Telefonica

5G SA networks (real 5G) remain conspicuous by their absence

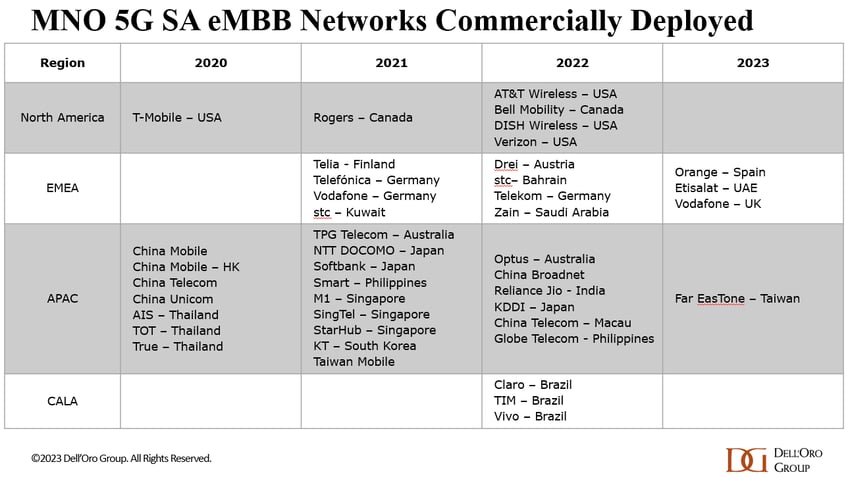

According to a May 2023 report from the Global mobile Suppliers Association (GSA), just 35 network operators in 24 countries and territories “are now understood to have launched or deployed public 5G SA networks.” That’s out of approximately 240 service providers which have now launched commercial 5G services, as per the recent Ericsson Mobility Report.

Dell’Oro’s Dave Bolan said, “Currently we count 43 live 5G SA networks for eMMB [enhanced mobile broadband]. For 2023, four [mobile network operators] have launched 5G SA networks,” he added. It should be noted that Dell’Oro doesn’t factor in fixed wireless access (FWA) or private 5G networks in its SA totals.

In Europe, Vodafone UK and Telefónica Spain join what remains a small set of network operators that have launched 5G SA, including Orange Spain and Vodafone Germany. Spain should provide an interesting study of what happens when two rival operators launch 5G SA service.

There are some glimmers of hope that 5G SA launches will accelerate soon. GSA (aka GSMA) has identified at least 1,063 announced devices with declared support for standalone 5G in sub-6GHz bands, 864 of which are commercially available. Furthermore, it said 116 operators in 53 countries and territories are now investing in 5G SA, including those that have actually deployed a public network. “This equates to 22.1% of the 524 operators known to be investing in 5G licenses, trials or deployments of any type,” the GSA said.

Separately, analysts say that 5G SA branding by network operators is quite confusing (we agree). Vodafone UK’s decision to use 5G Ultra for its 5G SA branding vs Telefonica using 5G+ are examples of that.

Gabriel Brown of Heavy Reading said, “customers don’t really know what it means, other than it denotes some form of technical advance.” He points out that 5G SA “requires a lot of investment and deep engineering expertise; this makes it a useful proxy for network quality. Operators need to take all the technical marketing opportunities they can get.”

“What happens when BT launches? Are they going to call it 5G+ or 5G Super Ultra or something like that? That’s going to make it even more confusing,” said Kester Mann, an analyst with CCS Insight. At the same time, he agrees that 5G standalone is a significant network upgrade and it makes sense that operators would want to gain a marketing edge over rivals that have yet to launch the service.

Notably, neither Vodafone nor Telefónica is charging extra for the more advanced 5G service, and both have focused on the improved speeds and reliability it will bring. They also emphasize eco-friendly aspects, such as lower energy consumption. However, Mann questioned Vodafone’s claim that customers with an eligible 5G Ultra device can expect up to 25% longer battery life. “Twenty-five percent faster than what?” he asked. “It’s a bit unclear.” However, such a claim would certainly be welcome news to consumers. “In a lot of our consumer research, battery life comes out as one of the common bugbears among people using mobile phones,” said Mann.

In the U.S., T-Mobile is the only network operator that’s deployed a 5G SA network. AT&T and Verizon have been talking about it for years, but the time frame for deployment has been pushed back several times.

Deloitte Global said it expects the number of mobile network operators investing in 5G SA networks via trials, planned deployments or rollouts to grow from more than 100 operators in 2022 to at least 200 by the end of this year.

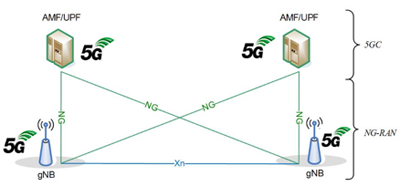

One reason why there are relatively few 5G SA networks deployed is there are no implementation standards. 3GPP 5G Architecture specs, rubber stamped by ETSI, provide several options to realize a 5G cloud-native core network which leads to different implementations. 3GPP decided NOT to liaise their 5G non-radio aspects specs (including 5G Architecture and 5G Security) to ITU-T.

Here are the key 3GPP 5G system specs:

- TS 22.261, “Service requirements for the 5G system”

- TS 23.501, “System architecture for the 5G System (5GS)”

- TS 23.502 “Procedures for the 5G System (5GS)”

- TS 32.240 “Charging management; Charging architecture and principles”

- TS 24.501 “Non-Access-Stratum (NAS) protocol for 5G System (5GS); Stage 3”

The latest 3GPP 5G Architecture spec is System architecture for the 5G System (5GS) (3GPP TS 23.501 version 17.9.0 Release 17), published by ETSI on July 5, 2023.

Source: 3GPP

Hence, the ITU JCA on IMT2020 and Beyond is dependent on other organizations for inputs to their roadmap. “The scope of JCA-IMT2020 is coordination of the ITU-T IMT-2020 standardization work with focus on non-radio aspects and beyond IMT2020 within ITU-T and coordination of the communication with standards development organizations, consortia and forums also working on IMT2020 and beyong IMT-2020 related standards.”

