Dell’Oro: #1 Huawei increased market share at the expense of Ericsson, Nokia and ZTE; Mobile CAPEX flat; 5G Market Forecasts

Top Telecom Equipment Vendors:

According to a new Dell’Oro Group report, the top seven telecom equipment makers as of 3Q 2018 are: Huawei, Nokia, Ericsson, Cisco, ZTE, Ciena, and Samsung. Huawei has captured a 29 percent share of the global telecom equipment market, increasing its market share by 8 percentage points since 2013. Huawei’s revenue share improved by two percentage points of market share annually in each of the past five years. That’s despite huge challenges in the U.S., UK, Australia and some European telecom markets due to security and backdoor issues.

During the same time period, Ericsson’s and Nokia’s market share declined about one percentage point annually on average until 2018 when both vendor held their market share flat. ZTE’s share, which had typically been at 10 percent, dropped two percentage points in 2018 due to the U.S. ban that caused the company to shut down portions of its business during the second quarter.

Additional key takeaways from the reporting period include:

- Following three years of decline, the overall telecom equipment market grew 1 percent year-over-year in 2018. The positive turn in the year was due to higher demand for Broadband Access, Optical Transport, Microwave, and Mobile RAN. The remaining equipment—Carrier IP Telephony, Wireless Packet Core, SP Router and Carrier Ethernet Switch—declined in the year. The two largest equipment markets in the year were Mobile RAN and Optical Transport.

- The worldwide Mobile RAN market surprised on the upside and performed better than expected in 2018. In addition to the strong focus on LTE and LTE-Advanced, the shift toward 5G NR (3GPP Release 15 New Radio – Non Stand Alone) continued to accelerate throughout the year.

- The worldwide Optical Transport market continued to expand for a fourth consecutive year driven by strong sales of DWDM equipment in China and to large Internet content providers for data center interconnect (DCI).

According to TelecomLead.com estimates, Huawei generated revenue of around $38 billion from carrier business, $10 billion from enterprises and $52 billion from phones and other devices — in 2018.

- Huawei said in December 2018 that it expects total revenue to increase 21 percent to $109 billion in 2018.

- Nokia Networks business revenue was 20.121 billion euro (–2 percent) or $22.82 billion last year.

- Ericsson’s revenue was SEK 210.8 billion (+3 percent) or $22.58 billion in 2018.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Mobile Operator CAPEX:

The latest GSMA report indicates that mobile operator CAPEX reached $161 billion in 2018 and is forecast to be $161 in 2019 and $160 billion in 2020. 5G related CAPEX will grow to $123 billion in 52 markets in 2020 from $81 billion in 19 markets in 2019 and $41 billion in two markets in 2018.

Mobile operators will invest around $480 billion worldwide between 2018 and 2020 in mobile CAPEX. Their investment focus will be 3G, 4G, 5G roll outs; and network optimization; capabilities beyond core telco.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

5G Market:

5G is on track to account for 15 per cent of global mobile connections by 2025, as the number of 5G network launches and compatible devices ramps up this year, according to a new GSMA report. The 2019 global edition of the GSMA’s flagship Mobile Economy report series reveals that a further 16 major markets worldwide will switch on commercial 5G networks this year, following on from the first 5G launches in South Korea and the US in 2018. It is calculated that mobile operators worldwide are currently investing around $160 billion per year (CAPEX) on expanding and upgrading their networks, despite regulatory and competitive pressures.

“The arrival of 5G forms a major part of the world’s move towards an era of Intelligent Connectivity, which alongside developments in the Internet of Things, big data and artificial intelligence, is poised to be a key driver of economic growth over the coming years,” said Mats Granryd, Director General of the GSMA. “While 5G will transform businesses and provide an array of exciting new services, mobile technology is also helping to close the connectivity gap. We will connect more than a billion new people to the mobile internet over the next few years, spurring adoption of mobile-based tools and solutions in areas such as agriculture, education and healthcare, which will improve livelihoods of people around the world.”

