AWS

Bain & Co, McKinsey & Co, AWS suggest how telcos can use and adapt Generative AI

Generative Artificial Intelligence (AI) uncertainty is especially challenging for the telecommunications industry which has a history of very slow adaptation to change and thus faces lots of pressure to adopt generative AI in their services and infrastructure. Indeed, Deutsche Telekom stated that AI poses massive challenges for telecom industry in this IEEE Techblog post.

Consulting firm Bain & Co. highlighted that inertia in a recent report titled, “Telcos, Stop Debating Generative AI and Just Get Going” Three partners stated network operators need to act fast in order to jump on this opportunity. “Speedy action trumps perfect planning here,” Herbert Blum, Jeff Katzin and Velu Sinha wrote in the brief. “It’s more important for telcos to quickly launch an initial set of generative AI applications that fit the company’s strategy, and do so in a responsible way – or risk missing a window of opportunity in this fast-evolving sector.”

Generative AI use cases can be divided into phases based on ease of implementation, inherent risk, and value:

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Telcos can pursue generative AI applications across business functions, starting with knowledge management:

Separately, a McKinsey & Co. report opined that AI has highlighted business leader priorities. The consulting firm cited organizations that have top executives championing an organization’s AI initiatives, including the need to fund those programs. This is counter to organizations that lack a clear directive on their AI plans, which results in wasted spending and stalled development. “Reaching this state of AI maturity is no easy task, but it is certainly within the reach of telcos,” the firm noted. “Indeed, with all the pressures they face, embracing large-scale deployment of AI and transitioning to being AI-native organizations could be key to driving growth and renewal. Telcos that are starting to recognize this is non-negotiable are scaling AI investments as the business impact generated by the technology materializes.”

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Ishwar Parulkar, chief technologist for the telco industry at AWS, touted several areas that should be of generative AI interest to telecom operators. The first few were common ones tied to improving the customer experience. This includes building on machine learning (ML) to help improve that interaction and potentially reduce customer churn.

“We have worked with some leading customers and implemented this in production where they can take customer voice calls, translate that to text, do sentiment analysis on it … and then feed that into reducing customer churn,” Parulkar said. “That goes up another notch with generative AI, where you can have chat bots and more interactive types of interfaces for customers as well as for customer care agent systems in a call. So that just goes up another notch of generative AI.”

The next step is using generative AI to help operators bolster their business operations and systems. This is for things like revenue assurance and finding revenue leakage, items that Parulkar noted were in a “more established space in terms of what machine learning can do.”

However, Parulkar said the bigger opportunity is around helping operators better design and manage network operations. This is an area that remains the most immature, but one that Parulkar is “most excited about.” This can begin from the planning and installation phase, with an example of helping technicians when they are installing physical equipment.

“In installation of network equipment today, you have technicians who go through manuals and have procedures to install routers and base stations and connect links and fibers,” Parulkar said. “That all can be now made interactive [using] chat bot, natural language kind of framework. You can have a lot of this documentation, training data that can train foundational models that can create that type of an interface, improves productivity, makes it easier to target specific problems very quickly in terms of what you want to deploy.”

This can also help with network configuration by using large datasets to help automatically generate configurations. This could include the ability to help configure routers, VPNs and MPLS circuits to support network performance.

The final area of support could be in the running of those networks once they are deployed. Parulkar cited functions like troubleshooting failures that can be supported by a generative AI model.

“There are recipes that operators go through to troubleshoot and triage failure,” Parulkar said “A lot of times it’s trial-and-error method that can be significantly improved in a more interactive, natural language, prompt-based system that guides you through troubleshooting and operating the network.”

This model could be especially compelling for operators as they integrate more routers to support disaggregated 5G network models for mobile edge computing (MEC), private networks and the use of millimeter-wave (mmWave) spectrum bands.

Federal Communications Commission (FCC) Chairwoman Jessica Rosenworcel this week also hinted at the ability for AI to help manage spectrum resources.

“For decades we have licensed large slices of our airwaves and come up with unlicensed policies for joint use in others,” Rosenworcel said during a speech at this week’s FCC and National Science Foundation Joint Workshop. “But this scheme is not truly dynamic. And as demands on our airwaves grow – as we move from a world of mobile phones to billions of devices in the internet of things (IoT)– we can take newfound cognitive abilities and teach our wireless devices to manage transmissions on their own. Smarter radios using AI can work with each other without a central authority dictating the best of use of spectrum in every environment. If that sounds far off, it’s not. Consider that a large wireless provider’s network can generate several million performance measurements every minute. And consider the insights that machine learning can provide to better understand network usage and support greater spectrum efficiency.”

While generative AI does have potential, Parulkar also left open the door for what he termed “traditional AI” and which he described as “supervised and unsupervised learning.”

“Those techniques still work for a lot of the parts in the network and we see a combination of these two,” Parulkar said. “For example, you might use anomaly detection for getting some insights into the things to look at and then followed by a generative AI system that will then give an output in a very interactive format and we see that in some of the use cases as well. I think this is a big area for telcos to explore and we’re having active conversations with multiple telcos and network vendors.”

Parulkar’s comments come as AWS has been busy updating its generative AI platforms. One of the most recent was the launch of its $100 million Generative AI Innovation Center, which is targeted at helping guide businesses through the process of developing, building and deploying generative AI tools.

“Generative AI is one of those technological shifts that we are in the early stages of that will impact all organizations across the globe in some form of fashion,” Sri Elaprolu, senior leader of generative AI at AWS, told SDxCentral. “We have the goal of helping as many customers as we can, and as we need to, in accelerating their journey with generative AI.”

References:

https://www.bain.com/insights/telcos-stop-debating-generative-ai-and-just-get-going/

Deutsche Telekom exec: AI poses massive challenges for telecom industry

Generative AI in telecom; ChatGPT as a manager? ChatGPT vs Google Search

Generative AI could put telecom jobs in jeopardy; compelling AI in telecom use cases

Generative AI Unicorns Rule the Startup Roost; OpenAI in the Spotlight

Forbes: Cloud is a huge challenge for enterprise networks; AI adds complexity

Qualcomm CEO: AI will become pervasive, at the edge, and run on Snapdragon SoC devices

Bloomberg: China Lures Billionaires Into Race to Catch U.S. in AI

AWS and OneWeb agreement to combine satellite connectivity with cloud and edge computing

Amazon Web Services (AWS) has signed an agreement this week with LEO satellite internet provider OneWeb to explore potential horizontal and vertical use cases that arise from bundling satellite connectivity with cloud and edge compute resources.

The objective is to develop a satellite constellation management solution as a service, making it available to both corporate clients and those already working in the space sector. OneWeb and AWS will work closely together on four key initiatives:

• Business Continuity: Bundling connectivity with cloud services and edge computing services, delivering continuity and resiliency through an integrated infrastructure backed by the LEO constellation.

• Virtualization of Mission Operations: Supporting virtual mission operations for customers through integrated and customizable solutions.

• Space Data Analytics: Aggregating and fusing new levels of predictive and trending big data analytics through data lakes to support space and ground operations.

• User Terminals & Edge Integration: Deploying seamless cloud to edge solutions with a LEO connected user terminal.

Image Credit: OneWeb

“We are incredibly excited to begin working with AWS to see cloud services extended even closer to the edge thanks to OneWeb’s network. This global agreement will change the market dynamics, with OneWeb’s high-speed, low-latency services powering connectivity that will enable customers to reach even the most remote edges of the world and everywhere in between,” said Maurizio Vanotti, VP for new markets at OneWeb, in a statement.

“We are excited to work with OneWeb in their efforts to provide cloud-based connectivity and deliver innovative services to customers worldwide. AWS is committed to helping customers reimagine space systems, accelerate innovation, and turn data into useful insights quickly. We look forward to working with OneWeb in their efforts to push the edge closer to where their customers need it most,” added Clint Crosier, director of aerospace and satellite solutions at AWS.