References:

https://www.silverliningsinfo.com/5g/5g-sa-springs-action

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

Orange-Spain deploys 5G SA network (“5G+”) in Madrid, Barcelona, Valencia and Seville

Counterpoint Research: Ericsson and Nokia lead in 5G SA Core Network Deployments

Tech Mahindra and Microsoft partner to bring cloud-native 5G SA core network to global telcos

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

https://urgentcomm.com/2023/01/19/standalone-5g-progress-remains-a-disappointment/

https://www.3gpp.org/technologies/5g-system-overview

https://www.itu.int/en/ITU-T/jca/imt2020/Pages/ToR.aspx

Telefónica – Nokia alliance for private mobile networks to accelerate digital transformation for enterprises in Latin America

Telefonica d’Espagne wants to pursue private mobile networks for businesses in the Latin American region and has enlisted Nokia assist. The Spain-based telecoms group and its network equipment vendor partner are talking up their ability to bring about digital transformation for enterprises in Latin America. Through their newly-announced partnership the pair intend to offer Nokia’s portfolio of industrial-grade private wireless network and digitalization platform solutions, concentrating primarily on what they describe as “the most promising industries in the region;” that’s ports, mining, energy and manufacturing.

Juan Vicente Martín, Director for B2B at Telefonica Movistar Empresas Hispanoamérica, said: “In this unprecedented alliance, the benefits of LTE & 5G private wireless will enable Industry 4.0 across industries. With our strategic partner Nokia, we provide the best connectivity, enable greater optimization of operations, achieving important productivity and efficiency rates and contributing to the digitalization of the industrial sectors throughout Latin America.”

Néstor González, Head of Customer Team for Telefonica Corporate, Nokia, said: “We are thrilled to partner with Telefonica, combining our leading Industrial-grade private wireless solutions with Telefónica Hispanoamérica’s growing B2B solutions and services footprint, to jointly reach a wide variety of enterprises and industries throughout the region. We are very excited to be at the forefront of digital transformation for enterprises in Latin America which have tremendous potential for productivity gains from Industry 4.0. We thank Telefónica Hispanoamérica for their confidence in Nokia and we are looking forward to jointly deploying many new networks”.

Nokia has deployed mission-critical networks to more than 2,600 leading enterprise customers in the transport, energy, large enterprise, manufacturing, webscale, and public sector segments around the globe. It has also extended its footprint to more than 595 private wireless customers worldwide across an array of industrial sectors and has been cited by numerous industry analysts as the leading provider of private wireless networking worldwide.

Nokia has statistics to help encourage enterprises to make the leap into private wireless. According to a late 2022 survey by Nokia and GlobalData there were 79 multinationals that have deployed Nokia industrial-grade private wireless solutions. Nearly 80 percent of survey respondents expected to achieve ROI within six months of deployment.

Currently, private mobile networks based on 4G are probably more of an opportunity for Telefonica than 5G-based rollouts, the latest generation of mobile technology being still very much in its infancy in the region.

Indeed, according to the latest iteration of Ericsson’s mobility report, published a week ago, 4G subscriptions accounted for a massive 74% of total mobile connections in the region at the end of last year, with 5G barely figuring at all. The Swedish vendor calculated that there were just 7 million 5G subscriptions in total in Latin America at year-end, while operators added over 60 million 4G subs over the 12 months.

However, Ericsson predicts that 5G uptake will become more meaningful from 2024 onwards and that by the end of 2028 the technology will account for 42% of all mobile subscriptions in the region.

Consumer uptake of 5G does not necessarily directly translate to the state of play in the private wireless market, of course. But it gives us an idea of the maturity of the overall market.

Last September, Ericsson declared a “digital revolution…underway in Latin America,” when it announced the deployment of what it said was the region’s first private 5G standalone network with a wholly on-premises network architecture, operating completely separately from the public mobile network. The customer was conglomerate Nestlé, in Brazil, and the pair worked with network operators Claro and Embratel.

While Nestlé might be the kind of customer telcos and vendors dream about, there is clearly an opportunity to serve smaller and less well-known outfits too, regardless of the state of deployment of 5G.

Nokia noted that it has more the 595 private wireless customers worldwide across various industrial sectors, although it did not mention how many of those are in Latin America. Quite likely a few at most, but as the technology develops in the region, so will the market opportunity.

References:

https://telecoms.com/522425/telefonica-and-nokia-partner-to-target-private-5g-market-in-latam/

Enable-6G: Yet another 6G R&D effort spearheaded by Telefónica de España

Telefónica de España has initiated yet another 6G R&D project, named Enable-6G, that aims to tackle the user privacy protection and energy-efficiency challenges associated with future generation wireless networks. In a statement, the Spanish telco announced the launch of the Enable-6G project, which is funded by the European Union’s economic recovery plan NextGenerationEU as well as Spain’s Ministry of Economic Affairs and Digital Transformation.

The initiative is led by the IMDEA Networks Institute (an innovation and development centre in Spain) and includes involvement from tech giant NEC and BluSpecs (a Spanish digital transformation consultant). It is designed to address “the challenges that will be faced by future 6G networks, such as increased connectivity, higher performance demands, and advanced object and environment detection and communication,” the company noted.

One of the main objectives is to ensure advanced privacy protections are built into the architecture, as precise mapping and sensing, data privacy and security have become major concerns, and has also become a major benefit for new use cases. Another strategic objective is the design and implementation of software-defined networks that can operationalise optimized edge-to-cloud processing to facilitate time-critical and geo-distributed network orchestration (e.g., via the application of control-task algorithms). The ENABLE-6G project represents a major step forward in the new technologies into 6G to improve wireless communications, provide environmental sensing and significantly reduce the energy footprint per device to avoid a large overall increase in network power consumption. We are excited about the potential impact of this project and look forward to collaborating with our partners to bring it to fruition.