The new GSMA report reveals that:

- The number of 5G connections will reach 1.4 billion by 2025 – 15 per cent of the global total. By this point, 5G is forecast to account for around 30 per cent of connections in markets such as China and Europe, and around half of the total in the US;

- 4G will continue to see strong growth over this period, accounting for almost 60 per cent of global connections by 2025 – up from 43 per cent last year;

- The number of global IoT connections will triple to 25 billion by 2025, while global IoT revenue will quadruple to $1.1 trillion;

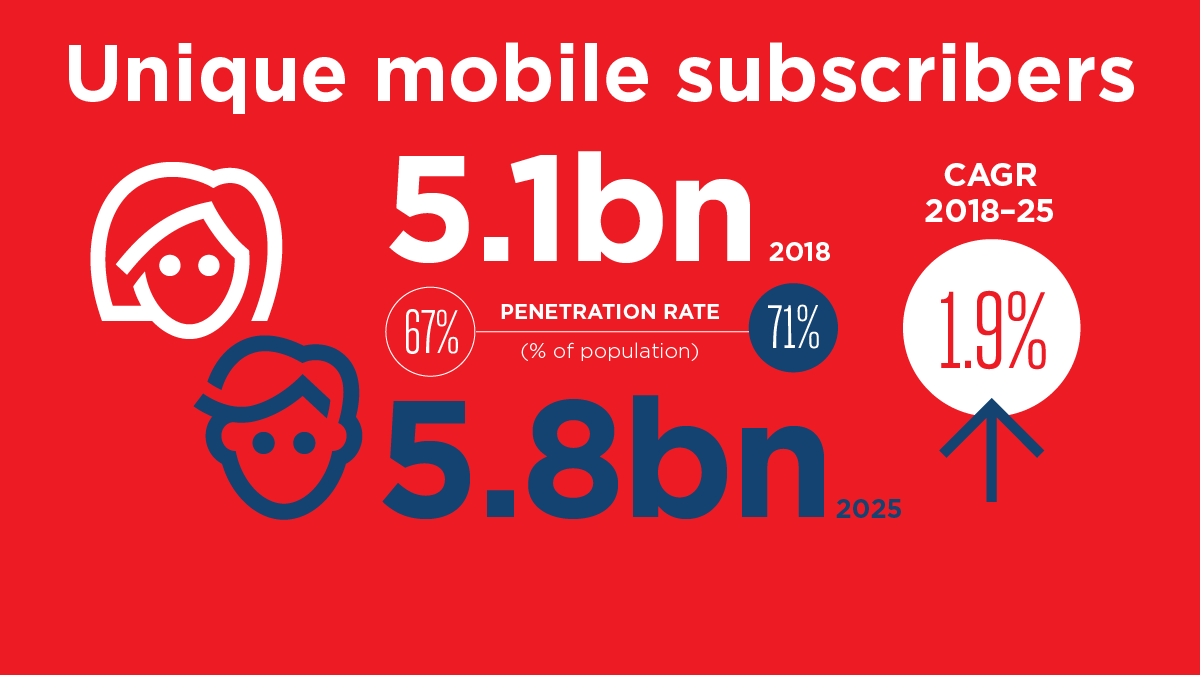

- One billion new unique mobile subscribers2 have been added in the four years since 2013, bringing the total to 5.1 billion by the end of 2018, representing about two thirds of the global population;

- More than 700 million new subscribers are forecast to be added over the next seven years, about a quarter of these coming from India alone;

- An additional 1.4 billion people will start using the mobile internet over the next seven years, bringing the total number of mobile internet subscribers globally to 5 billion by 2025 (more than 60 per cent of the population).

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

According to Telecomlead.com, Huawei has signed 30 plus 5G commercial contracts. Huawei has delivered over 40,000 5G base stations for commercial use. Huawei has 50 plus 5G engagements with customers. Nokia has 20 plus 5G contracts, and almost 100 5G engagements with customers. Samsung shipped 36,000 5G base stations – mainly to operators in the US and Korea — in 2018.

