Dish Network

Dish Network to FCC on its “game changing” OpenRAN deployment

Through disaggregation of the Radio Access Network (RAN) into functional blocks/modules and defining open interfaces between those modules, OpenRAN technology promises to allow newer, smaller players to sell into the 4G/5G equipment market. The intent is to offer more choices for cellular network operators who buy most of their gear from 4 or 5 big base station vendors.

Open RAN has been endorsed by 5G upstarts like Dish Network and Rakuten in Japan, but also by five big European carriers – Deutsche Telekom, Orange, Telecom Italia (TIM), Telefónica and Vodafone – which want to build an Open RAN ecosystem in Europe. AT&T has also expressed interest in the technology. However, there remains a lot of skepticism, especially for brownfield carriers.

…………………………………………………………………………………………………………………..

On March 14th, Dish Network executives participated in a video conference with a several FCC officials to discuss the company’s plans to launch a nationwide 5G network using Open RAN technology. Present on behalf of DISH were Stephen Bye, Chief Commercial Officer; Marc Rouanne, Chief Network Officer; Jeffrey Blum, Executive Vice President, External and Legislative Affairs; Sidd Chenumolu, Vice President, Technology Development; Alison Minea, Vice President, Regulatory Affairs; William Beckwith, Director of Wireless Regulatory Affairs; Hadass Kogan, Director & Senior Counsel, Regulatory Affairs; and Michael Essington, Senior Manager, Public Policy.

According to a Dish filing, the FCC requested the meeting to learn more about how Dish plans to deploy OpenRAN, rather than traditional purpose built RAN equipment, to build their 5G cellular network.

Ahead of its June 14, 2022 buildout milestone, DISH is launching a first-of-its-kind, cloud native, virtualized O-RAN 5G network in several major metropolitan areas of the country. Because DISH is building a greenfield network, we have the flexibility to choose the best technology to enter the market. While legacy carriers built closed end-to-end networks, DISH chose O-RAN because, among other reasons, it offers lower capital and operating costs, and is more resilient, secure, and energy efficient. In cooperation with more than 30 technology partners, DISH will offer a real-world example of the benefits of O-RAN as our 5G network rolls out to customers this year.

If more American carriers see the benefits of O-RAN and are able to adopt it as their networks evolve, the United States will be a stronger competitor in the global market. O-RAN is a game changer, among reasons, because:

- O-RAN networks increase vendor diversity

- O-RAN enhances spectrum utilization and enables network slicing

- O-RAN supports national security and cybersecurity objectives

- O-RAN networks are more secure and more agileO-RAN networks are more secure and more agile

In February 2021, the FCC published an OpenRAN Notice of Inquiry, stating:

Some parties assert that open radio access networks (Open RAN) are a potential path to drive 5G innovation, with industry proponents arguing that it could provide opportunities for more secure networks, foster greater vendor diversity, allow for more flexible network architectures, lower capital and operating expenses, and lead to new services tailored to unique use cases and consumer needs; others contend that Open RAN is still in its most formative stages, and that while promising, significant work remains before the benefits of the concept can fully be realized.

This Notice of Inquiry seeks input on the status of Open RAN and virtualized network environments: where the technology is today and what steps are required to deploy Open RAN networks broadly and at scale. It also seeks comment on whether and, if so, how deployment of Open RAN-compliant networks could further the Commission’s policy goals and statutory obligations, advance legislative priorities, and benefit American consumers by making state-of-the-art wireless broadband available more quickly and to more people in more parts of the country.

The financial analysts at New Street Research, say that U.S. government legislation could pave the way for “$1.5 billion for the Public Wireless Supply Chain Innovation Fund to deploy Open RAN equipment to spur movement toward open architecture, software-based wireless technologies and funding innovative leap-ahead technologies in the US mobile broadband market.”

The analysts added, “That provision might be of particular value to Dish, which is building out its network based on that technology.”

References:

https://www.lightreading.com/open-ran/fcc-calls-on-dish-about-open-ran/d/d-id/776166?

https://www.nokia.com/about-us/newsroom/articles/open-ran-explained/

Analysis of Dish Network – AWS partnership to build 5G Open RAN cloud native network

https://www.sdxcentral.com/articles/news/dish-missed-every-5g-commitment-it-made-in-2021/2021/12/

“There’s nothing like it;” AWS CEO announces Private 5G at AWS re-Invent 2021; Dish Network’s endorsement

Amazon Web Services (AWS) CEO Adam Selipsky kicked off day 2 of AWS re-Invent 2021 today with a keynote presentation loaded with exciting announcements, status updates, and long-term vision-setting for the AWS cloud platform. AWS is now in its 15th year. It currently has 81 Availability Zones, 250+ services, 475 instance types to support virtually any workload. And it has an always-evolving library of solutions designed for highly specific use cases.

The AWS cloud stores more than 3 trillion objects, AWS offers over 200 fully-featured services, with millions of customers around the world,” the CEO said. Of those customers, Netflix, NASA and NTT DoCoMo are highlighted as some of the most innovative use cases for AWS.

“In the last 15 years, cloud has become not just another tech revolution, but a shift in how businesses actually function. There’s no business that can’t be radically disrupted. And we’re just getting started,” Selipsky added, noting that only 5-15% of spending has moved to the cloud, so there’s a big opportunity to come, with 5G and IoT becoming super important too.

“We’re going to keep innovating to keep offering the broadest suite of services,” Selipsky said.

The most import announcement for IEEE Techblog readers was a new AWS Private 5G service that will allow users to launch and manage their own private mobile network in days with automatic configuration, no per-device charges, and shared spectrum operation. AWS provides all the hardware, software, and SIMs needed for Private 5G, making it a one-stop solution that is the first of its kind.

“It’s not easy to set up a private 5G network using offerings from existing 5G providers, according to AWS CEO. “Currently, private mobile network deployments require customers to invest considerable time, money and effort to design their network for anticipated peak capacity, and procure and integrate software and hardware components from multiple vendors. Even if customers are able to get the network running, current private mobile network pricing models charge for each connected device and make it cost prohibitive for use cases that involve thousands of connected devices.”

Selipsky said AWS customers will be able to select where they want to build a mobile network and the network capacity they need. AWS will then deliver and maintain the network’s necessary small cell radio units, servers, 5G core and radio access network (RAN) software, and subscriber identity modules (SIM cards) required for a private 5G network and its connected devices.

“AWS Private 5G automates the setup and deployment of the network and scales capacity on demand to support additional devices and increased network traffic,” the company explained, noting the network will work in “shared spectrum,” likely a reference to the 3.5GHz CBRS spectrum band in the U.S. “There are no upfront fees or per-device costs with AWS Private 5G, and customers pay only for the network capacity and throughput they request.”

“It’s (AWS Private 5G) shockingly easy,” according to Selipsky – AWS sends everything you need, from hardware to software to SIM cards. Automatic configuration makes it ideal for factories and workplaces, and you can ask for as many devices to be connected as you need. He added that the company will sell the service under a pay-as-you-go model, and won’t add any per-device fees. “There’s nothing like AWS Private 5G network out there,” the CEO concluded.

