Dell’Oro Group

Dell’Oro: RAN revenue growth in 1Q2025; AI RAN is a conundrum

Dell’Oro Group just completed its 1Q-2025 Radio Access Network (RAN) report. Initial findings suggest that after two years of steep declines, market conditions improved in the quarter. Preliminary estimates show that worldwide RAN revenue, excluding services, stabilized year-over-year, resulting in the first growth quarter since 1Q-2023. Author Stefan Pongratz attributes the improved conditions to favorable regional mix and easy comparisons (investments were very low same quarter lasts year), rather than a change to the fundamentals that shape the RAN market.

Pongratz believes the long-term trajectory has not changed. “While it is exciting that RAN came in as expected and the full year outlook remains on track, the message we have communicated for some time now has not changed. The RAN market is still growth-challenged as regional 5G coverage imbalances, slower data traffic growth, and monetization challenges continue to weigh on the broader growth prospects,” he added.

Vendor rankings haven’t changed much in several years, as per this table:

Additional highlights from the 1Q 2025 RAN report:

– Strong growth in North America was enough to offset declines in CALA, China, and MEA.

– The picture is less favorable outside of North America. RAN, excluding North America, recorded a fifth consecutive quarter of declines.

– Revenue rankings did not change in 1Q 2025. The top 5 RAN suppliers (4-Quarter Trailing) based on worldwide revenues are Huawei, Ericsson, Nokia, ZTE, and Samsung.

– The top 5 RAN (4-Quarter Trailing) suppliers based on revenues outside of China are Ericsson, Nokia, Huawei, Samsung, and ZTE.

– The short-term outlook is mostly unchanged, with total RAN expected to remain stable in 2025 and RAN outside of China growing at a modest pace.

Dell’Oro Group’s RAN Quarterly Report offers a complete overview of the RAN industry, with tables covering manufacturers’ and market revenue for multiple RAN segments including 5G NR Sub-7 GHz, 5G NR mmWave, LTE, macro base stations and radios, small cells, Massive MIMO, Open RAN, and vRAN. The report also tracks the RAN market by region and includes a four-quarter outlook. To purchase this report, please contact us by email at [email protected]

………………………………………………………………………………………………………………………………………………………………………………..

Separately, Pongrantz says “there is great skepticism about AI’s ability to reverse the flat revenue trajectory that has defined network operators throughout the 4G and 5G cycles.”

The 3GPP AI/ML activities and roadmap are mostly aligned with the broader efficiency aspects of the AI RAN vision, primarily focused on automation, management data analytics (MDA), SON/MDT, and over-the-air (OTA) related work (CSI, beam management, mobility, and positioning).

Current AI/ML activities align well with the AI-RAN Alliance’s vision to elevate the RAN’s potential with more automation, improved efficiencies, and new monetization opportunities. The AI-RAN Alliance envisions three key development areas: 1) AI and RAN – improving asset utilization by using a common shared infrastructure for both RAN and AI workloads, 2) AI on RAN – enabling AI applications on the RAN, 3) AI for RAN – optimizing and enhancing RAN performance. Or from an operator standpoint, AI offers the potential to boost revenue or reduce capex and opex.

While operators generally don’t consider AI the end destination, they believe more openness, virtualization, and intelligence will play essential roles in the broader RAN automation journey.

Operators are not revising their topline growth or mobile data traffic projections upward as a result of AI growing in and around the RAN. Disappointing 4G/5G returns and the failure to reverse the flattish carrier revenue trajectory is helping to explain the increased focus on what can be controlled — AI RAN is currently all about improving the performance/efficiency and reducing opex.

Since the typical gains demonstrated so far are in the 10% to 30% range for specific features, the AI RAN business case will hinge crucially on the cost and power envelope—the risk appetite for growing capex/opex is limited.

The AI-RAN business case using new hardware is difficult to justify for single-purpose tenancy. However, if the operators can use the resources for both RAN and non-RAN workloads and/or the accelerated computing cost comes down (NVIDIA recently announced ARC-Compact, an AI-RAN solution designed for D-RAN), the TAM could expand. For now, the AI service provider vision, where carriers sell unused capacity at scale, remains somewhat far-fetched, and as a result, multi-purpose tenancy is expected to account for a small share of the broader AI RAN market over the near term.

