Why It’s IMPORTANT: Telefonica, Rakuten MOU on Open RAN, 5G Core Network and OSS

Rakuten Mobile, Inc., and Telefónica, S.A. announced today the signing of a Memorandum of Understanding (MoU) to cooperate on a shared vision to advance OpenRAN, 5G Core and OSS (operations support systems).

“We’re excited to collaborate with Telefónica on this shared vision of advancing OpenRAN,” said Tareq Amin, Representative Director, Executive Vice President and CTO of Rakuten Mobile. “I envision our partnership to also co-explore further development around the Rakuten Communications Platform that will enable operators around the world to take advantage of cost-effective cloud-native mobile network architecture that is secure and reliable.” (Emphasis added)

Amin emphasised the partnership is not just about opening the interfaces: “It’s about the future possibilities when these networks become fully autonomous. What makes a difference is automation, as it enables much needed operational savings. We’re going to spend a lot of energy around joint development of automation, especially what we call OSS transformation to move away from legacy systems.”

Enrique Blanco, Chief Technology & Information Officer (CTIO) at Telefónica, said: “Telefónica strongly believes that networks are evolving towards end-to-end virtualization through an open architecture, and OpenRAN is a key piece of the whole picture. Beyond the flexibility and simplicity that OpenRAN will provide, it will change the supplier ecosystem and revolutionise the current 5G industry in the medium and long term. At the same time, open and virtualized networks will lead to a new telco operating model. Telefonica and Rakuten Mobile have signed this MoU to work towards evaluating and demonstrating the capability and feasibility of OpenRAN architectures and make them a reality.”

“This is a massive opportunity for all of us. This is an inclusive approach and how we can guarantee we are building the network for the future,” Blanco added. In addition to defining the interfaces, the companies are exploring procurement of hardware and software, Blanco said.

Under the terms of the MoU, Rakuten Mobile and Telefónica plan to collaborate on the following:

- To research and conduct lab tests and trials to support OpenRAN architectures, including the role of the AI (Artificial Intelligence) in the RAN Networks.

- To jointly develop proposals for optimal 5G RAN architecture and OpenRAN models as part of industry efforts to achieve quicker time to market, new price-points, and the benefits of software-centric RAN.

- To collaborate in building an open and cost-effective 5G ecosystem, based on open interfaces, that will help accelerate the maturity of 5G with global roaming.

- To develop a joint procurement scheme of OpenRAN Hardware and Software that will help increase volumes and reach economies of scale, including CUs, DUs, RRUs, and other necessary network equipment and/or software components.

In addition, the companies will also jointly work on 4G/5G Core and OSS technology utilized by Rakuten Mobile in Japan and its Rakuten Communications Platform.

“Vendor selection typically takes a long time in the telecoms industry compared with the web-scale companies. Maybe together with Telefonica the discussions with vendors might change a bit and require us to create new business models.”

Telefonica plans to introduce open RAN in three phases, with pilots starting this year, initial rollouts in 2021 and mass deployments in 2022. “I’m extremely convinced we’ll hit these targets, but we are trying to be conservative,” Blanco said. From 2022 to 2025, up to half of Telefonica’s 5G deployments will use open RAN, he added.

Why this MOU is IMPORTANT:

