Mobile Core Network Market

Dell’Oro: Optical Transport, Mobile Core Network & Cable CPE shipments all declined in 1Q-2024

Apparently, there’s no place to hide in any telecom or datacom market? We all know the RAN market has been in a severe decline, but recent Dell’Oro Group reports indicate that Optical Transport, Mobile Core Network and Cable CPE shipments have also declined sharply in the 1st Quarter of 2024.

Here are a few selected quotes from Dell’Oro analysts:

“The North American broadband market is in the midst of a fundamental shift in the competitive landscape, which is having a significant impact on broadband equipment purchases,” said Jeff Heynen, Vice President with Dell’Oro Group. “In particular, cable operators are trying to navigate mounting, but predictable, broadband subscriber losses with the need to invest in their networks to keep pace with further encroachment by fiber and fixed wireless providers,” explained Heynen.

Omdia, owned by the ADVA, expects cable access equipment spending to grow later in 2024 and peak in 2026 at just over $1 billion, then drop off to $700 million in 2029.

………………………………………………………………………………………………………

“Customer’s excess inventory of DWDM systems continued to be at the center stage of the Optical Transport market decline in the first quarter of 2024,” said Jimmy Yu, Vice President at Dell’Oro Group. “However, we think the steeper-than-expected drop in optical transport revenue in 1Q 2024 may have been driven by communication service providers becoming increasingly cautious about the macroeconomic conditions, causing them to delay projects into future quarters,” added Yu.

…………………………………………………………………………………………………..

“Inflation has impacted the ability of some Mobile Network Operators (MNOs) to raise capital, and it has also impacted subscribers when it comes to upgrading their phones to 5G. Many MNOs have lowered their CAPEX plans and announced that they have fewer than expected 5G subscribers on their networks; which limits MNOs’ growth plans. As a result, we are lowering our expectations for 2024 from a positive growth rate to a negative one,” by Research Director Dave Bolan.

- As of 1Q 2024, 51 MNOs have commercially deployed 5G SA (Stand Alone) eMBB networks with two additional MNOS launching in 1Q 2024.

References:

Optical Transport Equipment Market Forecast to Decline in 2024, According to Dell’Oro Group

Optical Transport Equipment Market Forecast to Decline in 2024, According to Dell’Oro Group