“Many of our customers want to leverage the power of 5G to establish their own private networks on premises, but they tell us that the current approaches make it time-consuming, difficult, and expensive to set up and deploy private networks,” said David Brown, Vice President, EC2 at AWS in a press release. “With AWS Private 5G, we’re extending hybrid infrastructure to customers’ 5G networks to make it simple, quick, and inexpensive to set up a private 5G network. Customers can start small and scale on-demand, pay as they go, and monitor and manage their network from the AWS console.”

Dell’Oro Group’s VP Dave Bolan wrote in an email, “What is new about this announcement, is that we have a new Private Wireless Network vendor (AWS) with very deep pockets that could become a major force in this market segment.”

Immediately after Selipsky keynote speech, Dish Network’s Chief Network Officer Marc Rouanne took the re-Invent stage to tout his own company’s forthcoming 5G network. [Note that AWS is providing the 5G SA cloud native core network for Dish]. Rouanne, touted the appeal of Dish’s planned (but delayed) 5G network for enterprise customers. He said Dish is building a “network of networks” that enterprise customers will be able to adapt to their needs. He said Dish’s 5G customers will be able to customize their services based on parameters such as speed and latency, but didn’t mention that’s based on network slicing which requires the 5G SA core network that Dish has outsourced to AWS.

“Some say we are the AWS of wireless,” Rouanne said, adding that Dish’s 5G will be as flexible as the cloud computing service built by Amazon. “Dish is going to be the enabler of technology that people have not even imagined yet.”

“We’re building the first architecture that is truly optimized for the cloud. It promises tremendous advances, not just for human communications, but also for machine to machine, and of course for humans to control those machines,” he added.

We have previously expressed skepticism that Dish can be an effective telecom/IT systems integrator with no experience whatsoever in that field. We wrote:

Dish said it would use Cisco for routing, IBM for automation, Spirent for testing and Equinix for interconnections – announcements noteworthy considering Dish is mere weeks from its first market launch. The ability to automatically, virtually and in parallel test new 5G Standalone services, slices and software updates in the cloud is key to Dish Network’s network strategy and its differentiation, according to Marc Rouanne, Dish EVP and chief network officer for its wireless business. Rouanne said that the ability to rapidly test and certify network software and services has been part of Dish’s vision for its network. Dish announced more than a year ago that it would use radio management software from both Mavenir and Altiostar, when Rakuten was a major investor in Altiostar (it now owns that company).

–>So it seams that Dish Network’s 5G role will be that of a systems integrator, putting together the many outsourced parts of its 5G greenfield network. It remains to be seen what combination of vendors will supply the Open RAN portion of the 5G network and what development, if any, Dish’s engineers will do for it. And how will Dish’s 5G SA core network via AWS interface with those Open RAN vendors?

In the previously referenced press release from AWS, Stephen Bye, Chief Commercial Officer, DISH said, “Selecting AWS has enabled us to onboard and scale our 5G core network functions within the cloud. They are a key strategic partner in helping us deliver private enterprise networks to our customers. AWS’s innovative platform allows us to better serve our consumer wireless customers, while unlocking new business models for enterprise customers across a wide range of industry verticals. Our ability to support dedicated, private 5G enterprise networks allows us to give customers the scale, resilience and security needed to support a wide variety of devices and services, unlocking the potential of Industry 4.0.”

In conclusion, it looks like the AWS Private 5G network (where Amazon provides the 5G RAN and 5G core) will compete with Dish’s 5G network (where Dish provides the RAN while AWS provides the 5G SA core network) for industrial customers. In that sense, it is a win-win proposition for Amazon as AWS will be competing with AWS (hah, hah!) for the 5G SA core network. It’s also significant that these announcements strengthened the trend to use 5G for industry/factory applications rather than for consumers where there is little or no benefits.

All in all, it send a strong competitive signal to wireless telcos that they’ll be competing with cloud hyperscalers as well as network equipment and software companies in the 5G private network market.

About Amazon Web Services:

For over 15 years, Amazon Web Services has been the world’s most comprehensive and broadly adopted cloud offering. AWS has been continually expanding its services to support virtually any cloud workload, and it now has more than 200 fully featured services for compute, storage, databases, networking, analytics, machine learning and artificial intelligence (AI), Internet of Things (IoT), mobile, security, hybrid, virtual and augmented reality (VR and AR), media, and application development, deployment, and management from 81 Availability Zones (AZs) within 25 geographic regions, with announced plans for 27 more Availability Zones and nine more AWS Regions in Australia, Canada, India, Indonesia, Israel, New Zealand, Spain, Switzerland, and the United Arab Emirates. Millions of customers—including the fastest-growing startups, largest enterprises, and leading government agencies—trust AWS to power their infrastructure, become more agile, and lower costs. To learn more about AWS, visit aws.amazon.com.

References:

https://reinvent.awsevents.com/

https://press.aboutamazon.com/news-releases/news-release-details/aws-announces-aws-private-5g

https://www.techradar.com/news/live/aws-reinvent-2021-keynote-live-blog

https://www.lightreading.com/open-ran/amazon-dish-peddle-dueling-5g-products/d/d-id/773802?

Analysis of Dish Network – AWS partnership to build 5G Open RAN cloud native network

Bloomberg: U.S. Billionaire’s Battle Over FCC’s 12 GHz Spectrum Policy

Charlie Ergen of Dish Network and Michael Dell of Dell Technologies have a plan to open up little-used wireless frequencies to millions of customers with a new 5G service. However, another billionaire strenuously objects. Elon Musk’s SpaceX filed an objection with the U.S. Federal Communications Commission (FCC), which governs airwaves distribution, saying the “scheme” would wreck his broadband-from-orbit service.

Dish Network responded with an FCC filing that accused SpaceX of “flimsy” and “far-fetched” criticism. RS Access LLC, a Dell company, cited what it calls SpaceX’s “long history of misleading information, rule-flaunting, and ad hominem attacks.”

The billionaires paths collide in a swath of spectrum known as the 12 gigahertz band [1.] Ergen and Dell have asked the FCC to allow higher-power traffic in 12 gigahertz airwaves they control in cities around the U.S. That’s 82 markets including New York and Chicago for Dish, and 60 markets including Austin, Texas and Omaha, Nebraska for Dell’s airwaves company, RS Access.

……………………………………………………………………………………………………………………………………………

Note 1. 12 GHz (more precisely 12.2-12.7 GHz Band ) is NOT one of the approved frequency bands in the revision to ITU Recommendation M.1036-6, which specifies ALL frequency bands for the TERRESTRIAL component of IMT (including IMT 2020). Despite that, the FCC is considering expanded terrestrial service rights in 500 megahertz of mid-band spectrum between 12.2-12.7 GHz (12 GHz band) without causing harmful interference to incumbent licensees.

………………………………………………………………………………………………………………………………………..

The 12 GHz spectrum band is currently restricted to one-way use. License holders include SpaceX, AT&T/DirecTV, Dish and other satellite providers, as well as companies that use the spectrum for downstream fixed wireless communications.