In short, improving something already done by 10% to 30% is not overly exciting. However, suppose AI embedded in the radio signal processing can realize more significant gains or help unlock new revenue opportunities by improving site utilization and providing telcos with an opportunity to sell unused RAN capacity. In that case, there are reasons to be excited. But since the latter is a lower-likelihood play, the base case expectation is that AI RAN will produce tangible value-add, and the excitement level is moderate — or as the Swedes would say, it is lagom.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Editor’s Note:

ITU-R WP 5D is working on aspects related to AI in the Radio Access Network (RAN) as part of its IMT-2030 (6G) recommendations. IMT-2030 is expected to consider an appropriate AI-native new air interface that uses to the extent practicable, and proved demonstrated actionable AI to enhance the performance of radio interface functions such as symbol detection/decoding, channel estimation etc. An appropriate AI-native radio network would enable automated and intelligent networking services such as intelligent data perception, supply of on-demand capability etc. Radio networks that support applicable AI services would be fundamental to the design of IMT technologies to serve various AI applications, and the proposed directions include on-demand uplink/sidelink-centric, deep edge, and distributed machine learning.

In summary:

- ITU-R WP5D recognizes AI as one of the key technology trends for IMT-2030 (6G).

- This includes “native AI,” which encompasses both AI-enabled air interface design and radio network for AI services.

- AI is expected to play a crucial role in enhancing the capabilities and performance of 6G networks.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

Dell’Oro: Private RAN revenue declines slightly, but still doing relatively better than public RAN and WLAN markets

ITU-R WP 5D reports on: IMT-2030 (“6G”) Minimum Technology Performance Requirements; Evaluation Criteria & Methodology

https://www.itu.int/dms_pubrec/itu-r/rec/m/R-REC-M.2160-0-202311-I!!PDF-E.pdf

Dell’Oro: Global telecom CAPEX declined 10% YoY in 1st half of 2024

According to a recent report by Dell’Oro Group, telecom operators are now scaling back their investments in 5G and fixed broadband technologies. Of course, that’s nothing new as telco CAPEX has been declining for quite some time (see References below). Preliminary Dell’Oro findings show that the more challenging conditions that shaped the second half of 2023 extended into the first half of 2024.

Worldwide telecom capex, the sum of wireless and wireline/other telecom carrier investments, declined 10% year-over-year (YoY) in the first half of 2024, partly due to built-up inventory, weaker demand in China, India, and US, challenging 5G comparisons, excess capacity, and elevated uncertainty.

“The high-level message is clear. The flattish revenue trajectory and the difficulties with monetizing new technologies and opportunities are impacting the risk appetite and willingness to raise the capital intensity levels for extended periods,” said Stefan Pongratz, Vice President for RAN and Telecom Capex research at Dell’Oro Group. “In addition, the reduced gap between advanced and less advanced regions, when it comes to adopting new technologies, is impacting the investment intensity on the way up and down,” continued Pongratz.

Additional highlights from the September 2024 Telecom Capex report:

- Global carrier revenues are expected to increase at a 1 percent CAGR over the next 3 years.

- Worldwide telecom capex is projected to decline at a mid-single-digit rate in 2024 and at a negative 2 percent CAGR by 2026.

- The mix between wireless and wireline remains largely unchanged, reflecting challenging times still ahead for wireless. Wireless-related capex will decline at a 3 percent CAGR by 2026.

- Capital intensity ratios are modeled to approach 15 percent by 2026, down from 17 percent in 2023.

In a previous Dell’Oro report last month, telecom equipment revenues fell by 17% worldwide during the first half of the year. Dell’Oro described that as ‘abysmal results’ and again blamed excess inventory, weaker demand in China, ‘challenging 5G comparisons’, and elevated uncertainty.

In a previous Dell’Oro report last month, telecom equipment revenues fell by 17% worldwide during the first half of the year. Dell’Oro described that as ‘abysmal results’ and again blamed excess inventory, weaker demand in China, ‘challenging 5G comparisons’, and elevated uncertainty.

