Dell’Oro: Optical Transport Market Down 2% in 1st 9 Months of 2021

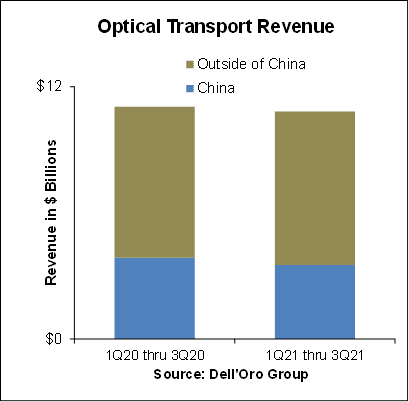

According to a recently published report from Dell’Oro Group, the Optical Transport equipment market contracted 2 percent year-over-year in the first nine months of 2021 due to lower sales in China. Outside of China, however, the demand for optical equipment continued to increase, outpacing supply.

“Optical equipment revenue in China took a sharp turn for the worse in 3Q 2021,” said Jimmy Yu, Vice President at Dell’Oro Group. “As a result, optical revenue in China declined at a double-digit rate in the quarter, resulting in a 9 percent decline for the first nine months of 2021. At this rate, we are expecting a full year optical market contraction in the country. Something that has not occurred since 2012. Helping to offset some of this lower equipment revenue from China was the robust demand in North America, Europe, and Latin America.”

“We estimate that Optical Transport equipment revenue outside of China grew 6 percent year-over-year in the third quarter. However, we believe this growth rate could have been higher, closer to 10 percent, if it was not for component shortages and other supply issues plaguing the industry. So, fortunately while optical demand is hitting a rough patch in China, it seems to be accelerating in other parts of the world,” added Yu.

The optical transport market is predicted to reach $18 billion by 2025, primarily as a result of demand for WDM equipment, Dell’Oro reported in July 2021. In addition, Dell’Oro says the ZR pluggable optics market could exceed $500 million in annual sales by 2025.

In a 2Q-2021 report by market research firm Omdia, analysts noted that 5G investment, cloud service growth and demand for “infotainment-at-home” are among the drivers increasing demand in the optical networking market. “The twin dynamics of increasing optical capillarity and increasing end-point capacity continue to drive the optical core,” Omdia wrote in a note to clients.

The Dell’Oro Group Optical Transport Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, average selling prices, unit shipments (by speed including 100 Gbps, 200 Gbps, 400 Gbps, and 800 Gbps). The report tracks DWDM long haul, WDM metro, multiservice multiplexers (SONET/SDH), optical switch, optical packet platforms, data center interconnect (metro and long haul), and disaggregated WDM. To purchase this report, please contact us at [email protected].

Jimmy Yu, Vice President, Dell-Oro Group

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, networks, and data center IT markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit https://www.delloro.com.

References:

Optical Transport Market Down 2 Percent in First Nine Months of 2021, According to Dell’Oro Group

Disaggregated DWDM Equipment Market Up 36 Percent in 2Q 2021, According to Dell’Oro Group

5-Year Forecast: Optical Transport Market Reaches $18 Billion by 2025