Some license holders, including Dish and fixed wireless provider RS Access, want the FCC to allow two-way use of the band. To support that view, RS Access submitted the RKF Engineering study that concluded that two-way use of the band would not interfere with incumbent users to the FCC.

Roberson and Associates found that 1 MHz of 12 GHz spectrum can carry 3.76 times as much data as 1 MHz of 28 GHz spectrum under peak throughput conditions.

Long-time 12 GHz 5G proponent RS Access refers to a report that identifies recent technology advances for making the 12 GHz band very desirable for 5G, including Massive MIMO, beamforming and 5G carrier aggregation.

………………………………………………………………………………………………………………………………………

This raucous battle of billionaires stands out on the ordinarily placid docket of the FCC, which is more often limited to detailed technical concerns such as antenna characteristics and signal power/ attenuation. It reflects the fortunes to be made as the U.S. moves toward 5G networks that will be used in many places, depending on the use case. A government auction earlier this year of 5G airwaves brought in $81 billion as the largest U.S. wireless providers snapped up frequencies; another airwaves sale that could net $25 billion is under way.

“It says they ain’t making spectrum no more!” said Tom Wheeler, a former FCC chairman. Spectrum describes the array of frequencies that companies use to offer telecommunications.

Space X also uses the 12 gigahertz frequencies. In FCC filings the company says the proposed higher-power signals could overwhelm the faint broadband signals that travel from its orbiting fleet of 1,500 or more satellites to customers’ rooftop receiving dishes.

Currently, services in the 12 gigahertz band are limited to low power under FCC rules designed to avoid interference with other users. Airwaves with higher power are typically worth more money, since their signals can travel farther and reach more customers. The increased potency can also increase the risk of overpowering other users’ signals.

Dish “has mastered the use of empty promises and attacks on competitors,” SpaceX told the FCC in a filing. Dell’s spectrum-holding RS Access told the FCC that SpaceX is offering a “false premise.” Dish then accused SpaceX of mounting an “attempt to obfuscate the issues.”

The fight has been brewing for at least five years. Dish and other holders of 12 gigahertz airwaves in 2016 asked the FCC to boost power for terrestrial users of the airwaves, citing skyrocketing demand for mobile data. At the time SpaceX’s first Starlink broadband satellite was three years from its 2019 launch. Dish and its partners at the time suggested satellite services should lose rights in the band.

Dell’s investment firm had made its purchase of 12 gigahertz airwaves via RS Access, which reached for influence inside the Beltway. It hired former House telecommunications counsel Justin Lilley, according to an October 2020 filing. Lilley’s roster of clients has included spectrum innovator Ligado Networks, wireless giant T-Mobile US and Facebook.

Lobbying expenses surged. Dell’s MSD Capital with no lobbying expenditures since its founding in 1998, spent $150,000 on lobbying in 2020, according to data compiled by Open Secrets, a non-profit that tracks money in Washington.

Dish, with a longtime presence in Washington, spent $1.8 million lobbying in 2020 and SpaceX spent $2.2 million, with each engaging more than three dozen lobbyists according to Open Secrets.

Dell called then-FCC Chairman Ajit Pai twice, in September and November of 2020. Ergen and Pai spoke in July of 2020. On Dec. 23, Musk called Pai — after two earlier calls between the two, according to FCC disclosure filings.

The FCC began its formal consideration with a 4-0 vote in January 2021, during the closing days of Ajit Pai’s tenure as FCC Chairman. The Republican left the agency following the presidential election, leaving the issue to the current FCC that is split 2-to-2 along partisan party lines.

Supporters formed a coalition that includes Dish, Dell, policy groups and two trade groups that include Dish as a member. RS Access presented a 62-page technical study that concluded coexistence between the 5G use and the satellite services can be achieved.

SpaceX, in a filing, said the airwaves are worth far less. Still it said RS Access and Dish were seeking “a windfall” by leveraging airwaves that today are useless.

“You don’t have to have them removed from the band at all,” V. Noah Campbell, chief executive officer of RS Access, said in an interview with Bloomberg. Campbell likened the proposal to a water main that’s been used at low capacity. “We just want the pipe open,” he said.

The spectrum in question could be worth as much as $54 billion if the FCC allows the change, according to a study submitted to the FCC by a Dell owned company. SpaceX, in a filing, said the airwaves are worth far less. The company said RS Access and Dish were seeking “a windfall” by leveraging airwaves that today are useless.

Dish Network has emphasized expanded demands for its 5G service, which is designed to connect not just mobile phones, but also IoT devices including baby monitors, vehicles, aerial drones, tractors, and factory gear. Dish has emphasized expanded demands for 5G service, which is designed to connect not just mobile phones, but also devices including baby monitors, vehicles, aerial drones, tractors, and factory gear.

“This band is really good for 5G,” Dish Executive Vice President Jeff Blum said in an interview with Bloomberg. “And it would be a missed opportunity if the commission left the status quo in place.”

References:

https://www.bloomberg.com/news/articles/2021-10-09/billionaires-musk-ergen-and-dell-brawling-over-spectrum-at-fcc (PREMIUM ARTICLE)

Battle Lines Thicken Over 5G Use of 12 GHz Spectrum, with SpaceX in the Crosshairs

https://www.fiercewireless.com/regulatory/massive-mimo-adaptive-beam-forming-spiff-up-12-ghz-band

Analysis of Dish Network – AWS partnership to build 5G Open RAN cloud native network

On its Q1-2021 earnings call, Dish Network Chairman and Co-founder Charlie Ergen did not provide any specifics regarding Dish’s deal with Amazon/AWS or its overall plan to build a nationwide 5G Open RAN, “cloud native” core network. Are you a bit tired of cliché’s like this:

“We’re building a Netflix in a Blockbuster world.” All Netflix did was put video on the cloud. Instead of going to a physical store, you put it in the cloud. Right. All the business plans in the world, all the numbers, all the thought if they just did something simple they put it in the cloud and the technology was they were a little ahead of the technology but the technology got there. All we’re doing is taking all those towers that you see as you drive down the highway, we basically put them in the cloud. And so instead of driving to physical store and rent a movie, you’re going to get all your data and information and automation everything from the cloud. And so it’s a dramatic paradigm shift in the way network is built and it should and it’s an advantage over legacy carriers who have 30-year-old architecture.” Of course, that’s incorrect as almost all 5G carriers plan to build a 5G cloud native core network.

Dish is planning to build the world’s first standalone, cloud-based 5G Open Radio Access Network (O-RAN), starting with the launch of a 5G wireless network for enterprise customers in Las Vegas, NV later this year.

Dish says it will leverage AWS’s architecture and services to deploy a cloud-native 5G network that includes O-RAN—the antennas and base stations that link phones and other wireless devices to the network. Also existing in the cloud will be the 5G core, which includes all the computer and software that manages the network traffic. AWS will also power Dish’s operation and business support systems.

“Amazon has made massive investments over the years in compute storage transport and edge, [and] we’ll be sitting on top of that and as we tightly integrate telco into their infra, then we can expose APIs to their development community, which we think makes and enables third-party products and services to have network connectivity, as well as enterprise applications,” said Tom Cullen, executive VP of corporate development for Dish, explaining some of the technical details of the arrangement during Thursday’s earnings call.