The Dell’Oro Group Telecom Capex Report provides in-depth coverage of around 50 telecom operators, highlighting carrier revenue, capital expenditure, and capital intensity trends. The report provides actual and 3-year forecast details by carrier, by region by country (United States, Canada, China, India, Japan, and South Korea), and by technology (wireless/wireline). To purchase this report, please contact by email at [email protected].

References:

Telecom Capex Down 10 Percent in 1H24, According to Dell’Oro Group

Dell’Oro: Abysmal revenue results continue: Ethernet Campus Switch and Worldwide Telecom Equipment + Telco Convergence Moves to Counter Cable Broadband

Analysts: Telco CAPEX crash looks to continue: mobile core network, RAN, and optical all expected to decline

Analysys Mason’s gloomy CAPEX forecast: “there will not be a cyclical recovery”

China Mobile & China Unicom increase revenues and profits in 2023, but will slash CAPEX in 2024

Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

Highlights of Dell’Oro’s 5-year RAN forecast

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

Dell’Oro: Abysmal revenue results continue: Ethernet Campus Switch and Worldwide Telecom Equipment + Telco Convergence Moves to Counter Cable Broadband

Dell’Oro Group recently reported that:

1. 2Q 2024 worldwide Ethernet Campus Switch revenues contracted year-over-year for the third quarter in a row. Ethernet campus switch sales hit an all-time high in 2Q 2023 and a year later, vendors are suffering in comparison.

“We expect another year-over-year contraction in sales next quarter, in 3Q 2024,” said Siân Morgan, Research Director at Dell’Oro Group. “However, the outlook is improving, and the Ethernet Campus Switch market is expected to return to growth in 4Q 2024.”

“While the economy in China remains soft, Huawei grew year-over-year campus switch revenues across the rest of Asia Pacific and CALA. Over half of Huawei’s campus switch sales were generated outside China,” added Morgan.

Additional highlights from the 2Q 2024 Ethernet Switch–Campus Report:

- The contraction in Ethernet campus switch sales was broad-based across both modular and fixed form factors, all verticals and regions.

- Sales to North America fell the most of any macro-economic region.

- Cisco grew campus switch revenues on a quarter-over-quarter basis, for the first time in a year.

The Dell’Oro Group’s Ethernet Switch–Campus Quarterly Report offers a detailed view of Ethernet switches built and optimized for deployment outside the data center, to connect users and things to the Local Area Networks. The report contains in-depth market and vendor-level information on manufacturers’ revenue, ports shipped, and average selling prices for both Modular and Fixed, and Fixed Managed and Unmanaged Ethernet Switches (100 Mbps, 1/2.5/5/10/25/40/50/100/400 Gbps), Power-over-Ethernet, plus regional breakouts as well as split by customer size (Enterprise vs. SMB) and vertical segments. To purchase these reports, please contact us by email at [email protected].

……………………………………………………………………………………………………….

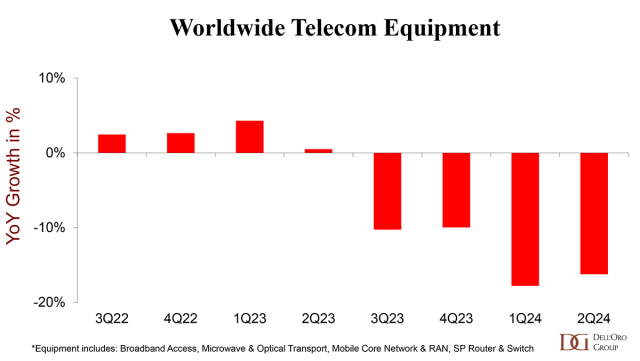

2. Preliminary findings indicate that worldwide telecom equipment revenues across the six telecom programs tracked at Dell’Oro Group—Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch—declined 16% year-over-year (Y/Y) in 2Q24, recording a fourth consecutive quarter of double-digit contractions. Helping to explain the abysmal results are excess inventory, weaker demand in China, challenging 5G comparisons, and elevated uncertainty.