Dell’Oro: Mobile Core Network market has lowest growth rate since 4Q 2017

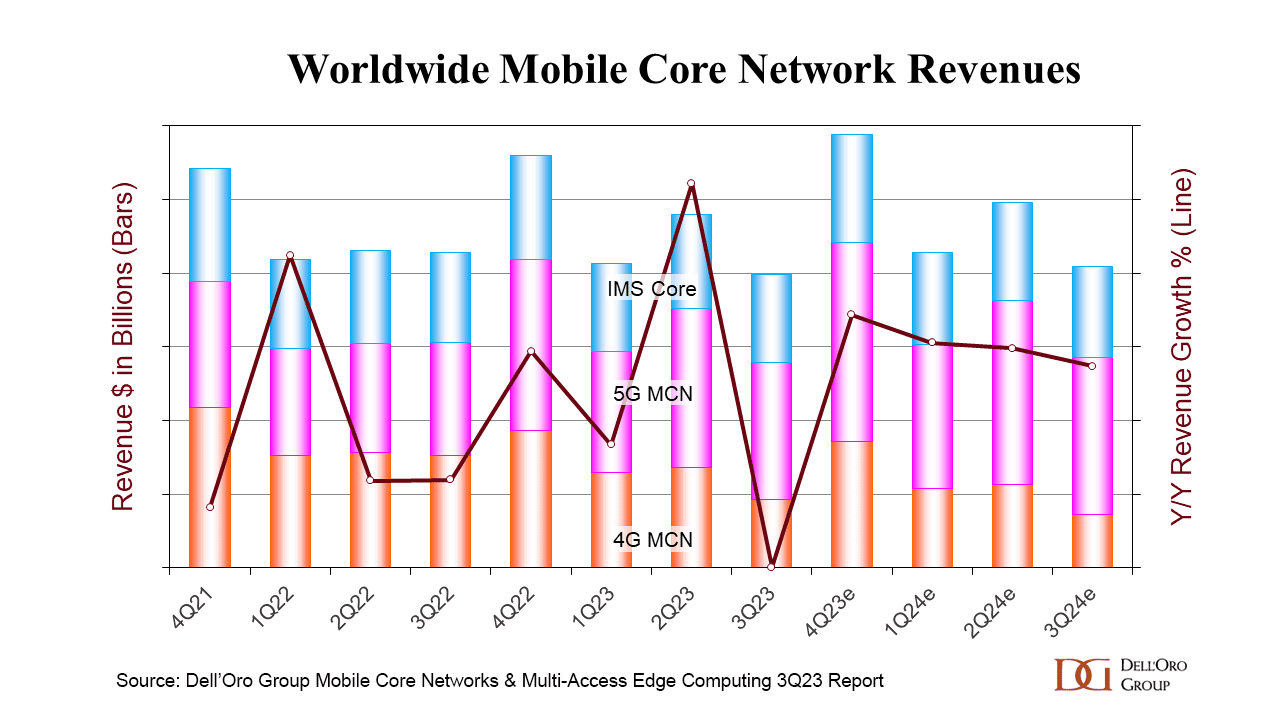

The global mobile core network (MCN) market has just turned in its lowest quarterly growth rate for almost six years, hit by a difficult political and economic climate, as well as by slow rollouts of 5G standalone core networks. Dell’Oro Group reports that the MCN market has become erratic, with the lowest growth rate since 4Q 2017. Europe, Middle East, and Africa (EMEA), and China were the weakest performing regions in 3rdQ 2023.

“It has become quite obvious the MCN market has entered into a very unpredictable phase after breaking the highest growth rate in 2ndQ 2023 since 1stQ 2021, and now hitting the lowest performing growth rate in 3rdQ 2023 since 4thQ 2017. Last quarter, EMEA and China were the strongest performing regions and flipped this quarter, becoming the weakest performing regions,” stated Dave Bolan, Research Director at Dell’Oro Group.

“Many vendors state that the market is volatile, attributing this phenomenon to macroeconomic conditions such as the fear of higher inflation rates, unfavorable currency foreign exchange rates, and the geopolitical climate.

“Besides subscriber growth, the growth engine for the MCN market is the transition to 5G Standalone (5G SA), which employs the 5G Core. But after five years into the 5G era, we are still seeing more 5G Non-Standalone (5G NSA) networks being launched than 5G SA, and the pace of 5G SA networks has slowed from 17 launched in 2022 to only seven so far in 2023. However, we expect more 5G SA networks to be deployed in 2024 than in 2023, and we expect 2024’s market performance to be better than 2023,” continued Bolan.

Additional highlights from the 3Q 2023 Mobile Core Network and Multi-Access Edge Computing Report include:

- Two new MNOs launched commercial 5G SA networks in 3Q23: Telefónica O2 in Germany and Etisalat in the UAE.

- Ericsson is the vendor of record for the 5G packet core for all seven 5G SA networks launched in 2023.

- As of 3Q 2023, 45 MNOs have commercially deployed 5G SA eMBB networks.

- The top MCN vendors worldwide for 3Q 2023 [1.] were: Huawei, Ericsson, Nokia, and ZTE.

- The top 5G MCN vendors worldwide for 3Q 2023 were Huawei, Ericsson, ZTE, and Nokia.

Note 1. Dell’Oro did not supply any actual MCN market share percentages or numbers.

……………………………………………………………………………………………………………………………….

In August the Global mobile Suppliers Association (GSA) released Q2 figures that showed just 36 operators worldwide has launched public 5G SA networks, including two soft launches, by the end of June, an increase of just one on the previous quarter.

In total, the GSA said that 115 operators in 52 countries had invested in public 5G SA networks – that includes actual deployments as well as planned rollouts and trials – by the end of Q2, with no new names added during the quarter, and an increase of just three on the end of 2022.

About the Report:

The Dell’Oro Group Mobile Core Network & Multi-Access Edge Computing Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, and IMS Core including licenses by Non-NFV and NFV, and by geographic regions. To purchase this report, please contact us at [email protected].

About Dell’Oro Group:

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, enterprise networks, and data center infrastructure markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit https://www.delloro.com.

