5G Cloud Native Core Network

How Network Repository Function Plays a Critical Role in Cloud Native 5G SA Network

NRF (Network Repository Function) facilitates cloud-native 5G networks by enabling dynamic and efficient discovery of peer Network Functions, enhancing scalability.

Ajay Lotan Thakur

Introduction:

DNS (Domain Name Service) has been widely used by networks to discover 3G and 4G Network Functions (NFs). Every time there is a change in the network, this entails adding or updating records in the DNS server. This solution was not cohesive. The 5G Network Repository Function (NRF), which was introduced in the 5G specification, addresses this issue. Every Network Function needs to register its profile with NRF when it’s ready to service the APIs. Every NF type contains unique information in the NF profile. For example, Session Management Function (SMF) might provide the set of Data Network Names (DNN) it serves.

It’s important to note is that SMF may still choose User Plane Function (UPF) using proprietary logic because the UPF interface to NRF is still optional. In this article we shall see various advantages provided by 3GPP’s NRF network function over traditional 3G/4G networks.

Advantages of 5G NRFs:

Using 5G Network Resource Function (NRF) for discovering peer Network Functions (NFs) compared to relying on DNS servers in 4G networks brings several advantages:

- Efficiency in Resource Discovery: NRF offers a more efficient and dynamic way of discovering peer NFs within the network. Unlike DNS servers, which rely on static records and hierarchical lookup mechanisms, NRF enables direct discovery of available NFs, reducing latency and enhancing resource utilization. NRF can search the NFs based on many parameters like load, slice Ids, DNN name etc.

- Enhanced Security: NRF can incorporate security features such as authentication and authorization mechanisms, ensuring that only authorized NFs can be discovered and accessed. This helps in mitigating security threats such as DNS spoofing or cache poisoning, which are concerns in traditional DNS-based architectures.

- Support for Network Slicing: NRF is well-suited for 5G network slicing, where multiple virtualized networks coexist on the same physical infrastructure. It allows for efficient discovery and allocation of NFs specific to each network slice, enabling tailored services and resource optimization.

- Service Orchestration: NRF facilitates service orchestration by providing real-time information about the available NFs and their capabilities. This enables dynamic service composition and adaptation based on changing network conditions and application requirements. NRF can be used to put some of the NFs under maintenance mode as well.

- Low Latency: With NRF, the latency in discovering and connecting to peer NFs is significantly reduced compared to DNS-based approaches. This is crucial for applications requiring real-time communication or low-latency services, such as edge computing or autonomous vehicles. In case NRF is overloaded then it can scale-out to bring down the latency.

- Scalability: NRF architecture is designed to handle the scalability demands of 5G networks, where the number of NF instances and their dynamic nature can be high. It allows for efficient scaling of network resources without relying on centralized DNS servers, which may face scalability challenges under heavy loads. This allows Network Functions to implement dynamic scale in & scale out without touching any DNS servers.

- Dynamic Network Updates: NRF supports dynamic updates of network information, allowing for real-time changes in the availability and status of NF instances. These are NRF notifications supported as per 3gpp specification. In contrast, DNS records may require time to propagate changes across the network, leading to potential inconsistencies or delays in service discovery. Each NF can update its profile as and when it sees changes.

Conclusions:

Overall, leveraging NRF for NF discovery in 5G networks offers improved efficiency, scalability, low latency, security, and support for advanced network functionalities compared to relying solely on DNS servers in 4G networks.

References:

3GPP TS 23.501 – System Architecture for the 5G System

3GPP TS 29.510 – Network Function Repository Services

GSA: More 5G SA devices, but commercial 5G SA deployments lag

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

Ericsson Mobility Report touts “5G SA opportunities”

Analysys Mason: 40 operational 5G SA networks worldwide; Sub-Sahara Africa dominates new launches

Samsung and VMware Collaborate to Advance 5G SA Core & Telco Cloud

5G SA networks (real 5G) remain conspicuous by their absence

GSM 5G-Market Snapshot Highlights – July 2023 (includes 5G SA status)

About the Author:

Ajay Lotan Thakur, Senior IEEE Member, IEEE Techblog Editorial Board Member, BCS Fellow, TST Member of ONF’s open source Aether (Private 5G) Project, Cloud Software Architect at Intel Canada.