Regional output deceleration was broad-based in the second quarter of 2024, reflecting slower revenue growth on a Y/Y basis in all regions, including North America, EMEA, Asia Pacific, and CALA (Caribbean and Latin America). Varied momentum in activity in the first half was particularly significant in China – the total telecom equipment market in China stumbled in the second quarter, declining 17% Y/Y.

The downward pressure was not confined to a specific technology, and initial readings show that all six telecom programs declined in the second quarter. In addition to the wireless programs (RAN and MCN), which are still impacted by slower 5G deployments, spending on Service Provider Routers fell by a third in 2Q24.

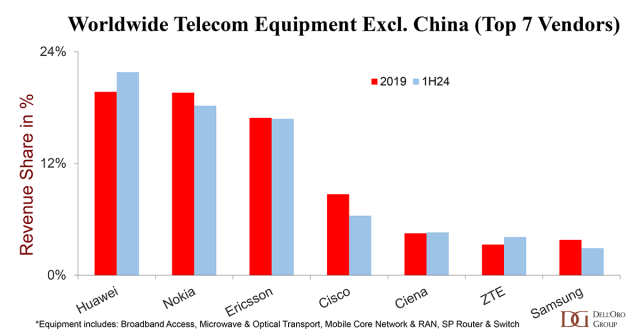

Supplier rankings were mostly unchanged. The top 7 suppliers in 1H24 accounted for 80% of the worldwide telecom equipment market and included Huawei, Nokia, Ericsson, ZTE, Cisco, Ciena, and Samsung. Huawei and ZTE combined gained nearly 3 percentage points of share between 2023 and 1H24.

Supplier positions differ slightly when we exclude the Chinese market. Despite the ongoing efforts by the U.S. government to curb Huawei’s rise, Huawei is still well positioned in the broader telecom equipment market, excluding China, which is up roughly two percentage points relative to 2019 levels.

- Even with the second half of 2024 expected to account for 54% of full-year revenues, market conditions are expected to remain challenging in 2024.

- The Dell’Oro analyst team collectively forecasts global telecom equipment revenues to contract 8 to 10% in 2024, even worse than the 4% decline in 2023.

3. U.S. Telcos Betting on Convergence and Scale To End Cable’s Broadband Reign

U.S. telcos have been very active the past two weeks with deals and partnerships.

- Verizon announced a $20B deal to acquire Frontier Communications and push the combined entity to a fiber footprint of 25 million homes and a fixed wireless footprint of approximately 60 million homes.

- AT&T announced partnerships with four open access network providers to help it expand the reach of its fiber services outside its existing wireline footprint. AT&T will serve as an ISP in these markets, delivering both residential and enterprise services via these partnerships. AT&T is on track to pass a minimum of 30 million homes with fiber by 2025 in its own footprint, as well as an additional 1.5 million homes through its Gigapower joint venture with BlackRock.

- AT&T has also quietly increased the availability of its Internet Air FWA (Fixed Wireless Access) services to over 130 markets, as It potentially positions the service to move beyond just a means of capturing existing DSL subscribers.

These deals follow on the heels of T-Mobile’s proposed acquisition of Lumos Networks, which is slated to pass 3.5 million homes with fiber by the end of 2028. Under the terms of the deal, Lumos will transition to a wholesale model with T-Mobile as the anchor ISP. This is exactly the type of arrangement T-Mobile has established with some of its other infrastructure partners. However, with its partial ownership of Lumos, T-Mobile can presumably generate better returns and healthier margins from its broadband service offerings. The joint venture also is consistent with T-Mobile’s goal of expanding its market presence and footprint without expending a significant amount of capital. In fact, if you take the $1.4B that T-Mobile will ultimately invest in Lumos as it increases its homes passed from 320K to 3.5M by the end of 2028, T-Mobile’s cost per home passed ends up being somewhat less than $500.

That $500 per home passed figure could be even lower should Lumos continue to secure additional American Rescue Plan Act (ARPA) Capital Project Fund grants as well as a portion of the $3.6 B in aggregate BEAD (Broadband Equity, Access, and Development) funding across North Carolina, South Carolina, and Virginia.

