical examples of 5G era use cases, ongoing deployments of 3GPP standards-compliant MCX services and interworking functionality for LMR-broadband interoperability, recent advances in 5G NR sidelink-based device-to-device communications capabilities and other trends such as the emergence of portable 5G networks and 5G network slicing services (which require a 5G SA core network) for first responder agencies.

Report Summary:

With the commercial availability of 3GPP-specification compliant MCX (Mission-Critical PTT, Video & Data), HPUE (High-Power User Equipment), IOPS (Isolated Operation for Public Safety) and other critical communications features, LTE and 5G NR (New Radio) networks are increasingly gaining recognition as an all-inclusive public safety communications platform for the delivery of real-time video, high-resolution imagery, multimedia messaging, mobile office/field data applications, location services and mapping, situational awareness, unmanned asset control and other broadband capabilities, as well as MCPTT (Mission-Critical PTT) voice and narrowband data services provided by traditional LMR (Land Mobile Radio) systems. Through ongoing refinements of additional standards – specifically 5G MBS/5MBS (5G Multicast-Broadcast Services), 5G NR sidelink for off-network D2D (Device-to-Device) communications, NTN (Non-Terrestrial Network) integration, and support for lower 5G NR bandwidths – 3GPP networks are eventually expected to be in a position to fully replace legacy LMR systems by the late 2020s. National public safety communications authorities in multiple countries have already expressed a willingness to complete their planned narrowband to broadband transitions within the second half of the 2020 decade.

A myriad of fully dedicated, hybrid government-commercial and secure MVNO/MOCN-based public safety LTE and 5G-ready networks are operational or in the process of being rolled out throughout the globe. The high-profile FirstNet (First Responder Network) and South Korea’s Safe-Net (National Disaster Safety Communications Network) nationwide public safety broadband networks have been successfully implemented. Although Britain’s ESN (Emergency Services Network) project has been hampered by a series of delays, many other national-level programs have made considerable headway in moving from field trials to wider scale deployments – most notably, New Zealand’s NGCC (Next-Generation Critical Communications) public safety network, France’s RRF (Radio Network of the Future), Italy’s public safety LTE service, Spain’s SIRDEE mission-critical broadband network, Finland’s VIRVE 2.0 broadband service, Sweden’s Rakel G2 secure broadband system and Hungary’s EDR 2.0/3.0 broadband network. Nationwide initiatives in the pre-operational phase include but are not limited to Switzerland’s MSK (Secure Mobile Broadband Communications) system, Norway’s Nytt Nødnett, Germany’s planned hybrid broadband network for BOS (German Public Safety Organizations), Netherlands’ NOOVA (National Public Order & Security Architecture) program, Japan’s PS-LTE (Public Safety LTE) project, Australia’s PSMB (Public Safety Mobile Broadband) program and Canada’s national PSBN (Public Safety Broadband Network) initiative.

Other operational and planned deployments range from the Halton-Peel region PSBN in Canada’s Ontario province, New South Wales’ state-based PSMB solution, China’s city and district-wide Band 45 (1.4 GHz) LTE networks for police forces, Hong Kong’s 700 MHz mission-critical broadband network, Royal Thai Police’s Band 26 (800 MHz) LTE network, Qatar MOI (Ministry of Interior), ROP (Royal Oman Police), Abu Dhabi Police and Nedaa’s mission-critical LTE networks in the oil-rich GCC (Gulf Cooperation Council) region, Brazil’s state-wide LTE networks for both civil and military police agencies, Barbados’ Band 14 (700 MHz) LTE-based connectivity service platform, Zambia’s 400 MHz broadband trunking system and Mauritania’s public safety LTE network for urban security in Nouakchott to local and regional-level private LTE networks for first responders in markets as diverse as Laos, Indonesia, the Philippines, Pakistan, Lebanon, Egypt, Kenya, Ghana, Cote D’Ivoire, Cameroon, Mali, Madagascar, Mauritius, Canary Islands, Spain, Turkey, Serbia, Argentina, Colombia, Venezuela, Bolivia, Ecuador and Trinidad & Tobago, as well as multi-domain critical communications broadband networks such as MRC’s (Mobile Radio Center) LTE-based advanced MCA digital radio system in Japan, and secure MVNO platforms in Mexico, Belgium, Netherlands, Slovenia, Estonia and several other countries.

