Edge Networking

T-Mobile and Google Cloud collaborate on 5G and edge compute

T-Mobile and Google Cloud announced today they are working together to combine the power of 5G and edge compute, giving enterprises more ways to embrace digital transformation. T-Mobile will connect the 5G Advanced Network Solutions (ANS) [1.] suite of public, private and hybrid 5G networks with Google Distributed Cloud Edge (GDC Edge) to help customers embrace next-generation 5G applications and use cases — like AR/VR experiences.

Note 1. 5G ANS is an end-to-end portfolio of deployable 5G solutions, comprised of 5G Connectivity, Edge Computing, and Industry Solutions – along with a partnership that simplifies creating, deploying and managing unique solutions to unique problems.

More companies are turning to edge computing as they focus on digital transformation. In fact, the global edge compute market size is expected to grow by 37.9% to $155.9 billion in 2030. And the combination of edge computing with the low latency, high speeds, and reliability of 5G will be key to promising use cases in industries like retail, manufacturing, logistics, and smart cities. GDC Edge customers across industries will be able to leverage T-Mobile’s 5G ANS easily to get the low latency, high speeds, and reliability they will need for any use case that requires data-intensive computing processes such as AR or computer vision.

For example, manufacturing companies could use computer vision technology to improve safety by monitoring equipment and automatically notifying support personnel if there are issues. And municipalities could leverage augmented reality to keep workers at a safe distance from dangerous situations by using machines to remotely perform hazardous tasks.

To demonstrate the promise of 5G ANS and GDC Edge in a retail setting, T-Mobile created a proof of concept at T-Mobile’s Tech Experience 5G Hub called the “magic mirror” with the support of Google Cloud. This interactive display leverages cloud-based processing and image rendering at the edge to make retail products “magically” come to life. Users simply hold a product in front of the mirror to make interactive videos or product details — such as ingredients or instructions — appear onscreen in near real-time.

“We’ve built the largest and fastest 5G network in the country. This partnership brings together the powerful combination of 5G and edge computing to unlock the expansion of technologies such as AR and VR from limited applications to large-scale adoption,” said Mishka Dehghan, Senior Vice President, Strategy, Product, and Solutions Engineering, T-Mobile Business Group. “From providing a shopping experience in a virtual reality environment to improving safety through connected sensors or computer vision technologies, T-Mobile’s 5G ANS combined with Google Cloud’s innovative edge compute technology can bring the connected world to businesses across the country.”

“Google Cloud is committed to helping telecommunication companies accelerate their growth, competitiveness, and digital journeys,” said Amol Phadke, General Manager, Global Telecom Industry, Google Cloud. “Google Distributed Cloud Edge and T-Mobile’s 5G ANS will help businesses deliver more value to their customers by unlocking new capabilities through 5G and edge technologies.”

T-Mobile is also working with Microsoft Azure, Amazon Web Services and Ericsson on advanced 5G solutions.

References:

https://www.t-mobile.com/news/business/t-mobile-and-google-cloud-join-5g-advanced-network-solutions

https://www.t-mobile.com/business/solutions/networking/5G-advanced-solutions

AWS enabling edge computing, supports mobile & IoT devices, 5G core network and new services

In an AWS re-Invent Leadership session titled “AWS Wherever You Need It,” [1.] Wayne Duso, vice president of engineering and product at AWS, expressed similar goals. “Today, customers want to use AWS services in a growing range of applications, operating wherever they want, whenever they require. And they’re striving to do so to deliver the best possible customer experience they can, regardless of where their customers or users happen to be located. One way AWS helps customers accomplish this is by bringing the AWS value to our regions, to metro areas, to on-premises, and to the furthest and evolving edge.”

Note 1. You can watch the 1 hour “AWS Wherever You Need It” session here (top right).

“We’re helping customers by providing the same experience from cloud to on-prem to the evolving edge, regardless of where your application may need to reside,” Duso explained. “AWS is enabling customers to use the same infrastructure, services and tools to accomplish that. And we do that by providing a continuum of consistent cloud-scale services that allow you to operate seamlessly across this range of environments.”

Duso explained how AWS is enabling edge computing by adding capabilities for mobile and IoT devices. “There are more than 14 billion smart devices in the world today. And it’s often in things we think about, like wristwatches, cameras, cellphones and speakers,” he said.

“But more often, it’s the stuff that you don’t see every day powering industries of all types and for all types of customers.” Duso cited the example of Hilcorp, a leading energy producer, which is using smart devices to monitor the health of its wells, optimize production and proactively predict failures so it can minimize capital expenditures.

With IoT devices becoming common among energy providers, edge computing is on the rise to handle the volume of data these devices generate. “Now, AWS IoT provides a deep and broad set of services and partner solutions to make it really simple to build secure, managed and scalable IoT applications,” Duso added.

Duso pointed to Couchbase as a use case for flexible AWS services: “Couchbase is a non-SQL database company that uses AWS hybrid edge services such as Local Zones, Wavelength, Outposts and the Snow Family to deploy its applications and highly scalable, reliable and performant environments to reduce latency by over 18 percent for its customers.” Each of these AWS managed services enables Couchbase to move data from the edge to the cloud or manage and process it where it’s generated.

“What we built on these AWS compute environments was a highly distributed, managed or self-managed database,” Duso explained. “For the cloud, an internet gateway for accessing that data securely over the web and synchronizing that data down to the edge. And that works across cloud, edge and on the offline, first-compute environments.”

“Our goal is I want to make AWS the best place to run 5G networks. That is the overarching objective. How can I make AWS, whether we are running it in the region, in a Local Zone, on an Outposts, on a Snow device, how do we make it the best place to run a 5G network, and then provide that infrastructure.”

AWS’ 5G network efforts include a cloud architecture that can support an operator’s 5G SA core network and applications, similar to what AWS is doing with greenfield U.S. wireless network operator Dish Network. Sidd Chenumolu, VP of technology development and network services at Dish Network, recently explained that the wireless carrier’s 5G core network was using three of AWS’ four public regions, was deployed in “multiple availability zones and almost all the Local Zones, but most were deployed with Nokia applications across AWS around the country.”

AWS is also working with Verizon to support a part of that carrier’s public MEC system. This includes use of AWS’ Outposts and Wavelengths, the latter of which AWS recently expanded in the United Kingdom with Vodafone.

Hofmeyr continued, “I think you have a spectrum (of different wireless carrier networks), from the total greenfields like what we did with Dish to the large tier-ones. The one thing that’s common across the board is the desire to modernize and become more cloud-like. That is common. Everyone wants that. Each one has a very unique job. There’s not one way that they all are executing in the same way. They’re taking this one workload and then building, so all of them are focusing on different workloads in the network and put it in the cloud.”

In conclusion Hofmeyr said, “I think all over the edge we find these use cases for which purpose-built systems were designed to handle that. And our goal is how do you make that available in the cloud.”

References:

https://reinvent.awsevents.com/leadership-sessions/

https://reinvent.awsevents.com/on-demand/?trk=www.google.com#leadership-sessions

https://www.sdxcentral.com/articles/analysis/aws-wants-to-be-the-best-place-for-5g-edge/2022/12/

https://biztechmagazine.com/article/2022/12/aws-reinvent-2022-harvesting-data-cloud-edge

Lumen Technologies expands Edge Computing Solutions into Europe

Lumen Technologies announced the expansion of its edge computing services into Europe. The low-latency platform businesses need to extend their high-bandwidth, data-intensive applications out to the cloud edge. This expansion is part of Lumen’s continued investment in next-generation solutions that transform digital experiences and meet the demands of today’s global businesses.

