Month: December 2018

SCWS Americas: Verizon and AT&T 5G Roadmaps Differ on FWA vs mobile “5G”

Verizon has no plans for linear or on-demand (or any other form) of pay TV for its “5G” FWA (Fixed Wireless Access) based residential/Verizon Home broadband service, according to Bill Stone, the company”s VP of technology development and planning. Stone stated that in a question from this author (during the Q&A session after his second presentation) at the excellent SCWS Americas conference in Santa Clara, CA on December 5, 2018. Instead, Verizon has a partnership with YouTube TV (first three months free) to provide OTT video to its FWA customers. Verizon Home customers get a free Apple TV 4K or Google Chromecast Ultra (Internet TV adapters with HDMI connection to the customer’s TV) when they sign up for 5G Home service.

Stone also said that Verizon’s FiOS will continue to offer higher speeds than its 5G Home service, which will transition from its proprietary “5G TF” spec to 3GPP release 15 5G NR NSA (non stand alone) in the near future. He told me privately that any wireless base station vendor that supports 5G NR would be able to interoperate on the carrier’s 5G FWA network (we don’t think so for many reasons). Verizon’s 5G Home service is currently available in Houston, Indianapolis, Los Angeles and Sacramento.

Stone noted with pride that the mega carrier continues to bolster its 4G LTE network with new technologies. “LTE has a lot of runway left,” Bill said to the audience.

Verizon currently says that customers of its 5G Home service will receive download speeds of at least 300 Mbps. A video was shown of satisfied customers who all got download speeds of 800 Mbps or higher. The mega carrier said that speeds can range up to 1 Gbps depending on customers’ location in relation to the towers for the service.

Verizon currently charges new customers $70 per month for 5G Home service, but only $50 per month for existing customers (with 1st three months free) who also subscribe to the carrier’s $30/month mobile data plan. Voice is offered along with high speed Internet access, but no pay TV is available as with FiOS.

“The peak data rates here in millimeter-wave will definitely increase,” Stone told the audience. Verizon currently runs its 5G Home service in its 28 GHz licensed spectrum in 400 MHz channels. But he said the carrier has the ability to increase that spectrum allotment to 600 MHz and 800 MHz channels (Verizon owns huge amounts of millimeter-wave spectrum via its purchases of XO and Straight Path). Stone explained that expanding the service’s spectrum channels would both increase user speeds and increase Verizon’s network capacity. Verizon will move from 400 MHz to 800 MHz, and that will result in the speeds and capacity available would double as a result.

Currently, the antennas and receivers for Verizon’s Home broadband service are installed by “white glove” professional technicians. In the future, the carrier is planning to offer a self-installation option for its 5G Home service. “Over time the goal is to introduce the ability to drop ship equipment that the customer can install on their own,”

Stone said, without providing a timeline for such a move. tone touched on several other data points for its FWA home broadband service:

- 50% of Verizon’s 5G Home customers do not subscribe to the operator’s mobile service.

- The service can transmit 1 Gbps downstream up to 3,000 feet.

- The millimeter-wave service works in conditions including rain, snow and non-line-of-sight scenarios. Indeed, Stone said some transmissions work better in non-line-of-sight scenarios than when customers are within sight of the tower, due to the fact that millimeter-wave transmissions can reflect off various objects in order to reach their intended destination.

- Verizon’s 5G Home customers are switching to the carrier from a variety of other service providers, though no details were provided.

- Verizon ultimately expects to expand 5G Home to 30 million households at some unspecified time in the future, though Dunne said the carrier may revisit that figure as the company’s rollout progresses.

- Verizon won’t build any more locations with its 5GTF equipment, and will instead wait for 3GPP release 15 5G NR equipment to become available before expanding to additional neighborhoods and cities. However, the implementation of 5G NR by vendors will initially be non stand alone (NSA), which means its dependent on a LTE core network and LTE signaling. That may differ amongst wireless base station vendors as will the frequencies used for different 5G NR carrier networks.

- Verizon is making significant progress toward implementing vRAN technology on its 5G network, working with its vendors—including Ericsson, Samsung and Nokia—to virtualize the lower layers of its network in addition to the upper layers. The process of virtualizing the baseband functions in the RAN is part of a broader trend in the wireless and wider telecom industry in which operators are increasingly looking to move away from expensive, dedicated hardware from traditional suppliers and toward general-purpose compute servers running (mostly) open source software.

- Verizon remains interested in providing edge computing services, services he said the operator could sell to companies looking to provide offerings ranging from drones to autonomous vehicles. Verizon’s efforts in edge computing stem from the carrier’s moves to densify its network and to virtualize parts of its network functions. Those efforts, Stone said, would create a foundation for Verizon to eventually run edge computing sevices for third parties.

5G Home is one of many services Verizon plans to offer via 5G network technology with mobile 5G (again, based on 3GPP release 15 “5G NR”o NSA) being the next “5G” offering. When mobile “5G” is deployed in the 11st half of 2019, the Motorola moto z3 smartphone, paired with the 5G moto mod and a Samsung 5G smartphone will be available. So will an Inseego 5G hotspot that can access Verizon’s mobile network.

Addendum: 5G is one network, multiple use cases, Verizon CEO says

Last week at the UBS Global Media and Communications Conference, Verizon CEO Hans Vestberg touted the carrier’s 5G home residential broadband service as complementing its wired Fios offering while extending the ability to provide a wireless alternative to home connectivity. While the fixed wireless access service is only available in four markets, the carrier said half of the customers are new to the company.