Even though critical public safety-related 5G NR capabilities defined in the 3GPP’s Release 17 and 18 specifications are yet to be commercialized, public safety agencies have already begun experimenting with 5G for applications that can benefit from the technology’s high-bandwidth and low-latency characteristics. For example, the Lishui Municipal Emergency Management Bureau is using private 5G slicing over China Mobile’s network, portable cell sites and rapidly deployable communications vehicles as part of a disaster management and visualization system.

In neighboring Taiwan, the Kaohsiung City Police Department relies on end-to-end network slicing over a standalone 5G network to support license plate recognition and other use cases requiring the real-time transmission of high-resolution images. The Hsinchu City Fire Department’s emergency response vehicle can be rapidly deployed to disaster zones to establish high-bandwidth, low-latency emergency communications using a satellite-backhauled private 5G network based on Open RAN standards. The Norwegian Air Ambulance is adopting a similar private 5G-based NOW (Network-on-Wheels) system for enhancing situational awareness during search and rescue operations.

In addition, first responder agencies in Germany, Japan and several other markets are beginning to utilize mid-band and mmWave (Millimeter Wave) spectrum available for local area licensing to deploy portable and small-scale 5G NPNs (Non-Public Networks) to support applications such as UHD (Ultra-High Definition) video surveillance, control of unmanned firefighting vehicles, reconnaissance robots and drones. In the near future, we also expect to see rollouts of localized 5G NR systems – including direct mode communications – for incident scene management and related use cases, potentially using up to 50 MHz of Band n79 spectrum in the 4.9 GHz frequency range (4,940-4,990 MHz), which has been designated for public safety use in multiple countries including but not limited to the United States, Canada, Australia, Malaysia and Qatar.

SNS Telecom & IT estimates that annual investments in public safety LTE/5G infrastructure and devices reached $4.3 Billion in 2023, driven by both new projects and the expansion of existing dedicated, hybrid government-commercial and secure MVNO/MOCN networks. Complemented by an expanding ecosystem of public safety-grade LTE/5G devices, the market will further grow at a CAGR of approximately 10% over the next three years, eventually accounting for more than $5.7 Billion by the end of 2026. Despite the positive outlook, some significant challenges continue to plague the market. The most noticeable pain point is the lack of a D2D communications capability.

The ProSe (Proximity Services) chipset ecosystem failed to materialize in the LTE era due to limited support from chipmakers and terminal OEMs. However, the 5G NR sidelink interface offers a clean slate opportunity to introduce direct mode D2D communications for public safety broadband users, as well as coverage expansion in both on-network and off-network scenarios using UE-to-network and UE-to-UE relays respectively. Recent demonstrations of 5G NR sidelink-enabled MCX services by the likes of Qualcomm have generated renewed confidence in 3GPP technology for direct mode communications.

Until recently, another barrier impeding the market was the non-availability of cost-optimized RAN equipment and terminals that support operation in spectrum reserved for PPDR (Public Protection & Disaster Relief) communications – most notably Band 68 (698-703 / 753-758 MHz), which has been allocated for PPDR broadband systems in several national markets across Europe, including France, Germany, Switzerland, Austria, Spain, Italy, Estonia, Bulgaria and Cyprus. Other countries such as Greece, Hungary, Romania, Sweden, Denmark, Netherlands and Belgium are also expected to make this assignment. Since the beginning of 2023, multiple suppliers – including Ericsson, Nokia, Teltronic and CROSSCALL – have introduced support for Band 68.

