Ookla: Starlink’s Satellite Internet service vs competitors around the world

Starlink’s broadband internet speeds continue to outpace those of competitive satellite broadband internet providers Viasat and HughesNet, according to telecom speed tracker Ookla.

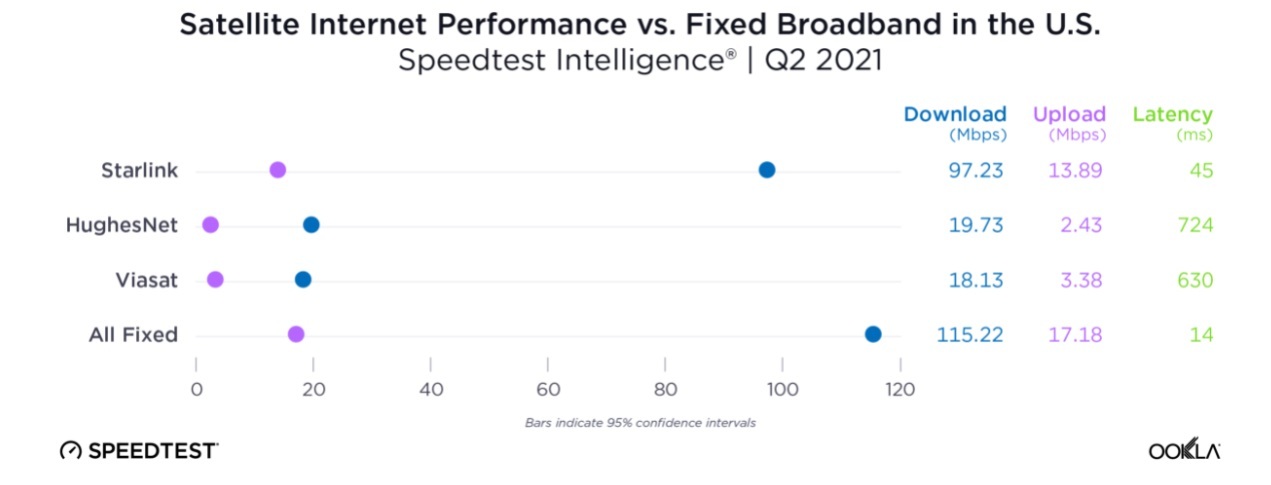

Given that satellite internet is often the only solution for folks in rural or underserved areas with little to no fixed broadband access, the Speedtest® results from HughesNet, Starlink and Viasat during Q2 2021 were encouraging. HughesNet was a distant second at 19.73 Mbps (15.07 Mbps in Q1 2021) and Viasat third at 18.13 Mbps (17.67 Mbps in Q1 2021). None of these are as fast as the 115.22 Mbps median download speed for all fixed broadband providers in the U.S. during Q2 2021, but it beats digging twenty miles (or more) of trench to hook up to local infrastructure.