Ergen reiterated Dish’s plan to spend up to $10 billion on its overall 5G network and provided milestone date for completion of the first phase of the 5G build-out.

“All of that $10 billion isn’t spent by June of 2023, which is our major milestone,” Ergen said, pointing to the company’s agreement with the U.S. government to cover at least 70% of the population with 5G no later than June 14, 2023. However, Ergen has an escape hatch:

“The agreement we have [with the FCC] recognizes that [there could be] supply chain issues outside of our control, and that the timelines could be adjusted. But we don’t look at it that way internally. There is always unforeseen circumstances, and this one might be particularly acute. But we’re not going to let anything stop us. We’re focused on meeting our timelines, and regardless of what the challenges are. And we’ll have to reevaluate that from time to time, but we’re focused right now on Las Vegas and we’re focused on the 20% build-out by June of next year.”

“We’re not going to let anything stop us, he added. The $10 billion “does take us through the complete (5G) buildout.”

On the 5G cloud native aspect, Ergen said:

“Yes, we anticipated a cloud native network from the beginning, he said. “So the $10 billion total build-out cost that we announced a couple of years ago–I think people are probably still skeptical … But you can see where we’re headed. Most of your models will probably take a lot of capex off the board when you understand the architecture, and we’re not going to go through all the architecture in this call, but it’s certainly has a material impact on capex.”

Dish said last week it plans to run all of its network computing functions inside the public AWS cloud – a plan that represents a dramatic break from the way most 5G networks around the world run today. Many analysts think that’s a huge cyber-security risk as the attack surface is much greater in a virtual, cloud based network.

Marc Rouanne — Executive Vice President and Chief Network Officer:

“Yeah, the way to think of our cloud native network is a network of networks, that’s the way it’s architected. So when a customer comes to us, it’s easy for us to offer one sub network, which we can call it private network and there are techniques behind that like slicing, like automation, like software defined, so I’m not going to go into the techniques, but natively the way to think of it is really this network of networks. Right. And then, as Stephen, you’ve seen that you plan this to the postpaid customers and telling you how they would shake lose sub networks.”

“Absolutely, yeah. No, I think we’ve talked to a number of customers across multiple verticals in different industry segments and is an increasing appetite in demand for the kind of network that we’re building, which is really to enable them to have more security, more control and also more visibility into the data that’s coming off the devices, so that they can control their business more effectively. So we’re seeing a terrific demand. And the network architecture, we’re putting in place actually enables and unlocks that opportunity for those enterprise customers and it’s again not restricted to any specific vertical.

We’re touching a lot of different companies and a lot of different vertical segments across the country and the other aspect of the opportunity that we see for ourselves is that while we build out a nationwide network, we are in the process of working with customers and prospective customers on private networks that are not limited by the geography of our national footprint. So we can deploy those within their environments to support their business operations as well. So the demand we’re seeing is terrific and we’re already engaged with a number of customers today.”

Ergen chimed in again:

“The cloud infrastructure as it existed a couple of years ago, really didn’t handle telco very well, there has been a lot of R&D and investment that they’ve had to make to transform their network into something that where a telco can operate in the cloud, because it’s a little bit different than their traditional IT infrastructure. And then today they are, they were best in class room for what we needed and whether it be their APIs and the documentation and discipline and vendor at the — community that supports them and their — the developers and then of course obviously reach into the enterprise business. So it was — so that’s the first and foremost.

And then the second thing I think is, is the company committed? I’m not going to put words in Amazon’s mouth, I’ll let them talk to their commitment, but they’ve done a lot of work for us to help us without knowing where they have the deal or not and very appreciative that it. I think it’s helpful that Andy will become the CEO because he’s owned this project from the start and he can — he will be able to move all the pieces within Amazon to focus on this. And so I think at the end of the day, I think we’re going to be their largest customer in cloud and I think they’re going to — they may be the largest customer in our network. I mean, but we have to build a network and prove it, and they have to build and prove it. I think that all other carriers around the world will, including the United States will look at Amazon as a real leader here because we’re just doing something different.”

Stephen Bye — Executive Vice President, Chief Commercial Officer

“Yeah. So just in terms of what the Las Vegas build looks like. I think there are several attributes that are really important to what we’re doing to build on Charlie’s comment. One is we are building a cloud native infrastructure. We are using an Open Radio Access architecture. But it’s also a 5G native network. We’re not trying to put 5G on top of 2G, 3G and 4G, the infrastructure that we’re deploying is optimized for 5G and the way we’ve designed the network from an RF perspective and a deployment perspective is to take advantage of the 5G architecture as well as the 5G platform. And so, what does that look like?

It’s basically a new network, it’s new infrastructure, it’s designed using all of the spectrum bands that we have and the RF is optimized to take advantage of that. So we’re on a path to launching that in the third quarter, but it’s one of a number of markets we have coming on. We just have announced those markets through the end of the year, but it’s the first, obviously a number that we have in flight today and we’ve got activity going on across the country to actually build out this network. So it will be the first one that people can touch and feel and get the experience, but it is really a 5G native network and we’ve proven that O-RAN from a technology perspective can work compared to that at the end of last year. Now we are in the execution phase, now we’re in the deployment phase and so you know Vegas will have to be the first one that it will be a fully deployed market that people will be able to touch and feel and experience.”

Bye added that the 5G build-out will be done in phases but the network is designed to support all customers across all segments.

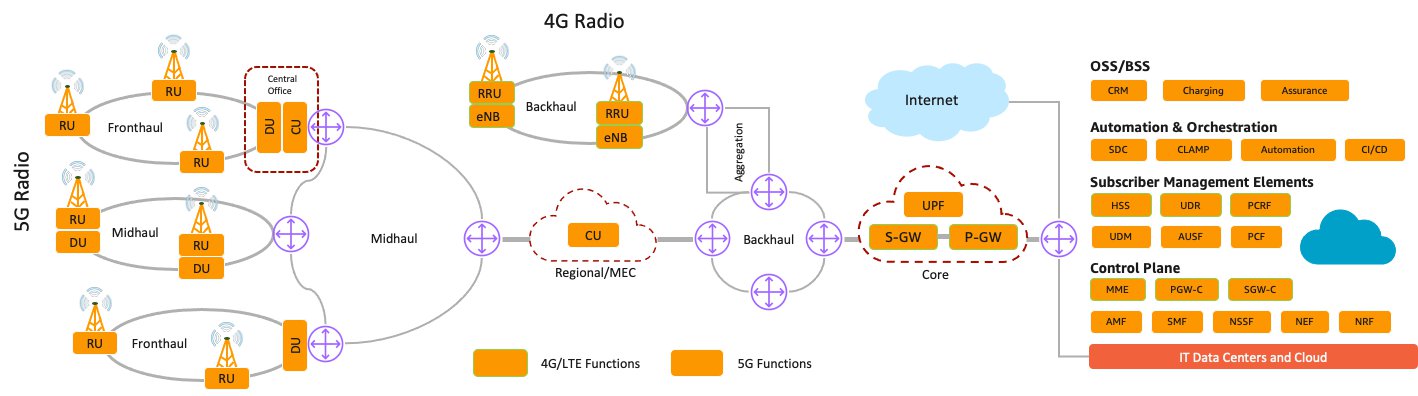

5G Network End-to-End Architecture. Image courtesy of AWS.