The agreement serves to highlight the importance of seamless connectivity to enterprise applications and data from just about anywhere. It also underscores just how far behind Amazon is with its own satellite strategy, Project Kuiper.

Its aim is to launch 1,500 LEO satellites over the next five years, increasing to precisely 3,236 over the longer term. So far though, it has launched zero. Amazon was due to launch a couple of prototypes late last year, but a last-minute change of rocket company pushed everything back. It was also waiting on the US Federal Communications Commission (FCC) to approve its ‘orbital debris mitigation plan’, which it eventually got in February.

Amazon’s new launch partner, United Launch Alliance (ULA), plans to include those two Kuiper prototypes on the inaugural flight of its brand new Vulcan Centaur rocket, but lift-off won’t take place until 4 May (May the fourth – geddit?) at the earliest.

This is a fairly long-winded way of saying Amazon is still a long way off from offering commercial LEO satellite broadband and cloud services via its own network, and so this OneWeb deal should give it some valuable real-world experience until its own constellation is ready.

This announcement is the latest effort by OneWeb in its mission to bridge the digital divide and bolster innovation through industry collaboration with best-in-class service providers, serving customers from government, telecommunications, airline, and shipping industries.

Meanwhile, AWS and OneWeb will need to have cloud security high on their mutual agenda, judging by some recent rumblings from the U.S. According to a Politico report last week, the White House plans to draw up cloud security regulations designed to prevent hackers from attacking cloud infrastructure. It will also roll out rules that aim to make it harder for foreign hackers to use US-based cloud providers as a staging point from which to conduct attacks.

With so many government bodies and private enterprises becoming increasingly reliant on public cloud for hosting their data and applications, the underlying infrastructure makes for a juicy target. The fear is that a successful attack could cause widespread disruption if important clients like hospitals and ports are suddenly and unexpectedly cut off.

“In the United States, we don’t have a national regulator for cloud. We don’t have a Ministry of Communication. We don’t have anybody who would step up and say, ‘it’s our job to regulate cloud providers,’” said Rob Knake, the deputy national cyber director for strategy and budget, in the Politico report, adding that this needs to change.

While the White House cracks on with working out how to regulate cloud security, it is also pushing ahead with implementing rules drawn up by the previous administration. The Trump-era executive order will impose ‘Know Your Customer’ (KYC) rules on cloud providers in an effort to stop foreign hackers from using US cloud infrastructure as a platform for their attacks.

References:

https://oneweb.net/resources/oneweb-announces-global-agreement-aws

https://telecoms.com/520618/oneweb-bags-aws-deal-as-cloud-security-comes-under-scrutiny/

Swisscom, Ericsson and AWS collaborate on 5G SA Core for hybrid clouds

Swiss network operator Swisscom have announced a proof-of-concept (PoC) collaboration with Ericsson 5G SA Core running on AWS. The objective is to explore hybrid cloud use cases with AWS, beginning with 5G core applications. The plan is for more applications to then gradually be added as the trial continues. With each cloud strategy (private, public, hybrid, multi) bringing its own drivers and challenges the idea here seems to be enabling the operator to take advantage of the specific characteristics of both hybrid and public cloud.

The PoC reconfirms Swisscom and Ericsson’s view of the potential hybrid cloud has as a complement to existing private cloud infrastructure. Both Swisscom and Ericsson are on a common journey with AWS to explore how use cases can benefit telecom operators.

The PoC will examine use cases that take advantage of the particular characteristics of hybrid and public cloud. In particular, the flexibility and elasticity it can offer to customers which can mean deployment efficiencies for use cases where capacity is not constantly needed. An example of this could be when maintenance activities are undertaken in Swisscom’s private cloud, or when there are traffic peaks, AWS can be used to offload and complement the private cloud.

Swisscom had already been collaborating with AWS on migrating its 5G infrastructure towards standalone 5G. In addition, it has also used the hyperscaler’s public cloud platform for its IT environments. Telco concerns linger [1.] around the use of public cloud in telecoms infrastructure (especially the core networks) for some operators, hybrid cloud is seemingly gaining momentum as a transitional approach.

Note 1. Telco concerns over public cloud:

- In a recent survey by Telecoms.com more than four in five industry respondents feared security concerns over running telco applications in the public cloud, including 37% who find it hard to make the business case for public cloud as private cloud remains vital in addressing security issues. This also means that any efficiency gains are offset by the IT environment and the network running over two cloud types.

- Many in the industry also fear vendor lock-in and lack of orchestration from public cloud providers. Around a third of industry experts from the same survey find it a compelling reason not to embrace and move workloads to the public cloud unless applications can run on all versions of public cloud and are portable among cloud vendors.

- There’s also a lack of interoperability and interconnectedness with public clouds. The services of different public cloud vendors are indeed not interconnected nor interoperable for the same types of workloads. This concern is one of the drivers to avoid public cloud, according to some network operators.

–>PLEASE SEE THE COMMENT ON THIS TOPIC IN THE BOX BELOW THE ARTICLE.

Quotes:

Mark Düsener, Executive Vice President Mobile Network & Services at Swisscom, says: “By bringing the Ericsson 5G Core onto AWS we will substantially change the way our networks will be built and operated. The elasticity of the cloud in combination with a new magnitude in automatization will support us in delivering even better quality more efficiently over time. In order to shape this new concept, we as Swisscom believe strategic and deep partnerships like the ones we have with Ericsson and AWS are the key for success.”

Monica Zethzon, Head of Solution Area Core Networks, Ericsson says: “5G innovation requires deep collaboration to create the foundations necessary for new and evolving use cases. This Proof-of-Concept project with Swisscom and AWS is about opening up the routes to innovation by using hybrid cloud’s flexible combination of private and public cloud resources. It demonstrates that through partnership, we can deliver a hybrid cloud solution which meets strict telecoms industry requirements and security while making best use of HCP agility and cloud economy of scale.”

Fabio Cerone, General Manager AWS Telco EMEA at AWS, says: “With this move, Swisscom is opening the door to cloud native networks, delivering full automation and elasticity at scale, with the ability to innovate faster and make 5G impactful to their customers. We are committed to working closely with partners, such as Ericsson, to explore new use cases and strategies that best support the needs of customers like Swisscom.”

“How to deploy software in different cloud environments – at a high level, it is hard making that work in practice,” said Per Narvinger, the head of Ericsson’s cloud software and services unit. “You have hyperscalers with their offering and groups trying to standardize and people trying to do it their own way. There needs to be harmonization of what is wanted.”

https://telecoms.com/520337/swisscom-ericson-and-aws-collaborate-on-hybrid-cloud-poc-on-5g-core/

https://telecoms.com/520055/telcos-and-the-public-cloud-drivers-and-challenges/

AWS Telco Network Builder: managed network automation service to deploy, run, and scale telco networks on AWS

Omdia and Ericsson on telco transitioning to cloud native network functions (CNFs) and 5G SA core networks

AWS Telco Network Builder: managed network automation service to deploy, run, and scale telco networks on AWS

Amazon Web Services, Inc. (AWS) today announced the general availability of AWS Telco Network Builder, a fully managed service that helps customers deploy, run, and scale telco networks on AWS. Now, communications service providers (CSPs) can use their familiar telecom industry standard language to describe the details of their network (e.g., connection points, networking requirements, compute needs, and geographical distribution) in a template uploaded to the service.

AWS Telco Network Builder translates the template into a cloud-based network architecture and provisions the necessary AWS infrastructure, shortening the deployment of an operational, cloud-configured telco network from days to hours. As customers update their networks, AWS Telco Network Builder automatically adjusts compute and storage resources, allowing CSPs to focus on business operations and deliver new services.

AWS Telco Network Builder provides a centralized dashboard to monitor and manage the network running on AWS infrastructure – whether on premises or in AWS Regions. There are no upfront commitments or fees to use AWS Telco Network Builder, and customers pay only for the AWS services used to manage their network.