“Edge computing is a game-changer. It will drive the next wave of business innovation and growth across virtually all industries,” said Annette Murphy, regional president, EMEA and APAC, Lumen Technologies. “Customers in Europe can now tap into the power of the Lumen platform, underpinned by Lumen’s extensive fiber footprint, to deploy data-heavy applications and workloads that demand ultra-low latency at the cloud edge. This delivers peak performance and reliability, as well as more capability to drive amazing digital experiences. Customers can focus efforts on developing applications and bringing them to market, rather than on time-consuming infrastructure deployment.”

Today, Lumen Edge Computing Solutions can meet approximately 70% of enterprise demand within 5 milliseconds of latency in the UK, France, Germany, Belgium, and the Netherlands. Additional locations are planned by end of year. Lumen Edge Computing Solutions bring together the power of the company’s expansive global fiber network, on-demand networking, integrated security, and managed services, with edge facilities and compute and storage services. This allows for quick and efficient deployment of applications and workloads at the edge, closer to the point of digital interaction. Customers can procure Lumen Edge Computing Solutions online, and within an hour gain access to high-powered computing infrastructure on the Lumen platform.

Lumen offers several edge infrastructure and services solutions to support enterprise innovation and applications of the 4th Industrial Revolution. These include:

- Lumen Edge Bare Metal offers dedicated, pay-as-you-go server hardware hosted in distributed locations and connected to the Lumen global fiber network. Edge Bare Metal delivers enhanced security and connectivity with dedicated, single tenancy servers designed to isolate and protect data and deliver high-performance.

- Lumen Network Storage enables customers to take advantage of secure, scalable, and fast storage where and when they need it. The service allows enterprises and public sector organizations to ingest and update data at the edge using whatever file storage protocol meets their needs.

- Lumen Edge Private Cloud provides pre-built infrastructure for high performance private cloud computing connected to the Lumen global fiber network. Lumen Edge Private Cloud is fully managed by Lumen and helps businesses go-to-market quickly with the capacity needed for interaction-intensive applications.

- Lumen Edge Gateway is a scalable Multi-access Edge Compute (MEC) platform for the premises. The service offers a compute platform for the delivery of virtualized wide area networking (WAN), security, and IT applications from multiple vendors on the premises edge.

Key Facts:

- Lumen Edge Computing Solutions meet approximately 97% of U.S. enterprise demand and approximately 70% of enterprise demand in the UK, France, Germany, Belgium, and the Netherlands within 5 milliseconds of latency.

- For a current list of live and planned Lumen edge locations, visit: https://www.lumen.com/en-uk/resources/network-maps.html#edge-roadmap

- As part of the Edge Computing Solutions deployment in Europe, Lumen enabled an additional 100G MPLS and IP network connectivity, as well as increased power and cooling at key edge data center locations.

- Lumen manages and operates one of the largest, most connected, most deeply peered networks in the world. It is comprised of approximately 500,000 (805,000 km) global route miles of fiber and more than 190,000 on-net buildings, seamlessly connected to 2,200 public and private third-party data centers and leading public cloud service providers.

- In EMEA, the Lumen network is comprised of approximately 42,000 (67,000 km) route miles of fiber and connects to more than 2,500 on-net buildings and 540 public and private third-party data centers.

Additional Resources:

- Lumen Edge Computing Solutions: https://www.lumen.com/en-us/solutions/edge-computing.html

- Lumen Edge Bare Metal: https://www.lumen.com/en-us/edge-computing/bare-metal.html

- Lumen Network Storage: https://www.lumen.com/en-us/hybrid-it-cloud/network-storage.html

- Lumen Edge Private Cloud: https://www.lumen.com/en-us/hybrid-it-cloud/private-cloud.html

- Lumen Edge Gateway: https://www.lumen.com/en-us/edge-computing/edge-gateway.html

About Lumen Technologies and the People of Lumen:

Lumen is guided by our belief that humanity is at its best when technology advances the way we live and work. With approximately 500,000 route fiber miles and serving customers in more than 60 countries, we deliver the fastest, most secure platform for applications and data to help businesses, government and communities deliver amazing experiences.

References:

Bell Canada deploys the first AWS Wavelength Zone at the edge of its 5G network

In yet another tie-up between telcos and cloud computing giants, Bell Canada is the first Canadian network operator to launch multi-access edge computing (MEC) services using Amazon Web Services’ (AWS) Wavelength platform.

Building on Bell’s agreement with AWS, announced last year, together the two companies are deploying AWS Wavelength Zones throughout the country at the edge of Bell’s 5G network starting in Toronto.

The Bell Canada Public MEC service embeds AWS compute and software defined storage capabilities at the edge of Bell’s 5G network.

The Wavelength technology is then tied into AWS cloud regions that host the applications. This moves access closer to the end user or device to lower latency and increase performance for services such as real-time visual data processing, augmented/virtual reality (AR/VR), artificial intelligence and machine learning (AI/ML), and advanced robotics.

Source: Bell Canada

……………………………………………………………………………………………………………………………………………………………………………….

“Because that link between the application and the edge device is a completely controllable link – it doesn’t involve the internet, doesn’t involve these multiple hops of the traffic to reach the application – it allows us to have a very particular controlled link that can give you different quality of service,” explained George Elissaios, director and GM for EC2 Core Product Management at AWS, during a briefing call with analysts.

Network infrastructure is the backbone for Canadian businesses today as they innovate and advance in the digital age. Organizations across retail, transportation, manufacturing, media & entertainment and more can unlock new growth opportunities with 5G and MEC to be more agile, drive efficiency, and transform customer experiences.

Optimized for MEC applications, AWS Wavelength deployed on service providers’ 5G networks provides seamless access to cloud services running in AWS Regions. By doing so, AWS Wavelength minimizes the latency and network hops required to connect from a 5G device to an application hosted on AWS. AWS Wavelength is now available in Canada, the United States, the United Kingdom, Germany, South Korea, and Japan in partnership with global communications service providers.

Creating an immersive shopping experience with Bell Canada 5G:

Increasingly, retailers want to offer omni-channel shopping experiences so that consumers can access products, offers, and support services on the channels, platforms, and devices they prefer. For instance, there’s a growing appetite for online shopping to replicate the in store experience – particularly for apparel retailers. These kinds of experiences require seamless connectivity so that customers can easily and immediately pick up on a channel after they leave another channel to continue the experience. These experiences also must be optimized for high-quality viewing and interactivity.

Rudsak worked with Bell and AWS to deploy Summit Tech’s immersive shopping platform, Odience, to offer its customers an immersive and seamless virtual shopping experience with live sales associates and the ability to see merchandise up close. With 360-degree cameras at its pop-up locations and launch events, Rudsak customers can browse the racks and view a new product line via their smartphones or VR headsets from either the comfort of their own home or while on the go. To find out more, please click here.

