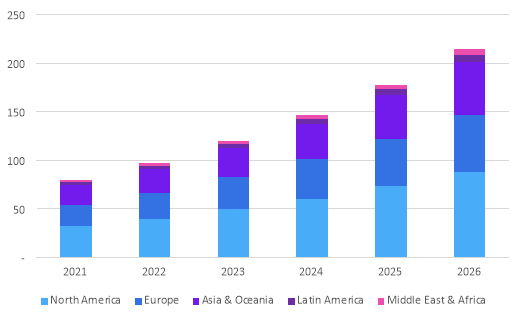

Omdia: Enterprise edge services market to hit $214 billion by 2026

According to a new report by Informa’s Omdia, revenue from edge services (where EXACTLY is the edge?) will reach $214 billion by 2026. That’s more than double the current size of the enterprise edge services market, which will reach $97.0 billion in 2022, says Omdia. With a compound annual growth rate (CAGR) of 20.4%, North America is predicted to dominate with 41% of global revenue share between 2021 and 2026.

This Omdia report discusses the latest global enterprise edge services forecast including edge consulting, integration, network, security, storage/compute and managed edge services considering use cases, verticals and edge deployment models.

Enterprise edge services forecast by region, 2021-26 ($ billions)

Source: Omdia (owned by Informa)

…………………………………………………………………………………………………………

While hyperscalers build out edge access points and systems integrators (SIs) design consulting and professional services for edge use cases, enterprises are looking to service providers to define business cases, run pilot projects and scope out different approaches to edge computing use cases, according to Omdia.

The Informa owned market research group outlines two main consumption models for edge services.

- In one model, enterprises will need consulting, systems integration and other support services to deploy physical edge infrastructure.

- The second method is a cloud-based, as-a-service and fully managed approach, where services provided by hyperscalers and independent software vendors (ISVs) are extended to the edge using local access points or gateways.

Omdia sees several opportunities for network providers to assist enterprises with the challenges that arise from implementing their edge strategies. The firm notes that telcos can help enterprises navigate data location and management considerations; regulatory compliance; network considerations such as the need for and availability of 5G, WAN/LAN and private networks; selecting the right edge setup and location; balancing use of internal skills with managed edge services; defining clear business cases; and more.

Edge consulting services from SIs, telcos, ICT solutions vendors and consulting firms form the largest part of the enterprise edge services market at 39.3% in 2022, says Omdia. While cybersecurity and network management subscriptions from service providers are critical to edge service packages, these subscription-based telco services are declining over time, the research group adds.

However, fully managed, cloud-delivered edge services, including multi-access edge computing (MEC) and workload and database management, are increasing in popularity. Omdia predicts that edge storage and compute services will be the strongest area of growth, with the services emerging as cloud services extensions to the edge provided by major hyperscalers, service providers and data center operators.

“As data volumes continue to grow and enterprises aim to move more workloads to the edge, they require more compute and storage capacity in the form of IaaS and PaaS at edge access points,”Omdia explained.

Edge locations will also shift from customers’ premises (53% in 2022 and 38% in 2026) to PoPs (point of presence) such as cloud access points and to a lesser extent, data centers.

“By 2026, over a third of edge services revenues will be realized as part of PoP deployments, which provides key opportunities and challenges for ICT service providers,” says Omdia.

