Analysis of Dish Network – AWS partnership to build 5G Open RAN cloud native network

On its Q1-2021 earnings call, Dish Network Chairman and Co-founder Charlie Ergen did not provide any specifics regarding Dish’s deal with Amazon/AWS or its overall plan to build a nationwide 5G Open RAN, “cloud native” core network. Are you a bit tired of cliché’s like this:

“We’re building a Netflix in a Blockbuster world.” All Netflix did was put video on the cloud. Instead of going to a physical store, you put it in the cloud. Right. All the business plans in the world, all the numbers, all the thought if they just did something simple they put it in the cloud and the technology was they were a little ahead of the technology but the technology got there. All we’re doing is taking all those towers that you see as you drive down the highway, we basically put them in the cloud. And so instead of driving to physical store and rent a movie, you’re going to get all your data and information and automation everything from the cloud. And so it’s a dramatic paradigm shift in the way network is built and it should and it’s an advantage over legacy carriers who have 30-year-old architecture.” Of course, that’s incorrect as almost all 5G carriers plan to build a 5G cloud native core network.

Dish is planning to build the world’s first standalone, cloud-based 5G Open Radio Access Network (O-RAN), starting with the launch of a 5G wireless network for enterprise customers in Las Vegas, NV later this year.

Dish says it will leverage AWS’s architecture and services to deploy a cloud-native 5G network that includes O-RAN—the antennas and base stations that link phones and other wireless devices to the network. Also existing in the cloud will be the 5G core, which includes all the computer and software that manages the network traffic. AWS will also power Dish’s operation and business support systems.

“Amazon has made massive investments over the years in compute storage transport and edge, [and] we’ll be sitting on top of that and as we tightly integrate telco into their infra, then we can expose APIs to their development community, which we think makes and enables third-party products and services to have network connectivity, as well as enterprise applications,” said Tom Cullen, executive VP of corporate development for Dish, explaining some of the technical details of the arrangement during Thursday’s earnings call.

Ergen reiterated Dish’s plan to spend up to $10 billion on its overall 5G network and provided milestone date for completion of the first phase of the 5G build-out.

“All of that $10 billion isn’t spent by June of 2023, which is our major milestone,” Ergen said, pointing to the company’s agreement with the U.S. government to cover at least 70% of the population with 5G no later than June 14, 2023. However, Ergen has an escape hatch:

“The agreement we have [with the FCC] recognizes that [there could be] supply chain issues outside of our control, and that the timelines could be adjusted. But we don’t look at it that way internally. There is always unforeseen circumstances, and this one might be particularly acute. But we’re not going to let anything stop us. We’re focused on meeting our timelines, and regardless of what the challenges are. And we’ll have to reevaluate that from time to time, but we’re focused right now on Las Vegas and we’re focused on the 20% build-out by June of next year.”

“We’re not going to let anything stop us, he added. The $10 billion “does take us through the complete (5G) buildout.”

On the 5G cloud native aspect, Ergen said:

“Yes, we anticipated a cloud native network from the beginning, he said. “So the $10 billion total build-out cost that we announced a couple of years ago–I think people are probably still skeptical … But you can see where we’re headed. Most of your models will probably take a lot of capex off the board when you understand the architecture, and we’re not going to go through all the architecture in this call, but it’s certainly has a material impact on capex.”

Dish said last week it plans to run all of its network computing functions inside the public AWS cloud – a plan that represents a dramatic break from the way most 5G networks around the world run today. Many analysts think that’s a huge cyber-security risk as the attack surface is much greater in a virtual, cloud based network.

Marc Rouanne — Executive Vice President and Chief Network Officer:

“Yeah, the way to think of our cloud native network is a network of networks, that’s the way it’s architected. So when a customer comes to us, it’s easy for us to offer one sub network, which we can call it private network and there are techniques behind that like slicing, like automation, like software defined, so I’m not going to go into the techniques, but natively the way to think of it is really this network of networks. Right. And then, as Stephen, you’ve seen that you plan this to the postpaid customers and telling you how they would shake lose sub networks.”

“Absolutely, yeah. No, I think we’ve talked to a number of customers across multiple verticals in different industry segments and is an increasing appetite in demand for the kind of network that we’re building, which is really to enable them to have more security, more control and also more visibility into the data that’s coming off the devices, so that they can control their business more effectively. So we’re seeing a terrific demand. And the network architecture, we’re putting in place actually enables and unlocks that opportunity for those enterprise customers and it’s again not restricted to any specific vertical.