Bell Canada Public MEC with AWS Wavelength is now available in the Toronto area, with additional Wavelength Zones to be deployed in the future. To find out more, please visit: Bell.ca/publicmec

AWS currently has Wavelength customers (see References below) in the United States, the United Kingdom, Germany, South Korea, Japan, and now Canada. It also has deals with Verizon, Vodafone, SK Telecom, and Dish Network.

Bell Canada explained that the service is targeted at enterprise customers. It will initially offer services to enterprises in Toronto, with expansion planned into other major Canadian markets.

“We’re excited to partner with AWS to bring together Bell’s 5G network leadership with the world’s leading cloud and AWS’ robust portfolio of compute and storage services. With general availability of AWS Wavelength Zones on Canada’s fastest network, it becomes possible for businesses to tap into all-new capabilities, reaching new markets and serving customers in exciting new ways. With our help, customers are thinking bigger, innovating faster and pushing boundaries like never before. Our team of experts are with customers every step of the way on their digital transformation journey. With our ongoing investments in supporting emerging MEC use cases, coupled with our end-to-end security built into our 5G network, we are able to give Canadian businesses a platform to innovate, harness the power of 5G and drive competitiveness for their businesses.”

– Jeremy Wubs, Senior Vice President of Product, Marketing and Professional Services, Bell Business Markets

“AWS Wavelength brings the power of the world’s leading cloud to the edge of 5G networks so that customers like Rudsak, Tiny Mile and Drone Delivery Canada can build highly performant applications that transform consumers’ experiences. We are particularly excited about our deep collaboration with Bell as it accelerates innovation across Canada, by offering access to 5G edge technology to the whole AWS ecosystem of partners and customers. This enables any enterprise or developer with an AWS account to power new kinds of mobile applications that require ultra-low latencies, massive bandwidth, and high speeds.”

– George Elissaios, Director and General Manager, EC2 Core Product Management, AWS

“With Bell’s Public MEC and AWS Wavelength we are able to offer new, fully immersive shopping experiences to our customers. Shoppers can virtually explore our new arrivals and interact in real-time with our staff and industry experts during interactive events and pop-ups. Thanks to the hard work, support and expertise of Bell, AWS and Summit Tech, we were able to successfully deliver our first immersive/interactive shopping event with the quality, innovation and excellence that our brand is known for.”

– Evik Asatoorian, President and Founder, Rudsak

“Canadian organizations across all industries are transforming their workflows by harnessing the power of new technologies to launch new products and services. In fact, 85% of Canadian businesses are already using the Internet of Things (IoT). In order to maximize the benefits of cloud computing, intelligent endpoints and AI, while adding emerging technologies like 5G, we need to modernize our digital infrastructure to embrace multi-access edge computing (MEC). Modernized edge computing interconnects core, cloud and diverse edge sites, enabling CIOs and business leaders to optimize their architectures to resolve technical challenges around latency, bandwidth and compute power, financial concerns about cloud ingress/egress and compute costs as well as governance issues such as regulatory compliance without losing advanced features like machine learning, AI and analytics. MEC offers the possibility of deploying modernized, cloud-like resources everywhere to support the ability to extract value from data.”

– Nigel Wallis, Research VP, Canadian Industries and IoT, IDC Canada

- Bell is the first Canadian telecommunications company to offer AWS-powered public MEC to business customers

- First AWS Wavelength Zone to launch in the Toronto region, with additional locations in Canada to follow

- Apparel retailer Rudsak among the first to leverage Bell Public MEC with AWS Wavelength to deliver an immersive virtual shopping experience

Bell is Canada’s largest communications company, providing advanced broadband wireless, TV, Internet, media and business communication services throughout the country. Founded in Montréal in 1880, Bell is wholly owned by BCE Inc. To learn more, please visit Bell.ca or BCE.ca.

References:

AWS looks to dominate 5G edge with telco partners that include Verizon, Vodafone, KDDI, SK Telecom

Verizon, AWS and Bloomberg media work on 4K video streaming over 5G with MEC

AWS deployed in Digital Realty Data Centers at 100Gbps & for Bell Canada’s 5G Edge Computing

Amazon AWS and Verizon Business Expand 5G Collaboration with Private MEC Solution

Omdia: Enterprise edge services market to hit $214 billion by 2026

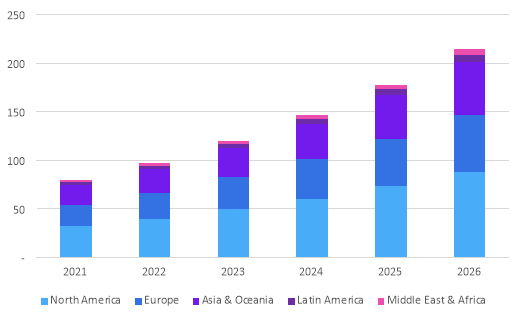

According to a new report by Informa’s Omdia, revenue from edge services (where EXACTLY is the edge?) will reach $214 billion by 2026. That’s more than double the current size of the enterprise edge services market, which will reach $97.0 billion in 2022, says Omdia. With a compound annual growth rate (CAGR) of 20.4%, North America is predicted to dominate with 41% of global revenue share between 2021 and 2026.

This Omdia report discusses the latest global enterprise edge services forecast including edge consulting, integration, network, security, storage/compute and managed edge services considering use cases, verticals and edge deployment models.

Enterprise edge services forecast by region, 2021-26 ($ billions)

Source: Omdia (owned by Informa)

…………………………………………………………………………………………………………

While hyperscalers build out edge access points and systems integrators (SIs) design consulting and professional services for edge use cases, enterprises are looking to service providers to define business cases, run pilot projects and scope out different approaches to edge computing use cases, according to Omdia.

The Informa owned market research group outlines two main consumption models for edge services.

- In one model, enterprises will need consulting, systems integration and other support services to deploy physical edge infrastructure.

- The second method is a cloud-based, as-a-service and fully managed approach, where services provided by hyperscalers and independent software vendors (ISVs) are extended to the edge using local access points or gateways.

Omdia sees several opportunities for network providers to assist enterprises with the challenges that arise from implementing their edge strategies. The firm notes that telcos can help enterprises navigate data location and management considerations; regulatory compliance; network considerations such as the need for and availability of 5G, WAN/LAN and private networks; selecting the right edge setup and location; balancing use of internal skills with managed edge services; defining clear business cases; and more.

Edge consulting services from SIs, telcos, ICT solutions vendors and consulting firms form the largest part of the enterprise edge services market at 39.3% in 2022, says Omdia. While cybersecurity and network management subscriptions from service providers are critical to edge service packages, these subscription-based telco services are declining over time, the research group adds.

However, fully managed, cloud-delivered edge services, including multi-access edge computing (MEC) and workload and database management, are increasing in popularity. Omdia predicts that edge storage and compute services will be the strongest area of growth, with the services emerging as cloud services extensions to the edge provided by major hyperscalers, service providers and data center operators.

“As data volumes continue to grow and enterprises aim to move more workloads to the edge, they require more compute and storage capacity in the form of IaaS and PaaS at edge access points,”Omdia explained.

Edge locations will also shift from customers’ premises (53% in 2022 and 38% in 2026) to PoPs (point of presence) such as cloud access points and to a lesser extent, data centers.

“By 2026, over a third of edge services revenues will be realized as part of PoP deployments, which provides key opportunities and challenges for ICT service providers,” says Omdia.