According to Dave Bolen of Dell’Oro Group, Cisco, Ericsson, Huawei, Nokia, and ZTE are the top-five wireless/ mobile packet core infrastructure vendors. At MWC 2019 in Barcelona, each put on a spectacular show with massive stands demonstrating its end-to-end technology prowess empowering 5G use cases, all enabled with their respective cloud-native cores. Their stands were packed with customers and potential customers leading to thousands of meetings. Each vendor had its share of press releases with 5G deals around the globe that are too numerous to name here. Links to the happenings at MWC19 from each of the top-five vendors may be found at Cisco, Ericsson, Huawei, Nokia, and ZTE.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

http://www.delloro.com/delloro-group/telecom-equipment-market-2018

http://www.delloro.com/dave-bolan/5g-mwc19-barcelona-observations-its-all-about-the-core

https://www.gsma.com/r/mobileeconomy/

https://www.gsmaintelligence.com/research/?file=5a33fb6782bc75def8b6dc66af5da976&download

8 thoughts on “Dell’Oro: #1 Huawei increased market share at the expense of Ericsson, Nokia and ZTE; Mobile CAPEX flat; 5G Market Forecasts”

Comments are closed.

Top 10 telcos in the world: https://www.gigabitmagazine.com/top10/top-ten-most-valuable-telecommunication-companies-world?utm_source=Mailer&utm_medium=ET_batch&utm_campaign=ettelecom_news_2019-03-12

5G To Get Big Push For Live Sports

Consumers are likely to first experience the new 5G speeds at sports events at large arenas.

Network operators are targeting sports arenas for 5G rollouts and the arenas are planning to use the new speeds for better fan experiences.

The majority (87%) of network operators intend to deliver new 5G services to major live sports and esports event organizers, according to a new study. More than half (52%) of operators plan to offer services to improve the fan experience in the arena, such as the ability to order food and beverages via mobile devices.

The study comprised a survey of senior decision-makers at 60 of the world’s largest communications and media companies conducted by Ovum for Amdocs.

By the end of 2020, most (91%) operators expect to have trialed 5G inside their venues and 93% pan to directly support mainstream sports in the 5G era. The majority (70%) of network operators say sports events have influenced their 5G rollouts.

New consumer-facing services expected to be offered to support live sports events include multiscreen pay TV (83%), virtual reality (63%), augmented/mixed reality (63%) and digital advertising (53%).

However, operators also see some challenges ahead, including lack of consumer interest in 5G use cases (23%), the willingness of 5G companies to collaborate (18%) and lack of appealing 5G devices (15%).

To drive 5G adoption, operators plan to subsidize some devices, including personal hotspot devices (53%), smartphones (43%), tablets (33%), smart VTV devices (28%) and AR headsets (25%). The new 5G speeds are just around the corner, and the industry deploying those speeds plans to provide a market push.

https://www.mediapost.com/publications/article/334310/5g-to-get-big-push-for-live-sports.html

How China’s Huawei took the lead on 5G –Washington Post:

As U.S. officials have pressured allies not to use networking gear from Chinese technology giant Huawei over spying concerns, President Trump has urged American companies to “step up” and compete to provide the next generation of high-speed, low-lag wireless service known as 5G.

“We cannot allow any other country to outcompete the United States,” Trump said Friday at a White House event to unveil the administration’s next steps on 5G – a massive airwaves auction and a proposed $20 billion broadband infrastructure fund.

There’s just one problem: Barely any U.S. companies manufacture the technology’s most critical components.

The absence of a major U.S. alternative to foreign suppliers of 5G networking equipment underscores the growing dominance of Huawei, which has evolved into the world’s biggest supplier of telecom equipment, sparking fears within the Trump administration that a 5G network powered by Huawei’s wireless parts could endanger national security. And it throws into sharp relief the years-long retreat by U.S. firms from that market.

Carriers such as Sprint and Verizon have moved swiftly to launch 5G services for consumers. But the wireless networking gear the industry relies on still comes from foreign suppliers: four companies – Sweden’s Ericsson, Finland’s Nokia and China’s Huawei and ZTE – account for two-thirds of the global market for telecom equipment, according to analyst estimates.

Some U.S. technology giants such as Cisco sell switches and routers that reside in the innermost parts of a carrier’s network. But despite its size, Cisco doesn’t compete in the market for “radio access,” or the wireless infrastructure that allows cell sites to connect with smartphones and other mobile devices.

“There is no U.S.-based wireless access equipment provider today that builds those solutions,” said Sandra Rivera, a senior vice president at Intel who helps guide the chipmaker’s 5G strategy.