We’re touching a lot of different companies and a lot of different vertical segments across the country and the other aspect of the opportunity that we see for ourselves is that while we build out a nationwide network, we are in the process of working with customers and prospective customers on private networks that are not limited by the geography of our national footprint. So we can deploy those within their environments to support their business operations as well. So the demand we’re seeing is terrific and we’re already engaged with a number of customers today.”

Ergen chimed in again:

“The cloud infrastructure as it existed a couple of years ago, really didn’t handle telco very well, there has been a lot of R&D and investment that they’ve had to make to transform their network into something that where a telco can operate in the cloud, because it’s a little bit different than their traditional IT infrastructure. And then today they are, they were best in class room for what we needed and whether it be their APIs and the documentation and discipline and vendor at the — community that supports them and their — the developers and then of course obviously reach into the enterprise business. So it was — so that’s the first and foremost.

And then the second thing I think is, is the company committed? I’m not going to put words in Amazon’s mouth, I’ll let them talk to their commitment, but they’ve done a lot of work for us to help us without knowing where they have the deal or not and very appreciative that it. I think it’s helpful that Andy will become the CEO because he’s owned this project from the start and he can — he will be able to move all the pieces within Amazon to focus on this. And so I think at the end of the day, I think we’re going to be their largest customer in cloud and I think they’re going to — they may be the largest customer in our network. I mean, but we have to build a network and prove it, and they have to build and prove it. I think that all other carriers around the world will, including the United States will look at Amazon as a real leader here because we’re just doing something different.”

Stephen Bye — Executive Vice President, Chief Commercial Officer

“Yeah. So just in terms of what the Las Vegas build looks like. I think there are several attributes that are really important to what we’re doing to build on Charlie’s comment. One is we are building a cloud native infrastructure. We are using an Open Radio Access architecture. But it’s also a 5G native network. We’re not trying to put 5G on top of 2G, 3G and 4G, the infrastructure that we’re deploying is optimized for 5G and the way we’ve designed the network from an RF perspective and a deployment perspective is to take advantage of the 5G architecture as well as the 5G platform. And so, what does that look like?

It’s basically a new network, it’s new infrastructure, it’s designed using all of the spectrum bands that we have and the RF is optimized to take advantage of that. So we’re on a path to launching that in the third quarter, but it’s one of a number of markets we have coming on. We just have announced those markets through the end of the year, but it’s the first, obviously a number that we have in flight today and we’ve got activity going on across the country to actually build out this network. So it will be the first one that people can touch and feel and get the experience, but it is really a 5G native network and we’ve proven that O-RAN from a technology perspective can work compared to that at the end of last year. Now we are in the execution phase, now we’re in the deployment phase and so you know Vegas will have to be the first one that it will be a fully deployed market that people will be able to touch and feel and experience.”

Bye added that the 5G build-out will be done in phases but the network is designed to support all customers across all segments.

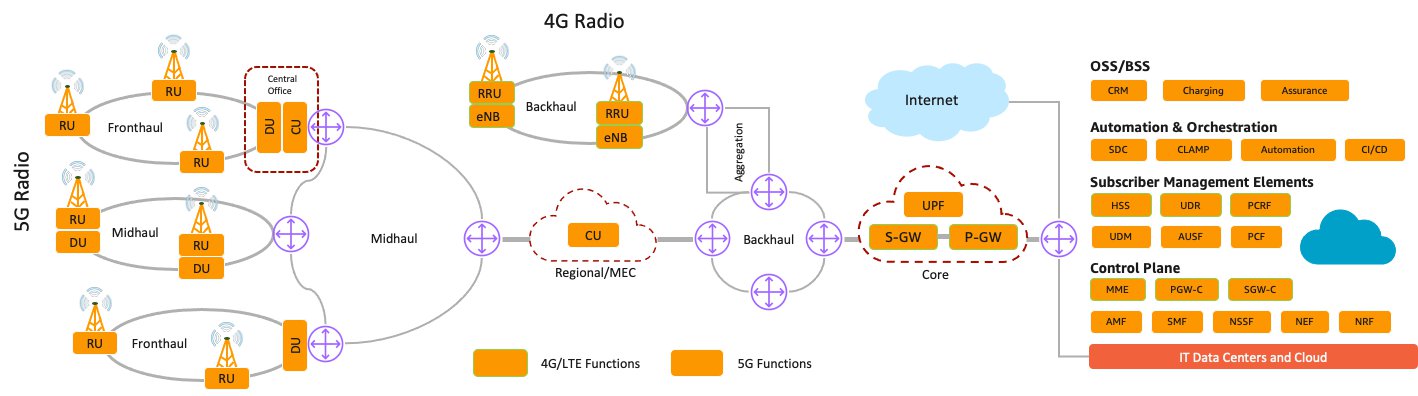

5G Network End-to-End Architecture. Image courtesy of AWS.