The “Public Safety LTE & 5G Market: 2023 – 2030 – Opportunities, Challenges, Strategies & Forecasts” report presents an in-depth assessment of the public safety LTE and 5G market, including the value chain, market drivers, barriers to uptake, enabling technologies, operational models, application scenarios, key trends, future roadmap, standardization, spectrum availability/allocation, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also presents global and regional market size forecasts from 2023 to 2030, covering public safety LTE/5G infrastructure, terminal equipment, applications, systems integration and management solutions, as well as subscriptions and service revenue.

The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report, as well as a list and associated details of over 1,300 global public safety LTE/5G engagements – as of Q1’2024.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.snstelecom.com/public-safety-lte

SNS Telecom & IT: Shared Spectrum 5G NR & LTE Small Cell RAN Investments to Reach $3 Billion

SNS Telecom & IT: CBRS Network Infrastructure a $1.5 Billion Market Opportunity

SNS Telecom & IT: Private LTE & 5G Network Infrastructure at $6.4 Billion by end of 2026

SNS Telecom & IT: Open RAN Intelligent Controller, xApps & rApps to reach $600 Million by 2025

SNS Telecom & IT: Shared Spectrum to Boost 5G NR & LTE Small Cell RAN Market

SNS Telecom & IT: Spending on Unlicensed LTE & 5G NR RAN infrastructure at $1.3 Billion by 2023

SNS Telecom: U.S. Network Operators will reap $1B from fixed wireless by late 2019

SNS Telecom & IT: CBRS Network Infrastructure a $1.5 Billion Market Opportunity

SNS Telecom & IT‘s latest research report indicates that annual spending on LTE and 5G NR-based CBRS network infrastructure – which includes RAN (Radio Access Network), mobile core and transport network equipment – will account for more than $1.5 Billion by the end of 2026.

After many years of regulatory, standardization and technical implementation activities, the United States’ dynamic, three-tiered, hierarchical framework to coordinate shared use of 150 MHz of spectrum in the 3.5 GHz CBRS (Citizens Broadband Radio Service) band has finally become a commercial success. Although the shared spectrum arrangement is access technology neutral, the 3GPP cellular wireless ecosystem is at the forefront of CBRS adoption, with more than half of all active CBSDs (Citizens Broadband Radio Service Devices) based on LTE and 5G NR air interface technologies.

LTE-based CBRS network deployments have gained considerable momentum in recent years and encompass hundreds of thousands of cell sites – operating in both GAA (General Authorized Access) and PAL (Priority Access License) spectrum tiers – to support use cases as diverse as mobile network densification, FWA (Fixed Wireless Access) in rural communities, MVNO (Mobile Virtual Network Operator) offload, neutral host small cells for in-building coverage enhancement, and private cellular networks in support of IIoT (Industrial IoT), enterprise connectivity, distance learning and smart city initiatives.

Commercial rollouts of 5G NR network equipment operating in the CBRS band have also begun, which are laying the foundation for advanced application scenarios that have more demanding performance requirements in terms of throughput, latency, reliability, availability and connection density – for example, Industry 4.0 applications such as connected production machinery, mobile robotics, AGVs (Automated Guided Vehicles) and AR (Augmented Reality)-assisted troubleshooting.

Examples of 5G NR-based CBRS network installations range from luxury automaker BMW Group’s industrial-grade 5G network for autonomous logistics at its Spartanburg plant in South Carolina and the U.S. Navy’s standalone private 5G network at NAS (Naval Air Station) Whidbey Island to mobile operator Verizon’s planned activation of 5G NR-equipped CBRS small cells to supplement its existing 5G service deployment over C-band and mmWave (Millimeter Wave) spectrum.