References:

Dell’Oro: RAN market declines at very fast pace while

Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

Dell’Oro: Mobile Core Network & MEC revenues to be > $50 billion by 2027

GSA 5G SA Core Network Update Report

5G SA networks (real 5G) remain conspicuous by their absence

Dell’Oro: Market Forecasts Decreased fo

r Mobile Core Network and Private Wireless RANs

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

A new report from Dell’Oro Group says RAN sales declined at their fastest pace in nearly seven years during Q2-2023. According to preliminary findings from the market research firm, following the ‘intense ramp-up’ from 2017 through 2021. While RAN revenues stabilized in 2022 and 1Q23, market conditions worsened in the second quarter, resulting in RAN declining at the fastest pace in nearly seven years. The decline was not unexpected by Dell’Oro, yet the magnitude of the reversal was much steeper than anticipated.

………………………………………………………………………………………………………………………………..

The RAN market decline was surely expected by IEEE Techblog readers, as this publication has warned for years about the commercial failure of 5G mobile networks.

………………………………………………………………………………………………………………………………..

“It is tempting to point the finger at data traffic patterns, 5G monetization challenges, and the odds stacked against an economy struggling with persistent levels of elevated inflation,” said Stefan Pongratz, Vice President at Dell’Oro Group. “Although these are, of course, important factors, we attribute the poor performance in the quarter to the clouds forming in North America. Alongside challenging 5G comparisons, the decline was amplified by the extra inventory accumulated over the past couple of years to mitigate supply chain risks,” Pongratz added.

Additional highlights from the Q2-2023 RAN report:

- Top 5 RAN suppliers for 1H23 include Huawei, Ericsson, Nokia, ZTE, and Samsung.

- Nokia recorded the largest RAN revenue share gains between 2022 and 1H23.

- Huawei’s quarterly RAN share reached the highest level in three years. Huawei’s 2Q23 RAN revenue share outside of North America was as large as Ericsson and Nokia combined.

- Ericsson and Samsung’s RAN revenue shares declined between 2022 and 1H23.

- Regional projections are mostly unchanged; however, the short-term outlook has been revised upward in APAC excluding China and downward in the North American region.

- Global RAN revenues are expected to decline in 2023.

…………………………………………………………………………………………………………….

In a separate report, Dell’Oro says the Mobile Core Network (MCN) market returned to growth in 2Q 2023. The China region returned to growth and Europe, the Middle East, and Africa (EMEA) had the strongest quarterly growth rate since 3Q 2020.

“The MCN market shined on many fronts this quarter. The China region returned to growth with increased spending by two of the four Mobile Network Operators (MNOs). The EMEA region had its best quarterly growth rate since 2020, Huawei had record high revenues for the quarter, and Ericsson had its highest growth rate since 2Q20, as examples,” stated Dave Bolan, Research Director at Dell’Oro Group. “As a result, we are raising our outlook for 2023 year-over-year (Y/Y) growth rate from low single-digit percent to mid-single-digit percent.”

“As of 2Q 2023, we counted 44 Mobile Network Operators (MNOs) that have launched commercial 5G SA networks. One was added in 2Q 2023, Telefónica – Spain. The North America and EMEA regions of the 5G MCN segment Y/Y growth rates were in the triple-digit percent, signaling capacity additions to the 5G SA networks in both regions,” continued Bolan.

Editor’s Note: Despite years of promises, neither AT&T or Verizon has yet to deploy a 5G SA core network, without which no 3GPP defined 5G features/functions are possible.

…………………………………………………………………………………………………………………………

Additional highlights from the 2Q 2023 Mobile Core Network and Multi-Access Edge Computing Report include:

- The top MCN vendors worldwide for 2Q 2023 were Huawei, Ericsson, Nokia, and ZTE.

- The top 5G MCN vendors worldwide for 2Q 2023 were Huawei, Ericsson, ZTE, and Nokia.

- Five MNOs launched commercial 5G SA networks in 1H 2023.