In a discussion with John Hodulik of UBS Investment Bank and HSBC analyst Sunil Rajgopal, Vestberg said 5G Home comes with a guaranteed 300 Mbps but its millimeter wave spectrum can support up to 800 Mbps or 900 Mbps.

“It’s a totally different way to doing broadband, meaning, instead of having a cord into the house, you have a wireless wave into the house, but the experience is the same in the house. And I think that’s a big opportunity for us. We have one footprint of Home, and that’s the Northeast where we have our Fios footprint. For the rest of the country, we don’t have it. So of course, we see that as an opportunity.”

…………………………………………………………………………………………………………………………………………………………………………………………………….

In a SCWS Americas keynote speech, title “Building our 5G network,” Al Burke, AT&T Assistant Vice President – RAN Hardware and Software Development, described the progress the carrier has made in upgrading its network for 5G. The key points he made were:

- 5G will facilitate and support new applications such as VR/AR, remote surgery (Bill said he doesn’t want to be one of the first patients), connected cars, etc.

- Small cells will be an integral part of 5G networks and “bring them to fruition”

- By the ned of 2017, 55% of AT&Ts network functions were virtualized (I take that to mean they were implemented as software running on commodity compute servers)

- There have been huge shifts in AT&Ts network in the last few years:

1. From hardware to software implementations (e.g SDN, NFV);

2. From centralized to decentralized control (e.g. EDGE computing)

3. From observation (of network events, alerts, alarms) to insight via AI/ML (e.g.AT&T’s INDIGO)

- Open RAN (ORAN) is the way to move forward. Via disaggregation of RAN functions with well defined interfaces, ORAN is “open, modular, enables automation, and is lower cost. ORAN results in interchangeable network modules (from different vendors) vs vendor proprietary equipment.

AT&T’s 5G Roadmap (only mobile 5G was shown on Al Burke’s slide – nothing on fixed 5G):

- 2019: 5G NR access with LTE Core network and LTE Access (=signaling?). The spectrum for AT&Ts initial mobile 5G rollout was not disclosed, but many believe it will be mmWave.

- 2020-2022+: 5G NR access with 5G Core network (3GPP Release 16 SA or IMT 2020?); also LTE Core with LTE Access

- 2019-2022+: mmWave NR : Evolution to Ultra High Speed and lower latency

- End of 2019-2022+: (unspecified time frame?), AT&T will provide sub 6 GHz 5G coverage in the U.S. speed and latency; dedicated & shared spectrum (LTE-NR-Coexistence)

…………………………………………………………………………………………………………………………………………………………………………………………………………….

When AT&T introduces its “5G” FWA residential service it will be based on LTE, according to Mr. Burke. In answer to a question from this author during the Q&A session, he said it would start as LTE but then transition to 5G NR based FWA. The spectrum to be used was not revealed, but you can assume it will be mmWave (like Verizon’s 5G Home).

Author’s Closing Comments:

A claim we’ve heard before (by Ericsson and Vodafone), but don’t believe: LTE network and terminal equipment will upgrade to 5G NR via “only a software upgrade.”As noted many times by this author and others,

AT&T has repeatedly stated they would roll out “standards based 5G” in 12 cities by the end of 2018 (they have only 3 weeks to fulfill that promise) and 19 cities in 2019. Some of the cities identified by AT&T for the 2018 launch include Houston TX, Dallas TX, Atlanta TX, Waco TX, Charlotte NC, Raleigh NC, Oklahoma City OK, Jacksonville FL, Louisville, KY, New Orleans LA, Indianapolis IN, and San Antonio TX.

How long can AT&T claim their “5G” network is standards based when they only support 3GPP release 15 “5G NR” NSA access with a LTE core network and LTE signaling? The ONLY 5G RAN/RIT standard is IMT 2020 which won’t be completed till the end of 2020.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Fierce Wireless writes about what to expect from AT&T’s 5G mobile service. We’d like to know How much will it cost? And who will subscribe when only a WiFi hotspot with 5G backhaul is offered?

Verizon, Samsung & Qualcomm achieve 1.7 Gbps in mobile 5G test; 5G smartphone for VZ and AT&T

Verizon, Samsung and Qualcomm report achieving a speed of 1.7 Gbps [1] through a mobile 5G connection while using the 28 GHz band. The test took place at Qualcomm’s San Diego, CA facilities, using Samsung’s 4G LTE and 5G NR gear, Verizon’s 28 GHz spectrum and a Qualcomm Snapdragon X50 5G modem.