The primary reason for T-Mobile’s push into both direct fiber network ownership and partnerships with open access fiber providers is that the operator has over 1 million customers on a waiting list for its fixed wireless service. These customers can’t be served because they are in markets where T-Mobile does not have enough 5G capacity to serve them. As T-Mobile expands the reach of its fiber offering, it can not only provide service to these customers but also existing FWA subscribers. Once an FWA subscriber switches to T-Mobile Fiber, that opens the spectrum for additional FWA subscribers.

US telcos are moving quickly to expand the reach of their fiber, fixed wireless, and ISP services to complement their nationwide mobile networks because they smell blood among the largest cable operators. Telcos are disrupting the broadband market faster and more efficiently right now—a disruption that could very well be amplified by Federal and State subsidies.

With the rollout of 5G networks having had little impact on the profitability of mobile services, fixed wireless has emerged as the most successful use case for mobile network operators (MNOs) can monetize their excess 5G capacity. FWA’s timing couldn’t have been better, with inflation having increased from 2021 on, pushing subscribers to seek out more affordable—but still high quality—broadband service offerings. FWA hit the market providing a powerful combination of affordability, speed, and availability.

The success of FWA combined with overall fiber network expansions has given telcos a potent tool for not only the convergence of mobile and fixed broadband services but also the emergence of these services being offered on an almost nationwide basis. It’s pretty simple math. If you can offer a product or service to a larger number of end customers, the higher the likelihood of continued net subscriber additions, all other things being equal.

Even in markets where there is overlap between fixed wireless and that MNO’s own (or marketed) fiber broadband services, there isn’t really a danger of cannibalization, because the two services will very likely address very different subscribers. As the telcos’ ARPU (average revenue per unit) results have shown, subscribers are willing to pay more for fiber-based connectivity. In 2Q24, for example, AT&T announced that its fiber broadband ARPU is $69 and that the mix shift of its subscribers to fiber has pushed overall broadband ARPU up to $66.17, representing a 6% increase from 2Q23.

Meanwhile, in the second quarter, T-Mobile reported an ARPA figure of $142.54, which was up from $138.94 in 2Q23. Partially fueling that increase was an increase in the number of customers per account, due largely to the adoption of FWA services. Remember, T-Mobile prices and treats its FWA offering as an additional line of service, making it very simple to add to an existing T-Mobile account.

With a starting price point of $50 and typical download speeds ranging from 33-182 Mbps and upload speeds of 6-23 Mbps, T-Mobile is clearly targeting the low-mid cable broadband tiers—and having a great deal of success in converting those subscribers.

Going forward, the 1-2 punch of FWA and fiber will allow the largest telcos to have substantially larger broadband footprints than their cable competitors. Combine that with growing ISP relationships with open access providers and these telcos can expand their footprint and potential customer base further. And by expanding further, we don’t just mean total number of homes passed, but also businesses, enterprises, MDUs (multi-dwelling units), and data centers. Fiber footprint is as much about total route miles as it is about total passings. And those total route miles are, once again, increasing in value, after a prolonged slump.

For cable operators to successfully respond, consolidation likely has to be back on the table. The name of the game in the US right now is how to expand the addressable market of subscribers or risk being limited to existing geographic serving areas. Beyond that, continuing to focus on the aggressive bundling of converged services, which certainly has paid dividends in the form of new mobile subscribers.

Beyond that, being able to get to market quickly in new serving areas will be critical. In this time of frenzied buildouts and expansions, the importance of the first mover advantage can not be overstated.

The push and pull of broadband and wireless subscribers isn’t expected to slow down anytime soon. Certainly, with inflation continuing to put pressure on household budgets, consumers are going to be focused on keeping their communications costs low and looking for value wherever they can find it. That means we are returning to an environment where subscribers take advantage of introductory pricing on services only to switch providers to extend that introductory pricing once the initial offer expires. That shifting and its expected downward pressure on residential ARPU will likely be countered by increasing ARPUs at some providers as they move existing DSL customers to fiber or, in the case of cable operators, move customers to multi-gigabit tiers.