Telefónica is one of the leading private R&D centers in Spain, aiming to explore and develop new technologies and solutions that can improve the company’s existing products and services, as well as identify and create new business opportunities in the telecommunications and technology sectors. One of the big companies joining this project is NEC Corporation, with a great capacity has a strong commitment to research and development and invests heavily in new technologies and innovative solutions. ENABLE-6G counts on the excellent IMDEA Networks scientists, one of the best innovation and development centres in Spain, with a variety of experts from all over the world. Finally, this project will count on the consultancy of BluSpecs, facilitating the digital transformation of private and public organisations through the application of knowledge, data, and methodologies in the field of strategy, implementation of new technologies and innovation.

…………………………………………………………………………………………………………………………………………………………………

Opinion: The rush to 6G R & D is incomprehensible to this author, as there are still so many holes in 5G specifications and standards. Moreover, 5G Advanced specs (3GPP Release 18) have not been completed. Hence, there is no ITU-R standards work even started for that. There isn’t even an ITU-R recommendation that specifies 6G functionality or features!

…………………………………………………………………………………………………………………………………………………………………

The development of the G project “has become crucial”, according to Telefónica, as it has become evident that 6G networks need to be “more adaptable and intelligent” so that they can give rise to a future vision that tackles “greater levels of complexity, contextualisation, and data traffic” – all the while consuming less energy, and providing enhanced security and privacy measures so that anyone developing future technology is given the level of trust required for the “widespread implementation of next-generation devices and nodes”.

A main objective for the Enable-6G project is to ensure “advanced privacy protections are built into the architecture,” given that precise mapping and sensing, as well as data privacy and security, are major concerns but also provide a great opportunity for new service development.

The initiative will also focus on designing and implementing software-defined networks (SDN) that can operationalise optimised edge-to-cloud processing, with the end goal being to support time-critical and geo-distributed network orchestration.

Enable-6G will look to provide “environmental sensing” which, according to Telefónica, will significantly reduce the energy footprint per device and prevent a large increase in overall network power usage.

While 5G networks and services are still being deployed and developed, many players in the industry are already exploring the potential of wireless 6G.

As well as Enable-6G, Telefónica is also active in another European 6G project, called Hexa-X-II, which involves participation from Orange and Telecom Italia, as well as vendors Nokia and Ericsson.

Also in Europe, German operator Deutsche Telekom is leading a consortium of 22 partners as part of the 6G-TakeOff research project within the broader 6G industrial projects funded by the German Federal Ministry of Education and Research (BMBF) – see Deutsche Telekom, Nokia take lead roles in European 6G projects. Ericsson is launching a €5.7m research and innovation consortium in Europe, called Deterministic6G, with which Orange is also involved, as well as several other members – see News brief: 6G R&D gathers pace in Europe.

Meanwhile, China plans to launch 6G by 2025 – way in advance of any standards which imply no interoperability! India has their Bharat 6G vision document with plans to launch a 6G research and development testbed.

In the UK, the government has invested £110m in 5G, 6G and telecom security research and development initiatives, in collaboration with BT, Cellnex, Virgin Media O2, Ericsson, Mavenir, Nokia, Parallel Wireless and Samsung, among others – see UK government pumps £110m into 5G, 6G R&D.

More recently, the UK Department for Science, Innovation and Technology (DSIT) announced that it plans to invest up to £100m into “a new long-term national mission to ensure that the UK is at the forefront of both adopting and developing 6G – the future of digital connectivity.”

Elsewhere, Japanese telco NTT Docomo is also taking strides towards shaping the future of 6G, including issuing advice in the form of whitepaper reports in partnership with its South Korean peer SK Telecom (SKT).

While in India, Prime Minister Narendra Modi has recently set out a vision, dubbed Bharat 6G, that aims to put India on the global map of leaders in the 6G era – see India eyes global leadership role in 6G.

North American is also involved into the 6G R&D sector. US industry group The Next G Alliance has been active in depicting a 6G vision for North America, drawing up a roadmap of necessary steps to secure the region’s leadership in wireless technology from the next decade onwards.

References:

Enable-6G launched to unlock the potential of Future 6G Networks

https://www.telecomtv.com/content/6g/telef-nica-joins-europe-s-latest-6g-r-d-effort-47305/

China to introduce early 6G applications by 2025- way in advance of 3GPP specs & ITU-R standards

India unveils Bharat 6G vision document, launches 6G research and development testbed

NTT DOCOMO & SK Telecom Release White Papers on Energy Efficient 5G Mobile Networks and 6G Requirements

Juniper Research: 5G to Account for 80% of Operator Revenue by 2027; 6G Requires Innovative Technologies

China’s MIIT to prioritize 6G project, accelerate 5G and gigabit optical network deployments in 2023

China Mobile unveils 6G architecture with a digital twin network (DTN) concept

Summary of ITU-R Workshop on “IMT for 2030 and beyond” (aka “6G”)

Telefónica Tech to integrate Red Hat’s OpenShift platform into new enterprise cloud service in Europe and Latin America

Telecom technology integrator Telefónica Tech has signed an agreement with IBM/Red Hat to integrate Red Hat’s OpenShift platform into a new cloud service marketed at enterprises across Telefónica’s footprint in Europe and Latin America.

The integration will be marketed as the Telefónica Red Hat OpenShift Service (TROS), which will tap into the use of containers to help organizations modernize their cloud applications and drive their digital transformation. It will allow those organizations to migrate applications to hybrid cloud or multi-cloud environments using either private or public clouds from hyperscalers like Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform (GCP).

OpenShift is based on the Kubernetes container orchestration project that allows for the migration of applications across different cloud and on-premises environments. A recent report from TBR Senior Analyst Catie Merrill noted that Red Hat’s OpenShift platform has four-times as many customers as it did before IBM acquired the company for $34 billion in mid-2019.

Red Hat OpenShift differentiates itself by combining multiple hardened open source technologies to provide a more complete modern application platform, enabling organizations to use it as the foundation for current and future IT strategies. Additionally, the use of Red Hat OpenShift allows for use in any type of cloud, facilitating the creation of this Multi-Cloud service for Telefónica Tech.