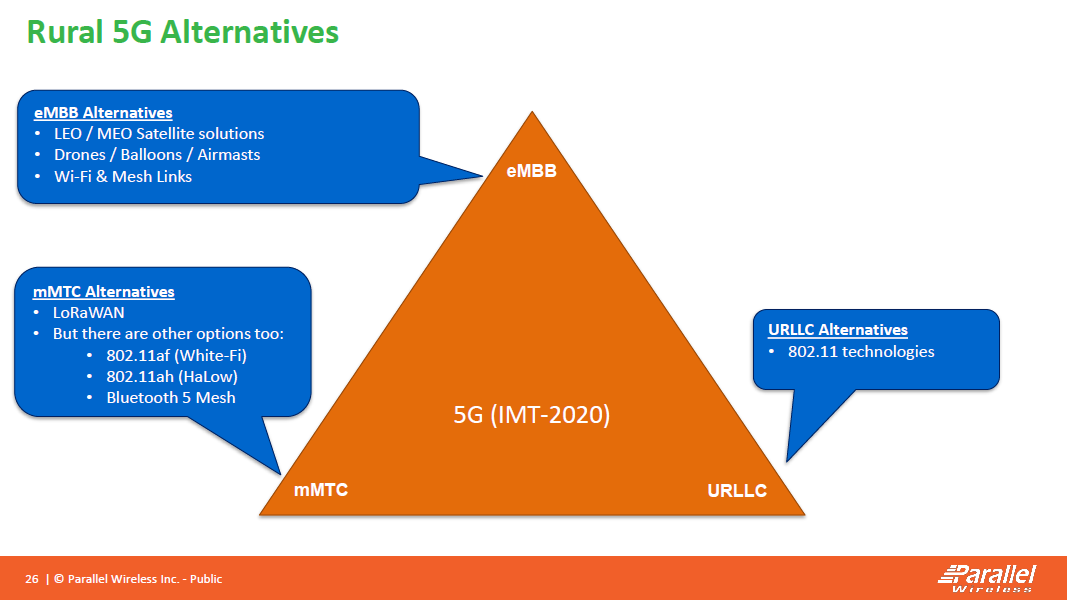

Note 1. For IMT 2020, the minimum requirements for peak data rate are: – Downlink peak data rate is 20 Gbit/s. – Uplink peak data rate is 10 Gbit/s. Recommendation ITU-R M.2083 defines eight key “Capabilities for IMT-2020”, which form a basis for the 13 technical performance requirements. Recommendation ITU-R M.2083 also recognizes that the key capabilities will have different relevance and applicability for the different usage scenarios addressed by IMT-2020 (enhance mobile broadband, massive machine to machine communications, and ultra reliable, low latency communications).

………………………………………………………………………………………………………………………………………………………………………………………….

“Successful inter-operation of multiple network technologies takes us another step closer to the commercialization of 5G mobility services,” Woojune Kim, the Senior Vice President and Head of North American Business at Samsung Electronics’ Networks Business said in a press release. “We are proud to join with Verizon and Qualcomm Technologies to spotlight the next steps driving network evolution. The use of substantial mmWave spectrum and EN-DC demonstrates how a seamless 5G/LTE approach succeeds in delivering high-speed, high-capacity mobility on next-generation networks.”

The year ahead likely will bring much news about the device market, which promises to be challenging. Indeed, the news seems to be picking up before the year arrives.

Verizon and Samsung said that they will bring a 5G smartphone [2] to market during the first half of 2019. They said that plans are to unveil a proof-of-concept 5G smartphone during the Qualcomm Snapdragon Technology Summit in Maui. The device seems similar to the one used in the data testing. It includes the Snapdragon Mobile Platform featuring the Snapdragon X50 5G NR modem and antenna modules with integrated RF transceiver, RF front-end and antenna elements.

Note 2. Samsung showed a prototype design of its first 5G phone at the Qualcomm Summit, one that it promised will launch with Verizon and AT&T in the first half of 2019. Those “5G” networks will be based on 3GPP Release 15 “5G NR” non stand alone (dependent on a LTE core network). The phone “is the result of years of collaboration to deploy an end-to-end solution for commercial 5G services using Samsung network equipment and personal devices,” the companies said in a press release.

……………………………………………………………………………………………………………………………………………………………………………….

AT&T also said that it will offer a Samsung 5G smartphone during the first half of the year. Cities AT&T is targeting for mobile 5G in 2019 are Atlanta; Charlotte, N.C.; Dallas; Houston; Indianapolis; Jacksonville; Louisville; Oklahoma City; New Orleans; Raleigh; San Antonio and Waco, Texas; Las Vegas; Los Angeles; Nashville; Orlando and San Diego, San Francisco and San Jose, CA.

……………………………………………………………………………………………………………………………………………………………………………………..

Verizon Tests Interoperable 5G and LTE Technology, Achieves Mobile 5G Speed of 1.7 Gbps

Verizon, Samsung & Qualcomm achieve 1.7 Gbps in mobile 5G test; 5G smartphone for VZ and AT&T

Verizon, Samsung and Qualcomm report achieving a speed of 1.7 Gbps [1] through a mobile 5G connection while using the 28 GHz band. The test took place at Qualcomm’s San Diego, CA facilities, using Samsung’s 4G LTE and 5G NR gear, Verizon’s 28 GHz spectrum and a Qualcomm Snapdragon X50 5G modem.

Note 1. For IMT 2020, the minimum requirements for peak data rate are: – Downlink peak data rate is 20 Gbit/s. – Uplink peak data rate is 10 Gbit/s. Recommendation ITU-R M.2083 defines eight key “Capabilities for IMT-2020”, which form a basis for the 13 technical performance requirements. Recommendation ITU-R M.2083 also recognizes that the key capabilities will have different relevance and applicability for the different usage scenarios addressed by IMT-2020 (enhance mobile broadband, massive machine to machine communications, and ultra reliable, low latency communications).

………………………………………………………………………………………………………………………………………………………………………………………….