……………………………………………………………………………………………………………………………

In a note to clients, analyst Craig Moffett said that Dish was purchasing services from AWS rather than Amazon investing in Dish’s 5G network:

“It was a purchase agreement, albeit one freighted with lots of rather fuzzy jargon, and nothing more. Notably, Verizon already has its own relationship with AWS, and theirs does call for AWS to co-market Verizon services to AWS’s enterprise customers. By contrast, the Dish agreement calls only for Dish to market AWS services to Dish’s customers, not the other way around. Objectively, it is Verizon, not Dish, that has the more strategic relationship.

Amazon isn’t likely to market a service to its customers unless they are highly confident that its quality is first rate and that its staying power is assured. Perhaps Dish will get there. But it won’t be clear that they have arrived at that point until their network is successfully serving customers… without the safety net of the T-Mobile MVNO agreement. That’s not until 2027. That feels to us like a long time to wait.”

Regarding Dish Network’s new business model, Craig said “It is now fair to say that Dish’s core business is wireless rather than satellite TV. Not by revenues, of course; the wireless business is today but the modest reseller stub of what once was Boost (Mobile). But certainly by valuation….What does matter, however, is the extent to which the satellite TV business can serve as a source of funds for financing the wireless business.”

………………………………………………………………………………………………………………………………………

References:

https://d1.awsstatic.com/whitepapers/5g-network-evolution-with-aws.pdf

https://docs.aws.amazon.com/whitepapers/latest/cicd_for_5g_networks_on_aws/5g-networks-on-aws.html

Ting Mobile Acquired by DISH; Tucows Enables Mobile Competition Globally

Dish Network has acquired the assets of MVNO Ting Mobile, including its customer relationships, from Tucows, for an undisclosed amount. Under the deal, most Ting Mobile customers across the US will become Dish customers from August. The customers will be able to access the new T-Mobile US network, continue using their own phones and keep their rates and customer experience, Dish said. Tucows remains the owner of the Ting Mobile tech stack.

The deal follows Dish’s recent entry on the mobile market through the acquisition of Sprint’s prepaid brand Boost Mobile. Started eight years ago, Ting also focuses on the prepaid market, targeting cost-conscious mobile users. Ting said it expects the deal to help Dish “disrupt the retail wireless market and become a major competitor in the US mobile industry.”

Here’s what the news means for Ting Mobile customers:

· No data migration, service interruption or billing changes

· The same great customer service with the same Ting Mobile team managing the service/running the business

· A renewed ability for Ting Mobile to innovate on price, staying true to its roots

John Swieringa, Group President, Retail Wireless and DISH COO:

“Today, we welcome Ting Mobile customers to DISH. Ting Mobile is a great brand that stands for better value in wireless, and we are eager to begin delivering our award-winning customer service to Ting subscribers. Our agreement with Tucows will accelerate our digital and operational capabilities in wireless. Elliot and his team have a strong track record as entrepreneurs and innovators, and we are excited to partner with them on our wireless venture.”

……………………………………………………………………………………………………………………………………………..

Tucows has separately launched Mobile Services Enabler (MSE) services, with Dish as its first customer. Tucows will going forward focus on growing its MSE business, delivering a wide range of functions such as billing, activation, provisioning, and funnel marketing to mobile providers. Tucows has more than 24 million domain names under management on its platform through a global reseller network of over 36,000 web hosts and ISPs.

References:

Dish’s 5G network plan may be delayed for years as a result of COVID-19

In August 2019, Dish Network Corporation agreed to pay $3.6 billion for spectrum and $1.4 billion for Sprint’s prepaid business, which serves 9.3 million customers nationwide. The wholesale agreement and prepaid divestitures would let Dish become a reseller in the near term, offering service to consumers over the T-Mobile/Sprint network. Upon completion of the Sprint/T-Mobile merger, Dish was to acquire 14 MHz of Sprint’s nationwide 800 MHz spectrum.

Dish also committed to building a 5G network as a precondition of T-Mobile’s acquisition of Sprint. Dish said its 5G network would cover 20% of the US population by 2022 and 70% by mid-2023. At the time, Dish founder and CEO Charlie Ergen stated that not building the 5G network would amount to “financial suicide, and we’re not suicidal.”

However, as the coronavirus pandemic sends tremors through the U.S. economy, Dish faces a hostile operating environment: the company continues to shed subscribers from its pay-TV business (which is now suffering from the loss of live sports); big banks have pulled back on loans; and Dish decided to cut staff to help weather the economic fallout of the pandemic.

The New York Post earlier reported that Ergen’s plans to build the country’s fourth nationwide wireless network by 2023 were being thrown into doubt, quoting a source saying there is no financing to build a new 5G wireless network.

Business Insider spoke with the president and CEO of NATE, Todd Schlekeway, who elaborated on the biggest challenges that the coronavirus poses for tower technicians:

“Number one: The PPE [Personal Protective Equipment] that they need is becoming very difficult to obtain from not only their normal supply channels, but [even] trying to go outside of those has been very difficult. Number two: Access to restaurants hasn’t been too big of an issue because a lot of places have drive-throughs, but some companies have narrowed their scope geographically during this pandemic … due to [limited access to] hotels. [This allows] their tower crews and their techs to come home every night, whereas before they may have been on the road a whole week. The logistics of sending a crew on the road is harder now because restrictions could be different between jurisdictions.”

These challenges will likely slow down and increase the costs of Dish’s plan to deploy 10,000 sites for its 5G network by 2022. Given Dish’s already questionable $10-billion budget for a complete network build-out, it appears improbable that Dish will reach its ambitious network build-out targets.

Though Dish will be hit hardest by the logistical challenges of performing telecom field work during the pandemic, we expect the impacts will be felt by the industry at large. Dish is in a particularly challenging position, as it must build a network from scratch in order to compete as a network operator once its seven-year MVNO deal with T-Mobile expires.

But the big three U.S. wireless carriers likewise have ambitious 5G network build-out plans. For example, the New T-Mobile intends to cover 99% of the U.S. with 5G within six years, as part of a plan that includes 10,000 new towers and 40,000 additional small cells.

As long as quarantine measures remain in effect, it will be more difficult for network operators to carry out extensive network upgrades. This presents a greater threat to the business strategies of would-be telco disruptors, as incumbents can fall back on their existing network capacity which doesn’t exist for the upstart wireless carriers like Dish.

Is Dish’s 5G network plan a pipe dream? NY Post infers it is:

NY Post composite photo

……………………………………………………………………………………………..

