Dell’Oro: Mobile Core Network market driven by 5G SA networks in China

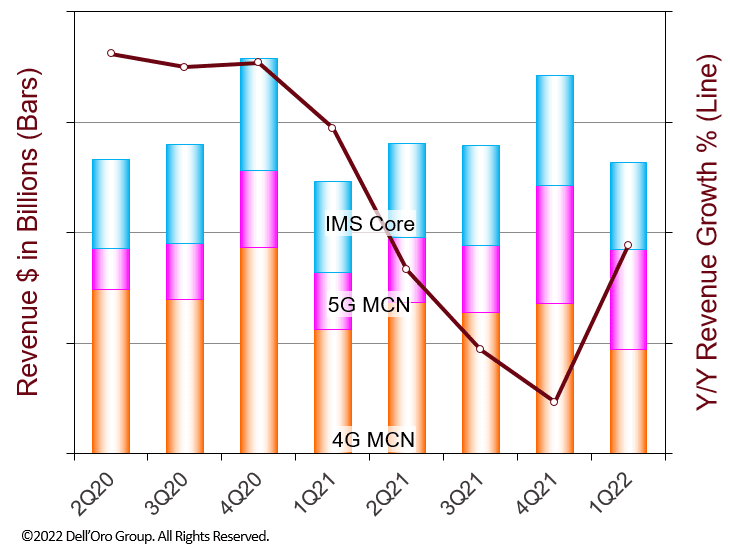

According to a recently published report from Dell’Oro Group, the total Mobile Core Network (MCN) and Multi-access Edge Computing (MEC) market revenues for 1Q 2022 rebounded to a positive year-over-year (Y/Y) growth rate after the decrease in 4Q 2021 which was the first decrease since 4Q 2017.

The MCN market growth was driven by an extremely high double-digit percentage Y/Y revenue growth rate in the 5G MCN market overcoming the Y/Y revenue declines in the 4G MCN and IMS Core markets. For the MCN market regionally, the China region had a high growth rate while the MCN market excluding China had a negative growth rate for the quarter.

“With the continued aggressive build-out of 5G Standalone (SA) networks in China, the China region in 1Q 2022 substantially increased its share of the 5G MCN market over last quarter,’ stated Dave Bolan, Research Director at Dell’Oro Group. “At the end of 1Q 2022, we have identified 25 Mobile Network Operators (MNOs) that have commercially launched 5G SA Mobile Broadband networks (MBB) with services available to consumers. The 5G Core vendors (in alphabetical order) include Cisco, Ericsson, Huawei, NEC, Nokia, Samsung, and ZTE. We have identified 150 MNOs with 5G Core contracts with the above vendors plus Mavenir. There are still more 5G Core contracts that vendors have acknowledged without revealing the associated MNOs.

“We see fewer 5G Core network launches slated for 2022 as compared to 2021 when 16 networks were launched. However, many are being readied for 2023 launches and we project mid-single-digit percentage Y/Y growth rates for the balance of 2022. One of the most anticipated and publicized 5G Core launches is Dish Wireless – the first to run 5G Core on the Public Cloud. The company is preparing to launch in many cities by mid-June 2022 to meet regulatory coverage requirements. In early May 2022, Dish had a soft launch in its first city, Las Vegas. Nokia is the primary 5G Core vendor.

“Multi-access Edge Computing deployed by MNOs has barely scratched the surface in spite of all the hype, except for the China region, which has deployed thousands of MEC nodes throughout their MNO networks, with a mix of Public MEC and Private MEC sites,” continued Bolan.

Additional highlights from the 1Q 2022 Mobile Core Network and Multi-Access Edge Computing Report:

- The top two vendors for the MCN, 4G MCN, and IMS Core markets were Huawei and Ericsson.

- The top two vendors for the 5G MCN market were Huawei and ZTE.

- Nokia and Ericsson had the highest Y/Y growth rates for the 5G MCN market coming from a low small base. However, Huawei had the highest dollar revenue gain, with a lower Y/Y growth rate coming from a larger base.

The Dell’Oro Group Mobile Core Network & Multi-Access Edge Computing Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, and IMS Core including licenses by Non-NFV and NFV, and by geographic regions. To purchase this report, please contact us at [email protected].

One thought on “Dell’Oro: Mobile Core Network market driven by 5G SA networks in China”

Comments are closed.

Hi Alan,

I listed the top 5 MCN vendors for AMF/MME, SMF/S-PGW-C, UPF/S-PGW-U, PCF/PCRF, UDM/HSS, SBC, TAS, CSCF software network function revenues. Only Microsoft Azure is a vendor for these software network functions, but is not in the top 5.

As an example, the Dish Wireless 5G Network will employ Nokia 5G Core and IMS Core software network functions on AWS infrastructure. Infrastructure revenues are captured in our Data Center IT Capex Report.

Best regards,

Dave Bolan