“Successful inter-operation of multiple network technologies takes us another step closer to the commercialization of 5G mobility services,” Woojune Kim, the Senior Vice President and Head of North American Business at Samsung Electronics’ Networks Business said in a press release. “We are proud to join with Verizon and Qualcomm Technologies to spotlight the next steps driving network evolution. The use of substantial mmWave spectrum and EN-DC demonstrates how a seamless 5G/LTE approach succeeds in delivering high-speed, high-capacity mobility on next-generation networks.”

The year ahead likely will bring much news about the device market, which promises to be challenging. Indeed, the news seems to be picking up before the year arrives.

Verizon and Samsung said that they will bring a 5G smartphone [2] to market during the first half of 2019. They said that plans are to unveil a proof-of-concept 5G smartphone during the Qualcomm Snapdragon Technology Summit in Maui. The device seems similar to the one used in the data testing. It includes the Snapdragon Mobile Platform featuring the Snapdragon X50 5G NR modem and antenna modules with integrated RF transceiver, RF front-end and antenna elements.

Note 2. Samsung showed a prototype design of its first 5G phone at the Qualcomm Summit, one that it promised will launch with Verizon and AT&T in the first half of 2019. Those “5G” networks will be based on 3GPP Release 15 “5G NR” non stand alone (dependent on a LTE core network). The phone “is the result of years of collaboration to deploy an end-to-end solution for commercial 5G services using Samsung network equipment and personal devices,” the companies said in a press release.

……………………………………………………………………………………………………………………………………………………………………………….

AT&T also said that it will offer a Samsung 5G smartphone during the first half of the year. Cities AT&T is targeting for mobile 5G in 2019 are Atlanta; Charlotte, N.C.; Dallas; Houston; Indianapolis; Jacksonville; Louisville; Oklahoma City; New Orleans; Raleigh; San Antonio and Waco, Texas; Las Vegas; Los Angeles; Nashville; Orlando and San Diego, San Francisco and San Jose, CA.

……………………………………………………………………………………………………………………………………………………………………………………..

Verizon Tests Interoperable 5G and LTE Technology, Achieves Mobile 5G Speed of 1.7 Gbps

IHS Markit: SD-WAN revenue reached $284M in 3Q-2018

Cloud service providers to offer SD-WAN, and telcos hedge their bets by choosing multiple SD-WAN vendors. SD-WAN (appliance + control and management software) revenue reached $284M in 3Q18, up 23% QoQ. VMware led the SD-WAN market with 19% share of 3Q18 revenue, Cisco moves into second with 13% revenue share, and Aryaka is in close third, according to the DC Network Equipment market tracker early edition from IHS Markit by Cliff Grossner, PhD.

In 3Q18, VMware and Azure announced an SD-WAN partnership worth closer scrutiny, as Azure wants to offer backbone connectivity as part of its service, allowing customers to “exit” to the Internet at different points of presence. This means Azure DCs are no longer only an end point, potentially making Azure competitive with other global networking providers.

Citrix, Versa Networks and Riverbed also announced availability of their SD-WAN offerings via Azure and AWS. Oracle took this one step further by stating its intent to acquire Talari Networks to enable greater connectivity to its Oracle Cloud offering; it also integrated Aryaka’s SD-WAN capabilities, giving its enterprise customers a choice of SD-WAN provider

“Cloud service providers have begun to realize the importance of bundling SD-WAN as part of a cloud service, ensuring a positive user experience when utilizing SaaS-based applications such as Office 365 or while migrating workloads to AWS or Microsoft Azure.”said Cliff Grossner, senior research director and advisor for cloud and data center at IHS Markit (Nasdaq: INFO), a world leader in critical information, analytics and solutions.

“Although the SD-WAN market is maturing, we still see a plethora of SD-WAN vendors in the market, and carriers are beginning to show concerns that when integrating an SD-WAN vendor into their network, there is a risk the SD-WAN vendor could be acquired or drastically change offerings in a year. As a result, carriers are selecting multiple SD-WAN vendors, creating frustration and integration complexity when there is a lack of interoperability with carrier APIs” said Josh Bancroft, senior research analyst at IHS Markit (Nasdaq: INFO), a world leader in critical information, analytics and solutions.

More Data Center Network Market Highlights

· 3Q18 ADC revenue increased 2% from 2Q18 to $457M and declined 3% from 3Q17

· Virtual ADC appliances stood at 34% of 3Q18 ADC revenue

· F5 garnered 49% ADC market share in 3Q18 with revenue up 4% YoY. Citrix had the #2 spot with 26% of revenue, and A10 (8%) rounded out the top 3 market share spots.

Data Center Network Equipment Report Synopsis

The IHS Markit Data Center Network Equipment market tracker is part of the Data Center Networks Intelligence Service and provides quarterly worldwide and regional market size, vendor market share, forecasts through 2022, analysis and trends for (1) data center Ethernet switches by category [purpose built, bare metal, blade and general purpose], port speed [1/10/25/40/50/100/200/400GE] and market segment [enterprise, telco and cloud service provider], (2) application delivery controllers by category [hardware-based appliance, virtual appliance], and (3) software-defined WAN (SD-WAN) [appliances and control and management software]. Vendors tracked include A10, ALE, Arista, Array Networks, Aryaka, Barracuda, Cisco, Citrix, CloudGenix, CradlePoint, Cato, Dell, F5, FatPipe, Fortinet, HPE, Huawei, Hughes, InfoVista, Juniper, KEMP, Nokia (Nuage), Radware, Riverbed, Silver Peak, Talari, TELoIP, VMware, Versa, ZTE and others.