Blog post edited by Alan J Weissberger

Analysis of Dish Network – AWS partnership to build 5G Open RAN cloud native network

On its Q1-2021 earnings call, Dish Network Chairman and Co-founder Charlie Ergen did not provide any specifics regarding Dish’s deal with Amazon/AWS or its overall plan to build a nationwide 5G Open RAN, “cloud native” core network. Are you a bit tired of cliché’s like this:

“We’re building a Netflix in a Blockbuster world.” All Netflix did was put video on the cloud. Instead of going to a physical store, you put it in the cloud. Right. All the business plans in the world, all the numbers, all the thought if they just did something simple they put it in the cloud and the technology was they were a little ahead of the technology but the technology got there. All we’re doing is taking all those towers that you see as you drive down the highway, we basically put them in the cloud. And so instead of driving to physical store and rent a movie, you’re going to get all your data and information and automation everything from the cloud. And so it’s a dramatic paradigm shift in the way network is built and it should and it’s an advantage over legacy carriers who have 30-year-old architecture.” Of course, that’s incorrect as almost all 5G carriers plan to build a 5G cloud native core network.

Dish is planning to build the world’s first standalone, cloud-based 5G Open Radio Access Network (O-RAN), starting with the launch of a 5G wireless network for enterprise customers in Las Vegas, NV later this year.

Dish says it will leverage AWS’s architecture and services to deploy a cloud-native 5G network that includes O-RAN—the antennas and base stations that link phones and other wireless devices to the network. Also existing in the cloud will be the 5G core, which includes all the computer and software that manages the network traffic. AWS will also power Dish’s operation and business support systems.

“Amazon has made massive investments over the years in compute storage transport and edge, [and] we’ll be sitting on top of that and as we tightly integrate telco into their infra, then we can expose APIs to their development community, which we think makes and enables third-party products and services to have network connectivity, as well as enterprise applications,” said Tom Cullen, executive VP of corporate development for Dish, explaining some of the technical details of the arrangement during Thursday’s earnings call.

Ergen reiterated Dish’s plan to spend up to $10 billion on its overall 5G network and provided milestone date for completion of the first phase of the 5G build-out.

“All of that $10 billion isn’t spent by June of 2023, which is our major milestone,” Ergen said, pointing to the company’s agreement with the U.S. government to cover at least 70% of the population with 5G no later than June 14, 2023. However, Ergen has an escape hatch:

“The agreement we have [with the FCC] recognizes that [there could be] supply chain issues outside of our control, and that the timelines could be adjusted. But we don’t look at it that way internally. There is always unforeseen circumstances, and this one might be particularly acute. But we’re not going to let anything stop us. We’re focused on meeting our timelines, and regardless of what the challenges are. And we’ll have to reevaluate that from time to time, but we’re focused right now on Las Vegas and we’re focused on the 20% build-out by June of next year.”

“We’re not going to let anything stop us, he added. The $10 billion “does take us through the complete (5G) buildout.”

On the 5G cloud native aspect, Ergen said:

“Yes, we anticipated a cloud native network from the beginning, he said. “So the $10 billion total build-out cost that we announced a couple of years ago–I think people are probably still skeptical … But you can see where we’re headed. Most of your models will probably take a lot of capex off the board when you understand the architecture, and we’re not going to go through all the architecture in this call, but it’s certainly has a material impact on capex.”

Dish said last week it plans to run all of its network computing functions inside the public AWS cloud – a plan that represents a dramatic break from the way most 5G networks around the world run today. Many analysts think that’s a huge cyber-security risk as the attack surface is much greater in a virtual, cloud based network.

Marc Rouanne — Executive Vice President and Chief Network Officer:

“Yeah, the way to think of our cloud native network is a network of networks, that’s the way it’s architected. So when a customer comes to us, it’s easy for us to offer one sub network, which we can call it private network and there are techniques behind that like slicing, like automation, like software defined, so I’m not going to go into the techniques, but natively the way to think of it is really this network of networks. Right. And then, as Stephen, you’ve seen that you plan this to the postpaid customers and telling you how they would shake lose sub networks.”