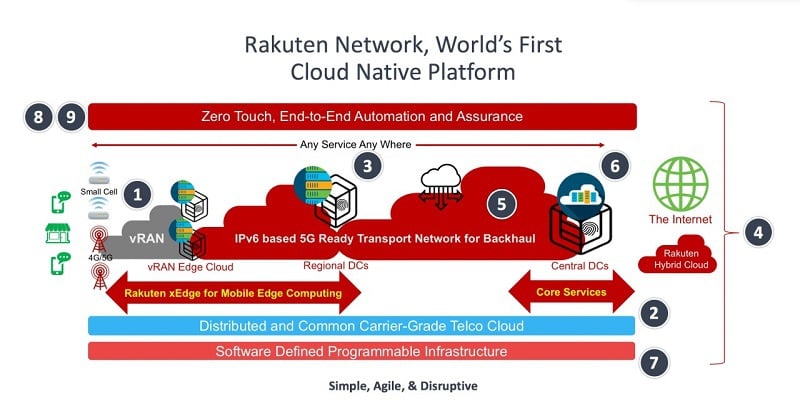

- As there are no ITU recommendations or 3GPP specs detailing how to implement a 5G Core/5G SA network, the Rakuten-NEC 5G core could become a defacto standard. As we’ve stated many times, the 3GPP specs on 5G Core are network architecture specs that leave the various implementation choices to the implementer. And 3GPP is not even sending their 5G non-radio specs to ITU-T for consideration as future recommendations.

- Meanwhile, Rakuten and NEC have created a 5G “cloud native” core spec (proprietary of course) built on containers, which NEC (and likely other vendors) will implement in Rakuten’s 5G network. Rakuten and NEC plan to offer there 5G Core as a product to other 5G network operators.

- The Rakuten Communications Platform for Open RAN could similarly be sold to other carriers that want to deploy an Open RAN 4G/5G network. The catch here is that any legacy wireless carrier wanting to do so would have to support two incompatible sets of cellular infrastructure to serve its customers: 1] The traditional “closed box base stations” (from Huawei, Ericsson, Nokia, Samsung, ZTE, etc) in cell towers AND 2] The new Open RAN, multi-vendor base stations using totally different hardware/software platforms which requires a significant amount of systems integration and tech support/trouble resolution. Rakuten’s platform could, at the very least, simplify systems integration and avoid “finger pointing” when troubleshooting a failure or degraded service.

- Both the Rakuten-NEC 5G Core and Rakuten Communications Platform for Open RAN could be terrific products to sell to greenfield carriers (with no existing wireless infrastructure). Apparently, that’s too late for Dish Network and Reliance Jio, which claim they’re building their own “open 5G” network. Meanwhile, India based Tech Mahindra claims it can build a complete 5G network now, which they would surely sell to would be 5G network providers, utilities, and government agencies around the world.

- The OSS co-operation amongst these two carriers is significant, because (once again) there are no standards for 5G SA OSS’s such that the deliverable output of cooperation here could become a defacto standard.

- Co-operative work on automation of network functions and operations will also be vitally important. Otherwise, that too will be proprietary to the wireless network provider which would require different software for the SAME functions for different carriers. The work will probably start with these 2800 series 3GPP specs: TS 28.554 Management and orchestration; 5G end to end Key Performance Indicators (KPI); TS 28.555 Management and orchestration; Network policy management for 5G mobile networks; Stage 1 TS 28.556 Management and orchestration; Network policy management for 5G mobile networks; Stage 2 and stage 3. There are similar ITU-T SG 13 high level Recommendations on these subjects.

Image Credit: STL Partners

………………………………………………………………………………………………………………………………………………………………………………

About Rakuten Mobile

Rakuten Mobile, Inc. is a Rakuten Group company responsible for mobile communications, including mobile network operator (MNO) and mobile virtual network operator (MVNO) businesses, as well as ICT and energy. Through continuous innovation and the deployment of advanced technology, Rakuten Mobile aims to redefine expectations in the mobile communications industry in order to provide appealing and convenient services that respond to diverse customer needs.

About Telefónica

Telefónica is one of the largest telecommunications service providers in the world. The company offers fixed and mobile connectivity as well as a wide range of digital services for residential and business customers. With 342 million customers, Telefónica operates in Europe and Latin America. Telefónica is a 100% listed company and its shares are traded on the Spanish Stock Market and on those in New York and Lima.

Telefonica was a co-founder of the Open RAN Policy Coalition, and previously partnered with five companies including Altiostar and Intel to foster the approach.

