Hyperscalers Outpace Network Operators in Private 5G

Microsoft is the most innovative private network provider globally, according to enterprises already using a private LTE and 5G network, finds a new study from Omdia.

AT&T and Deutsche Telekom are also singled out as industry pace setters, according to Omdia’s latest Private LTE and 5G Networks research which surveyed enterprises globally. Two thirds of enterprises require private network suppliers to demonstrate integration with their existing cloud platform before they will buy. Similar demands apply to enterprises’ IoT and application management platforms.

“Enterprises have needs beyond connectivity when they buy a private network,” advises Omdia principal analyst for Private Networks Pablo Tomasi. “The top two reasons enterprises invest in private networks are better security and digital transformation. They need partners that can service those needs. Telcos may lose out if they don’t step up.”

Enterprises also want these results to be achieved promptly. 55% of enterprises expect a two-year return on their private network investment, but almost a fifth of those already deployed expect ROI in only a year.

Consumption preferences are changing fast: three quarters of enterprises now planning a private network prefer a hybrid model instead of the fully dedicated private networks that dominate 70% of deployments today.

The findings are from an annual survey conducted by Omdia on enterprises using, trialling, or planning to deploy private LTE and 5G networks in six key verticals, part of the Private Networks Intelligence Service. A total of 451 respondents from seven countries participated in the survey.

Full analysis of the survey is available in Omdia’s Private LTE and 5G Network Enterprise Survey Insight – 2021 report.

………………………………………………………………………………………………………………….

What is Private Wireless?

One of the challenges with the private wireless concept is that it is not a specific technology but rather more of a broad term encompassing a wide range of technologies. Marketing departments will have some wiggle room, as the meaning of private wireless varies significantly across the ecosystem.

Some Wi-Fi suppliers, for example, believe they provide private wireless connectivity to enterprises. Smaller radio access network (RAN) suppliers without macro footprints typically associate private wireless with dedicated standalone connectivity for enterprises, while some of the more established macros RAN suppliers envision private wireless as encompassing a broader set of technologies, including both macro and small cell networks.

Suppliers focused on mission-critical and public safety networks see private LTE and NR combined with a new spectrum as an opportunity to upgrade existing private narrowband communications equipment. With the number of LoRa end nodes surpassing 0.2 B, LoRa base station suppliers believe they are dominating the private wireless IoT market.

The operators are also positioning the concept differently, with some focusing on the benefits with broader coverage, while others are capitalizing on some of the new local concepts.

While definitions or interpretations vary widely on the part of both suppliers and operators, there appears to be a greater consensus among customers.

For end-users, private wireless typically means consistent, reliable, and secure connectivity, not accessible by the public, to foster efficiency improvements. For industrial sites, private wireless typically means low latency and high reliability. It is less about the underlying technology, spectrum, or business model and more about solving the connectivity challenge. In other words, end-users don’t care what is under the hood.

From a Dell’Oro perspective, we consider private wireless as nearly synonymous with 3GPP’s vision for NPNs. According to 3GPP, NPNs are intended for the sole use of a private entity, such as an enterprise. NPNs can be deployed in a variety of configurations, utilizing both virtual and physical elements located either close to or far away from the site. NPNs might be offered as a network slice of a Public Land Mobile Network (PLMN), be hosted by a PLMN, or be deployed as completely standalone networks.

From an end-user perspective, private wireless is also a broader term, generally including not just the RAN but also transport, mobile core network (MCN), Multi-Access Edge Computing (MEC), and corresponding services.