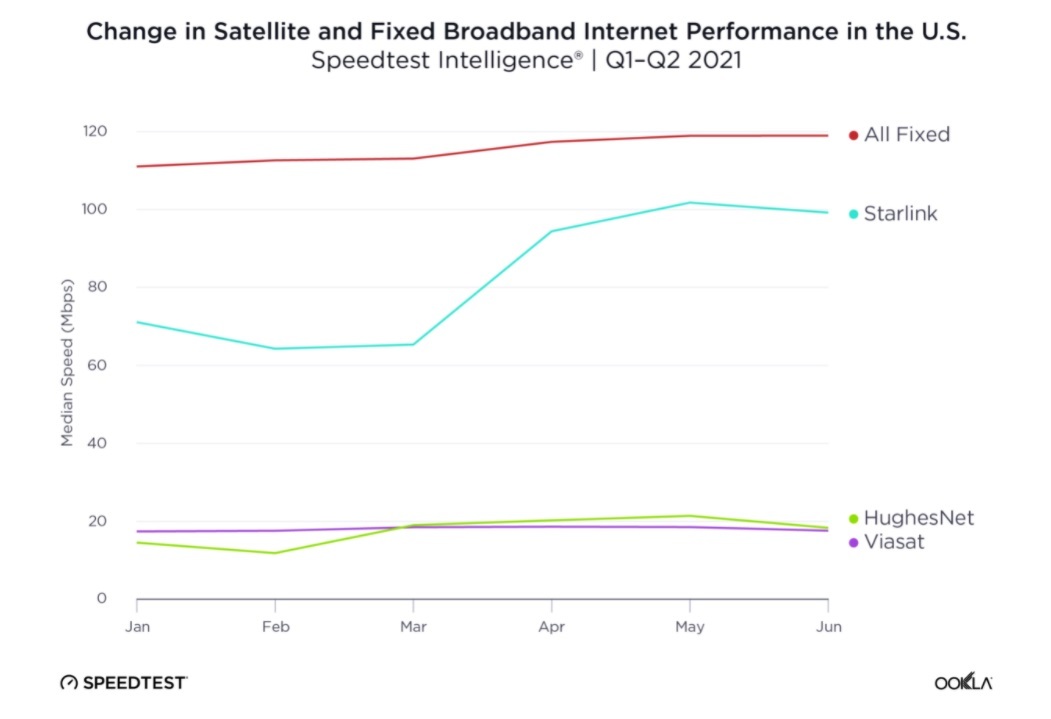

Moreover, Starlink was the only satellite internet provider in the United States with fixed-broadband-like latency figures, and median download speeds fast enough to handle most of the needs of modern online life at 97.23 Mbps during Q2 2021 (up from 65.72 Mbps in Q1 2021).

Starlink’s median download speeds in the U.S. are starting to rival those of fixed-line broadband networks, according to Ookla’s latest round of Speedtest data.

While Starlink’s U.S. download speeds are “fast enough to handle most of the needs of modern online life,” they do trail the 115.22 Mbit/s median download speed for all U.S. fixed broadband providers, Ookla explained in its report.

In some areas, Starlink’s U.S. download median speed has surpassed those of fixed wireline network providers.

In its analysis of the Ookla data, PCMag (Ookla and PCMag are both owned by Ziff Davis) notes that Starlink’s median download speed in Morgan County, Alabama, reached 168 Mbit/s. Starlink’s slowest median download speed for the U.S. in the quarter, at 64.5 Mbit/s, appeared in Madison County, Indiana.

There’s only a slight difference between Starlink and broadband wireline networks in the upstream direction. Ookla said Starlink’s median upload speed for Q1 2021 was 13.89 Mbit/s, compared to a median upload speed of 17.18 Mbit/s among U.S. fixed wireline broadband networks. Meanwhile, both Viasat and HughesNet trailed with median upload speeds of 3.38 Mbit/s and 2.43 Mbit/s, respectively.

Starlink’s growing network of low-Earth orbit (LEO) satellites continued to deliver relatively low latencies, important for apps such as online gaming and videoconferencing, when compared to geosynchronous (GEO) systems. Ookla said Starlink’s median latency in Q1 2021 was 45 milliseconds. While that was well behind the 14 milliseconds of latency found on fixed-line networks, it was considerably better than the median latency for Viasat (630 milliseconds) and HughesNet (724 milliseconds).

saw sufficient samples during Q2 2021 to analyze Starlink performance in 458 counties in the U.S. While there was about a 100 Mbps range in performance between the county with the fastest median download speed (Morgan County, Alabama at 168.30 Mbps) and the county with the slowest median download speed (Madison County, Indiana at 64.51 Mbps), even the lower-end speeds are well above the FCC’s Baseline performance tier of at least a 25 Mbps download speed. We also saw many more counties qualify for analysis during Q2 2021 than we saw in Q1 2021.

United Kingdom: Starlink beats fixed broadband providers

Starlink showed a much faster median download speed in the U.K. during Q2 2021 (108.30 Mbps) than the country’s average for fixed broadband (50.14 Mbps). Starlink’s upload speed was also slightly faster (15.64 Mbps vs. 14.76 Mbps), and the latency was pretty good, given the distance traveled (37 ms vs. 15 ms). This brings Starlink closer to contender status for consumers across the U.K., not just those stranded in internet-free zones in Northern Scotland, once the service interruptions are under control. It also shows that because satellite internet is not constrained by the infrastructure of a given country, there is the potential to radically outperform fixed broadband.