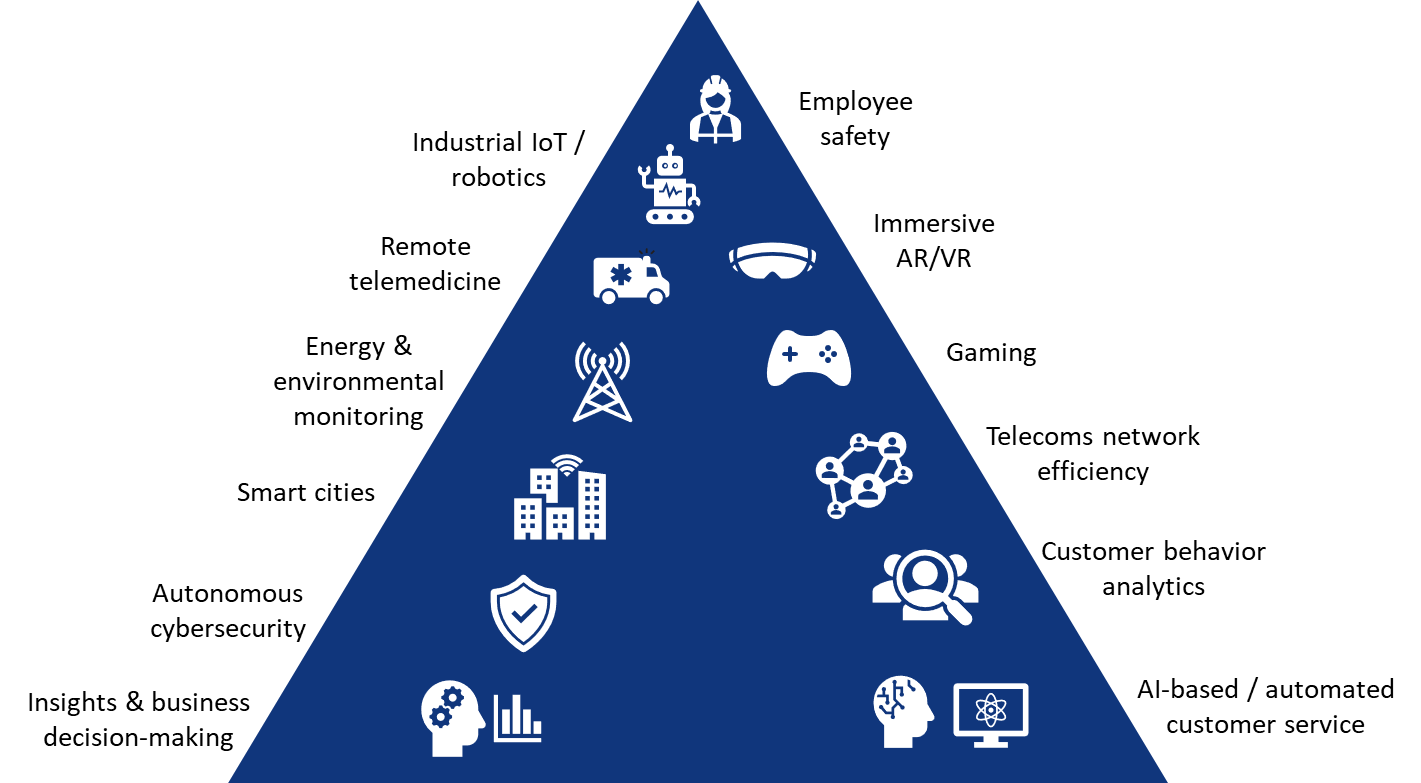

Emerging edge use cases

Edge use cases initially took flight in industrial applications and IoT use cases for worker safety, automated production lines, mining and logistics, explains Omdia. Over the next five years, the largest vertical forecasted to lead growth in edge services is the financial market, which could use AI-based analytics and cognitive systems for business decisions, market insight, risk assessment and customer service platforms.

Source: Omdia

Source: Omdia

…………………………………………………………………………………………………………………

Additional edge service use cases, which network operators could deliver as managed services, include smart meters for energy use and environmental monitoring; transport and container tracking; customer behavior analytics in retail; network efficiency; and data protection compliance and cybersecurity.

What applications do enterprises expect to run at the edge?

Omdia recommends several approaches for service providers, SIs, hyperscalers and ICT solutions vendors to consider when working with enterprises on edge services. Suggestions include developing vertical and workload-specific edge services that can be largely replicated to different customers, creating innovation hubs for edge solutions to test edge setups with customers, developing consulting services and creating a partner ecosystem to reduce vendor lock-in for customers.

References:

https://omdia.tech.informa.com/OM024012/Enterprise-Services-at-the-Edge–Forecast-202226

The Amorphous “Edge” as in Edge Computing or Edge Networking?

Multi-access Edge Computing (MEC) Market, Applications and ETSI MEC Standard-Part I

IBM says 5G killer app is connecting industrial robots: edge computing with private 5G

ONF’s Private 5G Connected Edge Platform Aether™ Released to Open Source

The Amorphous “Edge” as in Edge Computing or Edge Networking?