Private Wireless RAN and Core Configurations

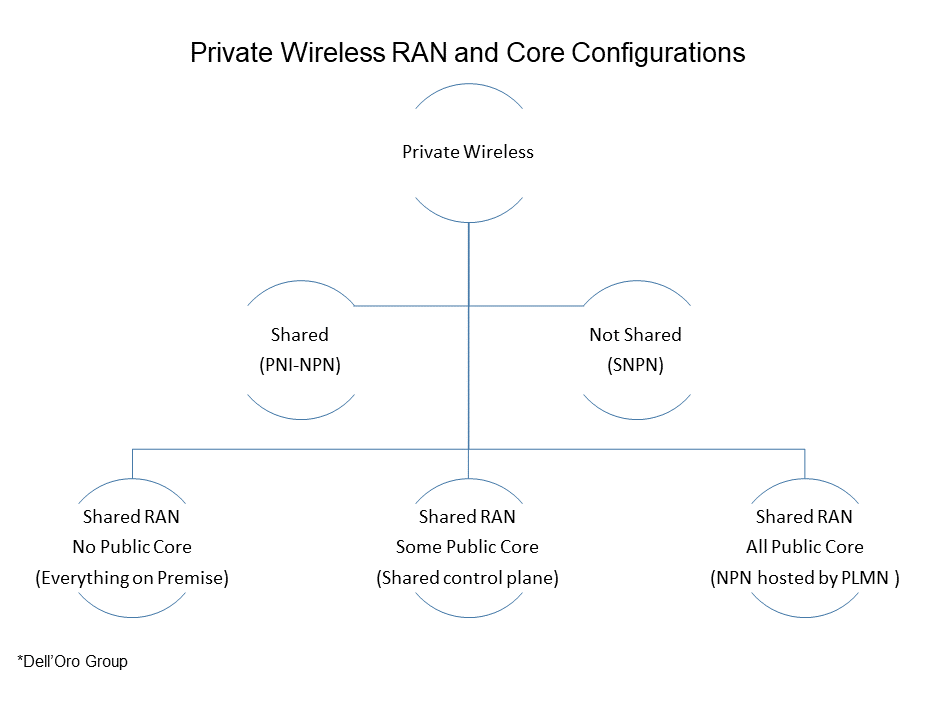

There is no one-size-fits-all when it comes to private wireless. We are likely looking at hundreds of deployment options available when we consider all the possible RAN, Core, and MEC technology, architectures, business, and spectrum models.

At a high level, there are two main private wireless deployment configurations, Shared (between public and private) and Not Shared:

- The shared configuration, also known as Public Network Integrated-NPN (PNI-NPN), shares the resources between the private and public networks.

- Not Shared, also known as Standalone NPN (SNPN), reflects dedicated on-premises RAN and core resources. No network functions are shared with the Public Land Mobile Network (PLMN).

Market Status

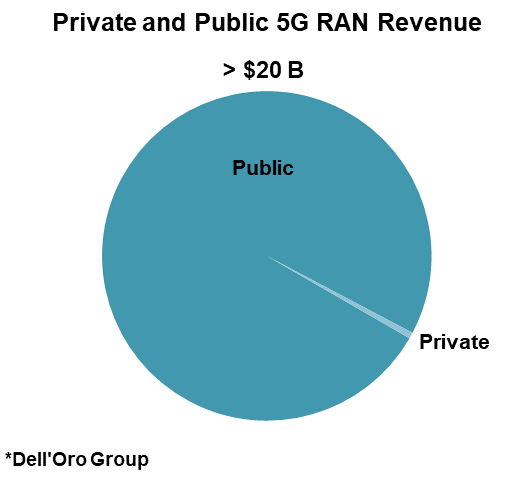

Preliminary 3Q21 estimates suggest the high-level trends remain unchanged with MBB and FWA dominating the 5G capex while private RAN revenues remain small —leading RAN vendors are reporting that private 5G revenues are still negligible relative to the overall public and private 5G RAN market.

Meanwhile, private wireless activity using both macro and local base stations is rising:

- Huawei estimates there are now around 10 K 5G B2B projects globally and the supplier is engaged in thousands of trials focusing on various 5G private use cases.

- Ericsson is currently involved in hundreds of private wireless customer engagements, including pilots with time-critical use cases.

- Even though Nokia’s enterprise business declined year-over-year in 3Q21, Nokia’s private wireless segment continued to gain momentum in the quarter–Nokia now has 380+ private wireless customers.

- ZTE has developed more than 500 cooperative partners in 15 industries, including industrial engineering, transportation, and energy. They have jointly explored 86 innovative 5G application scenarios and successfully carried out more than 60 demonstration projects worldwide supporting multiple 5G IoT use cases.

- Federated Wireless, one of the leading CBRS SAS providers, is working on hundreds of CBRS-based private wireless trials in multiple vertical domains, including warehouse logistics, agriculture, distance learning, and retail applications.