The US broadband market is definitely in for a wild ride over the next few years as the competitive landscape changes across many markets. The net result is certain to be shifts in market share and ebbs and flows in net subscriber additions depending on consumer sentiment. One thing that will remain constant is that value and reliability will remain key components of any subscription decision. The providers that deliver on that consistently will ultimately be the winners.

References:

Ethernet Campus Switch Revenues Plunge by 30 Percent in 2Q 2024, According to Dell’Oro Group

US Telcos Betting on Convergence and Scale To End Cable’s Broadband Reign

Dell’Oro: Private RAN revenue declines slightly, but still doing relatively better than public RAN and WLAN markets

Dell’Oro: Campus Ethernet Switch Revenues dropped 23% YoY in 1Q-2024

Dell’Oro: RAN revenues declined sharply in 2023 and will remain challenging in 2024; top 8 RAN vendors own the market

Dell’Oro: Broadband Equipment Spending to exceed $120B from 2022 to 2027

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

Dell’Oro: Optical Transport market to hit $17B by 2027; Lumen Technologies 400G wavelength market

Nokia’s 760 global private networking contracts are mostly 4G-LTE Advanced

Backgrounder:

Private Wireless Radio Access Network (RAN) revenue growth slowed in the fourth quarter of 2023 on a year-over-year basis. However, full-year revenues accelerated by approximately 40% in 2023, propelling private wireless to comprise around 2% of the overall RAN market.

“Private wireless RANs are now growing at a formidable pace, in contrast to public RAN and enterprise WLAN – both segments are projected to contract in 2024,” said Stefan Pongratz, Vice President at Dell’Oro Group in April.

The top 3 Private Wireless RAN suppliers in 2023 were Huawei, Nokia, and Ericsson. Excluding China, they were Nokia, Ericsson, and Samsung.

……………………………………………………………………………………………………………………………………………..

Nokia leads in Private RANs:

Nokia recently told Fierce Network that it signed 30 new private networking contracts in the second quarter of 2024. Nokia has said that it has signed more than 760 private network contracts around the world. NGIC, Sigma Lithium and Solis are some of the most recent names it has signed.

Nokia said that 78% of its private network business is based on 4G LTE-Advanced [1.], compared to 18% being 5G only, and the remaining 4% combining the two broadband cellular technologies.

Note 1. In October 2010, LTE-Advanced successfully passed the ITU-R’s evaluation process and was found to meet or exceed IMT-Advanced requirements. It was standardized a “IMT Advanced,” which support low to high mobility applications and a wide range of data rates in accordance with user and service demands in multiple user environments. IMT Advanced also has capabilities for high quality multimedia applications within a wide range of services and platforms, providing a significant improvement in performance and quality of service.

Image courtesy of Research Gate

…………………………………………………………………………………………………………………………………………….

David de Lancellotti, VP of enterprise campus edge business at Nokia talked to Fierce about Nokia’s performance in the private networking space. “Thirty in Q2, and roughly 50 — a little more than 50 — in the first half,” he said of contracts signed.

“We kind of jumped into this a bit earlier than anybody else,” Nokia’s de Lancellotti explained. “I think we’ve always taken a real service provider approach in terms of quality, in terms of feature set [and] in terms of roadmap,” while noting Nokia’s “real drive to pick up the enterprise space.”

Industry verticals – transportation, energy and manufacturing – continue to “lead the way” for private networking contracts in Q2. “When we talk about transportation, I think that’s the port side of business, which continues to be strong for us,” David said.