……………………………………………………………………………………………………………………………

In a note to clients, analyst Craig Moffett said that Dish was purchasing services from AWS rather than Amazon investing in Dish’s 5G network:

“It was a purchase agreement, albeit one freighted with lots of rather fuzzy jargon, and nothing more. Notably, Verizon already has its own relationship with AWS, and theirs does call for AWS to co-market Verizon services to AWS’s enterprise customers. By contrast, the Dish agreement calls only for Dish to market AWS services to Dish’s customers, not the other way around. Objectively, it is Verizon, not Dish, that has the more strategic relationship.

Amazon isn’t likely to market a service to its customers unless they are highly confident that its quality is first rate and that its staying power is assured. Perhaps Dish will get there. But it won’t be clear that they have arrived at that point until their network is successfully serving customers… without the safety net of the T-Mobile MVNO agreement. That’s not until 2027. That feels to us like a long time to wait.”

Regarding Dish Network’s new business model, Craig said “It is now fair to say that Dish’s core business is wireless rather than satellite TV. Not by revenues, of course; the wireless business is today but the modest reseller stub of what once was Boost (Mobile). But certainly by valuation….What does matter, however, is the extent to which the satellite TV business can serve as a source of funds for financing the wireless business.”

………………………………………………………………………………………………………………………………………

References:

https://d1.awsstatic.com/whitepapers/5g-network-evolution-with-aws.pdf

https://docs.aws.amazon.com/whitepapers/latest/cicd_for_5g_networks_on_aws/5g-networks-on-aws.html

9 thoughts on “Analysis of Dish Network – AWS partnership to build 5G Open RAN cloud native network”

Comments are closed.

Wild ideas. But dreamers need to take risks to win. There’s a lot of opportunity so the rising tide floats all boats as 5G adoption for the IoT connected enterprise takes off.

I wonder if Dish Network will need to take out loans to come up with the billions required to build out their new 5G Open RAN, cloud native core network?

Maybe AWS will give them some sort of credit or incentives to get going with this?

Using cloud technology on a subscription basis may allow Dish to do some “Just In Time (JIT)” build outs with specific customers, thereby making it profitable on a project by project basis. Since the revenues from satellite TV are in a steep decline this new concept may help make Dish’s existing infrastructure more profitable.

All three U.S. cloud providers (AWS, Azure, Google Cloud) are making a big push into edge computing and 5G “cloud native” core networks. That effectively makes them leaders in those new tech markets, with the traditional network providers playing a subservient role as the proverbial “dumb pipe” providers.

Thanks for the excellent summary, Alan.

There is a fascinating statement, by Ergen, “…I think they’re going to — they may be the largest customer in our network.” Ergen seems to be implying that Amazon will be a customer of Dish’s 5G network. This would be a pretty big deal, if true. Judging by Moffett’s comments about Amazon marketing Verizon services, this would seem doubtful.

The other thing that is fascinating is that they are looking at the private network option as well, “…we are in the process of working with customers and prospective customers on private networks that are not limited by the geography of our national footprint.” It seems like this would be a distraction to find these customers given the complexity of building a network from scratch. Of course, if it becomes something that becomes part of AWS feature offering, perhaps the customers will be coming to Dish.

Aside from the services that AWS will supply, Dish also has a head start on the last-mile part of the network with their agreement with Crown Castle for space on 20k towers.

https://investor.crowncastle.com/news-releases/news-release-details/dish-signs-multi-year-anchor-tenant-tower-agreement-crown-castle

From SDxCentral:

“Everything north of the base station, the site, is in the cloud,” Dish EVP and Chief Network Officer Marc Rouanne said, adding that Dish is also targeting multiple options for edge computing with AWS. One of those options involves the use of AWS Outposts, a small rack of Amazon-supplied equipment and fully managed services that effectively places the AWS cloud directly into an enterprise’s network.