CSPs want to take advantage of the cloud’s performance, elasticity, and scale to build modern telco networks that support emerging use cases like smart cities, autonomous vehicles, and robotics. However, designing and scaling a telco network in the cloud can be a laborious, time-intensive process due to the iterative nature and breadth of network use cases, such as business support systems, mobile core, and radio networks. CSPs must first deploy and securely interconnect hundreds of specialized network functions (NFs)—containerized network appliances, like routers and firewalls—across dozens of vendors and thousands of locations, often hardcoding the infrastructure’s parameters when replicating across deployment locations.

Once the NFs are deployed, the CSP must update each NF individually to incorporate new software capabilities or make configuration changes, which is time-consuming work that strains resources. Building and running the network also requires skilled network architects with experience in cloud design and management. Additionally, CSPs must often purchase, setup, and maintain separate monitoring tools to observe the health of their on-premises and cloud-based infrastructures, making it challenging to obtain a complete view of their networks and address issues. As a result, CSPs can sometimes allocate too many resources to the undifferentiated heavy lifting of network management instead of focusing on innovating new experiences.

AWS Telco Network Builder is a fully managed network automation service that enables CSPs to deploy, run, and scale their telco networks on AWS faster and more easily. To start, a CSP populates their network architecture (e.g., routing requirements, location of deployment, specific NFs) as a template in the service’s console using telecom industry standard language, making it intuitive and easy to begin. AWS Telco Network Builder translates the customer’s network specifications into a cloud-based network architecture, streamlining programming requirements across multiple software vendors and accounting for the network’s geographic footprint. AWS Telco Network Builder automatically maps the provided topology to network services, provisions the necessary compute and storage resources, and connects the NFs to create an operational telco network. Customers can then reuse the uploaded templates to replicate that network architecture in new regions. As customers change their network configuration or run software updates, AWS Telco Network Builder handles lifecycle management for the NFs, performs updates to the NFs, and adjusts related infrastructure.

AWS Telco Network Builder is being sold to both public and private network operators, including those with existing network operations as well as those launching new networks.

Jan Hofmeyr, VP of Amazon EC2 said telcos those network functions in the format that telecom network operators have can continue to run their networks in the way they have in the past, even as they shift network functions into the AWS cloud. “It’s really an attempt to make it easier for them,” Hofmeyr said of the new product. “It doesn’t require them to be cloud experts on day one.”

Together, AWS Telco Network Builder and Amazon CloudWatch provide a comprehensive view of the NFs and AWS infrastructure, so customers can efficiently monitor and manage their networks to identify and remediate issues more quickly. AWS Telco Network Builder also integrates with popular third-party, end-to-end orchestrators for CSPs to maintain continuity across existing telco network operations and business systems. With AWS Telco Network Builder, customers only pay for the AWS products and services they use, so they can quickly scale their network based on business requirements.

“The telecom industry is undergoing a transformation as CSPs navigate building their telco networks in the cloud,” said Jan Hofmeyr, vice president of Amazon Elastic Compute Cloud (Amazon EC2). “Some of the biggest challenges CSPs face as they look to migrate include manually configuring and then managing these complex networks, which impedes growth and stifles innovation. Groundbreaking in the value it provides to the telecom industry, AWS Telco Network Builder removes the burden of translating a customer’s desired telco network into a cloud architecture, empowering them to easily modernize and quickly scale to meet demand while freeing time and capital to build new offerings, expand coverage, and refocus on invention.”

AWS Telco Network Builder is generally available today in U.S. East (N. Virginia), US West (Oregon), Asia Pacific (Sydney), Europe (Frankfurt), and Europe (Paris), and with availability in additional AWS Regions coming soon.

Amdocs is a leading provider of software and services to communications and media companies. “The current era of 5G cloud-based networks creates an opportunity for communications service providers to deliver accelerated value at unparalleled scale and efficiency,” said Anthony Goonetilleke, group president at Amdocs Technology. “Amdocs Intelligent Networking Suite takes advantage of AWS Telco Network Builder’s support of telecom interfaces to simplify service and network orchestration while bringing agility to network planning, deployment and operations.”

Cloudify is an open source, multi-cloud orchestration platform that packages infrastructure, networking, and existing automation tools into self-service environments. “We’ve observed the challenges the industry faces in bridging the gap between applications and cloud environments,” said Nati Shalom, CTO and founder of Cloudify. “Our work with AWS Telco Network Builder will help communications service providers more easily manage their network services by automating network planning, deployment, and operations activities using standard DevOps and IT service management tools. We are excited to use AWS Telco Network Builder to simplify the orchestration of network workloads using standard European Telecommunications Standards Institute-based interfaces.”

Infosys is a global leader in next-generation digital services and consulting. “The cloud’s scalability and efficiency are key to enabling innovation and reducing the complexity of managing telco network operations, which arms us with the tools to deliver new services for our end users continuously,” said Anand Swaminathan, executive vice president and global industry leader – Communications, Media, and Technology at Infosys. “As we look to build and operate cloud-based networks for our clients with Infosys Cobalt, we are excited to leverage AWS Telco Network Builder to increase the operational efficiency of mobile and private networks, ultimately enabling a streamlined operational model across Multi-G technologies.”

Mavenir is a network software provider building the future of networks with leading 4G, 5G, Core, and IP Multimedia Subsystem cloud-native software. “Managing 4G, 5G, Core, and IP Multimedia Subsystem networks is complex. Often these networks are distributed across the edge continuum,” said Bejoy Pankajakshan, chief strategy officer at Mavenir. “AWS Telco Network Builder allows us to create repeatable network templates that speed up the definition, provisioning, deployment, and upgrading of network services for our customers. The collaboration between Mavenir and AWS offers customers flexibility and agility in the deployment of network functions, furthering us toward our goal of building a single, software-based automated network.”

O2 Telefónica is a leading telecommunications provider in Germany, with around 47 million mobile telephone lines and 2.3 million broadband lines. “As we transition our telco network to the cloud, we strive to achieve greater operational simplicity while accelerating the roll-out of our network and services,” said Bas Hendrikx, head of Cloud Center of Excellence at O2 Telefónica. “We are exploring AWS Telco Network Builder to enable us to leverage automation to deliver new 5G network services faster and manage our networks more efficiently. At O2 Telefónica, we are committed to shaping digital change that benefits everyone, and our investments in building cloud-native networks and using AWS services help to provide greater value and performance to our customers.”

Dish Network in the U.S., Swisscom in Switzerland, and Spark in New Zealand are among the operators that have agreed to put their 5G SA core network functions into the AWS cloud.

To learn more, visit aws.amazon.com/tnb

References:

https://www.businesswire.com/news/home/20230221005644/en/AWS-Announces-AWS-Telco-Network-Builder

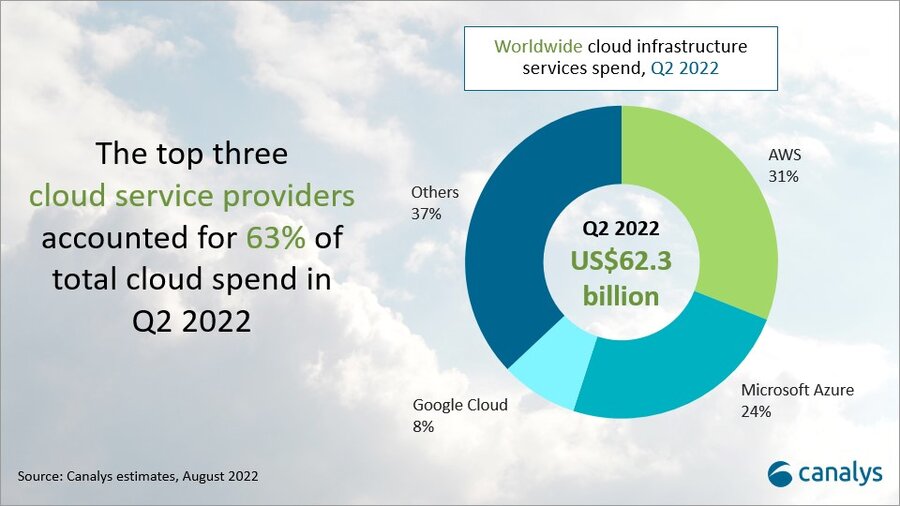

Canalys: Global cloud services spending +33% in Q2 2022 to $62.3B

According to market research firm Canalys, cloud infrastructure services continued to be in high demand in Q2 2022. Worldwide cloud spending increased 33% year on year to US$62.3 billion, driven by a range of factors, including demand for data analytics and machine learning, data center consolidation, application migration, cloud-native development and service delivery. The growing use of industry-specific cloud applications also contributed to the broader horizontal use cases seen across IT transformation. The latest Canalys data shows expenditure was over US$6 billion more than in the previous quarter and US$15 billion more than in Q2 2021.