References:

RAN Declines at the Fastest Pace in Seven Years, According to Dell’Oro Group

Mobile Core Network Market Returns to Growth in 2Q 2023, According to Dell’Oro Group

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

Dell’Oro: OpenRAN revenue forecast revised down

through 2027

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

Dell’Oro: Mobile Core Network & MEC revenues to be > $50 billion by 2027

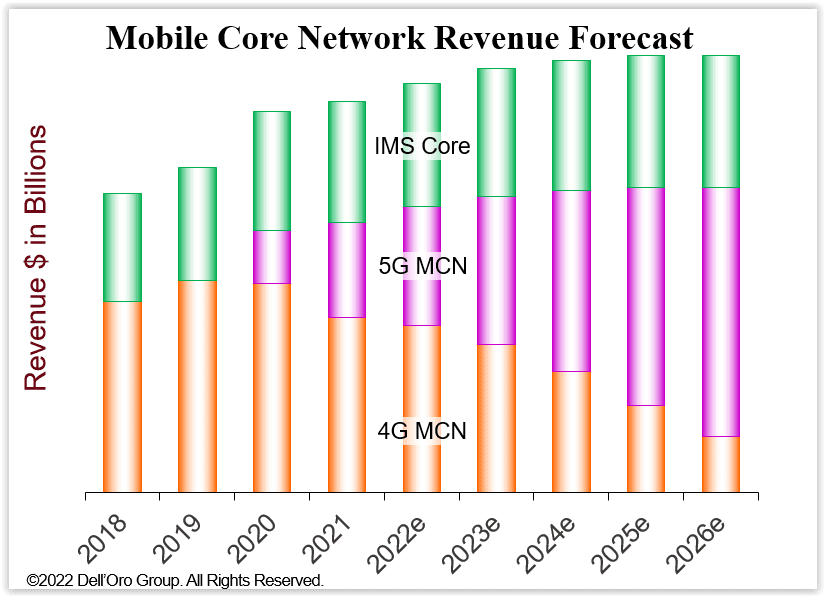

According to a recently published report from Dell’Oro Group, the Mobile Core Networks (MCN) [1.] and Multi-access Edge Computing (MEC) market revenues are expected to reach over $50 billion by 2027.

Note 1. The Mobile Core Network is in a transitional stage from 4G to 5G and a new type of core network called the 5G Core Service Based Architecture (SBA). The 5G Core SBA is designed to be a universal core that can be the core for mobile and fixed wireless networks, wireline networks, and Wi-Fi networks. This includes the ability to be the core for 2G/3G/4G, so only one core is necessary for the long term. In addition, the IMS Core will migrate into the 5G Core SBA.

…………………………………………………………………………………………………………………………………………………………………

“The MNC and MEC market revenues are expected to grow at a 2 percent CAGR (2022-2027). We expect the MCN market for the China region to reach maturity first—due to its early start on 5G SA deployments—and is projected to have -4 percent CAGR throughout the forecast period,” stated Dave Bolan, Research Director at Dell’Oro Group.

“The worldwide market, excluding China, is projected to have a 3 percent CAGR. The Asia Pacific (APAC) and the Europe, Middle, East, and Africa (EMEA) region are expected to have the highest CAGRs throughout the forecast period as MNOs accelerate the deployments of 5G SA networks and expand their respective coverage footprints.