This data is changing rapidly as satellite internet providers launch new service locations and improve their technology. Ookla will be excited to see if Starlink is still the satellite provider to beat next quarter and in what other countries satellite internet provides a viable alternative to fixed broadband.

……………………………………………………………………………………….

References:

https://www.speedtest.net/insights/blog/starlink-hughesnet-viasat-performance-q2-2021/

https://www.pcmag.com/news/starlink-moves-closer-to-matching-or-even-beating-fixed-broadband-speeds

https://www.lightreading.com/satellite/starlink-speeds-accelerate-in-q2-ookla-says-/a/d-id/771322?

Starlink now covers all of UK; Plans to connect vehicles with satellite Internet service

8 thoughts on “Ookla: Starlink’s Satellite Internet service vs competitors around the world”

Comments are closed.

Starlink’s results are impressive. Still, it is not clear that these point-in-time measurements made by Ookla capture the entire story.

One anecdote from a recent conversation this author had with a merchant who has Starlink suggests that the service drops for about 3-minutes each hour. She also indicated that there would be outages in foggy conditions. She was skeptical of how well it would perform in the stormy Colorado winters. For the time being, she was keeping her Viasat service as a backup.

With that said, she was extremely pleased by the price and the general performance. Her main need is processing credit card transactions and for that, the Starlink service has been a champ.

To see an image of that particular deployment, along with an idea for how Starlink might be used as backhaul for CBRS cellular hotspots, check out this link

https://viodi.com/2021/07/23/broadband-built-block-by-block-by-blockchain-part-2-5g/#starlink-backhaul-helium-powered-cbrs-front-haul

Alan — Thanks for posting this article. My comments:

Starlink performance is completely understandable given that it is LEO based compared to GEO service providers. In another couple of years, there will be at least one other major player (Amazon’s Kuiper) in this space. Pretty soon, all the rural/underserved customers also will be bombarded with Ads/Algorithm based recommendations etc.

Alan: You are the best in covering the geo-sync and LEO satellite Internet market! [email protected]

Hi Henry, Because I know you, I edited and then posted your complementary comment. Please be more accurate in the future. In particular, Starlink does NOT offer geo-sync satellites, but rather Low Earth Orbiting (LEO) satellites. Also, I don’t like being called “chief.” Either Alan or Professor is preferred. Thanks!

SpaceX to focus on 10 rural Lok Sabha constituencies for 80% of Starlink terminals shipped to India

SpaceX will shortly apply to the Indian government for a licence to launch its Starlink satellite broadband services in the country and is aiming to touch 200,000 active terminals by December 2022.

https://telecom.economictimes.indiatimes.com/news/spacex-to-focus-on-10-rural-lok-sabha-constituencies-for-80-of-starlink-terminals-shipped-to-india-india-head/86724937

Bloomberg: Musk’s Starlink Brings Internet to Ukraine, and Attention to a New Space Race

SpaceX enabled its Starlink satellite broadband service in Ukraine and began shipping additional dishes. Those dishes are especially valuable now that Russia’s military is targeting Ukrainian infrastructure. “Received the second shipment of Starlink stations!” Mykhailo Fedorov, Ukraine’s minister of digital transformation, tweeted on March 9. “@elonmusk keeps his word!”

The dishes Starlink’s Elon Musk has provided to Ukraine and to Tonga following its January tsunami have cast a spotlight on low-Earth-orbit (LEO) satellites, a new generation of spacecraft that can circle the globe in just 90 minutes and connect users to the internet. They’re small and inexpensive: A Starlink satellite weighs 260 kilograms (573 pounds) and costs from $250,000 to $500,000, while an Inmarsat Group Holdings Ltd. geostationary satellite can clock in at 4 metric tons and sell for $130 million.

The satellite networks will be able to provide broadband access to tens of millions of people in places such as rural India that otherwise lack access to more traditional mobile and fixed-line networks. “There is a large opportunity to bridge the digital divide in remote areas where the cost of terrestrial communication is high, and hence both voice and broadband communication have not been set up,” says Anil Bhatt, director general of the Indian Space Association.