The top three vendors in Q2 2022, Amazon Web Services (AWS), Microsoft Azure and Google Cloud, together accounted for 63% of global spending in Q2 2022 and collectively grew 42%. The key to increasing global market share is continually growing and upgrading cloud data center infrastructure, which all big three cloud service providers are working on.

- AWS accounted for 31% of total cloud infrastructure services spend in Q2 2022, making it the leading cloud service provider. It grew 33% on an annual basis.

- Microsoft Azure was the second largest cloud service provider in Q2, with a 24% market share after growing 40% annually.

- Google Cloud grew 45% in the latest quarter and accounted for an 8% market share.

In the next year, AWS plans to launch 24 new availability zones in eight regions, and Microsoft plans to launch 10 new cloud regions. Google Cloud, which accounted for 8% of Q2 cloud spend, recently announced Latin America expansion plans.

The hyperscale battle between leader AWS and challenger Microsoft Azure continues to intensify, with Azure closing the gap on its rival. Fueling this growth, Microsoft had a record number of larger multi-year deals in both the US$100 million-plus and US$1 billion-plus segments. Microsoft also said it plans to increase the efficiency of its server and network equipment by extending the depreciable useful life from four years to six.

A diverse go-to-market ecosystem, combined with a broad portfolio and wide range of software partnerships is enabling Microsoft to stay hot on the heels of AWS in the race to be #1 in cloud services.

“Cloud remains the strong growth segment in tech,” said Canalys VP Alex Smith. “While opportunities abound for providers large and small, the interesting battle remains right at the top between AWS and Microsoft. The race to invest in infrastructure to keep pace with demand will be intense and test the nerves of the companies’ CFOs as both inflation and rising interest rates create cost headwinds.”

Both AWS and Microsoft are continuing to roll out infrastructure. AWS has plans to launch 24 availability zones across eight regions, while Microsoft plans to launch 10 new regions over the next year. In both cases, the providers are increasing investment outside of the US as they look to capture global demand and ensure they can provide low-latency and high data sovereignty solutions.

“Microsoft announced it would extend the depreciable useful life of its server and network equipment from four to six years, citing efficiency improvements in how it is using technology,” said Smith. “This will improve operating income and suggests that Microsoft will sweat its assets more, which helps investment cycles as the scale of its infrastructure continues to soar. The question will be whether customers feel any negative impact in terms of user experience in the future, as some services will inevitably run on legacy equipment.”

Beyond the capacity investments, software capabilities and partnerships will be vital to meet customers’ cloud demands, especially when considering the compute needs of highly specialized services across different verticals.

“Most companies have gone beyond the initial step of moving a portion of their workloads to the cloud and are looking at migrating key services,” said Canalys Research Analyst Yi Zhang. “The top cloud vendors are accelerating their partnerships with a variety of software companies to demonstrate a differentiated value proposition. Recently, Microsoft pointed to expanded services to migrate more Oracle workloads to Azure, which in turn are connected to databases running in Oracle Cloud.”

Canalys defines cloud infrastructure services as those that provide infrastructure-as-a-service and platform-as-a-service, either on dedicated hosted private infrastructure or shared public infrastructure. This excludes software-as-a-service expenditure directly, but includes revenue generated from the infrastructure services being consumed to host and operate them.

For more information, please contact: Alex Smith: [email protected] OR Yi Zhang: [email protected]

References:

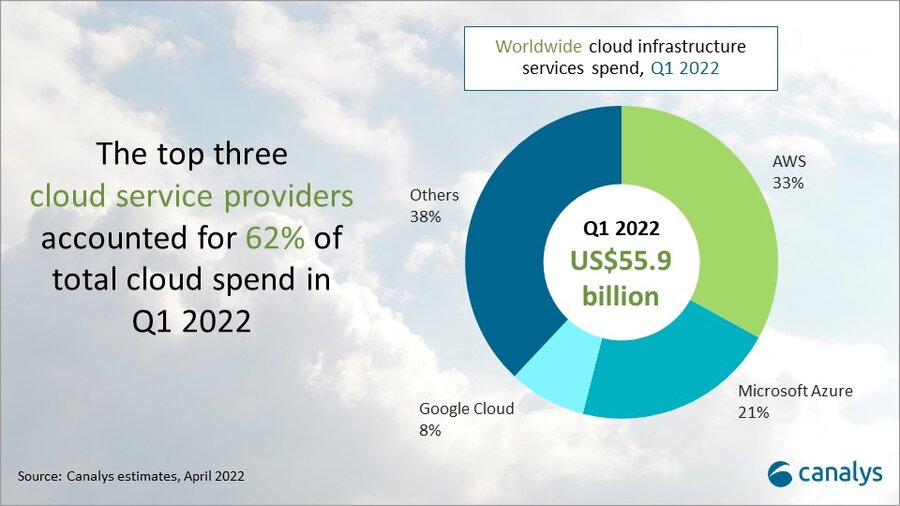

AWS, Microsoft Azure, Google Cloud account for 62% – 66% of cloud spending in 1Q-2022

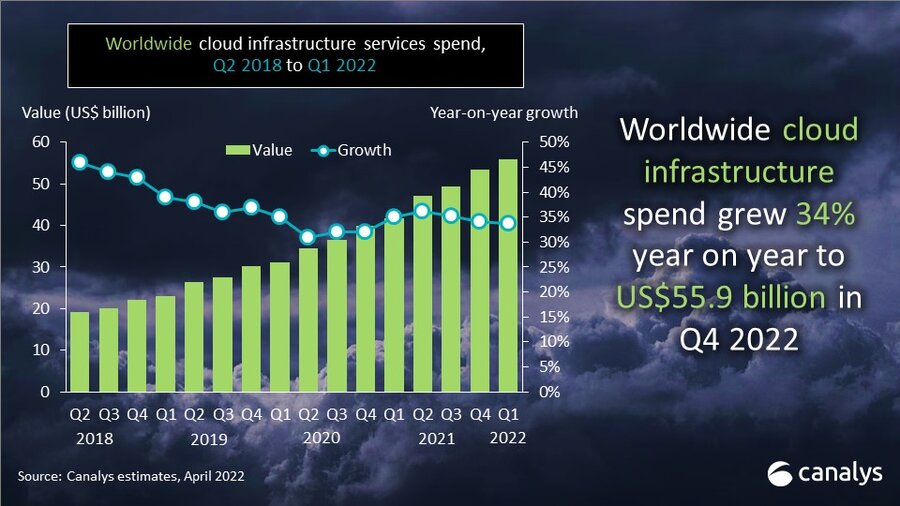

New data from Synergy Research Group shows that Q1 enterprise spending on cloud infrastructure services was approaching $53 billion. That is up 34% from the first quarter of 2021, making it the eleventh time in twelve quarters that the year-on-year growth rate has been in the 34-40% range.

To the surprise of no one, Amazon AWS continues to lead with its worldwide market share remaining at 33%. For the third consecutive quarter its annual growth came in above the growth of the overall market.