IHS Markit: 2G, 3G and LTE hardware revenues -8% YoY; 5G ramping up

By Stéphane Téral, executive director, mobile infrastructure and carrier economics, IHS Markit

Highlights

- Total combined 2G, 3G, 4G and 5G infrastructure hardware revenues are forecast to bottom out at $49.7 billion in 2018, declining 8 percent over the previous year.

- Global 5G hardware revenue is expected to reach $19 billion in 2022, starting from a very low base of early adopters in the United States in the second half of 2018, followed by 5G rollouts in South Korea and massive 5G trials set for China in 2019.

IHS Markit analysis

After more than two decades of existence, the global mobile infrastructure hardware market – including all types of radio access network (RAN), switching and core equipment – has reached maturity. It now fluctuates between $31 billion and $48 billion annually, depending on macroeconomic cycles and shifts in technology generations. The 2G and 3G markets are both continuing to decline, as 4G reached maturity after its rollout peak in 2015. Today, 5G is on the imminent horizon, with the first rollouts occurring in the second half of 2018.

Fueled by LTE upgrades and the start of 5G rollouts in the third quarter of 2018, hardware revenue was stronger than it was the rest of the year. Continuing LTE activity in the US again propelled sequential double-digit growth in the North American market. There was also moderate activity in Europe and South Korea and other countries in Asia. In China, which has the world’s largest LTE footprint of 4 million E-UTRAN Node Bs (eNodeBs), the market dipped significantly again at the end of the first half of the year.

It’s still an LTE world, as we know it

LTE continues its penetration around the world, becoming even more ubiquitous globally. Although preparing existing LTE footprints for 5G upgrades is bringing much-needed fuel to the mobile infrastructure market, LTE deployment volume is far from its peak level as the number of LTE-upgradable mobile networks continues to diminish significantly. 5G is not expected to create a major investment spike any time soon, and mobile network operators are still struggling to deliver a compelling business case for 5G, even as LTE is delivering more 5G-like elements and services as it develops.

5G plans around the world

In order to leverage the LTE network, most service providers are starting their 5G rollouts with 5G non-standalone (NSA) New Radio (NR) technology, as follows:

- United States: AT&T’s and Verizon’s initial rollouts of 5G NSA NR 28 gigahertz (GHz) and 39 GHz for enhanced mobile broadband (eMBB) and fixed wireless access (FWA) use cases, respectively, have started as planned in the second half of 2018. Verizon launched its 5G FWA service in October, using its own 5G Technical Forum (5GTF) standard. Sprint is deploying 5G in its 2.6 GHz by implementing massive multiple-input multiple-output (MIMO) for eMBB services, while T-Mobile is targeting coverage with the 600 megahertz (MHz) spectrum band.

- South Korea: SK Telecom, LG U+ and KT recently turned on their 5G networks, beginning the launch of commercial 5G services in the country. The country’s three telecommunications companies [1] have already deployed a few thousand 5G NR units — LG U+ alone already has 4,000 in Seoul — and are gearing up for 5G eMBB commercial launch at 3.5 GHz and 28 GHz with NSA NR in the first quarter of 2019.

- China: The country is gearing up for its massive 5G trial in 2019 and has already started minor trials this year. China Unicom pledged to roll out more than 300 5G NRs. Trials will be conducted in six cities, to test 5G connectivity, coverage and mobility. China will increase 5G NR volumes very quickly, having so far shown little interest in 5G NSA NR.

- Japan: Moderate 5G rollouts are planned for 2019, to test the technology during the Rugby World Cup. The country will also showcase potential 5G services — 4.5 GHz and 28 GHz — during the 2020 Tokyo Olympics, followed by a commercial launch in 2021. A nationwide 5G launch is not expected until 2023.

- United Kingdom: EE, the leading mobile network in the UK and part of BT Group, is rolling out 5G, to switch on 5G sites in 16 cities in 2019.

Note 1. At yesterdays excellent SCWS Americas conference, Ki Seok Yang, Manager, Access Network Lab introduced SK Telecom’s in-building service in LTE: improving network quality and capacity in 5G which included an in building 5G repeater. After his talk he told me that SK Telecom and the two other South Korea wireless network operators have been coordinating and collaborating their 5G network specs and IMT 2020 RIT contributions. That will ensure there is a comov 5G spec implemented on all of Korea’s 5G networks, which is very much UNLIKE the U.S. where each carrier will have their own version of 5G, based on 3GPP NR non standalone (LTE Core network), Suc carrier collaboration might be inferred from the IEEE Techblog post titled South Korean Mobile Operators to Launch 5G Simultaneously on Korea 5G Day.

Mr. Yang sai that South Korea’s Telecommunications Technology Association (TTA) facilities that coordination and collaboration covers telecommunications, information technology, radio communications and broadcasting. The Association establishes industry standards and has been instrumental in creating the current Korean Information and Communication Standards. TTA also collaborates with international and national standards organizations, such as ITU and other organizations.

Mobile Infrastructure Market Tracker – Regional

The “Mobile Infrastructure Market Tracker” from IHS Markit provides quarterly data and analysis for the 2G, 3G, 4G and 5G mobile infrastructure market – including market size, vendor market share, forecasts and market trends.