Market Opportunity and Forecast

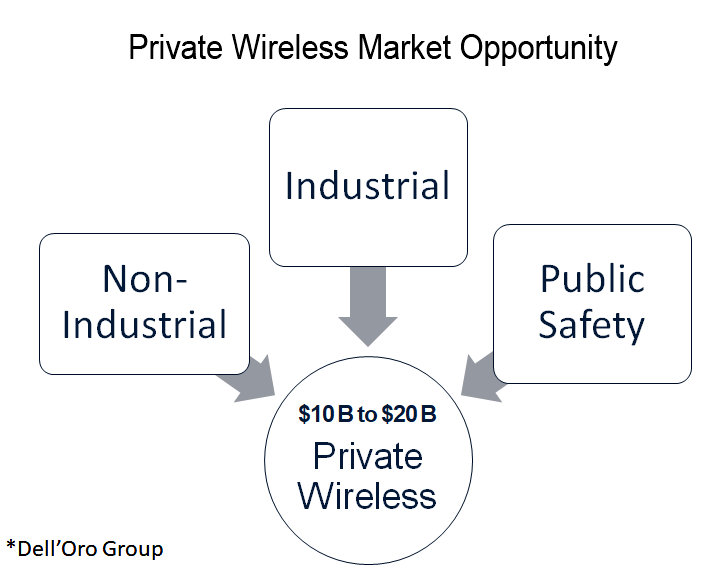

One of the more compelling aspects with private wireless is that we are talking about new revenue streams, incremental to the existing telco capex. More importantly, the TAM is large, approaching $10–20 B when we include Non-Industrial, Industrial, and Public Safety driven applications.

At the same time, it is important to separate the TAM from the forecast. Here at the Dell’Oro Group, we continue to believe that it will take some time for enterprises to fully conceptualize the value of 5G relative to Wi-Fi. And as much as we want 5G to be as easy to deploy and manage as Wi-Fi, the reality is that we are not yet there.

Still, the uptick in the activity adds confidence the industry is moving in the right direction. And although LTE is dominating the private wireless market today, private 5G NR revenues remain on track to surpass $1 B by 2025.

2 thoughts on “Hyperscalers Outpace Network Operators in Private 5G”

Comments are closed.

One of the findings of a new report from Light Reading sister company Omdia: 2022 Trends to Watch: Private Networks and the Shadow of 5G:

More than 90% of enterprises that are looking to deploy a private network in the next two years are considering 5G as the main technology for their deployments.

Pablo Tomasi, principal analyst of private networks in Omdia’s service provider enterprise and wholesale practice – and the report’s author – nonetheless warned CSPs it won’t all be plain sailing.

While the “hype of 5G” will get CSPs in the door with enterprises, he said, they’ve still got it all to prove in terms of delivery and meeting enterprises’ expectations.

“CSPs have many challenges that they need to face to make an impact in this market,” Tomasi told Light Reading. “Among others, they need to stop talking about 5G as the fix to solve all problems and start talking about addressing an enterprise pain-point with a solution based on whatever technology is more suitable.”

Tomasi emphasized that CSPs should be pragmatic in their technology recommendations, whether it be private LTE or private 5G, or even an alternative technology.

“They also need to accelerate their investment in their private networks teams and decide how they want to gain vertical expertise, which is essential for targeting vertical markets,” said Tomasi.

CSPs, he said, will have to weigh up the pros and cons of an in-house versus a partnership approach to build up private-network teams with the necessary know-how.

Although none of the enterprises currently surveyed by Omdia have deployed private networks to cover more than 10 sites, Tomasi thinks this will change in the next couple of years with 6% of enterprises aiming to deploy in more than 11 sites.

Enterprises currently prefer private network deployments that are fully dedicated, both in the RAN and the core, but Tomasi observes a “clear shift” in enterprises’ planning towards hybrid solutions involving a mixture of private and public networks.

“This plays directly into the hands of the CSPs that are increasingly deploying and expanding their private 5G networks,” said Tomasi, “but CSPs must ride this trend carefully as their first order of business is still gaining the trust of the enterprise and of the [wider] ecosystem.”

How successful CSPs might be in the private network space is not entirely in their own hands. Awarding highly localized spectrum to enterprises – a trend already seen in Germany – poses a “significant threat” to CSPs in Tomasi’s view.

“Spectrum liberalization is dangerous for [CSPs], because if providing spectrum to the enterprise works then regulators all over the world will be encouraged to continue this trend.” Tomasi told Light Reading.

“This will affect how much spectrum will be available for CSPs as well as the ability for other players, such as vendors and system integrators. to directly serve enterprises’ connectivity needs.”

https://www.lightreading.com/private-networks/csps-got-it-all-to-prove-with-private-5g-networks—omdia/d/d-id/774303?

Hyperscalers with their global scale are encroaching on the international and global aspects of the telecoms industry. Cloud brings a new means of delivering many services into both the CSPs themselves as well as business es and individuals. Hyperscalers are extending their reach ever closer to the customers, potentially squeezing the role of the connectivity providers. CSPs, on the other hand, have the hyper-local granularity to serve everyone and everything. As CSPs rationalise their own infrastructure they are benefiting from the Hyperscalers scale and skills to make themselves more attractive to the end user markets. Does this end in a Mexican stand-off, global political manoeuvring or national pride? Can they play nicely together in the digital sandpit or will it end in tears?

https://www.telecomtv.com/content/the-great-telco-debate/live-debate-telcos-and-the-hyperscalers-43084/