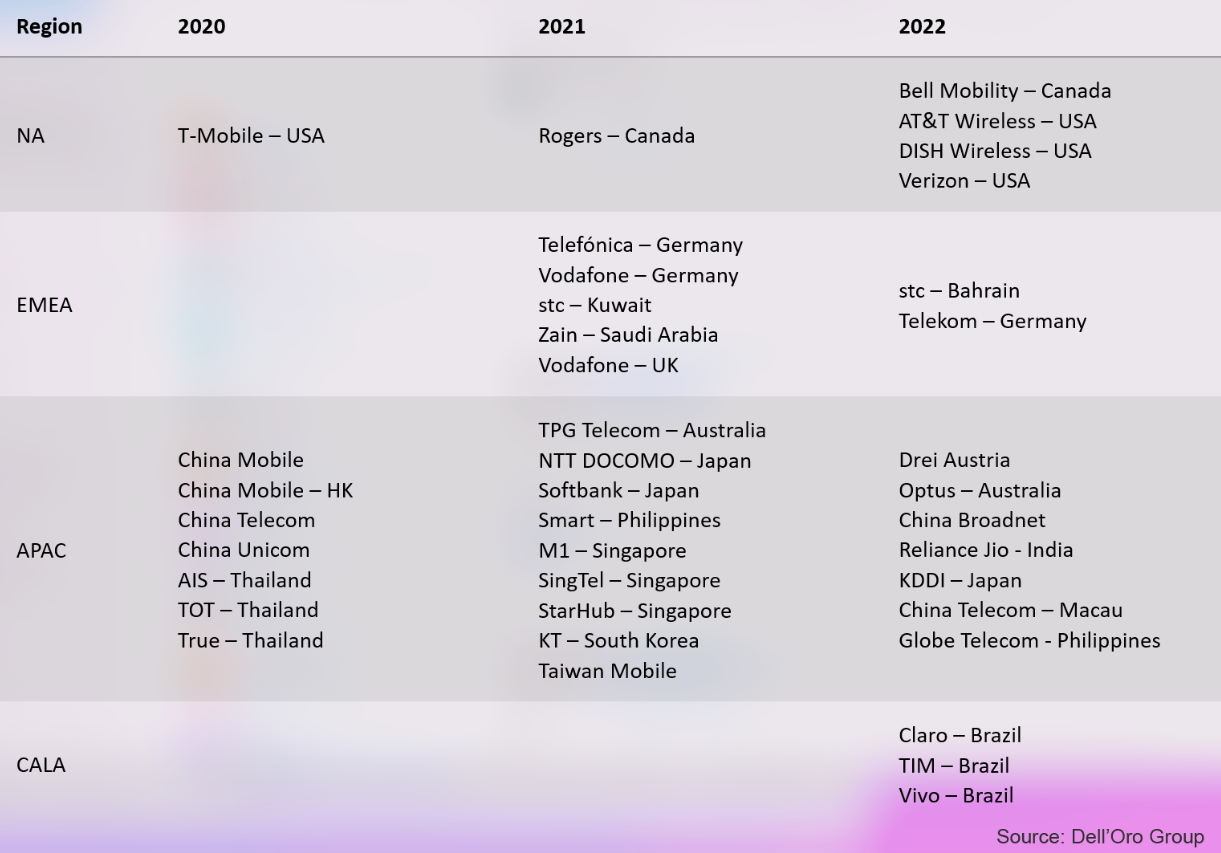

“There were hopes early in the year that many more [SA networks] would be launched in 2022, but the hopes were lowered as the year progressed,” Bolan explained. At the close of 2022, Dell’Oro identified 39 MNOs (Mobile Network Operators) that have commercially launched 5G SA eMMB networks.

“Reliance Jio, China Telecom-Macau, and Globe Telecom were new MNOs added to the list of 39 MNOs launching 5G SA eMMB networks in the fourth quarter of 2022. Reliance Jio has announced a very aggressive deployment schedule to cover most of India by the end of 2023. In addition, AT&T and Verizon plan large expansions to their 5G SA coverage in 2023, raising the projected Y/Y growth rate for the total MCN and MEC market for 2023 higher than 2022,” added Bolan.

Additional highlights from the January 2023 MCN and MEC 5-Year forecast report:

- The MEC segment of the MCN market will have the highest CAGR, followed by the 5G MCN market and the IMS Core market.

- As networks migrate to 5G SA, the 4G MCN market is expected to decline at a double-digit percentage CAGR.

The Dell’Oro Group Mobile Core Network & Multi-Access Edge Computing Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, and IMS Core including licenses by Non-NFV and NFV, and by geographic regions. To purchase this report, please contact us at [email protected].

………………………………………………………………………………………………………………………………………………………………

From Deloitte:

“The coming migration to 5G standalone core networks is expected to allow for increased device density, reliability, and latency, opening the door to advanced enterprise applications,” according to several analysts from Deloitte’s Technology, Media & Telecommunications industry group.

“5G SA’s big attraction for MNOs are the new service and revenue opportunities it creates, Along with near-zero latency and massive device density, 5G SA enables MNOs to provide customers – specifically enterprise customers – access at scale to fiber-like speeds, mission-critical reliability, precise location services, and tailored network slices with guaranteed service levels.”

Deloitte expects the number of mobile network operators investing in 5G SA networks – with trials, planned deployments, or rollouts – to double from more than 100 operators in 2022 to at least 200 by the end of 2023.