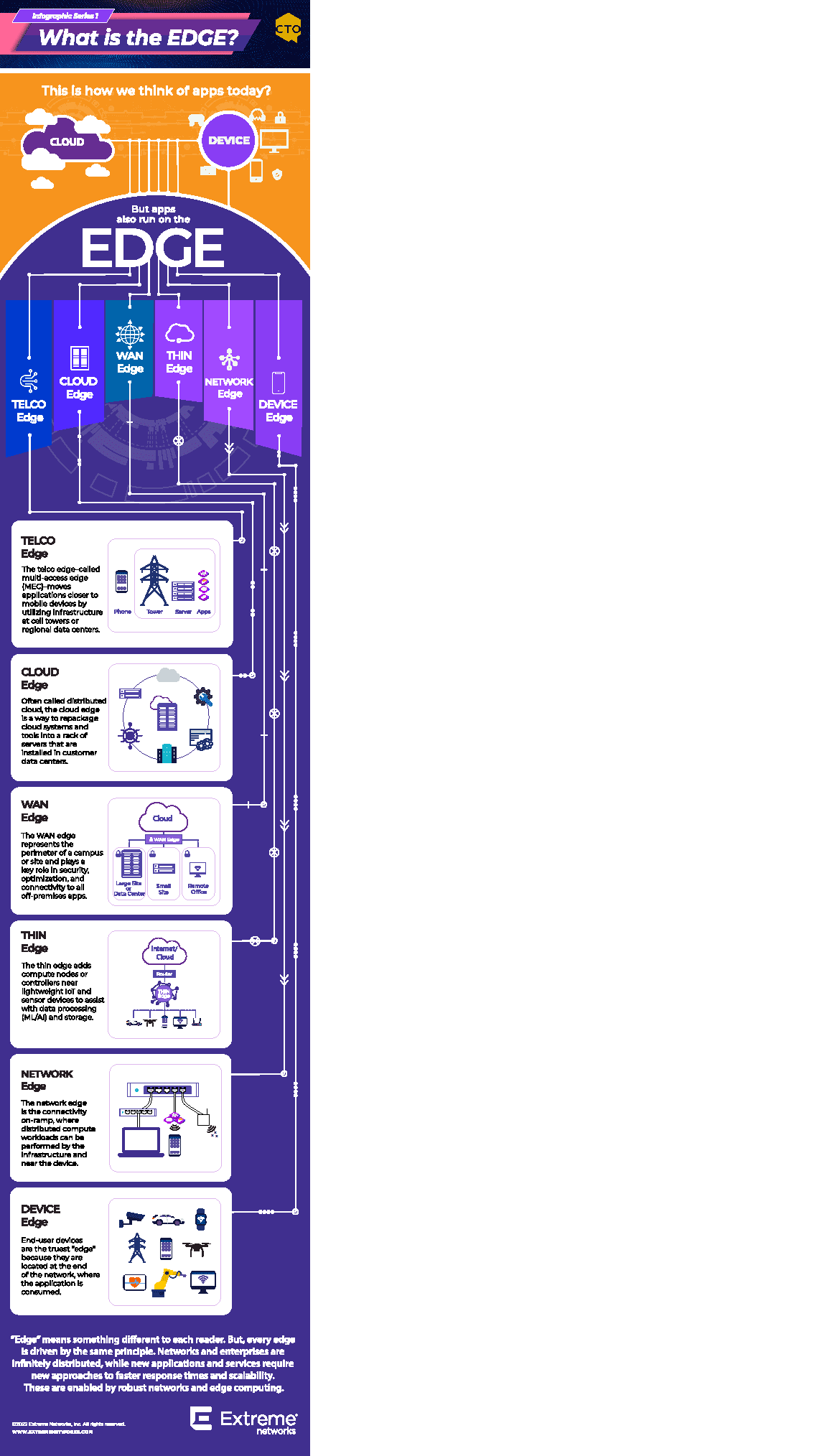

There are many definitions for where the “edge” is actually located. To datacenter experts, the edge is a small datacenter closer to users. For telecom people, the edge is regional data center or carrier owned point of presence that is not in the cloud. To enterprise users, the edge can be on premises. What does the “edge” mean to you?

Extreme Networks suggests the edge is “any form of application delivery that is not in the cloud. To illustrate the concept, and the multiplicity of edges, the company created an infographic that highlights some of the most common meanings of “edge.”

Image Courtesy of Extreme Networks

References:

Multi-access Edge Computing (MEC) Market, Applications and ETSI MEC Standard-Part I

AWS deployed in Digital Realty Data Centers at 100Gbps & for Bell Canada’s 5G Edge Computing

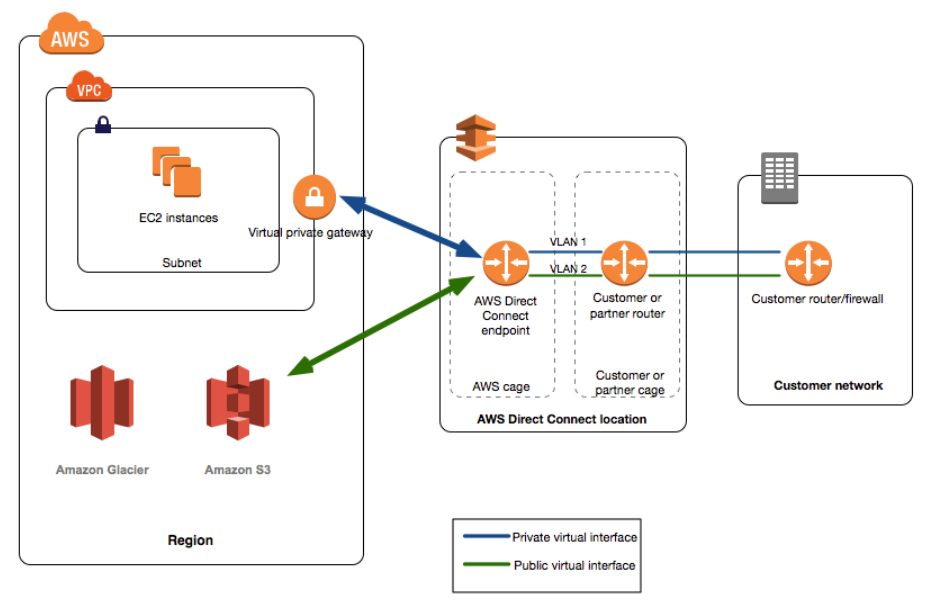

I. Digital Realty, the largest global provider of cloud- and carrier-neutral data center, colocation and interconnection solutions, announced today the deployment of Amazon Web Services (AWS) Direct Connect 100Gbps capability at the company’s Westin Building Exchange in Seattle, Washington and on its Interxion Dublin Campus in Ireland, bringing one of the fastest AWS Direct Connect [1.] capabilities to PlatformDIGITAL®. Digital Realty’s platform connects 290 centers of data exchange with over 4,000 participants around the world, enabling enterprise customers to scale digital business and interconnect distributed workflows on a first of its kind global data center platform.

Note 1. AWS Direct Connect is a cloud service solution that makes it easy to establish a dedicated network connection from your premises to AWS. This can increase bandwidth throughput and provide a more consistent network experience than internet-based connections.

……………………………………………………………………………………………………………………………….

As organizations bring on new technologies and solutions such as artificial intelligence (AI) and IoT at scale, the explosive growth of digital business is posing new challenges, as data takes on its own gravity, becoming heavier, denser, and more expensive to move.

The new AWS Direct Connect 100Gbps is tailored to providing easy access to larger data sets, enabling high availability, reliability and lower latency. As a result, customers will be able to move bandwidth-heavy workloads seamlessly – and break through the barriers posed by data gravity. Customers gain access to strategic IT infrastructure that can aggregate and maintain data with less design time and spend, enabling access to AWS with one of the fastest and highest quality AWS network connections available.

As an AWS Outposts Ready Partner, Digital Realty’s global platform is optimized to support the needs of data-intensive, secure hybrid IT deployments. Digital Realty supports AWS Outposts deployments by enabling access to more than 40 AWS Direct Connect locations globally to address local processing, compliance, and storage requirements, while optimizing cost and performance. When coupled with the availability of AWS Direct Connect 100Gbps connections, the Westin Building Exchange and Interxion Dublin campuses become ideal meeting places for customers to tackle data gravity challenges and unlock new opportunities with their AWS Outposts deployments.

“As emerging technologies such as AI, VR and blockchain move from the margins to the mainstream, enterprises need new levels of performance from their hybrid solutions,” said Tom Sly, General Manager, AWS Direct Connect. “Deploying AWS Direct Connect at 100Gbps at Digital Realty facilities in Seattle and Dublin is critical to our strategy of helping customers build more sophisticated applications with increased flexibility, scalability and reliability. We’re excited to see the value Digital Realty’s PlatformDIGITAL® delivers for our mutual customers.”

The Westin Building Exchange serves as a primary interconnection hub for the Pacific Northwest, linking Canada, Alaska and Asia along the Pacific Rim. The building is one of the most densely interconnected facilities in North America, and is home to leading global cloud, content and interconnection providers, housing over 150 carriers and more than 10,000 cross-connects, giving Amazon customers low-latency access to the largest companies and services representing the digital economy. The 34-story tower is adjacent to Amazon’s existing 4.1 million square foot campus in Seattle.