References:

https://www.fierce-network.com/wireless/nokia

Private Wireless RAN Revenues up ~40 Percent in 2023, According to Dell’Oro Group

https://en.wikipedia.org/wiki/LTE_Advanced

https://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-adv/Pages/default.aspx

https://www.researchgate.net/figure/Network-architecture-of-LTE-Advanced_fig1_333886291

Dell’Oro: Mobile Core Network market driven by 5G SA networks in China

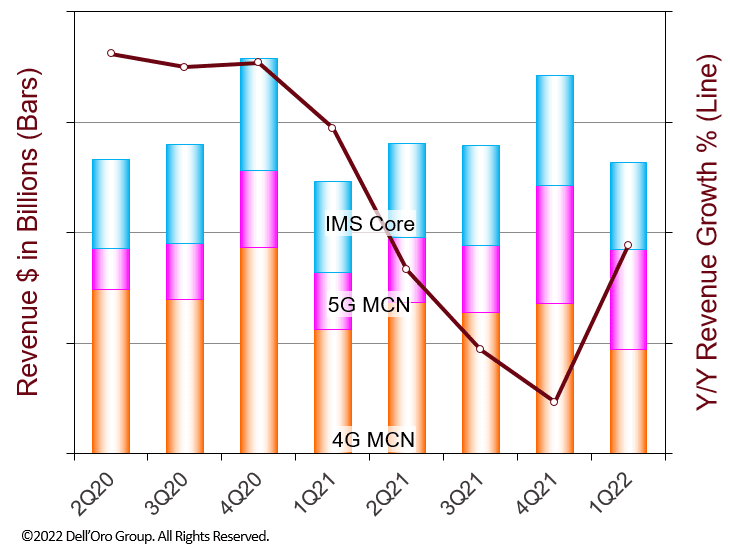

According to a recently published report from Dell’Oro Group, the total Mobile Core Network (MCN) and Multi-access Edge Computing (MEC) market revenues for 1Q 2022 rebounded to a positive year-over-year (Y/Y) growth rate after the decrease in 4Q 2021 which was the first decrease since 4Q 2017.

The MCN market growth was driven by an extremely high double-digit percentage Y/Y revenue growth rate in the 5G MCN market overcoming the Y/Y revenue declines in the 4G MCN and IMS Core markets. For the MCN market regionally, the China region had a high growth rate while the MCN market excluding China had a negative growth rate for the quarter.

“With the continued aggressive build-out of 5G Standalone (SA) networks in China, the China region in 1Q 2022 substantially increased its share of the 5G MCN market over last quarter,’ stated Dave Bolan, Research Director at Dell’Oro Group. “At the end of 1Q 2022, we have identified 25 Mobile Network Operators (MNOs) that have commercially launched 5G SA Mobile Broadband networks (MBB) with services available to consumers. The 5G Core vendors (in alphabetical order) include Cisco, Ericsson, Huawei, NEC, Nokia, Samsung, and ZTE. We have identified 150 MNOs with 5G Core contracts with the above vendors plus Mavenir. There are still more 5G Core contracts that vendors have acknowledged without revealing the associated MNOs.

“We see fewer 5G Core network launches slated for 2022 as compared to 2021 when 16 networks were launched. However, many are being readied for 2023 launches and we project mid-single-digit percentage Y/Y growth rates for the balance of 2022. One of the most anticipated and publicized 5G Core launches is Dish Wireless – the first to run 5G Core on the Public Cloud. The company is preparing to launch in many cities by mid-June 2022 to meet regulatory coverage requirements. In early May 2022, Dish had a soft launch in its first city, Las Vegas. Nokia is the primary 5G Core vendor.

“Multi-access Edge Computing deployed by MNOs has barely scratched the surface in spite of all the hype, except for the China region, which has deployed thousands of MEC nodes throughout their MNO networks, with a mix of Public MEC and Private MEC sites,” continued Bolan.

Additional highlights from the 1Q 2022 Mobile Core Network and Multi-Access Edge Computing Report:

- The top two vendors for the MCN, 4G MCN, and IMS Core markets were Huawei and Ericsson.

- The top two vendors for the 5G MCN market were Huawei and ZTE.

- Nokia and Ericsson had the highest Y/Y growth rates for the 5G MCN market coming from a low small base. However, Huawei had the highest dollar revenue gain, with a lower Y/Y growth rate coming from a larger base.

The Dell’Oro Group Mobile Core Network & Multi-Access Edge Computing Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, and IMS Core including licenses by Non-NFV and NFV, and by geographic regions. To purchase this report, please contact us at [email protected].