That will allow Dish to put its software, riding on AWS, at the edge, Rouanne explained. Dish is also working with AWS to build what he described as a “next generation distributed unit,” the compute part of an open radio access network, that will allow it to bring more cloud-based services to the RAN as well, he said.

The early phase of that work is built around Intel’s FlexRAN reference architecture, but it’s also working with AWS on a second generation of the cloud-based RAN architecture riding on a broadening effort at Qualcomm to establish a similar technical blueprint using its forthcoming 5G RAN silicon, Rouanne explained.

That follow-on effort will provide for higher speeds, massive multiple input, multiple output (MIMO), the use of shared CBRS spectrum, and other technologies, according to Rouanne.

https://www.sdxcentral.com/articles/news/surveying-the-aftermath-of-dishs-5g-cloud-deal-with-aws/2021/05/

From Matt Kapko of SDxCentral:

AWS has already expanded beyond the confines of its regional data centers with Outposts, Wavelength, and Local Zones, which collectively provide enterprises or operators with more distributed clouds for specialized use cases.

Wavelength, a service that marries operators’ 5G networks with AWS’ edge compute service, was first launched with Verizon last year, and is also commercially available with SK Telecom in South Korea, KDDI in Japan, and will be deployed soon with Vodafone in Europe. “We have a pretty substantive edge compute working today in production with customers running production workloads,” explained David Brown, Amazon’s VP of Elastic Compute Cloud (EC2).

That level of maturity helped AWS land a far-reaching deal with Dish Network that will see the greenfield network operator house everything it can in the cloud, including radio access network (RAN) compute functions in the distributed unit. “We’re partnering with Dish to build what is going to be the world’s first 5G network built entirely on public cloud infrastructure,” he said, adding that trials are also underway with Telefónica in Germany and other operators he declined to name.

Outposts Gain Prominence in RAN

“In the case of open RAN, the fact that there are very well-defined APIs gives us a lot of opportunity for deeper integration, and so whether that’s running on an Outpost down at a cell site, or all the way up through the RAN, we’re able to do it pretty well,” Brown added.

Those RAN sites will be running on AWS’s 1U size Outposts, which are equipped with the Amazon-designed Graviton2 processor, that will start shipping by September, according to Brown.

“When you put an Outpost in a cell site, you can manage that Outpost as if it was in an AWS data center, so your development team can actually write some software and deploy that to that remote location or 10,000 remote locations in exactly the same way as if it was all running within a region,” he explained.

AWS is also optimistic about the performance lift and lower costs it claims network operators can realize by using its Arm-based Graviton2 processors. “A customer running a workload today on an x86 processor, if they are to move that workload to Graviton2 you’d actually see it cost you 40% less to run the same workload and it only consumes about half the power of the Intel or the x86 processor,” Brown said.

“We’re managing virtually from the infrastructure layer all the way up, as opposed to other frameworks like the [Google Cloud] Anthos and the [Microsoft Azure] Arcs of the world, which is really just a layer on top of some infrastructure that the provider has to manage,” he said.

One of the factors that makes the rise of cloud computing more interesting or unique in the wireless sector is that data centers and RAN sites are widely distributed, Brown explained.

“It’s not like I’m taking over a data center that they don’t want to be running anymore,” he said. “This is their core competency, this is the thing that makes them successful as a telco or not successful as a telco, and so we really do feel the weightiness of that as a cloud provider. We need to partner with them deeply on their workloads, make sure that we do a phenomenal job in running those workloads while we continue to give them enough control and enough insight and visibility into those workloads so that they can continue to run the telco business, which is really about the network.”

Wireless carriers increasingly realize how the cloud has benefited many other industries, and “I think we’re well positioned to do that again in the telco space, and I expect it to move relatively quickly,” Brown said.

“What we’re doing with Dish is really a milestone and will spark a lot of the ecosystem. I think that the large players are definitely watching closely,” he said. “We’re going to move as fast as they want to move. Speed matters in business. Those that move quickly I think are going to get ahead. Those that take a little longer are probably going to want to hurry up and catch up.”

https://www.sdxcentral.com/articles/news/aws-exec-scopes-5g-telco-cloud-aspirations/2021/05/

From SDX Central:

Dish Network intends to run Nokia’s 5G standalone (SA) core software on Amazon Web Services (AWS), making it one of the first operators to deploy its network core in a public cloud.