This new, open hybrid, multi-cloud approach will allow Telefonica Tech to strengthen and differentiate its value proposition, and provide more flexibility to its customers in their digital transformation and application modernization in the markets where Telefónica Tech is present.

The complementary nature of cloud technologies integrated in TROS will enable Telefónica Tech, Red Hat and IBM to jointly define innovative use cases and provide high value-added professional services to customers to help them make the process more efficient, cost-effective and cost-optimal.

The strategic agreement also enables Telefónica Tech to develop additional services on TROS based on Red Hat technologies and IBM Cloud Paks so that customers can accelerate their transformation to cloud-native applications, enabling a more consistent user experience both in their own cloud and on the hyperscalers.

María Jesús Almazor, CEO of Cybersecurity and Cloud at Telefónica Tech, said: “This strategic agreement allows us to strengthen our differential multicloud offer by integrating world class technologies from Red Hat and IBM and consolidate our position as a leading partner for the digital transformation of businesses. We continue to evolve our ecosystem of alliances to enhance the digital capabilities of our professionals and to include in our portfolio the most innovative proposals in the market, fundamental aspects to continue offering the best service to our customers.”

Horacio Morell, IBM General Manager for Spain, Portugal, Greece and Israel: “This alliance enables us to take a quantum leap in our business collaboration with Telefonica Tech to continue co-creating enterprise multi-cloud and cybersecurity solutions that will enable companies around the world, across all industries, to implement their technology transformation strategies with greater speed, consistency and agility, while ensuring data control, privacy and reliability and increasing decision-making efficiency through the unique capabilities of IBM’s technologies.”

Julia Bernal, Country Manager for Spain and Portugal at Red Hat, said: “Red Hat is fully committed to helping our customers and partners optimize their business with open hybrid cloud and focus on innovation rather than simply managing their IT infrastructure. Our mission is to mitigate the complexities of modern cloud-scale IT environments and with managed cloud services they can do just that. Telefónica Red Hat OpenShift Service enables customers to free resources to create and manage applications more quickly across multiple clouds, streamlining time to market and accelerating growth opportunities.”

“It is going to be the way forward and what many customers who want to evolve their business models,” said Santiago Madruga, VP for ecosystem success in EMEA at Red Hat, in an interview with SDxCentral. “When going digital, it’s not just putting workloads on the cloud but really transforming businesses.” Madruga added that the use of OpenShift also allows for the micro-segmentation of application components that will open the door for edge distributed cloud work.

References:

https://www.sdxcentral.com/articles/news/ibm-red-hat-expand-telefonicas-cloud-push/2022/06/

https://newsroom.ibm.com/2021-09-23-Telefonica-Chooses-IBM-To-Implement-Its-First-Ever-Cloud-Native-5G-Core-Network-Platform

Microsoft and Telefonica Tech to deliver hybrid cloud services to public administrations

Microsoft and Telefonica Tech, Telefonica’s digital business unit, has signed a new deal with Microsoft, to supply confidential hybrid cloud services to public administrations and companies in regulated sectors. The focus will be on monitoring and encryption services to ensure the security and privacy of data in Microsoft Azure, Microsoft 365 and Microsoft Dynamics 365.

- The joint solutions of both companies will enable Spanish public administrations and companies in regulated sectors to respond to the needs of digital sovereignty.

- Telefónica Tech and Microsoft meet the most demanding legal and technical requirements for cloud trust principles, guaranteeing them with Microsoft’s Confidential Computing technology and Telefónica Tech’s cyber threat monitoring and management capabilities.

- Telefónica Tech will provide professional and managed advisory, implementation, and operational services to deploy and operate the cloud services, which will be marketed through Telefónica Empresas.

Under the latest agreement, Microsoft will deliver its privacy safeguards, technologies and certifications. The company has high-level National Security Scheme certification for Azure, Microsoft 365 and Dynamics 365 and has made a contractual commitment to legally oppose access to its enterprise and public sector customer data by any government. Microsoft has also announced the EU Data Boundary initiative to allow customers to store and process their personal data within the EU. This commitment applies to Microsoft Azure, Microsoft 365 and Dynamics 365 cloud services.

Telefonica Tech will provide consultancy, implementation and operation services that will enable the deployment of maximum security cloud services, guaranteeing compliance with information privacy, quality of service and regulatory compliance requirements at all times. The company will also deliver value-added services, such as the intelligent management of communications and infrastructures or the monitoring and management of cyber threats from its Cybersecurity Operations Centre, with the aim of guaranteeing a rapid and secure adoption of cloud services by the different organisations and institutions. It will in addition offer specialised consulting services for the design, deployment and operation of Big Data platforms on Microsoft Azure Cloud capabilities. Finally, specific services will be supplied to the Defence sector. These will include 5G connectivity services offered by Telefonica with Microsoft cloud services.

All of the services will be implemented in Microsoft’s current cloud environments and will be complemented by the upcoming availability of the new Cloud Region that Microsoft will open in Spain.

Telefonica joined Microsoft and Repsol in June to create an artificial intelligence consortium focused on the industrial sector in Spain.

Telefonica and Microsoft partnered in May to jointly develop private 5G connectivity and on-premises edge computing services for the industrial sector. The partners will now provide public sector organizations, including Defense, with cloud computing and infrastructure services to advance their digital transformation plans, while complying with data protection provisions and recommendations defined by the European Data Protection Board (EDPB).

José Cerdán, CEO of Telefónica Tech, assures: “We believe that the alliance between Microsoft and Telefónica represents a giant step forward in enabling the digital transformation of the public sector and, in general, of the country. The combination of Microsoft’s technology with Telefónica’s service, management and control capabilities guarantees sovereignty and privacy as well as scalability and evolution of infrastructure and citizen services, all with the highest level of quality“.