“Absolutely, yeah. No, I think we’ve talked to a number of customers across multiple verticals in different industry segments and is an increasing appetite in demand for the kind of network that we’re building, which is really to enable them to have more security, more control and also more visibility into the data that’s coming off the devices, so that they can control their business more effectively. So we’re seeing a terrific demand. And the network architecture, we’re putting in place actually enables and unlocks that opportunity for those enterprise customers and it’s again not restricted to any specific vertical.

We’re touching a lot of different companies and a lot of different vertical segments across the country and the other aspect of the opportunity that we see for ourselves is that while we build out a nationwide network, we are in the process of working with customers and prospective customers on private networks that are not limited by the geography of our national footprint. So we can deploy those within their environments to support their business operations as well. So the demand we’re seeing is terrific and we’re already engaged with a number of customers today.”

Ergen chimed in again:

“The cloud infrastructure as it existed a couple of years ago, really didn’t handle telco very well, there has been a lot of R&D and investment that they’ve had to make to transform their network into something that where a telco can operate in the cloud, because it’s a little bit different than their traditional IT infrastructure. And then today they are, they were best in class room for what we needed and whether it be their APIs and the documentation and discipline and vendor at the — community that supports them and their — the developers and then of course obviously reach into the enterprise business. So it was — so that’s the first and foremost.

And then the second thing I think is, is the company committed? I’m not going to put words in Amazon’s mouth, I’ll let them talk to their commitment, but they’ve done a lot of work for us to help us without knowing where they have the deal or not and very appreciative that it. I think it’s helpful that Andy will become the CEO because he’s owned this project from the start and he can — he will be able to move all the pieces within Amazon to focus on this. And so I think at the end of the day, I think we’re going to be their largest customer in cloud and I think they’re going to — they may be the largest customer in our network. I mean, but we have to build a network and prove it, and they have to build and prove it. I think that all other carriers around the world will, including the United States will look at Amazon as a real leader here because we’re just doing something different.”

Stephen Bye — Executive Vice President, Chief Commercial Officer

“Yeah. So just in terms of what the Las Vegas build looks like. I think there are several attributes that are really important to what we’re doing to build on Charlie’s comment. One is we are building a cloud native infrastructure. We are using an Open Radio Access architecture. But it’s also a 5G native network. We’re not trying to put 5G on top of 2G, 3G and 4G, the infrastructure that we’re deploying is optimized for 5G and the way we’ve designed the network from an RF perspective and a deployment perspective is to take advantage of the 5G architecture as well as the 5G platform. And so, what does that look like?

It’s basically a new network, it’s new infrastructure, it’s designed using all of the spectrum bands that we have and the RF is optimized to take advantage of that. So we’re on a path to launching that in the third quarter, but it’s one of a number of markets we have coming on. We just have announced those markets through the end of the year, but it’s the first, obviously a number that we have in flight today and we’ve got activity going on across the country to actually build out this network. So it will be the first one that people can touch and feel and get the experience, but it is really a 5G native network and we’ve proven that O-RAN from a technology perspective can work compared to that at the end of last year. Now we are in the execution phase, now we’re in the deployment phase and so you know Vegas will have to be the first one that it will be a fully deployed market that people will be able to touch and feel and experience.”

Bye added that the 5G build-out will be done in phases but the network is designed to support all customers across all segments.