References:

Mobile Core Network Market to Reach over $50 billion by 2027, According to Dell’Oro Group

Mobile Core Network (MCN) growth to slow due to slow roll-out of 5G SA networks

Dell’Oro: Mobile Core Network market driven by 5G SA networks in China

Dell’Oro: Market Forecasts Decreased for Mobile Core Network and Private Wireless RANs

According to a newly published Dell’Oro Group report, Mobile Core Network (MCN) market growth will be decreasing. Worldwide MCN 5-year growth is now forecasted at a 2% compounded annual growth rate (CAGR), compared to our January 2022 forecast of 3% CAGR.

“The July 2022 forecast is more conservative than the January 2022 forecast due to industry headwinds, including supply chain challenges, higher inflation, an impending recession, Mobile Network Operators’ (MNO) challenges to increase revenues, and regional political conflicts,” said Dave Bolan, Research Director at Dell’Oro Group. “As a result, we reduced the 2022 to 2026 cumulative revenue forecast by 6 percent, decreasing revenues by $3.2 B. The July 2022 cumulative revenue forecast (2022-2026) is now $50.3 B resulting in a 2 percent CAGR.

“We are tracking the number of 5G Standalone (5G SA) MBB networks that have been launched commercially by MNOs. In the first half of 2022, only three new 5G SA networks were launched, KDDI in Japan, DISH Wireless in the US, and China Broadnet in China bringing the total deployed around the world to 27 MNO 5G SA MBB networks,” Bolan added.

Additional highlights from the MCN 5-Year July 2022 Forecast report:

- Year-over-year (Y/Y) MCN revenue growth rates for each year in the forecast are positive but will decrease each year; by 2026, Y/Y revenues will be essentially flat.

- MCN market CAGR forecast by industry segments we expect 5G MCN to be 21 percent, 4G MCN -20 percent, IMS Core 2 percent, and the User Plane Function (UPF) required for Multi-access Edge Computing (MEC) 67 percent.

- The North America and China regions are expected to have the lowest CAGRs, while Europe, Middle East, and Africa (EMEA), and Asia Pacific without China regions are expected to have the highest CAGRs.

Dell’Oro Group’s Mobile Core Network & Multi-Access Edge Computing 5-Year January Forecast Report offers a complete overview of the market for Wireless Packet Core including MEC for the User Plane Function, Policy, Subscriber Data Management, and IMS Core with historical data, where applicable, to the present. The report provides a comprehensive overview of market trends by network function implementation (Non-NFV and NFV), covering revenue, licenses, average selling price, and regional forecasts for various network functions. To learn more about this report, please contact us at [email protected]

………………………………………………………………………………………………………………………………………………

In a related Dell’Oro “Private Wireless Advanced Research Report,” Stefan Pongranz states that private wireless radio access network (RAN) shipments and revenues are coming in below expectations, resulting in another decreased forecast.

“We have not made any changes to the potential market calculations and still estimate private wireless is a massive opportunity,” said Stefan Pongratz, Vice President at Dell’Oro Group. “At the same time, the message we have communicated for some time still holds – we still envision the enterprise and industrial play is a long game. This taken together with the fact that the standalone LTE/5G market is developing at a slower pace than previously expected forms the basis for the near-term downgrade,” continued Pongratz.

Additional highlights from the Private Wireless Advanced Research Report:

- Private wireless projections have been revised downward to reflect weaker than expected progress with private wireless LTE and 5G small cells.

- Total private wireless RAN revenues, including macro and small cells, are projected to roughly double between 2022 and 2026.

- Standalone private LTE/5G is now expected to account for a low single-digit share of the total RAN market by 2026.