Alberto Granados, president of Microsoft Spain, remarks: “We at Microsoft have long demonstrated our commitment to meeting and exceeding the data protection requirements of the European Union. This joint value proposition with Telefónica to provide confidential hybrid cloud solutions responds to the needs of digital sovereignty and is evidence that we continue to advance this commitment.”

Regarding this alliance, Carme Artigas, Secretary of State for Digitalization and Artificial Intelligence, points out: “The proposal of confidential public cloud solutions together with hybrid cloud designed specifically for public administrations and companies in regulated sectors in Spain, responds to the important objective of digital sovereignty and constitutes a very relevant advance to accelerate the digitalization of our economy.”

Microsoft was the first hyperscale cloud provider to achieve certification for compliance with the high level of the National Security Scheme in 2016, demonstrating the company’s commitment to delivering cloud products with the highest security requirements. This certification is available for all three Microsoft public clouds: Microsoft Azure, Microsoft 365 and Dynamics 365. It has also been the first to provide Confidential Computing services working with Intel and AMD. These Microsoft cloud services add in-use protection to existing protections for data in transit and at rest, ensuring maximum privacy. In addition, the company offers advanced encryption services that complement the base encryption measures, allowing the implementation of encryption systems using keys provided and managed by the customer or a third party, in this case Telefónica, and managed and dedicated hardware security module (HSM) services.

Telefónica Tech, through its capabilities and experience, accelerates the implementation of technology through its Cybersecurity, Cloud, IoT, Big Data, Artificial Intelligence and Blockchain services. It has 12 specialized Digital Operations Centers (DOC) with 24×7 services from where more than 30,000 servers are managed and more than 100 million cybersecurity events per year are monitored. It also has more than 3,000 expert professionals with the highest certifications in cloud services and cybersecurity who serve the Telefónica Group’s 5.5 million B2B customers in 175 countries.

References:

IBM will build Telefónica’s 5G core network with Cloud Pak for Network Automation, Red Hat OpenShift and Juniper networking

IBM has been awarded a multi-year contract to help Telefonica build its new ‘Unica Next’ cloud-based 5G core network platform. In a statement, IBM said the Spanish operator has engaged IBM Global Business Services – the consultancy arm of IBM, Red Hat and Juniper Networks – to deploy an “open-standard open-networking” platform across multiple central, regional and distributed data centers to deliver low latency and high bandwidth services.

As a member of the IBM Cloud for Telecommunications ecosystem, Juniper is proud to support IBM and Red Hat as they work with Telefónica to build and deploy a modern 5G network. Juniper says it is committed to bringing the power of open hybrid cloud architecture to clients around the world.

The partners said the first Unica Next data centers are set to be inaugurated in October 2021 with a scalable architecture designed to address ETSI and other relevant industry standards (there are none for 5G SA core network). The new network is built on IBM Cloud Pak for Network Automation, Red Hat OpenShift and Juniper Networks Apstra and QFX technology to deliver end-to-end orchestration and operations.

These new capabilities will be engineered to allow Telefónica to more quickly deploy network services and new network functions, leveraging the IBM Cloud for Telecommunications partner ecosystem. Telefónica, as a pioneer in the adoption of open networks, has already deployed a live implementation using the IBM Cloud for Telecommunications in Europe and is continuing to innovate for their customers with speed and improved value.

IBM added that the combination will give Telefonica increased observability and control for managing the Unica Next Kubernetes environment and drive 5G and edge innovation more quickly and with less complexity. Its IBM Cloud Pak for Network Automation product is AI-powered automation software designed to provide extreme automation, zero-touch provisioning and closed loop operation capabilities.

“We are proud to partner with Telefónica to reach this historic moment for the telecommunications industry in Europe,” said Steve Canepa, managing director, IBM Global Communications Sector. “This implementation of Telefónica’s cloud-native, 5G core network platform reflects IBM’s significant investments in AI-powered automation software and the telco prime systems integration expertise required to deploy modern telecommunication networks – core, access, and edge. We are energized by the opportunity to enable Telefónica and all our clients to modernize their networks and enable new revenue-generating services that deliver tremendous value to consumer and enterprise customers.”

IBM Global Telco Solutions Lab in Coppell, Texas, connected along with Telefónica’s Network Cloud Lab in Madrid, will help accelerate UNICA Next’s evolution by building new fully integrated releases using CI/CD methodology for ongoing life-cycle upgrades to the existing UNICA Next platform. By working with IBM in this way, Telefónica will be able to increase agility and data security and continue to innovate and transform, drawing on IBM’s large network function ecosystem, Red Hat’s vast ecosystem of certified partners, and Juniper’s relationships with network function and hardware vendors.

Telefonica has already deployed a live implementation of the open network using the IBM cloud for telecommunications in Europe. The partners also announced that IBM Global Telco Solutions Lab in Coppell, Texas, will be connected to Telefonica’s Network Cloud Lab in Madrid to help accelerate Unica Next’s evolution by building new fully integrated releases using CI/CD methodology for ongoing life-cycle upgrades.

“Building out the UNICA Next platform with its next-generation network architecture shows how important it is to build the infrastructure now to support the deployment of 5G. 5G has the potential to support thousands of use cases and applications for consumers and enterprises in all industries. Our collaboration will not only help us to harness the potential of 5G, but also prepare for the future through a hybrid-cloud led technology and business transformation. With IBM, Telefónica is combining the latency and bandwidth advancements of 5G with the customization and intelligence of the cloud: we anticipate the results will be transformative in Europe and beyond,” said Javier Gutierrez, director of strategy, network, and IT development for Telefónica.

It’s interesting that last year, Telefónica Germany said it would build it’s 5G core network on AWS for the public cloud infrastructure and Ericsson for the core and orchestration components.