Digital Realty offers six colocation data centers in the Irish capital, which forms a strategic bridge between Europe and the U.S. Ireland has particular significance as a global trading hub and provides the headquarters location for several global multinationals within the software, finance and life science industries. Multiple transatlantic cables also land in Ireland before continuing to the UK or continental Europe, making Interxion Dublin a prime location for the new AWS Direct Connect 100Gbps at the heart of a vibrant connected data community.

“Today’s announcement of the opening of AWS Direct Connect 100Gbps on-ramps significantly expands opportunities for customers to scale their digital transformation through our global PlatformDIGITAL®,” added Digital Realty Chief Technology Officer Chris Sharp. “AWS serves some of the world’s most innovative and demanding customers, from start-up to enterprise, that are looking to drive the digital economy forward. Our platform expands the coverage, capacity, and next-generation connectivity that AWS customers need to extend workloads to the cloud rapidly. We are honored to open up next-generation access in collaboration with AWS and specifically at the heart of the rich digital communities at the Westin Building Exchange and on our Interxion Dublin campus.”

The new deployments create centers of data exchange in Network Hubs deployed on PlatformDIGITAL®, enabling distributed workflows to be rapidly scaled and securely interconnected – reducing operating costs, enhancing visibility, saving time and improving compliance. The new capability also gives AWS customers instant access to a growing list of powerful AWS services such as Blockchain, Machine Learning, IoT and countless others – all over a direct, private connection optimized for high performance and security.

AIB, Inc., a leading data exchange and management firm with a software as a service platform deployed at over 1,600 automotive industry customers, recognized the value of deploying a physical Network Hub on PlatformDIGITAL® coupled with a virtual direct interconnection to AWS to enable flexibility in its hybrid IT environment.

“Our Texas-based operations required new cloud zone diversity solutions for our cloud native national vision. Digital Realty provided an innovative and comprehensive solution for AWS cloud access through PlatformDIGITAL®,” said Kellen Dunham, CTO, AIB, Inc.

Digital Realty’s global platform enables low-latency access to both the nearest AWS Region as well as a wide array of options to connect edge deployments or devices. Customers can securely connect to their desired AWS Region using both physical and virtual connectivity options. Globally, PlatformDIGITAL® offers access to more than 40 AWS Direct Connect locations, including 11 in EMEA, providing secure, high-performance access to numerous AWS Outposts-Ready data centers around the world. In addition, the Digital Realty Internet Exchange (DRIX) supports AWS Direct Peering capabilities and dedicated access to multiple third-party Internet Exchanges on PlatformDIGITAL®, providing a direct path from on-premise networks to AWS. The solution is part of PlatformDIGITAL®’s robust and expanding partner community that solves hybrid IT challenges for the enterprise.

About Digital Realty:

Digital Realty supports the world’s leading enterprises and service providers by delivering the full spectrum of data center, colocation and interconnection solutions. PlatformDIGITAL®, the company’s global data center platform, provides customers a trusted foundation and proven Pervasive Datacenter Architecture (PDx™) solution methodology for scaling digital business and efficiently managing data gravity challenges. Digital Realty’s global data center footprint gives customers access to the connected communities that matter to them with 290 facilities in 47 metros across 24 countries on six continents. To learn more about Digital Realty, please visit digitalrealty.com or follow us on LinkedIn and Twitter.

Additional Resources:

- For more information on locations and availability please visit www.digitalrealty.com/cloud/aws-direct-connect

- Learn about Digital Realty’s Data Hub featuring AWS Outposts solution for data localization and compliance on PlatformDIGITAL

- Explore global coverage options on PlatformDIGITAL®

- Read the AIB case study on deploying hybrid IT flexibly with Digital Realty and AWS

………………………………………………………………………………………………………………………………………

II. Bell Canada today announced it has entered into an agreement with Amazon Web Services, Inc. (AWS) to modernize the digital experience for Bell customers and support 5G innovation across Canada. Bell will use the breadth and depth of AWS technologies to create and scale new consumer and business applications faster, as well as enhance how its voice, wireless, television and internet subscribers engage with Bell services and content such as streaming video. In addition, AWS and Bell are teaming up to bring AWS Wavelength to Canada, deploying it at the edge of Bell’s 5G network to allow developers to build ultra-low-latency applications for mobile devices and users. With this rollout, Bell will become the first Canadian communications company to offer AWS-powered multi-access edge computing (MEC) to business and government users.

“Bell’s partnership with AWS further heightens both our 5G network leadership and the Bell customer experience with greater automation, enhanced agility and streamlined service options. Together, we’ll provide the next-generation service innovations for consumers and business customers that will support Canada’s growth and prosperity in the years ahead,” said Mirko Bibic, President and CEO of BCE and Bell Canada. “With this first in Canada partnership to deploy AWS Wavelength at the network edge, where 5G’s high capacity, unprecedented speed and ultra low latency are crucial for next-generation applications, Bell and AWS are opening up all-new opportunities for developers to enhance our customers’ digital experiences. As Canada recovers from COVID-19 and looks forward to the economic, social and sustainability advantages of 5G, Bell is moving rapidly to expand the country’s next-generation network infrastructure capabilities. Bell’s accelerated capital investment plan, supported by government and regulatory policies that encourage significant investment and innovation in network facilities, will double our 5G coverage this year while growing the high-capacity fibre connections linking our national network footprint.”

The speed and increased bandwidth capacity of the Bell 5G network support applications that can respond much more quickly and handle greater volumes of data than previous generations of wireless technology. Through its relationship with AWS, Bell will leverage AWS Wavelength to embed AWS compute and storage services at the edge of its 5G telco networks so that applications developers can serve edge computing workloads like machine learning, IoT, and content streaming. Bell and AWS will move 5G data processing to the network edge to minimize latency and power customer-led 5G use cases such as immersive gaming, ultra-high-definition video streaming, self-driving vehicles, smart manufacturing, augmented reality, machine learning inference and distance learning throughout Canada. Developers will also have direct access to AWS’s full portfolio of cloud services to enhance and scale their 5G applications.

Optimized for MEC applications, AWS Wavelength minimizes the latency involved in sending data to and from a mobile device. AWS delivers the service through Wavelength Zones, which are AWS infrastructure deployments that embed AWS compute and storage services within a telecommunications provider’s datacenters at the edge of the 5G network so that data traffic can reach application servers within the zones without leaving the mobile provider’s network. Application data need only travel from the device to a cell tower to an AWS Wavelength Zone running in a metro aggregation site. This results in increased performance by avoiding the multiple hops between regional aggregation sites and across the internet that traditional mobile architectures require.

Outside of the AWS Wavelength deployment, Bell is also continuing to evolve its offerings to enhance its customers’ digital experiences. From streaming media to network performance to customer service, Bell will leverage AWS’s extensive portfolio of cloud capabilities to better serve its tens of millions of customers coast to coast. This work will allow Bell’s product innovation teams to streamline and automate processes as well as adapt more quickly to changing market conditions and customer preferences.

“As the first telecommunications company in Canada to provide access to AWS Wavelength, Bell is opening the door for businesses and organizations throughout the country to combine the speed of its 5G network with the power and versatility of the world’s leading cloud. Together, Bell and AWS are bringing the transformative power of cloud and 5G to users all across Canada,” said Andy Jassy, CEO of Amazon Web Services, Inc. “Cloud and 5G are changing the business models for telecommunications companies worldwide, and AWS’s unmatched infrastructure capabilities in areas like machine learning and IoT will enable leaders like Bell to deliver new digital experiences that will enhance their customers’ lives.”