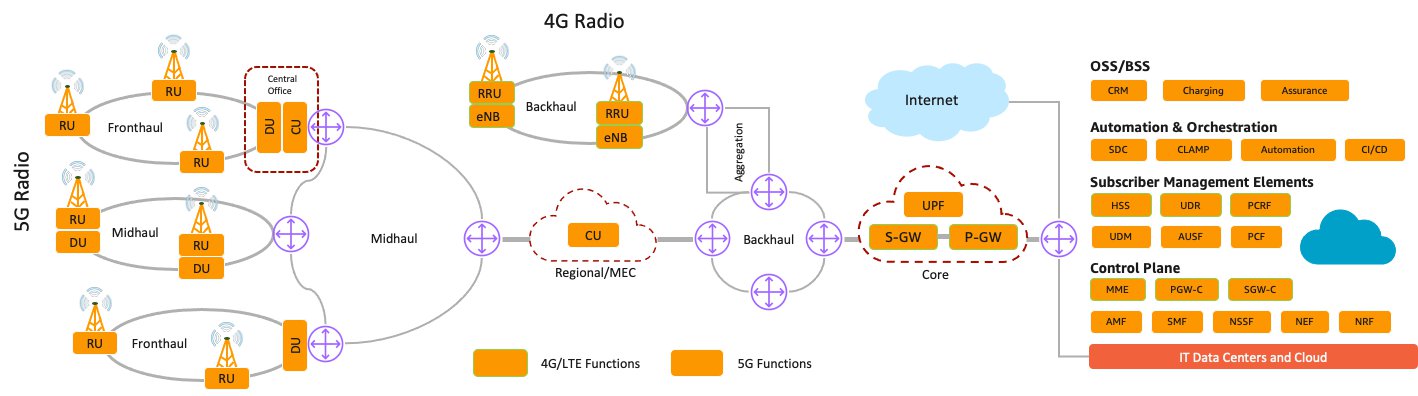

5G Network End-to-End Architecture. Image courtesy of AWS.

……………………………………………………………………………………………………………………………

In a note to clients, analyst Craig Moffett said that Dish was purchasing services from AWS rather than Amazon investing in Dish’s 5G network:

“It was a purchase agreement, albeit one freighted with lots of rather fuzzy jargon, and nothing more. Notably, Verizon already has its own relationship with AWS, and theirs does call for AWS to co-market Verizon services to AWS’s enterprise customers. By contrast, the Dish agreement calls only for Dish to market AWS services to Dish’s customers, not the other way around. Objectively, it is Verizon, not Dish, that has the more strategic relationship.

Amazon isn’t likely to market a service to its customers unless they are highly confident that its quality is first rate and that its staying power is assured. Perhaps Dish will get there. But it won’t be clear that they have arrived at that point until their network is successfully serving customers… without the safety net of the T-Mobile MVNO agreement. That’s not until 2027. That feels to us like a long time to wait.”

Regarding Dish Network’s new business model, Craig said “It is now fair to say that Dish’s core business is wireless rather than satellite TV. Not by revenues, of course; the wireless business is today but the modest reseller stub of what once was Boost (Mobile). But certainly by valuation….What does matter, however, is the extent to which the satellite TV business can serve as a source of funds for financing the wireless business.”

………………………………………………………………………………………………………………………………………

References:

https://d1.awsstatic.com/whitepapers/5g-network-evolution-with-aws.pdf

https://docs.aws.amazon.com/whitepapers/latest/cicd_for_5g_networks_on_aws/5g-networks-on-aws.html

Telenor trial of multi-vendor 5G Standalone (SA) core network on vendor neutral platform

Telenor Group [1.] today said it has established a 5G standalone core network environment using a vendor-neutral platform, with network functions from Oracle, Casa Systems, Enea and Kaloom, all running on Red Hat Openshift. It has deployed Palo Alto Networks Prisma Cloud Compute protection and a 5G New Radio (NR) cellular transmission system from Huawei. Telenor said its 5G standalone (SA) trial using commercially available components proves that a multi-vendor environment is possible.

Note 1. Telenor Group is a Norwegian majority state-owned multinational telecommunications company headquartered at Fornebu in Bærum, close to Oslo, Norway.

The Palo Alto Networks Next Generation Firewall is being used to securing internet connectivity for mobile devices, said Telenor. Red Hat’s Ansible Platform is being used as a scalable automation system, and Emblasoft is providing automated network testing capabilities. The Norwegian Armed Forces have tested Security as a Service enabled by the multi-vendor set-up, it added.