Microsoft Azure continues to gain almost two percentage points of market share per year while Google Cloud’s annual market share gain is approaching one percentage point.

In aggregate all other cloud providers have grown their revenues by over 150% since the first quarter of 2018, though their collective market share has plunged from 48% to 36% as their growth rates remain far below the market leaders.

Synergy estimates that quarterly cloud infrastructure service revenues (including IaaS, PaaS and hosted private cloud services) were $52.7 billion, with trailing twelve-month revenues reaching $191 billion. Public IaaS and PaaS services account for the bulk of the market and those grew by 37% in Q1. The dominance of the major cloud providers is even more pronounced in public cloud, where the top three control 71% of the market. Geographically, the cloud market continues to grow strongly in all regions of the world.

“While the level of competition remains high, the huge and rapidly growing cloud market continues to coalesce around Amazon, Microsoft and Google,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “Aside from the Chinese market, which remains totally dominated by local Chinese companies, other cloud providers simply cannot match the scale and geographic reach of the big three market leaders. As Amazon, Microsoft and Google continue to grow at 35-50% per year, other non-Chinese cloud providers are typically growing in the 10-20% range. That can still be an attractive proposition for those smaller providers, as long as they focus on regional or service niches where they can differentiate themselves from the big three.”

…………………………………………………………………………………………………………………..

Separately, Canalys estimates global cloud infrastructure services spending increased 34% to US$55.9 billion in Q1 2022, as organizations prioritized digitalization strategies to meet market challenges. That was over US$2 billion more than in the previous quarter and US$14 billion more than in Q1 2021.

The top three cloud service providers have benefited from increased adoption and scale, collectively growing 42% year on year and accounting for 62% of global customer spend.

Cloud-enabled business transformation has become a priority as organizations face global supply chain issues, cybersecurity threats and geopolitical instability. Organizations of all sizes and vertical markets are turning to cloud to ensure flexibility and resilience in the face of these challenges.

SMBs, in particular, have driven investment in cloud infrastructure services to support workload migration, data storage services and cloud-native application development. At the same time, infrastructure hardware shortages and the threat of further price inflation has spurred many large enterprises to invest in large-scale, multi-year cloud contracts to lock in upfront discounts with the hyperscalers.

All the major cloud providers have seen a significant increase in order backlogs as a result, which now total several hundred billion dollars worldwide. This in turn is driving the importance of cloud marketplaces as a sales channel for third-party software and security, as businesses seek to burn down these cloud commitments, further fueling infrastructure consumption.

“Cloud has continued to be a hot market and transformation strategies are emphasizing digital resiliency to face the market challenges of today and tomorrow,” said Canalys Research Analyst Blake Murray. “To be effective in resiliency planning, customers are turning to channel partners with the technical and consulting skills to help them effectively embrace hyper-scaler cloud services.”

Top cloud partners are doubling down on certification efforts and skills recruitment around hyper-scaler cloud services.

Global systems integrators, including Accenture, Atos, Deloitte, HCL Technologies, TCS, Kyndryl, Tech Mahindra and Wipro, are building practices with tens of thousands of cloud engineers and consultants. This has also included acquisitions of cloud application development and migration specialists, as well as the launch of new dedicated cloud services brands.

Smaller consultants, resellers, service providers and distributors are pursuing similar strategies as mid-market and SMB customers also demand support with cloud adoption.

“As the use cases for cloud infrastructure services expand so does the potential complexity, and we see that hybrid and multi-cloud deployments are commonplace in the market,” said Canalys Research Analyst Yi Zhang. “The hyperscalers are investing in rapid channel development and partners are responding as the opportunities grow.”

…………………………………………………………………………………………………………….

About Synergy Research Group:

Synergy provides quarterly market tracking and segmentation data on IT and Cloud related markets, including vendor revenues by segment and by region. Market shares and forecasts are provided via Synergy’s uniquely designed online database SIA ™, which enables easy access to complex data sets. Synergy’s Competitive Matrix ™ and CustomView ™ take this research capability one step further, enabling our clients to receive on-going quantitative market research that matches their internal, executive view of the market segments they compete in.

About Canalys:

Canalys is an independent analyst company that strives to guide clients on the future of the technology industry and to think beyond the business models of the past. We deliver smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our innovative use of technology and our high level of customer service.

References:

https://www.canalys.com/newsroom/global-cloud-services-Q1-2022

………………………………………………………………………………………………………………………………………..

May 6, 2022 Update from Light Counting:

|

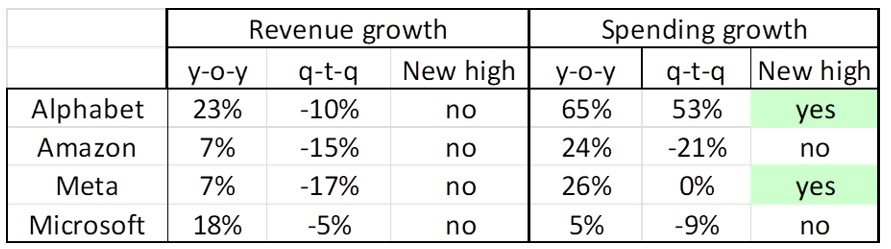

ICPs (Internet Cloud Providers) have grown spending by double digit rates (year-over-year) for many quarters and Q1 2022 looks like it will be no exception, as the combined spending of Alphabet, Amazon, Meta, and Microsoft increased 29% versus Q1 2021. What is surprising though is that Alphabet, not Meta, showed the fastest growth, with a 65% increase to more than $9.5 billion, a new record. And Alphabet’s big increase was not fueled by spending on infrastructure however, but by the closing of purchases of office facilities in New York, London, and Poland, which the company said added $4 billion to total spending in the quarter. We expect Alphabet’s Q2 capex will return from the stratosphere to the $5 billion range it has been running at. If Alphabet’s real estate spending is removed, Q1 capex for the group of four was up only 15% compared to Q1 2021, at the low end of the typical range for the Top 15 ICPs. While ICP spending appears on track to continue growing at double-digit rates this year, Q1 revenues were decidedly ‘off’ for the four majors that have reported, with no records set, and two of the four (Amazon and Meta) growing sales by only single-digit growth rates y-o-y. |

|

|

The Cloud services revenues of Alphabet, Amazon, and Microsoft continued to grow faster than overall company sales, increasing 44%, 37%, and 17% respectively.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Network equipment makers sales growth in Q1 2022 declined by 1% y-o-y in aggregate among the reported companies, but this figure belies the fact that individual company growth rates ranged from strong double-digits (Adtran, ADVA), middling single-digits (Ericsson Networks, Infinera, ZTE), to sales declines (Nokia Networks, Ribbon Communications).

Five Chinese optical transceiver vendors have reported Q1 results, and four of them showed strong growth: HG Tech, Innolight, Accelink, and Eoptolink. CIG was negatively impacted by shutdowns in both Shanghai and Shenzhen, which affected its ability to fulfill orders.

Among U.S.-based optical component makers, Neophotonics reported Q1 2022 revenue of $89 million, up 47% year-over-year, with 400G and above products growing 70% y-o-y to $54 million. The company is now shipping production volumes of 400ZR modules to cloud and data center customers.

Two years after the start of the COVID-19 pandemic, the effects of the COVID mitigation measures continue to disrupt manufacturing, shipping, and sales in the optical industry. Several companies warned that shortages and higher component and shipping costs would persist or even worsen as 2022 progresses. And finally, costs from Russia’s invasion of Ukraine, and subsequent withdrawals from the Russian telecoms market are starting to become known, ranging from $5 million (Infinera) to 900 million Euro (Ericsson).

|

Telenor expands cloud-based core network with AWS to deliver 5G and edge services for customers

Nordic network operator Telenor signed a strategic collaboration agreement with Amazon Web Services (AWS) to help expand its 5G core transformation, the telco said in a press release.