SNS Telecom & IT estimates that annual investments in LTE and 5G NR-based CBRS RAN (Radio Access Network), mobile core and transport network infrastructure will account for nearly $900 Million by the end of 2023. Complemented by an expanding selection of 3GPP Band 48/n48-compatible end user devices, the market is further expected to grow at a CAGR of approximately 20% between 2023 and 2026 to surpass $1.5 Billion in annual spending by 2026. Much of this growth will be driven by private cellular, neutral host and fixed wireless broadband network deployments, as well as 5G buildouts aimed at improving the economics of the cable operators’ MVNO services.

The “LTE & 5G NR-Based CBRS Networks: 2023 – 2030 – Opportunities, Challenges, Strategies & Forecasts” report presents a detailed assessment of the market for LTE and 5G NR in CBRS spectrum including the value chain, market drivers, barriers to uptake, enabling technologies, key trends, future roadmap, business models, use cases, application scenarios, standardization, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also provides forecasts for LTE and 5G NR-based CBRS network infrastructure and terminal equipment from 2023 to 2030. The forecasts cover three infrastructure submarkets, two air interface technologies, two cell type categories, five device form factors, seven use cases and 11 vertical industries.

The report comes with an associated Excel datasheet suite covering quantitative data from all numeric forecasts presented in the report, as well as a database of over 800 LTE/5G NR-based CBRS network engagements – as of Q3’2023.

The report has the following key findings:

-

SNS Telecom & IT estimates that annual investments in LTE and 5G NR-based CBRS network infrastructure will account for nearly $900 Million by the end of 2023. Complemented by an expanding selection of 3GPP Band 48/n48-compatible end user devices, the market is further expected to grow at a CAGR of approximately 20% between 2023 and 2026 to surpass $1.5 Billion in annual spending by 2026.

-

LTE-based CBRS network deployments have gained considerable momentum in recent years and encompass hundreds of thousands of cell sites to support use cases as diverse as mobile network densification, fixed wireless broadband in rural communities, MVNO offload, neutral host small cells for in-building coverage enhancement, and private cellular networks for vertical industries and enterprises.

-

Commercial rollouts of 5G NR network equipment operating in the CBRS band have also begun, which are laying the foundation for Industry 4.0 and advanced application scenarios that have more demanding performance requirements in terms of throughput, latency, reliability, availability and connection density.

-

By eliminating the entry barriers associated with exclusive-use licensed spectrum, CBRS has spurred the entry of many new players in the cellular industry – ranging from private 4G/5G network specialists such as Celona, Betacom, Ballast Networks, Kajeet and BearCom to neutral host solutions provider InfiniG.

-

The secondary market for leasing and monetizing CBRS PAL spectrum rights is starting to get off the ground with the availability of spectrum exchange platforms – from the likes of Federated Wireless and Select Spectrum – which connect license holders with prospective third-party users to streamline transactions of under-utilized PAL spectrum.

Summary of CBRS Network Deployments

Summarized below is a review of LTE and 5G NR-based CBRS network across the United States and its territories:

-

Mobile Network Densification: Verizon has progressively rolled out CBRS spectrum for its LTE service across thousands of cell sites and is in the final stage of activating 5G NR-equipped CBRS small cells to supplement its existing 5G service deployment over C-band and mmWave (Millimeter Wave) spectrum. Claro Puerto Rico and several other mobile operators are also using CBRS to expand the capacity of their networks in high-traffic density environments.

-

Fixed Wireless Broadband Services: Frontier Communications, Mediacom, Midco, Nextlink Internet, Mercury Broadband, Surf Internet, Cal.net, IGL TeleConnect, OhioTT and MetaLINK are some of the many WISPs (Wireless Internet Service Providers) that have deployed 3GPP-based CBRS networks for fixed wireless broadband services in rural and underserved markets with limited high-speed internet options.

-

Mobile Networks for New Entrants: Comcast and Charter Communications are leveraging their licensed CBRS spectrum holdings to install RAN infrastructure for targeted wireless coverage in strategic locations where subscriber density and data consumption is highest. The CBRS network buildouts are aimed at improving the economics of the cable operators’ MVNO services by offloading a larger proportion of mobile data traffic from host networks.