Patrick Waldemar, vice president and head of technology at Telenor Research, said:

“The main component of 5G-SA is the 5G mobile core, the ‘brain’ of the 5G system. Unfortunately, most 5G core deployments are still single vendor dependent, with strong dependencies on that vendor’s underlying proprietary architecture. This single-vendor dependency can be a killer for innovation. It restricts open collaboration from the broader 5G ecosystem of companies developing new technology, use cases, and services that the market expects.”

“To protect the 5G infrastructure from cyber threats, we deployed Palo Alto Networks Prisma Cloud Compute, and their Next Generation Firewall is also securing Internet connectivity for mobile devices. Red Hat Ansible Automation Platform is being used as a scalable automation system, while Emblasoft is providing automated network testing capabilities. The 5G New Radio (NR) is from Huawei,” says Waldemar.

Telenor’s 5G-SA trial, with commercially available components, demonstrates that a truly multi-vendor environment is possible. However, this author has doubts that a multi-vendor 5G SA core network will go into production anytime soon.

“We believes that such a multi-vendor environment will stimulate innovation, reduce cost of the infrastructure, increase competition and accelerate the development of an open 5G-ecosystem which in turn will enable a range of new services for Telenor’s consumers, industry and government customers,” says Waldemar.

……………………………………………………………………………………………………………………………………..

Heavy Reading Survey:

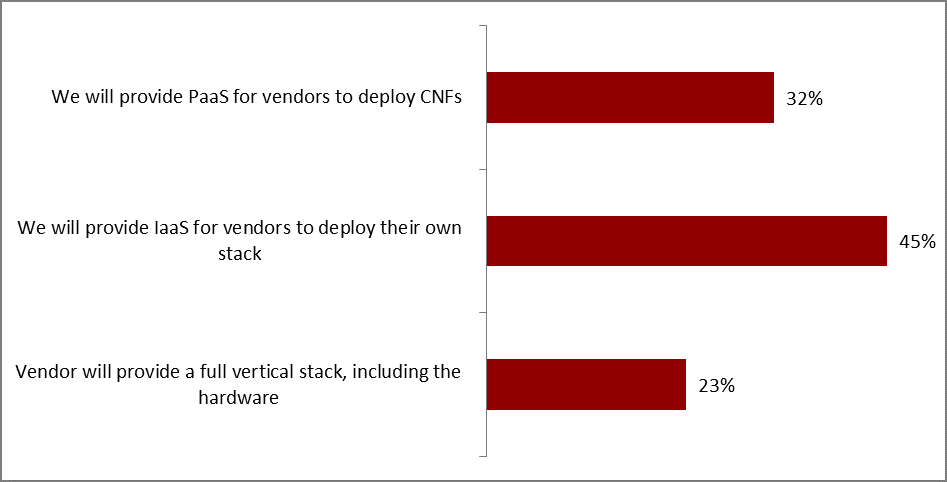

One of the key choices for a 5G cloud native core network is between infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS).

A Heavy Reading “Cloud-Native 5G Core Operator Survey” published in March 2021 identifies a preference for an IaaS model (45%) over PaaS (32%) and vendor-integrated full stack (23%). Larger operators, however, prefer PaaS.

Respondents working for operators with revenue of more than $5 billion annually are somewhat more likely to select PaaS, with a score of 44% versus 41% for IaaS and 16% for the vendor full stack. Conversely, respondents working for operators with revenue of less than $5 billion reported a score 23% for PaaS, 49% for IaaS and 28% for the vendor full stack. This difference reflects corporate cloud technology strategies and, to some extent, the internal capabilities of the operator’s technology team.

Source: Heavy Reading

The overall picture, according to the survey, is that both PaaS and IaaS models are likely to be used over the near and medium terms. This accords with Heavy Reading’s understanding that both models are already in use, in production, for 5G core. Nevertheless, Heavy Reading expect the PaaS model and the container as a service (CaaS) variant to prevail over the longer term, especially as 5G core workloads move closer to the edge.

For more information contact:

Stian Kristoffer Sande, Communication Manager, Telenor Group [email protected]

References:

https://www.telecompaper.com/news/telenor-runs-5g-sa-trial-of-multi-vendor-core-on-red-hat–1380126

https://www.lightreading.com/5g/cloud-infrastructure-for-5g-core/a/d-id/768873?