Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

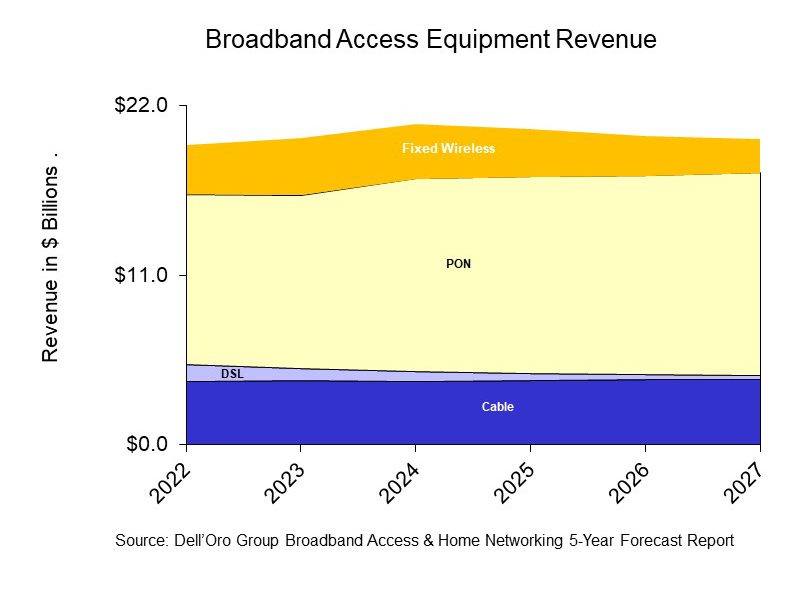

A newly published report by Dell’Oro Group predicts that sales of PON (Passive Optical Network) equipment for fiber-to-the-home deployments, cable broadband access equipment, and fixed wireless CPE will all increase from 2022 to 2027, as service providers continue to expand their fiber and DOCSIS 4.0 networks, while expanding the types of services they deliver to residential subscribers.

“Service providers around the world continue to transition their broadband networks to fiber and retire their existing copper and DSL networks,” said Jeff Heynen, Vice President at Dell’Oro Group. “With markets expected to become more competitive, broadband providers will have to continue spending in order to differentiate their services not only by increasing advertised speeds, but also improving latency and expanding managed Wi-Fi services,” added Heynen.

Additional highlights from the Broadband Access & Home Networking 5-Year January 2023 Forecast Report:

- PON equipment revenue is expected to grow from $11.0 B in 2022 to $13.2 B in 2027, driven largely by XGS-PON deployments in North America, EMEA, and CALA.

- Revenue for Cable Distributed Access Equipment (Virtual CCAP, Remote PHY Devices, Remote MACPHY Devices, and Remote OLTs [1.]) is expected to reach $1.5 B by 2027, as operators ramp their DOCSIS 4.0 and fiber deployments.

- Revenue for Fixed Wireless CPE [2.] is expected to reach $2.2 B by 2027, led by shipments of 5G sub-6GHz and 5G Millimeter Wave units.

Note 1. Remote OLTs (Optical Line Terminals) can be deployed in distributed access nodes to support targeted deployments of FTTP. Comcast is already doing that for its next-gen HFC network. But others, such as Charter Communications, are also ramping up their respective efforts and pursuing similar deployment models.

“You’re now talking about a whole new architecture with remote OLTs, virtual CMTSs and remote PHY. It will take longer to operationalize. It’s a slower burn than it used to be in the past,” Heynan said. He expects cable access network spending to continue climbing past 2027 as other cablecos join the mix.

Note 2. Heynen expects FWA CPE spending to stay steady through 2024, but notes that some providers might run into capacity issues that curtail growth and will also be faced with fiercer competition from fiber and newly upgraded HFC networks. “That puts a ceiling on how much growth can happen for fixed wireless,” he said. While T-Mobile and Verizon are now driving FWA growth in the U.S., we wonder how the future will shake out for the WISP (wireless ISP) sector, which is also seeing steady growth at the moment. As WISPs (Wireless Internet Service Providers) seek out government subsidy opportunities, some may need to consider licensed spectrum or transition to fiber across their footprint.

The Dell’Oro Group Broadband Access & Home Networking 5-Year Forecast Report provides a complete overview of the Broadband Access market with tables covering manufacturers’ revenue, average selling prices, and port/unit shipments for PON, Cable, Fixed Wireless, and DSL equipment. Covered equipment includes Converged Cable Access Platforms (CCAP), Distributed Access Architectures (DAA), DSL Access Multiplexers (DSLAMs), PON Optical Line Terminals (OLTs), Customer Premises Equipment ([CPE] for Cable, DSL, PON, Fixed Wireless), along with Residential WLAN Equipment, including Wi-Fi 6E and Wi-Fi 7 Gateways and Routers. For more information about the report, please contact [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, enterprise networks, data center infrastructure markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

References:

Broadband network spending set to climb as cable gets its groove back | Light Reading