Dell’Oro: 5G Mobile Backhaul + WDM equipment market grew 15% in 3Q-2018

- 5G MOBILE BACKHAUL ISN’T ALL FIBER:

Point-to-point microwave has a place in the future

Mobile radio technology is moving from 4G to 5G, but it cannot move in isolation. Operators learned this valuable lesson with the move to 4G. In particular, the transport layer, often referred to as mobile backhaul, became a network choke point at cell sites with upgraded 4G mobile radios and legacy backhaul systems. To avoid these past mistakes, operators are placing as much emphasis on the transport layer as they do on 5G mobile radios.

5G will need more backhaul capacity

One area of concern for operators planning their transport layer is determining whether the mobile backhaul network must shift away from wireless systems, such as point-to-point (PTP) microwave, to fiber-based systems, such as packet transport network (PTN) systems.

The main issue, of course, is not the cost of the equipment; it is the cost of either installing fiber, maintaining fiber (ex. fixing fiber breaks), or leasing fiber. One of the benefits of a wireless backhaul system is the freedom from incurring the high cost of owning a large fixed asset—a fiber plant.

The second issue is operators have already invested a large amount of resources (time and money) on the 4G backhaul network using a mix of fiber and wireless systems. We estimate that by the end of 2017, the percentage of macro cells using wireless backhaul systems was approximately 45%, so one can imagine the cost if all those cell sites have to be retrofitted with fiber links. The good news for the operators and major microwave vendors—Ceragon, Ericsson, Huawei, 5G mobile backhaul isn’t all fiber NEC, and Nokia—is that we do not think this will be the case. In fact, we think that 5G will bring back a growing demand for PTP microwave. In our latest study of mobile backhaul and microwave (July 2018), we assessed that operators have installed fiber and microwave backhaul capacities ranging from 50 Mbps to 500 Mbps in their 4G networks. Therefore, with a 500 Mbps backhaul link, a mobile phone user will likely experience a peak download speed ranging from 65 Mbps to 130 Mbps in a non-congested area, based on factors such as the distance from the antenna, number of antenna sectors, and spectrum. With a 50 Mbps backhaul link, the user peak download speeds should be about 1/10th of those values.

Is this capacity enough for 5G? Perhaps initially but it is unlikely for the long term. That being said, we also predict that only a few sites will be installed to operate at the maximum 5G advertised user download rate of 20 Gbps.

We think that in most cases, a 5G mobile radio network will double or triple the user download speed from what users have experienced with 4G. Research we have seen states that the average 4G user experiences only about 20 Mbps of download speed with the more developed countries such as Singapore and South Korea averaging closer to 50 Mbps. Therefore, if an operator aspires to triple this download speed, a cell site with six sectors would likely require no more than about 1 Gbps of backhaul capacity, which can be accomplished with PTP microwave. The latest microwave systems operating in E-band (70/80 GHz) have 10 Gbps of link capacity over a single carrier and 20 Gbps over dual carriers. Hence, the use of wireless backhaul systems becomes a point of congestion only when the backhaul link capacity requirement exceeds 20 Gbps, which can provide a user download speed exceeding 2.5 Gbps. Simply stated, PTP microwave will meet the capacity demands of most 5G macro cell sites for many years to come, and operators that want to stay with wireless backhaul over fiber can continue to do so with 5G.

https://www.telecomasia.net/system/files/story/file_attachments/5GInsights_1118_digital.pdf

Editor’s Note: We were told today at the SCWS Americas conference in Santa Clara, CA.. that 5G backhaul could be 5G itself, microwave or (more likely) fiber. It all depends on densification of the network, e.g. number of small/macro cells within a given geographical area.

…………………………………………………………………………………………………..

- The optical transport WDM equipment market grew 15% year-over-year in the third quarter, according to a report by Dell’Oro Group.

The majority of the optical transport WDM equipment growth occurred in the Asia Pacific region, according to the report. In the third quarter, coherent wavelength shipments increased 30%.

Service providers are replacing legacy gear to accommodate the growth of higher speed fixed broadband and data center interconnection, which has, for the most part, driven up WDM equipment shipments.

Shipments of 100 Gbps wavelengths increased by nearly 15% year-over-year while shipments of 200 Gbps and higher wavelengths more than doubled over the same time frame. Over the past few years, service providers have been migrating from 100 Gbps to 200 and 400 Gbps.

The top third-quarter manufacturers of WDM systems on a revenue basis were Huawei, Ciena, ZTE, and Nokia.

“The Optical market outperformed in the third quarter,” said Jimmy Yu, Vice President at Dell’Oro Group. “All of the growth was driven by rising demand for coherent wavelengths in metro and long haul WDM systems. Shipment of 100 Gbps wavelengths continued to rise, but it was a newer, higher speed wavelengths operating at 200 Gbps that truly moved the market revenue higher,” added Yu.

Additional highlights from the 3Q 2018 Optical Transport Quarterly Report:

- Majority of optical transport WDM equipment revenue growth occurred in the Asia Pacific region.

- Lead manufacturers of WDM systems on a revenue basis were Huawei, Ciena, ZTE, and Nokia.

- Shipment of 100 Gbps wavelengths grew nearly 15 percent year-over-year.

- Shipment of 200+ Gbps wavelengths (speeds higher than 100 Gbps) more than doubled year-over-year.

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 40 Gbps, 100 Gbps, 200 Gbps, and 400 Gbps). The report tracks DWDM long haul terrestrial, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, and data center interconnect (metro and long haul).