Telenor said that the new deal will allow it to deliver new 5G and edge services to enterprise customers worldwide. As part of the agreement, Telenor and AWS will invest in joint go-to-market activities in select industries—such as manufacturing, supply chain and logistics, and automotive—to enable more 5G and edge services for customers. Working with existing customers to demonstrate the possibilities of cloud-based resources, Telenor will scale its cloud footprint, while innovating to develop new services that use a combination of the most advanced and secure cloud technologies from AWS.

The agreement further expands the existing collaboration between both companies, with Telenor also becoming a member of the AWS Partner Network. Working with AWS, Telenor has already implemented an entire mobile core, running in the cloud, for Vimla, which is Telenor’s virtual mobile network operator (MVNO) brand in Sweden.

Running on AWS, Vimla’s mobile core is scalable, programmable, and employs self-service APIs, enabling Vimla to create new services for its customers. Vimla uses a wide range of AWS services, including Amazon ElastiCache, AWS Lambda and AWS Transit Gateway, among others.

The new cloud-based mobile core at Vimla is developed and managed as-a-service by Working Group Two, a company incubated by Telenor. The Nordic operator also said it plans to expand the work at Vimla to other areas in the company’s worldwide network.

As part of their collaboration, Telenor and AWS will continue to innovate in the areas of 5G edge for mobile private networks (MPNs) and edge computing. For example, Telenor 5G enabled a “network on wheels (NOW)” prototype powered by AWS. The NOW gives customers the ability to set up an autonomous private 5G network wherever it is needed. The NOW prototype is currently being used by the Norwegian defense material agency and the Norwegian Public Service broadcaster Norsk Rikskringkasting (NRK) for critical communication and remote production use cases, respectively. Internationally, Telenor’s Thailand brand dtac, launched a 5G private network proof-of-concept for Thai enterprises based on edge computing and the AWS Snow Family. This solution helps customers process real-time, artificial intelligence (AI)-based video analytics and other applications in remote locations.

Working with AWS, Telenor has already implemented an entire mobile core, running in the cloud, for Vimla—Telenor’s virtual mobile network operator brand in Sweden. Running on AWS, Vimla’s mobile core is scalable, programmable, and employs self-service APIs, enabling Vimla to create simple, innovative and valuable services for its customers. Vimla uses a wide range of AWS services, including Amazon ElastiCache, AWS Lambda, AWS Transit Gateway, and others to help scale elastically and provide a better service to more customers. The new cloud-based mobile core at Vimla is developed and managed as-a-service by Working Group Two, a company incubated by Telenor. As a result of driving network transformation on AWS, Telenor plans to expand the work at Vimla to other areas in the company’s worldwide network.

“Working with AWS, we are continuing to advance and modernize the telecoms industry—digitalizing and expanding our offerings beyond connectivity. Together, we are building on our individual strengths and scaling secure, robust, and advanced cloud services, alongside the latest networking technology, for our customers much faster than we could ever do before. Our shared ambition is to use scalable and flexible building blocks from AWS to continuously raise the bar for what’s possible,” said Sigve Brekke, president and CEO of Telenor Group.

“Telenor is pushing the boundaries of innovation by running their Vimla core on AWS. Cloud technology is allowing Telenor to scale their network in a way that was not possible before and is allowing them to experiment and develop new experiences for customers to keep them engaged, entertained, and online. We are pleased to collaborate with Telenor as they continue to expand this innovative work to other parts of their business,” said Adam Selipsky, CEO of AWS.

%20resized.jpg)

In addition to its home market in Norway and MVNO in Sweden, Telenor has operations in Denmark, Finland, Bangladesh, Pakistan, Thailand and Malaysia (and Myanmar, but it is trying to exit that market), but currently Telenor is not disclosing the details of which markets will be next or when the next deployment might happen.

Telenor and AWS have developed what they call a ‘Network On Wheels’ (NOW), which “gives customers the ability to set up an autonomous private 5G network wherever it is needed.” This model is already being used by the Norwegian Defence Material Agency for critical communications needs and by Norway’s public service broadcaster, Norsk Rikskringkasting (NRK), for remote production use cases.

In Thailand, Telenor group operator dtac has developed a 5G private network proof-of-concept for local enterprises using AWS Snow Family edge compute devices.

“This solution helps customers process real-time, artificial intelligence (AI)-based video analytics and other applications in remote locations, even in areas with intermittent connectivity,” Telenor said.

Ray Le Maistre of Telecom TV wrote: “Telenor has clearly identified AWS as the cloud partner that can help it with its specific need in both the consumer and enterprise markets, so this will be a relationship well worth tracking as the operational models are innovative.”

This author wonders what has become of Telenor’s deal with Nokia to launch a new cloud-native core solution in Denmark, Norway and Sweden. When it was announced in May 2020, Nokia said the deployment will “enhance performance and reliability and drive mobile broadband service agility as Telenor prepares for the introduction of 5G.”

………………………………………………………………………………………………………………………

References:

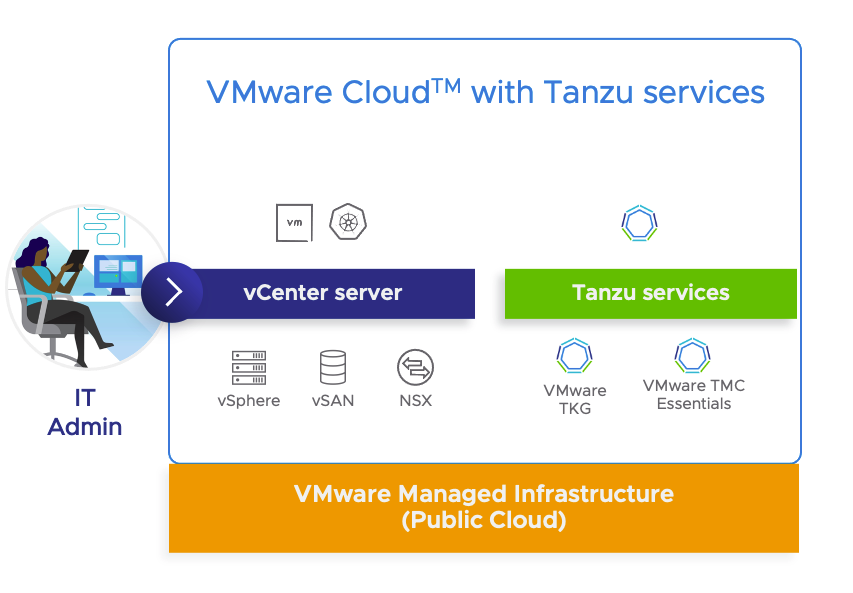

VMware Cloud with Tanzu services delivers enterprise-grade kubernetes services

VMware has announced new advancements for VMware Cloud on AWS [1.], a multi-cloud computing infrastructure. The new innovations include a new portfolio of managed Kubernetes services to modernize apps on VMware Cloud. The new functions will make it simpler and safer to run enterprise apps in VMware Cloud. This new VMware initiative supports the need for customers to run their IT software in sovereign clouds, as well as technology previews that showcase the future of VMware Cloud.

Note 1. VMware Cloud on AWS is the preferred service for AWS for all vSphere-based workloads [2.]. VMware Cloud on AWS brings VMware’s enterprise-class SDDC (Software Defined Data Center) [3.] software to the AWS Cloud with optimized access to native AWS services. Powered by VMware Cloud Foundation, VMware Cloud on AWS integrates VMware’s compute, storage, and network virtualization products (VMware vSphere, VMware vSAN, and VMware NSX [4.]) along with VMware vCenter Server management, optimized to run on dedicated, elastic, bare-metal AWS infrastructure.

VMware Cloud on AWS uses NSX-T to create and manage internal SDDC (Software Defined Data Center) networks and provide endpoints for VPN connections from the customer’s on-premises network infrastructure. This subnet is used by the vCenter, NSX, and HCX appliances in the SDDC.

Note 2. vSphere is a server virtualization software application from VMware. It debuted in 2009 as the successor to the company’s flagship VMware Infrastructure solution and serves as a complete platform for implementing and managing virtual machine (VM) infrastructure on a large scale.