It’s this part of the Internet ecosystem that is increasingly important as more devices and appliances gain wireless connectivity and smart capabilities. 5G is expected to shape technological innovation for years to come, providing mobile data connections for virtual-reality headsets, driverless cars and more. Proponents say 5G eventually will support download speeds of 1,000 megabits per second, roughly 100 times faster than today’s 4G standard.

The rising global demand for 5G equipment highlights how the United States, a technology leader in other respects, is largely absent from the wireless networking industry. It reflects the decline of a once vibrant ecosystem of American companies that formerly went toe-to-toe with the likes of Nokia and Ericsson. And it puts a focus on Chinese firms such as Huawei, whose rise to prominence has come at the expense of Western networking titans and sparked a global campaign by U.S. officials eager to persuade allies not to allow Chinese equipment into their networks.

At the dawn of the wireless age 30 years ago, U.S. companies jostled for primacy in wireless networking. Companies such as Motorola and Lucent – an offshoot of the old AT&T monopoly – were sources of innovation, exploring new ways of delivering voice and data wirelessly. It was Lucent, for example, that helped introduce Code Division Multiple Access, or CDMA, a mobile technology that promised to improve the capacity of wireless carriers.

But their fortunes declined around the turn of the century as they failed to keep pace with a changing market. No U.S. company stepped in to fill the gap as those companies faded – partly because of the growing strength of foreign alternatives and partly because of the immense scale required to survive in that line of business, according to industry experts.

“Lucent basically collapsed because they didn’t have a big enough wireless arm to keep them afloat when the Internet backbone [business] collapsed” in the dot-com bust, said Roger Entner, a telecom analyst at Recon Analytics. “Motorola, over time, simply became less competitive because the other vendors had more economies of scale.”

Motorola and Lucent’s wireless infrastructure businesses were soon gobbled up by Finland’s Nokia and France’s Alcatel, respectively. One reason the European companies proved so successful, Entner said, was because the European industry agreed from the start to develop a common standard for wireless communication, known as GSM, that all European telecoms would share. By contrast, the industry in North America took a looser approach, with some carriers backing network technologies that weren’t mutually compatible.

Take CDMA. First developed for mobile use in the 1990s, the standard was technologically superior, allowing carriers such as Verizon to pump more traffic through their cell sites over the same amount of time compared with alternative standards. But the technology created headaches for consumers who found they couldn’t keep their phones when they switched from Verizon to a network like T-Mobile’s, which ran on GSM.

While the American approach allowed for more technological experimentation and innovation, a fragmented market based on competing standards made it more challenging for U.S. wireless equipment sellers to amass a large customer base.

Today, Nokia and Ericsson are the top providers of telecommunications networking gear in North America and are No. 2 and No. 3, respectively, in the world. The two companies each recorded revenue of about $25 billion last year.

But both have been surpassed by Huawei, which in the span of three decades has become the world’s largest provider of telecom equipment.

“I do think the Western companies did underestimate how credible Huawei was,” said Paul de Sa, a telecom industry analyst and co-founder of the advisory firm Quadra Partners. “There were executives who basically laughed [at the idea] that Huawei or ZTE could compete.”

Founded in the late 1980s by Ren Zhengfei, a former engineer for the Chinese military, Huawei began as a technology supplier for Chinese customers. But by the early 2000s, Huawei had begun selling globally, and now does a robust business not only in network equipment but also in consumer smartphones and enterprise services. Last month, the privately held company reported that it had finished 2018 with revenue of $107 billion, up 20 percent despite the U.S. campaign. Profits rose 25 percent, the company said, to $8.8 billion.

To give another perspective on Huawei’s enormous influence, the company’s chief rivals, Nokia and Ericsson, account for 17 percent and 13 percent of the global market for telecom equipment, respectively, according to figures compiled by the research firm Dell’Oro Group.

Huawei’s market share, at 28 percent, is nearly as large as both of them combined.

Despite an early reputation for cheap knockoff hardware, Huawei today is recognized for low prices, reliable equipment and engaging customer service, analysts say. As Huawei has invested in its own research and development, even Western telecom companies acknowledge that Huawei’s products are as good as – if not better than – competing equipment from Nokia or Ericsson.