To purchase this report, please contact us at [email protected]

Optical Transport WDM Equipment Market Grew 15 Percent in 3Q 2018, According to Dell’Oro Group

ETTelecom survey: Challenges to 5G adoption in India

Availability of an inadequate ecosystem — spectrum and handsets – along with the financial burden on Indian telecom operators will prove to be the major challenges to adoption of 5G technology in the country, an ETTelecom 5G survey findings revealed.

A large portion of respondents believes that India will be ready to launch the technology commercially before 2022. However, 50% of the respondents who work at a telecom equipment vendor firms such as Nokia, Ericsson believe that 5G will be deployed during 2020.

About 80% executives from the industry further hold the view that 5G could account for more than 10% of operator revenues by 2023.

A large proportion of the respondents believe that an inadequate ecosystem in terms of spectrum and handsets (69%) and the financial burden on MNOs (68%) are the major challenges to 5G adoption in India. Moreover, 89% of the respondents working at C-level roles believe the financial burden on telcos be a major challenge.

Some respondents mentioned that lack of fiber for backhaul, and passive infrastructure such as towers and optical fiber cable will be some major challenges for telcos in India.

ETTelecom published a report on 5G evolution and roadmap in India in collaboration with Analysys Mason which showed that smart cities (70%) and high-speed broadband at home (69%) are the most relevant use cases of 5G in India.

Respondents working at telecom equipment vendors believed high-speed broadband at home to be the most relevant use case with 85% responding positively. Smart cities are the most relevant use case according to respondents currently working at telcos such as Airtel, Vodafone, Idea, Reliance Jio etc. with 78% mentioning it as a relevant use case.

The respondents also believe that smart manufacturing, smart home and cloud, AR/VR are also relevant to the Indian market.

Media and Entertainment driven by higher throughput on mobile broadband is believed to be the industry that will benefit the most from 5G and drive adoption with a large majority of the respondents (83%) believing so. Healthcare (64%) and automotive (60%) are other industries which the respondents feel will benefit from 5G and drive its adoption.

When it comes to industry’s expectations on the key spectrum bands for 5G, there is a mixed sentiment with no clear spectrum band getting more than 50% positive response. However, 67% of the respondents working at C-level positions expect the sub-1GHz band to be the preferred for 5G deployment.

68% of the respondents feel that fibre backhaul is the most important technology, which could be crucial towards deployment of 5G. Ultra-dense network of small cells (50%) and massive MIMO (48%) are other technologies that respondents believe could be crucial.

Also, 82% of the respondents working with Indian telcos believe fibre backhaul to be a crucial technology and 85% of those working at telecom equipment vendors believe the same.

53% of the respondents suggested that legacy technologies such as 2G and 3G could still co-exist with 4G and 5G by 2025, while 40% believe they will be replaced. However, 67% of the C-level respondents believe legacy technologies will be replaced and, on the other hand several users also point out that while 3G will be replaced, 2G will continue to co-exist.

A clear majority with 73% responses suggested that the initial rollout of 5G would be limited to urban pockets. Additionally, 59% of the respondents believe that 5G could cannibalize fixed broadband in India if it can offer high-speed broadband.

What about rural 5G which is needed in India?

For more insights, download ETTelecom-Analysys Mason’s 5G readiness in India report.

5G Network and Smartphone Update: AT&T Verizon and Qualcomm

AT&T is sticking to its “end of the year” 5G commercial deployment schedule, but no smartphones or tablets will be available at that time. AT&T plans to have 5G available in parts of 12 markets up by the end of the year. AT&T Communications CEO John Donovan. said AT&T’s 5G is expected to move into 19 cities (so far) in 2019. AT&T has told Light Reading that it has 5G sites live in Dallas and Waco, Texas now. But the operator has not yet launched its commercial 5G service.

The only confirmed 5G device announced for AT&T’s mobile 5G network is the Netgear Nighthawk 5G Mobile Hotspot, which AT&T calls a “puck.”

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13592246/Nighthawk_5G_Hotspot_crop.jpg)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/11914977/IMG_20180802_150637.jpg)

…………………………………………………………………………………………………………………………………………………………………………

“We believe the early 5G opportunities are going to be in enterprise,” Donovan said. He noted that AT&T’s work with Samsung Corp. on“robotic manufacturing” and augmented reality with Magic Leap Inc. will be future 5G enterprise offerings. 5G smartphones will be available in 2019, according to Donovan.

According to The Verge, Verizon will technically have a phone when it launches its mobile 5G offering in early 2019. If you buy the existing, Verizon-exclusive Moto Z3 which is advertised as “5G ready.” Verizon says its first 5G device will be a magnetic, modular 5G Moto Mod attachment you can snap onto that phone to add speedy 5G NR (3GPP Release 15) connectivity.

AT&T and Verizon both say they’re exclusively rolling out millimeter wave (mmWave) radios, which inherently provide far more bandwidth and capacity than today’s networks. But at 39GHz and 28GHz, those millimeter wave signals also don’t travel as far or penetrate buildings as easily as conventional cellular. That means you’ll probably drop down to LTE speeds when you transition indoors, and in order to cover the same area as today’s LTE cell towers, carriers will need to provide many more smaller cell sites. AT&T says it’s focusing on outdoor cells first, but is also looking at indoor ones for public venues like stadiums and concert halls.