Note 3. A SDDC network has two notional tiers:

- Tier 0 handles north-south traffic (traffic leaving or entering the SDDC, or between the

Management and Compute gateways). - Tier 1 handles east-west traffic (traffic between routed network segments within the SDDC).

Note 4. NSX is a network virtualization and security platform that enables the virtual cloud network, a software-defined approach to networking that extends across data centers, clouds and application frameworks.

…………………………………………………………………………………………………………………………………..

The company said that together, the innovations will give VMware Cloud customers more tools to accelerate modernization of their enterprise apps, increase business agility and resiliency, and significantly reduce costs compared to existing approaches.

VMware Cloud on AWS is an integrated cloud offering jointly developed by Amazon Web Services (AWS) and VMware.

………………………………………………………………………………………………………………………………………………..

VMware Cloud with Tanzu services (see illustration below) is a new portfolio of managed Kubernetes services that will be available at no additional charge as part of VMware Cloud on AWS (see illustration above), for enterprise-grade Kubernetes on a fully managed, hybrid-cloud ready Infrastructure as a Service (IaaS) for all enterprise applications.

IT admins will be able to use the VMware vCenter interface to unify VM and container management on a common platform and provision Kubernetes clusters within minutes. Platform operators or SREs will be able to manage Kubernetes clusters consistently across clouds using Tanzu services as a multi-cloud Kubernetes management plane.

VMware Cloud with Tanzu services

Tanzu services include the following capabilities:

- Managed Tanzu Kubernetes Grid Service: ision Tanzu Kubernetes clusters within a few minutes using a simple, fast, and self-service experience in the VMware Cloud console. The underlying SDDC infrastructure and capacity required for Kubernetes workloads is fully managed by VMware. Use vCenter Server for managing Kubernetes workloads by deploying Kubernetes clusters, provisioning role-based access and allocating capacity for Developer teams. Manage multiple TKG clusters as namespaces with observability, troubleshooting and resiliency in vCenter Server.

- Built in support for Tanzu Mission Control Essentials: Attach upstream compliant Kubernetes clusters including Amazon EKS and Tanzu Kubernetes Grid clusters. Manage lifecycle for Tanzu Kubernetes Grid clusters and centralize platform operations for Kubernetes clusters using the Kubernetes management plane offered by Tanzu Mission Control. Tanzu Mission Control provides a global visibility across clusters and clouds and increases security and governance by automating operational tasks such as access and security management at scale.

Tanzu services on the VMware Cloud on AWS platform brings together the three personas working on modern applications. vSphere Administrators manage virtual machines on-premises and in the cloud and allocate resources for platform operators to deploy workloads. The operators use Tanzu Mission Control to manage and maintain clusters across environments. Developers can create code using a flexible platform for container and virtual machine-based workloads.

The managed Tanzu Kubernetes Grid Service, which is one of the Tanzu services, will enable admins to provision Tanzu Kubernetes clusters within a few minutes using a simple, fast, and self-service experience in the VMware Cloud console.

- The underlying SDDC (Software Defined Data Center) infrastructure and capacity required for Kubernetes workloads is fully managed by VMware. Use vCenter Server for managing containerized workloads by deploying Tanzu Kubernetes Grid clusters, provisioning role-based access and allocating capacity for Developer teams.

- One can manage multiple TKG clusters as namespaces with observability, troubleshooting and resiliency in vCenter Server.

……………………………………………………………………………………………………………………………….

References:

https://blogs.vmware.com/cloud/2021/10/05/introducing-vmware-cloud-with-tanzu-services/

https://blogs.vmware.com/cloud/2021/10/05/vmware-cloud-tanzu-services-a-technical-introduction/

https://docs.vmware.com/en/VMware-Cloud-on-AWS/services/vmc-on-aws-networking-security.pdf

Ericsson IoT Accelerator Cloud Connect to connect cellular IoT devices to AWS

Ericsson has launched IoT Accelerator Cloud Connect to make it easier for enterprises using Ericsson’s IoT Accelerator platform to cellular devices to connect to the Amazon Web Services (AWS) server securely. According to Ericsson, Cloud Connect shifts the complex encryption required for secure IoT connectivity away from the device and onto the edge of the cellular network.

With an estimated five billion cellular IoT devices to be in use by the end of 2026, according to the Ericsson Mobility Report (June 2021), enterprises are increasingly outsourcing IoT device authentication and data management to public cloud providers such as AWS.

Enterprises on Ericsson IoT Accelerator-managing cellular devices such as sensors, meters, or tracking devices now have a much simpler way to connect to the already secure AWS server through Ericsson’s IoT Accelerator Cloud Connect, which moves complex encryption from the device to the edge of the cellular network.

Quotes from companies across multiple industry sectors:

Steve Dunn, CEO and Co-Founder at Digital Keys, a smart IoT security company, says: “Our cellular connected smartlocks with digital keys application are used for banks, hotels, universities, office buildings, shared labs, and apartments. Every smartlock has a SIM card that needs to connect to the cellular networks and the AWS cloud securely. It was a smooth process with Ericsson’s IoT Accelerator Cloud Connect.”

Communication service providers (CSPs) play a crucial role in the IoT ecosystem, providing global cellular connectivity using Ericsson IoT Accelerator. With more than 35 global CSPs already on Ericsson’s IoT Accelerator, enterprises of any size can manage the connectivity of their devices worldwide. It is now even easier to connect to AWS IoT Core.

Cristoff Martin, Chief Marketing Officer, Telenor Connexion, says: “This capability, integrated with our IoT Cloud service also developed together with AWS, will allow even more efficient development and operation of new connected solutions taking benefit of network technologies like Narrowband-IoT and the superior security capabilities of mobile networks in general.”

Jan Willem Smeenk, Chief Architect at SODAQ, a leading company in solar-powered asset tracking that specializes in scalable and efficient IoT hardware and software to empower businesses, says: “It is costly and complicated to connect our smart asset trackers securely, but with Ericsson as a key partner, we were able to order SIM cards from the operator on IoT Accelerator, insert them into our device with no additional encryption or certificate management required. Then, using Ericsson’s IoT Accelerator Cloud Connect, the device is authorized and automatically provisioned to the target AWS destination. It was simple and can serve our customers of any scale and size.”

Connecting to AWS IoT Core requires each connected device to use Transport Layer Security (TLS) encryption for all communications. With Cloud Connect, the IoT Accelerator service offers a plug-and-play alternative. In this, enterprises benefit from simple activation of devices that tunnel to the edge of the cellular infrastructure before automatically self-provisioning to AWS and securely connecting via Cloud Connect generated encryption and keys.

Rauno Jokelainen, Chief Technology Officer at UROS Group, a leading company in digital water services, says: “We see high value with the use of Cloud Connect in the UROS Sense Liquid Quality as a Service solution to provide real-time water quality detection to the municipalities and enterprises around the world in an easily deployable manner. With this solution, we can bring the peace of mind to the CIOs of the municipalities that their water networks are monitored in a secure manner.”

With Ericsson’s IoT Accelerator Cloud Connect, devices with unencrypted yet privately secured communications over cellular network leveraging Message Queuing Telemetry Transport (MQTT) or narrowband User Data Protocols (UDP) – such as Constrained Application Protocol (CoAP) – can connect seamlessly to AWS IoT Core, resulting in significantly lower power and data consumption.

Initial results show that Ericsson’s IoT Accelerator Cloud Connect enables low-powered devices to reduce mobile data by up to 95 percent and extend battery life by up to 50 percent by removing the need to run public end-to-end internet encryption.

Michael MacKenzie, General Manager, AWS IoT Connectivity & Control, says: “As enterprises connect more IoT devices to the public cloud, they want an easy and secure way to ingest IoT device data to AWS. Simple solutions like Ericsson’s IoT Accelerator Cloud Connect give enterprises flexibility by leveraging AWS IoT to easily manage and authorize devices, use zero touch provisioning, and ensure data is encrypted and secure.”