-

Neutral Host Networks: Among other neutral host CBRS network installations, social media and technology giant Meta has built an in-building wireless network – using small cells operating in the GAA tier of CBRS spectrum and MOCN (Multi-Operator Core Network) technology – to provide reliable cellular coverage for mobile operators Verizon, AT&T and T-Mobile at its properties in the United States.

-

Private Cellular Networks: The availability of CBRS spectrum is accelerating private LTE and 5G network deployments across a multitude of vertical industries and application scenarios, extending from localized wireless systems for geographically limited coverage in factories, warehouses, airports, rail yards, maritime terminals, medical facilities, office buildings, sports venues, military bases and university campuses to municipal networks for community broadband, distance learning and smart city initiatives. Some notable examples of recent and ongoing deployments are listed below:

-

Education: Higher education institutes are at the forefront of hosting on-premise LTE and 5G networks in campus environments. Texas A&M University, Purdue University, Johns Hopkins University, Duke University, Cal Poly, Virginia Tech, University of Wisconsin-Milwaukee, Stanislaus State, West Chester University and Howard University are among the many universities that have deployed cellular networks for experimental research or smart campus-related applications. Another prevalent theme in the education sector is the growing number of private LTE networks aimed at eliminating the digital divide for remote learning in school districts throughout the United States.

-

Governments & Municipalities: The City of Las Vegas is deploying one of the largest private cellular networks in the United States, which will serve as an open connectivity platform available to local businesses, government, and educational institutions for deploying innovative solutions within the city limits. Local authorities in Tucson and Glendale (Arizona), Santa Maria (California), Longmont (Colorado), Shreveport (Louisiana), Montgomery (Alabama), and Dublin (Ohio) and several other municipalities have also deployed their own private wireless networks using CBRS spectrum.

-

Healthcare: During the height of the COVID-19 pandemic, regional healthcare provider Geisinger took advantage of CBRS spectrum to deploy a private LTE network for telemedicine services in rural Pennsylvania while Memorial Health System utilized a temporary CBRS network to provide wireless connectivity for frontline staff and medical equipment in COVID-19 triage tents and testing facilities at its Springfield (Illinois) hospital. Since then, healthcare providers have begun investing in CBRS-enabled private wireless networks on a more permanent basis to facilitate secure and reliable communications for critical care, patient monitoring and back office systems in hospital campuses and other medical settings.

-

Manufacturing: German automotive giant BMW has deployed an industrial-grade 5G network for autonomous logistics at its Spartanburg plant in South Carolina. Rival automaker Tesla is migrating PROFINET/PROFIsafe-based AGV (Automated Guided Vehicle) communications from Wi-Fi to private 5G networks at its factories. Agricultural equipment manufacturer John Deere is installing private cellular infrastructure at 13 of its production facilities. Dow, another prominent name in the U.S. manufacturing sector, has adopted a private LTE network to modernize plant maintenance at its Freeport chemical complex in Texas. FII (Foxconn Industrial Internet), Del Conca USA, Logan Aluminum, OCI Global, Schneider Electric, Bosch Rexroth, CommScope, Ericsson, Hitachi and many other manufacturers are also integrating private 4G/5G connectivity into their production operations.

-

Military: All branches of the U.S. military are actively investing in private cellular networks. One noteworthy example is the U.S. Navy’s standalone private 5G network at NAS (Naval Air Station) Whidbey Island in Island County (Washington). Operating in DISH Network’s licensed 600 MHz and CBRS spectrum, the Open RAN-compliant 5G network delivers wireless coverage across a geographic footprint of several acres to support a wide array of applications for advanced base operations, equipment maintenance and flight line management.