References:

https://www.telecompaper.com/news/ibm-to-help-telefonica-build-5g-core-network-platform–1398173

https://www.ibm.com/industries/telecommunications/network-automation

Telefónica Germany builds 5G core network on AWS to capture Industry 4.0 market

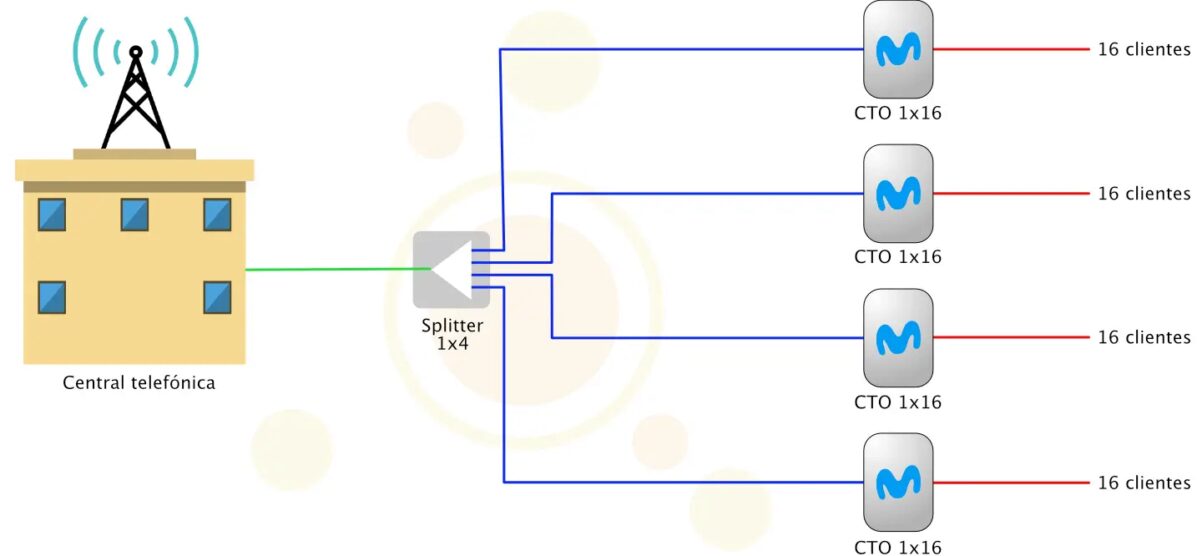

Telefonica España to activate XGS-PON network in 2022; DELTA Fiber to follow in Netherlands

Telefonica España will begin the commercial deployment of a 10 Gbps fiber broadband network using XGS-PON technology in Spain in the first half of 2022, reports website bandaancha.eu.

The gradual rollout is part of Telefonica’s ‘Banda Ancha Abierta‘ (Open Broadband) project to install an efficient, open, scalable and virtualized network model that will facilitate fixed-mobile convergence (fixed access with mobile backhaul), Multi-access Edge Computing capabilities ( MEC), and the deployment of third-party applications.

Telefónica’s FTTH network in Spain passes 26.1 million homes as of June 2021, for which 4,726,700 clients are served through the Movistar and O2 brands. In addition, there are 2,801,700 clients of other operators served through indirect fiber optics.

The introduction of XGS-PON will introduce two new lambdas or wavelengths on the existing GPON fiber infrastructure. The same fiber cable will carry wavelengths corresponding to GPON and in parallel new colors of the laser for XGS-PON so that the two technologies do not interfere with each other.

XGS-PON raises the available throughput for an entire fiber branch to 10 Gbps downstream and 10 Gbps upstream for up to 64 client endpoints. That will permit Telefonica to commercialize speeds of up to 2.5 Gbps symmetric and, in the medium term, up to 10 Gbps.

XGS-PON requires new customer premises equipment. Telefónica customers have been waiting for years for the new XHGU router that the operator announced in 2018 and that is compatible with XG-PON, in addition to bringing high-penetration WiFi 6.

With the arrival of XGS-PON, Movistar will begin to distribute this new router or temporarily provide an ONT XGS-PON.

……………………………………………………………………………………….

In a related story, DELTA Fiber has attracted 2 billion euros to back a planned roll-out of XGS-PON technology throughout the Netherlands. The 10G PON deployment will expand DELTA Fiber’s network to 2 million fiber connections in 2025. It currently expects to reach 1 million connections by the end of this year.

The company expects to begin rolling out XGS-PON this September. It will use the technology exclusively in its future builds with an eye toward making gigabit broadband widely available.

DELTA Fiber also said it plans to deploy 25G PON in the future. Along these lines, the company recently announced a partnership with Proximus of Belgium to deploy fiber to the home networks in Flanders. Proximus has already adopted 25G PON technology.

References:

https://bandaancha.eu/articulos/movistar-actualizara-velocidad-red-fibra-9973

Telefonica in 800 Gbps trial and network slicing pilot test

With this initiative the intention is also to begin building services for customers to be marketed via Telefónica’s 5G network. The project will thus enable Telefónica to obtain key results that will serve to drive the ecosystem and promote the interoperability and standardisation of this technology with a view to its marketing towards the end customer. Some of the sectors that can benefit the most from Network Slicing are the State Security Corps and Forces, media and communication, cars, industry and hotels.

Why It’s IMPORTANT: Telefonica, Rakuten MOU on Open RAN, 5G Core Network and OSS

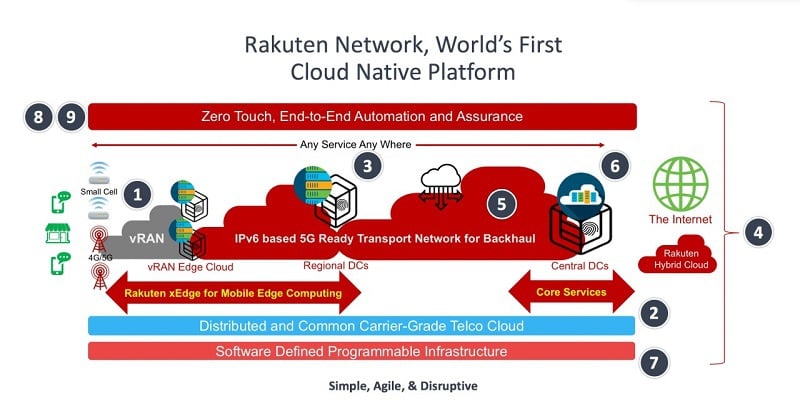

Rakuten Mobile, Inc., and Telefónica, S.A. announced today the signing of a Memorandum of Understanding (MoU) to cooperate on a shared vision to advance OpenRAN, 5G Core and OSS (operations support systems).