Dish last year landed a deal with Nokia to use its 5G SA core software and more recently inked a broad agreement with AWS to house everything it can on the world’s largest public cloud.

More than 30 vendors are involved in Dish’s 5G network deployment plan, and as the operator gets closer to actually deploying a cloud-native 5G service for commercial use, it’s connecting the dots, explaining where these various technologies will reside and how they will interact.

Executives from Dish and Nokia are scheduled to share more details about this 5G SA core running on AWS during a session at MWC Barcelona later this month. The operator and vendor are working together to implement zero-touch automation, and develop new services for Dish customers, according to the description for the session.

Dish claims many firsts because of its strict adherence to a cloud native open RAN architecture, however nothing is active yet. It might be the first operator with a 5G core running in a public cloud, but Telefónica is just as likely to beat it to that goal. Both operators have selected AWS as the public cloud of choice for their 5G cores.

Telefónica last month said it validated AWS Outposts as an “effective infrastructure option” for Vivo Brazil’s 5G SA core. The multinational operator, which is based in Spain, is also using Nokia’s 5G core software with an assist from Mavenir and Oracle.

While neither is commercially deployed, Dish and Telefónica “appear to be the first out of the gate” with 5G cores running on a public cloud, according to Will Townsend, senior analyst at Moor Insights & Strategy.

“It’s at least the first large-scale deployment,” said Daryl Schoolar, Omdia’s fixed and mobile infrastructure practice leader.

“If successful, if it goes well, you could see other operators start to move more workloads out there,” he said, adding that Dish’s status as a greenfield operator affords it a lot of flexibility and significantly less complexity compared to existing operators that have to maintain legacy workloads and systems. “They need to be successful on this probably before you can do a brownfield one,” he said.

“The significance to me is this at least gives everybody something to look at,” Scholar said. “Can you run a really heavy eventual workload in a public cloud environment versus running it in your own private cloud?”

Nokia’s 5G core software is also baked into T-Mobile US’ 5G SA core network that it activated in August 2020, but no public clouds are involved in that deployment. Nokia claims 25 of the top 40 communications service providers are using its network core products.

https://www.sdxcentral.com/articles/news/dish-pushes-nokia-5g-core-to-aws/2021/06/

June 30, 2021 Update from Light Reading:

AWS and other cloud players will need “many years” to catch up with Japan’s Rakuten in building and running cloud mobile networks, Rakuten CTO Tareq Amin has warned.

Amin said reports that AWS could deliver costs below Rakuten for the Dish network were “completely wrong.”

“Let me just tell you a secret today,” he told a recent press briefing. “There is no magic that AWS have that could make a telco workload elastic by itself. It just doesn’t exist.”

It would require “a far more cloud-native architecture” to enable elasticity, he said.

He added that while he would “love to compare” Rakuten’s costs with those of the AWS Dish platform, the cloud giant’s partnership with the US startup was good for the industry.

“Competition is a good thing, so we want to see a lot more public cloud entering this space.”

But cloud players would be on a learning curve, he cautioned.

Rakuten’s communications platform had some “unique attributes” and it would take AWS and others “many, many years to learn how to manage and run large-scale networks.”

Amin said their strength was in running huge enterprise IT workloads and they lacked the expertise in handling the “uniqueness in the radio domain that has never existed in a typical IT workload.”

For example, a radio domain required predictable 1 microsecond latency, which required enhancements of the real-time kernel and the virtualization environment.

“These are not trivial workloads. They are going to discover is that radio is not simple to do.”

https://www.lightreading.com/service-provider-cloud/aws-many-years-behind-in-cloud-mobile-says-rakuten-cto/d/d-id/770579?

Just want to say your article analyzing the Dish Network AWS 5G partnership is astonishingly good. The clearness in your blog post is spectacular and reveals that you are very knowledgeable on this subject.

Thanks a million and please keep up your terrific analysis of the telecom industry.

Well I definitely enjoyed reading your analysis of the Dish Network-AWS 5G partnership. It seems Dish will build the 5G NR based RAN, while AWS will do the 5G SA core network (where all the 5G intelligent functions reside).

This article is very effective for proper planning of 5G networks: where the telco builds out the RAN and a cloud service hyper-scaler providing the 5G SA Core network.