Launched in June 2020, Bell’s 5G network is now available to approximately 35% of the Canadian population. On February 4, Bell announced it was accelerating its typical annual capital investment of $4 billion by an additional $1 billion to $1.2 billion over the next 2 years to rapidly expand its fibre, rural Wireless Home Internet and 5G networks, followed May 31 by the announcement of a further up to $500 million increase in capital spending. With this accelerated capital investment plan, Bell’s 5G network is on track to reach approximately 70% of the Canadian population by year end.

5G will support a wide range of new consumer and business applications in coming years, including virtual and augmented reality, artificial intelligence and machine learning, connected vehicles, remote workforces, telehealth and Smart Cities, with unprecedented IoT opportunities for business and government. 5G is also accelerating the positive environmental impact of Bell’s networks. The Canadian Wireless Telecommunications Association estimates 5G technology can support 1000x the traffic at half of current energy consumption over the next decade, enhancing the potential of IoT and other next-generation technologies to support sustainable economic growth, and supporting Bell’s own objective to be carbon neutral across its operations in 2025.

About Bell Canada:

The Bell team builds world-leading broadband wireless and fiber networks, provides innovative mobile, TV, Internet and business communications services and delivers the most compelling content with premier television, radio, out of home and digital media brands. With a goal to advance how Canadians connect with each other and the world, Bell serves more than 22 million consumer and business customer connections across every province and territory. Founded in Montréal in 1880, Bell is wholly owned by BCE Inc. (TSX, NYSE: BCE). To learn more, please visit Bell.ca or BCE.ca.

Bell supports the social and economic prosperity of our communities with a commitment to the highest environmental, social and governance (ESG) standards. We measure our progress in increasing environmental sustainability, achieving a diverse and inclusive workplace, leading data governance and protection, and building stronger and healthier communities. This includes confronting the challenge of mental illness with the Bell Let’s Talk initiative, which drives mental health awareness and action with programs like the annual Bell Let’s Talk Day and Bell funding for community care, research and workplace programs nationwide all year round.

……………………………………………………………………………………………………………………………………..

Comment and Analysis:

AWS already has an edge compute footprint that covers parts of Asia, Europe and North America. AWS, Google Cloud and Microsoft Azure increasingly (unsurprisingly) look like the real power brokers and empire builders in multi-access/mobile edge computing. Rogers and Telus, Bell’s two main rivals. will likely contract with one of the three big cloud service providers for their 5G edge computing needs.

References:

Google Cloud and Intel partner for 5G Cloud Native Core & Edge Networking

Google Cloud and Intel plan to collaborate to develop cloud-native 5G core, 5G services and edge networking for network operators, enterprises, and the growing pool of vendors involved in mobile networks.

The partnership spans three main areas focused on:

- Accelerating the ability of communications service providers to deploy their virtualized radio access network (RAN) and open RAN solutions with next-generation infrastructure and hardware.

- Launching new lab environments to help communications service providers innovate for cloud native-based 5G networks.

- Making it easier for communications service providers to deliver business applications to the network edge.

“The next wave of network transformation is fueled by 5G and is driving a rapid transition to cloud native technologies,” said Dan Rodriguez, Intel corporate vice president and general manager of the Network Platforms Group, in a press release. “As communications service providers build out their cloud infrastructure, our efforts with Google Cloud and the broader ecosystem will help them deliver agile, scalable solutions for emerging 5G and edge use cases.”

The partnership’s cloud native 5G objectives will be “across the telecommunications stack, with application providers, carriers and communications service providers, hardware providers, and global telecoms,” according to the press release, to decrease the cost and time-to-market needed for the telecommunications industry.

……………………………………………………………………………………………..

Last March, Google Cloud announced a telecommunications industry strategy that focused on cloud capabilities with 5G connectivity and this builds upon that plan.

Google Cloud recently announced an initiative to deliver 200+ partner applications to the edge via Google Cloud’s network and 5G.

Opinion:

Partnerships like this one will be increasingly necessary to build 5G cloud native core networks and services (like network slicing), because there are no implementation specific standards (more below).

Ericsson wrote in a blog post:

“Of course, the implementation of a fully cloud native network will take considerable time and the new and legacy infrastructure will have to co-exist in a hybrid mode to begin with. Nevertheless, depending on your market requirements, it is important to start the journey towards a cloud native 5G Core now and focus future investments in accordance with the new target architecture. This is also the reason why we have re-designed our EPC software to also be cloud native and created a solution we call the Ericsson dual-mode 5G Core.”

“The new 5GC will live together with EPC for a considerable time and it’s important to define an evolution path that is smooth and cost efficient, while still supporting your business strategy and ambitions. We have developed a solution we call dual-mode 5G Core, where 5GC and EPC live together under one common O&M system for efficient TCO. This enables a smooth migration at your own pace and in accordance with your business needs.”

Images Courtesy of Ericsson

…………………………………………………………………………………………………

3GPP High Level Specs on 5G Network Architecture/5G Core:

The high level 3GPP technical specs for 5G Core (5GC) call for a service based architecture (SBA), which is designed for cloud native deployment.

These three 3GPP Technical Specs (TS’s) are the basis for 5G core networks, but they do not specify implementation details:

- 23.501 System architecture for the 5G System (5GS)

- 23.502 Procedures for the 5G System (5GS)

- 23.503 Policy and charging control framework for the 5G System (5GS); Stage 2

The ETSI standard is a transliteration of 3GPP TS 23.501: https://www.etsi.org/deliver/etsi_ts/123500_123599/123501/15.03.00_60/ts_123501v150300p.pdf

From section 4.2.1:

“The 5G architecture is defined as service-based and the interaction between network functions is represented in two ways.

– A service-based representation, where network functions (e.g. AMF) within the Control Plane enables other authorized network functions to access their services. This representation also includes point-to-point reference points where necessary.

– A reference point representation, shows the interaction exist between the NF services in the network functions described by point-to-point reference point (e.g. N11) between any two network functions (e.g. AMF and SMF).

Service-based interfaces are listed in clause 4.2.6.

Reference points are listed in clause 4.2.7.

Network functions within the 5GC Control Plane shall only use service-based interfaces for their interactions.”

………………………………………………………………………………………………..

References:

More information on use cases and the full news release can be found on Google’s website.

More Context: 5G & Wireless Communications at Intel

Intel Partner Stories: Intel Customer Spotlight on Intel.com | Partner Stories on Intel Newsroom

https://www.ericsson.com/en/blog/2020/10/building-a-cloud-native-5g-core-the-guide-series

Intel, Google Cloud Aim to Advance 5G Networks, Edge Innovations

SK Telecom and AWS launch 5G edge cloud service and collaborate on other projects

South Korea’s #1 wireless network operator SK Telecom (SKT) has launched a 5G edge cloud service in partnership with Amazon Web Services (AWS). ‘SKT 5GX Edge’ uses AWS Wavelength at the edge of SKT’s 5G network. SKT said that SKT 5GX Edge will enable customers to develop mobile applications that require ultra-low latency.

With SKT 5GX Edge, applications are connected to ‘AWS Wavelength Zones’, which are located at the edge of SK Telecom’s 5G network, making it unnecessary for application traffic to hop through regional aggregation sites and the public internet.