For more information about Telefónica: www.telefonica.com

References:

https://stlpartners.com/research/5g-bridging-hype-reality-and-future-promises/

4 thoughts on “Why It’s IMPORTANT: Telefonica, Rakuten MOU on Open RAN, 5G Core Network and OSS”

Comments are closed.

In an email to FierceWireless, a Telefónica spokesperson said, “As far as general open RAN initiatives, we will deploy pilots in our core markets of Brazil, Germany, Spain and the UK between this year and the beginning of next year. Our objective in these pilots is creating a new RAN vendor that comprises a specific consortium with better chances to deliver open RAN successfully. To do so, we are working to develop the technology through our strategic collaboration with Altiostar, Gigatera Communications, Intel, Supermicro and Xilinx.”

The 5G SA core from NEC is based on containers. And not only will Rakuten Mobile use this core in its own network, but Rakuten and NEC plan to offer it as a product to other operators, so it’s possible that Telefónica could be a first customer for this 5G core product.

And finally, Telefónica and Rakuten Mobile will refine OSS technology that is currently used by Rakuten Mobile in Japan. Rakuten Mobile’s OSS is based on technology from the startup Innoeye, a company that Rakuten purchased in May.

https://www.fiercewireless.com/tech/telefonica-works-rakuten-mobile-to-deploy-open-ran-phases

Light Reading: Rakuten Mobile and Telefonica today announced a wide-ranging open RAN partnership that could provide an important blueprint for the industry.

It also sounds like a fillip for Altiostar and other vendors building Rakuten’s networks.

That is because one of its key elements will entail joint procurement of open RAN hardware and software, including the components used at central, distributed and remote radio units.

The basic idea is to boost the open RAN ecosystem and give it some of the scale economies that traditional vendors already enjoy.

But joint procurement, done properly, would imply buying products from identical suppliers.

And because Rakuten has already chosen its vendors, and launched a commercial network Blanco admires, that would mean Telefónica swinging behind many of the same companies.

“For sure,” said Blanco, when asked by Light Reading if this was so.

“All the experience that Rakuten has with these providers will be critical for us … It is not only about antennas but also about the software business and the OSS [operational support services] evolution.”

At the forefront of this bunch is Altiostar, a US software company in which both Rakuten and Telefónica have made investments.

Its open RAN software already powers hardware provided by KMW and Nokia in Rakuten’s 4G network. Starting later this month, it will also be used in conjunction with 5G radios provided by Airspan and NEC.

And it now looks set to figure in a future Telefónica deployment.

“We decided with the Altiostar solution that it is an extremely relevant software provider and a significant part of open RAN,” said Blanco during a Zoom call with reporters this morning.

“We will be closing with the Altiostar guys a deal, but we will be cooperating with Rakuten.”

Rakuten’s roll call of vendors is longer than most of yesteryear’s tradeshow exhibitor lists.

Aside from Altiostar and the radio vendors already mentioned, it includes Allot, Ciena, Innoeye, Intel, Mavenir, Netcracker, OKI, Qualcomm, Quanta, Red Hat, Tech Mahindra and Viavi.

Some have a more obvious role than others. Intel, for instance, is providing its Xeon processors for use on Quanta servers. In small cell deployments, Qualcomm is providing chips.

India’s Tech Mahindra, another investor in Altiostar, is the systems integrator for the entire project.

But Telefónica has also called out some other vendors it is likely to use during a future open RAN deployment.

They include Gigatera Communications, a US firm that develops remote radio units featuring advanced components – known as field programmable gate arrays (FPGAs) – from Xilinx.

Servers based on Intel’s X86 platform might come from Super Micro, another Telefónica partner.

For both the Japanese and Spanish operators, the main objective is to lower the cost of open RAN components in a kind of sub-ecosystem, according to Gabriel Brown, a principal analyst with Heavy Reading.

“You need to get the scale economies of a big vendor applied across a multivendor deployment,” he says. “One of the ways that seems to be happening is through little ecosystems within the wider open RAN ecosystem.”

