ABI Research: Network-as-a-Service market to be over $150 billion by 2030

Global technology market intelligence firm ABI Research expects the Network-as-a-Service (NaaS) [1.] market to expand significantly, reaching over $150 billion by 2030.

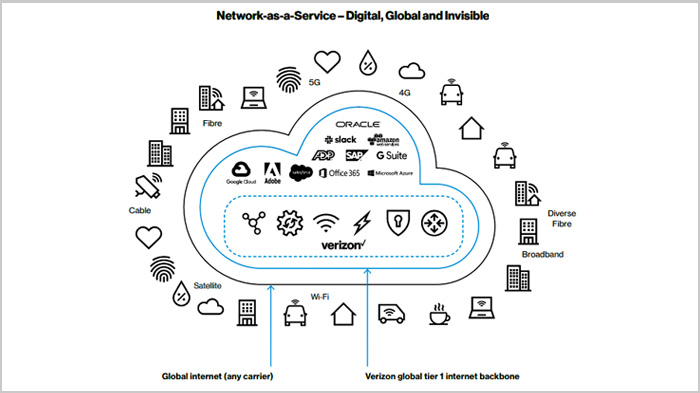

Note 1. NaaS is a secure, cost-effective subscription-based model that lets businesses of all sizes consume network infrastructure on-demand and as needed. It offers scale-up or scale-down flexibility that many businesses require to stay competitive in today’s unpredictable data traffic environment.

Networks have been commoditized over the last few years and the cost of connectivity has fallen. Value has shifted from network infrastructure to the services built on top of the network. Enterprises need scalable solutions that offer cloud-native agility, multi-cloud accessibility, and services that can dynamically fluctuate to support digital transformation. This has led to significant interest in the NaaS market, according to ABI Research.

Image Credit: Verizon

The firm’s blog promoting their NaaS report notes that telecom operators currently lack business models that allow them to build on their physical connectivity advantages to gain control of the NaaS market.

“Telcos must seize the opportunity to dominate the NaaS market, as revenue generated from connectivity provision will continue to decline. However, their investment strategy, business, operational, and ‘go-to-market’ models are not ready to deliver a competitive NaaS solution, explains Reece Hayden, Distributed & Edge Computing Analyst at ABI Research. “The market is immature and highly fragmented, but telco market revenue will exceed US$75 billion by 2030 if they act now and transform technology, culture, and structure to better align with the requirements of the NaaS market.”

Currently, telcos face NaaS competition from two key players. Interconnection providers (e.g., Megaport and Packet Fabric) have built their agile solutions from the ground up, focusing energy on virtualization and software specialization. At the same time, cloud infrastructure providers (e.g., Amazon AWS, Google GCP, and Microsoft Azure) continue to offer cloud-specific NaaS solutions.

“Telecom operators remain in the best position to lead the market as long as they recognize their service/innovation limitations, invest/restructure successfully, and focus their messaging appropriately,” according to Hayden.

Telcos must look to transform three areas. First, telcos must virtualize network infrastructure to deliver cloud-native services and continue to invest heavily to integrate automation (AIOps) throughout network services, including paying attention to 5G slice-as-a-service and other ‘value-add services’ which are critical to monetization.

Second, telecom operators must restructure business and operating models with a look toward openness and partnerships across the industry and reduce internal fragmentation to drive cross-business service continuity.

Third, telcos must look to develop a problem-solving culture and realign their ‘go-to-market’ strategy to better position themselves within the NaaS market. This involves developing vertical and enterprise size-specific sales strategies and establishing consultative processes that educate enterprises to bridge the ever-present gap between awareness and understanding. Telco executives should focus more on service provision and up/reskilling their workforce.

NaaS adoption will rapidly grow over the next eight years. ABI Research expects that by 2030, just under 90% of enterprises will have migrated at least 25% of their global network infrastructure to be consumed within a NaaS model. However, this process will not be organic, suppliers will have to drive education and consultative practices, as significant skepticism within SMEs and MNCs pervades the market. “To drive short-run sales, suppliers must educate and tailor their sales strategy to focus on first adopters (startups and SMEs) and specific verticals,” Hayden recommends.

The outlook in the NaaS market is hugely positive for telcos, especially given the rising demand from startups and SMEs. “But a lot still needs to be done to bridge technological, cultural, and structural gaps,” Hayden concludes. “Although it seems like an expensive and risky uphill battle, developing NaaS will be crucial to the long-term upside. But, if telcos miss this opportunity and drop the ball, interconnection providers and hyperscalers will be waiting and willing to catch it.”

These findings are from ABI Research’s Network-as-a Service: Business, Operational, and Technological Strategies for Telco Digital Service Transformation application analysis report. This report is part of the company’s Distributed and Edge Computing research service, which includes research, data, and ABI Insights. Based on extensive primary interviews, Application Analysis reports present an in-depth analysis of key market trends and factors for a specific application, which could focus on an individual market or geography.

ABI’s NaaS report does not include IT equipment and software vendors like Cisco, Dell Technologies, and Hewlett Packard Enterprise (HPE), which have been bolstering their own NaaS hardware and software stacks while established sales channels into most enterprises.

About ABI Research:

ABI Research is a global technology intelligence firm delivering actionable research and strategic guidance to technology leaders, innovators, and decision makers around the world. Our research focuses on the transformative technologies that are dramatically reshaping industries, economies, and workforces today.

………………………………………………………………………………………………………………….

References:

https://www.verizon.com/about/news/network-service-explained

One thought on “ABI Research: Network-as-a-Service market to be over $150 billion by 2030”

Comments are closed.

NTT Data is teaming with Aviatrix, an intelligent cloud networking company to deploy the Aviatrix Cloud Networking Platform.

NTT Data Business Solutions leverages Aviatrix to deliver business-critical SAP application services for customers and to overcome networking, security, visibility and multicloud limitations of AWS, Azure and Google Cloud services.

“Migrating business-critical enterprise applications, such as SAP, to the cloud requires business-critical cloud infrastructure and expertise,” said Andrie Jumari, head of cloud infrastructure services Malaysia at NTT Data Business Solutions.

“Our service infrastructure operations teams will support multiple cloud providers in a consistent way, with advanced capabilities not available across cloud providers.

“Aviatrix allows us to deliver a cloud NaaS to support enterprise SAP deployments in a unique way, like increasing customer satisfaction and SAP application up-time.”

The cloud networking platform will offer providers both private and public advanced network, security and operational visibility to support business-critical applications.

“Multicloud networking is fundamental to enterprise cloud infrastructure today,” said Nauman Mustafa, vice president of business development and global service provider partners at Aviatrix.

“NTT DATA Business Solutions is a globally recognized solution provider, delivering proven solutions for business-critical enterprise SAP applications in the cloud. It has been a pleasure working with our partners at NTT DATA Business Solutions to architect, deploy, and operate their cloud NaaS infrastructure in support of their Intelligent Enterprise SAP services.”

https://www.capacitymedia.com/article/2b4udkxmu636wfeybnf9c/news/ntt-data-launches-cloud-platform-with-aviatrix