“About 25 percent of our members have Huawei or ZTE” in their networks, Carri Bennet, an attorney for the Washington-based Rural Wireless Association, told lawmakers at a recent House Judiciary subcommittee hearing.

Gordon Smith, the chief executive of Sagent, a network intelligence and analytics company formerly known as Clover Telecom, estimated that Huawei gear typically costs “tens of percents” less than the competition’s.

With the support of China’s state-owned development bank, Huawei also has been able to undercut competitors with attractive financing for its products. In February alone, Huawei announced partnerships with wireless carriers in eight countries, including Iceland, Switzerland, Saudi Arabia and Turkey.

It doesn’t hurt that Huawei serves a massive domestic market in China, which grants it tremendous advantages of scale that many tech companies, including American ones, are hungry to access themselves. China is so critical to Apple, for example, that the iPhone maker blamed the country’s economic slowdown for a downward revision in Apple’s recent quarterly sales estimates – the company’s first such warning in 15 years.

Huawei’s success, however, has been clouded by allegations of intellectual property theft.

The U.S. government accused two Huawei units this year of trying to copy a robotic arm used by T-Mobile to test smartphones. (Huawei has pleaded not guilty.) In the past, Huawei has also been accused of stealing technology from Cisco; the two firms became locked in a legal dispute in 2003 and settled months later, after Huawei conceded that Cisco-made code had ended up in a Huawei product. The code was later removed.

Then there is Nortel Networks’ discovery in 2004 that hackers – traced to IP addresses in Shanghai – had stolen nearly 1,500 sensitive files from the Canadian telecom giant’s computer systems. The company’s subsequent investigation failed to prove China’s direct involvement, much less Huawei’s. But after analyzing the stolen files – which bore cryptic names such as “Photonic Crystals and Large Scale Integration,” “Eco_Strategy.ppt” and “HDX R2 Standard Reconfigurations Test Plan – Draft 0.2†³ – and a months-long probe, Nortel’s security adviser at the time, Brian Shields, became convinced Huawei benefited indirectly from the breach. The file names, a list of which Shields provided to The Washington Post, have not been previously reported.

“Nobody would be interested in these kinds of documents other than a competitor,” Shields said. “In my opinion, looking at what the hackers went after, it is likely these documents made it to Huawei.”

That seemingly ancient history is newly relevant, as U.S. officials argue that incorporating Huawei gear into U.S. carriers’ 5G networks poses a significant spying risk.

At an industry conference in Barcelona in February, U.S. officials urged allies in bilateral meetings not to use Huawei equipment over concerns that it could enable eavesdropping by authoritarian regimes. U.S. partners largely acknowledge the risk but have asked for more concrete evidence to back up the case.

“The Europeans really keep pushing for this concept of, ‘Where’s the smoking gun?’ ” said a person familiar with the discussions, who spoke on the condition of anonymity to speak more freely about the closed-door meetings. “They say, ‘Hey, we don’t want security threats, either . . . but you can’t just come in here and tell us that there is a unity of interest between Beijing and Huawei and have that be the end of your presentation.’ ”

Some analysts say that in a previous era, America’s allies might have been more sympathetic to the Trump administration’s message. But Trump’s conduct, they say – berating NATO allies, canceling a visit to a World War I memorial because of rain, calling Europe a “foe” on trade – has not helped.

“In a world where the U.S. had more soft power,” Entner said, “I’m pretty sure the Europeans would be a lot more receptive.”

[email protected]

Exhaustion of LTE will push migration towards 5G: Nokia

Romita Majumdar from Mumbai (Bombay), India. Business Standard

The internet data boom and rising consumption of content and related services will eventually lead 4G LTE resources to exhaust, leaving operators no choice but to adopt 5G networks, said Alexander Tikhonov (vice-president and global head of customer solutions architects at Nokia).

Last week, Nokia confirmed its position with 42 commercial 5G deals (more than any other wireless telecom equipment vendor has announced) in place with operators around the world, 22 with named customers such as T-Mobile, Telia Company, and Softbank. Including these deals, Nokia’s 5G deals, trials and demos total over 100 5G customer engagements to date.