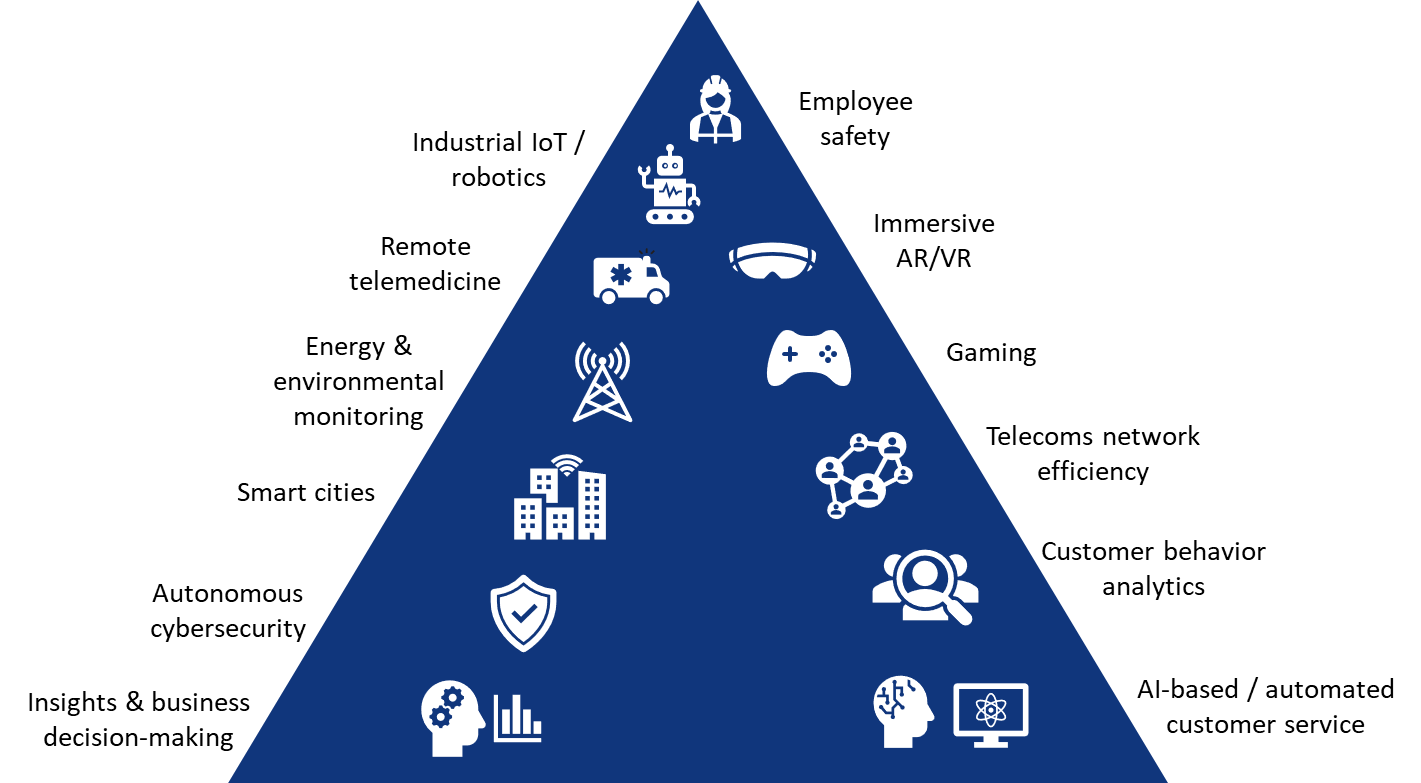

Emerging edge use cases

Edge use cases initially took flight in industrial applications and IoT use cases for worker safety, automated production lines, mining and logistics, explains Omdia. Over the next five years, the largest vertical forecasted to lead growth in edge services is the financial market, which could use AI-based analytics and cognitive systems for business decisions, market insight, risk assessment and customer service platforms.

Source: Omdia

Source: Omdia

…………………………………………………………………………………………………………………

Additional edge service use cases, which network operators could deliver as managed services, include smart meters for energy use and environmental monitoring; transport and container tracking; customer behavior analytics in retail; network efficiency; and data protection compliance and cybersecurity.

What applications do enterprises expect to run at the edge?

Omdia recommends several approaches for service providers, SIs, hyperscalers and ICT solutions vendors to consider when working with enterprises on edge services. Suggestions include developing vertical and workload-specific edge services that can be largely replicated to different customers, creating innovation hubs for edge solutions to test edge setups with customers, developing consulting services and creating a partner ecosystem to reduce vendor lock-in for customers.

References:

https://omdia.tech.informa.com/OM024012/Enterprise-Services-at-the-Edge–Forecast-202226

The Amorphous “Edge” as in Edge Computing or Edge Networking?

Multi-access Edge Computing (MEC) Market, Applications and ETSI MEC Standard-Part I

IBM says 5G killer app is connecting industrial robots: edge computing with private 5G

ONF’s Private 5G Connected Edge Platform Aether™ Released to Open Source