“You might see two, three or four operator-led open RAN ecosystems, often involving similar players in each but not completely mapping across,” he adds.

O-RAN-compliant?

All this comes amid growing industry concern about fake open RAN – deployments in which vendors have been able to work together and guarantee interoperability without using the interfaces defined by the O-RAN Alliance, the main specifications group.

“One of the things we are wondering is how much of the market will be O-RAN-compliant versus just multivendor, and how multivendor it will be,” says Brown.

The development of ecosystems within an ecosystem sounds like a potential threat to a global standard.

Within their own little club, Telefónica and Rakuten hope they can steer vendors through “jointly developed proposals.” They also plan research into the use of artificial intelligence.

Yet they insist one of their goals is to avoid industry fragmentation, and Amin rejects any suggestion they would do anything that “doesn’t follow the standards.”

“We belong to the same industry forums that are helping to define what these standards look like and how they evolve,” he said.

“What makes open RAN slightly more complicated is how to create jointly together the necessary O-RAN-compliant hardware that we need to manage software on this network, the creation of an entire ecosystem around this.”

Amin is now promising “no delay at all” to the launch this month of Rakuten’s 5G service, based on radio gear developed by Airspan and NEC.

As for Telefónica, open RAN pilots are already underway or planned in the major markets of Brazil, Germany, Spain and the UK.

A “massive deployment” in one of those markets will start by the first quarter of 2022, says Blanco.

https://techblog.comsoc.org/2020/09/16/telefonica-rakuten-mou-on-open-ran-5g-core-network-and-oss/

Rakuten Mobile signed a deal to help U.S.-based Ligado Networks design a private 5G network that uses the Japanese operator’s customizable platform.

The deal has the companies initially working to define a strategy that uses the Rakuten Communications Platform (RCP) and corresponding ecosystem to support Ligado’s L-Band spectrum holdings in the 1.6 GHz band. That work is set to begin this quarter and will target a 5G private network targeted at enterprise customers.

Rakuten unveiled its RCP plans late last year. The platform is a combination of the operator’s various technical and intellectual property that it’s using to construct its software-centric network in Japan. The RCP model is focused on mobile operators, enterprises interested in private networks, and governments.

Rakuten began demonstrating the RCP platform in August and claims it reduces capex for mobile operators by 40% and opex by 30%. Rakuten CEO Hiroshi Mikitani, at the time, said the global market for a platform like RCP, including traditional network costs for mobile operators, reaches up to $375 billion annually.

Details on the work with Ligado remain light, though that should be expected considering Ligado’s history.

Ligado currently provides mobile satellite service to government and commercial users in North America. It has been working with the federal government for years to use its spectrum assets to provide terrestrial service that can also tie into its satellite offering.

The Federal Communications Commission (FCC) last month voted to deny a petition from the National Telecommunications and Information Administration (NTIA) that would prevent Ligado from commencing work with its spectrum holdings. NTIA had argued that the work would impact government GPS use. That FCC vote came one day before the agency’s previous head stepped down in alignment with the presidential administration change.

Ligado’s spectrum concerns have been a long-running issue within the cellular community. Under its previous incarnation as LightSquared, it fought with the GPS community over potential interference issues in using its spectrum holdings for a terrestrial network. It eventually struck deals with a number of commercial entities in that community but also struggled through a complicated bankruptcy process and various attempts to partner with carriers and vendors to build out a cellular network.

https://www.sdxcentral.com/articles/news/rakuten-strikes-5g-platform-deal-with-ligado-networks/2021/02/

June 23, 2021 email from Dave Bolan of Dell’Oro Group:

All of 5G Core will be Cloud-Native, mostly Container-based. Except there are different cloud-native versions and container versions, not making it truly open. Anyone that wants to put their core on the public cloud will have to customize it for each cloud platform. Same may be true for the NFVI if it runs on – x86, AMD, ARM, or Nvidia – and couple that with the different UPF acceleration techniques, it gets complex very quickly.