“The data consumption (in India and globally) is video centred on internet devices at very high quality. That will exhaust LTE spectrum at a point in time in near future, that is, between 2021 and 2023 as per studies across most countries. And they will need to shift to 5G to satisfy consumer demand,” said Tikhonov.

According to a recent Assocham-PwC report, data consumption in India will grow from 7.2 million MB in 2017 to 1.09 billion MB (megabytes) in 2022, growing at a compound annual growth rate (CAGR) of about 72.6 per cent. While internet penetration is increasing in India, with mobile internet penetration set to reach 56.7 per cent in 2022, from a mere 30.2 per cent in 2017, with video-on-demand driving usage.

In fact, according a Nokia report last year, video streaming constitutes up to 75 per cent of the data traffic. According to telecom experts, the humongous video streaming levels is also a reason for rising network congestion (even for voice services) in the country.

While incumbent telecom operators like Bharti Airtel and Vodafone Idea (VIL) have been up in arms against 5G spectrum auction in the near future due to a financial crunch in the sector, Reliance Jio has been quite vocal about going ahead with 5G trials.

Bharti Airtel hopes that the Centre will bring down the proposed base price for the 5G auctions for the company to consider participating in the airwave sale. In a recent investor conference call Gopal Vittal, chief executive officer of Bharti Airtel, said that since 5G requires large quantity of spectrum and investments in the range of ~50000-55,000 crore and “clearly these are prices we can’t afford as they are exorbitant, we hope the government will bring down pricing and then we will look seriously at 5G”.

While spectrum cost is a concern, telecos are also bidding on data usage as a means to grow revenue and usage over voice services.

Airtel currently has 115 million data subscribers compared, to 306 million of Reliance Jio and 146 million of Vodafone Idea. Airtel, however, has the highest data usage at 11 GB per subscriber per month, compared to 10.9 GB for Jio and 8.8 GB for Vodafone Idea.

“ With 4G penetration for Bharti Airtel and Vodafone Idea still at 25-30 per cent of the subscriber base, limited use cases of 5G at present, and a nascent 5G ecosystem, we believe it will be negative for operators to spend over $7 billion on a project offering limited returns,” noted Deepti Chaturvedi, research analyst at CLSA, in a note to investors.

Further, with 275MHz spectrum available in 3.4-3.6GHz band and only three operators in play, there is enough supply. So, even if Reliance Jio bids in current auctions, incumbents led by Bharti Airtel can purchase spectrum in subsequent auctions.

Deferring purchase will likely also lead to a cut in price of spectrum. Historically, the govt has cut spectrum prices by 30-40 per cent if it saw no demand in the previous auction, Chaturvedi wrote.

Operators in South Korea, Japan and China have been granted 100-200MHz spectrum each in the 3.5-3.7GHz band for 5G services. Over past few months, commercialisation of 5G has also started with Korean operators introducing 5G plans and Samsung launching the first commercial 5G smartphone.

In USA, Verizon launched its mobile 5G service called 5G Ultra Wideband in April in a couple of cities and plans to expand this to another 20 cities in 2019.

Sweden’s Ericsson sees Brazil switching on 5G network by early 2021

Ericsson expects Brazil to switch on its fifth-generation (5G) network by early 2021, several months after a spectrum auction set for March next year, a top executive told Reuters.

The company is working closely with local operators and Brazilian telecoms regulator Anatel to test the technology ahead of the long-awaited auction, said Eduardo Ricotta, president of Ericsson Latam South.

He said the pace of 5G deployment in Brazil would depend on each carrier’s strategic plan, but it could take several months to switch on the ultrafast network once they win the spectrum rights, as work to avoid interference from other services is required.

“Cleaning up the bandwidth is necessary because some of the frequencies to be allocated to 5G might have interferences with satellites,” Ricotta said. “We are still conducting tests with Anatel to determine what has to be done, but deployment is likely between the end of 2020 and the beginning of 2021.”

https://telecom.economictimes.indiatimes.com/news/swedens-ericsson-sees-brazil-switching-on-5g-network-by-early-2021/70201234

Ericsson, Nokia, Huawei may suffer badly with Indian telcos set to curtail capex

They added that with balance sheets of the two telcos likely to be further weakened, existing tenancies and future growth of telecom tower companies like Bharti Infratel could be at risk as well.