On March 9, Musk boasted that SpaceX had sent 48 more satellites into orbit, adding to its over 2,000 already circling the Earth. But Musk has rivals with their own LEO satellite ambitions. They include fellow space billionaire Jeff Bezos. Amazon.com Inc.’s Kuiper Systems wants to launch more than 7,000 satellites. On March 5 a Chinese rocket launched six LEO satellites for Beijing-based GalaxySpace, which plans a constellation with as many as 1,000. The European Union in February announced a plan for a constellation that would cost about €6 billion ($6.6 billion). And Indian billionaire Sunil Mittal’s Bharti Global, along with the British government, is an investor in OneWeb Ltd., which plans to begin operating its LEO constellation of 648 satellites this year. It intended to launch its latest group of satellites on March 5 aboard a Russian rocket, but canceled after the Kremlin’s space agency demanded that the U.K. sell its stake. OneWeb is looking for alternative services for six future launches.

Unlike more established operators, which have a relatively small number of satellites in fixed locations about 36,000 kilometers (22,369 miles) above sea level, companies launching LEO satellites place them at heights of 550 to 1,200 km. That makes it easier for the satellites to provide speedy services than those higher in space, says Marco Caceres, an analyst with Teal Group, an aerospace and defense market analysis firm. “They’re going to make a lot of these traditional systems dinosaurs overnight,” he says, adding that Starlink alone is likely to have 4,500 satellites in operation by the middle of the decade. “They’re moving at lightning speed.”

SpaceX began signing up customers in India in 2021 even though it didn’t have a license to offer Starlink service there. India’s government in January demanded the company return money from would-be customers. As SpaceX works out its entry strategy for India, Reliance Jio Infocomm Ltd.—the telecommunications operator controlled by Mukesh Ambani, India’s richest person—in February formed a joint venture with Luxembourg-based satellite operator SES SA to provide internet access via satellites in geostationary and medium-Earth orbits.

While the new satellite companies boast of their ability to reach underserved communities, many will struggle to make their equipment affordable for some target markets, says Bloomberg Intelligence analyst Matthew Bloxham. According to BI, a standard Starlink plan costs $499 for the hardware, plus a monthly fee of $99. But there are other reasons governments are likely to provide financial support for internet via satellite, Bloxham says: “It provides resilience in case of a cyberattack that takes out the regular internet that we know today.”

Still, critics say Musk and others aren’t considering the risks of having too many satellites in a relatively narrow band above Earth. “What’s going on now is there’s a race to put up as many as possible for the rights that are implied by having those satellites, even if it’s not economically justified, or safe, or sustainable,” says Mark Dankberg, chairman of Viasat Inc., a California-based satellite operator of geostationary satellites, which in November agreed to buy rival Inmarsat for $4 billion. As operators attempted to bulk up in response to the challenge from newcomers, M&A deal volume for the satellite industry in 2021 reached its highest level since 2007, according to data compiled by Bloomberg, with companies signing 60 deals worth $18 billion.

China in December said two of Starlink’s satellites came dangerously close to its space station. The U.S. said there had been no “significant probability” of a Starlink collision with the Chinese station, but some experts worry that the situation was a sign of what’s to come. International agreements governing space date to the 1960s and ’70s, when billionaires didn’t have their own space programs. “We have so many of these new actors coming on board, and we don’t have sufficiently strong international law,” says Maria Pozza, a director at Gravity Lawyers in Christchurch, New Zealand, who advises clients on space law and regulation. “We’ve got a little bit of a mess.”

https://www.bloomberg.com/news/articles/2022-03-16/musk-bezos-satellite-companies-target-low-orbit-networks

That’s a wonderful comparison you have provided here regarding satellite internet services and other broadband internet competitors. It is important to understand the kind of internet services you are going to deal with before getting one. Thank you very much.

Great information! Testing the satellite internet speed is necessary before hiring any one provider. The above information will help many people to decide. Through quality satellite internet, one can perform various tasks properly. Thank you very much.