Dell’Oro Group’s Private Wireless Advanced Research Report with a 5-year forecast includes projections for Private Wireless RAN by RF Output Power, technology, spectrum, and region. To purchase this report, please contact us at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, enterprise networks, data center infrastructure, and network security markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

References:

Industry Headwinds to Decrease Mobile Core Network Market Growth, According to Dell’Oro Group

Private Wireless Forecast Adjusted Downward, According to Dell’Oro Group

Dell’Oro: Mobile Core Network market driven by 5G SA networks in China

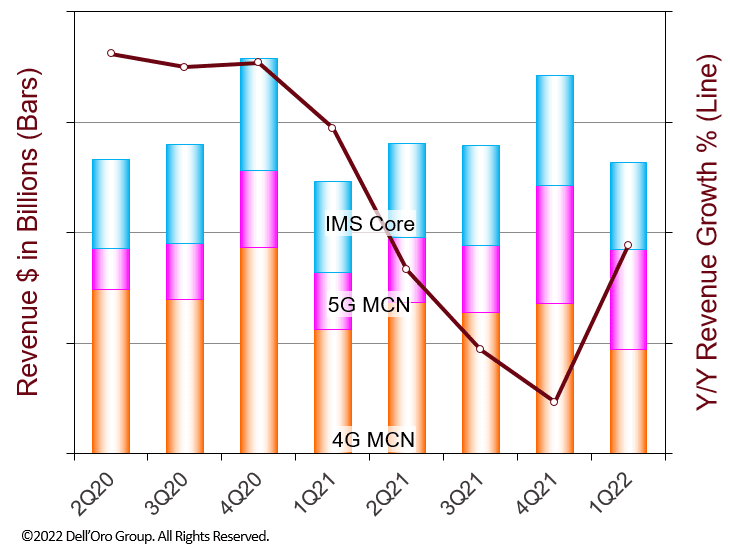

According to a recently published report from Dell’Oro Group, the total Mobile Core Network (MCN) and Multi-access Edge Computing (MEC) market revenues for 1Q 2022 rebounded to a positive year-over-year (Y/Y) growth rate after the decrease in 4Q 2021 which was the first decrease since 4Q 2017.

The MCN market growth was driven by an extremely high double-digit percentage Y/Y revenue growth rate in the 5G MCN market overcoming the Y/Y revenue declines in the 4G MCN and IMS Core markets. For the MCN market regionally, the China region had a high growth rate while the MCN market excluding China had a negative growth rate for the quarter.

“With the continued aggressive build-out of 5G Standalone (SA) networks in China, the China region in 1Q 2022 substantially increased its share of the 5G MCN market over last quarter,’ stated Dave Bolan, Research Director at Dell’Oro Group. “At the end of 1Q 2022, we have identified 25 Mobile Network Operators (MNOs) that have commercially launched 5G SA Mobile Broadband networks (MBB) with services available to consumers. The 5G Core vendors (in alphabetical order) include Cisco, Ericsson, Huawei, NEC, Nokia, Samsung, and ZTE. We have identified 150 MNOs with 5G Core contracts with the above vendors plus Mavenir. There are still more 5G Core contracts that vendors have acknowledged without revealing the associated MNOs.

“We see fewer 5G Core network launches slated for 2022 as compared to 2021 when 16 networks were launched. However, many are being readied for 2023 launches and we project mid-single-digit percentage Y/Y growth rates for the balance of 2022. One of the most anticipated and publicized 5G Core launches is Dish Wireless – the first to run 5G Core on the Public Cloud. The company is preparing to launch in many cities by mid-June 2022 to meet regulatory coverage requirements. In early May 2022, Dish had a soft launch in its first city, Las Vegas. Nokia is the primary 5G Core vendor.

“Multi-access Edge Computing deployed by MNOs has barely scratched the surface in spite of all the hype, except for the China region, which has deployed thousands of MEC nodes throughout their MNO networks, with a mix of Public MEC and Private MEC sites,” continued Bolan.

Additional highlights from the 1Q 2022 Mobile Core Network and Multi-Access Edge Computing Report:

- The top two vendors for the MCN, 4G MCN, and IMS Core markets were Huawei and Ericsson.

- The top two vendors for the 5G MCN market were Huawei and ZTE.

- Nokia and Ericsson had the highest Y/Y growth rates for the 5G MCN market coming from a low small base. However, Huawei had the highest dollar revenue gain, with a lower Y/Y growth rate coming from a larger base.

The Dell’Oro Group Mobile Core Network & Multi-Access Edge Computing Quarterly Report offers complete, in-depth coverage of the market with tables covering manufacturers’ revenue, shipments, and average selling prices for Evolved Packet Core, 5G Packet Core, Policy, Subscriber Data Management, and IMS Core including licenses by Non-NFV and NFV, and by geographic regions. To purchase this report, please contact us at [email protected].