-

Mining: Compass Minerals, Albemarle, Newmont and a number of other companies have deployed 3GPP-based private wireless networks for the digitization and automation of their mining operations. Pronto’s off-road AHS (Autonomous Haulage System) integrates private cellular technology to support the operation of driverless trucks in remote mining environments that lack coverage from traditional mobile operators.

-

Oil & Gas: Cameron LNG has recently implemented a private LTE network for industrial applications at its natural gas liquefaction plant in Hackberry (Louisiana). Chevron, EOG Resources, Pioneer Natural Resources and Oxy (Occidental Petroleum Corporation) are also engaged in efforts to integrate LTE and 5G NR-based CBRS network equipment into their private communications systems.

-

Retail & Hospitality: Private cellular networks have been installed to enhance guest connectivity and internal operations in a host of hotels and resorts, including the Sound Hotel in Seattle (Washington), Gale South Beach and Faena Hotel in Miami (Florida), and Caribe Royale in Orlando (Florida). The American Dream retail and entertainment complex in East Rutherford (New Jersey) and regional shopping mall Southlands in Aurora (Colorado) are notable examples of early adopters in the retail segment.

-

Sports: The NFL (National Football League) is utilizing CBRS spectrum and private wireless technology for coach-to-coach and sideline (coach-to-player) communications during football games at all 30 of its stadiums. HSG (Haslam Sports Group) and other venue owners have installed 3GPP-based private wireless infrastructure at stadiums, arenas and other sports facilities for applications such as mobile ticket scanning, automated turnstiles, POS (Point-of-Sale) systems, digital signage, immersive experiences, video surveillance, crowd management and smart parking. FOX Sports and ARA (American Rally Association) have employed the use of private 4G/5G networks to support live broadcast operations.

-

Transportation: Private cellular networks have been deployed or are being trialed at some of the busiest international and domestic airports, including Chicago O’Hare, Newark Liberty, DFW (Dallas Fort Worth), Dallas Love Field and MSP (Minneapolis-St. Paul), as well as inland and maritime ports such as SSA Marine’s (Carrix) terminals in the ports of Oakland and Seattle. Other examples in the transportation segment range from on-premise 4G/5G networks at Amazon’s FCs (Fulfillment Centers), CalChip Connect’s Bucks County distribution center and Teltech’s Dallas-Fort Worth warehouse to Freight railroad operator’s private LTE network for rail yard workers at its outdoor rail switching facilities.

-

Utilities: Major utility companies spent nearly $200 Million in the CBRS PAL auction to acquire licenses within their service territories. Southern Linc, SDG&E (San Diego Gas & Electric), SCE (Southern California Edison) and Hawaiian Electric are using their licensed spectrum holdings to deploy 3GPP-based FANs (Field Area Networks) in support of grid modernization programs while Duke Energy has installed a private LTE network operating in the unlicensed GAA tier of CBRS spectrum. Among other examples, Enel has deployed a CBRS network for business-critical applications at a remote solar power plant.

-

Other Verticals: LTE and 5G NR-ready CBRS networks have also been deployed in other vertical sectors, including agriculture, arts and culture, construction and forestry. In addition, CBRS networks for indoor wireless coverage enhancement and smart building applications are also starting to be implemented in office environments, corporate campuses and residential buildings. Prominent examples include the Cabana Happy Valley residential complex in Phoenix (Arizona) and Rudin Management Company’s 345 Park Avenue multi-tenant commercial office building in New York City.

-

References:

https://www.snstelecom.com/cbrs

SNS Telecom: Private LTE & 5G Network Infrastructure at $6.4 Billion by end of 2026

SNS Telecom & IT: Open RAN Intelligent Controller, xApps & rApps to reach $600 Million by 2025

SNS Telecom & IT: Shared Spectrum to Boost 5G NR & LTE Small Cell RAN Market

SNS Telecom & IT: Spending on Unlicensed LTE & 5G NR RAN infrastructure at $1.3 Billion by 2023