……………………………………………………………………………………………………………………………………………………………………………

Qualcomm president Cristiano Amon expects the first real wave of 5G smartphones to arrive in Q2 2019 at the earliest. ”We are working, so as early as the second quarter of 2019, you’ll have smartphones being launched across the United States, across Europe, across South Korea, Australia. Some early in the quarter, some later in the quarter… they’re all going to be Android flagship devices,” says Amon. “You go to CES [in January], you’ll start to see a lot of phone announcements; you go to MWC [in February], you’ll see a lot of actual phone launches.”

Author’s Note: Don’t expect a 5G smartphone from Apple till 2020 at the earliest. The company is closely tracking the REAL 5G standard- ITU-R IMT 2020 which won’t be completed till year end 2020. Companion IMT 2020 standards from ITU-T won’t be finalized till 2021 or later.

………………………………………………………………………………………………………………………………………………………………………………………………

“We need to build a crescendo,” says Amon. “You’re not going to change your phone unless the battery life is higher, the form factor is attractive, and you need companies that can actually deliver the performance,” he added.

“Today you stream music everywhere. You don’t download music anymore; even if you have low coverage, you have enough quality to stream music. 5G will do that for video,” Amon says, before moving on to fancier, further-out predictions like unlimited storage and on-demand processing power from the cloud that can, he imagines, virtually cram the power of a Magic Leap-like augmented reality headset into a normal pair of glasses.”

The Verge says that Qualcomm will announce a new Snapdragon processor at its third annual Snapdragon Technology Summit next week in Maui. It is targeted at 5G NR smartphones. A “Snapdragon 1000” processor for a new wave of always-connected Windows laptops will also be introduced at the summit.

5G Network and Smartphone Update: AT&T Verizon and Qualcomm

AT&T is sticking to its “end of the year” 5G commercial deployment schedule, but no smartphones or tablets will be available at that time. AT&T plans to have 5G available in parts of 12 markets up by the end of the year. AT&T Communications CEO John Donovan. said AT&T’s 5G is expected to move into 19 cities (so far) in 2019. AT&T has told Light Reading that it has 5G sites live in Dallas and Waco, Texas now. But the operator has not yet launched its commercial 5G service.

The only confirmed 5G device announced for AT&T’s mobile 5G network is the Netgear Nighthawk 5G Mobile Hotspot, which AT&T calls a “puck.”

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13592246/Nighthawk_5G_Hotspot_crop.jpg)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/11914977/IMG_20180802_150637.jpg)

…………………………………………………………………………………………………………………………………………………………………………

“We believe the early 5G opportunities are going to be in enterprise,” Donovan said. He noted that AT&T’s work with Samsung Corp. on“robotic manufacturing” and augmented reality with Magic Leap Inc. will be future 5G enterprise offerings. 5G smartphones will be available in 2019, according to Donovan.

According to The Verge, Verizon will technically have a phone when it launches its mobile 5G offering in early 2019. If you buy the existing, Verizon-exclusive Moto Z3 which is advertised as “5G ready.” Verizon says its first 5G device will be a magnetic, modular 5G Moto Mod attachment you can snap onto that phone to add speedy 5G NR (3GPP Release 15) connectivity.

AT&T and Verizon both say they’re exclusively rolling out millimeter wave (mmWave) radios, which inherently provide far more bandwidth and capacity than today’s networks. But at 39GHz and 28GHz, those millimeter wave signals also don’t travel as far or penetrate buildings as easily as conventional cellular. That means you’ll probably drop down to LTE speeds when you transition indoors, and in order to cover the same area as today’s LTE cell towers, carriers will need to provide many more smaller cell sites. AT&T says it’s focusing on outdoor cells first, but is also looking at indoor ones for public venues like stadiums and concert halls.

……………………………………………………………………………………………………………………………………………………………………………

Qualcomm president Cristiano Amon expects the first real wave of 5G smartphones to arrive in Q2 2019 at the earliest. ”We are working, so as early as the second quarter of 2019, you’ll have smartphones being launched across the United States, across Europe, across South Korea, Australia. Some early in the quarter, some later in the quarter… they’re all going to be Android flagship devices,” says Amon. “You go to CES [in January], you’ll start to see a lot of phone announcements; you go to MWC [in February], you’ll see a lot of actual phone launches.”

Author’s Note: Don’t expect a 5G smartphone from Apple till 2020 at the earliest. The company is closely tracking the REAL 5G standard- ITU-R IMT 2020 which won’t be completed till year end 2020. Companion IMT 2020 standards from ITU-T won’t be finalized till 2021 or later.

………………………………………………………………………………………………………………………………………………………………………………………………

“We need to build a crescendo,” says Amon. “You’re not going to change your phone unless the battery life is higher, the form factor is attractive, and you need companies that can actually deliver the performance,” he added.

“Today you stream music everywhere. You don’t download music anymore; even if you have low coverage, you have enough quality to stream music. 5G will do that for video,” Amon says, before moving on to fancier, further-out predictions like unlimited storage and on-demand processing power from the cloud that can, he imagines, virtually cram the power of a Magic Leap-like augmented reality headset into a normal pair of glasses.”

The Verge says that Qualcomm will announce a new Snapdragon processor at its third annual Snapdragon Technology Summit next week in Maui. It is targeted at 5G NR smartphones. A “Snapdragon 1000” processor for a new wave of always-connected Windows laptops will also be introduced at the summit.