Telecom gear makers such as Europe’s Ericsson and Nokia, and China’s Huawei could be staring at significant growth challenges with the Supreme Court’s ruling on adjusted gross revenue (AGR) likely to force their main clients Vodafone Idea Ltd. (VIL) and Bharti Airtel to curtail capex plans, say analysts.

With the balance sheets of the two telcos likely to be further weakened, existing tenancies and future growth of telecom tower companies like Bharti Infratel could be at risk as well, they said.

Rajiv Sharma, the co-head of research at SBICap Securities, said all vendors would be affected except Samsung (the Korean company sells equipment only to Reliance Jio Infocomm in India, and the country’s newest telecom operator isn’t affected by the judgement) because telcos’ capital expenditure plan would take a back seat.

“A sharp cut in the capex deployments over the next 12-18 months at the least is expected, and it could be prolonged. VIL will find it hard to do meaningful capex if they were to pay, and Airtel will also be selective,” Sharma added.

https://telecom.economictimes.indiatimes.com/news/ericsson-nokia-huawei-may-suffer-badly-with-indian-telcos-set-to-curtail-capex/71761382

A shadow over 5G?

Do consumers really want 5G? Will they pay any extra for the eye-watering data speeds that have been promised? Or is 5G an answer in search of a question? In recent months, the technology hype cycle has continued to run its course, with a broad range of reports and commentators interrogating the 5G value proposition.

Some of this analysis is pertinent -– for example, relating to the urgent need to improve deployment regulation as well as planning and orchestration tools to cut costs and maximise assets in dense networks. And some of it is weirdly occult – only even number radio iterations (i.e. 2G, 4G) turn out to be successful. Real Wireless CTO Simon Fletcher attempts to bring some balance to the debate.

https://www.real-wireless.com/5g-behind-the-hype/?

Reducing 5G’s energy consumption is ‘an industry responsibility’, says Ericsson

A new report from Ericsson argues that it will be possible to overcome 5G networks “energy curve”

From 2G to 4G, the increase in energy demand from generation to generation of mobile technology has been steady and predictable. With more data traffic comes higher power consumption, and some operators are predicting that 5G will double their current power usage once fully deployed.

But it does not have to be this way, suggests a new report from Swedish vendor Ericsson.

The report outlines a four-point strategy for tackling the issue of power consumption, paraphrased here:

1) Modernising the network by replacing old, inefficient tech, rather than simply adding to it

2) Utilising energy saving software to reduce energy demand while retaining network performance

3) Optimising the 5G network through using new tech to minimise the need for hardware

4) Capitalising on AI to increase site infrastructure efficiency

It will come as no surprise that all these points can be facilitated with Ericsson technology. The company’s Energy Infrastructure Operations solution, for example, can offer a decrease of up to 15% in energy-related OpEx and 30% in energy-related outages.

Nonetheless, it is interesting that the report suggests that new technologies made possible or enhanced by 5G, like AI and machine learning, could play a significant role in reducing power consumption. In a sense, 5G will go some way to solving its own network efficiency problems, but there is still much to be done on the part of the operators.

“With this new report, we answer the billion-dollar question: is it possible to quadruple data traffic without increasing energy consumption? We believe that it is not only an option, it is an industry responsibility,” said Erik Ekudden, Eriksson’s senior VP, CTO and head of group function technology. “We are now sharing our insights into how the industry can achieve this new reality.”

With the world in a climate crisis, the telecoms industry is slowly increasing the pace of its environmental projects. Many operators have already pledged to go carbon neutral, but the target dates vary widely. O2, for example, recently announcing its new 2025 target, but rival BT still wants another quarter of a century to reach its target, currently aiming for carbon neutrality in 2045.

Some operators are doing a much better job – Finnish operator Elisa earlier this week announcing that it was on course to achieve carbon neutrality this year – but for the rest of the industry reducing energy consumption should be a priority when deploying 5G, not an afterthought.

As operators around the world race to deploy 5G as quickly as possible, energy efficiency should be at the forefront of their mind. An efficient strategy to deploying 5G will not only save them money but could also help save the planet.

https://www.totaltele.com/505201/Reducing-5Gs-energy-consumption-is-an-industry-responsibility-says-Ericsson