Kyle Okamoto, General Manager IoT, Ericsson, says: “Ericsson’s IoT Accelerator Cloud Connect removes barriers for enterprises to connect their IoT devices to numerous public clouds and to optimize the IoT data management infrastructure offered by providers like AWS. This means a faster time to market for enterprise devices and products. We are excited to offer this service to our IoT Accelerator community of over 7,000 enterprises globally.”

RELATED LINKS:

……………………………………………………………………………………………………………

Separately, Ericsson is cutting hundreds of jobs in China after losing market share during the recent awards of 5G contracts, according to Light Reading.

“Layoffs will happen by the end of this year as Ericsson merges three separate customer units in China into one. Until now, it has maintained a unit for each of China’s big mobile operators – China Mobile, China Telecom and China Unicom – but the restructuring will create a single mainland China customer unit catering to them all.”

Ericsson’s recent loss of market share has left it with a lower volume of 5G business to serve. Its move is aimed at rebalancing sales and costs so that it remains competitive on price.

Employees in China were briefed on the plans at an internal company meeting earlier today, where Chris Houghton, Ericsson’s head of market area for northeast Asia, said: “I sincerely regret that we now need to make changes to our great team, in order to reflect Ericsson’s changing market share position in China. We are committed to China and delivering value to our customers with our leading technology and solutions.”

The restructuring comes weeks after China Mobile gave Ericsson just 2% of the 700MHz bid on top of its existing share in 2.6GHz. This phase-two allocation in 5G is down from about 11% last year.

Ericsson has also picked up only a 3% share of the phase-two 5G work for China Telecom and China Unicom, which have joined forces to build a 5G network.

References:

https://www.ericsson.com/en/news/2021/9/ericsson-iot-cloud-connect-connects-iot-devices-to-aws

NEC expands partnership with AWS for global 5G, digital government, hybrid cloud

NEC Corp. expanded its collaboration with Amazon Web Services (AWS) in areas that include global 5G, digital government, and hybrid cloud in support of accelerating digital transformation for business customers.

In November 2020, NEC and AWS concluded a corporate-level strategic collaboration agreement and have been developing offerings and strengthening delivery functionalities since then. NEC will now expand this collaboration and strengthen efforts in the following areas: global 5G, digital government, and hybrid cloud as follows:

1. Global 5G

NEC aims to develop an end-to-end 5G offering and to provide it globally by combining NEC’s high-performance cloud-native open 5G mobile core, OSS/BSS solutions, local 5G use cases etc., and AWS cloud and edge solutions. NEC will accelerate telecom carriers’ cloudification of network workloads and enhance digital transformation for enterprises by deploying 5G-based infrastructure and applications at the network edge. This combined solution stack will be supported by NEC’s system integration services to enable customers to efficiently deploy and scale 5G networks, enhance automation and drive significant improvement in operational economics.

2. Digital government

NEC has been certified as an AWS Government Competency Partner based on the strategic collaboration that started last year and its achievements for governments to date. Going forward, NEC will further strengthen its relationship with AWS and focus on developing and providing a menu of offerings to accelerate the digital transformation for government activities in Japan.

3. Hybrid cloud

By collaborating with AWS, NEC aims to develop and provide a menu of offerings that connects on-premises and cloud environments securely, at high speed, and with low latency. This will contribute to the acceleration of digital transformation through modernization that utilizes the customer’s existing information technology (IT) assets.

To accelerate these initiatives, the NEC Group has increased the number of AWS-certified engineers to 2,000 at present, aiming for 3,000, double the number from the start of collaboration in 2020, and firmly maintains one of Japan’s largest delivery capabilities for cloud projects. Going forward, NEC will continue to strengthen these positions and to ensure that it responds to customers’ digital transformation demands.

NEC also intends to enhance its hybrid cloud offering with support from AWS, providing services that connect both on-premises and cloud environments in order to support enterprise digital transformation strategies. NEC has already been building up expertise in this field. The Japanese IT vendor has increased the number of AWS-certified engineers to 2,000, up from 1,500 in November 2020, and is aiming for 3,000 in three years. Furthermore, NEC has been certified as an AWS Government Competency Partner and said it will focus on “developing and providing a menu of offerings to accelerate the digital transformation for government activities in Japan.”

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Comments from both companies on this collaboration are as follows:

“NEC is pleased to announce the expansion of its strategic collaboration with AWS. Last year, NEC announced this global collaboration as the first of its kind between AWS and a Japanese company. It has been a great year, seeing many successes in the areas of government, modernization and in the skill enhancement of NEC engineers. NEC is now expanding the collaboration with AWS in the areas of global 5G, digital government and in enhanced hybrid cloud offerings. With the strong global support from AWS, NEC will help drive digital transformation in the government sector and across industries as part of orchestrating a brighter world,” says Toshifumi Yoshizaki, Executive Vice President at NEC Corporation.

“We are delighted to deepen our relationship with NEC. AWS welcomes NEC’s commitment and delivery of solutions built on AWS to deliver high-quality solutions that accelerate customers’ digital transformations. We look forward to NEC’s continued expansion of offerings and further expansion of delivery capabilities to optimize these transformations,” says Doug Yeum, Global Head of Alliances & Channels at Amazon Web Services, Inc.

Toshifumi Yoshizaki, Executive Vice President at NEC Corporation and Matt Garman, Senior Vice President at Amazon Web Services Inc.

NEC and its Netcracker subsidiary have already deployed their 5G core and full stack digital BSS/OSS on AWS cloud infrastructure to orchestrate and automate 5G digital services. The service was demonstrated at Mobile World Congress 2021, when NEC deployed its 5G core control plane on an AWS Region and its 5G UPF on an AWS Outposts’ edge location.

Other NEC cloud related partnerships:

- NEC’s collaboration with Rakuten Mobile, Japan’s disruptive open RAN and cloud-native 4G/5G wireless service provider, has certainly raised its open RAN and 5G Core profile. In May, Rakuten Mobile signed MoUs with Fujitsu and NEC to try and accelerate “global expansion” of Rakuten Communications Platform (RCP).

- In June, NEC and Rakuten Mobile said they would jointly develop the containerized standalone (SA) 5G core network (5GC) to be utilized in Rakuten Mobile’s fully virtualized cloud native 5G network.

- Later in June, Rakuten Mobile, NEC and Intel announced that they have achieved a performance of 640 Gbps per server for the containerized User Plane Function (UPF) on the containerized 5G SA core network jointly developed by Rakuten Mobile and NEC running on the Rakuten Communications Platform (RCP).

- In July, NEC expanded its “multi-year strategic partnership” with Microsoft whereby NEC adopted Microsoft Azure as its preferred cloud platform provider. (But now it’s in bed with AWS?)

- In August, NEC announced a collaboration with Fujitsu on interoperability testing for 5G base stations that conform to specifications from the O-RAN Alliance.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………..

About NEC Corporation:

NEC Corporation has established itself as a leader in the integration of IT and network technologies while promoting the brand statement of “Orchestrating a brighter world.” NEC enables businesses and communities to adapt to rapid changes taking place in both society and the market as it provides for the social values of safety, security, fairness and efficiency to promote a more sustainable world where everyone has the chance to reach their full potential. For more information, visit NEC at https://www.nec.com.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

To view and hear the comments from Toshifumi Yoshizaki, Executive Vice President at NEC Corporation and Matt Garman, Senior Vice President at Amazon Web Services Inc (pictured above), please visit: https://www.nec.com/en/press/202109/global_20210908_01.html

https://www.lightreading.com/5g/nec-expands-aws-tie-up-to-gain-5g-edge/d/d-id/771938?

Rakuten Mobile, Inc. and NEC to jointly develop the containerized standalone (SA) 5G core network

Why It’s Important: Rakuten Mobile, Intel and NEC collaborate on containerized 5G SA core network