References:

https://www.businessinsider.com/dish-faces-challenges-with-5g-build-out-amid-coronavirus-2020-4

https://nypost.com/2020/04/12/ergens-wireless-network-plans-dim-amid-coronavirus-pandemic/

AT&T boosts wireless network capacity in spectrum-sharing deal with DISH Network

DISH Network is loaning AT&T 20 MHz of spectrum in the AWS-4 band, as well as its entire supply of 700 MHz airwaves, for two months. This is the third spectrum-sharing arrangement that the satellite provider has made since Sunday as telecom network providers prepare for extra data traffic from people working at home.

“DISH is proud to join forces with AT&T to achieve a common, critical goal: supporting the connectivity needs of Americans during this challenging time,” said Jeff Blum, DISH SVP of public policy and government affairs, in a statement.

This follows last week’s news that DISH would lend its complete 600 MHz portfolio of spectrum to T-Mobile. In addition to loaning spectrum to T-Mobile and AT&T, DISH was given permission yesterday by the FCC to also loan spectrum to Verizon.

/cdn.vox-cdn.com/uploads/chorus_image/image/66528643/DSC_4155.0.jpg)

According to analyst Jonathan Chaplin at New Street Research, AT&T will be able to deploy the AWS-4 spectrum quickly and easily using its AWS-1 and AWS-3 equipment. In addition, AT&T can use Dish’s 700 MHz E-Block in conjunction with the D-Block that AT&T has started deploying in some markets. Analysts are speculating that these loans during the COVID-19 crisis might later be turned into ongoing leases.

Chaplin wrote: “All told, DISH has now loaned out spectrum that could be leased at an annual run rate of $940 million. They still have the PCS H-Block and another 20 MHz of AWS-4, which would be worth another $580 million.”

Chaplin of New Street says: “All we know at this stage is that DISH is helping in a crisis; we don’t know that either side would be willing to convert the loan to a lease.”

DISH’s generosity in lending its spectrum during the coronavirus scare is highlighting how helpful the spectrum is to other operators in order to increase their capacity.

Wells Fargo analyst Jennifer Fritzsche wrote, “Once this crisis passes, we believe the heavy demand on wireless and wired networks will shine the light on the need for additional spectrum allocation and continued programs to support push-out of broadband into rural areas to lessen the digital divide.”

………………………………………………………………………………….

PC Magazine has a breakdown of how Dish is distributing its unused spectrum over the next 60 days. Each provider is getting spectrum that can temporarily help bolster its 4G LTE data network and increase speeds. In AT&T’s case, Segan estimates that wireless customers could notice up to a 20Mbps uptick in data performance while the spectrum loan is in effect.

DISH has often been criticized for hoarding spectrum and not putting it to any actual use. The company even risked fines from the FCC for failing to build an actual wireless network with the spectrum it owns. But that was before the company was brought into the T-Mobile and Sprint deal and positioned as the replacement fourth “major” carrier once the merger is finalized.

Earlier today, T-Mobile issued a news release stating that the company remains prepared to close the merger with Sprint even as financial markets are in turmoil due to the coronavirus pandemic. All necessary US regulators have already approved it and the two providers emerged victorious over a challenge from several US states.

References:

https://www.fiercewireless.com/wireless/dish-lends-spectrum-to-at-t-during-covid-19-pandemic

https://www.pcmag.com/news/att-4g-gets-a-big-capacity-boost-in-coronavirus-crisis

Justice Dept approves the “New T-Mobile” via Sprint merger; Dish Network becomes 4th U.S. wireless carrier with focus on 5G

The Justice Department approved T-Mobile US Inc. ’s merger with Sprint Corp. after the companies agreed to create a new wireless carrier by selling assets to satellite-TV provider Dish Network Corp. The federal approval for T-Mobile and Sprint caps a more than yearlong review of a combination that fell apart twice in the past five years over terms of the deal or fears that the Justice Department would object.

The landmark antitrust agreement seeks to address concerns that the combination of T-Mobile, the nation’s No. 3 carrier by subscribers, and No. 4 Sprint will drive up prices for consumers. It would leave more than 95% of American cellphone customers with the top three U.S. operators.

A deal brokered by the Justice Department will require Dish, which has been sitting on valuable airwaves, to build a 5G network for cellphone customers. To help it get started, T-Mobile will sell Sprint’s prepaid brands to Dish and give access to its network for seven years.

“The remedies set up Dish as a disruptive force in wireless” with the pieces needed for the company to have a cellphone service that is ready to go, Makan Delrahim, the Justice Department’s antitrust chief, said in a news conference.

Critics of the arrangement include a group of state attorneys general that broke with the Justice Department and have filed an antitrust lawsuit seeking to block the more than $26 billion merger. Five states that weren’t part of the lawsuit joined the federal government in the settlement announced Friday.

“Why scramble so much to create a fourth competitor when you already have one?” said Samuel Weinstein, an assistant law professor at the Cardozo School of Law at Yeshiva University who worked previously in the Justice Department’s antitrust unit.

The deal gives Dish Network, a satellite-TV provider, about nine million Sprint prepaid cellphone customers and additional wireless spectrum. Those subscribers, which mostly come from its Boost Mobile business, represent about one-fifth of Sprint’s customer base. Dish’s service, which could keep the Boost brand or take on a new name, would also be able to move from pay-as-you-go plans to postpaid service, which tends to be more profitable.

T-Mobile and Sprint must also give Dish access to at least 20,000 cell sites and hundreds of retail locations. The new T-Mobile must provide “robust access” to its network, the Justice Department said. Please see comments on Dish in the box below this article.

The union of T-Mobile and Sprint, years in the making, would create a wireless company surpassing 90 million U.S. customers, closing the gap with Verizon Communications Inc. and AT&T Inc., which each have roughly 100 million wireless customers. It also would fulfill a long-held goal of Japan’s SoftBank Group Corp., which owns most of Sprint, and Deutsche Telekom AG, which controls T-Mobile.

T-Mobile and Sprint currently use separate frequencies, often requiring different cell towers:

Under the merger:

- Dish rents capacity from the new T-Mobile, creating a new carrier to serve Boost Mobile customers and giving it time to build its own network.

- After seven years, Dish runs its own network using spectrum from its past acquisitions and its own equipment installed on fewer towers.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

Federal Communications Commission Chairman Ajit Pai, who had previously backed the deal, said Friday the Justice Department settlement, coupled with T-Mobile and Sprint’s earlier commitments to deploy a nationwide 5G network, will preserve competition and advance U.S. leadership in rolling out next-generation networks.

In its agreement with the government, T-Mobile promised not to raise prices for three years and cover 97% of the U.S. population with 5G service in three years. T-Mobile has been adding millions of customers at the expense of its rivals, pushing unlimited data plans and lower prices than the incumbents. Sprint, despite owning valuable airwaves, has been shedding millions of subscribers and has struggled to be profitable.

T-Mobile surpassed Sprint to become the number three wireless carrier by subscribers and argued the acquisition of the smaller carrier’s airwaves would help speed its deployment of a 5G network so that it could better compete with Verizon and AT&T. U.S. carriers have been battling for customers in the $180 billion wireless voice-and-data market, where growth has slowed now that the companies have rolled out unlimited data plans and most Americans have upgraded to smartphones.