“We’re excited to collaborate with Telefónica on this shared vision of advancing OpenRAN,” said Tareq Amin, Representative Director, Executive Vice President and CTO of Rakuten Mobile. “I envision our partnership to also co-explore further development around the Rakuten Communications Platform that will enable operators around the world to take advantage of cost-effective cloud-native mobile network architecture that is secure and reliable.” (Emphasis added)

Amin emphasised the partnership is not just about opening the interfaces: “It’s about the future possibilities when these networks become fully autonomous. What makes a difference is automation, as it enables much needed operational savings. We’re going to spend a lot of energy around joint development of automation, especially what we call OSS transformation to move away from legacy systems.”

Enrique Blanco, Chief Technology & Information Officer (CTIO) at Telefónica, said: “Telefónica strongly believes that networks are evolving towards end-to-end virtualization through an open architecture, and OpenRAN is a key piece of the whole picture. Beyond the flexibility and simplicity that OpenRAN will provide, it will change the supplier ecosystem and revolutionise the current 5G industry in the medium and long term. At the same time, open and virtualized networks will lead to a new telco operating model. Telefonica and Rakuten Mobile have signed this MoU to work towards evaluating and demonstrating the capability and feasibility of OpenRAN architectures and make them a reality.”

“This is a massive opportunity for all of us. This is an inclusive approach and how we can guarantee we are building the network for the future,” Blanco added. In addition to defining the interfaces, the companies are exploring procurement of hardware and software, Blanco said.

Under the terms of the MoU, Rakuten Mobile and Telefónica plan to collaborate on the following:

- To research and conduct lab tests and trials to support OpenRAN architectures, including the role of the AI (Artificial Intelligence) in the RAN Networks.

- To jointly develop proposals for optimal 5G RAN architecture and OpenRAN models as part of industry efforts to achieve quicker time to market, new price-points, and the benefits of software-centric RAN.

- To collaborate in building an open and cost-effective 5G ecosystem, based on open interfaces, that will help accelerate the maturity of 5G with global roaming.

- To develop a joint procurement scheme of OpenRAN Hardware and Software that will help increase volumes and reach economies of scale, including CUs, DUs, RRUs, and other necessary network equipment and/or software components.

In addition, the companies will also jointly work on 4G/5G Core and OSS technology utilized by Rakuten Mobile in Japan and its Rakuten Communications Platform.

“Vendor selection typically takes a long time in the telecoms industry compared with the web-scale companies. Maybe together with Telefonica the discussions with vendors might change a bit and require us to create new business models.”

Telefonica plans to introduce open RAN in three phases, with pilots starting this year, initial rollouts in 2021 and mass deployments in 2022. “I’m extremely convinced we’ll hit these targets, but we are trying to be conservative,” Blanco said. From 2022 to 2025, up to half of Telefonica’s 5G deployments will use open RAN, he added.

Why this MOU is IMPORTANT:

- As there are no ITU recommendations or 3GPP specs detailing how to implement a 5G Core/5G SA network, the Rakuten-NEC 5G core could become a defacto standard. As we’ve stated many times, the 3GPP specs on 5G Core are network architecture specs that leave the various implementation choices to the implementer. And 3GPP is not even sending their 5G non-radio specs to ITU-T for consideration as future recommendations.

- Meanwhile, Rakuten and NEC have created a 5G “cloud native” core spec (proprietary of course) built on containers, which NEC (and likely other vendors) will implement in Rakuten’s 5G network. Rakuten and NEC plan to offer there 5G Core as a product to other 5G network operators.

- The Rakuten Communications Platform for Open RAN could similarly be sold to other carriers that want to deploy an Open RAN 4G/5G network. The catch here is that any legacy wireless carrier wanting to do so would have to support two incompatible sets of cellular infrastructure to serve its customers: 1] The traditional “closed box base stations” (from Huawei, Ericsson, Nokia, Samsung, ZTE, etc) in cell towers AND 2] The new Open RAN, multi-vendor base stations using totally different hardware/software platforms which requires a significant amount of systems integration and tech support/trouble resolution. Rakuten’s platform could, at the very least, simplify systems integration and avoid “finger pointing” when troubleshooting a failure or degraded service.

- Both the Rakuten-NEC 5G Core and Rakuten Communications Platform for Open RAN could be terrific products to sell to greenfield carriers (with no existing wireless infrastructure). Apparently, that’s too late for Dish Network and Reliance Jio, which claim they’re building their own “open 5G” network. Meanwhile, India based Tech Mahindra claims it can build a complete 5G network now, which they would surely sell to would be 5G network providers, utilities, and government agencies around the world.

- The OSS co-operation amongst these two carriers is significant, because (once again) there are no standards for 5G SA OSS’s such that the deliverable output of cooperation here could become a defacto standard.

- Co-operative work on automation of network functions and operations will also be vitally important. Otherwise, that too will be proprietary to the wireless network provider which would require different software for the SAME functions for different carriers. The work will probably start with these 2800 series 3GPP specs: TS 28.554 Management and orchestration; 5G end to end Key Performance Indicators (KPI); TS 28.555 Management and orchestration; Network policy management for 5G mobile networks; Stage 1 TS 28.556 Management and orchestration; Network policy management for 5G mobile networks; Stage 2 and stage 3. There are similar ITU-T SG 13 high level Recommendations on these subjects.

Image Credit: STL Partners

………………………………………………………………………………………………………………………………………………………………………………

About Rakuten Mobile

Rakuten Mobile, Inc. is a Rakuten Group company responsible for mobile communications, including mobile network operator (MNO) and mobile virtual network operator (MVNO) businesses, as well as ICT and energy. Through continuous innovation and the deployment of advanced technology, Rakuten Mobile aims to redefine expectations in the mobile communications industry in order to provide appealing and convenient services that respond to diverse customer needs.