SKT 5GX Edge with AWS Wavelength is expected to enable SK Telecom’s enterprise customers and developers to build innovative services in areas including machine learning, IoT, video games and streaming using the AWS services, APIs, and tools they already use.

SK Telecom and AWS started operating the first AWS Wavelength Zone in South Korea in the central city of Daejeon (140 kilometers south of Seoul) earlier this month. They plan to expand the SKT 5GX Edge infrastructure to other parts of the country, including Seoul in 2021.

SK Telecom has been cooperating with AWS since February of this year to deploy AWS Wavelength Zones on SK Telecom’s 5G network and worked with 20 enterprise customers to test the service.

SKT and AWS are actively cooperating in the area of non-face-to-face services as demand grows due to the pandemic. The two companies have been working with video conferencing solution provider Gooroomee to build an environment where two-way video conferencing and remote education services are provided without delay, and have realized a service with a latency of less than 100 milliseconds for multiple simultaneous sessions.

“With AWS Wavelength on SKT’s 5G network, customers in South Korea can develop applications that take advantage of ultra-low latencies to address use cases like machine learning inference at the edge, smart cities and smart factories, and autonomous vehicles – all while using the same familiar AWS services, API, and tools to deploy them to 5G networks worldwide,” said Matt Garman, Vice President of Sales and Marketing, AWS.

“In collaboration with AWS, SK Telecom has successfully integrated private 5G and edge cloud. By leveraging this new technology, we will lead the efforts to create and expand innovative business models in game, media services, logistics, and manufacturing industries,” said Ryu Young-sang, President of MNO at SK Telecom.

………………………………………………………………………………………………………………………………

SK Telecom and AWS also report that they have been working to improve operational stability of autonomous robots and efficiency in remote monitoring and control. Together with Woowa Brothers, the operator of food delivery app ‘Baedal Minjok,’ the two companies have completed tests of applying the 5G MEC service to outdoor food delivery robot Dilly Drive. Meanwhile, work continues with local robotics company Robotis to test run autonomous robots in the 5G cloud environment.

SK Telecom and AWS have also signed an agreement with Shinsegae I&C and Maxst to build an AR navigation and guidance system in the Coex Starfield shopping mall in Seoul. They are also working on potential use of the 5G cloud service with Deep Fine, an AR glass solution developer, and Dabeeo, a spatial recognition service provider. With the National IT Industry Promotion Agency (NIPA), SK Telecom has launched an open lab to develop realistic contents optimized for the 5G network and to support the growth of the related ecosystem.

Collaboration is also ongoing with Looxid Labs, a provider of real-time analysis for eye-gaze tracking and brain wave data, to develop services on the 5G MEC for a senior citizen center in Busan.

SK Telecom and AWS are also cooperating in the area of non-face-to-face services as demand grows due to the COVID-19 pandemic. The two companies have been working with video conferencing services provider Gooroomee to develop an environment where 2-way video conferencing and remote education services are provided without delay, and claim they have achieved a service with a latency of less than 100 milliseconds for multiple simultaneous sessions.

………………………………………………………………………………………………………………………………………………

References:

https://www.sktelecom.com/en/press/press_detail.do?page.page=1&idx=1494&page.type=all&page.keyword=

https://www.telecompaper.com/news/sk-telecom-launches-5gx-edge-cloud-service-with-aws–1366915

IBM and Verizon Business Collaborate on 5G, Edge Computing and AI Solutions for Enterprise Customers

Verizon Business and IBM are working together on 5G and edge computing innovation to help enable the future of “Industry 4.0.” The two companies plan to combine the high speed and (yet to be proven) low latency of Verizon’s 5G and Multi-access Edge Compute (MEC) functionalities, IoT devices and sensors at the edge, and IBM’s expertise in AI, hybrid multi-cloud, edge computing, asset management and connected operations. These will be jointly offered with IBM’s Maximo Monitor with IBM Watson and advanced analytics. The combined products may help clients detect, locate, diagnose and respond to system anomalies, monitor asset health and help predict failures in near real-time. The first solutions to be aimed at helping improve industrial quality, availability and performance.

“Through this collaboration, we plan to build upon our longstanding relationship with Verizon to help industrial enterprises capitalize on joint solutions that are designed to be multi-cloud ready, secured and scalable, from the data center all the way out to the enterprise edge,” IBM’s Bob Lord, SVP of cognitive applications, blockchain and ecosystems, said in a press release from the companies.

“Through this collaboration, we plan to build upon our longstanding relationship with Verizon to help industrial enterprises capitalize on joint solutions that are designed to be multi-cloud ready, secured and scalable, from the data center all the way out to the enterprise edge.”

“This collaboration is all about enabling the future of industry in the Fourth Industrial Revolution,” said Tami Erwin, CEO, Verizon Business. “Combining the high speed and low latency of Verizon’s 5G UWB Network and MEC capabilities with IBM’s expertise in enterprise-grade AI and production automation can provide industrial innovation on a massive scale and can help companies increase automation, minimize waste, lower costs, and offer their own clients a better response time and customer experience.”

Image Credit: iStockphoto/LHG

…………………………………………………………………………………………………………………………………………………………………………….

IBM and Verizon said their first offerings would target “mobile asset tracking and management solutions,” and that, eventually, they hope to offer products for remote control robotics, real-time video analysis and plant automation. The two companies also plan to collaborate on potential joint solutions to address worker safety, predictive maintenance, product quality and production automation.

Many industrial enterprises are today seeking ways to use edge computing to accelerate access to near real-time, actionable insights into operations to improve productivity and reduce costs. To address industrial firms’ need for edge computing ways to accelerate access to near real-time insights into operations, the first products planned from this collaboration are mobile asset tracking and management products to help enterprises improve operations, optimise production quality, and help clients enhance worker safety.

IBM and Verizon are also working on potential combined products for 5G and MEC-enabled use cases such as near real-time cognitive automation for the industrial environment.

Verizon and IBM also plan to collaborate on potential joint products to address worker safety, predictive maintenance, product quality and production automation.

Light Reading’s Mike Dano had this comment:

For IBM, the announcement underscores its efforts to offer products and services in the edge computing marketplace, an area that’s becoming a key focus for a variety of businesses looking for speedy computing services via nearby or onsite facilities.

And for Verizon, the announcement adds further momentum to its 5G and edge computing ambitions. Company executives have long argued that the combination of 5G and edge computing has a wide range of enterprise applications, and Verizon’s new pairing with IBM could open the doors to more potential customers for such services.

To be clear, Verizon has been working to stamp out a position in the 5G and edge computing sector for years. The company hopes to offer its high-speed, millimeter-wave 5G network across 60 cities by the end of this year, and concurrently it has said it will launch nationwide 5G on lowband spectrum in that same timeframe. Separately, Verizon late last year announced it would team up with Amazon to support its AWS edge computing initiative.

But Verizon’s edge computing efforts don’t stop there. The company joined América Móvil, KT, Rogers, Telstra and Vodafone to establish the “5G Future Forum” in January in part to accelerate the development of Multi-access Edge Computing (MEC)-enabled solutions. The group this week announced it will release its first technical specifications in the third quarter.

………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.lightreading.com/the-edge/verizon-ibm-team-up-on-5g-and-edge-computing/d/d-id/762452?