Letitia James, the New York attorney general, said the proposed merger would cause harm to consumers nationwide. “To be clear: The free market should be picking winners and losers, not the government, and not regulators,” she said during a call with reporters. Ms. James said Dish lacks the experience to operate a nationwide mobile network.

Mr. Delrahim said his office will share its settlement with the federal judge overseeing the states’ lawsuit. “Sometimes independent sovereigns do make independent determinations,” he said. A trial is expected later this year. On Friday, T-Mobile and Sprint extended the deadline to close their deal, from July 29 to Nov. 1.

The Justice Department stopped sharing information with the Democratic attorneys general after they decided to file their lawsuit in June without notifying their federal counterparts, Mr. Delrahim said. “That was their choice, not ours,” he said.

…………………………………………………………………………………………..

T-Mobile said it expects to close its Sprint purchase in the second half of this year despite the states’ lawsuit. Under the deal, Dish will pay $1.4 billion for the Sprint customer accounts, most of which come from its Boost prepaid brand, and $3.6 billion three years later to buy Sprint spectrum licenses in the 800-megahertz range, which can travel long distances and cover rural areas.

The new T-Mobile will have the option to lease back part of that spectrum for an additional two years after the airwaves sale closes. The companies have also agreed to negotiate for T-Mobile to lease Dish spectrum in the 600-megahertz range.

Dish is set to start its wireless life with a base of Sprint’s pay-as-you-go customers, though carriers often struggle to keep those so-called prepaid subscribers. More than 4% of Sprint’s prepaid customers choose to drop their service or are disconnected for nonpayment each month, according to company filings.

The deal creates a fake competitor, said Andrew Jay Schwartzman, a lecturer at Georgetown Law, adding that even if Dish builds out its own network it will take years. During that time, the three large carriers will be able to introduce 5G and lock in their subscriber bases, he said.

“Rather than having Sprint as a weak fourth competitor, the combined companies will now face an extremely weak fourth competitor,” Mr. Schwartzman said.

Sprint ended March with nearly $33 billion of net debt on its balance sheet. Even though it had more than 40 million customers, Sprint said during deal negotiations that it was in poor health and wouldn’t be able to launch nationwide 5G service without the merger.

Dish has argued it can build a better network by starting from scratch. Even before he pursued a deal with the Justice Department, Dish Chairman Charlie Ergen said his business could invest capital more efficiently without the burden of old equipment and software holding back its ambitions. Dish hasn’t made public the prices or structure of the wireless plans it will sell.

“These developments are the fulfillment of more than two decades’ worth of work and more than $21 billion in spectrum investments intended to transform Dish into a connectivity company,” Dish CEO Ergen said in a press release. “Taken together, these opportunities will set the stage for our entry as the nation’s fourth facilities-based wireless competitor and accelerate our work to launch the country’s first standalone 5G broadband network.”

Dish says:

The 800 MHz nationwide spectrum adds to Dish’s existing 600 MHz and 700 MHz low-band holdings. The low-band portfolio, well suited for wide geographic coverage and in-building penetration, complements Dish’s AWS-4 and AWS H Block mid-band offerings, which promise high data capacity potential with narrower operating range.

Dish has committed to new buildout schedules associated with the company’s 600 MHz, AWS-4, 700 MHz E Block and AWS H Block licenses. In addition, DISH has committed to deploy 5G Broadband Service utilizing those licenses.

Senior FCC officials said on a call with reporters that they are confident the new carrier under Dish will be viable because the wholesale deal it has struck with the new T-Mobile is more aggressive than any other such arrangement the carrier and Sprint currently have. Its terms give Dish the financial ability to compete in the prepaid market against T-Mobile’s Metro brand, they said. The settlement also included provisions designed to make sure Dish actually builds the promised infrastructure. Among other penalties, Dish agreed to pay the government up to $2.2 billion if it fails to meet its network expansion requirements.

Following the closing of T-Mobile’s merger with Sprint and subsequent integration into the New T-Mobile, DISH will have the option to take on leases for certain cell sites and retail locations that are decommissioned by the New T-Mobile for five years following the closing of the divestiture transaction, subject to any assignment restrictions. The companies have also committed to engage in good faith negotiations regarding the leasing of some or all of DISH’s 600 MHz spectrum to T-Mobile.

The completion of the T-Mobile and Sprint combination remains subject to remaining regulatory approvals and certain other customary closing conditions. T-Mobile and Sprint expect to receive final federal regulatory approval in Q3 2019 and currently anticipate that the merger will be permitted to close in the second half of 2019. Additional information can be found at www.NewTMobile.com.

………………………………………………………………………………………………………………………………………………………………………

Addendum from WSJ Editorial Board July 27, 2019 print edition:

The Justice Dept has rescued Dish Chairman Charlie Ergen from his bet of buying wireless spectrum but keeping it idle. Mr. Ergen loudly opposed the merger, and his reward was the chance to buy Sprint’s pre-paid customers at a bargain price and have access to 20,000 T-Mobile-Sprint cell sites and hundreds of retail locations. But Dish has no experience running a wireless network, and it will take years to build one even as the Big Three invest to gain an edge in 5G wireless…………………………………………………..

A strong third competitor will be good for consumers and 5G deployment in the U.S. The combined company should force Verizon and AT&T to focus on 5G rather than dabbling in content acquisitions like Time Warner. Three strong competitors are better than two.

………………………………………………………………………………….

FCC Comments:

“That’s a real significant win for U.S. leadership in 5G. It’s been my top priority. It’s been a big priority for the Trump administration. And by accelerating 5G build-out through this deal, 99% of Americans are going to see 5G faster,” FCC Commissioner Carr said.

In addition to the Justice Department, FCC Chairman Ajit Pai announced support for the more than $26 billion merger in May. The deal still faces a lawsuit from 13 state attorneys general and the District of Columbia that seeks to block it.

…………………………………………………………………………………..

References:

https://www.t-mobile.com/news/t-mobile-sprint-merger-doj-clearance

https://www.cnbc.com/2019/07/26/dish-network-finally-has-a-plan-for-a-new-wireless-network.html

https://techblog.comsoc.org/2018/08/03/dish-network-on-track-for-5g-build-out-phase1-is-nb-iot/

Dish Network on track for 5G build-out; Phase1 is NB-IoT

Despite skepticism from industry analysts and some recent prodding by the FCC, Dish Network Corp. is steadfastly confident that it can meet its service and buildout commitments for the wireless spectrum it owns. On it’s second quarter earings call (see excerpts below), Dish stressed that it’s “on track” to complete the first phase of a 5G-capable network, initially supporting Narrow Band Internet of Things (NB-IoT) services, by March 2020.

Author’s Note: Of course, NB-IoT is a 3GPP spec and is not part of true standardized 5G (ITU-R IMT 2020).

……………………………………………………………………………………………………………………………………..

CEO Charlie Ergen on Dish’s 2Q-2018 earnings call earlier this week:

When we first started talking about it, I think there was a high degree of skepticism that an IoT network — that narrowband IoT network was the business. And of course since that time, you’ve seen Verizon, and AT&T, and T-Mobile now has a national plan all around the world Vodafone, companies in China very far ahead in IoT. So think it’s now recognized that narrowband IoT is in fact a major contributor in the world moving forward.