About Telefónica

Telefónica is one of the largest telecommunications service providers in the world. The company offers fixed and mobile connectivity as well as a wide range of digital services for residential and business customers. With 342 million customers, Telefónica operates in Europe and Latin America. Telefónica is a 100% listed company and its shares are traded on the Spanish Stock Market and on those in New York and Lima.

Telefonica was a co-founder of the Open RAN Policy Coalition, and previously partnered with five companies including Altiostar and Intel to foster the approach.

For more information about Telefónica: www.telefonica.com

References:

https://stlpartners.com/research/5g-bridging-hype-reality-and-future-promises/

Telefónica switches on 5G; 75% of Spain to be covered this year

Telefónica has launched commercial 5G services throughout Spain, pledging to reach 75 percent of the Spanish population by the end of the year. In a statement, the company’s executive chairman Jose Maria Alvarez-Pallete described the deployment as the most ambitious in the European Union. “The launch of 5G is a leap forward towards the hyperconnectivity that will change the future of Spain,” he said, noting that “it’s 5G for everyone, without any exceptions, in all the autonomous communities.” [That assumes low enough 5G tariffs, such that poorer working class Spaniards can afford the service]. Telefonica is accelerating “the digitalisation of small and medium companies, public administrations and citizens, ”Alvarez-Pallete added.

“Our network has always been a differential asset. People’s lives pass through it and it has demonstrated unparalleled strength when it’s been most needed”, Álvarez-Pallete continued. He pointed out that Spain already leads Europe’s digital infrastructures with the largest fiber optic network.

Editor’s Note: Telefonica’s 5G announcement follows Vodafone – Spain‘s commercial 5G network deployment in 21 cities in Spain. Initial 5G speeds of up to 1 Gbps for Vodafone subscribers in Madrid, Barcelona, Valencia, Seville, Malaga, Zaragoza, Bilbao, Vitoria, San Sebastian, La Coruna, Vigo, Gijon, Pamplona, Logrono and Santander. Speeds will rise to 2 Gbps by the end of the year, some 10 times the current 4G maximum, with latency reduced to less than 5 milliseconds in ideal conditions.

Orange and Masmovil set to launch their 5G networks in Spain this month. All four of Spain’s MNOs (Mobile Network Operators) are expected to bid for frequencies in the 700 MHz band when the government holds its delayed spectrum auction in the first quarter of 2021.

…………………………………………………………………………………………………………………………………………………………………………………………………….

Telefonica said 5G technology will give residential customers access to far faster speeds and lower latency, allowing sports fans to enjoy live 360-degree broadcasts and mobile gamers to access a “fibre-like” experience. Businesses will have access to services such as Multi-Access Edge Computing, 5G private networks, mass IoT and critical communications, as well as network virtualisation to facilitate more effective use of the network’s resources.

The Spain based network operator (also active in Latin America) clarified that it will initially launch NSA (non-standalone) 5G combined with DSS (Dynamic Spectrum Sharing) ahead of the “immediate deployment” of 5G SA (standalone) when the technology becomes fully available after standardisation. The company said it will make use of its current sites and infrastructure for the initial rollout, to be complemented by new base stations and small cells according to capacity and coverage needs.

It’s also having to rely on the 3.5 GHz band, together with mid-band (1800-2100 MHz) frequencies, for the initial coverage thanks to equipment that can operate with 4G and 5G at the same time. Telefonica also announced that it intends to shut down its 3G network in 2025, when 100 percent of its copper network will have been replaced by fiber optics.

“With 5G everything happens in a millisecond. A millisecond is what makes remote surgery, autonomous cars, the smart management of energy resources and cities and highly advanced entertainment possible. A millisecond is much more than a new response time. It’s Telefónica’s response to the new times. It’s Telefónica’s commitment to the country’s future”, concluded Álvarez-Pallete.

For residential customers, in addition to the benefits brought by 5G in terms of greater speed and lower latency, which will allow them, for example, to download a film in seconds, 5G will provide the possibility, among other features, of enjoying live sports broadcasts during which users will obtain a 360º experience and be able to view any angle of the match as if they were on the pitch itself. Gaming enthusiasts will obtain a mobility experience similar to that provided by fibre in the home, in other words, without any interruptions or latency. 5G will thus enable them to play on their mobile phones as if they were on their home computer screens or their video consoles.

5G business customers will have access to services like Multi-Access Edge Computing, which offers ultra-low latency services and greater computing capacity “on the network edge”, in addition to services such as 5G private networks, mass IoT and critical communications, as well as network virtualisation to facilitate more effective use of the network’s resources in keeping with the customers’ needs.

…………………………………………………………………………………………………………………………………………………………………………………………………………………….

Telefónica operates with the latest radio (base station) generations that allow dual 4G and 5G usage, with the aim of bringing 5G to the largest number of people from the outset. This first phase will witness the launch of the 5G network, thanks to a technology that combines the deployment of NSA (non-standalone) 5G and DSS (Dynamic Spectrum Sharing) and the subsequent immediate deployment of the SA (standalone) 5G network when the technology becomes fully available after standardisation. This initial deployment will also make use of the current sites and infrastructure and, in the mid and long terms, it will be complemented by new base stations and small cells as the capacity and coverage require.

The 3.5 GHz band frequency (the only 5G band frequency already licensed to operators) and the mid-band (1800-2100 MHz) frequencies are being used for this purpose. This is the current location of 4G, capitalising on the possibility of using NR (New Radio) equipment that can operate with both technologies (4G and 5G) at the same time.

The new deployments will take place in tandem with a gradual shut-down of the old second and third-generation networks. 100% of the copper network will have been replaced by fibre by 2025, when the 3G network will also be shut down. This will permit more effective management of investments, as it won’t be necessary to increase them to address the new deployments.

……………………………………………………………………………………………………………………………………………………………………………………………………