So we have a track record of being innovative, disruptive and it may be on the — maybe being on the very, very leading edge of where technologies go and we have another opportunity to do that in 5G…. I think that the FCC is maybe just like many people in this call and many investors and that there is some skepticism on DISH’s ability to execute that plan it’s a big project. And I think as the months go by, as people see the progress that we made, you turn that into people coming to the realization that we can in fact — we face same skepticism when we were going to launch satellites and compete against with — compete against incumbents and major corporations. And we never done that before, it was a big project for us. But with a dedicated team of people focused on the right direction we’re confident that we’ll be able to do that.

But the big paradigm shift in 5G, not the market in 5G that you’re going to hear about , but the real paradigm shift in 5G is Release 16 from 3GPP, which for standalone network is December of 2019, that’s when the specification comes out. It allows you to do three things that you can’t do in 5G today; it allows massive broadband; it allows massive IoT connectivity; and it allows the network to have low latency, so very, very low latencies.

Editor’s Note: That is absolutely correct- it’s 3GPP release 16, along with parts of release 15, that will be submitted to ITU-R WP 5D for consideration as an IMt 2020 RIT.

We also are in a position with clean sheet of paper to do one — two more things really; one is to virtualize the network in a day and virtualize every aspect of our network, not just portions of it; and to slice our network so that it looks like separate networks to potential partners and customers. So it’s a huge, huge paradigm shift in terms of being 100% 5G with Release 19. So that release comes out at December 19, which means that people have to go build product for that. So product becomes available sometime later in 2020.

The second thing that happens is that our uplink spectrum. Let’s take 600 megahertz as an example that is not cleared by the broadcasters fully cleared until July of 2020. So we can’t build a modern network. The state-of-the-art we can’t start building that until 2020. And we’re hampered today just as a sideline, we’re very hampered today in building network because our uplink spectrum — we only have 5 megahertz of uplink spectrum. You can’t build a massive broadband network with 5 megahertz of uplink spectrum. So we have a lot of downlink spectrum, but we don’t have corresponding uplink. So we’ve got to get that cleared. And it’s not — it’s the 600 megahertz, it’s still the DE issues that are outstanding, all those things need to get cleared up for us to be able to do it. But everything comes together in 2020 for us to build a modern network.

The competitors will start building hybrid networks, but they’re not going to get to a full 5G platform without ripping out what they already have. And they have hundreds of millions of customers with phones. So the phone customer is not going to see that much difference in latency. So that some of the things that we’re going to do aren’t going to be that attractive from a cost to benefit ratio to the incumbents. But if we want to lead in 5G, we want to lead in artificial intelligence, virtual reality, autonomous vehicles,, smart cities, you’re going to need a more modern network for that and we’ll play big part in that.

Dish expects NB-IoT deployments to start “in earnest” this fall, Tom Cullen, Dish’s EVP of corporate development said. He pointed out that this part of the buildout is already funded by cash on the company’s balance sheet.

As I mentioned on the last call, we’ve made a lot of good progress and it’s the number one priority here at DISH and we’ve got a dedicated team working on it day-in and day-out. And we’ll start seeing radios in the next in the coming weeks and the deployment will start in earnest later this fall and that as we’ve mentioned before, it can be funded off of cash on the balance sheet.

On the number of NB-IoT cell sites/towers, Ergen said:

We’re not, at this point, disclosing the number of towers. As you know — as you’re doing RF planning and deployment that’s a pretty fluid environment and the number of towers is changing as we make progress going down the road. So I can’t address that specifically other than, as I said earlier, we feel like we’re making good progress and we’ll have pretty meaningful insight I think in the next four to six months.

I think you can assume that we would have materially less towers in phase one than phase two as you get into some of 5G applications that once the Release 19 is that you’ll need a denser network for sure. We have disclosed that we expect to spend between $500 and $1 billion on wireless through 2020. So they give you’re a range where we think it is no matter how many towers it is, we’re probably going to be in that range. And we’re working with a third party for RF design in terms of how many towers. And then obviously once we get it to test, we could verify that the specifications that the RF design and the vendors have said to us, is accurate. And so we’re — the answer is we don’t surely know, but we do know it’s materially less towers than perhaps the incumbents have today on a nationwide basis just because the range is clearly farther to the spec.

Cullen on 3GPP NB-IoT coverage:

I would only say that the 3GPP standard spec) today is about 35 kilometer coverage. But the 3GPP is currently entertaining, changing the NB-IoT standard (spec) to 120 kilometers of coverage and some of the vendors we’re working with are able to provide 100 km. Now you can’t do that in every area, obviously, because of clutter and urban density and so forth. But that — because of that level of propagation, it reduces the number of towers necessary to provide the required terrestrial signal coverage as dictated by the license.

Ergen refuted persistent suggestions that Dish should just sell its spectrum, holding that Dish is committed to the network buildout because 5G is critical to the company’s future.

I don’t think you’ve heard me talking much about selling spectrum even, question number one. And then analysts have talked about that but I think that we see such an opportunity for 5G in terms of what that does realizes is our network is going to be different as a standalone network, it’s a little bit different. And we think the customer we might go after might be quite a bit different than the incumbents. And we see that as the long-term future of how this company is relevant 30 years from now. And so that’s a tough transition and tough on investors to be patient while it goes through that. But that has been our focus and has always been our focus.

We originally want to be built an LTE 4G network. We just — the rules on H-block got changed where we suddenly lost some of our — from interference perspective and we had to change course and then we had to go downlink this is all things that took place we had to wait for the next paradigm shift. And that’s — the good news is the 5G paradigm shift is much bigger than the LTE paradigm shift.

How much capital will be needed for the 5G build-out? Here’s what Ergen said:

There is no question that we need to raise capital for the build-out. But realize we’re two-thirds of the way there — more than two-thirds of the way there in terms of capital for total 5G network. So run the math on that and it’s something like dollar megahertz per pop with a totally standalone 5G network, right. The number of people that might be attractive to is very long. What way you might structure partnerships and the ability for capital are many, many, many, many options to how you might do that.

There isn’t an industry in the next decade that doesn’t need what we’re going to build; and tens of billions of dollars is going to autonomous vehicles, but they’re going to need a piece of what we have; tens of billions of dollars goes to healthcare, they need a piece of what we have; tens of billions of dollars goes in utilities, they need a piece of what we have; tens of billions dollars is going into artificial intelligence, they need a piece of what we have; tens of billions of dollars are going in virtual reality, autoimmune reality and need a piece of what we have; tens of billions dollars is going into smart cities, they need a piece of what we have.

How long will NB-IoT build out take and what comes next?

It takes three years to build this first phase (NB-IoT). But the first phase leads to the second phase, which I think everybody is going to be pretty thrilled about, including the FCCs and investors and consumers. The first phase is going to be important but it’s not going to be as massive as we all would like. But for our license that’s not required and there is practical reasons why we can’t make it more massive today.